“The Future of the International Monetary System,” a talk by Mark Sobel, former Treasury Deputy Assistant Secretary, Executive Director at the IMF, current US Chair next Tuesday (4/4), at H.F. DeLuca Forum (“Discovery Building”), 330 N. Orchard Street. Co-sponsored by the Center for European Studies and the La Follette School of Public Affairs.

Why is the dollar the world’s leading international currency? To what extent are the Euro and Renminbi potential challengers to the dollar? Have the sanctions placed on Russia by the US and its allies reinforced or threatened the dollar’s dominance in global finance? What are the greatest threats to dollar hegemony in the years ahead? Should the Federal Reserve take international developments into account when formulating monetary policy? Drawing on his decades of experience as a senior official at the US Treasury, G7, G20, and International Monetary Fund, Mark Sobel will discuss these crucial issues about global finance and the international monetary system. Mark Copelovitch, Director of European Studies, and Menzie Chinn, Professor of Public Affairs and Economics, will serve as discussants.

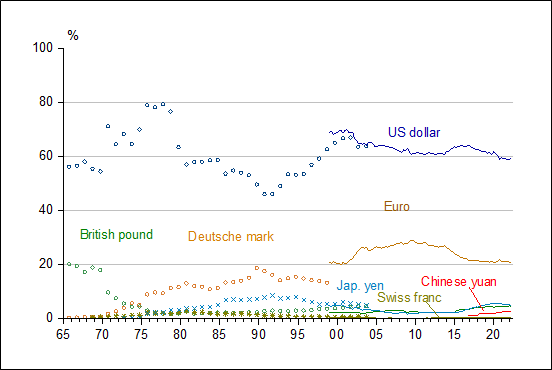

One aspect of dollar dominance is the use of the dollar as a reserve currency.

Figure 1: Share of reserves, from IMF, COFER.

A previous exchange with Sobel (and Bob Dohner) on the dollar (back in 2020) here.

Mark Sobel is also presenting in the LaFollette Seminar “The International Monetary Fund – Current Challenges” (Wednesday, 12:30-1:45, Rm 1328 Sterling Hall). The topic includes

critiques of the IMF from the left and right, thoughts on the IMF’s global financing role, the governance structure and resource adequacy, low-income country debt, Ukraine, and the climate.

It should be interesting!

https://www.reuters.com/business/energy/chinas-xi-tells-gulf-nations-use-shanghai-exchange-yuan-energy-deals-2022-12-09/

https://www.reuters.com/markets/commodities/china-led-sco-bloc-agrees-expand-trade-national-currencies-2022-09-16/

https://money.usnews.com/investing/news/articles/2023-02-07/china-says-it-will-set-up-yuan-clearing-arrangements-in-brazil

I suspect that the pace has quickened as major non-Western economies have come to realize that their foreign currency reserves could be stolen by the West if they happen to run afoul of the U.S.

Stolen? OK – our little idiot decided he wasn’t being noticed enough.

Over the years the US has seized (euphemistically called frozen) the foreign reserves of a number of countries that have run afoul, including Iran, Venezuela, Afghanistan, and Russia. It was the seizure of Russian reserves assets that finally made non-Western countries sit up and take notice. If it could happen to Russia it could happen to anyone. Over the long haul, the seizures will likely prove counter productive, as countries move to protect themselves by moving away from dollars. This is already starting with petrol states, originally at the root of dollar hegemony and with other economically important nations, like Brazil.

Sure the effects are not large yet, but the determination is there and the impact will become noticeable in the not too distant future.

JohnH: And here I thought the origins of dollar dominance were rooted in the dollar’s role at the center of the international monetary system created at the end of World War II. Silly me! I will immediately recast my understanding of international finance in light of your wisdom.

Oh my God – this is how the US makes money? Enforcing international law? Nothing else. Come on man – I never imagine anyone could be this dumb but hey.

“…the determination is there and the impact will become noticeable in the not too distant future.”

I guess the Great Karnak has spoken. Johnny knows what the future will bring for reserve management, just like he knows that there is no U.S. data series for real median income. Just like he knows that I work in the financial sector. Just like he knows that Russia’s invasion of Ukraine is all Ukraine’s fault…er, all NATO’s fault. Or was it all the fault of the U.S? Liberals? And just like he knows that interest rates don’t matter to investment. Johnny knows about “determination” and the future and stuff.

