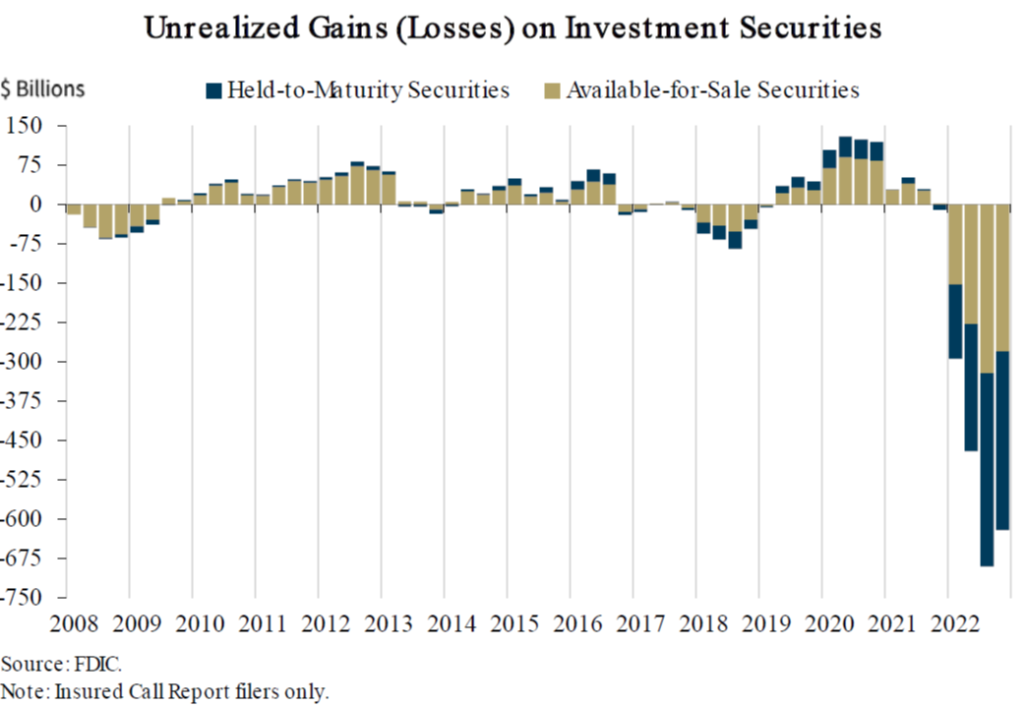

Consider the following graph of unrealized losses on securities held by reporting banks (from Rupkey/Financial Markets This Week):

Source: Rupkey, “Financial Markets This Week,” March 20, 2023.

This made me wonder what would make these unrealized losses go to zero? Obviously a reduction in interest rates. I don’t have the data to do the calculation on hand, but I have marketable federal debt at par value and at market value. I can look at the ratio of those two and how that ratio moves with a given interest rate.

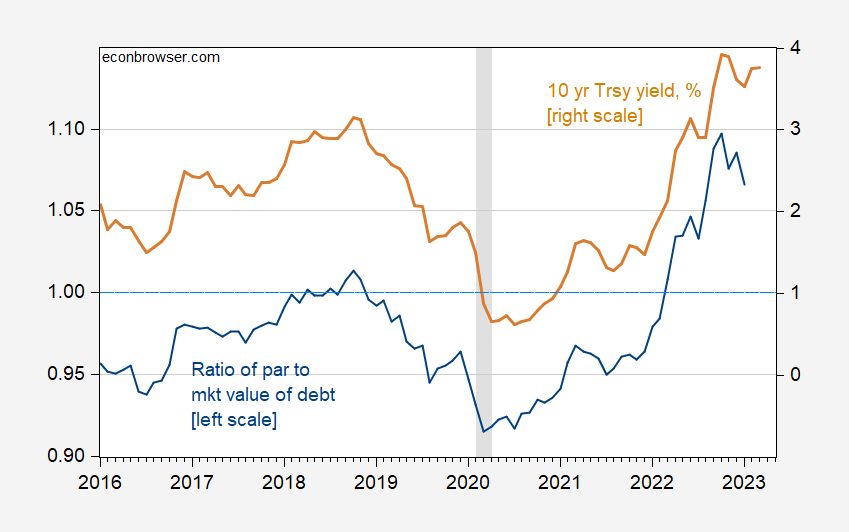

Figure 1: Ratio of par value of marketable debt to market value (blue, left scale), and ten year Treasury yield, % (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Dallas Fed, Treasury, NBER, and author’s calculations.

