From Fout and Duncan, Journal of Structured Finance (2020):

Source: Fout and Duncan (2020).

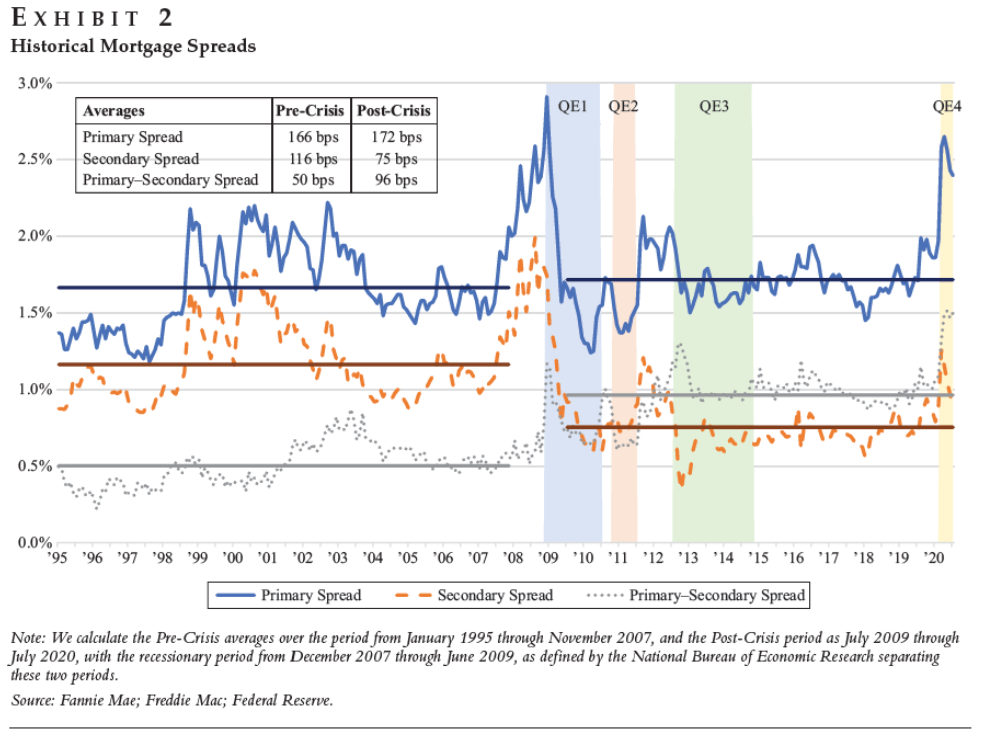

The “Primary Spread” is the 30 year fixed rate mortgage rate and 10 year Treasury. The “Secondary Spread” is the difference between the return on mortgage backed securities and 10 year Treasury. The “Secondary-Primary Spread” is the difference between the 30 year fixed rate mortgage and the mortgage backed securities return.

From the summary:

• Mortgage spreads, especially the primary–secondary spread (mortgage rate versus current coupon yield on MBS), remain historically wide following the COVID outbreak in the US.

• Increases in liquidity in the mortgage-backed securities (MBS) market coinciding with the Federal Reserve’s increased MBS purchases have historically been correlated with declines in the secondary spread (current coupon yield on MBS versus Treasuries), con-sistent with the post-COVID surge in Fed MBS purchases and subsequent decline in the secondary spread.

• Increases in the primary–secondary spread have historically been correlated with increased capacity constraints faced by lenders, for instance, measured by increases in production per mortgage-related employee. The persistent widened primary–secondary spread in the aftermath of COVID-19 is consistent with this historical pattern.

In other news, big job gain in April, bid downward revision to prior months.

As a rule of thumb, downward revisions occur when trend job growth slows.

https://www.bls.gov/news.release/empsit.nr0.htm

THE EMPLOYMENT SITUATION — APRIL 2023

Total nonfarm payroll employment rose by 253,000 in April, and the unemployment rate changed little at 3.4 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in professional and business services, health care, leisure and hospitality, and social assistance.

