Figure 1: US defense consumption and investment, in bn.Ch2012$ SAAR (blue). NBER defined peak-to-trough recession dates shaded gray. Note 1960-2001 data converted to 2012$ using index. Source: BEA, NBER, and author’s calculations.

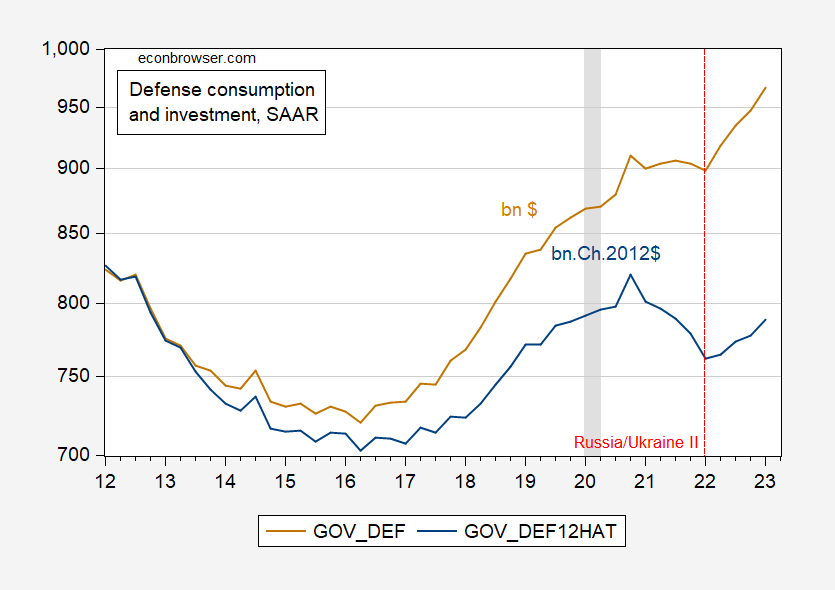

Figure 2: US defense consumption and investment, in bn.Ch2012$ SAAR (blue), in bn.$ (tan). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Bottom line. It is useful to understand the difference between nominal and real magnitudes.

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

September 30, 2022

Defense spending was 58.0% of federal government consumption and investment in 2020. *

$882.4 / $1,520.6 = 58.0%

Defense spending was 22.5% of all government consumption and investment in 2020.

$882.4 / $3,928.9 = 22.5%

Defense spending was 4.2% of GDP in 2020.

$882.4 / $21.060.5 = 4.2%

* Billions of dollars

As Paul Krugman stated – the Federal government is an insurance company with an army. Which as I have noted over and over is why your little ratio is devoid of any real meaning. The Federal government does not do much in the way of public education or transportation or even local police/fire enforcement. Now if you wanted to show how much of government purchases comes from defense v. nondefense, you should include the massive amount done by the state and local governments. But you never do – which means you are being less than honest.

pgl actually noticed: “The Federal government does not do much in the way of…” And that’s exactly the problem with the bloated, unauditable “defense” budget–there are a LOT of other needs that are not being addressed because so much money goes for military spending. Take universal health insurance for example. The US is the only developed country not to offer it.

But pgl thinks that bloated, unauditable “defense” budget is more important than universal health insurance.

More lying about what I said? You are indeed the most worthless troll ever created.

ltr is doing what Shein did:

https://www.npr.org/2023/06/30/1184974003/shein-influencers-china-factory-trip-backlash

Ham-handed efforts to cover up bad behavior.

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

May 25, 2023

Defense spending was 55.6% of federal government consumption and

investment in January through March 2023. *

$967.0 / $1,739.9 = 55.6%

Defense spending was 20.8% of all government consumption and investment in January through March 2023.

$967.0 / $4,654.9 = 20.8%

Defense spending was 3.7% of GDP in January through March 2023.

$967.0 / $26,486.3 = 3.7%

* Billions of dollars

https://watson.brown.edu/costsofwar/files/cow/imce/papers/2023/One-pager%20on%20Heidi%27s%20paper-3.pdf

June 8, 2023

We Get What We Pay For:

The Cycle of Military Spending, Industry Power and Economic Dependence

By Heidi Peltier

The topline:

The United States consistently allocates most of its federal discretionary budget to the military. As a result, the military industry continues to gain disproportionately large amounts of power in the U.S. economy and political sphere, which in turn ensures continued growth in the military budget. This has the effect of squeezing out the resources and power of other sectors, and weakening the United States’ ability to perform core functions such as healthcare, infrastructure, education, and emergency preparedness. This perpetuates a vicious cycle: high military spending means the strong military sector will only continue to get political power and gain public trust, which will in turn ensure it receives disproportionate resources at the expense of other sectors, which means the military will take on roles that should go to other agencies, and the cycle repeats.

Discretionary Budget Authority By Agency

Fast facts:

● For Fiscal Year 2022, more than half of the discretionary budget went to national security spending.

● Of the money allocated to the Department of Defense, about half went to military contractors. About 30% of that went to the “Big 5” alone: Lockheed Martin, Boeing, Raytheon, General Dynamics, and Northrop Grumman.

● In 2022, the Department of Defense accounted for 34 percent of the civilian federal workforce, and Veterans Affairs made up another 20 percent, so that more than half of federal civilian employees are devoted to the military and veterans.

● The federal government workforce is comprised of about 3.5 million workers, if we include both civilians and uniformed active-duty personnel. Of this, about 72 percent is defense-related employment, including Department of Defense civilians, uniformed military personnel, and those working in Veterans Affairs. By comparison, the Department of Health and Human Services made up 4 percent of federal employees, and the Department of State only 1 percent.