There’s an obvious correlation. From the regression:

ratio = 0.8817 + 0.0455(gs10)

adj-R2 = 0.83, NObs = 85, DW = 0.20

Using this correlation, it turns out a 10 year yield of 2.6% will do the trick (so far through March, they’re 3.8%, roughly the same as February). Obviously, this is back-of-the-envelope (and the ratio of par to market is not the same as the ratio of purchased price to market price), but you get the idea that if yields fall, some of the unrealized losses will disappear.

How reasonable is this outcome? Not very, but I’ll note that the 10 year rate has fallen by half a percentage point since the beginning of the March…

That’s actually fascinating. Gives people an idea how quick interest rates can change banks’ risk picture. And why matching maturities and having a wide spectrum of terms/maturities is important for banks’ asset picture. My thought on it is basically SVB F’ed up in more ways than one. as did Republic and Signature. Are there more like them?? Probably. I would still argue strongly it’s NOT a systemic problem. It’s individual examples of very bad management. If you have a class of 40 students, you can kind of count on 3–5 of them staring out the window, gabbing, playing on the mobile phone, etc. “Well we found 5 bad apples, the whole class has gone to hell”. NO, NO, It hasn’t. Those 5 kids/students are in every “typical” class.

So we found those banks, better we find the SVBs, the Signatures, and the Republics NOW than later. Like finding out your BF/GF was screwing around on you 10 days before you were going to get married. They did you a favor letting you know before you got farther down the road. That’s how I look at these 3 banks whose leadership had their head up their ____

iirc sub had 59% assets in agency/treasuries, I suspect the other 40% had credit risk as well.

Yeah, but related to crypto. I just don’t see systemic risk.

As to systemic risk, there has been an improvement in symptoms, but far from complete remission:

https://en.macromicro.me/charts/45928/us-fra-ois-spread

https://fred.stlouisfed.org/series/BAMLC0A4CBBB

https://www.macrotrends.net/1447/ted-spread-historical-chart

Eh, it looks over. The primary dealers will buy up and rip up these “little” guys as they fail. Will anybody care then???? I think the unwinding of the dollar as the reserve currency is the bigger issue. Let’s note, in the 1920’s when it happened after wwi, it blew up a big credit bubble. I see a large capex boom and a substantial bust in “28-29” .

Monetary policy operates through a number of channels – credit provision, investment, exchange rates, expected income and consumption as a result of the wealth effect. Add to the list as you are inspired to do so.

The banking wobble will directly affect bank credit, but Figure 1 also provides a rough indication of what’s going on with the wealth effect. Estimates of the effect vary wdely, Some researchers finds no wealth effect from housing. Others find that a dollar of housing wealth turned into 8 cents of consumption spending during the housing boom, but only 5 cents thereafter, while the estimates for equity wealth are 3 cents during, 2 cents after. Bonds? Most researchers don’t bother, perhaps because bond wealth is assumed to be offset by bond income. Assumed…

The Fed isn’t tasked with (directly) boosting consumer demand, though. The Fed is tasked with boosting employment. One recent study finds that a 20% increase in equity values increases labor income by 1.7% and hours by 0.75% two years after the increase in stock values:

https://www.nber.org/papers/w25959

A 20% increase in wealth to engineer a 0.75% increase in hours, when the goal is maximum employment? Is that sensible? Stock wealth is held mostly by well-off households, which also tend to enjoy pretty stable employment, while job gains matter most to the marginally employed. Big swings in asset values can produce really damaging swings in real economic activity and welfare, with the impact on the Fed’s legitimate goal, jobs comparatively small.

I am not aware of any literature on the wealth effects of fiscal policy (I’m not aware of much), but there is good evidence of the effects of fiscal policy on employment, and the impact is a good deal stronger than 5 cents on the dollar.