The view from India and concern about weaponizatiion of the dollar: “ The tremendous hold of the US dollar—which along with the Euro, is 80 percent of the world’s reserve currency assets—has become increasingly problematic for economies worldwide. This was already an issue after the 2008 financial crisis and the subsequent zero percent rate era, leading to distortions of asset prices. The post-pandemic era has aggravated the issue.

First, the weaponisation of the dollar by the US, especially seizing Russian reserve dollar assets, reminded the world of the reach and dependence on the dollar.”

https://www.forbesindia.com/article/bharatiya-vidya-bhavan039s-spjimr/petroyuan-or-petrobrics-the-need-for-better-alternative-reserve-currencies-to-break-dollar-dominance/84063/1

Ducky and pgly’s comments sound like a couple of smug, chauvinistic British Cassandras drinking tea in New Delhi a century ago, patting each other on the back, congratulating each about how clever they are, how the good tomes will never end, the sun will never set on the British empire, the pound will reign supreme forever. Then…poof…a few decades later, it was all gone. Cracks in the foundation start small and are easy to overlook and deny.

“the weaponisation of the dollar by the US”

JohnH – the Jim Jordan of international finance. You need to check into the Cukoo’s Nest.

“Moreover, the US’s attempt to counter domestic inflation by coming out of the zero rate era led to severe distortions in the global currency markets due to the dollar strengthening. With the world’s safest asset now yielding positive returns, global capital flowed to the dollar—it climbed ~15% percent against global currencies and ~30 percent against the Japanese Yen by late 2022. Central banks around the world could either increase rates with the US Fed (for example, RBI in India), sacrificing growth and yet get some currency depreciation; or hold rates but see their currency tumble (for example, Bank of Japan’s stance and the Yen’s great fall).”

Calling this “weaponizatiion of the dollar” is pathetically stupid even for you. Especially since you keep telling high interest rates are good for economic growth. Poor little Jonny cannot keep his lies straight.

its a game of choice, john. you complain about the usa and the dollar. but people have had some choices over the past decade. there was nothing stopping them from using the yuan form china, or the ruble from russia. most folks chose not to use them. as much as you complain about the usa, you think china and russia would offer worry free finances? what a crooked fool you are john. why not take all of your cash and move it into yuan or rubles? why have you not done so, john? or are you all talk?

Poor Johnny…. He doesn’t understand how things work, so he reliese on insults to make his argument, such as it is. Economics is hard, so why bother, right Johnny?

Recently, Johnny’s arguments in the face of economics have been that that:

I work in finance, so can’t understand financial decisions made outside the financial sector. Johnny doesn’t know where I work, but pretends he does.

Johnny linked to a paper about business investment decisions which impled that over 31% of firms would have reduced investment plans since January 2022 due to rising interest rates as evidence that interest rates don’t matter to investment.

Now, Johnny says I’m wrongbecause I’m a smug Cassandra. Johnny’s knowledge of ancient Greek literature is apparently as shakey as his knowledge of economics – Cassandra was cursed to be always right about the future, but never believed. Nice one, Johnny! Can we do colonial era literature next?

Johnny, if you are going to rely on cheap debating tricks, maybe you should get beter at them.

Assuming that by “the pace”, you mean the pace of decline in dollar reserves, you have based you suspicion on a faulty assumption. Reserves are held as assets denominated in the reserve currency, typically fixed income assets. Overseas holdings of Chinese fixed income assets have fallen lately, not risen:

https://www.ceicdata.com/en/indicator/china/external-debt

Based on the link you’ve provided, you have also mistaken reserve status for international medium-of-exchange status. Medium-of-exchange status is a necessary but not sufficient condition for reserve status. You iught also to recognize that, whie China is campaigning for expanded use of the yuan as a medium of exchange, othe countries have to take China up on its demand. Members of trading blocs may say they agree, but if those members aren’t command economies, it’s not really up to the governents.

This is rather like your misreading of the Fed paper on investment sensitivity to interest rates. You really don’t have a handle on how things work.

And, by the way, when are you going to make good on your claim that I work in the financial sector? You stated that as a fact, but have never come through with evidence. If you claimed to have knowledge you don’t have, then you were lying, Johnny. So, prove you aren’t lying. Tell the folks where I work.