● Dollar for dollar, spending on other sectors creates more jobs than spending on the military. Spending on other priorities such as clean energy, health care, or public education would create between 9 percent and 250 percent more jobs than the same amount of spending on the military.

Discretionary Spending Over Time

Job Creation In Each Sector Per $1M of Federal Spending

The bottom line:

In the same way that the rich get richer and the poor get poorer, continuing to spend in this way will ensure that the military industrial sector grows at the expense of other, more generative economic sectors. This is a missed opportunity: reducing the military budget and funding other priorities such as healthcare, education, clean energy, and infrastructure will help increase other forms of security – the kind of meaningful human security rooted in good health, good living conditions, and a productive and well-educated society – while also increasing employment nationwide. *

* https://watson.brown.edu/costsofwar/files/cow/imce/papers/2023/Peltier%202023%20-%20We%20Get%20What%20We%20Pay%20For%20-%20FINAL%20-%200608.pdf

“The United States consistently allocates most of its federal discretionary budget to the military.”

Something we noted to CoRev when this lying troll went off discretionary spending. But now you are once again citing a misleading statistic. Most of Federal transfer payments are called mandatory spending.

Now if you want to be as dishonest as CoRev – you are off to a good start.

Ole Bark, bark, why do you persist with lying? “Something we noted to CoRev when this lying troll went off discretionary spending.” We realize you are probably the dumbest troll here, but please spend some of your discretionary income on a book on Federal Government operations. If you use your credit card to buy the book please note the difference between buying (spending) and paying down the balance on that ole credit card.

You seem totally ignorant of the various steps in that simple financial process.

The lying ignorant liberal mind is an amazement. Yours in particular.

Gee – little CoRev is trying to keep up with the stupidity of JohnH. Dude – you need to try a lot harder.

Nice!

The other problems is that the more toys the military gets, the more they’re motivated to use them.

Nice? This graph contradicts all your stupid lies on this topic. OK maybe you don’t want to remind us you are dumber than a rock and dishonest as it gets. So hey!

tracks bastiat’s concern for French investments in fortifications, almost any other use of the money was better.

until the forts were successful, which it turns they were not useful in 1914 and 1940

The intent was to show just what defense spending was in 2020, and in the first quarter (annualized) in 2023. The posts were correct, carefully constructed and labelled, and precisely as intended. I am entirely pleased with the posts.

Thank you so much for allowing just what I intended to post.

https://news.cgtn.com/news/2023-06-28/The-magic-seed-How-does-Chinese-rice-helps-Africa-combat-hunger–1l0nLrn43MA/index.html

June 28, 2023

The magic seed: How does Chinese rice help Africa combat hunger?

Rice, an important food crop in the world, feeds more than half of the world’s population. Africa has a long history of planting rice, but it has been suffering from a low yield, with key bottlenecks, such as a shortage of new rice varieties and planting expertise.

To solve the problem, China has sent rice scientists to the tropical continent, hoping to bring new prospects to China-Africa cooperation in agriculture and poverty alleviation.

Chinese hybrid rice expert Hu Yuefang arrived in Madagascar in 2008 and has been devoted to studying localized hybrid rice varieties and helping the local people increase their rice yields.

The 65-year-old is still working at the China National Hybrid Rice Research and Development Center’s Africa sub-center in Madagascan town Mahitsy, about 8,500 kilometers away from his hometown of Yiyang in central China’s Hunan Province.

With an area of about 600,000 square kilometers, the African island experiences four kinds of climate, featuring four types of terrains: tropical rainforest, tropical savanna, tropical plateau and a semi-arid zone. Hu and his team have traveled to almost every rice-growing area on the island to find the best-adapted varieties.

In 2010, Hu and his team selected three hybrid rice varieties capable of achieving high yields in areas with different altitudes, which received technical validation from Madagascar’s Ministry of Agriculture.

“The yield per hectare of these three hybrid rice varieties is three to four times higher than that of traditional Malagasy rice,” said Hu.

Madagascar has been cooperating with China in developing hybrid rice since 2007. Currently, the cumulative area of Chinese hybrid rice cultivation in the country has exceeded 50,000 hectares, with an average yield of around 7.5 tonnes per hectare.

In Africa, Madagascar has the largest area of hybrid rice cultivation and the highest yield, and it is also the first African country to realize the whole industrial chain of hybrid rice breeding, seed production, planting, processing and sales.

In Madagascar, the pattern of Chinese hybrid rice is printed on its 20,000 ariary banknote, the largest denomination in the country. It shows the gratitude of the country’s government and people who have taken a major step toward food self-sufficiency by planting hybrid rice.

Talent training

Heading to the “heart of Africa,” Burundi faced a similar rice cultivation challenge though the East African country boasts favorable conditions for rice production. Farming is the main industry of the landlocked country, making rice an important ingredient in a typical Burundian meal.

Since 2009, China has sent 45 senior experts in five batches under bilateral technical cooperation programs to cultivate new rice varieties in Burundi. The Chinese experts selected and introduced eight rice seed varieties suitable to the local environment. Now, poor yields or the threat of total crop failure caused by rice plague in mountainous areas has become a thing of the past.

Yang Huade, chief of the Chinese team of farming experts at the Gihanga research center, received the good harvest award the, “Cup of the Ambassador of China to Burundi 2022,” from the Burundian President last May.

Yang said the hybrid rice yield currently ranges between nine and 10 tonnes per hectare, more than triple that of 2015 when he arrived in Burundi.

According to Yang, some 49 students trained by the research center supervise over 1,500 farmers who received training in rice growing as well.

He added that the research center also trained agronomists for the Burundian environment, agriculture and livestock ministry….