I’m afraid our self-labeled “hobbyist” is going to take this information release in a personal way, or in the wrong way, and be hard on himself. Personally I would take his “hobbyist” NFP forecasts over many labeling themselves “professional” forecasters. As you mentioned the revisions are apt to be lower numbers. I hope he takes this in the right light, and keeps rolling with the punches. I’m very jealous of his number crunching abilities, but don’t let anyone else on the blog know, alright??

wink : )

On come on Macro. Those were not large at all considering seasonal effects of a warm winter. Better takes please.

Interesting. If there are capacity constraints, it’s only because the industry laid off many of its loan originators. So what’s left to attribute the unusually high mortgage spreads to?

Value of prepayment option rising with mortgage rates as I explained to our Village Idiot at least 20 times. And you are still stupid to get it? Damn!

And see what Macroduck provided – one more time. OK – you won’t get that either. DUH!

pgl failed to read the short summary that the host provided. Nowhere did the summary reference the prepayment option, though I agree that there must be something else at play, something that the short summary referenced…but the ever brilliant pgl somehow manages to miss.

Hint: it’s hiding in plain sight.

JohnH: Prepayment option is not in the summary, but *is* in the paper.

Jonny boy got past the headline and managed to read one paragraph. Progress I guess.

The prepayment option is the center piece of this paper. Of course, JohnH will not likely read this paper either.

https://academic.oup.com/rfs/article-abstract/31/3/1132/4741361?redirectedFrom=fulltext&login=false

Macroeconomic-Driven Prepayment Risk and the Valuation of Mortgage-Backed Securities Get access Arrow

Mikhail Chernov, Brett R. Dunn, Francis A. Longstaff

The Review of Financial Studies, Volume 31, Issue 3, March 2018, Pages 1132–1183.

We develop a three-factor no-arbitrage model for valuing mortgage-backed securities in which we solve for the implied prepayment function from the cross-section of market prices. This model closely fits the cross-section of mortgage-backed security prices without needing to specify an econometric prepayment model. We find that implied prepayments are generally higher than actual prepayments, providing direct evidence of significant macroeconomic-driven prepayment risk premiums in mortgage-backed security prices. We also find evidence that mortgage-backed security prices were significantly affected by Fannie Mae credit risk and the Federal Reserve’s quantitative easing programs.

Johnny, isn’t this where you admit to misrepresenting pgl’s state of knowledge? You accused him of not knowing something you knew, when in fact, he knew something you didn’t know.

So shouldn’t you be honest and admit it?

Though, since your bag of debating tricks has narrowed down mostly to misrepresenting others’ knowledge, views and positions, I guess you don’t see this case as anything special. Honesty is not really your thing, is it?

By the way, what financial firm do I work for? You did claim to know that I’m in finance. Who do I work for? Johnny?

You are expecting little Jonny to be honest about anything? Ain’t gonna happen.

Wow – Jonny boy read the abstract. I figured you would not read the actual paper. Now was there some point to your latest emotional rant? After all – you have already embarrased your entire family.

” The second, the primary–secondary spread measures the difference between the FRM30 and the CCY30. This spread represents the additional components of the mortgage rate beyond the rate paid to investors, including servicing fees, guarantee fees (gfees), and excess servicing.”

Only the janitor of Rocket Mortgage would translate this into “capacity constraints” from having fewer loan originators.

“Increases in the primary–secondary spread have historically been correlated with increased capacity constraints faced by lenders, for instance, measured by increases in production per mortgage-related employee.” Well, that’s not a problem…production per employee was dropping as evidenced by the industry’s laying off of originators. If it had been a problem, they would have hired more.

pgl just doesn’t get it…it’s hiding in plain sight!

No, Johnny. You just made that up If hiring more were always possible, then we wouldn’t know that

“Increases in the primary–secondary spread have historically been correlated with increased capacity constraints faced by lenders…”

If capacity constraints were never a problem because hiring can always avoid capacity constraints, we could not know how spreads react to capacity constraints.

Seriously, you need to put your eagerness to shout “I win!” aside just long enough to check your logic.

If we know about the effect of capacity constraints, then capacity constrains have occurred. If they have occurred, they can occur. If they can occur, then it is not necessarily true that “If it had been a problem, they would have hired more.”