It’s like little Jonny never learn to read a graph. Our host provided him with one which shows US$ represent 60% while Euros represent 20%. The yuan less than 5%.

Come on Jonny boy – preK teacher is trying to teach you how to read. Pay attention.

Why Jonny’s lust for Russian and Chinese dominance is not going to happen on this issue:

https://markets.businessinsider.com/news/currencies/dollar-dominance-russia-china-us-currency-wars-ruble-yuan-trade-2023-2

Russia’s attempts to combat the supremacy of the US dollar are unlikely to work, experts say, even as the country cozies up to China in a move to to challenge the greenback with an alternative reserve currency.

After being targeted by western sanctions over its invasion of Ukraine, Russia has vowed to “de-dollarize” its economy, with measures including shunning currencies from “unfriendly” countries and planning to create a new reserve currency with China to challenge the dollar’s position as the leading currency of global trade.

Last year, Russia announced that it would work with other BRICS countries (Brazil, Russia, India, China, South Africa) to develop an alternative reserve currency. However, those efforts to topple the greenback from its perch atop international markets are futile, experts say, and neither Russia’s ruble nor any move to promote a new reserve currency with China will mount a significant challenge.

According to Jay Zagorsky, an economist from Boston University, one of Russia’s chief problems is that its economy is inherently tied to the dollar through its oil trade. Crude oil is one of Moscow’s main revenue sources, and transactions are widely denominated in the US currency.

Zagorsky is skeptical that Russia’s plans for a reserve currency with China and other nations would see much demand. Past attempts to create a common reserve currency, such as recent plans between Brazil and Argentina, have typically failed, especially when partner nations are on uneven economic footing.

“Russia is a fragile economy and they’re heavily sanctioned. They’ve got a tremendous amount of economic difficulty,” according to Bob Stark, the head of market strategy at Kyriba. “Would Russia love to topple to US dollar? I’m sure, but that’s not really the conversation.”

The yuan is rising but challenges remain

The bigger player in all of this is China, which has struck a number of partnerships with other countries to boost the presence of its yuan on the world stage. Russia joining those efforts was simply a method of survival, a way to keep its economy afloat and keep trade flowing after being upended by western sanctions.

“It’s less of Russia trying to challenge dollar dominance more than China rising as a supereconomic power in the world. It’s part of a larger China strategy,” Stark said. He pointed to warnings from”Dr. Doom” economist Nouriel Roubini, who said a bipolar currency system could emerge over the next decade, wherein the yuan will rival the dollar in global trade.

But while Stark thinks a yuan-vs-dollar regime is possible, he said that scenario is only a distant possibility. It takes a long time for a currency to be trusted and widely used in trade, and it’ll take a long time to topple the greenback ,which has accounted for 96% of world trade in recent decades, according to data from the Federal Reserve. Meanwhile, the yuan accounted for just 2% of global trade in the first half of 2022.

Zagorsky rebuffed the notion that the dollar would be displaced by the yuan at all, due to China’s capital controls on its currency, such as limiting the amount of yuan that can be taken out of the country. As long as those rules are in place, that makes the yuan less liquid than currencies like the US dollar, and therefore less attractive.

“International investors and traders do not want to use a currency when they are worried their money will get trapped inside a country and they will be unable to move it out,” he added.

A report from the Carnegie Endowment for International Peace claimed that the yuan wasn’t a threat to the greenback, as the yuan’s internationalization requires dollar reserves to keep it stable. Nobel Prize-winning economist Paul Krugman added that he didn’t fear the US dollar losing its dominant position, and even if it did, it would be “hardly earth-shattering” for the US economy.

Paul Krugman notes this may be much ado about nothing:

https://markets.businessinsider.com/news/currencies/paul-krugman-dollar-dominance-weakening-currencies-china-yuan-russia-ruble-2023-2?utm_medium=ingest&utm_source=markets&utm_medium=ingest&utm_source=markets

Investors shouldn’t lose sleep over the recent focus on potential threats to the dollar’s dominance, according to top economist Paul Krugman.

The Nobel Prize-winning economist said Friday that he’s not expecting to see the greenback unseated as the major currency for international trade anytime soon – despite countries like Russia, China, and Brazil all cooking up potential challenges to it.

