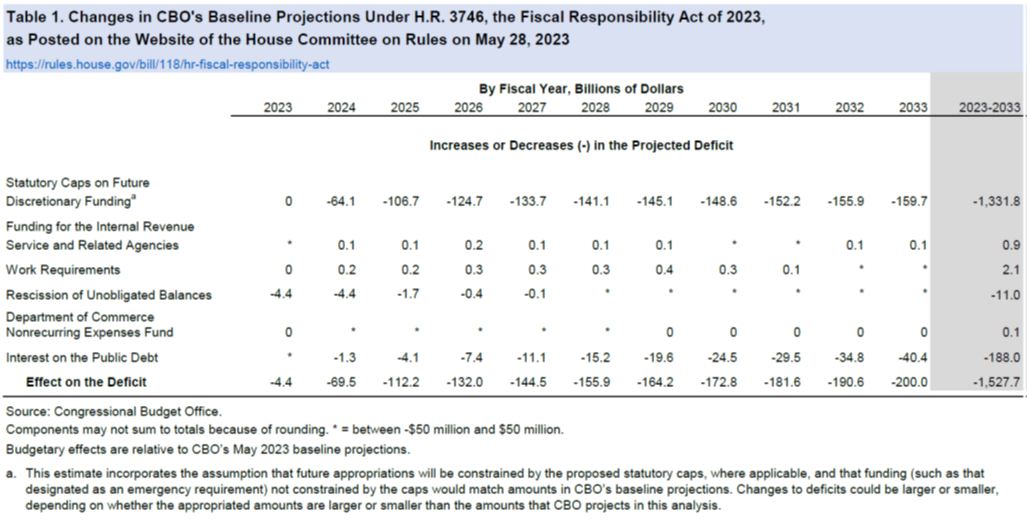

Note in the table reductions in deficit only start from FY 2024. The reduction is about 0.25 ppts of GDP in FY2024, about 0.37 ppts in FY2025.

Macro Impact? Relative to no debt-crisis standoff, from Bloomberg:

The peak impact will come later next year by lowering real GDP by 0.15%, cutting 150,000 jobs and increasing unemployment by about 0.1 percentage points, according to Mark Zandi, chief economist at Moody’s Analytics. “Not desirable given the uncomfortably high recession risks, but manageable,” he says.

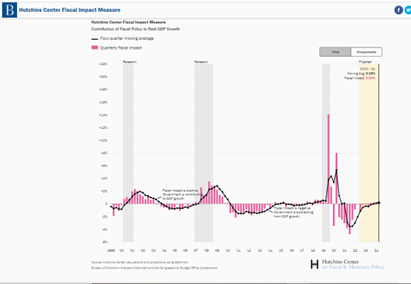

How does the plan affect the fiscal impulse? Pre-agreement, fiscal policy was going to exert a drag (even if neutral in 2023Q1). With little change occurring to spending until FY2024, this trajectory remains largely in place.

Source: Brookings Hutchins Center, accessed 5/31/2023.

Micro. Why no bigger impact from work requirements (and indeed why does spending rise)? CBO explains.

Work Requirements

Division C of the bill would modify work requirements for SNAP and TANF. CBO estimates that those provisions would increase federal spending by about $2.1 billion over the 2023–2033 period, consisting of an increase of $2.1 billion for SNAP and a reduction of $5 million for TANF. Those estimates are informed by a 2022 CBO report that examined the effects of work requirements on enrollment and earnings for participants in means-tested programs.7Supplemental Nutrition Assistance Program. To receive SNAP benefits for more than 3 months within a 36-month period under current law, able-bodied adults under the age of 50 who do not live with any dependent children must work or attend a training program for at least 80 hours a month. States can waive the SNAP work requirement for people who live in an area without sufficient jobs and, at the state’s discretion, can use a limited number of monthly exemptions for people who otherwise would be subject to the requirement. Under current law, states can carry over any unused discretionary exemptions indefinitely.

H.R. 3746 would make several changes to work requirements. The requirement would be expanded first (in fiscal year 2024) to able-bodied adults ages 50 to 52 who do not live with dependent children and then (in fiscal years 2025 and later) to able-bodied adults up to age 54 who do not live with dependent children. Several groups would newly be exempt from work requirements: people experiencing homelessness, veterans, and people ages 18 to 24 who were in foster care when they turned 18. Those changes would terminate on October 1, 2030.

The bill also would permanently reduce the number of monthly discretionary exemptions that states can use for people who otherwise would be subject to work requirements, and it would prevent states from carrying over unused exemptions for more than one year.