I provided a discussion on this issue from one of your favorite sources. Ah Jonny boy – you got this wrong too. But then why screw up a perfect record of getting everything wrong.

BTW your little claim that there is some alleged shortage of originators was never backed up by a shred of evidence (the Jonny boy standard) but I did find this:

https://www.nationalmortgagenews.com/news/nonbank-mortgage-job-cuts-nearing-completion

The latest monthly payroll estimates show mortgage bankers and third party originators have made a lot of headway in downsizing aimed at bringing staffing in line with current business volumes, but they still have more to do before fully reversing the gains in the past three years. Roughly 120,000 positions were added as government stimulus drove an unusual boom in business in 2020 after the arrival of the U.S. pandemic in March of that year. Three years later, around 80,000 of those positions have been cut, according to the Bureau of Labor Statistics.

A housing boom followed by less home shopping business. On net, we have 40 thousand MORE originators than we had before 2020.

Damn Jonny boy – you never get a single thing right. BTW – neither this factual story nor your stupid comment has a thing to do with the spreads at issue in this blog post. But then again – you often make off point retarded comments.

Exactly as I have said three times, there is no shortage of originators to explain the rise in mortgage costs and the mortgage spread, a fact consistent with the industry’s decision to lay off 80,000 workers….with more layoffs needed. THERE ARE NO CAPACITY CONSTRAINTS such as the ones the Fed paper found to explain the high mortgage spread.

pgl needs to go back to elementary school for remedial reading…

Dude – you reading comprehension sucks. You can say it 30 times but you got this wrong. And you are stupid to get it? DAMN! You are DUMB!

THERE ARE NO CAPACITY CONSTRAINTS such as the ones the Fed paper found to explain the high mortgage spread.

As Macroduck note – you were the moron that claimed there were capacity constraints. The paper did not say that – you did. And now you are retreating from the dumbass claim you made up all by yourself.

JohnH – KLOWN show.

A while back, when Johnny was carrying on about mortgage spreads as if, hmmm – it’s never been clear why Johnny has carried on so about mortgage spreads – pgl asked if I had an explanation for the wdening of mortgage spreads. Can’t find the comment now, but from my notes, it started like this:

“Short answer –

The Fed stopped buying MBS and has for some time signaled a reduction in holdings.

Perceived MBS risk has increased since 2016.

Those two facts have led to MBS selling to reduce portfolio risk in a year when risk reduction is really popular.

Wild speculation – I think mortgage investors expect a lot of mortgages to be under water soon.

Same answer, only longer –

Couple of thing I think are enlightening:

– Flow into and out of the Fed’s MBS portfolio and

– MBS spread peformance relative to corporate spreads.

They provide a type of evidence. After the evidence, I’ll speculate.

The Fed’s purchase of mortgages looks to have been pretty effective in driving mortgages spreads. The goal of MBS purchases has always been to create a relative shortage of risk, driving down risk spreads. It works…”

But Johnny has kept up this repeated, aggressive-toned demand that somebody explain the widening of mortgage spreads. If he actually cared, he could have found Fount and Duncan. Or he could have read comments here.

Speaking of Jonny boy – he is still repeating that Oct. 2021 nonsense from John Cochrane about how actual inflation WAS exceeding expected inflation. Cochrane later retreated from this claim as even Cochrane has figured out that inflation since June 2022 has been only 3.2% per annum.

Little Jonny is even arguing with our host ad nauseam as our host keeps reminding little Jonny boy of prior posts. But little Jonny boy persists with his version of Cochrane ala Oct. 2021.

Why is little Jonny boy so out of touch? My theory is that Putin is really mad that his spree of war crimes is faring poorly so much that he has cut off his Kremlin pet poodles which Jonny boy heads off from the real world.

BTW – it took me a while but me thinks Jonny boy has finally figured out that people who borrow in the mortgage market has the prepayment option which has higher value when mortgage rates are high. Now I had to explain this to our favorite moron many many times. But something tells me that Jonny boy is incapable of articulating this basic concept. Yea – Jonny boy such at financial economics.

