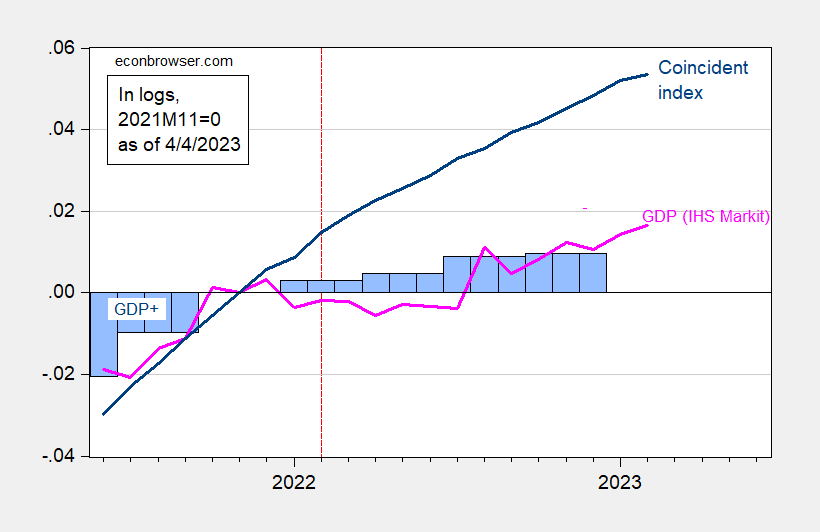

The divergence between performance recorded by primarily labor market indicators (in the coincident index for February released today) and output based indicators persists.

Figure 1: GDP+ (blue bars), Monthly GDP (pink line), and coincident index (blue), all in logs 2021M11=0. GDP+ level calculated by iterating growth rates on 2019Q4 actual GDP. Red dashed line at expanded Russian invasion of Ukraine. Source: Philadelphia Fed, Philadelphia Fed via FRED, S&P Market Intelligence, and author’s calculations.

Off topic – Commercial real estate is being talked up as the next liquidity domino:

https://www.moneycontrol.com/news/business/economy/will-us-commercial-real-estate-cause-the-next-banking-crisis-10359961.html

https://markets.businessinsider.com/news/stocks/commercial-real-estate-market-outlook-global-bank-turmoil-leon-cooperman-2023-4

And not just because of banking sector troubles. Commercial real estate has been sick for some time, and is getting sicker in some markets:

https://www.mercurynews.com/2023/04/04/san-jose-san-francisco-silicon-valley-office-vacant-real-estate-tech/

https://www.bizjournals.com/albany/news/2023/04/03/columbia-circle-albany-office-foreclosure.html

And there’s this:

https://www.jpmorgan.com/commercial-banking/insights/what-a-us-debt-default-means-for-multifamily-real-estate

Except Commercial real estate is getting a liquidity influx. Outdated articles aren’t particularly useful.

Bott, you puffed-up twit, none of these “outdated” articles is more than a few days old. Do you have any evidence, any at all, for your claim.

Not much real debt into CRE banking. Crypto was about a 2 trillion bubble in 2021 money. Oil bubble 1 trillion in 2014 dollars. Real Estate bubble??? 16 trillion in 2008 dollars. Y2K bubble??? 6 trillion in 2000 dollars. I doubt CRE is even 500 billion in 2023 dollars. Couple that with the bottleneck phase of Covid over, businesses are returning to the office. Thirdly, I agree with Morgan that this tech recession is probably over. Most of the layoffs were in the summer/fall of last year and have really fallen off outside media banter which occurs in business cycle lags.

These articles seem like the “corporate debt bubble” hype of the late 2010’s. A misunderstanding of how debt operates and why it operates. Leverage proceeds debt expansion. Its the build of leverage that basically creates the debt cycle. For example, 99-00 saw a build up of leverage in financial markets of ready made debt. This may surprise people. If not for the Y2K layoffs, which blunted its release for a year, the housing bubble may have proceeded quicker. Once by the end of 2001 and most of the layoffs over, the system surged and created a massive bubble not seen since the Great Depression. Pent up demand from aging Baby Boomers who delayed housing construction in the 90’s, then turned into flipperfest by 2004 pushed by ARMS.