Oh, my Dog!!! ltr is shown to be innumerate and her response is to repeat every word of her innumerate blather? And todeclare herself proud of the effort?

China needs better trolls.

You say innumerate. I say dishonest. I had to advocate banning trolls but ltr and Jonny boy are wasting space with nonstop dishonesty.

If ltr = let tyranny reign really knew what they were doing, they’d highlight extreme U.S. policy hypocrisy such as the following:

https://www.nytimes.com/2023/06/29/business/economy/russia-oil-imports-ban.html

But ltr = let tyranny reign isn’t really here to promote good national policies or good government, ltr is here to rationalize autocrats like Xi Jinping’s and Putin’s murder and abuse of their own citizens.

On a morality basis, I could make a strong argument ltr is the most morally vacuous person on the blog. But I am for everyone getting a chance to express themselves, and roaches tend to scurry in the light and thrive in the darkness. That why I say donald trump only exposed American racism that was already there. ltr reminds us how nationalistic most mainland Chinese are, and therefor ltr fills a function to Americans not cognizant of China’s extreme nationalism. I could battle with ltr everyday here in comments in a way that makes pgl seem timid. But the fact is, after 7 years in mainland China, rural and city, this is well worn ground for me. I am tired of it. and I would rather “revisit” it in my head after about 6 Smirnoff malt drinks, than revisit the topic with a moral neanderthal like ltr (I’d say moral mongoloid but…. the neanderthal peg fills the same slot).

@ Macroduck

China’s RMB dropping pretty quickly recently, and Michael Pettis still discussing that much of China’s real estate problems are still there. Reading Michael Pettis Twitter thread recently is very worth it. They are selling off dollars and trying everything in the book to keep the RMB from dropping.

https://www.wsj.com/articles/chinas-property-market-enters-troubling-new-phase-1fe3143d

The cut in the policy rate, while most of the world is hiking, may have something to do with the renmimbi slide:

https://tradingeconomics.com/china/interest-rate

By the way, for a country which needs to find some form of fiscal stimulus other than mal-investment, and which claims to be engaged in a policy of consumption-led growth, get a load of the personal income tax rate:

https://tradingeconomics.com/china/interest-rate/indicators

Bottom row of the table shows a 45% rate.

Something for pgly and Ducky to contemplate: “Carrie Xiao at PV Tech reports that in the first five months of 2023, China has installed 62.1 gigawatts of solar capacity at a cost of $13.6 billion. Year on year, it was a 140% expansion. Just to give you an idea of the magnitude of this advance, a typical nuclear power plant has a nameplate capacity of 1 gigawatt.

Consider that the US installed 6.1 gigawatts of new solar in the first quarter…”

https://www.juancole.com/2023/06/gigawatts-capacity-compared.html

Lots of things for the federal government to spend money on besides the bloated and unauditable “defense” budgets.

The jingos here should start thinking seriously about the US’ misplaced priorities.

Are you now dating ltr? Soul mates in lying for the mighty Xi!

Let’s pull out the calculator since little Jonny boy has no idea how to do this. For 2023, China will install 4 times what the US will do. But since China’s population is 4 times the US population, on a per capita basis, the US is on par with China.

Someone call Mrs. Hofer and tell her she really needs to change little Jonny boy’s stinky diaper.

“Bottom line. It is useful to understand the difference between nominal and real magnitudes.”

How many times do we have to remind JohnH of this. He actually said there was no peace dividend in the 1990’s. DUH!

Dear Fellow Frogs – re: the pot is boiling. In Madison WI – children and carpenters are warned not to go outside because of choking, eye scorching smoke. In Texas, the Governor GOP Climate Denier is not allowing workers to take water breaks in 120 degree F heat. And folks – my reading of climate science – indicates it will get worse. Can we spend less on military and more on climate warming defense/climate change mitigation? Hire legions to plant trees. Switch to electric EVs. Build more walk and bike paths. Invest in ESG funds. Invest in renewable energy production. BTW – I still think this Position Statement on Climate Change that I helped edit in 2011 lays out the case for agriculture pretty well – https://www.agronomy.org/files/science-policy/asa-cssa-sssa-climate-change-policy-statement.pdf Folks that was more than 10 years ago. Is it clear now?

(Also Menzie – read this interesting article on stress of smaller/mid-size regional banks from Fed relentless march to higher rates. It must be hell for a bank to have loaned out money at 3% and now having to pay 5% CD. It seems that not only does current Fed want to put us out of work and tighten our belts – but they also want to force a consolidation of banks into a few large firms. https://www.bloomberg.com/graphics/2023-us-banks-expensive-fix-declining-deposits-problem/)

It’s interesting that in 1965, America spent far more on defense as percentage of GDP

@ Ramesh

I agree it’s interesting, but it may have been connected to early operations in Vietnam, the Cold War. I would imagine just nuclear programs alone at that time took a lot of resources. America having bombers with nuclear warheads in the air 24/7 etc.

— is shown to be innumerate…

China needs better trolls.

— is shown to be innumerate…

China needs better trolls.

— is shown to be innumerate…

China needs better trolls.

[ Always but always racism and horrid bullying. ]

I’ve corrected your lies on this point before. You’re hiding behind this racism thing again. I find you despicable because of what you write, the lies and hypocrisy, not because of superficial genetic differences. You, ltr, you are a moral wreck. You hide behind your race, but you personally are the target of my comments. Get it through your lying skull – you, personally, are the problem. Not all of China. You, you sniveling liar.

https://www.whitehouse.gov/omb/budget/historical-tables/

‘pglJune 24, 2023 at 2:35 am

“OK, pgl, since you can’t do the math, here’s the answer. In the past five years real defense spending has increased about 8%.”