Here’s the link that I made to Cochrane and inflation: https://johnhcochrane.blogspot.com/2022/10/inflation-expectations.html

It mocks inflation forecasts and illustrates how bad they are. It also shows their policy bias of eventually returning inflation to whatever the Fed is trying to achieve.

The rest of pgl’s unhinged rant shows he good a candidate he is for Eli Lilly’s donanemab.

https://investor.lilly.com/news-releases/news-release-details/lillys-donanemab-receives-us-fdas-breakthrough-therapy

Check the date liar. October 2021. Cochrane posted a more recent post taking this all back when inflatoin did come down as the forecasts suggested.

Hey Jonny boy – you just admitted you are a worthless little liar. Well done!

Alzheimer’s disease? I remembered that Cochrane later reversed what he said in October 2021. Either you have Alzheimer’s disease or you are the biggest liar known to mankind.

I noted the last time you pulled out this October 2021 blog post from Cochrane that he also put on a post on January 14, 2023 called Waning Inflation.

You now suggest I have memory problems? No so you disgusting little troll. You are an integrity problem. No – you are a serial liar and everyone here knows it.

BTW over the past 9 months CPI has risen by only 2.4% as I have noted many times. What’s the matter Jonny boy – do you not realize this by now? After all no one can be that stupid. Except you.

See Dr. Chinn’s graph. The spread fell after QE1, after QE2, after QE3, and after QE4. So you are onto something. Not that JohnH will ever figure it out!

Congrats, Ducky…a good contribution that explains a lot of what’s going on.

In other words, the exact opposite of what the Fed paper observed is now happening: The Fed paper observed: “Increases in liquidity in the mortgage-backed securities (MBS) market coinciding with the Federal Reserve’s increased MBS purchases have historically been correlated with declines in the secondary spread (current coupon yield on MBS versus Treasuries), con-sistent with the post-COVID surge in Fed MBS purchases and subsequent decline in the secondary spread.” Instead of declines in the secondary spread, we are now seeing rises.

In other words, the Fed’s decision to end the surge in MBS purchases would be correlated with increases in the secondary spread. It didn’t help that other big lenders were pulling back, too. Yet, when I pointed this out months ago, pgl went into one of his extreme versions of Mt Trashmore, spewing garbage everywhere, hoping some would stick.

I think this is important because most of the focus has been on the Fed’s behavior at the short term end of the market, little on the long term. But it’s seems clear that QT is having an effect.

Johnny, whatever your motives, you’ve been an annoying brat – again – with your endless “What about mortgage spreads” repetition.

If you knew the answer to your own question, you could have offered it. You didn’t, and you often don’t know what you’re talking about, so I see no reason to believe you had this figured out.

Several regular commenters here offer valuable information in their comments. You sneer and misrepresent and mislead. You, and others like you, have nothing informative to say. It’s all agenda-driven crap. Where, in any comment you’ve posted, did you explain the role of Fed MBS operations in determining mortgage spreads?

Seriously, folks, with everything going on in the world, we’re feeding this troll’s ego too much and discussing reality too little.

“we’re feeding this troll’s ego too much and discussing reality too little.”

Precisely. Most bloggers would have banned this worthless little liar by now.

https://fred.stlouisfed.org/graph/?g=Q9pS

January 4, 2018

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2017-2023

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

https://fred.stlouisfed.org/graph/?g=IBTh

January 4, 2020

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2023

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

Interesting decomposition.

The “Secondary-Primary Spread” is the difference between the 30 year fixed rate mortgage and the mortgage backed securities return.

Using post-crisis figures, let’s see if I get this right. I go into a bank to get a long term mortgage and the bank decides to charge me an overall credit spread = 1.75%. But wait – they repackage my mortgage with other mortgages into an MBS whose return exceeds the government bond rate by only 0.75%. So the middleman is pulling off a 1% spread without really taking the risk. That strikes me as a rather huge market imperfection.