Monetary policy lost it’s groove before the zero-lower-bound experiment; the experiment was tried because monetary policy had lost its groove. Generating extremes in wealth with destabilizing effects on finance seems like a poor way to maintain employment. Doing so when monetary policy is so weak that years of zero rates and asset purchases fail to raise inflation to target was simply nuts. Fiscal policy works directly on employment. Might even have boosted inflation.

Doesn’t unrealized losses on securities have to be overwhelming initial equity for there to be a solvency problem? That is a very different calculation.

Can you run this analysis in terms of the 3 mo treasury rate? The problem is not on the long side, but on the short (liabilities) side.

And this:

Bloomberg weekend [reported] that US mid-sized banks [have] demanded a two-year total deposit insurance scheme from the FDIC, and warned if it doesn’t arrive, there may lots more shotgun weddings (or shotguns)… [Further,] Bloomberg reported that “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.”

Looks like a systemic crisis, doesn’t it?

https://cointelegraph.com/news/us-exploring-ways-to-guarantee-the-country-s-18t-of-bank-deposits-report

This pretty much locks it in for me. We now know this is NOT systemic, because Kopits thinks it is, we have a very strong reverse indicator.

It is worse than that. If Stevie had a clue what he is babbling about, it would be an alleged solvency problem. Of course Macroduck notes the big banks are doing better not worse. So now little Stevie reads a plan to insure deposits and he in own confused way thinks this is systemic problem? Yea – he is really dumb.

More stupid comments? Now let’s see Stevie was worried that banks were holding fixed interest rate long-term government bonds so our host looks into the market value of these assets. But then little Stevie goes no, no, no – it is the liability. Of course, little Stevie used to complain that the FED had not raised short-term rates but NOW these rates are too high.

Your rants do have a habit of being incoherent to the point they contradict each other. Then again you know nothing about these issues but you do have to babble on and on and on.

“Bloomberg’s sources indicated, however, that U.S. authorities don’t deem such a drastic move necessary at the moment, as recent steps taken by financial regulators are likely to be sufficient.”

Little Stevie started his parade of babble by claiming regulators botched the SVB matter. But it seems they are taking care of the banking system. So little Stevie now says this is not a matter for regulators. Oh no – short-term rates are too high.

Hey Stevie – we get you are one confused nutjob. So chill.

How about a 2-year ban on stock buybacks and bonuses.

Man, that’s naive! Using the lobbying efforts of business groups as evidence? Guarantees for all deposits is good for banks, without regard to market condition. “Never let a crisis go to waste.”

And citing a crypto bro news outlet parroting an unsourced Bloomberg article? That’s some high-quality argumentation you’ve got there. Kinda like when Johnny finds a single link the (he thinks) agrees with him and declares “I win!”

I just wish people would take this stuff seriously. For once.

Ducky wants the 1%’s deposits protected. Why stop there? Why not protect their bonds from losses? Why not their stocks? Why not compensation for lost profits?

You gotta love these corporate Democrats trashing moral hazard for the benefit of the wealthy!

Johnny either doesn’t understand what he has read, or he’s lying. Don’t be shocked – this is the normal state of affairs for Johnny.

Let’s have a look at what Johnny responded to. Stevie claimed that lobbying by small and medium-sized banks for two years of deposit insurance for all deposits, not just those below $250,000, is evidence of systemic risk. I pointed out that lobbying is a shakey form of evidence. That’s all that happened. I did not call for two years of deposit insurance. Johnny, in claiming that want to protect the “1%’s deposits” implies that I did call for two year’s insurance. Either Johnny doesn’t understand what he read or he lied about what he read. I don’t see any other explanation.

Johnny frequently declares that others think some prety bizarre things. He does it with economists, with Democrats, with me, with other commenters. Often, his declaration is at odds with the truth, because truth is not the point. It’s a cheap debating trick. Johnny does the same thing with Russia’s attack on Ukraine – anyone who is opposed to Russia’s invasion must, simply must, want Russia destroyed! No, Johnny, we just want Russia out out of Ukraine.

Ducky now denies that he recently supported the call for all depositors to be insured…very confused guy! Or just sticking his middle up and seeing which way the wind is blowing?

