I wondered whether Chinese inflation behavior was anomalous. Answering that question depends critically on (1) what model you believe in, (2) what you believe the model parameters are, (3) what you think the input values are, and (4) whether you think the model has been stable over time. Here’s one answer.

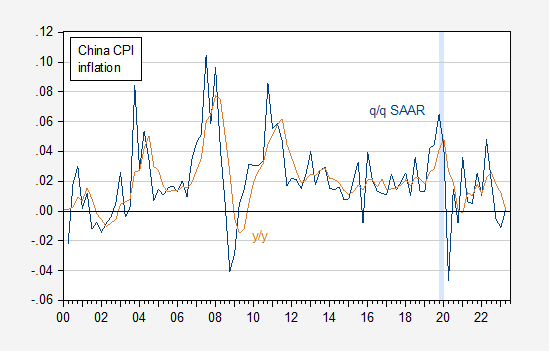

Consider the evolution of CPI inflation in China.

Figure 1: Quarter-on-quarter Chinese CPI inflation (blue), year-on-year (tan), calculated as log differences. ECRI defined recession dates shaded light blue. CPI adjusted using X-13. Source: World Bank.

This is the CPI series published by Kose and Ohnsorge at World Bank. The quarter on quarter series is seasonally adjusted using X-13 in levels, and then log differences calculated. The year-on-year series is the seasonally unadjusted series calculated using log differences.

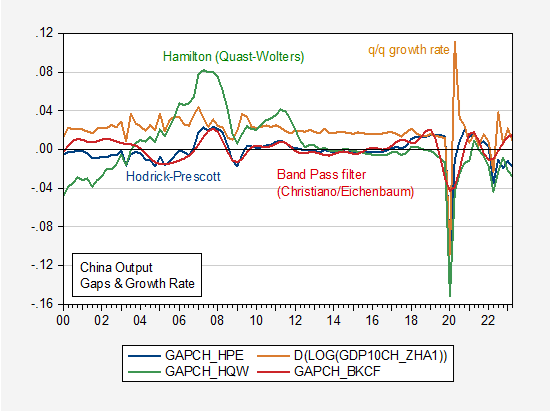

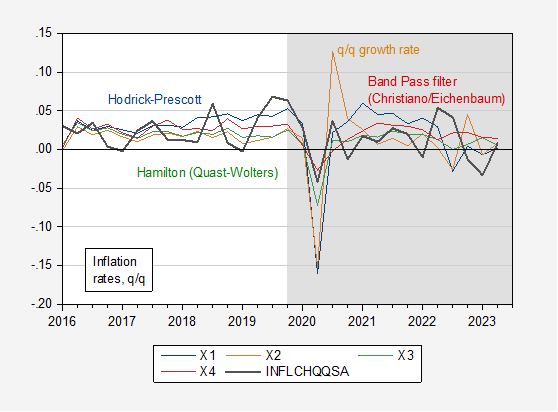

Can the evolution of Chinese inflation be explained by a Phillips curve, either pre-pandemic or post? In order to answer this question, one would need a measure of the output gap, or some other measure of economic activity. Figure 2 shows three output gaps, measured using statistical methods, and the growth real of real GDP.

Figure 2: HP filtered GDP on extended sample (blue), band pass filter (Eichenbaum-Christiano) on extended sample (red), Hamilton filtered (Quast-Wolters) (green), and quarter-on-quarter GDP growth (tan). Source: GDP from Higgins & Zha/Atlanta Fed, author’s calculations.

- Hodrick Prescott is filter applied to GDP data extended 2 years using an ARIMA(1,1,0) to account for end of sample estimation problems associated with two-sided filter.

- Band Pass filter is applied to same extended GDP time series.

- Modified Hamilton filter is the Jim Hamilton filter setting h=4 to 12 instead of 8 following Quast and Wolters (2023)

- Growth rate is annualized q/q growth rate of GDP.

GDP data is Higgins and Zha (Atlanta Fed) data updated from 2018Q1 using actual reported growth rates reported by NBS.

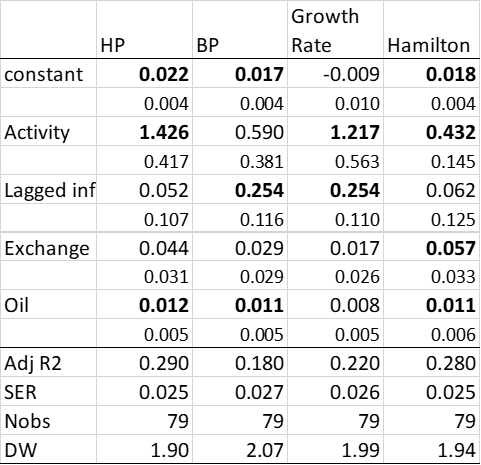

I run a regression of q/q annualized inflation on lagged output gap/growth rate measure, lagged trade weighted nominal exchange rate depreciation, and contemporaneous change in oil price in CNY over the 2000Q1-19Q3 period.

πt = β + βgapt-1 + γ πt-1 + φ Δqt + φΔptoil

The estimates are in Table 1.

