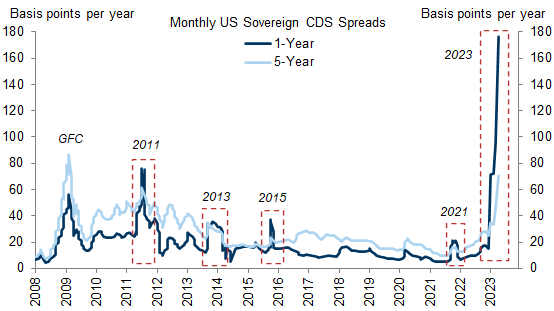

Higher (a lot) than 2011.

Source: Alec Phillips and Tim Krupa (Goldman Sachs, May 1, 2023).

They write “…at this point, we still think the Treasury is more likely than not to be able to pay all of its bills until late July without an increase in the debt limit.

However, there is a good chance that the Treasury’s cash balance will dip as low as $25-30bn for a few days in June.”

Yellen says June 1 is a possible x-date. CBO says sometime in June is not unlikely.

I think Yellen in her mind knows it’s later than June 1, but her kindly and patriotic nature of ringing the alarm bell is moving the date up.

A reading of the political realities would suggest that we will indeed end up with a default. Biden fully understand that he cannot give in to the GOP nutcases and those nutcases don’t understand that they are about to hurt themselves even more than they will hurt the country.

Risk is irrelevant. It’s whether a deal will be made or Biden declares the 14th and keeps paying debt irrelevant of Congress. June 1st is the drop dead date for a deal.

The only irrelevant things here are your worthless comments. Please go away.

Kids say the darndest things.

Meanwhile the mortgage spread (using FreddieMac data) is about 3%…as high as it has been at any point in the last 40 years.

https://fred.stlouisfed.org/graph/?g=BcSv

January 15, 2020

Thirty- and Fifteen-Year Fixed Rate Mortgage Average, 2020-2023

https://fred.stlouisfed.org/graph/?g=qVRC

January 15, 2018

Thirty- and Fifteen-Year Fixed Rate Mortgage Average, 2017-2023

Thanks for reminding us that mortgage rates were higher in early November than they are now. It seems JohnH does not know that even if he was chirping about mortgage spreads back then.,

Have you found a way to link to a FRED graph showing results of calculations? It would be interesting to see the 30 year mortgage rate minus the 10 year treasury, I.e. the mortgage spread. I did the calculation but haven’t found a way to paste a link to the graph with results showing.

You did the calculation incorrectly if we are to take the nonsense you wrote seriously.

The topic is CDS spreads, which of course little Jonny does not understand either. So he changes topics to mortgage rates which he decries as being too high. But wait – Jonny boy used to praise high interest rates. Yea – little Jonny boy has no clue what little Jonny said just yesterday.

FRED tells us that the 30 year mortgage rate = 6.43%.

FRED tells us that the 30 year government bond rate = 3.84%.

The difference is 2.59% which I guess is close to 3% if one’s IQ is in the single digits.

It has never been higher since 1983? Jonny boy’s evidence? Oh yea – little Jonny boy said so.

This is rich. When pgl can’t trash someone on legitimate grounds, he just makes stuff up…like his definition of the mortgage spread. I’ve tried explaining this to him many times…it’s the 30 year mortgage rate minus the 10 year treasury…but pgl’s brain remains as thick as a doorknob.

Proof? Here’s a definition provided courtesy of the St. Louis Fed: “Total mortgage spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the 10-year Treasury yield.”

https://www.stlouisfed.org/on-the-economy/2020/july/mortgage-rates-not-matching-declines-in-treasury-yields

And why, pray tell, would it be that instead of pgl’s fabricated mortgage spread? “The 30-year mortgage rate typically tracks the 10-year Treasury yield.”

Earth to pgl…can you read English?

My Lord – your huffing and puffing is pathetic. Yea some people don’t get maturity matching so neither does little Jonny boy. Hey troll – do you know what the Term Structure is? Didn’t think so as little Jonny boy never learned to tie his shoes.

