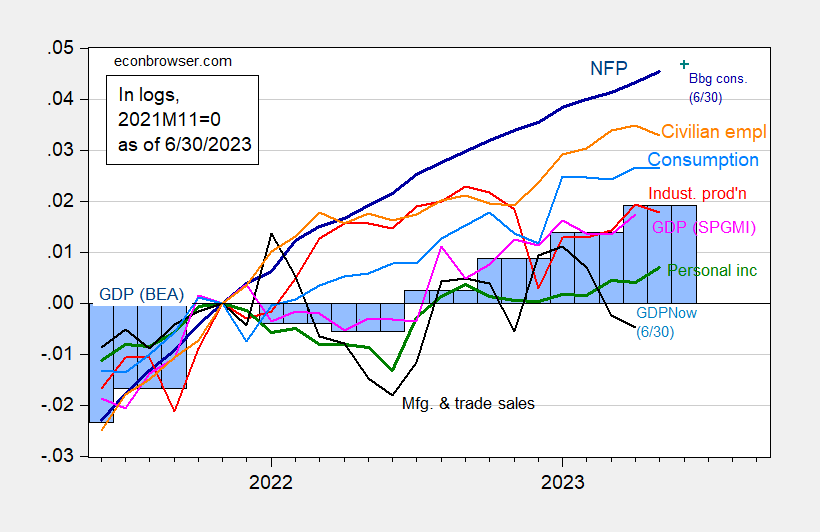

With today’s spending and income release, we have this picture of key indicators followed by the NBER Business Cycle Dating Committee (consumption, income, sales), along with monthly GDP. Atlanta Fed has also released a new nowcast of GDP.

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), 2023Q2 is GDPNow of 6/30, all log normalized to 2023M01=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 3rd release via FRED, Atlanta Fed, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (6/1/2023 release), and author’s calculations.

Maybe there’s a slowdown in the past few months (consumption flat, but personal income ex-transfers up), but the recession does not yet appear to be here (subject to the caveat all these data will be revised, including GDP very substantially).

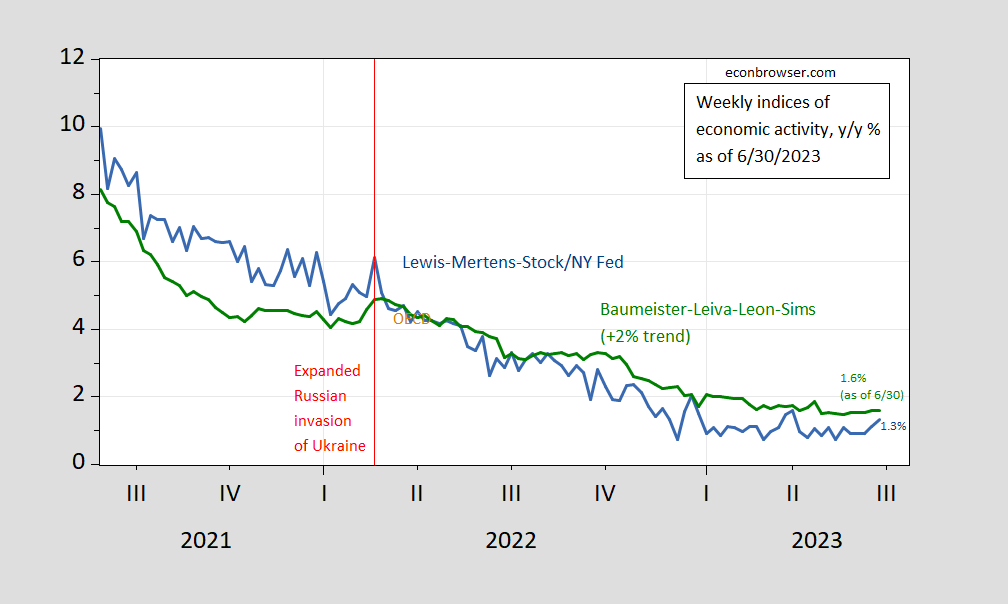

Weekly indicators support continued y/y growth, although taken literally they also imply (given Q1 GDP) negative growth in Q2.

Figure 2: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 6/30, and author’s calculations.

Gasoline $3.03 today. Will pick up some tomorrow and hope it hangs around the same price. I can get two fish sandwiches at a fastfood joint for about $6.50. Not bad by recent years’ standards.