Putin and his band of war criminals got some really bad news:

https://www.yahoo.com/news/russian-mercenary-chief-prigozhin-says-083500662.html

Yevgeny Prigozhin, leader of Russia’s Wagner Group mercenary force, said in a dramatic announcement on Friday that his forces would pull out of the Ukrainian city of Bakhmut that they have been trying to capture since last summer. Prigozhin said they would withdraw on May 10 – ending their involvement in the longest and bloodiest battle of the war – because of heavy losses and inadequate ammunition supplies. He asked defence chiefs to insert regular army troops in their place. “I declare on behalf of the Wagner fighters, on behalf of the Wagner command, that on May 10, 2023, we are obliged to transfer positions in the settlement of Bakhmut to units of the defence ministry and withdraw the remains of Wagner to logistics camps to lick our wounds,” Prigozhin said in a statement. “I’m pulling Wagner units out of Bakhmut because in the absence of ammunition they’re doomed to perish senselessly.”

Good news for the average peace loving Ukrainians. But now we know why JohnH has been spewing all sorts of trash of late. Putin has decided he will not feed his pet poodle anymore.

I remain worried that Putin and Prigozhin may simply be lying about their intentions and motives. Bakhmut has kept Wagner’s mercenaries tied down, and a good many Ukrainian troops, too, but not so many Russians. Lots of death for mercenaries, but they aren’t great on the battlefield, so why not? Killing Ukrainian troops, though in lesser numbers, and using up Ukrainian materiel may have been seen as a good thing to do in the winter. Summer is coming, and battlefield fighting will resume, so Wagner redeploys while pretending defeat.

Or Wagner may have been defeated. Don’t know. Nor do I believe I can tell whose view of military things in Ukraine is credible. There is an enormous effort to make Ukraine seem doomed and an enormous effort to say Ukrainian victory is assured if western support continues. Assurance that “the truth must lie somewhere in between” partakes of a common human irrationality, so I find no comfort there.

More drones visiting the Kremlin would be nice.

By the way, I hear Prigozhin is arranging to be in line to replace Putin if anything should, ya know, happen.

One might conclude that mortgage-backed securities have been punished for their misbehavior of the 2000-2010 decade.

misbehavior?

Not following. Are you saying low spreads are a bad thing? I would say the opposite.

Or are you in that “interest rates were too low for too long” (John B. Taylor forgetting he was an economist).

Now if you are saying we needed better regulation – then maybe!

I think he’s talking about the tranches and swaps and derivatives. I forgot some of the names but I think you get the gist. Hiding the high risk with the low risk in the same package of loans. A little angry with myself I can’t remember the name, but anyway.

Mezzanine loan was the descriptor I couldn’t remember. Wow, When I’m drinking, that could have made me insane trying to remember that for like two days straight.

I never worked for Country Wide but I had to review some of their nonsense with the assistance of a very young financial genius. When he saw how they priced CDOs he asked me if he could short sell Country Wide. I had to tell him that would be a huge ethical violation. Too bad as he would have made a fortune. But yea their pricing models were pure fraud and anyone that understood them would have known that.

@ pgl

I appreciate you not mentioning “too much” my drinking. I’ll never ever mention your “real” name”, it’s not a

“trade” or “transactional” in my mind. I hope you feel the SAME about it. Just feel. it’s the “right thing to do”. Is that fair?? Whatever I think about you or you feel to me, I wish that’s how you’d think about it from here on.

Uncle Moses

Off topic, the risk of default –

On way in which this time is different – a single Republican House member is all it takes to boot McCarthy. So the House now allows an even tougher filibuster than the Senate.

“This difference between the mortgage rate and the 10-year Treasury, commonly referred to as the primary mortgage spread, has widened to approximately 250 bps in 2020, among the widest historical spreads ever observed.”

The authors might want to check out Dr. Chinn’s post.

‘Commonly referred to as?’ I’m sorry but the premise that measuring the spread this way is the correct way has been demolished by the grown ups here even if JonnH wants to continue to wet his diaper over this.

Yea 2.5% is high but not nearly the highest as Dr. Chinn’s graph clearly shows. Oh –

“among the widest historical spreads ever observed”.

I see. Not that I’m criticizing their research which decomposed this into the primary v. secondary spreads, which adds some interesting information to the discussion.