“The 30-year mortgage rate typically tracks the 10-year Treasury yield.”

Tracks is one thing but the failure to do proper maturity matching is another. BTW JohnH Magoo – have someone help you read his graph which shows periods of this measure of the spread WAY over 3%.

Your link dumba$$. Check it out. DAMN!

“A credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity.” – Investopedia

Check any reliable source and this is how one calculates a credit spread. The part about “same maturity” is key but of course little Jonny boy never got this basic concept either.

BTW there was a JohnH clown who told us that real after tax mortgage rates were negative. Dr. Chinn called out this lie from that JohnH. THIS JohnH is trying to tell us how high mortgage rates are. OK! But go back to how Dr. Chinn measured things – comparing 15 year mortgage rates to 10 year government bond rates. Yea – he gets maturity matching even if the two confused JohnH’s do not.

Jonny sees a legend in a graph and this clown thinks the author of the blog post is the entire St. Louis FED? But at least this clown has finally learned to read legends in a graph. Maybe he can finally realize that Dr. Chinn provides clear legends in his graph. As in his latest post – which of course mocks little Jonny boy with no mercy.

I just checked and little Jonny boy started chirping about mortgage spreads back in November. This spread was over 2.8% back then which I noted.

Now little Jonny boy has declared a 2.59% spread as being the highest over the past 40 years.

I have suggested little Jonny boy has malleable opinions. I have suggested little Jonny boy lies about what even he has said.

Maybe I am being too hard – after all little Jonny boy may have a serious case of dementia.

No. The spread was higher in the summer of 1986:

https://fred.stlouisfed.org/graph/?g=13678

If you actually check the data, it hard to get that wrong. You didn’t check, did you?

Ducky makes the momentous observation that the mortgage spread is the highest it has been in 37 years, not 40 years as I said!

WOW! A distinction without a real difference!

DAMN! You are DUMB. You lied. But that is nothing new. See Dr. Chinn’s latest post – just for you!

Little Jonny boy was not able to kick the football 40 years so little Jonny boy had to move the goal posts!

makes you wonder why he even chose 40 years. add another decade, and you get 50 years. and the chaos of the early reagan years where the spread is even higher. much higher.

Jonny boy is going to accuse you of moving the goal posts. Yea – his favorite cheap debating trick.

Jonny is incompetent with data and graphs. But yea he loves your measure:

30-Year Fixed Rate Mortgage Average in the United States-Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity

Wait 30 year rate v. 10 year rate. I would ask people to consider maturity matching but little Jonny boy does not understand that either.

https://news.cgtn.com/news/2023-05-03/Young-Chinese-recognizing-importance-in-innovation-and-hard-work-1jv71ku1Ays/index.html

May 3, 2023

Young Chinese recognizing importance in innovation and hard work

By Hu Chao

The 36-year-old engineer Liao Xi starts work at 7 a.m. every weekday. He’s been developing super-thin stainless-steel foils for more than six years at Taiyuan Iron & Steel Company, or TISCO, in north China’s Shanxi Province. On May 12, 2020, President Xi Jinping visited the facility to observe production and took a look at the 0.02-millimeter-thick stainless-steel foil.

“It’s one-fourth the thickness of an A4 page. But it’s very strong and can easily roll up,” Liao said. “President Xi came to visit at about 10:00 a.m. He picked up a piece and folded it gently. He said it looks like tin-foil paper and tempered steel has been made so soft that it can wind around a finger.”

Shanxi is a major coal producing province in China and has been undergoing an economic transformation. During his visit here, President Xi Jinping said he was glad to see how both high and new technology were thriving in the province, and that TISCO has been achieving continuous progress, transformation and upgrading.

Super-thin stainless steel foil is widely used in many high-end industries.

In the past, no one in China was able to produce it, so the country relied solely on imports. Many countries banned exports of it to China.

In the two years after 2016, Liao and his team experienced about 700 failures to produce the paper-like stainless steel foil. Almost every day they were suffering failure.