Table 1: Chinese Inflation Rate Determinants

Notes: Bold denotes significance at 10% using HAC robust standard errors.

Notice the gap (or growth rate) is usually significant (exception is band pass filter), while lagged inflation is only significant when using the modified Hamilton filter. Oil prices always significant.

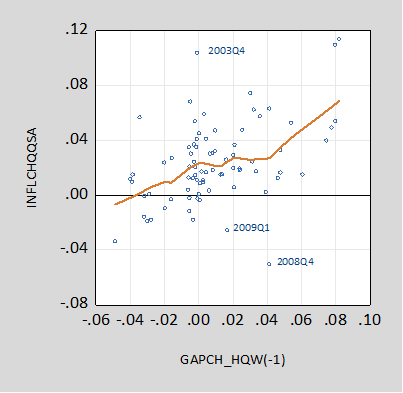

Here’s a scatterplot of inflation (q/q AR) vs. Hamilton (modified) gap, 2000Q1-19Q3:

Figure 3: Quarter-on-quarter annualized inflation vs. lagged gap (Hamilton filter).

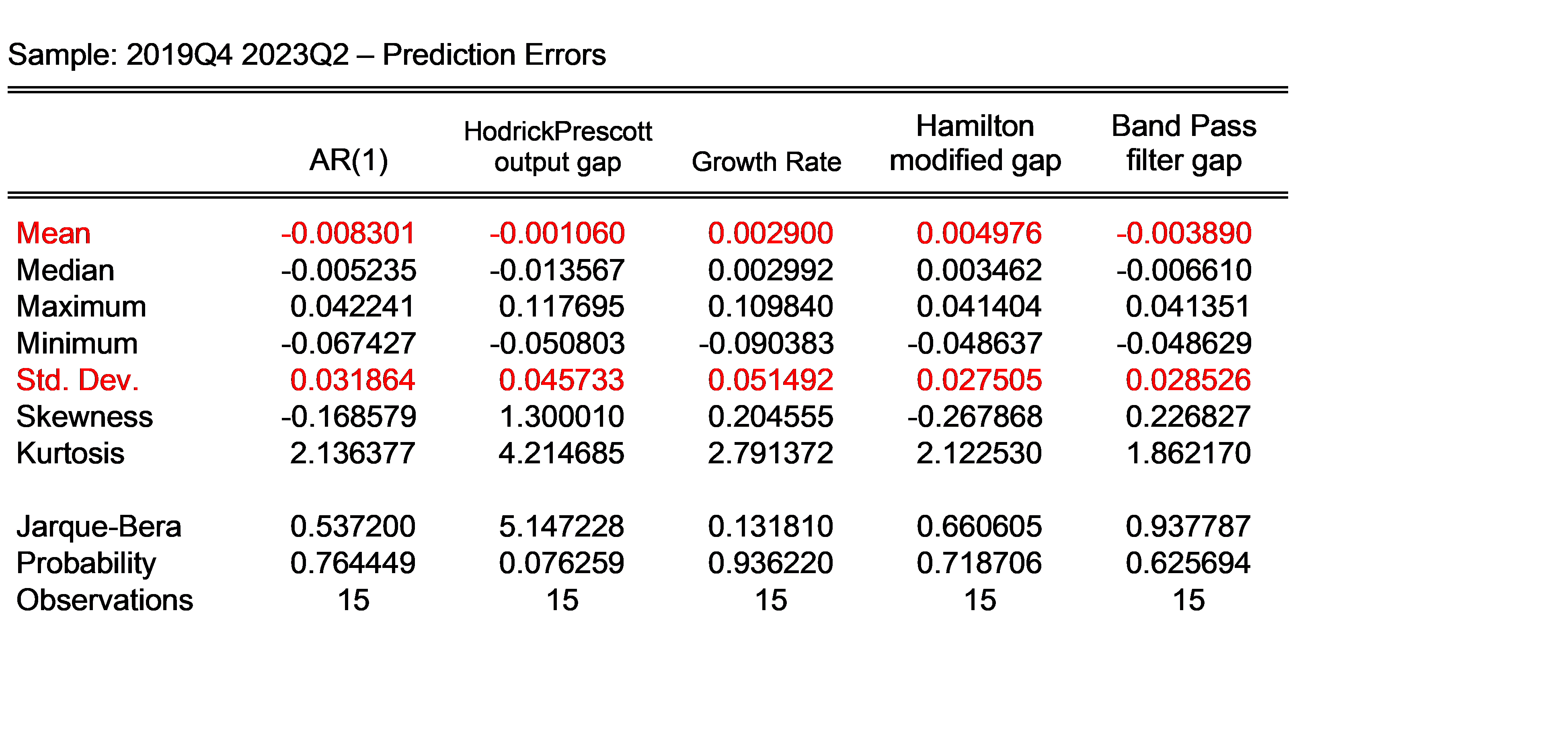

Using these estimates, I predicted the inflation rates (note the inflation rate shown below does not match those reported in the press because they are seasonally adjusted q/q rates). This is a test of how stable the estimated regressions are in the post-Covid period.