CBO estimates that all of the changes to SNAP work requirements would increase direct spending by $2.1 billion over the 2023–2033 period. During the 2025–2030 period, when the group of people up to the age of 54 would be subject to the work requirement and the new exclusions were in effect, approximately 78,000 people would gain benefits in an average month, on net (an increase of about 0.2 percent in the total number of people receiving SNAP benefits).Those changes are the result of several offsetting effects, CBO estimates. First, on its own, expanding the work requirement to adults up to the age of 52 in 2024 and up to age 54 over the 2025–2030 period would reduce spending for SNAP by $6.5 billion over the 2023–2033 period. Second, on its own, the exclusion of several groups would lead to a spending increase of $6.8 billion over the same period.

CBO expects that additional increases in direct spending would occur because the provisions would be enacted simultaneously. The new exclusions would not only apply to some beneficiaries under age 50 who otherwise would be subject to the work requirement under current law, but also would apply to some beneficiaries ages 50 to 54 who otherwise would be subject to work requirements under the bill. As a result, CBO estimates, direct spending would increase by an additional $1.8 billion. CBO estimates that the changes to discretionary exemptions would reduce spending for SNAP by a negligible amount.

Temporary Assistance for Needy Families. Under current law, to receive the full federal block grant for TANF, a state must ensure that adult recipients in at least 50 percent of single-parent families and 90 percent of two-parent families are engaged in a work-related activity. The percentages are lower for states that have reduced their TANF caseloads since 2005 and for states that spend more than a required amount of state funds to support TANF recipients’ activities. The Department of Health and Human Services (HHS) can reduce a state’s grant for failure to meet the percentage requirements unless the agency determines that the state has an approved reason for not meeting the standard or the state is complying with a corrective plan.Title I of division C would set the benchmark year for the caseload reduction to 2015 (rather than 2005) and would prevent people who receive less than $35 in state funding within a period determined by the Secretary of HHS from being included in a state’s accounting for the work requirement. CBO estimates that HHS would reduce state grants slightly because some states would not meet the work requirement and would not comply with a corrective plan, and HHS would not approve their reason for not meeting the standard. CBO estimates that the resulting reduction in block grants would reduce direct spending by $5 million over the 2023–2033 period.

Footnote 7 refers to this CBO Working Paper by Justin Falk.

Relative to debt default, we avoid a world recession of unimaginable nature.

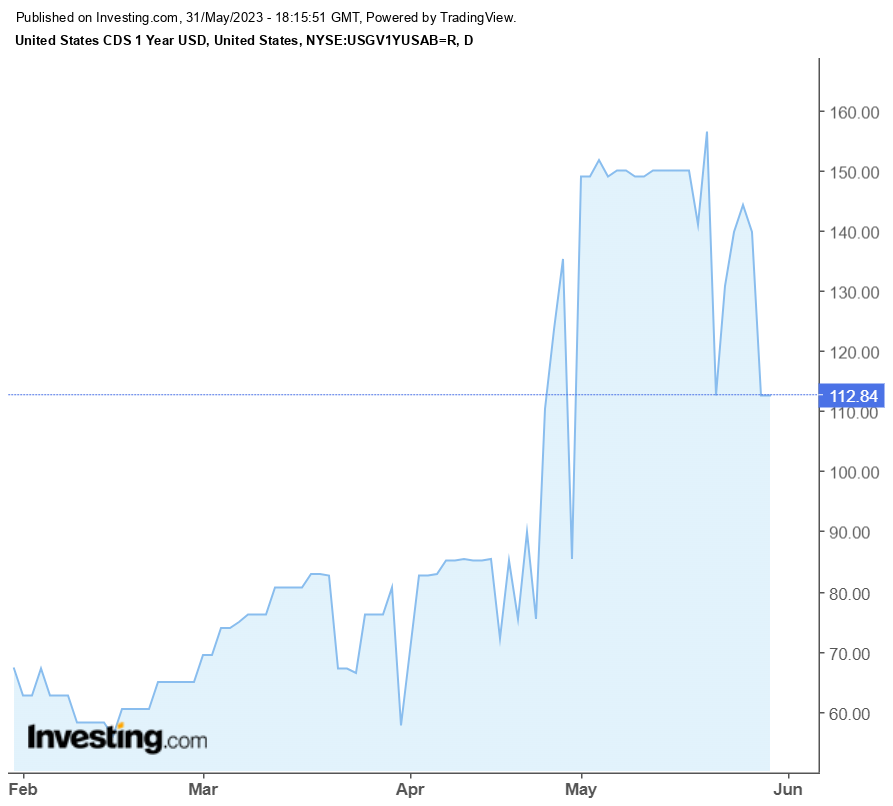

Odds of passage. Market betting as of yesterday.

Source: Investing.com, accessed 5/31/2023, 1:20pm Central.