CRE is small relative to residential MBS, corporate junk, and a variety of other borrower sectors. But mid-sized banking is 80% of the credit provision to CRE. If (as) mi-sized banks engage in more stringent liquidity management (in other words, limiting loans to riskier credits(, CRE is vulnerable to a liquidity crunch.

In these articles, there isn’t much talk of the risk of CRE to the banks. Rather of the banks to CRE. Vacancy rates are up in 65% of the 200 largest markets since 2019, down in only 35%. That’s a problem for cash flow and for debt-service ratios, which is a problem for loan roll-over. The fact that credit to CRE is heavily dependent on mid-sized banks – which often means regional banks – compounds the risk to CRE.

The divergence could be partly due to this:

https://fred.stlouisfed.org/graph/?g=gUc

Capital investment as a share of GDP has been low since the Covid recession.

And this:

https://fred.stlouisfed.org/graph/?g=12aUj

Lower productivity sectors have been adding workers faster than higher productivity sectors.

Investment demand has a pro-cyclical nature. But yea – it does respond to changes in the cost of capital.

Jonny boy in his zest to convince us otherwise found another paper this fool did not understand. You see – the paper produces lots of reasoning and actual evidence that the interest sensitivity of investment may be less than it was decades ago but the evidence still notes investment decisions are interest sensitive. Yea Jonny boy gets on his soap box and tosses out papers that he only thinks supports his weird view even though any sane person would realize that Jonny’s own links contradict his latest BS.

“Yet, a large body of empirical research offer mixed evidence, at best, for a substantial interest-rate effect on investment. In this paper, we examine the sensitivity of investment plans to interest rates using a set of special questions asked of CFOs in the Global Business Outlook Survey conducted in the third quarter of 2012. Among the more than 500 responses to the special questions, we find that most firms claim to be quite insensitive to decreases in interest rates, and only mildly more responsive to interest rate increases.” [repeated yet again, as promised.]

https://www.federalreserve.gov/pubs/feds/2014/201402/201402pap.pdf

And this: “According to our findings, expansionary interest rate shocks have had expansionary effects on real investment in the decades before the 1980s, this seems to be less the case more recently. Our results suggest that, in recent decades, interest rate shocks have displayed ambiguous real effects on investment and may be neutral. The decrease in the interest rate sensitivity of investment is particularly pronounced for the United States.”

https://www.econstor.eu/bitstream/10419/222283/1/intrate_sens.pdf

It’s understandable that pgl would stubbornly cling to a dubious fundamental tenet of investment theory and the traditional theory of monetary policy transmission, particularly when that theory supports his principal pretext for helping Wall Street investors.

You can repeat your first link all you want. The phone calls with stupid CFOs does not impress anyone except a moron like you. Your other link notes interest rates still impact investment decisions which contradicts the garbage you keep spewing. So Jonny boy’s point is ??? That he lies and/or he’s stupid. OK!

Johnny, you poser I have pointed out repeatedly that the text of the study you are quoting indicates that over 31% of U.S. firms will have reduced investment plans since the beginning of 2022, based on the increase in borrowing rates over that period. You have never addressed that fact. Repeating carefully selected quotes from that study, but ignoring the rest, is dishonest. Refusingto address the actual implication of the article is intellectual cowardice.

Yes, Ducky, 31% of firms—a very significant minority—reduce their investment plans…but 69% are insensitive. Since when do we make policy decisions exclusively for the significant minority, who may create new jobs sometime in the future? The lag time between an investment decision and its being shovel-ready could be years. And then there will be some additional jobs, but not nearly as many as mainstream economists would have you believe, given documented evidence that corporations are increasingly insensitive to changing rates.

By contrast, Wall Street investors see an almost instantaneous boost to the values of their portfolios and are the immediate beneficiaries, though Ducky and pgly are loath to mention that! I wonder why…could they be using the “benefit to workers” narrative to justify a policy that benefits the wealthy? It happens all the time…

Ducky and pgly never mention the other downside, which Stiglitz illustrates: “Older people who depend on interest income, hurt further, cut their consumption more deeply than those who benefit — rich owners of equity — increase theirs, undermining aggregate demand today.”

https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

It’s not just older people. Anyone who is trying save—for a down payment on a house, for their kids college, or for their own retirement—needs to invest in relatively safe assets…exactly the ones bearing a marginally positive interest rate for the last 15 years. Low interest rates adversely affect tens of millions, if not hundreds of millions of Americans. But you won’t catch Ducky and pgly talking about any downsides to their Wall Street first advocacy.