CoRev had a love child with JohnH and he is in Congress (Jim Jordan):

https://www.msn.com/en-us/news/politics/jim-jordan-sends-letter-to-esg-cartel-requesting-info-on-possible-anti-trust-violations/ar-AA1aMYAJ?ocid=msedgdhp&pc=U531&cvid=57e833fe45fc4d26af82d006bad980a7&ei=10

Republican Reps. Jim Jordan (OH) and Dan Bishop (NC) sent a letter to the CEO of the sustainability organization Ceres, accusing the company facilitating “collusion” with a company named Climate Action 100+, which they say may be violating U.S. antitrust law. The lawmakers called Climate Action 100+ a “cartel” that gets businesses to take action on climate change, The Daily Caller reported.

😉 Trashy abode , but still loving life living in your head.

Hey – did Congressman Jordan teach you his tricks for seducing college wrestlers?

Faux News is terrified that we might see what Tucker Carlson has said:

https://www.msn.com/en-us/news/us/fox-news-lawyers-send-cease-and-desist-to-stop-media-matters-from-publishing-leaked-videos-of-tucker-carlson-s-comments/ar-AA1aNhtB?ocid=msedgdhp&pc=U531&cvid=1395662fa8494495a2edfb8a66375e04&ei=15

Wilson Sonsini Goodrich & Rosati sent a letter on Friday to Media Matters’ President and Chief Executive Officer Angelo Carusone demanding the immediate “cease and desist from distribution, publication, and misuse of Fox’s misappropriated proprietary footage,” according to a copy obtained by Insider. “That unaired footage is FOX’s confidential intellectual property; FOX did not consent to its distribution or publication; and FOX does not consent to its further distribution or publication,” the letter said.

Business Insider

Business Insider

Fox News’ lawyers send cease and desist to stop Media Matters from publishing leaked videos of Tucker Carlson’s comments

Story by cpanella@insider.com (Chris Panella) • 1h ago

Tucker Carlson speaks during 2022 FOX Nation Patriot Awards at Hard Rock Live at Seminole Hard Rock Hotel & Casino Hollywood on November 17, 2022 in Hollywood, Florida. Jason Koerner/Getty Images

Tucker Carlson speaks during 2022 FOX Nation Patriot Awards at Hard Rock Live at Seminole Hard Rock Hotel & Casino Hollywood on November 17, 2022 in Hollywood, Florida. Jason Koerner/Getty Images

© Jason Koerner/Getty Images

Fox News’ lawyers sent a cease and desist letter to Media Matters over coverage of Tucker Carlson.

The letter demands Media Matters stop publishing behind-the-scenes videos of Carlson.

Media Matters has shared videos of Carlson making sexist remarks and complaining about Fox.

Fox News’ lawyers have sent a cease and desist letter to Media Matters for America over its publication of leaked videos showing Tucker Carlson making offensive and embarrassing comments off-air.

Wilson Sonsini Goodrich & Rosati sent a letter on Friday to Media Matters’ President and Chief Executive Officer Angelo Carusone demanding the immediate “cease and desist from distribution, publication, and misuse of Fox’s misappropriated proprietary footage,” according to a copy obtained by Insider.

Bryan Freedman, the lawyer hired by Tucker Carlson and Don Lemon, is a Hollywood heavyweight who could secure them mega-million payouts

Full screen

1 of 10 Photos in Gallery©Matt Winkelmeyer/Getty Images

Bryan Freedman, the lawyer hired by Tucker Carlson and Don Lemon, is a Hollywood heavyweight who could secure them mega-million payouts

Tucker Carlson and Don Lemon have both hired heavyweight lawyer Bryan Freedman.

Fox News host Carlson and CNN anchor Lemon left their networks on Monday.

Freedman’s former clients have included Vin Diesel, Quentin Tarantino, and Mariah Carey.

Tucker Carlson and Don Lemon have hired high-powered Hollywood attorney, Bryan Freedman, after leaving their networks Fox News and CNN Monday.

Freedman is known for aggressively pursuing lawsuits on behalf of clients fired by TV networks — and securing multi-million dollar payouts.

His hiring is a sign that Carlson and Lemon could be gearing up to sue their former employers over their dismissals.

Here’s a look at Freedman’s career, and the cases that made his name.

See More

“That unaired footage is FOX’s confidential intellectual property; FOX did not consent to its distribution or publication; and FOX does not consent to its further distribution or publication,” the letter said.