Figure 4: Actual q/q inflation (black), prediction using HP filter (blue), using BP filter (red), using Hamilton filter (green), and using growth rate (tan).

The Hamilton filter based output gap yields the lowest root mean squared error (but underpredicts the most).

Table 2: Actual minus predicted

Short summary

Measures of economic activity are positively associated with inflation, after accounting for cost push shocks (particularly oil shocks). Lagged inflation doesn’t usually enter.

https://english.news.cn/20230721/03a3ecff119c49c48f2ff49c0688c5a5/c.html

July 21, 2023

China adds 6.78 mln new jobs in urban regions in H1

BEIJING — China added 6.78 million new jobs to the labor market in urban regions in the first half of 2023 (H1), achieving 57 percent of the annual jobs target, according to data released Friday by the Ministry of Human Resources and Social Security.

In June, the surveyed urban unemployment rate stood at 5.2 percent, the data showed. China aims to add 12 million jobs in cities this year and keep the surveyed urban jobless rate at around 5.5 percent.

According to a statement by the ministry on its website after a press conference, the government had stepped up efforts in prioritizing employment in H1 with concrete measures. For instance, the government subsidized enterprises with funds to the tune of 52.8 billion yuan (about 7.4 billion U.S. dollars) in H1 to encourage companies to provide job openings, the statement said.

It said the government also fully promoted the employment of young people, such as college graduates, through various action plans and training initiatives. The government has continued to encourage enterprises to provide 1 million internship opportunities for unemployed youths this year. As of the end of June, 683,000 such internship positions were open, and 519,000 people had taken part in internship programs.

The country has also prioritized large-scale vocational skills training targeting young people, especially college graduates, the statement said. In H1, more than 7.7 million vocational training coupons, which trainees use to access free training courses, were issued by the government.

The ministry said that it would continue to promote employment for college students in its next step of work.

https://english.news.cn/20230720/da2585741ff44b8892ad9f5ba7246c36/c.html

July 20, 2023

Chinese economy on track for strong, high-quality growth

BEIJING — Positive signs spotted in the recent economic data released by the government indicate that China has maintained a steady momentum in economic recovery and is well on track for strong growth in the second half of the year.

The world’s second largest economy grew 6.3 percent in the second quarter of 2023, bringing the growth for the first half of the year (H1) to 5.5 percent. Both figures are higher than the 3 percent growth registered last year, demonstrating clearly an upward recovery trend. China has set a growth target of around 5 percent for 2023. The H1 economic performance placed China on a steady path to realizing the annual target.

Describing the 5.5-percent H1 growth as “high-valued,” Fu Linghui, spokesperson of the National Bureau of Statistics, said that China’s economic growth has supported global economic recovery, given that China was the fastest-growing economy among the world’s major economies in H1. He added that such a performance did not come easily considering that the global economy was in the doldrums.

Pundits and experts who study the Chinese economy have largely viewed the 2023 half-year data with high regard, explaining that the data should be looked at through a holistic lens by also analyzing other important aspects of the economy such as quality of growth, optimization of economic structure, innovation, food and energy security, and people’s income, among others, rather than merely focusing on the end-result growth rate figures.

Early this month, China’s 20 millionth new energy vehicle (NEV) rolled off the production line in Guangzhou, capital of the southern Guangdong Province. NEV output and sales both exceeded 3.7 million units in the first half of this year, each representing a year-on-year growth rate of more than 40 percent.

The booming NEV industry epitomizes China’s impressive progress in green transition. Chinese customs data showed the total export value of China’s three major tech-intensive green products — solar batteries, lithium-ion batteries and electric vehicles — soared 61.6 percent year on year in H1….

https://english.news.cn/20230723/bdd3d8a6581b4fb6a513971873548aef/c.html

July 23, 2023

Cooperation between village and city boosts rural development

SHIJIAZHUANG — Every weekend, 2,000 or so residents living in nearby cities travel to Tayuanzhuang Village in Zhengding County, north China’s Hebei Province, to enjoy leisure time there.

Tang Xiaoying was cheerfully and energetically peddling vegetables, confident that the pesticide-free produce cultivated with intelligent planting technologies tasted good.

In front of an intelligent farm is an automatically-controlled-temperature glass house in which Tang has been working, and where rows of lettuce can be seen growing in water. The 65-year-old villager is already quite skilled at modern hydroponic vegetable planting methods, and she said that the 60-square-meter building can produce approximately 1,000 kg of vegetables a year.

The farm is the result of cooperation between the village and Tongfu Group Co., Ltd, a leading agricultural company.

Zhengding County, since it is separated from the provincial capital city Shijiazhuang by just one river, decided as early as the 1980s to develop its economy based on the demands of the city.

Tayuanzhuang Village, two thirds of which is located on floodplain areas, lacks sufficient land resources. However, the village has taken advantage of its proximity to both the county and provincial capital and adopted the mode of “village-enterprise cooperation” to inject new vitality into its development.

In the past, villagers needed to pedal a cart to transport food and vegetables to the city to sell, while now visitors from the city tend to walk in the fields to pick and gather fresh fruits and vegetables themselves, said Wu Feng, head of Tongfu rural revitalization demonstration park.