JohnH (or is calling himself Mr. Hofer) these days is chirping about the recent flow in new solar power in China v. US without bothering to tell us what the stocks were. Yea – little Jonny boy can’t do basic research so let me:

https://www.nsenergybusiness.com/features/solar-power-countries-installed-capacity/#:~:text=Top%20five%20countries%20for%20solar%20power%20capacity%20in,…%205%205.%20India%20%E2%80%93%2038%20GW%20

As of 2019, China’s stock was about 2.7 times the US stock but then China’s population is 4 times that of the US. This link notes other nations stock. Maybe we can get Jonny boy to do the other nations on a per capita basis (if he ever passes preK arithmetic). Also note:

The US had the world’s second-largest installed solar capacity in 2019, totalling 76 GW and producing 93.1 TWh of electricity.

Over the coming decade, US solar installations are forecast to reach around 419 GW as the country accelerates its clean energy efforts and attempts to fully decarbonise its power system by 2035.

And little Jonny boy told us the US is not investing in solar capacity. Increasing capacity by a factor of 5.5 does not seem as trivial as little Jonny boy claimed.

Poor, pathetic pgl., who cheers the forecast that, “US solar installations are forecast to reach around 419 GW as the country accelerates its clean energy efforts and attempts to fully decarbonise its power system by 2035.” How nice! China already had 430 GW by the end of March. Talk about being behind!

Further, “China adds 62 Gigawatts of Solar Capacity in Just 5 Months, Compared to 10 Gigs in the US”

https://www.juancole.com/2023/06/gigawatts-capacity-compared.html

Why is this important? China has it’s priorities straight. The US spends 3.5% of its GDP on the military; China only 1.5%.

https://www.cia.gov/the-world-factbook/field/military-expenditures/country-comparison

Imagine what we could do with $.5 Trillion if we spent on “defense” at the same percent of GDP as China…things like solar power…an industry that China will clearly dominate due to sheer economy of scale. But pgl sees nothing wrong with that. And he can find no better use for that $.5 Trillion, even though “defense” spending is unauditable, a significant portion going to waste, fraud and mismanagement.

Why not use that $.5 Trillion to reduce the budget deficit or fund universal health insurance, which is standard in all developed countries but the US. But pgl prefers to spend it on a bloated defense budget and a futile and pointless ware in Ukraine!

Do you have a clue what per capita means? Didn’t think so.

Now I get why we have to endure those stupid commercials telling us to buy gold:

https://www.msn.com/en-us/money/markets/75-tonnes-of-russian-gold-imported-into-switzerland-since-beginning-of-war/ar-AA1dgS4D?ocid=msedgdhp&pc=U531&cvid=8b8caa8d33524394bbb9621ed0c1978b&ei=5

Since March 2022, the beginning of Russia’s full-scale invasion of Ukraine, Swiss factories have received 75 tonnes of gold from Russia for processing, taking advantage of the fact that it is imported through London and does not violate sanctions. The outlets found out that in recent years, the gold refineries in Switzerland have processed a large amount of gold of Russian origin, which came through London. In total, since 2021, 110 tonnes of gold worth more than 6 billion Swiss francs [about US$6.6 billion] have passed through Swiss refineries. Since the start of the full-scale war in March 2022, 75 tonnes have been refined in Switzerland alone. Before the full-scale war, Switzerland imported an average of 20 tonnes of Russian gold per year, while in the first five months of this year alone, 38 tonnes of gold from Russia were imported into Switzerland through London. Similarly, Russian gold exports to the UK have increased in recent years.

I’m curious which multinationals are doing this. Given the Swiss tax rate is a lot lower than that 20% corporate tax rate for Russia, I bet there is a wee bit of transfer pricing manipulation.

I would have expected a noticeable slowdown in the US economy by now. Wrong.

I am wondering if a few factors are at work here.

+ The economy is still recovering from the pandemic shutdown.

+ NATO member country economic and financial sanctions against Russia have been even more ineffective than anticipated.

+ Central banks are still hesitant to tighten (and it looks like North American central banks will once again raise overnight rates in July).

+ Equity markets are once again wrong but they reflect general optimism and are contributing a small wealth effect to growth.

I am not heavily invested in any of the above but if you have hypotheses or decent guesses, share away. These are interesting times.

“NATO member country economic and financial sanctions against Russia have been even more ineffective than anticipated.”

Wait – hurting Russia more leads to a US recession? Please explain. Or are you saying more sanctions on Russia will raise energy prices here? Something tells me that this is not quite right.

Corporate profiteering……. those who present their statistics and them who lie for them…… ?? Ohp, unacceptable answer?? Nevermind. Back to watching Letterman repeats.

We may have a problem with the trolls I call the Usual Suspects (CoRev, Bruce Hall, Econned, Rick Stryker, Princeton Steve etc.) but they are far less worse than JohnH (aka John A. Hofer). Just consider his latest two rant in light of how Dr. Chinn took this lying moron down on real defense spending

JihnHJuly 1, 2023 at 4:10 am

Maybe pgl should direct his ire at the White House, which published all those nominal figures! I mean, have you ever heard of anything so abominable as using actual, nominal figures. Per pgl, those folks at the White House must be “overwhelming us with one lie after another,” just because they use nominal figures.