In a statement shared with Insider, Carusone said: “Reporting on newsworthy leaked material is a cornerstone of journalism. For Fox to argue otherwise is absurd and further dispels any pretense that they’re a news operation.” He added: Perhaps if I tell them that the footage came from a combination of WikiLeaks and Hunter Biden’s laptop, it will alleviate their concerns.”

Off topic, the geographic distribution of economic activity –

ADP has reported job losses in the South in March and April of over 300,000, while the other broad regions all reported job growth. Heard someone on Marketplace radio claim that Southern stocks have performed worse than those of the U.S. as a whole – haven’t figured out how to check that, but I will. Construction has been a big deal in the South and is now in the dumps, which might explain some of the poor recent performance there in growth and employment. Mortgage trouble may be worse in the South because of rapid housing growth and rapidly rising prices, which could be a problem for Southern banks.

So maybe not off topic, if mortgages are to blame.

Anyone have any sources or details on regional performance?

Another headline on the global rice shortage:

https://www.cnbc.com/2023/04/19/global-rice-shortage-is-set-to-be-the-largest-in-20-years-heres-why.html

China is a big part of the problem.

“There’s a strained supply of rice as a result of the ongoing war in Ukraine, as well as weather woes in rice-producing economies like China and Pakistan.”

I noted this about a week ago. Ever since ltr has been on a tear trying to deny reality. After all she really thinks China has solved the world food problem forever. Be prepared for one of her patented tirades.

FRED on rice prices through March:

https://fred.stlouisfed.org/series/PRICENPQUSDM

A more recent reporting on rice prices.

https://markets.businessinsider.com/commodities/rice-price

More on the jobs report – The index of aggregate hours started Q2 down 0.2% on the month, but higher than the Q1 average, so positive for GDP growth, but only if there are no further declines. With jobs up, it’s a shorter workweek that’s the drag on aggregate hours.

Aggregate hours represent labor input to rally GDP. Here’s a picture:

https://fred.stlouisfed.org/graph/?g=13cjd

“…real GDP.” Thumb problems, again.

Ever since — has been on a tear trying to deny reality. After all she really thinks China has solved the world food problem forever. Be prepared for one of her patented tirades.

Ever since — has been on a tear trying to deny reality. After all she really thinks China has solved the world food problem forever. Be prepared for one of her patented tirades.

Ever since — has been on a tear trying to deny reality. After all she really thinks China has solved the world food problem forever. Be prepared for one of her patented tirades.

[ Bizarre bullying and attempted intimidation, over and over and over. ]

Be prepared for one of her patented tirades.

Be prepared for one of her patented tirades.

Be prepared for one of her patented tirades.

[ The repeated object is bullying and attempted intimidation, no matter how ferocious. ]

You’re proving pgl’s point.

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

May 5, 2023

FAO Food Price Index

The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices (cereal, vegetable oil, dairy, meat, sugar) weighted by the average export shares of each of the groups over 2014-2016.

Monthly release dates for 2023: 6 January, 3 February, 3 March, 7 April, 5 May, 2 June, 7 July, 4 August, 8 September, 6 October, 3 November, 8 December.

The FAO Food Price Index rebounded slightly in April

The FAO Food Price Index (FFPI) averaged 127.2 points in April 2023, up 0.8 points (0.6 percent) from March and standing 31.2 points (19.7 percent) below its value in the corresponding month last year. The slight rebound in the FFPI in April was led by a steep increase in the sugar price index, along with an upturn in the meat price index, while the cereals, dairy and vegetable oil price indices continued to drop.

https://fred.stlouisfed.org/graph/?g=KyLW

January 15, 2018

Global prices of Food and Agricultural Raw Materials, 2017-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=Kw2N

January 15, 2018

Global prices of Food and Agricultural Raw Materials, 2017-2023

(Indexed to 2017)

Add to this, developing country after country, through the present:

https://english.news.cn/20220326/d84a463b3a214c16a9b3ee14f95fec87/c.html

March 26, 2022

Philippines, China enhance agricultural cooperation to safeguard food security

MANILA — The Philippines is reaping fruits of its agricultural collaboration with China in increasing food supply and safeguarding food security in the country, Agriculture Secretary William Dar said on Friday.