Wu added that the intelligent farm also features aquaculture including fish, shrimp and crab breeding and uses bio-organic bacterial fertilizer to improve soil fertility.

Business opportunities are booming. From cultural tourism and varied forms of farming to in-depth agricultural research and other projects, a rural industrial ecosystem has been formed. As of July, the park had received more than 900,000 visits this year.

and on cue, as soon as a posting about china occurs, ltr savagely links to a bunch of chinese ccp propaganda sites to muddy the waters.

ltr, care to link to a ccp site discussing the uighur detention camps in western china? no? well you can read about it here:

https://www.cnn.com/interactive/2020/02/asia/xinjiang-china-karakax-document-intl-hnk/

Time to ban ltr for copyright infringement.

China is a developing country; a benign country that is socialist with Chinese characteristics; a country that needs to and should be understood or analyzed on its own terms. This is a 5,000 year old civilization, a people who have given rise to economists skilled and creative enough to have ended poverty for hundreds of millions of people, produced a middle class of hundreds of millions, and created conditions for 45 years of brilliant modernizing growth.

https://fred.stlouisfed.org/graph/?g=17icc

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and European Union, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=17ici

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and European Union, 1977-2022

(Indexed to 1977)

Not that it will make any difference to you, but the idea that any country “needs to and should be understood on its own terms” is out-and-out absurd. Stalin’s Russia? Russia’s torture and murder of thousands of civilians in Ukraine today? Hitler’s Germany? 18th and 19th century America and its “peculiar institution?”

Give me a break.

Now there’s a perspective worth considering.

Phillips curve is dogma desperately seeking confirmation bias. Silly economists.

That’s what you take away from this post?

Stalker.

This from the right wing moron who worships the Quantity Theory of Money?

“Lagged inflation doesn’t usually enter.”

If I understand this statement correctly, it’s more or less the same as saying inflation persistence is low. That’s kind of important. It means that shocks and real economic factors matter more than past inflation performance in determining current inflation.

U.S. inflation persistence has decreased as the long-term average of inflation has decreased:

https://www.richmondfed.org/publications/research/economic_brief/2022/eb_22-31#:~:text=An%20important%20implication%20of%20inflation,of%20what%20inflation%20is%20today.

Maybe there is some regularity in economic behavior which links persistence with higher rates of inflation?

As the Richmond Fed text notes, and as we have just experienced, low persistence means a long period of low inflation doesn’t offer much protection from inflation spikes. It also means we should question the idea that inflation is likely to become entrenched merely because it remains above target for a while.

Bullard’s idea that economies move from one inflation regime to another, and that policy decisions should take the current inflation regime into account, needs examination in light of the decline in persistence. It certainly seem right that periods of high persistence amounted to “regimes”. Is there any sense in the notion of inflation regimes now, when persistence appears to be low?

So the DeSantis fanboys think they found 16 people who benefitted from slavery but let’s review the facts:

https://www.tampabay.com/news/education/2023/07/21/benefited-slavery-critics-say-some-states-examples-were-never-even-slaves/

Responding to mounting criticism, the department issued a statement Thursday offering 16 examples of historic figures it said fit that description. That they developed highly specialized abilities that helped them later in life is “factual and well documented,” the department stated.Asked for more information on Friday, Florida’s Department of Education cited as references “The Colored Patriots of the American Revolution,” an 1895 book by William Cooper Nell, and “Encyclopedia of African American History 1619-1895,″ a 2006 book edited by Paul Finkelman. Alex Lanfranconi, a spokesperson for the department, said the experts stand behind their examples. Frances Presley Rice, a co-founder of the Yocum African American History Association and chairperson of the National Black Republican Association, provided the information to the department.

But other sources offer conflicting descriptions of the 16 historic figures, and critics came forward to attack the department’s claims. Among the problems: Historic sources show several of the 16 individuals were never even slaves.

So out of 4 million slaves they found 16 that presumably “benefitted” from being enslaved. Do these people even have a concept of numbers?

Maybe they would like to exchange my $16 for $4 million? I mean $16 is some money and $4 million is some money. Some slaveowners chopped the hands of their slaves, some slaveowners raped then tortured to death their slaves, some slaveowners threw their slaves into boiling oil. If we are going to report the 4 in a million events there is a long long list of things that obviously deserve to be mentioned.

From the best political cartoonist in the US. He was fired when his newspaper was taken over by a right wing news mogul. Now he runs his own “blog”

https://robrogers.com/2023/07/26/slavery/

the sad thing is that narrative on how slavery benefited some slaves with skills and knowledge has been around for decades. I remember folks making that argument when I was a kid as well. there was nothing redeeming about slavery. for an adult like desantis to be pushing for this narrative is really appalling. it shows ignorance. it also shows contempt for the African American community. in their view, slavery was not a problem, but welfare is destabilizing the entire African American community. people like this are dangerous when holding political office.

Output gap: Conceptually sound, empirically tricky.

Great work Menzie. As far as I understand, the vast majority of central bankers and monetary policy pundits around the world are still relying on an expectations-augmented Keynesian approach to do the heavy lifting. Those that deviate from this approach seem to get into big trouble.