JohnHJuly 1, 2023 at 7:03 am

pgl can’t seem to get anything right! The figures I used to show pgl’s poor math skills came from Table 4.1 Outlays by Agency, not from my own projections, as pgl mendaciously claimed.

But you can count on pgl to shop around amongst the tables in search of something that proves me wrong…and if he doesn’t find it, he’ll just make things up, as he has so many times in the past.

Now let’s recap. Jonny boy told us we never saw a reduction in real defense spending in the 1990’s. He told us defense spending rose in the first two years of the Biden Administration.

Dr. Chinn’s graph shows both claims are false. And Jonny boy’s only comment? NICE.

Jonny boy told us that defense spending in 2023 is expected to be 28% higher than it was in 2018. As line 5 of table 6.1 clearly shows this figure represents nominal spending. Line 17 of the same table shows the projected increase is more like 10% (which Jonny boy calculated later to be 8% and yet he accuses me of poor math skills.

NOW he blames his stupidity on the government because they reported both nominal and real figures? Just wow. Oh wait – this moron decided not to look at table 6.1 at all. And that is the fault of the White House or me?

A lot of people have accused Jonny boy of being dishonest. He is. But I had suggested he may be just dumb. No it goes deeper than that. Jonny boy is both mentally retarded and mentally deranged. I think we can all agree that someone like that should not be given access to the internet.

Poor pathetic pgl. The White House Table 4.1 – OUTLAYS BY AGENCY: 1962 – 2028 clearly shows that “defense” spending is estimated to rise by 28% over the past five years.

But pgl reckons that if he bloviates enough and blows enough smoke, the numbers will magically be obscured!

BTW that table shows that “defense” spending is estimated to rise by 11.8% in the 2024 budget alone. Budget deficits be damned! Universal health insurance, RIP.

“The White House Table 4.1 – OUTLAYS BY AGENCY: 1962 – 2028 clearly shows that “defense” spending is estimated to rise by 28% over the past five years.”

That is also clearly marked as NOMINAL spending. Same as line 5 of table 6.1 but go down to line 17.

That has been my simple point from the beginning. That was the point of Dr. Chinn’s post. And little Jonny boy still does not get it. Yea – you are not just dumb. You are mentally retarded. Keep reminding us that you the dumbest troll God ever created!

Most published statistics are nominal, not real. What’s pgl’s point?

The advantage of nominal figures is that they haven’t been manipulated after shopping around for the most advantageous deflator and the author’s own unknown calculations.

In any case, Table 4 shows that the White House forecast “defense” spending in 2024 to rise by almost 12%. Which deflator does pgl recommend to make it appear that real “defense” spending is going down? Why not cut waste, fraud, abuse and mismanagement in order to cut “defense” spending?

“Most published statistics are nominal, not real. What’s pgl’s point?”

It does seem you are indeed the most mentally retarded troll ever. Why are you still chirping – we figured out you are a moron a long time ago. This is an economist blog not your preK class. Every one knows we should express things in real terms and table 6.1 line 17 made this clear even before Dr. Chinn’s post.

Hey Jonny – keep reminding us you are a mental retard. Damn!

“The advantage of nominal figures is that they haven’t been manipulated”

You are now accusing the BEA of data manipulation? Damn – you are one disgusting little boy who needs his stinky diaper changed.

National Income and Product Accounts, revised data:

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

June 30, 2023

Defense spending was 55.4% of federal government consumption and investment in January through March 2023. *

$959.2 / $1,732.1 = 55.4%

Defense spending was 20.6% of all government consumption and investment in January through March 2023.

$959.2 / $4,649.8 = 20.6%

Defense spending was 3.6% of GDP in January through March 2023.

$959.2 / $26,529.8 = 3.6%

* Billions of dollars

Eurostat data that I found startling, causing me to question the extent to which European countries are social democracies as I had supposed:

https://ec.europa.eu/eurostat/en/web/products-eurostat-news/w/DDN-20230614-1

June 14, 2023

People at risk of poverty or social exclusion in 2022

Greece ( 26.3)

Spain ( 26.0)

Italy ( 24.4)

European Union ( 21.6) *

France ( 21.0)

Germany ( 20.9)

Ireland ( 20.7)

Portugal ( 20.1)

Luxembourg ( 19.4)

Belgium ( 18.7)

Sweden ( 18.6)

Austria ( 17.5)

Denmark ( 17.1)

Netherlands ( 16.5)

Finland ( 16.3)

* https://ec.europa.eu/eurostat/databrowser/view/ILC_PEPS01N__custom_6444563/default/table

https://fred.stlouisfed.org/graph/?g=15KWB

August 4, 2014

Real per capita Gross Domestic Product for Italy and Greece, 2000-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=15KWP