Did forget to show your homework again? Of course you told us that the PROJECTED nominal increase from 2018 to 2023 was 28% not 8%. Now maybe little Jonny boy has some forecast of the 2023 deflator indicating that it might increase by 20% relative to 2018. But no one here trusts little Jonny boy’s forecasting abilities. And little Jonny boy did not show his homework so who knows.

But at least after some 2000 stupid and dishonest comments little Jonny boy finally got the obvious point about real v. nominal. Yea little Jonny boy is SLOW.’

We have been overwhelmed with one lie after another from Jonny boy so it is important not to let this weasel deny what he said. Now he gave us this link which has table 6.1. Jonny kept using line 5 (current dollars) as if it showed real defense spending even though it shows nominal spending. I guess Jonny boy never figured the same table’s line 17 was the right one to use.

BTW – Jonny boy might need a calculator as that real increase was 10% not 8%. Jonny boy never passed preK arithmetic!

Maybe pgl should direct his ire at the White House, which published all those nominal figures! I mean, have you ever heard of anything so abominable as using actual, nominal figures. Per pgl, those folks at the White House must be “overwhelming us with one lie after another,” just because they use nominal figures.

Of course, pgl won’t address the real issue here—priorities. Should we be spending all this money on “defense?” Or should we direct some of that money to paying down the deficit or to proving heal insurance for all?

Pgl goes ballistic about the White House using nominal rather than real numbers, but he recoils at the suggestion that we cut “defense” spending by reducing waste, fraud and mismanagement, whose magnitude would be clearly revealed if DOD could pass an audit. But no, pgl wants to keep spending enormous amounts with no accountability.

pgl sounds like a real defense industry shill.

How effing stupid can you get? Yes – they provided BOTH nominal figures and real figures clearly labeled. It is not their fault you are too stupid to get the difference.

pgl can’t seem to get anything right! The figures I used to show pgl’s poor math skills came from Table 4.1 Outlays by Agency, not from my own projections, as pgl mendaciously claimed.

But you can count on pgl to shop around amongst the tables in search of something that proves me wrong…and if he doesn’t find it, he’ll just make things up, as he has so many times in the past.

Seriously Jonny boy – you never bothered to tell us how you came with your numbers. Look – we all know you are a dumbass. So stop blaming others for your incessant stupidity.

“The figures I used to show pgl’s poor math skills came from Table 4.1 Outlays by Agency”

My God you are stupid. It was table 6.1 that provided defense spending both in nominal terms as well as in real terms.

Come on Jonny boy – your incompetence is already apparent to everyone. You do not need to remind us of your stupidity on an hourly basis.

Trigger warning: The following topic may be connected to a “boomer” cultural phenomenon formerly known as MERIT BASED. Please stop reading here and go to your campus safe space if you even felt a tingle of butterflies in your stomach just now when you read the words MERIT BASED. Also please avoid ANY topic which makes you uncomfortable, for this is how the great achievers in life approach life~~avoiding any topic which makes them squeamish. Now, please don’t study harder. Move back to your parents home and find a small recessed wall to cry in until someone can find new ways to add points to your exam scores. Thanks, this was for minorities’ mental health

Does this mean I’m not getting my Gender Studies scholarship??

https://www.nytimes.com/live/2023/06/29/us/affirmative-action-supreme-court

Did DeSantis hire CoRev as his economic advisor. After all DeSantis wants to end various key Federal agencies including the IRS (balance the budget with no tax revenues at all), the Department of Education (letting morons rule the world, Commerce (because Disney is a Communist plot), and of course “energy” as of course we need as much as Global Warming as possible.

There are a few Republicans who worship St. Reagan and claim to hate Trump. But notice that both of them massively increased defense spending. After the end of Vietnam, President Carter lowered defense spending but St. Reagan reversed that. OK the peace dividend (which JohnH denies ever existed) lowered defense spending but George W. Bush changed all of that. Now we got defense spending under control under Obama but then came big spending Donald Trump.

Yea Republicans claim they want to balance the budget but they love defense spending all paid for by tax cuts for the rich!

I was around dod for the post vietnam cuts, carter killed b-1 bc it failed testing. Reagan was applauded bc they bought100 w/o fixing issues.

I was around for post cold declines they made sense bc Reagan bought a lot and operations were not consuming.

I cannot recall the late obama declines, by then I was “consulting”, there was plenty of “work”.

Final (for now) Q1 GDP data show stronger consumer demand and weaker inventory investment than previously reported. Disposable personal income improved and the saving rate rose. All of this bodes well for Q2 growth.

Q1 profits down 4.1% after a 2.0% drop in Q4. Corporate profits tend to lead recessions, but with lots of false positives.

Aside from the GDP data, auto demand is reported to be cooling, with inventories building and rail tens of thousands of autos not available for sale due to rail delays. Anyhow, this suggests downward pressure on auto prices.

Heck, while I’m at it, reports from the housing sector suggest bottoming. Starts recently jumped, prices have stabilized, but differences between locations are large.

So maybe this “dodged a bullet” stuff isn’t entirely crazy.

Trump is running, so guess who’s back:

https://www.agweb.com/markets/pro-farmer-analysis/no-trade-free

Can we just call him Darkhizer??