GIGO.

you want to be a little more specific here? otherwise, a silly statement on your part.

Among the most frustrated people I met in my professional life were those trying to build models of the Chinese economy, based on data that was barely worthy of the name. Internal consistency among seemingly related data is not a strong suit, nor are definitions routinely akin to those in the OECD. The sum of the parts (e.g., provincial GDP) never equals the whole (national GDP).

Garbage in, garbage out.

GIGO.

Thank you.

@ David O’Rear

Did you happen to notice a recent WSJ (July 18 hardcopy version) said that the Chinese government has yet to report any deaths from the heat wave?? What Menzie calls “data inputs” into a model are very much related to “data omissions” when we discuss China, as you well know.

china had no deaths from covid either, according to government data. ltr will vouch for that.

Y’all know how Republican legislators keep saying they want to cut Social Security, then screaming “liar” at anyone who notices. Here’s Ron DeSantis, telling Fox he wants cuts:

https://news.yahoo.com/ron-desantis-eyeing-cutting-social-152454816.html

Let’s see how long that lasts.

DeSantis is considering repealing the 13th Amendment – after all being a slave allows one to build certain skills.

“Let’s see how long that lasts”

I mean this in the most complimentary way possible that you made me think of my late father and grin when you said this, as this was a phrase my Dad often used, and 98% of the time ending up spot on correct. I agree, and as faulty as my memory is lately, I’m going to try and remember this statement by you, and post the link here on the blog in whatever is the most recent post when you inevitably turn out correct.

Marketplace.org ran a story today about universal basic income. A fellow at a group which tracks UBI programs claimed he has had contacts from hundreds of communities regarding UBI programs so far this year.Here’s a partial list of active programs:

https://mashable.com/article/cities-with-universal-basic-income-guaranteed-income-programs

I was not aware of most of them.

Finance in many cases came from federal Covid funding, so the programs are likely to die off. UBI really works. Often, such programs more than pay for themselves in reduced court, jail, emergency room, school and social support programs – kind like permanent housing for the homeless pays for itself. Both UBI and permanent housing turn out to be among the most effective uses of public spending.

Sure would be nice to keep them going.

Teamster and UPS strike a 5 year deal:

https://www.msn.com/en-us/money/companies/ups-teamsters-reach-agreement-averting-strike/ar-AA1elc0L?ocid=msedgdhp&pc=U531&cvid=9fb7ed2f98b6493a899d0d7e77b41343&ei=9

If ratified – strike avoided.

Extreme heat in North America, Europe and China in July 2023 made much more likely by climate change

https://spiral.imperial.ac.uk/bitstream/10044/1/105549/8/Scientific%20Report%20-%20Northern%20Hemisphere%20Heat.pdf

Authors

1. Mariam Zachariah, Grantham Institute, Imperial College London, UK

2. Sjoukje Philip, Royal Netherlands Meteorological Institute (KNMI), De Bilt, The Netherlands

3. Izidine Pinto, Royal Netherlands Meteorological Institute (KNMI), De Bilt, The Netherlands

4. Maja Vahlberg, Red Cross Red Crescent Climate Centre, The Hague, the Netherlands

5. Roop Singh, Red Cross Red Crescent Climate Centre, The Hague, the Netherlands

6. Friederike E L Otto, Grantham Institute, Imperial College London, UK

Review authors

1. Clair Barnes, Grantham Institute, Imperial College London, UK

2. Julie Arrighi, Red Cross Red Crescent Climate Centre, The Hague, the Netherlands

Main findings

● Heatwaves are amongst the deadliest natural hazards with thousands of people dying from heatrelated causes each year. However, the full impact of a heatwave is rarely known until weeks or months afterwards, once death certificates are collected, or scientists can analyse excess deaths. Many places lack good record-keeping of heat-related deaths, therefore currently available global mortality figures are likely an underestimate.

● In line with what has been expected from past climate projections and IPCC reports these events are not rare anymore today. North America, Europe and China have experienced heatwaves increasingly frequently over the last years as a result of warming caused by human activities, hence the current heat waves are not rare in today’s climate with an event like the currently expected approximately once every 15 years in the US/Mexico region, once every 10 years in Southern Europe, and once in 5 years for China.

● Without human induced climate change these heat events would however have been extremely rare. In China it would have been about a 1 in 250 year event while maximum heat like in July 2023 would have been virtually impossible to occur in the US/Mexico region and Southern Europe if humans had not warmed the planet by burning fossil fuels.

● In all the regions a heatwave of the same likelihood as the one observed today would have been significantly cooler in a world without climate change. Similar to previous studies we found that the heatwaves defined above are 2.5°C warmer in Southern Europe, 2°C warmer in North America and about 1°C in China in today’s climate than they would have been if it was not for human-induced climate change.

● Unless the world rapidly stops burning fossil fuels, these events will become even more common and the world will experience heatwaves that are even hotter and longer-lasting. A heatwave like the recent ones would occur every 2-5 years in a world that is 2°C warmer than the pre industrial climate.