All the hype from mainstream economists promotes the narrative that lower interest rates help workers, which is true to a Why do Ducky and pgly preference wealthy stock market investors and hurt savers? I think we know the answer.

Johnny, you changed your story. Your claim was that private firms are insensitive to interest rates in their investment decisions – an absolute statement. That absolute statement was wrong. And, by the way, that 31% is the number for a 200 basis point increase in rates. Rates have risen more than that, but the paper in question only discusses 100 and 200 bp rate increases. So your assertion that “69% are insensitive” is wrong. At best, 69% are insensitive to smaller interest rate increases than we have experienced – a point I have made repeatedly but that you seem not to have understood.

“Since when do we make policy decisions exclusively for the significant minority?” Ridiculous question, having nothing to do with how policy is made and not much to do with the debate your losing so badly. Your simply grubbing around for something, anything, to defend your nonsensical position.

Tirst, where’d that come from? That’s not a position anyone had staked out till you brought it up. Second, what’s with “exclusively”? That’s a dumb condition, a rhetorical trick. And finally, of course they would! Would the Fed change policy if a “significant minority” of workers lost their jobs? Absolutely. Pllease don’t pretend they wouldn’t. Would it matter to Fed policy if a “significant minority” of consumer prices were falling? Of course it would. That’s why the San Francisco Fed maintains data on price dispersion.

All this thrashing around you’re doing is just digging you in deeper. Investment, in the aggregate, Is sensitive to interest rates. The paper you cited made that clear, even though you didn’t realize it. Why we’re suddenly on to the topic of policy makers’ response to a “significant minority” of this or that, I don’t know, but you’re wrong about that, too.

Way back when you decided to plant your flag in the stupid idea that rates don’t matter, I mentioned marginal analysis. You should have paid attention. A truisms of economics is that all the action is at the margin. You claim about investment sensitivity and about policy both ignore that truism.

You’re bad at this economics stuff, Johnny. And you’ll never get better until you admit that fact.

Jonny boy found ONE paper to rehash and misrepresent over and over again. Get used to it as Jonny boy has serious emotional issues.

The judge will likely not put a gag order on Trump today but a lot of smart lawyers are talking about “progressive” enforcement if Trump keeps shooting off his pathetic mouth. Some of these lawyers have 3 year old kids and note that they sometimes use progressive enforcement when their little kids gets out of line.

Donald J. Trump – 3 year old brat!

Marjorie Taylor Greene came to Manhattan hoping to lead a pro-Trump rally:

https://www.msn.com/en-us/news/politics/alexandria-ocasio-cortez-celebrates-marjorie-taylor-greene-getting-heckled-in-new-york-city-at-a-pro-trump-rally/ar-AA19tnQl?ocid=msedgdhp&pc=U531&cvid=fa4439ee891241c3bef555dda5312cac&ei=11

We know AOC does not like Greene but it seems everyone in NYC hates Greene. So Greene tucked her tail and ran.

You may have missed the live video:

https://tenor.com/view/oops-turn-around-run-back-baby-whoops-gif-15733702

That comment is defamatory to three-year-olds. First, their ignorance is excusable. Second, at three years old the brain has not developed sufficiently to discern truth from fiction. Third, a three-year old will rehabilitate.

This goes to Macro’s poor points above, but SVB and its ilk wasn’t a bank run. It was a wealth adjustment. Banks that specialized in tech startups caused by the crypto fad got caught up in a huge deposit surge. This is not a banking crisis at all. People need to educate themselves. It would REALLY help. Wealth moves. These banks losses or normalization was other markets gains.

