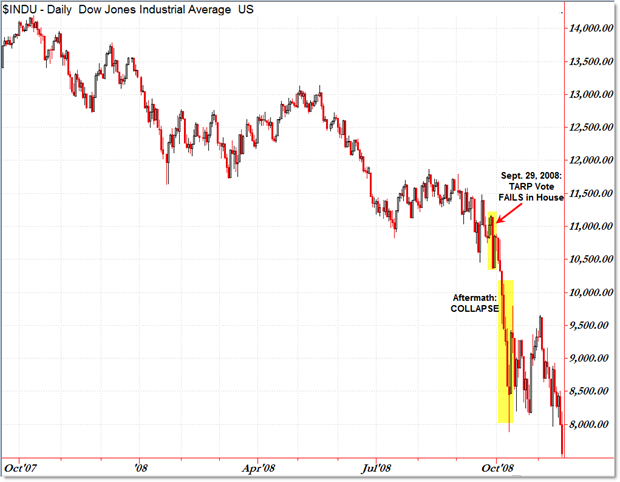

The shading denotes the decline of the Dow Jones around September 29th, when the TARP legislation went down the first time. Here’s the detail:

Source: ATT.

As the WSJ noted:

The Dow, which had opened sharply lower on fears of more possible bank failures, finished the day down 7%, with a 777.68 point drop to 10365.45. Losses to shares on the broader Dow Jones Wilshire 5000 index amounted, on paper, to $1.2 trillion — eclipsing the size of the proposed bailout package. The Nasdaq Stock Market finished down 9.1%.

My guess is the effect of a default would be much larger on impact, given it’s news regarding the safety of a global benchmark.

Edelberg and Sheiner discuss the implications of a default, citing among other points a 2013 Fed study indicating a 30% stock market decline. Last week, CEA released an analysis, examining a scenario involving a stock market decline of 45%. (For comparison, the October 2008 to March 2009 decline was 22%.)

That time period was also the period after the collapse of Lehman Brothers. Yea – TARP should have been passed unless policy makers had the good sense to actually nationalize the megabankers. But didn’t Luskin poo poo any notion of a recession back then?

make no mistake, a default will introduce tremendous volatility on the downside for stocks. it will not behave in the cavalier attitude some republican want to portray.

let us simply look at a very recent situation to provide some context. the year long increase in fed funds rates has decreased the mark to market value of almost all treasuries beyond one year. the interest rate/duration issue was a primary driver in the recent collapse of several regional banks, some of which were actually quite large. this spooked the market, because those treasuries dropped in value (but were not close to a total loss). a debt default will value those treasuries at a total loss. which means, in addition to those banks with duration match issues, even banks that originally matched duration well will take a HUGE loss mark to market. you think the market will take it well, when all banks suddenly hold safe assets that are mark to market, worthless? for those that had an issue with the fed policy these past few months (and many of those same folks also have an issue with extending the debt limit), why do you expect the market to simply shrug off the debt default? why would republicans choose this path of destruction?

I also want to add, the recent letter from republicans who oppose raising the debt limit without spending cuts is a flat out lie. they predicate their move by saying this is necessary to eliminate the catastrophe of the current economy. what catastrophe? unemployment at all time lows. economy that is growing? republicans cannot seem to acknowledge truth anymore (the trump effect), and simply make up a false economy to justify their actions? what a dishonorable mob the party has turned into. if you cannot win, you simply torch the nation? pathetic.

if the goal is to remove the United States from the center of the global financial system, destroy the dollar, lose the reserve currency status of the dollar, destroy wealth and introduce economic despair, then the republicans have finally come across a policy that will achieve their goals.

The initial failure to pass TARP was remediable, as would be default on federal obligations. So this is an apt comparison.

TARP was one part of a larger series of events which caused a 4% peak-to-trough decline in global GDP and over $10 trillion in lost asset value in the U.S. alone. There is considerable risk that default would trigger its own series of bad events. Pakistan is sliding into an economic meltdown. China has a mountain of bad debt. Global warming is causing water shortages, fires and floods. The Fed and ECB are tempting fate. Trump is leading the Republican presidential pack. There is war in Europe. Plenty of things which would be exacerbated by financial turmoil.

The Great Recession induced social and political fragmentation in the U.S. and abroad, which has subsequently grown worse. The politicization of Covid was built on that fragmentation.

Today’s debt ceiling debate takes place in the context of that fragmentation. Today’s Republican lawmakers have engaged in divisiveness to win their seats. They make the Kool Aid and they drink it. These are the people who have to vote to raise the debt ceiling.

Which very likely means something other than an increase in the debt crop will be needed to avoid disaster. Premium bonds. The Coin. Stand on the 14th Amendment.