● Heat action plans are increasingly being implemented across all three regions and there is evidence that they lead to reduced heat-related mortality. Furthermore, cities that have urban planning for extreme heat tend to be cooler and reduce the urban heat island effect. There is an urgent need for an accelerated roll-out of heat action plans in light of increasing vulnerability driven by the intersecting trends of climate change, population ageing, and urbanisation.

Peter Navarro rants and raves for about 6 minutes. Take a listen and please explain to me how someone can be so utterly insane:

https://www.msn.com/en-us/news/politics/peter-navarro-warns-democrats-attacks-will-come-back-to-haunt-you-when-republicans-take-country-from-your-cold-woke-hands/ar-AA1ekcR1?ocid=msedgdhp&pc=U531&cvid=ca7062b55aa54108ad6dbc35b284b782&ei=9

UPS and the Teamsters have reached a deal. No strike. Recession averted.

Off topic, the BRICS currency –

Not any time soon, apparently:

https://news.bitcoin.com/russias-central-bank-brics-currency-requires-consent-of-many-parties-faces-implementation-challenges/

Two key appointments:

BEIJING, July 25 (Xinhua) — China’s top legislature voted to appoint Wang Yi as foreign minister and Pan Gongsheng as central bank governor, as it convened a session on Tuesday.

[Nothing terribly unusual about that. However, …]

BEIJING, July 25 (Xinhua) — Pan Gongsheng, newly appointed governor of the People’s Bank of China (PBOC), made a public pledge of allegiance to the Constitution at the Great Hall of the People in Beijing on Tuesday.

First, he is pledging allegiance to the state constitution, not that of the party.

Second, he is not a member of the Central Committee, nor an alternate member, nor a member of the Discipline Inspection Commission.

He is the CCP secretary of the PboC (since July 1), and has been Deputy Governor since late December 2012, and head of foreign exchange management (SAFE) since 2015. Given that Pan is only 60 years old, it is quite odd that he was not named to the Central Committee last autumn.

Extraordinary heat in the Northern Hemisphere is pushing up agricultural prices. Cotton, canola, soy oil, OJ, oats and pork futures prices have all risen betwen 10% and 20% over the past month:

https://www.barchart.com/futures

Even corn, which is down slightly from a month ago, is up from its 5-year average:

https://www.barchart.com/futures/quotes/ZCZ23/overview

Most agricultural commodities are priced above their 5-year averages. There is, however, discussion in the agricultural press of the relatively low prices of farm commodities, given the stress of climate change on farm commodities:

https://modernfarmer.com/2023/06/farmers-are-struggling-with-climate-change-but-yields-continue-to-rise-whats-going-on/

The reporting I’m familiar with is mostly U.S. focused. The upshot is that (already existing) technology and switching to crops which tolerate higher temperatures and drought best have helped boost output, limiting price increases. The question raised is, how much longer can technology and management undo the harm caused by climate change?

Off-topic Desantis having campaign funding problems. Or maybe more like spending problems. Netanyahu squashing Israel’s Supreme Court, and this seems to be interesting footnote on China bureaucratic musical chairs:

https://www.cnn.com/2023/07/25/china/china-foreign-minister-qin-gang-replaced-wang-yi-intl-hnk/index.html

This is one of the stranger things about China, while at the same time a kind of “normal” there for decades, high-profile people just disappearing either right after making a non-sanctioned comment, or for some “unknown” reason. I suspect he popped off at the mouth to Xi, but there’s really no way of knowing.

Ryobi mower and weed-wacker still working great, but the old man almost did himself in today using old school manual clippers on overly high hedges at near noon time for 2 and 1/2 hours. No I didn’t drink any adult beverages before going at it.

desantis keeps waging culture wars with major corporations. the average republican will tire of this soon. besides, desantis is going to destroy the higher education system in Florida, at least the public schools. and his revisionist history of an equitable period of slavery is understood to be a joke elsewhere in the country. his campaign is tanking faster than I thought it would.

now may I suggest you abandon the manual clippers and buy the small ryobi hedger? the thing about the battery infrastructure is the temptation to keep buying the single use tools that form a “set” that you will rarely use. but they look seriously coordinated hanging in the garage. my battery powered pole saw is an example. however, the one use was to eliminate a limb during a hurricane. I actually went out and bought it while the storm was raging. would have lost the tree without, so in principle the purchase was good. but lost the tree a few years later anyways!

used a lawn service the past few years. recently went back to cutting it myself, with my trusty battery powered system. save a hundred buck a month. but the heat is overwhelming this year and will eventually send me to the emergency room and wipe out those savings….

From the St. Louis Fed:

https://www.stlouisfed.org/open-vault/2020/january/what-is-phillips-curve-why-flattened

“ China’s anti-Mario Draghi moment surprises markets…Eschewing former European Central Bank chief’s pledge to ‘do whatever it takes’ to stabilize via monetary easing…

On Draghi’s watch, the ECB unleashed stimulus on a level that would’ve been unfathomable to Bundesbank officials of old. In Tokyo, between 2013 and 2018, the Kuroda BOJ’s balance sheet swelled to the point where it topped the size of Japan’s $5 trillion economy.