Something he wrote over 12 years ago:

https://www.washingtontimes.com/news/2011/may/9/donald-trump-is-no-liberal-on-trade/

LIGHTHIZER: Donald Trump is no liberal on trade

Get-tough views on China recall roots of Republican Party

With Donald Trump getting more TV coverage than Charlie Sheen and rising in the polls among Republicans, it is not a surprise that the knives have come out for him. “He’s just another liberal,” screams the libertarian Club for Growth. “He’s not one of us,” echoes Karl Rove. All of that may be true, but one piece of cited evidence is quite puzzling. Mr. Trump’s GOP opponents accuse him of wanting to get tough on China and of being a protectionist. Since when does that mean one is not a conservative? For most of its 157-year history, the Republican Party has been the party of building domestic industry by using trade policy to promote U.S. exports and fend off unfairly traded imports. American conservatives have had that view for even longer. At the beginning of this nation, Alexander Hamilton and his followers were staunch conservatives who helped found American capitalism – and avowed protectionists. By contrast, Thomas Jefferson – the founder of the Democratic Party – was much more of a free trader. During the first half of the 19th century, pro-business politicians like Henry Clay were ardent supporters of an “American system” that would use tariffs to promote American industry. Clay’s political descendents – such as Abraham Lincoln – went on to form the Republican Party. Every Republican president starting with Lincoln – and for almost 100 years thereafter – generally supported tariffs, while Democrats tended to promote free trade. Would anyone argue that presidents like William McKinley, William Howard Taft and Calvin Coolidge were not conservatives – or that free traders like Woodrow Wilson and Franklin D. Roosevelt were not liberals?

Republicans love to tell us St. Reagan was a free trader but his record suggests otherwise.

More weak data out of China:

http://www.cnbc.com/2023/06/30/china-economy-june-pmi-shows-manufacturing-activity.html

The CNBC article notes a survey showing doubt about the effectiveness of monetary easing:

https://www.cnbc.com/2023/06/30/china-beige-book-second-quarter-recovery.html

I’m not familiar with the “China Beige Book” – and a little put off by its misleading moniker – but we have lots of examples of monetary policy running out of forces. Lord Keynes wrote about it, I believe.

This article in Foreign Affairs identifies a pattern in Xi’s policy behavior I hadn’t been aware of, and also offers an explanation for weak demand growth in China. The authors argue that “consumption-led growth” will fail because the public know how quickly Xi changes course, so will continue to favor precautionary saving:

https://www.foreignaffairs.com/china/xis-plan-chinas-economy-doomed-fail

This explanation is consistent with the failure of monetary easing to stimulate credit growth.

Here’s new bank lending:

https://tradingeconomics.com/china/banks-balance-sheet

One way the Wagner Group makes its money:

https://www.msn.com/en-us/news/world/un-ends-peacekeeping-mission-in-mali-us-blames-russia-s-wagner/ar-AA1dguTP?ocid=msedgdhp&pc=U531&cvid=8a5b21ebf2e24894b473df08e6cfa180&ei=8

UNITED NATIONS (Reuters) – The United Nations Security Council on Friday unanimously voted to end a decade-long peacekeeping mission in Mali after the West African country’s military junta abruptly asked the 13,000-strong force to leave – a move the United States said was engineered by Russia’s Wagner mercenary group. The end of the operation, known as MINUSMA, follows years of tensions and government restrictions that have hobbled peacekeeping air and ground operations since Mali teamed up in 2021 with Russia’s Wagner group, which was behind an abortive armed mutiny in Russia last weekend. U.N. peacekeepers are credited with playing a vital role in protecting civilians against an Islamist insurgency that has killed thousands. Some experts fear the security situation could worsen when the mission departs, leaving Mali’s underequipped army alone with about 1,000 Wagner fighters to combat militants who control swaths of territory in the desert north and center. The 15-member council adopted a French-drafted resolution asking that the mission on Saturday begin “the cessation of its operations, transfer of its tasks, as well as the orderly and safe drawdown and withdrawal of its personnel, with the objective of completing this process by Dec. 31, 2023.” As the Security Council voted, the White House accused Wagner leader Yevgeny Prigozhin of helping engineer the departure of U.N. peacekeepers from Mali, and said it has information indicating Mali’s authorities have paid more than $200 million to Wagner since late 2021. “What isn’t as widely known is that Prigozhin helped engineer that departure to further Wagner’s interests,” White House national security spokesman John Kirby told reporters. “We know that senior Malian officials worked directly with Prigozhin employees to inform the U.N. secretary-general that Mali had revoked consent for the MINUSMA mission.”

Yevgeny Prigozhin is a ruthless war lord. But he served the interests of Putin until recently so back in the good old days – JohnH loved the criminal behavior of Yevgeny Prigozhin.

I guess pgl has never heard of Academi, formerly Blackwater.

“Blackwater”: the major crimes of the most famous American PMCs”

“https://www.ilawjournals.com/blackwater-the-major-crimes-of-the-most-famous-american-pmcs/

Of course, it’s perfectly fine with pgl when the US’ hired goons commit war crimes–no complaints from him.

I not only heard of Blackwater. I also condemned their actions in the past. Oh my little Jonny come later is both ignorant as it gets (what’s new) but also throwing little temper tantrums. Damn it – tell your mommy to change your stinky diaper.

BTW – when is John A. Hofer going to have the courage to condemn Russian war crimes. Oh yea – when hell freezes over.

Sure, I have no problem condemning Russia’s war crimes. It’s easy…like barking at the moon. But what difference does it make other than giving yourself an inflated sense of your own moral superiority?

Really, any war crime is unconscionable. But where criticizing a war crime could make a difference is when your own country does it. In other words, a government that commits war crimes and claims to act on behalf of its citizens should be held accountable by its own citizens when it misbehaves. When has that ever happened?

pgl claims to have condemned Blackwater’s war crimes in the past. Funny, I don’t recall ever reading him say that here. Of course, It’s easy for him to claim pretty much anything when he doesn’t have to substantiate it, something he does all the time.