Off topic but an interesting example of how corrupt a big shot accounting firm can be:

https://www.news.com.au/finance/money/tax/ok-until-the-ato-gets-grumpy-emails-revealed-in-pwc-tax-scandal/news-story/1323e6bb5a920ae49d624b583ad933d8

‘OK until the ATO gets grumpy’: Emails revealed in PwC tax scandal

Secret emails at the heart of a scandal engulfing consultancy firm PwC have been revealed, in a senate estimates hearing, as politicians blast the “cover-up”.

Secret emails at the heart of a scandal engulfing consultancy firm PwC have been read out during a Senate Estimates hearing.

Labor Senator Deborah O’Neill on Tuesday read what she described as the “famous last words” of PwC Australia partner Peter Collins — who is alleged to have shared confidential government information with colleagues in order to then effectively market tax avoidance schemes around the world.

PwC on Monday stood down nine unnamed partners over the widening scandal, which is now the subject of an Australian Federal Police (AFP) investigation.

According to Ms O’Neill, Mr Collins wrote in emails and text messages to colleagues, “OK in practice until the ATO gets grumpy and figures out the joke.”

He continued, “Little real chance of any anti-hybrid rule anytime soon. I spent three painful hours today. BOT [Board of Taxation] has zero idea. The only thing they get now is that it is complicated, and perhaps we should not rush, no need to share this because all supposed to be secret.”

The Senator said the excerpts were “just a smattering” of what was included in the 144 pages of PwC emails, The Australian Financial Review reported.

Yeah it is amazing how very smart people can be soo dumb.

“Note in the table reductions in deficit only start from FY 2024. The reduction is about 0.25 ppts of GDP in FY2024, about 0.37 ppts in FY2025.”

I guess this is why the Freedom Caucus is so upset. They wanted a massive reduction in spending so we would be assured of a large 2023/24 recession. MAGA!

The information on the work requirements is on top of my read pile. Thanks!

Overall Budgetary Effects of H.R. 3746

In CBO’s estimation, if H.R. 3746 was enacted and appropriations that are subject to caps on discretionary funding for 2024 and 2025 were constrained by the limits specified in section 101(a) of the bill, the agency’s projections of budget deficits would be reduced by about $1.5 trillion over the 2023–2033 period relative to its May 2023 baseline projections (see Table 1). Reductions in projected discretionary outlays would amount to $1.3 trillion over the 2024–2033 period (see Table 3). Mandatory spending would, on net, decrease by $10 billion, and revenues would, on net, decrease by $2 billion over the

2023–2033 period (see Table 4).

Not surprising that the fall in MANDATORY SPENDING (ooops – my PC was temporarily taken over by CoRev’s ChatGPT 1.0) was modest. Of course little CoRev told us none of this would fall at all.

Of course we know DISCRETIONARY defense spending was exempt from these scale backs. Oh wait – little CoRev did not know that.

Two things –

1) Note that the biggest predicted deficit savings come late in the ten-year forecast window, and that reduction in interest expense accounts for an increasing share of that reduction over time, but only 20% even in the final year of the forecast. This is the “current law” effect seen in such forecasts. Current law will no be in effect past the next budget cycle. Nearly all of the $1.5 billion in deficit reduction from the debt ceiling bill is an accounting fiction, including the saving on interest expense. This game of chicken was much more in service of politics than deficit reduction.

2) Zandi says the hit to GDP will probably be 0.15% in 2024. I earlier said the effect would be a 0.1% drag. I will fight Zandi to the death over that 0.05% difference…

Speaking of politics over deficits, remember that Democrats had the votes to raise the debt limit lwst year, and could have avoided giving Repulicans an election talking point by raising the limit in November or December. Democrats wanted this fight. They made a bet that Republicans would be hurt by once again showing their disregard for public welfare and their adherence to silly dogma.

Given the tiny concessions made to Republicans, Democrats won the fight. It is not yet clear that they won their bet. We won’t know until November, 2024. Can’t say I admire their tactics, but if they win control of the House and hold on to the Senate and presidency, the country will have some benefit from this poliical calculation.

This has all the way though been a master class of brilliant politics by the Biden administration. The fact that more democrats than republicans voted for this, in the house, says it all. The democrats have gotten their talking points without much of any pain. Sure it is “taking food away from poor people while taking tax enforcement away from the rich and corporations”, but when you look at the actual numbers those cuts are very small. The lack of increased taxes on rich and corporations are also a great talking points for democrats without giving GOP an opening on “tax and spend” against the democrats. Biden is clearly prepping for 2024 with the hope to win it all so he can institute even better policies than the impressive accomplishment he got so far. The extremes did not get their bloody fights against evil so both parties may have a motivating their hard core to come out and vote. But my guess is that the hard left are smart enough to look at and understand substance vs talking points.