Commercial real estate banking has been whined about since 1980. But its never produced a banking crisis on its own, because its too small and little actual ties to the dealer network. Similar to the Oil bubble the market created after 2010 despite global production growing along its normal trend path since 1983. People predicted ‘bank failures’ but it really didn’t add up to much. The biggest near miss of a bank run was on the subprime commercial side in 2019. Leverage had popped and interest rates were skying on these products which had popped a auto bubble. The Covid “packages” basically paid them off. What if the same had been done in the spring of 2008??? Probably no bank run that fall. Money talks. Money moves.

Bott’s poor effort to cover his own errors relies on redefining bank runs, misunderstanding sources of credit and misconstuing what I wrote.

When depositors pull deposits in an effort to get their money before the money runs out, that’s a run. That’s what happened to SVB. Anyone who has any doubt can check the statements and testimony of bank regulators.

Commercial real estate doesn’t rely heavily on brokers, but so what? Medium-sized banks are the source for about 80% of commercial real estate lending, as is stated in at least one of the articles I linked to. Bott wither didn’t bother to read them, didn’t understand them, or is engaged in some silly effort at misdirection.

Bott offers a little lecture on bank runs and oil, but the lecture has little to do with the risk of liquidity shortage for commercial real estate, which is the point I raised and the point of the first two articles I referenced.

Bott routinely asserts some notion or other, in a few words, without offering evidence for his assertion. Here, he does the same thing, but at greater length. Greater length reveals greater deficiencies. He either doesn’t understand the point I made, or has chosen not to address it, but to pretend that he has.

Here’s Bott, once again claiming knowledge with no evidence to back it up. He talks down to Anonymous, relying on the Bott “I know stuff, so I don’t need evidence” attitude.

Good old Manny Kant offers the correct understanding of Bott:

“Arrogance is, as it were, a solicitation on the part of one seeking honor for followers, whom he thinks he is entitled to treat with contempt.”

Let me also expand on how bad people like “Anon” misread oil. After the financial crisis, world oil production stayed about the same. The price rising in 2010 was complete fraud. Yes, it was financial engineering. They already had tankers full of gas and oil 1000’s lines long. By 2014, they realized it was ovet. Yet oil production never changed. Educate yourself anon. Please.

Yes, anybody into investment banking knows it was just post financial crisis fraud. The Arab Spring which ended up not changing oil production a great cover for the fraud. They charged excessive prices in a weak economy, until by the summer of 2014, when after years of manipulation oil companies said no mas with the excess storage. Sachs dumped their long positions and prices crashed. US oil production was irrelevant. Tar oil is very limited in its use. Nominally it looked like production was surging, but not when compared to world wide production. It was just a benefit of the price bubble.

i occasionally post petrol supply and product data from weekly eia reports. mostly micro and mostly short time horizon.

what do you think i get wrong? i have views on pricing and for-exchange impacts but i do not recall sharing here.

since jan 2023 i am less long on oil…. has to do with my expectation of demand trends near term.

between us’ sanctions, us’ shifts to strong exporter of product and modestly lower importer of crude, fueled by releases from the strat petrol reserve too much market interference in world’s largest [net] consuming bloc.

you may have a different anonymous?

Trump fingerprints leaked from NYPD.

https://twitter.com/williamlegate/status/1643336535981400065

Did any of these prints look like a mushroom? Let’s ask Stormy Daniels.

I knew he was slimy, but slimy enough to leak?!? Pretty bad!

Adding to my point above. World oil production has not grown since the pandemic. Oil is the Arab life blood and their economies depend on it. OPEC has really been a zombie since the 90’s, just a KSA mouthpiece. Officially disbanding it would not surprise me. You stop pumping, you die.

https://www.bls.gov/news.release/jolts.nr0.htm

‘The number of job openings decreased to 9.9 million on the last business day of February’

Less than 10 million for the first time in a while. The press is freaking out that the high interest rates from the FED may be having an effect.

But forgot all of that as Nobel Prize winner whatever tells us that high interest rates have no aggregate demand effect. Yea he keeps rehashing a couple of papers that he continues to blatantly misrepresent. But you have to understand – Jonny boy knows everything and we economists are all paid for boobs. So forget this news from the BLS. Never happened~!