So, go ahead, pgl, tell us that you believe Blackwater should be brought to justice for the war crimes it committed in Iraq and Afghanistan. And tell us that you believe that US government officials who hired and oversaw Blackwater’s activities should also be jailed. Go ahead! It’s easy!

‘Really any war crime is unconscionable. But….’ The inevitable…But…

Gee, what a surprise. JH equivocates before getting quickly to the “what about?”

Classic 5th grade logic.

Anti War John condemns Russian war crimes before excusing them because, well, others do it too.

Ho Hum. More drivel on moral superiority from this site’s biggest fraud.

“I have no problem condemning Russia’s war crimes.”

But you never do. Invited to do so hundreds of time and each time you run to mommy as the rest of us call you out to be the Putin poodle you were are.

Read the room dumbass – EVERYONE knows you have zero credibility. Find some other blog to pollute.

Given your well earned reputation as this site’s most vociferous cheerleader for all Russian misdeeds in Ukraine, your first mention of Prigozhin came when you loudly cheered the failed “coup.”

You parade around as an advocate for peace—drawing many laughs—but said nothing about bloodletting by both Russian mercenaries and the Russian military.

You’re a fraud. We know it. You know it. Get over yourself. Being Putin’s Pimp is all you can or want to be?

“I have no problem condemning Russia’s war crimes.”

Jonny boy has no problem? Seriously? He refuses to call out Putin just once. Go figure!

In JH Land, no crime is punishable, until all who commit similar crimes are punished?

He’s really against the slaughter of innocent civilians. But…however….what about…

Beyond pathetic that such (way less than) sophomoric drivel dominates his replies.

More war crimes in Ukraine:

https://radaronline.com/p/wagner-mercenaries-hung-ukrainian-pows-trees-botched-putin-coup/

Wagner mercenaries working for Yevgeny Prigozhin allegedly hung Ukrainian prisoners of war from trees before launching their botched coup against Vladimir Putin, RadarOnline.com has learned. In a harrowing development to come as Putin’s war against Ukraine continues to escalate, and just days after Moscow squashed Prigozhin and Wagner’s rebellion, sources on the frontlines of the ongoing invasion revealed the grizly details taking place in Ukraine. According to Brandon Mitchell, a Canadian volunteer medic who traveled to Ukraine after President Volodymyr Zelenskyy asked for international help, Prigozhin’s mercenaries tortured Ukrainian POWs before hanging the victims from trees and leaving them for dead. “Before I came back here I worked in Avdiivka south of Bakhmut and some of our guys were hung,” Mitchell revealed, according to Daily Star. “The officers were never found but soldiers were hung from trees outside.”

Prigozhin at the time was working on Putin’s behalf so JohnH is fine with these war crimes.

Funny! Just a week ago pgl was celebrating Pirozhin as a freedom fighter and cheering him on!

That’s another lie and you know it. This is all little Jonny boy has? You are a stupid dishonest disgusting worthless little weasel. And that’s your best side!

Noneconomist

July 1, 2023 at 1:45 pm

Given your well earned reputation as this site’s most vociferous cheerleader for all Russian misdeeds in Ukraine, your first mention of Prigozhin came when you loudly cheered the failed “coup.”

You parade around as an advocate for peace—drawing many laughs—but said nothing about bloodletting by both Russian mercenaries and the Russian military.

You’re a fraud. We know it. You know it. Get over yourself. Being Putin’s Pimp is all you can or want to be?

He nailed your worthless lying rear end. Address his statement if you can. Coward.

Shadow reserves — how China hides trillions of dollars of hard currency

China has a lot of foreign exchange reserves that do not show up in the official books of the People’s Bank of China. Those funds have been hidden in the state banks, and largely escaped scrutiny.

Brad Setser Published June 29, 2023

https://thechinaproject.com/2023/06/29/shadow-reserves-how-china-hides-trillions-of-dollars-of-hard-currency/

China is so big that how it manages its economy and currency matters enormously to the world. Yet over time the way it manages its currency and its foreign exchange reserves has become much less transparent – creating new kinds of risks for the global economy.

From 2002 to 2012, China’s central bank was active in the currency market almost every day — usually buying dollars to keep China’s currency from rising, and to make sure China’s exports stayed cheap.

During this period, China’s foreign exchange reserves steadily increased. So did China’s holdings of Treasuries and the bonds issued by Freddie Mac and Fannie Mae— the two major types of “Agency” bonds that are implicitly backed by the U.S. federal government Economists worried that China’s intervention in the currency market was keeping trade unbalanced; foreign policy gurus worried that China might sell bonds in a moment of geopolitical tension, turning a security crisis into a financial crisis.

Poof!

But a funny thing happened sometime over the last ten years: China’s reserves stopped rising. Sure, the number reported by the foreign exchange authorities bounces around a bit, as the market value of China’s long-term bonds and euros sambas with global markets. But the foreign exchange reserves reported by the central bank (the People’s Bank of China or PBoC), which accounts for its reserves on its balance sheet at their historical purchase price, has been constant.

The stability of China’s reported reserves is a real puzzle. Despite all the talk of deglobalization, China’s export surplus is actually at an all time high. China’s true current account surplus is likely larger than the $400 billion that China now officially reports. And currency traders know that China’s currency bounces around a lot less than other big currencies — the yuan doesn’t act like a currency that is tightly pegged to the dollar anymore, but it doesn’t act like a freely floating currency either.

So what is going on?

Just as China has “shadow banks” — financial institutions that act like banks and take the kind of risks that a bank might normally take but aren’t regulated like banks — China has might be called “shadow reserves.” Not everything that China does in the market now shows up in the PBoC’s balance sheet.