“Under section 101(a), the caps on base discretionary funding for 2024 would total $1.590 trillion ($886 billion for defense and $704 billion for nondefense funding”

FRED is reporting that total defense spending is nearly $950 billion per year. I’m guessing so correct me if I’m wrong but this includes more than ‘base discretionary funding’ (and please have any correction not being the usual CoRev barking about MANDATORY).

I raise this because little Lindsey Graham insists we need another $50 billion per year. Huh – cut taxes for rich people and spend $1 trillion per year on defense spending will balance the budget and Chris Christie will lose weight if he eats even more doughnuts! m

One more brilliant part of the negotiated bill is that if the GOP blocks passing the detailed budget bills the default is to cut all spending (military and discretionary) equally. So the incentives are much stronger on GOP to make compromises to pass those bills. That makes it a lot less likely that GOP will put poisonous pill provisions into the budget bills or force government shutdowns over them.

At the end of this disturbing story there is a video of Tyler Russell aka little CoRev:

https://www.msn.com/en-us/news/politics/we-want-dictator-trump-america-first-activist-publicly-calls-for-trumpian-reich/ar-AA1bWQp8?ocid=msedgdhp&pc=U531&cvid=59931e8da5084722980880e1a4f8684f&ei=8

Tyler Russell, a Canadian nationalist leader of the America First movement, has called for Donald Trump to be installed as “dictator” in a “Trumpian Reich.” In a clip obtained by Right Wing Watch, Russell told the audience of his daily broadcast about his vision for a Trump government. “All of these DeSantis, you know, libertarian populist people that are like, we need to actually have political substance,” he complained. “No, I don’t give a f–k about that, okay? I don’t care about your political substance.” “I want a Trump Reich,” he continued. “And I want Trump’s face to be, you know, projected onto every single tallest skyscraper in every city around America, okay?” Russell insisted that his followers did not want “freedom.” “We want a total Trumpian Reich, okay?” he said. “That’s what we want. We want a total Trumpian Reich. We want dictator Trump.” “We want Trump to rule forever and ever and make America great again,” Russell added. “And we want all these people who are acting in bad faith, who are traitors to this nation, to go to jail. That’s what we want.”

Apologies to mp123 for hijacking his comment, but the link is a very useful contribution to discussion of renewable energy, and deserves lots of attention.

mp123

May 30, 2023 at 2:57 pm

JPM’s Private Bank piece on the subject is worth a read. Particularly the problems with LCOE as a metric, which only grows as more capacity is added. It was published in March 2023.

https://assets.jpmprivatebank.com/content/dam/jpm-wm-aem/campaign/energy-paper-13/growing-pains-renewable-transition-in-adolescence.pdf

Trump is once again running for president as a white nationalist:

https://thehill.com/homenews/campaign/4026334-trump-pledges-to-end-birthright-citizenship-on-first-day-in-office/

The Constitution is not a white nationalist document – 14th Amendment, Section 1:

“All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside. No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.”

A good Supreme Court would read this section as intended, and prevent States from attempting to disenfranchise Black, Hispanic, college educated, poor or Democratic voters.

“According to the Trump campaign, the executive order “will explain the clear meaning of the 14th Amendment,” which it says is that the children of foreign nationals born in the United States are not subject to the jurisdiction of the United States as defined in the Constitution.”

Maybe King Donald I will disband the Supreme Court as part of the Deep State.

Macroduck: “Speaking of politics over deficits, remember that Democrats had the votes to raise the debt limit last year, and could have avoided giving Repulicans an election talking point by raising the limit in November or December.”

Nope, they did not have the votes. It takes 50 votes in the Senate plus Harris to pass a reconciliation bill. Joe Manchin and Kyrsten Sinema announced that they would not support a debt ceiling fix that did not have bi-partisan support. So the reconciliation bill which became the Inflation Reduction Act had the debt ceiling fix excised. If not, there would have been no IRA.

With both Manchin and Sinema likely to be replaced by Republicans in the next election, the IRA is likely the last big Democratic legislation you are likely to see for a long, long time.

Dems had the votes had Joe Manchin and Kyrsten Sinema not turned all MAGA. But yea – these two are definitely DINOs.

As frustrating as Manchin and Sinema can be, there wouldn’t be an Inflation Reduction Act without them, perhaps the most momentous Democratic legislation since Obamacare. So calling them DINOs is wrong.

Keep in mind that Manchin was elected in a state that voted for Trump over Biden by 39 points! He must have some sort of magic. As for Sinema, she seems to be a total flake with no guiding principles.

With Manchin and Sinema gone in the next election, there are no more Democratic judges and no more Democratic legislation for a long time.

“With Manchin and Sinema gone in the next election, there are no more Democratic judges and no more Democratic legislation for a long time.”

Now there is the faint hope that the Dems can take a few Republican Senate seats back. Not saying I know which ones right now but damn the Dems need to do better in elections.