Dar made the remarks at a ceremony marking the inauguration of new breeding laboratories at the Philippine-Sino Center for Agricultural Technology (PhilSCAT) in Munoz city in Nueva Ecija province, north of Manila.

Dar said PhilSCAT, as an important initiative aided by China, has helped the Philippines increase its rice production thanks to the introduction of hybrid rice introduced from China.

“We can use agricultural technology to increase our local food production, and hybrid rice technology is one on top of the other interventions like good agricultural practices,” Dar told reporters.

Dar also thanked China for donating urea fertilizer and farm machinery units to help ensure food security amid the global food supply challenge. “Unity is needed in this time of crisis for us to sustain food security in this country,” Dar said.

Chinese Ambassador to the Philippines Huang Xilian said the project has undergone three development phases over the past two decades. “Proud to see this project bore rich fruits and became a model of agricultural cooperation between our two countries,” he said.

“We hope that we will continue to work even closer together with the Philippines to improve the people’s livelihood and ensure food security,” Huang added….

https://news.cgtn.com/news/2023-04-11/China-s-CPI-up-0-7-in-March-1iUon3cep7W/index.html

April 11, 2023

China’s consumer inflation rose mildly in March

China’s consumer price index (CPI), a leading measure of inflation, rose 0.7 percent in March, year-on-year, data from the National Bureau of Statistics (NBS) showed on Tuesday.

Senior NBS statistician Dong Lijuan attributed the increase to the continued recovery of production and residents’ daily activities, and sufficient supply in the consumer market.

Food prices, in particular, rose by 2.4 percent, a decrease of 0.2 percentage points from February. In the non-food category, service prices rose 0.8 percent. Notably, flight prices rocketed 37 percent as travel demand heats up.

The core CPI, which excludes food and energy prices, rose by 0.7 percent year-on-year, an increase of 0.1 percentage points from the previous month.

https://news.cgtn.com/news/2023-04-11/China-s-CPI-up-0-7-in-March-1iUon3cep7W/img/94073b08a3334f509b2a7d5d4211afed/94073b08a3334f509b2a7d5d4211afed.jpeg

“The non-food category CPI and the core CPI are expected to fluctuate and remain at low levels this year, while the relatively limited inflationary pressure will still not constrain macro policies such as monetary policy,” Pang Ming, chief economist and head of research for Greater China at JLL told CGTN.

China has set an inflation target of about 3 percent in 2023, following a 2 percent increase in 2022….

The Fulton County District Attorney may be the first to take Trump down:

https://www.cnn.com/2023/05/05/politics/georgia-trump-fake-electors-immunity

At least eight of the Republican “fake electors” in Georgia have accepted immunity deals in an ongoing criminal investigation into efforts by Donald Trump and his allies to overturn the 2020 election there, according to a new court filing.

Fulton County District Attorney Fani Willis had previously notified all 16 GOP fake electors in Georgia that they were targets in her investigation. Last month, Willis offered immunity deals to several of the Republicans who served as pro-Trump electors and they accepted, according to the filing.

https://www.documentcloud.org/documents/23801050-debrow-court-filing-fulton-county-georgia

Off topic, Russia’s economy –

Remember the various efforts to provide checks on China’s economic data, because China’s official data are unreliable? Using import and export data, satellite imagery and pollution data as proxies for domestic production? Well, Russia presents a similar (though much smaller) problem, and The WSJ has a report on pollution data used to check Russia’s economic data:

https://www.wsj.com/articles/pollution-reveals-what-russian-statistics-obscure-industrial-decline-cdd7103e

Since the WSJ piece is behind a paywall, here’s a report on the report:

https://www.google.com/amp/s/markets.businessinsider.com/news/stocks/russian-economy-industrial-decline-air-pollution-satellite-data-ukraine-war-2023-5%3famp

This is not direct evidence that Russia’s war on Ukraine or related economic sanctions are causing harm to Russia’s economy. Rather, it is evidence that Russia doctors its data to hide the effects of war and sanctions.