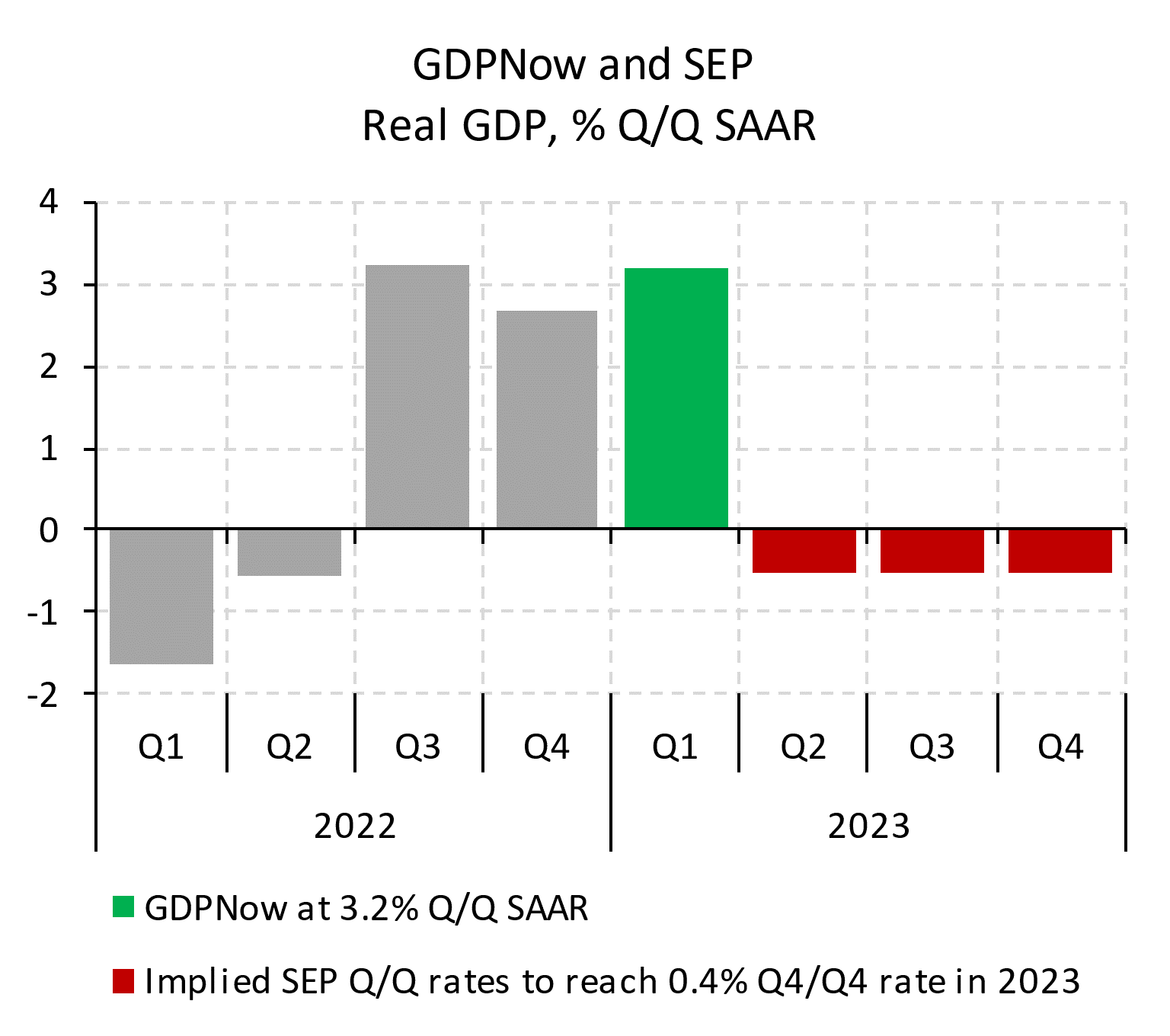

Here’re some indicators at the weeky frequency for the real economy. Bloomberg notes that GDPNow (3/16) combined with SEP median of 0.4% growth rate for 2023 implies 3 quarters of negative GDP growth starting in Q2. The latest data below relate to late in Q1.