August 4, 2014

Real per capita Gross Domestic Product for Italy and Greece, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=16HiS

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and China, 2000-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=16HiZ

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and China, 2000-2021

(Indexed to 2000)

[ That the unrepresentative leadership of the European Union is discouraging economic relations with China by these peripheral countries is distressing to me. ]

Dean Baker nails it: “New York Times Headlines Article “Public Tired of ‘Neo-Liberal’ Policies Designed to Make Rich Richer…

The massive upward redistribution of income in the last four decades is not really a debatable point. However, as a political matter, it is far more salable to say that this upward redistribution was the result of the forces of technology and globalization than of policies designed to make the rich richer…

While it’s obvious why the people who benefitted from this upward redistribution would insist that the causes were the natural forces of globalization and technology, it is difficult to understand why opponents of these policies largely accept this framing. This matters not just as a matter of attributing blame but also in designing better policies going forward…

I know this point can’t be made in the NYT or other major media outlets, but why are so few progressives interested in this obvious fact?”

https://cepr.net/new-york-times-headlines-article-public-tired-of-neo-liberal-policies-designed-to-make-rich-richer/

And why do so many economists at public policy websites show so little interest in this obvious fact? And why do they talk so little about inequality in general? As I’ve noted before (with only anecdotal refutation), Krugman manages to address only about 2% of his columns to the issue, which gives a sense of how important it is to him…

Dean Baker’s focus is on the patent system. Krugman would agree with this point. Krugman also supports more anti-trust enforcement. Krugman also notes the damage done by monopsony power.

But for some reason dishonest little Jonny boy has to attack Krugman as not caring about these issues. Why? Because the only thing little Jonny boy knows how to do is to LIE about the positions of others. Yea – little Jonny boy cannot bring himself to have an adult conversation.

“And why do so many economists at public policy websites show so little interest in this obvious fact?”

WTF do you mean by public policy websites? Maybe you are referring to the National Review but that is nothing more than a right wing rag.

Now this blog discusses public policy issues and if you think Dr. Chinn ignores these issues, then you are indeed a mentally retarded troll.

“ Sanders Unveils Bill to Force Pentagon to Pass an Audit—or Return Part of Its Budget The Pentagon and the military-industrial complex have been plagued by a massive amount of waste, fraud, and financial mismanagement for decades. That is absolutely unacceptable…

A fact sheet released by Sanders’ office argues that “the need for this audit is clear,” pointing to a Commission on Wartime Contracting in Iraq report estimating that “$31-60 billion had been lost to fraud and waste.”

“Separately, the special inspector general for Afghanistan Reconstruction reported that the Pentagon could not account for $45 billion in funding for reconstruction projects,” the fact sheet notes. “A recent Ernst & Young audit of the Defense Logistics Agency found that it could not properly account for some $800 million in construction projects. CBS News recently reported that defense contractors were routinely overcharging the Pentagon—and the American taxpayer—by nearly 40-50%, and sometimes as high as 4,451%.”

https://www.commondreams.org/news/sanders-audit-pentagon-bill

Of course pgl has said that forcing the Pentagon to pass an audit won’t result in any savings, even though we’re sending hundreds of billions to the notorious Ukraine kleptocracy!

In fact, pgl pretty much opposes audits altogether. Bernie’s 2012 audit of the Fed upset him, even though it revealed major conflicts of interest. And he has never seen the need for a DOD audit and has refused to support requiring DOD to pass one many times in the past.

Now imagine what we could do with the potential savings revealed by a DOD audit—deficit reduction, universal health insurance, faster development of solar power capacity… But pgl prefers write blanks and allow DOD to waste money instead!

“Of course pgl has said that forcing the Pentagon to pass an audit won’t result in any savings, even though we’re sending hundreds of billions to the notorious Ukraine kleptocracy! In fact, pgl pretty much opposes audits altogether.”

It seems you have to blatantly LIE about what I believe on an hourly basis. Dude – your emotional issues are not my fault. But do seek emotional help as you truly have gone over the edge.

OK, pgl. It’s easy! Just go ahead and say that you support the Audit the Pentagon Act. That would clarify your beliefs.

But instead of simply stating that he supports the Audit the Pentagon Act, pgl chooses to weasel out by saying others lie about what he believes!

I have never opposed it. Pass it. But that alone does not lower defense spending. What would? Putin backing down in Ukraine.

Hey Jonny boy – you have yet to call out Putin’s war crimes. Why not?

“pgl chooses to weasel out by saying others lie about what he believes”

You do lie about what I and others believe. All the time. Your little temper tantrums does not change this basic fact. Mrs. Hofer? Could you please change little Jonny’s diaper? Damn!