“No, the dollar’s dominance isn’t under threat,” Krugman wrote in a New York Times op-ed. “And even if it were, it wouldn’t be a big deal.”

The US has applied wide-ranging financial sanctions against Moscow since the invasion of Ukraine last year – prompting Russia and several other countries to work on dollar alternatives to reduce their reliance on the currency.

China is pushing for the yuan to replace the dollar in oil deals, while Russia and Iran are reportedly working together to develop a gold-backed stablecoin that could be used in international trade.

Brazil and Argentina could also team up to launch a joint currency that would serve as a South American equivalent to the euro, although Krugman has previously slammed the so-called “sur”.

“The idea seems to be that some regimes will turn away from the dollar to protect themselves against sanctions in the event they do something America disapproves of,” he said Friday.

“And so we have reports that China is trying to promote oil trade in yuan and Russia and Iran are considering creating a gold-backed cryptocurrency,” Krugman added. “And for some reason Brazil and Argentina are talking about creating a common currency along the lines of the euro, which is a really terrible idea.”

Krugman also noted that some of the chatter about the dollar’s potential decline had come from the rise of crypto.

Digital asset bulls have often proposed bitcoin as a future alternative to the greenback, although the token lost a lot of its shine last year when a combination of rising interest rates and the implosion of high-profile companies like FTX led to its price plunging over 60%.

“Where is the death-of-the-dollar buzz coming from all of a sudden? Some of it is coming from the crypto cult,” Krugman said. “Although cryptocurrencies have been around for many years and still haven’t come to play any significant role in legitimate business — not to mention the astonishing scale of the scandals that have plagued the industry — they’re still being hyped.”

But Krugman isn’t worried about any of those potential challenges to the dollar’s dominance.

He pointed out that when central banks have diversified their holdings away from the dollar in recent years, they’ve tended to favor small currencies like the Swedish krona and South Korean won over potential threats like the euro, Japanese yen, or bitcoin.

Krugman added that the main benefit the US enjoys from the dollar’s dominance is slightly discounted borrowing – which he called “ultimately trivial for what is, after all, a $26 trillion economy.”

“It’s hardly earth-shattering,” Krugman said. “Dollar dominance sounds important if you haven’t thought about it much, but much less so if you have. In fact, in general, the more you know about international currencies, the less important you think they are.”

On who worked for who and at what level, Jonny boy still has not told us the name of that former Fortune 200 company he worked for but maybe he did let on he was their CFO. Jonny boy told us his company’s hurdle rate was 15% for the years he worked there even as market rates varied a lot.

OK – this company hired a Village Moron as its CFO which is why this company went bankrupt.

Here’s something I’m sure “I love high interest rates because borrowers need to suffer” Jonny boy likely does not know. It seems with higher US interest rates that China as holders of 10-year government bonds are getting a 3.55% as opposed to the 2.8% interest rate on 10-year Chinese government bonds.

So who is stealing here? Oh yea – the PRC with those awful low interest rates – assuming little Jonny boy had an ounce of consistency. Which of course we know he never does.

Sad I can’t go to see Menzie and Mr Sobel. If I was in that geographic region I would try to make the effort. Unfortunately for me it’s been a long time since I was in the Chicago or Iowa areas (besides, if I was still driving, my dispatcher would probably screw me out of the two day break anyway)

I have expressed my disgust with Trump’s new toady lawyer Joe Tacopina. It seems some on Team Trump agree with me:

https://www.rollingstone.com/politics/politics-features/joe-tacopina-lawyer-donald-trump-alvin-bragg-1234707943/

A source familiar with the matter and another person close to Trump tell Rolling Stone that a number of Trump’s other current lawyers have privately described Tacopina as “dumb” and a “loudmouth.”

Well Joe’s client is dumb and a loud mouth so why not?

It’s like little Jonny never learn to read a graph. Our host provided him with one which shows US$ represent 60% while Euros represent 20%. The yuan less than 5%.

Come on Jonny boy – preK teacher is trying to teach you how to read. Pay attention.

Watching the NCAA Women’s final and both Iowa and LSU are giving us a shooting clinic. Some really excellent basketball.