Or a change in theory. Brad Delong notes that an opinion from Jimmy Carter’s Justice Department – that the debt ceiling could not be ignore on the basis of new legislation supercede older legislation – is the basis for the belief that the debt ceiling is binding. That cautious opinion has allowed repeated efforts at political blackmail. Democratic presidents have always stood up to he blackmailers. Biden was involved every time. It’s hard to believe he’ll knuckle under. Yellen has been around for every effort at blackmail and for the Great Recession and for the Covid epidemic and for the Asian Crisis. She’ll help Biden choose how to stand up to the blackmailers and how to navigate the aftermath.

It’s time to stop this nonsense.

Princeton Steve routinely screams two very divergent things as if both have to be true:

(1) The US has been in a RECESSION for while; and (2) oil prices will SOAR well past $100 a barrel.

This story notes how market forces might just say one of Stevie’s “the sky is falling” claims sort of works the other. But that will never stop Stevie from screaming the sky is falling, the sky is falling!

https://www.msn.com/en-us/money/markets/oil-climbs-over-2-as-recession-fears-begin-to-fade/ar-AA1aU3Vw?ocid=msedgdhp&pc=U531&cvid=cb318ebdee4346c0909a5fce114f5a1d&ei=4

Oil prices rose over 2% on Monday as U.S. recession fears eased and some traders saw crude’s three-week slide on demand worries as overdone …. A healthy U.S. jobs report for April helped oil to climb by about 4% on Friday even though labour market strength could compel the Federal Reserve to keep interest rates higher for longer.

Federal employees have filed suit in federal court to prevent enforcement of the debt ceiling:

https://thehill.com/regulation/court-battles/3993782-government-employees-union-sues-yellen-biden-over-unconstitutional-debt-limit-law/

If the judge were to impose a temporary injunction against enforcement, that would (unless overturned by a higher court) serve as a suspension of the debt ceiling until a final ruling could be passed down, or until the action could be voided due to a resolution. Since the arguments being made are not specific to this debt ceiling fight, the lifting of the debt ceiling might not be enough to void the action.

After all the tricks run out and the debt limit must be enforced it should be noted that the constitution is prohibiting default on debt – so it will have to be a default on obligations. Every treasury that matures must be paid and immediately thereafter the government will issue new treasuries. So the debt will stay at the selling level and no government bond will be defaulted on. However, obligations such as veterans and social security benefits will have to be postponed until sufficient tax revenues are collected to cover those obligations. So warn grandma that the monthly check may come late next month and even later the following month. The political fallout for GOP could be a catastrophe.

the current conservative stance can be summed up as follows: max out the credit card and then refuse to make your monthly payment while you look for ways to reduce your spending. seriously, this is the gop position right now.

Something about the name McCarthy. Real life version of Voldemort?? Beetlejuice??

Somebody always emerges from each such event wealthier.

In that case it was the largest banks who basically got government guarantees for all time (“too big to fail”). That put them in the position they have today of being able to pick up discounted assets of “not quite big enough” regionals.

There are always unintended consequences or at least unforeseen consequences.

this unforeseen consequences narrative is simply your way of pushing for a particular agenda, in this case against the big banks. these are not unforeseen consequences. they are simply the result of a free market capitalist society. somebody was going to have to pick up those discounted assets. and historically, those distressed sales go to deep pockets. historically, shallow pockets are rarely in a position to scoop up deals. this was true before too big to fail. still true today. it is one of the advantages that drives businesses to scale.

In effect, there was a ‘doughnut hole” created between a too-big-to-fail guarantee for the biggest and the FDIC insurance upper limit for individual savers. Regional banks were not large enough but they attracted depositors with accounts too large to do banking with accounts under the FDIC guarantee. Small banks mostly have smaller depositors. So the biggest and smallest had protections but not those in the middle.

I would not call this unintended consequences. those banks that failed chose this path, because they thought it was more profitable. the ones that failed typically focused on a niche (crypto, tech, wealth management) rather than diversify. this increased their risk. on top of that, they also chose very poor interest rate term management. I get what you are arguing, and you have a point. but claiming unintended consequences somehow tries to shift the blame away from the bank. those banks were POORLY run, and when sh!t hit the fan, they failed. many others did not fail.

that said, I have never been much of a fan of FDIC deposit limits. or at least, the limits that have been publicized. checking and savings accounts are not really “investment” accounts, so people don’t put money there simply to invest. it is primarily a safe haven, with some small amount of income. our banking system, overall, is better off if all people believe their deposits are protected in their entirety and liquid. it keeps funds in the banking system, and not in riskier shadow holding places. increasing those limits eliminates your doughnut hole.