Love it. Ducky alleges that I misrepresent him with his own total misrepresentation of my position, fabricating my view as “anyone who is opposed to Russia’s invasion must, simply must, want Russia destroyed.”

No, my position is that this is just another in a long series of pointless and futile wars that the US has waged since WWII. My other position is that Americans are being subjected to a very successful propaganda campaign that puts a positive spin on the rationale for war and for what’s happening on the ground. Such promotional propaganda was also a characteristic of past pointless and futile fiascos in Vietnam, Iraq, and Afghanistan.

And, like other wars, propaganda (fortunately) works for only so long. More voices are questioning America’s role in Ukraine. Polls are showing a decline in support. What should happen in any democracy before engaging in a war only seems to happen after a couple years. But at least it happens.

But at least it’s not as bad as what’s happening in Ukraine, where leaders should have studied what it means to become a US proxy in a pointless and futile war. Chris Hedges reported on the ground from some of these misadventures, so he understands what Ducky can’t imagine: “Ukraine’s Death by Proxy.” https://consortiumnews.com/2023/03/14/chris-hedges-ukraines-death-by-proxy/

JohnH

March 22, 2023 at 5:53 am

Ducky now denies that he recently supported the call for all depositors to be insured…very confused guy!

He was clearly being sarcastic. Damn Jonny – you attempts to smear people are stupid even for you.

https://files.stlouisfed.org/files/htdocs/publications/review/90/01/Option_Jan_Feb1990.pdf

Mark Flood’s 1990 paper on option pricing models and deposit insurance is a must read for the grown ups here even if it way over the pea brains of JohnH and Stevie pooh.

“trashing moral hazard”

Damn you are one stupid little turd. The moral hazard concern goes to the risky behavior of the bank – not the holders of fixed return deposits. I know Princeton Steve is a total village moron but Jonny boy is even dumber.

“ Moral hazard refers to the incentive for increased risk-taking that is present in deposit insurance as well as in other kinds of insurance. To the extent that depositors are protected, they have little incentive—and in some cases limited access to the necessary information—to monitor the performance of insured institutions. As a result, in the absence of regulatory or other restraints, funds are available for weak institutions and for high-risk ventures at lower cost than otherwise would be the case. Unless effective steps are taken to curtail moral hazard, the deposit insurance system faces the possibility of increased losses and the economy as a whole may suffer from imbalances if more funds are channeled into high-risk activities.

Incentives for increased risk-taking are greatest under a system of blanket guarantees, whereby full protection is provided to all depositors and other stakeholders in response to a financial crisis that threatens the collapse of the financial system.

https://www.fdic.gov/deposit/deposits/international/guidance/moralhazard.pdf

Our self-anointed know-it-all, pgl, fails to comprehend the moral hazard related to blanket insurance for all, advocated by Ducky.

If Ducky were really interested in protecting depositors, he could advocate for compensating small savers for negative real interest rates they have endured during the last decade. But making small depositors whole is not in Ducky’s interest…protecting wealthy ones is his shtick…just like pgl.

https://twitter.com/toby_n/status/1638075763206283265

This is your real name, and you are related to Steven Kopits?? Your link is more intelligent than anything Steven (your son??) has ever posted here, which really doesn’t take…… well nevermind. You need to assume control and take over Steven’s consultancy business as quickly as possible. I fear he could lose his pants anytime this week.

My mistake. Two quick on click.

Too quick on click, twice it seems.

NO worries, I was kinda shocked in more ways than one. Pretty rare a woman her age would be playing on Twitter. But one never knows in today’s world. My Dad was clear into his 80s age wise and loved wandering the internet, clicking news links all the day through. A Democrat who loved Matt Drudge’s website. It’s hard to understand your own relatives sometimes, isn’t it??

True.

Were you wearing a dress?

Edina Kopits?

I hope you are not married to Steve Kopits. But if you are – we can recommend a good divorce attorney.

If we are to believe the honesty of the blog name and the NYT, I think it would be Steven’s Mom. I don’t want to disrespect her (I am being genuine there) she may be a very kind and classy person, and if she wants to comment here regular I give my word to “lay off” and extend an olive branch to her (at least directly to her). My replies directly to her son I cannot guarantee.