3 idiot officials took Caitlin Clark out of the game for breathing. Congrats NCAA on F*cking up another title game on bad officiating. Where’d they find these 3 officials?? At an eye clinic doubling as the meeting place for anger management therapy sessions?? Take the greatest player in the game circa 2022-2023 and have her playing with one hand tied behind her back. Congrats to the F*ck up 3 person officiating crew. You 3 were the standout defenders for the LSU Tigers on April 2, 2023. Maybe they’ll hoist up the 3 officials’ names on a banner at LSU’s court “Co-MVPs 2023 Title Game”

An NCAA Championship game, decided by the following:

https://twitter.com/maggiehendricks/status/1642673619762307072/photo/1

Congrats NCAA for once again proving you are the only group of people as F**Ked up as donald trump’s WH staff. We knew it when you railroaded Tarkanian. We knew it when you railroaded Barry Switzer. We knew it when you never punished Bill Self for doing much worse things than Mike Boynton’s colleague did that you took a sledgehammer to Boynton and his innocent players for. And we know you are a F**ked up institution today, taking the ball out of the hands of the best player in the women’s game during a title game. Never change NCAA, as I barely watch 10 hours of your crap games yearly as it is now. 150 minutes of my life today wasted watching commercials and bad refereeing that I can never get back. Go to hell NCAA and go to hell zebras who think we watch the game to see their fatty belly dressed in stripes.

It was a bad call but come on. LSU won by 17 points.

it was nevertheless a wonderful tournament for clark and her hawkeyes. they will be back again next year. the tournament was great for the women’s game.

the ncaa is not held accountable to anybody, which is why they behave the way they do. who in their right mind thought it was a good idea to criminalize taking a poor young athlete out for a steak dinner? those rules were asinine. millions and billions of dollars were being made by everybody but the athletes on the field. that was not right. and the NIL rules are not any better. but they are the result of the ncaa ignoring its problems for way too many years. the lesson to be learned: take care of your business with fair rules today. or somebody else may impose worse rules tomorrow.

I watched this game. LSU was scoring at will and playing defense to the point I began to think of the Pistons from the 1990’s. Now I love brutal defense so when this got chippy, I was sort of glad to see a woman’s game turn real. But yea – these refs in their attempt to reign in the chippiness make some awful calls.

Caitlin Clark did manage to get 30 points but had she been allowed to go past 40 – the end would have been better.

One question – why did they let the LSU coach stand on the court for much of the game? They have a sideline area for a reason.

Look for the high school 3-point shooting finals. It’s a hoot.

Why Jonny’s lust for Russian and Chinese dominance is not going to happen on this issue:

https://markets.businessinsider.com/news/currencies/dollar-dominance-russia-china-us-currency-wars-ruble-yuan-trade-2023-2

Russia’s attempts to combat the supremacy of the US dollar are unlikely to work, experts say, even as the country cozies up to China in a move to to challenge the greenback with an alternative reserve currency.

After being targeted by western sanctions over its invasion of Ukraine, Russia has vowed to “de-dollarize” its economy, with measures including shunning currencies from “unfriendly” countries and planning to create a new reserve currency with China to challenge the dollar’s position as the leading currency of global trade.

Last year, Russia announced that it would work with other BRICS countries (Brazil, Russia, India, China, South Africa) to develop an alternative reserve currency. However, those efforts to topple the greenback from its perch atop international markets are futile, experts say, and neither Russia’s ruble nor any move to promote a new reserve currency with China will mount a significant challenge.

According to Jay Zagorsky, an economist from Boston University, one of Russia’s chief problems is that its economy is inherently tied to the dollar through its oil trade. Crude oil is one of Moscow’s main revenue sources, and transactions are widely denominated in the US currency.

Zagorsky is skeptical that Russia’s plans for a reserve currency with China and other nations would see much demand. Past attempts to create a common reserve currency, such as recent plans between Brazil and Argentina, have typically failed, especially when partner nations are on uneven economic footing.

“Russia is a fragile economy and they’re heavily sanctioned. They’ve got a tremendous amount of economic difficulty,” according to Bob Stark, the head of market strategy at Kyriba. “Would Russia love to topple to US dollar? I’m sure, but that’s not really the conversation.”

The yuan is rising but challenges remain

The bigger player in all of this is China, which has struck a number of partnerships with other countries to boost the presence of its yuan on the world stage. Russia joining those efforts was simply a method of survival, a way to keep its economy afloat and keep trade flowing after being upended by western sanctions.