ADP reports only 145,000 new jobs in March. But what do they know? JohnH keeps telling us high interest rates do not matter. Folks – disregard any economist or any economic report as we must trust the serial babble of Jonny boy to be reality. Cause he said so,

OTOH tens of millions of small savers still are still receiving negative real interest rates…essentially paying the bank to hold their money, which loses more purchasing power the longer it sits. And this nonsense has been going on for 15 years.

And yet pgl wants to make real rates even more negative, so that tens of millions of small savers suffer even more…making it harder to accumulate the down payment on a house, save for their kids education, or retire. That’s how he cares about workers? He won’t even talk about any downside to lowering interest rates!

I wouldn’t believe a word from mainstream economists who say that they care about workers. Their “care” is a cynical ploy to get support for lowering interest rates so as to boost the value of Wall Street investors’ portfolios.

Wait – small savers are not getting the high interest rates you kept telling were wonderful because there was no way high interest rates could lower aggregate demand. Of course you repetitive misrepresentations of what your own self selected paper said have been called out.

There is are reasons why small savers do not capture the recent rise in the returns to short-term interest rates. Stiglitz has noted the market imperfections that should be addressed but little Jonny boy is too busy misrepresenting what Stiglitz has written to have noticed the good economics I have often noted, which could help small savers without risking a recession.

But little Jonny boy is too busy sitting on his stupid soap box to actually engage in real economics. So the most worhtless troll just chirps pointless little insults at people like Macroduck and me.

Macroduck has this right – you are stupid, pointless a serial liar, and not worthy to have a seat at the grown ups table. Now if you ever STFU and bothered to learn economics – let us know when you are ready to have an adult conversation.

Higher rates are wonderful…but they’re still not positive real interest rates.

pgl likes negative real interest rates…the lower the better…because they’ll the value of his stock portfolio rise. And maybe he’ll even spend a little of the gain. But ordinary folks, particularly retired folks would be more like to spend the income from increased rates, thereby increasing aggregate demand.

As Stiglitz has said, “older people who depend on interest income, hurt further [by negative real rates,] cut their consumption more deeply than those who benefit — rich owners of equity — increase theirs, undermining aggregate demand today.”

https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

pgl simply can’t abide the fact that low rates have downsides and hurt tens of millions of .

The ADP jobs export for March was softer than expected, showing 145,000 new jobs. The 3-month average for Q1 is a gain of 119,000 per month, the slowest since the 3 months ended in February, 2021.

Several sectors reported job losses, including manufacturing, finance, professional and business services and information.

Among regions, the South reported 228,000 jobs lost, which looks a bit suspicious. All three southern sub-regions lost jobs, also suspicious.

ADP’s commentary made no mention of job losses in the south; I have to wonder whether ADP is a bit suspicious, too, but doesn’t want to draw attention to something for which they have no explanation.

FedEx has announced 25,000 job cuts by May, so 12,500 per month on average, in the next two jobs reports.

Interesting context for the UPS labor talks staring this month, which have beenprefaced by threats of a strike starting August 1 if a deal hasn’t been reached.

CNBC reports the 3-month average ADP hiring figure at 175,000. Dunno why my FRED-based average is different. Better trust CNBC.

Odd little story from CNBC. It reports that high inventory costs are leading to inventory reduction, and that those costs are being passed on to consumers:

https://www.cnbc.com/2023/04/05/as-economy-weakens-inflations-inventory-gluts-are-here-to-stay.html

The only explanation offered for the oddity of excess Inventories leading to higher prices (or anyhow, the intention of high prices) is that a majority of firms report that they don’t plan to liquidate excess Inventories.

Similar reporting, same source:

https://www.cnbc.com/2023/02/13/a-new-inflation-warning-for-consumers-coming-from-the-supply-chain-.html

‘high inventory costs are leading to inventory reduction’ Wait – wait higher interest rates might lower a component of aggregate demand? NO, NO, NO – JohnH says this is not possible. And he even has two papers that he has totally misrepresented. Give Jonny boy his Nobel Prize!

Of course costs are being passed on to consumers? Hasn’t Ducky noticed that corporate margins are near an all time high? Of course, savings from a more stable supply chain have yet to be passed along. (It must all be the fault of workers and government, Corporate America’s favorite scape goats!

Apparently, Johnny has had his wee feelings hurt. Such a tantrum, little Johnny!