Today was supposed to be the big day for MAGA Republicans in Manhattan and their protest that their boy Trump might have to actually be indicted for one of his multiple times:

https://www.msn.com/en-us/news/politics/trump-protest-fizzles-out-more-reporters-here-than-trump-supporters/ar-AA18SbA7?ocid=msedgdhp&pc=U531&cvid=a41ab0c0a3f94551b42861d0105b46cf&ei=24

Wow – not exactly the ticker take parade for the NYGiants when they last won the Super Bowl.

I understand that a lot of people whose brains have been damaged by the secret microchip brain control devises nefariously placed in MAGA hats were afraid to go. It was rumored that the UN would take the opportunity to arrest all the protestors and send them to Gitmo. I sure hope that rumor is not just an evil ploy.

@ pgl

Ok, I’m being very serious now…… when exactly did you start wandering the dark web, getting into 4chan, QAnon, state militias, and when exactly did you infiltrate MAGA leadership to embed yourself and create this ultimate trap of the MAGAs and when did they finally catch on to your plot??

https://www.yahoo.com/news/despite-trumps-calls-protests-few-093009406.html

pgl…… For the benefit of our nation, you have to “come clean” now. You must come clean. Either that or I’m sicking Bruce Hall on you. I warn you, I’ll do it…… I’ll sick Bruce Hall on you. I will……

“Rather than organizing protests, prominent Trump supporters online are instead driving a different narrative: That any public events are a “trap” set by law enforcement, and that attending any events will be counterproductive and will likely result in protesters being arrested. That reaction fits a pattern, experts say: Broadly, extremist movements are often whipsawed, with aggressive activity followed by pushback from law enforcement, resulting in withdrawal as remaining followers grow paranoid.”

As they used to say on the A Team, I love it when a plan comes together!

: ) Syringes for plane flights always handy.

Anyone Trump toadie who says we cannot indict serial criminal Trump is responsible for what this nutjob is spewing:

https://www.salon.com/2023/03/20/right-wing-host-calls-for-military-to-execute-obama-if-is-indicted/

Far-right broadcaster Pete Santilli called on members of the military to execute former President Barack Obama, former Attorney General Eric Holder, and former National Security Advisor Susan Rice if former President Donald Trump is arrested.

This garbage needs to stop and perhaps the only way it will is to ship Trump off to Moscow where I bet he will feel more at home.

Interesting how they are absolutely convinced that Trump is innocent – yet equally convinced that he will be found guilty by all 12 jurors in a trial.

I am no fan of Trump, yet I hope the grand jury and the DA decide not to prosecute this specific case. I am not at all sure that there wouldn’t be at least 1 juror who refused to convict.

I was curious how the total assets and total liabilities of all commercial banks. FRED showed the former as reaching $23 trillion by the beginning of 2023 slipping back to $22.8 trillion. Liabilities on the other hand have retreated to $20.7 trillion:

https://fred.stlouisfed.org/series/TLBACBW027NBOG

I know Princeton Little Chicken Hawk Stevie wants us to believe the world is coming to end but folks – relax.

You may seen some of MAGA trolls criticizing the CdC for not warning us sooner over COVID-19’s ability to spread. Well Kevin Drum presents the real culprit here and his name is Donald Trump:

https://jabberwocking.com/cdc-critics-should-turn-their-bazookas-on-donald-trump-instead/

I bought 2,000 shares of FRC (First Republic) at $16 today. If the Fed does not increase its rate by more than a quarter point, I believe I will make money by putting my money where my mouth is (i.e. not systemic, but a big enough problem that the industry will provide a white knight rescue). If the Fed raises by a half a point, I think I will lose at least 50% of the speculation by tomorrow. Come on 2.6!

Interesting move. Stock tip – short sell Bed Bath and Beyond.

Closed at 15.77 after bouncing to 18-ish on new JMP is providing more support. Tick…tick…

Jamie Dimon strikes me as being in another merger mood. After all – he is not going to stop until JPM is THE Bank of the United States.