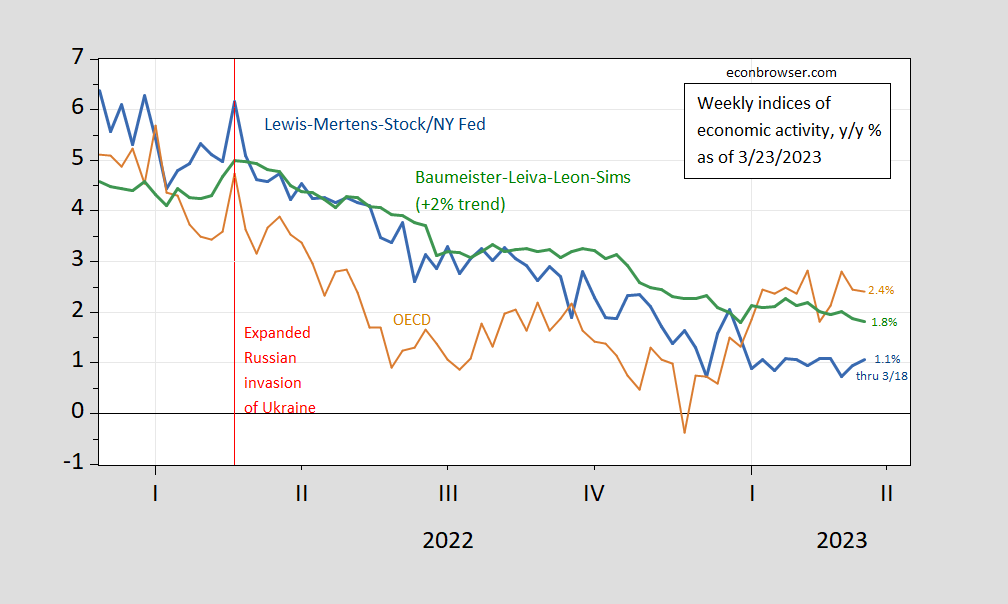

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The Weekly Tracker continues to read strong growth, for the week ending 3/18, exceeding the WEI (1.1%) and WECI+2% (1.8%). The WEI reading for the week ending 3/18 of 1.1% is interpretable as a y/y quarter growth of 1.1% if the 1.1% reading were to persist for an entire quarter.The Baumeister et al. reading of -0.02% is interpreted as a -0.02% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.8% growth rate for the year ending 3/18. The OECD Weekly Tracker reading of 2.4% is interpretable as a y/y growth rate of 2.4% for year ending 3/18.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker — at 2.4% — is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

Pawel Skrzypczynski does the work on what the GDPNow calculation plus median SEP implies:

Source: Pawel Skrzypczynski. [corrected 3/24]

This is an interesting story. I think if this story became well-known among the broader public of China, Xi Jinping would have a difficult time explaining why he keeps showing obeisance to Putin and helping him out in a losing war:

https://www.thedailybeast.com/witnesses-accuse-russias-wagner-group-of-killing-9-chinese-miners-in-central-african-republic

Putin and Wagner are signaling to China “if you try to compete in our mining areas overseas, we will murder en mass Chinese citizens. That tends not to “go over” well with Chinese. And it shows Xi Jinping as being weak to “the foreign devils”. Where’s ltr to explain things when you need him??

*en masse

Excuse me, that’s what happens when I try to use themz Frenchie’s words. My brain gets discombobulated and fatigoooooooooed.

Wagner may have stepped seriously out of line on this one.

They have always had a single minded and narrow focus on their own immediate goals – with little understanding of the larger and strategic context of where they are. In Ukraine they kept biting the hand that feds them ammo and convict soldiers until they suddenly found both being withheld. Now they are busy kissing up as they are seeing their real soldiers being wasted as cannon fodder in Bakhmut. Wagner is now indicating they may take their soldiers out of Ukraine for important missions in foreign countries.

With this exquisitely poorly timed stupidity, someone may soon be scheduled for some unscheduled “air-lessons”. Putin may have to pull Wagner out of central Africa if he wants the continued flow of essential materials from China. Xi is by far the strongest partner in this relationship and he could demand heads rolling to compensate for this humiliation – or else.

Then come revisions…….everything you thought….never was. SEP is the kind of intellectual jumbo mumbo that creates cringe induced slobber.

Real y/y GDP growth rarely (never?) falls below 0.9% other than in recession. The FOMC’s median GDP growth estimate, and its median jobless rate estimate, are admissions that recession is more likely than not in the Fed’s current outlook.

https://tradingeconomics.com/united-states/durable-goods-orders

Apparently Pawel made a typing error or input error when making his graph. I encourage you to delete my/this comment after looking at the link:

https://twitter.com/p_skrzypczynski/status/1639153767332589568

Something I had been curious about lately. Seems we have a semi-answer here:

“WTI crude futures slumped more than 3% to below $68 per barrel on Friday, as US Energy Secretary Jennifer Granholm told lawmakers that it will be “difficult” to refill strategic oil reserves this year, prompting speculations that the US government would only start buying at even lower prices.”

https://tradingeconomics.com/commodity/crude-oil

Does anyone remember where Steven Kopits predicted oil prices would be in early Spring?? I’m always up for some comedy.