“It’s less of Russia trying to challenge dollar dominance more than China rising as a supereconomic power in the world. It’s part of a larger China strategy,” Stark said. He pointed to warnings from”Dr. Doom” economist Nouriel Roubini, who said a bipolar currency system could emerge over the next decade, wherein the yuan will rival the dollar in global trade.

But while Stark thinks a yuan-vs-dollar regime is possible, he said that scenario is only a distant possibility. It takes a long time for a currency to be trusted and widely used in trade, and it’ll take a long time to topple the greenback ,which has accounted for 96% of world trade in recent decades, according to data from the Federal Reserve. Meanwhile, the yuan accounted for just 2% of global trade in the first half of 2022.

Zagorsky rebuffed the notion that the dollar would be displaced by the yuan at all, due to China’s capital controls on its currency, such as limiting the amount of yuan that can be taken out of the country. As long as those rules are in place, that makes the yuan less liquid than currencies like the US dollar, and therefore less attractive.

“International investors and traders do not want to use a currency when they are worried their money will get trapped inside a country and they will be unable to move it out,” he added.

A report from the Carnegie Endowment for International Peace claimed that the yuan wasn’t a threat to the greenback, as the yuan’s internationalization requires dollar reserves to keep it stable. Nobel Prize-winning economist Paul Krugman added that he didn’t fear the US dollar losing its dominant position, and even if it did, it would be “hardly earth-shattering” for the US economy.

Why Jonny’s lust for Russian and Chinese dominance…

Why Jonny’s lust for Russian and Chinese dominance…

Why Jonny’s lust for Russian and Chinese dominance…

[ Precisely the way in which racism is used to intimidate and harm a person. ]

The Chinese have no interest in “dominance.” That is an unfortunate colonial or imperial projection. China is developing and intends to continue and to share in developing partner countries. President Xi repeatedly explains this and developing nations increasingly understand and intend to share in the experience:

https://english.news.cn/20230324/d219437df2ed4eef9e9d897a7a2c68d2/c.html

March 24, 2023

From sapling to flourishing tree, vision of shared future thrives

BEIJING — Stepping onto an islet in Yanqi Lake of Beijing’s Huairou District, one can easily spot a grove of 21 white-barked pines standing in the tranquil location.

On Nov. 11, 2014, Chinese President Xi Jinping, along with leaders and representatives from other Asia-Pacific Economic Cooperation (APEC) economies, planted these trees to express the hope that the 21-member APEC community will realize common development….

https://english.news.cn/20230322/84e0cca10e57465c974b2d860925b383/c.html

March 22, 2023

Ten years on, China-proposed vision on community with shared future boosts world prosperity, stability

Tibet? Imperialism. Hong Kong? Imperialism. Taiwan? Imperialism. Uyghurs? Slavery and imperialism.

ltr – Jonny boy is a white dude. Yea he is also Putin’s poodle. Oh – I’m scaring a little dog. Excuse me.

Some recent stuff from our host are relevant to the discussion.

China is far less financially open than the U.S., and so less qualified to serve as the printer of a reserve currency:

https://econbrowser.com/archives/2022/10/the-chinn-ito-financial-openness-index-updated-to-2020

And there are entangled, self-reinforcing economic and geo-pitical factors that support continued dollar dominance as a reserve, investment, financial and payment currency:

https://libertystreeteconomics.newyorkfed.org/2022/07/the-feds-inaugural-conference-on-the-international-roles-of-the-u-s-dollar/

There are more where these came from. Menzie, I couldn’t find you Japanese press article, but it’s worth repeating, if you’d be so kind.

Reserve currency status is superficially a choice by reserve managers, but fundamentally, it’s a reflection of fundamentals. China’s efforts aim at providing government-created institutional alternatives to the natural state of affairs

There is no reason to think that China cares about displacing the “king” of currencies, rather than making sure the dollar cannot be effectively used to limit China’s development. The United States has been waging a war against Chinese development; a war against development that was shaped by Congress in 2011, and made more comprehensive during the Trump presidency and still more comprehensive during the Biden presidency.

China is simply countering the US; as in methodically building a comprehensive, independent and advanced space exploration program since 2011. The Chinese countering defense will continue, and will continue in fundamental material terms such as the successful development of an advanced Stirling engine * for shipping in 2021 and just now the introduction of a Stirling engine for deep space exploration.