Neither monetary boom did much, if anything, to make the broader European or Japanese economies more competitive, productive or, broadly speaking, more prosperous. Instead, executive monetary support generated a bubble in complacency.“

https://asiatimes.com/2023/07/chinas-anti-mario-draghi-moment-surprises-markets/

What? No wealth effect to stimulate growth? Heresy!!!

Your line at the end is your usual dumb rubbish. Gee – Jonny. I guess you did not understand the article. Surprise, surprise, surprise!

pgl’s insult generator is alive and well…I guess he doesn’t understand the wealth effect of cheap money…something that China is apparently going to eschew. But as we all know, pgl is all about cheap money to bolster his portfolio.

I understand what economists mean by the wealth effect. Jonny doesn’t. But what’s new. Your link discussed a lot of interesting things but not this concept. Of course Jonny boy did not understand anything in his own link. But what’s new.

This is not Pesek’s best work. Monetary policy is not a competitiveness tool. It’s a stabilization tool. Anyone who thinks otherwise doesn’t know much about monetary policy.

Pesek’s notion that monetary easing prevents labor market “loosening” is little more than the modern expression of “Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.” It’s kinda funny that Johnny, who endlessly scolds… somebody?…about U.S. wages, links to an article which calls for labor market loosening. Does Johnny not understand what he’s linking too, or not care?

China’s policy makers had shown no sign that they were likely to take a big swing at this week’s meeting. I don’t know whether market participants expected more, but if they did, it was wishful thinking.

Really looks like Pesek phoned this one in.

You have to commend China for trying to find a way other than trickle down monetary policy to stimulate the economy. Instead of simply lowering rates to banksters and letting them decide on who to pass the lower rates along to (often encouraging stock market investment and hampering small and medium sized enterprises), China is trying to find a more targeted approach that will result in productive, not speculative investment. I don’t expect Ducky to remotely understand this…

@ JohnH

You don’t think China’s policies over multiple years have encouraged speculative real estate purchases, speculative use of credit, and nonproductive assets?? You’ve entered the CoRev Zone of idiocy.

The ignorance is acute in this one.

It seems to believe that interest rates — and not bank lending officers acting on orders from above — determine the volume and direction of lending.

More, it seems to have never encountered the informal lending market at all.

Strange.

Trickle down monetary policy? Seriously dude – READ your own damn link as the PRC is using supply side sillinesss – the classic trickle down nonsense. Yea – you had no clue what your own link said. Per usual.

” Instead of simply lowering rates to banksters”

Excuse me for interrupting the dumbest troll ever but interest rates in China are well below interest rates in other nations:

http://www.worldgovernmentbonds.com/country/china/#:~:text=Last%20Update%3A%2022%20Jul%202023%202%3A15%20GMT%2B0%20The,is%20A%2B%2C%20according%20to%20Standard%20%26%20Poor%27s%20agency.

But you can count on little Jonny boy of NOT checking market data before he opines on matters that he has no effing clue about.

Funny, funny Johnny. When he misunderstands, he accuses others of misunderstanding. Johnny tried this same “Heterodoxy Roooools!!!” nonsense when Turkey’s Erdogan cut rates to combat inflation. As soon as Turkey’s election was over, Erdogan reversed course and tightened. Johnny fell for Erdogan’s “heterodox” policy claim. Now, he just knows China is ultra clever.

So Johnny, ‘splain it to us. How does China’s ultra clever policy work? What is it that you understand, but that poor, befuddled me couldn’t possibly? Enlighten us, boy.

Ducky really needs his meds..now he’s hallucinating! When did I ever right about inflation in Turkey?!?

So, Ducky, go ahead…fabricate something I wrote about Turkey. Making stuff up about others is so you.

And you might educate yourself about things the Fed could do besides trickle down monetary policy, you might try reading Stiglitz’ Price of Inequality. The section on the Fed is particularly interesting.

JohnH

July 26, 2023 at 4:03 pm

JohnH must have really enjoyed Guide for a Married Man (1963) as has “deny, deny, deny” down cold.

instead china will invest in its state operated enterprises as a way to improve productivity…

Did Pesek even get what he wrote here:

‘Instead of aggressive plans for massive monetary easing and fiscal pump priming — as markets had assumed — the chatter is about prudent policymaking with an emphasis on lower taxes and fees and incentivizing increased investment.’

Lower taxes is not fiscal pump priming? OK. It is sad that Xi is going all Art Laffer style “supply side” economics.

There were lots of things in this discussion to consider but the only thing little Jonny boy commented on was an alleged lack of a wealth effect. Odd – Pesek never said that. Then again I’ll willing to bet the ranch little Jonny does not even know what the wealth effect even is.

OK boys and girls – now that we have had to end Jonny boy babbling about something else he never understood (wealth effects), maybe we should read something on this topic from a smart person – Mark Zandi:

https://www.economy.com/mark-zandi/documents/2015-10-10-Wealth-Matters-A-Lot.pdf

October 2015

Wealth Matters (A Lot)

BY MARK ZANDI, BRIAN POI AND SCOTT HOYT

Abstract

U.S. consumers are once again driving the economic train. They aren’t spending with the abandon displayed prior to the Great Recession, but they are doing more than their part to power the economy’s growth. A better job market, record low debt burdens, lower gasoline prices, and cheap and more available credit are all helping. Not as well appreciated is how important the bull market in stocks and rebound in house prices have been to the revival of the American consumer.