China’s lack of transparency here is a bit of a problem for the world. China structurally is so central to the global economy that anything it does, seen or unseen, will eventually have an enormous impact on the rest of the world. China’s enormous purchases of U.S. Agency bonds before the global financial crisis pushed private investors into riskier mortgage backed securities, helping to create the conditions that gave rise to the 2008 shock.

China post-crisis push to diversify its reserves helped give rise to the Belt and Road Initiative, which started as a new way for the policy banks to help Beijing put its ever-accumulating foreign exchange to use before a genuine strategic purpose was grafted on to it. More recently, China’s state banks have become a big source of dollars for their global peers — including, rather strangely, Japanese institutions looking to juice their returns in the dollar bond market.

So, while exchange reserves may seemingly be of interest only to economists, their management and use can have enormous real-world effects. They are powerful enough of an economic force such that an entire, global, decades-long infrastructure plan was, in some ways, just a side effect of a 2009 decision to find new ways to manage China’s foreign exchange.

So how can a country make its foreign exchange reserves disappear?

One way is to set up a sovereign wealth fund — the central bank basically sells its foreign exchange to a specialized government agency that has a mandate to invest in risky (non-reserve) assets. China of course did so, setting up the China Investment Corporation (CIC) back in 2007. But CIC got burned on a couple of its initial investments and actually didn’t use the bulk of the $120 billion it raised to buy foreign exchange off the books of the PBoC until 2009 or 2010.

The main way China has hid its reserves has been its big state banking system. For much of the early history of the People’s Republic, there wasn’t much of a distinction between the central bank and the state banks — they were all just part of the government. The Bank of China, whose iconic I.M. Pei designed tower helps define the Hong Kong skyline, was the de facto central bank of the early Chinese Republic, and was China’s only foreign exchange bank in the early days of the People’s Republic. As recently as the 1990s, it helped manage a portion of the government’s formal reserves — and it is rumored to still occasionally act in the market on the government’s behalf.

Step 1: Put the money in state commercial banks

There is actually a well-documented money trail between the PBoC and the state commercial banks in the years between 2003 and 2008 — though this history is now often forgotten. (The major state commercial banks are the Bank of China, Industrial & Commercial Bank of China or ICBC, China Construction Bank,and the Agricultural Bank of China.)

Back in 2003, China used $45 billion of its reserves — a big sum at the time — to recapitalize the Bank of China and China Construction Bank. ICBC, one of the other four major state-owned banks, got $15 billion in 2005. The banks took over the management of $45 billion of China’s reserves — the reserves were never sold, they were just handed over to the bank — and China’s central bank got equity in the banks in exchange.

The PBoC also moved about $150 billion over to the state commercial banks in late 2005 and calendar 2006. It did so by swapping dollars for the yuan held by the banks. Doing this as a swap rather than a loan had some technical advantages for the central bank — and it kept the transaction off the PBoC’s formal balance sheet. The dollars shifted into the banks were invested in foreign bonds (holdings of foreign bonds by “private” investors in China went from around $50 billion to close to $200 billion). The entire transaction is all visible in the banking data if you know exactly where to look.

Finally, in 2007 and 2008, the PBoC more or less forced the banks to hold $200 billion of their required reserves in dollars even though the banks at the time didn’t have many dollar deposits. This too can be tracked: the banks’ foreign currency reserves appeared on the PBOC’s balance sheet as “other foreign assets.”

All told, by the end of 2008 China’s government had about $400 billion in “hidden” reserves — small by today’s standards, but a sum then equal to about 10% of China’s GDP.

Step 2: Put the money in policy banks

After the global financial crisis of 2008-2009, China settled on a new strategy for making use of its excess foreign exchange reserves: handing a portion of its foreign exchange to the big policy banks — the China Development Bank (CDB) and the Export-Import Bank of China — so that they could lend to support China’s ballooning overseas investment.

One of the first signs of this policy shift came when the China Development Bank started to lend huge sums to support an increase in global oil output to help meet the needs of China’s growing economy. Scholar Erica Downs noted back in 2011: “Since 2009, China Development Bank has extended lines of credit totaling almost $75 billion to national energy companies and government entities in Brazil, Ecuador, Russia, Turkmenistan and Venezuela.” Russia’s state oil company for example got a $15 billion loan to expand production in the far east, and Russia’s oil pipeline company got $10 billion to build a pipeline to bring the oil to market. Venezuela got at least $30 billion. Angola got over $20 billion.

The CDB and the Export-Import Bank of China also lent big sums to countries looking to buy Chinese telecommunications equipment. That helped drive the global expansion of firms like Huawei, which has a credit line of at least $30 billion with the CDB. Work by Aid Data and the World Bank documents how the Export-Import Bank of China also ramped up its support for road, dam and powerplant construction across the world.

All this is well known by now. It was institutionalized in 2013 with the formal launch of Xí Jìnpíng’s 习近平 Belt and Road Initiative.

What isn’t as well known is that the policy bank’s overseas lending also served, in effect, to hide some of China’s reserves. When China’s reserve manager, the State Administration of Foreign Exchange (SAFE), lends money to CDB or the Export-Import Bank of China, those funds are — correctly — no longer counted as part of China’s official reserves.

However, the money trail through the policy banks is much harder to follow than the pre-global crisis money trail to the state commercial banks.