Recalling President Xi’s visit, Liao was still a bit excited. “When President Xi picked up a piece of the stainless-steel foil, I really wanted to tell him it was developed by us, and we’ve put blood and sweat into it. It looks simple but hundreds of people have spent so much time and energy on developing it,” he said.

Liao and his team successfully developed the super-thin stainless-steel foil in 2018, which has truly tackled bottlenecks in many industry chains.

With this new material, the number of times the screen of a foldable phone could fold has increased to 200,000 to 300,000 from 40,000 to 50,000.

President Xi pointed out that products and technology are the fundamentals for an enterprise and expected TISCO to scale new heights unremittingly and bravely in the field of stainless steel. “His words are the biggest acknowledgement for us grass-roots technology developers,” Liao said.

Three months after President Xi’s visit, Liao and his team persisted with technological innovation and developed even thinner stainless-steel foil, which is 0.015 millimeter thick, a new world record.

Liao revealed, “It’s thinner by five micrometers and can enhance the battery capacity by 17 percent. No other country now can make it. Our high-value products now account for over 80 percent.” …

CBO Sees Greater Risk That the Treasury Will Run Out of Funds in Early June

On January 19, 2023, the statutory limit on the amount of debt that the Department of the Treasury can issue was reached. At that time, the Treasury announced a “debt issuance suspension period” during which it can take well-established “extraordinary measures” to borrow additional funds without breaching the debt ceiling.

In February, CBO projected that those extraordinary measures would probably be exhausted between July and September 2023. Because tax receipts through April have been less than CBO anticipated in February, CBO now estimates that there is a significantly greater risk that the Treasury will run out of funds in early June.

https://www.cbo.gov/

The CBO? That some kinda liberal mouthpiece? Where’s CoRev?

With my feet out of the trash living in your head.

The liberal mind is an amazement as they never clean up after failed policies. Being in denial make s it hard to identify failures.

Michael Milken is lecturing banks?

https://www.msn.com/en-us/money/markets/michael-milken-says-recent-crisis-is-the-same-mistake-banks-have-been-making-for-decades/ar-AA1aEYZf?ocid=msedgdhp&pc=U531&cvid=9a124b9e09d84b03999151cc0ced71d9&ei=8

Famed investor Michael Milken said Tuesday that the current banking crisis stemmed from a classic asset-liability mismatch that has played out miserably time and again in history. “You shouldn’t have borrowed short and lent long… Finance 101,” Milken said on CNBC’s “Last Call.”

I used to think Milken was smart but corrupt. But in his old age, I guess he has forgotten why we even have banks.

What do you do when your behavior is so corrupt you have a lifetime ban from trading on Wall Street?? You hang out the shingle “Advisor to Banks and Those Looking for New Ways to Cheat the System” and hope your reputation as a world class fraudster and amoral human being shines through to the broader public.

NBC News

NBC News

Russia claims Ukraine tried to assassinate Putin in drone attack on the Kremlin

Russia claimed Wednesday that Ukraine tried to assassinate President Vladimir Putin in an overnight drone attack on the Kremlin, news that drew denials from Kyiv and furious demands for retaliation from nationalists in Moscow. The Kremlin’s accusation, made without providing evidence, was the latest in a string of reported incidents far from the war’s front lines. Kyiv said it had nothing to do with the alleged incident and suggested it could be used as a pretext for a new Russian attack inside Ukraine.

https://www.msn.com/en-us/news/world/russia-claims-ukraine-tried-to-assassinate-putin-in-drone-attack-on-the-kremlin/ar-AA1aGkxd

The Kremlin is lying here as this is another Putin false flag hoping to motivate his failing troops.

But if Ukraine did manage to kill Putin – the world would toast them for ending a reign of war crimes.

ADP reports 296,000 net new private jobs in April, with just over half of those in leisure and hospitality. Manufactory jobs, as did business services and finance. Once again, the South is a net job lower.

The chit-chat which accompanies the data says wage gains are slowing. Good thing the Fed is hiking rates today.

Yep – see the latest post!

Ducky notes “Manufactory jobs, as did business services and finance.” Still having trouble with your English as a third language?

And we thought CoRev was a pointless whiney little troll. He has nothing on little Jonny boy.