I’m not saying your wager is a bad one. But you know what I would say your biggest risk is here?? If they issue more common shares or offer a “special deal” to the white knight of shares/equity given at par value, or preferred shares. That leads to a dilution of the value/equity of the shares. That’s basically what happened with Buffett. So he is the one that went “laughing to the bank” (no pun intended) while the rest of the shareholders had to wait quite awhile to get their money back.

https://www.yahoo.com/news/warren-buffett-invested-5b-goldman-195420885.html

https://www.businessinsider.com/buffett-gets-21-billion-from-goldman-2013-10

https://www.reuters.com/article/us-goldmansachs-berkshire/buffett-trades-warrants-for-smaller-stake-in-goldman-idUSBRE92P0K820130326

So if I was you that’s my big worry, if they offer more common shares, or some “special deal” to the white night. Because equity-wise, the white knight will be reaching into your pocket (again equity-wise) to do it. If they announce that type of “special deal” to a white knight, that’s the point when I would mess my trousers. Outside of that, looking at just the surface and not digging into the 10-k 10-Q, it’s not a bad bet.

This breakdown basically goes along with my train of thought on your FRC investment:

https://seekingalpha.com/article/4589312-first-republic-dimons-rescue-is-bad-news-for-commons

Any “injection of capital” is highly likely to come “with strings attached”. The white knight, whoever they may be, has all of the leverage in discussions.

https://finance.yahoo.com/news/retail-traders-plowed-more-than-200-million-into-regional-bank-stocks-over-the-last-week-171107308.html

“retail investors” is a not so subtle putdown.

We analyze U.S. banks’ asset exposure to a recent rise in the interest rates with implications for financial stability. The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity. Marked-to-market bank assets have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%. We illustrate that uninsured leverage (i.e., Uninsured Debt/Assets) is the key to understanding whether these losses would lead to some banks in the U.S. becoming insolvent– unlike insured depositors, uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run. A case study of the recently failed Silicon Valley Bank (SVB) is illustrative. 10 percent of banks have larger unrecognized losses than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent of banks having lower capitalization than SVB. On the other hand, SVB had a disproportional share of uninsured funding: only 1 percent of banks had higher uninsured leverage. Combined, losses and uninsured leverage provide incentives for an SVB uninsured depositor run. We compute similar incentives for the sample of all U.S. banks. Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk. Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4387676

As I pointed out the last time you waved this around, the premise of the study is that half of uninsured deposits withdraw. I asked how likely that is. You didn’t answer. And nine if your “I know stuff cause I write as if I know stuff” nonsense. What are the odds, with the FDIC offering expanded deposit insurance and Primary Borrowing vastly expanded, that 190 banks will suffer a loss of half their previously uninsured deposits?

A little realism. Please.

And even as we speak a lot of uninsured deposits are converted to insured deposits by banks offering to split each million into 4 different insured accounts of 250K each. So uninsured deposits are going down.

Good point. Last I checked total deposits were also going down. Something tells me that Stevie’s usual the world is falling apart will not pan out.

There are roughly 4,155 FDIC insured banks in the U.S. At $250,000 per deposit, a single individual or entity could ho!d $1,038,750,000 in insured deposits. Sure hope that’s enough…

The insured limit is the same at banks large and small.

It’s interesting to note, most of these “bailouts” recently were privately funded bailouts.

https://finance.yahoo.com/news/pacwest-lands-14-billion-in-new-cash-after-deposits-drop-20-145014160.html

It tells observers not trying to create their own narrative something. But seemingly it tells “free markets” Kopits nothing. Kopits is looking with his own eyes as his wife enters the convent due to boredom but chooses to believe the story she told him that she’s shacking up with Channing Tatum.

Stevie??? STEVIE!!!

Guess not.

We used to call him “Little Stevie” back in the day. That was before the MAGAs kidnapped him, took him to the militia governed areas of Michigan, and performed scientology-like dianetics and auditing on him. Edith was never the same after that and refuses to discuss it. Every once in awhile you can hear Edith whisper ever so faintly “Where’s my Little Stevie?? Oh…… Little Stevie”

Dude – we all read that discussion already. Do try to catch up with the grown ups.