Excess inventories typically put downward pressure on prices. Didn’t think I needed to explain that, but for Johnny, I guess I do. So firms are planning to behave in a way that is unusual. I found that interesting, relevant to both the inflation outlook and policy. Apparently, Johnny only cares about tantrums.

Why are you not seeking professional help for your obvious emotional problems?

Interesting piece from Politico: “ Bragg’s case against Trump hits a wall of skepticism — even from Trump’s critics.”

https://www.politico.com/news/2023/04/05/alvin-bragg-case-against-trump-00090602

Question is, why haven’t Democrats been able to pin Tump with a consequential case? Why do we have to keep repeating, “are we there yet,” like my kids, when the trip gets too long. Seven years targeting Trump and nothing, nada!

As it is, Democrats are making Trump a martyr and a mockery of the judicial system. Wow! Great job!

Somebody needs to get the goods on Tump, but it seems that Democrats are too pathetic to target his corruption (Republicans might return the favor.)

Only in a world in which the justice system is a purely political tool does Johnny’s comment make sense. Democrats in the House impeached Trump twice.

The wheels of justice grind slowly. Collect evidence. Evaluate evidence. Gather testimony. Evaluate some more. Prosecutors, who ought not turn their offices into political tools, are in charge of these efforts, not members of Congress or political hacks. It takes time and effort. Kinda like economics in that regard, and Johnny doesn’t have patience for that, either.

Mike Pence is about to testify. I wonder if Jonny boy is working with the Trump team to trash the former VP in advance.

“why haven’t Democrats been able to pin Tump with a consequential case?”

Ah – Jonny boy plays Trump defense attorney. Watch out behind you as Jack Smith is going to take him down on two yuuuuge issues. Come on Jonny boy – time for you to defend Putin’s war crimes.

pgl: Remember this howler about whether Ukraine would push back the Russians, from JohnH Sept 2, 2022:”How is that trap working out?”

Yea – Jonny boy is inept at warfare, macroeconomics, and even the criminal justice system. The perfect person for a Trump Presidency if our nation turns really stupid in 2024.

Yeah, and Russia’s GDP dropped by 30% last year!

JohnH: The Bloomberg consensus of 3/25 was 9.6% drop.

Who predicted a 30% drop? Not me – not Macroduck, Maybe your little friend Princeton Steve but he is almost as dumb as you are.

Russia Seen on Course for Deep Two-Year Recession, 20% Inflation

Economy will contract 9.6% in 2022, 1.5% in 2023, survey shows Inflation seen at 20% this year, forcing rates to stay high

Yes, the Bloomberg consensus drop was 9.6%, but someone, who apparently chooses to remain anonymous, declared last June that Russia’s GDP was slated to drop by 30%. That kind of puts my skepticism about the success of a Ukrainian counteroffensive in context. In fact, it’s not entirely clear how much of offensive it was…or whether the Russian decided to retreat, recognizing that Kherson city, being on the far side of the Dnieper from their supply lines, would have been extremely costly to defend.

Wow!

Ducky forgets the whole Clinton Whitewater inquisition when he says, “Only in a world in which the justice system is a purely political tool does Johnny’s comment make sense.” And he forgets about problems like driving while Black. And he forgets how Obama and Holder gave “get out of jail free” passes. It makes you wonder how long Ducky has been living in la-la land.

The whole justice system may not be political, but there are clearly elements of it that are…and the folks at Politico (a Democratic leaning site) clearly worry that Bragg’s indictment of Trump may be one…making a martyr out of Trump as well as further damaging people’s faith in the justice system.

Personally, I’d like to see Trump convicted for something really consequential with irrefutable evidence, but it doesn’t look like anybody’s got enough goods on the Trump crime family to do him in.

Johhny is trying to cover up hos ethical gaff (a gaffe is when a political hack tells the truth) by pretending to read my mind. I didn’t say the judicial system isn’t used for political ends. I just don’t think it should be – separationof powers and all that. Johnny’s comment shows that he thinks tainting the legal system with politics is just fine.