* For converting heat to electricity

https://news.cgtn.com/news/2023-02-17/China-rolls-off-first-domestic-high-efficiency-heavy-duty-gas-turbine-1huP7qwZxTi/index.html

February 17, 2023

China rolls off first domestic high-efficiency heavy-duty gas turbine

China’s first domestic air-cooled heavy-duty gas turbine with the highest energy-efficiency level was rolled off the production line in Qinhuangdao City of north China’s Hebei Province, marking a breakthrough in the country’s heavy-duty gas turbine manufacturing technology.

A gas turbine, a device that converts natural gas and some other fuel into electricity as a core equipment for power plants, is described as the “crown jewel” by many engineers in China.

The heavy-duty gas turbine that rolled off the production line this time represents the most advanced technology in the current gas turbine power generation industry. It is also the most efficient thermal power conversion equipment in the world today.

The gas turbine has a length of 11 meters and weight of 400 tonnes.

It can use natural gas as fuel and can also be mixed with hydrogen to reduce carbon emissions. Compared with coal-fired power plants, the annual operation of its one unit can reduce carbon emissions by more than 1.5 million tonnes.

In addition, the gas turbine has strong peak-shaving capabilities and can increase power generation output within just one minute, providing support for new energy sources such as wind power and photovoltaic power generation.

Its power generation efficiency exceeds 64 percent, with a maximum of more than 830,000 kilowatts….

Says Xi’s slavery-denying, whiney propagandist. When you slip that leash off, come back and we’ll talk.

https://news.cgtn.com/news/2022-11-26/China-ships-its-first-F-class-heavy-duty-gas-turbine-1fhxPw7vfNK/index.html

November 26, 2022

China ships its first F-class heavy-duty gas turbine

By Gong Zhe

China has shipped its first F-class heavy-duty gas turbine from Deyang City, Sichuan Province on Friday, according to a report from China Media Group (CMG). *

The turbine, with a capacity of 50 megawatts, signifies China’s breakthrough in the area, CMG said.

It took over 13 years for the country to design and build such a turbine, which will enter real-world operations after shipment.

Heavy-duty gas turbines are core equipment for power plants. Many engineers in China describe it as the “crown jewel” in the manufacturing industry.

The turbine has tens of thousands of parts, which involved hundreds of companies and research institutions to design and manufacture. China has formed a supply chain of designing and building such turbines without the use of imported technologies.

* https://www.globaltimes.cn/page/202105/1224391.shtml

While on the topic of dollar kingship, this might be interesting:

https://www.phenomenalworld.org/analysis/the-imperial-fed/

The author (PIMCO guy, among other things) makes a case for expansionist motives for the creation of the Fed. I can’t vouch for the scholarship (not yet, but I’m going to look into it), but it’s an interesting premise.

Given the subject matter, we can expect the usual suspects to chip in with their usual-suspect stuff. Apologies for giving them an opening.

: )

Broad/tolerant view always wins the race. Ask the half turtle/ half hare

https://fred.stlouisfed.org/series/DGS20

Market Yield on U.S. Treasury Securities at 20-Year Constant Maturity

How a lot of financial economists measure the risk-free rate, which fell from 8% in late 1993 to 3% around 2016. JohnH pretends he was some big shot at a Fortune 200 company back in the day but refuses to say what he did when for whom. I doubt he was the CFO for Amazon from 1993 to 2016 but let’s pretend he was.

Jonny boy tells us that his company choose its cost of capital (hurdle rate) to be 15% and never changed it. Let’s see – the risk premium for Amazon is near 7% so back in 1993, the cost of capital just might be 15%. But by 2016 any rational CFO would have lowered it to 10%. I’m sure Amazon did which explains why it expanded so much.

But not Jonny’s firm which is why it went banrkupt.

Pgl refuses to say who he works for or who his patrons and handlers are…

If it makes you happy – I work for the mob. And we have decided to hunt you down and eliminate your boring lying rear end for the good of sane bloggers. BTW – your mother will thank us as you have embarrassed her enough.

@ pgl

I didn’t tell him who you work for or your name, I promise. Would YOU or Rosser have given me the same courtesy?? I doubt it. It’s OK I still love you Brother.