The first signs appeared back in 2010, when reports emerged that the CDB and the Export-Import bank of China were making “entrusted loans” on behalf of the State Administration of Foreign Exchange. Caixin reported:

The State Administration of Foreign Exchange (SAFE)… has taken initial steps toward giving policy and commercial banks authority to handle loans for intergovernmental cooperation projects. The reforms also expanded SAFE’s responsibilities beyond its traditional role of managing foreign exchange reserves, effectively turning the agency into a foreign-currency lender. The new forex direction dates from the end of last year, when the State Council asked SAFE to take the lead in projects, including a Chinese loan-for-Russian-oil exchange deal. The agency was also told to study additional innovations for policy lending.

The policy banks initially weren’t totally happy about the initial financial set up for “entrusted loans” — they got a fee for managing SAFE’s money when they would rather have taken in a deposit from SAFE and then made the loan on their own balance sheet. The scale of these entrusted loans has never been transparently disclosed, but there are hints that it is big. Back in 2015, for example SAFE converted $93 billion ($45 billion for Exim, $48 billion for CDB) of entrusted loans were converted into equity in the policy banks.

The PBoC also contributed to a set of opaque funds that help the policy banks out. SAFE supplied 65% (over $25 billion) to the $40 billion Silk Road Fund. SAFE supplied 80% of the “initial” $10 billion of the China-Africa Fund for Industrial Cooperation (CAFIC) and 85% of the $30 billion for the China-Latin America Cooperation Fund (a.k.a. China-LAC Cooperation Fund). SAFE’s 2020 annual report celebrated the “10th Anniversary of the Diversified Use of Foreign Exchange Reserves” by SAFE’s contribution to diversifying China’s reserves by highlighting its “entrusted loans” to “small, medium and large sized financial institutions” and its capital investments in CIC International Co., Ltd. and CNIC Co.

CIC International is of course the Hong Kong branch of China’s sovereign wealth fund; CNIC is a Hong Kong based mining, energy and infrastructure investment company that had an initial capitalization of $11 billion.

Sum it all up and the disclosed funds provided to these initiatives total over $150 billion — and that is likely only the tip of the iceberg. These funds are of course on top of the funds provided through entrusted loans and the conversion of entrusted loans into equity.

These hidden funds, backed with foreign exchange moved out of the reserve holdings of China’s central bank, are likely to be a big reason why China’s reported reserves are stable. It is completely fair not to report these foreign currency assets as part of China’s formal reserves — they aren’t being held in easy to sell, safe foreign assets. But China should separately report all of the foreign currency assets held by the PBoC, including its foreign currency funding of state banks and investment funds.

Step 3: Convince the State Commercial Banks To Act Like the PBOC

There is one other important source of hidden reserves — the domestic foreign currency deposits of the state commercial banks. The deposit taking banks, a set of state banks that are separate from the big policy bank, now have over $1.1 trillion in foreign assets. They only have $200 billion in foreign liabilities, so they have about $900 billion in foreign holdings that are funded domestically. Some of these funds historically have come from the State Administration of Foreign Exchange, as noted above (though the accounting for entrusted assets may be complex). But the banks also have taken in more domestic foreign currency deposits than they have lent out domestically in foreign currency, so these domestic deposits — think deposits from the state oil companies and other big state-owned enterprises — are balanced by offshore foreign currency assets.

The strange thing about these deposits is that they don’t act like normal deposits. Dollar deposits rose when dollar interest rates were below the rate on yuan, and recently have slid even though dollar rates now top yuan rates. The net foreign asset position of the state banks looks like the balance sheet of a central bank that is acting in the market to stabilize its currency. Perhaps that is just a coincidence — but I rather doubt it.

A six trillion dollar pile of money?

All told, institutions that report to China’s central government probably have closer to $6 trillion in foreign assets than the $3.12 trillion SAFE reported in December 2022.

This total counts the foreign assets of the state commerWhy should we care?

What does any of this matter?

Well, China is so big an economy – and such an unbalanced economy – that all its activities just have an outsized global impact.

China’s shadow reserves are big. Bigger than the formal reserves of the world’s second largest holder of reserves (Japan). Bigger than the assets of the world’s largest sovereign wealth (Norway, though Singapore would be in close competition if its sovereign fund disclosed its true size). It isn’t a surprise that these massive pools of foreign exchange are at the center of most interesting debates. China’s contribution to global debt distress is a function of the diversion of foreign exchange out of the U.S. bond market and into global infrastructure lending. Yet China’s banks have access to so many dollars that China’s state commercial banks came to play an important role in providing funding to other global banks through cross currency swaps (what the Bank for International Settlements or BIS calls hidden debt) even as the policy banks turned low income countries into their playground. Looking at China’s reported holdings of Treasuries just misses the bulk of China’s global financial presence these days.

The scale of these hidden reserves — foreign current currency assets that aren’t formally counted as “reserves” — also highlights an important fact that is often forgotten amid all the talk of China’s domestic debt problems. Globally China is still a massive creditor, and the weight of China’s massive accumulation of foreign exchange is still felt around the globe.

UPS has won some breathing room from the Teamsters:

https://thehill.com/business/4076298-teamsters-hold-off-on-strike-after-ups-counteroffer/

Not there yet, but progress has been made. Strkes me that any number of days of a strike against UPS is a bigger risk to the economy than the same number of days government shutdown.

While in a weird way I hope you are correct on that (because I am pro union-power), that would mildly shock me to be honest with you. Would love to see the numbers. But I don’t doubt UPS shutdown would hurt on a national level. Would also be interested to see it compared to a railroad labor strike (I assume the railroad strike would hit harder than UPS). What they should do (if union leaders were sincere and/or ever grew a brain) UPS and the railroad labor would strike simultaneously. Now that would be leverage.

You and MD made me curious how UPS did last year so I checked its 10K for fiscal year ended 12/31/2022.

Revenues over $100 billion and operating profits over $13 billion. Pay your workers fellows as that is a fair chuck of change!