Johnny misreading history while pretending to be a mind-reader. First, there’s this regarding White Water:

“Neither Bill Clinton nor Hillary Clinton were ever prosecuted, after three separate inquiries found insufficient evidence linking them with the criminal conduct of others related to the land deal.”

https://en.m.wikipedia.org/wiki/Whitewater_controversY

Johnny is using a case in which the Clinton’s were found innocent to argue for political interference by Democrats (how, exactly?) to see to it that Trump is found guilty. The White Water investigation lasted eight years. Johnny is all whiney about “why is it taking so long?” when investigations into Trump are of much shorter duration.

And yes, of course the Clinton case was driven by politics. Starr was in the pocket of the GOP, and manufactured a case against Clinton in the Lewinsky case after the White Water case produced no proesecutions.

So here’s Johnny, getting history wrong in an effort to claim I forgot. This is about a difference in ethics, not forgetfulness. Johnny – bad at economics, bad at history, bad at ethics.

Is Jonny boy’s real name Roger Stone? That would explain a lot.

“manufactured a case against Clinton in the Lewinsky case after the White Water case produced no proesecutions.”

Now how many times has Trump cheated on his wives? And some of these affairs were with porn stars who needed to be paid off. And yet there never were any impeachment charges on these matters. Impeachment for sheer treason – I guess little Jonny boy sees that as pure politics.

Menzie – off topic – but I really enjoy when you do economic comparison between states and their policy choices – it is analysis you rarely get in mainstream media as well as holding policy makers to task for their poor performance. Example – I recently read in NPR ( https://www.npr.org/sections/health-shots/2023/03/25/1164819944/live-free-and-die-the-sad-state-of-u-s-life-expectancy) about how the “U.S. was stalling on health advances” leading to lower life expectancy – it got me thinking about the poor healthcare choices red state policy makers/political leaders urged on their constituents – (don’t bother washing your hands or wearing a mask or social distancing or taking a vaccine) – a quick scan reveals the CDC life expectancy tables by state – https://www.cdc.gov/nchs/data/nvsr/nvsr70/nvsr70-1-508.pdf – Is it any surprise that Joe “Senator of the libertarian paradise – and mountain top mining/resource extraction” Manchin’s West Virginia is at the bottom of the chart – along with red states that limit access to healthcare? Oh really NPR? – it is “the U.S.” when a quick look at the chart reveals an almost ten year difference of life expectancy between blue states and red states. However, I did find a Krugman column in my quick scan – if the reporters don’t take note at least an economist does https://www.nytimes.com/2023/04/03/opinion/red-state-life-expectancy-death.html (labeled an Opinion by the sad grey NYTimes of the all the news that is fit to print)

(BTW – yes there is a mealy mouth but “what about” bad policy choices by unnamed individuals at the end of the NPR article)

Given the lag times involved, now is the proper time for the Fed to be cutting rates.

But instead, let’s wait a year or two and then look back and say the Fed should have been cutting in April, 2023.

It’s a tradition.

What I have been saying as I (like you) want to avoid a recession. Of course JohnH will claim we are Wall Street homeys for not cheering on high interest rates (that small savers do not get). If you have not followed the conflicting claims of JohnH, don’t as life is too short for a parade of stupid disinformation.

Higher rates are wonderful…but they’re still not positive real interest rates.

pgl likes negative real interest rates…the lower the better…because they’ll the value of his stock portfolio rise. And maybe he’ll even spend a little of the gain. But ordinary folks, particularly retired folks would be more like to spend the income from increased rates, thereby increasing aggregate demand.

As Stiglitz has said, “older people who depend on interest income, hurt further [by negative real rates,] cut their consumption more deeply than those who benefit — rich owners of equity — increase theirs, undermining aggregate demand today.”

https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

pgl simply can’t admit the fact that low rates have downsides and hurt tens of millions of people

Yes, the Bloomberg consensus drop was 9.6%, but someone, who apparently chooses to remain anonymous, declared last June that Russia’s GDP was slated to drop by 30%. That kind of puts my skepticism about the success of a Ukrainian counteroffensive in context. In fact, it’s not entirely clear how much of offensive it was…or whether the Russian decided to retreat, recognizing that Kherson city, being on the far side of the Dnieper from their supply lines, would have been extremely costly to defend.