All hail Trey Young. : )

Remember EconoKash of Angrybear? It was a shame he got outed. I would not do that to anyone. BTW – I’m frustrated with my Hawks as all season they have been rather lackluster at defense. If they make it out of the Play-ins, there going down in the first round. Ahem.

OMG…pgl embarrasses himself yet again with his shameless ignorance about the hurdle rate in corporate investment decisions. The Fed paper clearly states that corporate hurdle rates had. been quite stable for a long time, even after implementation of QE. Corporations simply do not constantly readjust their hurdle rates in response to fluctuations in interest rates.

If he doesn’t that, he knows absolutely nothing about corporate investment decision making, and refuses to learn from what the Fed survey made abundantly clear

This is your answer to us asking you if you know basic finance? Damn – you are STUPID.

“The Fed paper clearly states that corporate hurdle rates had. been quite stable for a long time”

No troll – you are now misrepresenting what this SURVEY said. BTW – there is a serious litigation over the value of transferred IP for Facebook. Maybe you should call the Facebook lawyers and offer up your services as an expert witness as their own “expert” (who is a clown) is saying the cost of capital is only 14%. I would put this closer to 10$ based on solid financial economics.

So when you say you can defend a 15% rate – the taxpayer’s lawyers might want to know how you came up with this higher number, which would help their case. Now when you start babbling about a worthless survey expect them to fall on the floor laughing. Sorry dude but they will stick with their current clown as they would instantly know you would be a worthless “expert”.

List of required reading topics:

Arbitrage Pricing Model

Modigliani and Miller

Capital Asset Pricing Model

Hamada Equation

Divisional Cost of Capital

Applied Empirical Work on above applied to specific sectors.

All basic finance which you have shown over and over again that you do not remotely understand. Now a survey of CFOs even dumber than you is not learning financial economics not matter how often you make a fool out of yourself. But any CFO who is as inept as you are at estimating their own cost of capital should be fired before the shareholders sue upper management.

Now if you want us to stop calling you a lying moron, please tell us how the above applies to estimating the “hurdle rate” for TSMC and why is it far below your stupid 15%.

Johnny, your selective reading of that study is a sign either dishonesty or inability to comprehend what you’ve read. I’ve corrected you on this before, so I tend to think it’s dishonesty.

The study you’re citing said that investment plans were less sensitive to declining rates than to rising rates. The study was done at a time when policy rates and market rates were historically low. We are no longer in an environment of persistent low rates. Rates are rising. So the conclusion you keep repeating (and misstating) doesn’t apply to the current environment. And now, for the third time (fourth?), the study you cited implies that AT LEAST 31% OF FIRMS WILL HAVE REDUCED INVESTMENT PLANS SINCE EARLY 2022 DUE TO RISING INTEREST RATES!

Give it up boy! I’m Cassandra – you said so. And Cassandra is never wrong.

Jonny boy hears about some term hurdle rate and now he thinks he is Merton Miller. Oh wait – Jonny boy does not know who Merton Miller is. Other topics Jonny boy cannot address:

Arbitrage Pricing Model

Modigliani and Miller

CAPM

Hamada Equation

Divisional Cost of Capital

All key concepts when a smart CFO has to worry about estimating the cost of capital.

Now Jonny boy told us he gets the weighted cost of capital (sort of like knowing how to tie one’s shoes) but this dimwitted troll cannot do even a simple example.

BUT Jonny boy knows somehow that no CFO uses basic finance to the cost of capital? REALLY? All corporations are blatantly losing shareholder value? Jonny knows things the rest of us could never imagine.

Its good to be King

https://encrypted-tbn2.gstatic.com/images?q=tbn:ANd9GcQsWW5zhY1n8CxuWDbbrgvfsA0LDoBjvx0VTDc2eRvfZ5SZJdIu

Off topic, a thoughtful rehash of the whole Fed hikes/asset prices/banks/debtors-and-creditors thing:

https://adamtooze.substack.com/p/chartbook-207-the-trillion-dollar?

Tooze offers mostly “what is” rather than “what ought to be”, which apparently drove some of his readers crazy. It’s a pretty common response to thinking stuff through.

I got a non-payed subscription to Tooze. Most of his stuff is good and I feel a little ashamed I never seem to get around to reading it. Laziness and other things.