This study, based on new data on consumer spending and household financial and housing wealth across states and metropolitan areas, shows that the so-called wealth effect – the impact on consumer spending of changes in household wealth – has been instrumental to the economy’s gains since the recession. The stock wealth effect has been especially potent since the recession. Housing wealth matters, but about as little as it has in the past quarter century, particularly in areas of the country where house prices have yet to fully recover from the crash. Indeed, for the first time ever, the stock wealth effect is larger than the housing wealth effect. There are many implications of these results. Most obvious, the wealth effect has been a vital support to the economic recovery, accounting for more than one-fifth of real GDP growth since the recession. This suggests that the Federal Reserve’s quantitative easing policy, which served to lift asset prices including stocks and housing, has been highly successful supporting the economy. The importance of the wealth effect highlights the threat to the economy from the recent correction in the stock market, especially if it presages the start of a bear market. It also highlights the economic upside from continued expected solid gains in house prices, especially as prices rise above their pre-crash peaks in more areas

Their paper continues – not that little Jonny boy will understand a single word of it.

Exactly…”The stock wealth effect has been especially potent since the recession” AKA trickle down monetary policy. Lower interest rates drive higher stock prices, which makes the rich richer. Of course, it also induces more spending by the top 10% who own most stocks and take home almost half of income. Unfortunately the top 10% have a higher propensity to save and a lower propensity to consume thus attenuating their stimulatory impact vis-a-vis the impact of getting money to those who live paycheck to paycheck.

But economists still love the top 10%! (But maybe the Chinese are more interested in broad-based prosperity.)

JohnH

July 26, 2023 at 2:57 pm

More evidence that Jonny boy cannot be bothered to READ economic analyzes. If that is all Jonny by got from what Zandi et. alia then he is even more mentally retarded than I could ever imagine.

JohnH

July 26, 2023 at 4:03 pm

JohnH must have really enjoyed Guide for a Married Man (1963) as has “deny, deny, deny” down cold.

Rudy Giuliani admits he is a lying scumbag:

https://www.msn.com/en-us/news/politics/rudy-giuliani-is-not-disputing-that-he-made-false-statements-about-georgia-election-workers/ar-AA1enQ0L?ocid=msedgdhp&pc=U531&cvid=8fea2d4d79b9420f96eef721a89b466d&ei=8

Rudy Giuliani is not disputing that he made public comments falsely claiming two Georgia election workers committed ballot fraud during the 2020 presidential race but he argues that his words are constitutionally protected statements, according to a court filing. That assertion by Giuliani, who as part of Donald Trump’s legal team tried to overturn results in battleground states, came Tuesday in a lawsuit by Ruby Freeman and Wandrea “Shaye” Moss. The December 2021 lawsuit accused the former New York City mayor of defaming them by falsely stating that they had engaged in election fraud while counting ballots at State Farm Arena in Atlanta. The lawsuit says Giuliani repeatedly pushed debunked claims that Freeman and Moss — mother and daughter — pulled out suitcases of illegal ballots and committed other acts of fraud to try to alter the outcome of the race. Though Giuliani is not disputing that the statements were false, he does not concede that they caused any damage to Freeman or Moss. That distinction is important because plaintiffs in a defamation case must prove not only that a statement made about them was false but that it also resulted in actual damage.

Excuse me? The damage to these two ladies were immense. I hope RUDY has to pay a fine that bankrupts this disgusting piece of trash.

Between

1. saying he didn’t say it or

2. saying it was true or

3. saying it didn’t hurt them

His lawyers must have told him the last was the least absurd.

I guess I’ll put everyone here into shock (you know the kind of shock you get after spending two hours cutting overgrown hedges/branches for two hours in 105 heat index and then jumping into a cold shower) and comment on the topic of the post. My problem is the input values.

Methinks you and Mr. O’Rear see similar problems. Both of you seem to have up-close reasons for your views.

Mr. O’Rear and I rarely agree, even about China, so the fact we found something to agree on speaks of something.

He’s obviously getting wiser over time. (just a little humor there folks)

Real world stuff can jump up and bite the backside when you least expect it.

Mr Herzog has the sound of someone who has experience avoiding unhappy outcomes.

Nope, just once every 10 days I douse them with alcohol and the unhappy outcomes become hazier and hazier.

I still get angry at someone I semi-trusted losing photos of my better memories in China. It’s just as well the jerk lost the photos, so I don’t fixedly gaze at them hours on end this way. Some images are still clear in the mind, like listening to someone’s mother say in Chinese and a friend translate “At least we were happy in the Mao years”. Yeah, so are the MAGA fans in their trailer park homes. I don’t want to be that kind of “happy”.

Then there was the middle aged Chinese English teacher, a “colleague” (puke), who as much as I exerted myself I couldn’t get rid of by speed-walking (almost jogging) home from campus, who with a straight face asked me “Why/how did America gift the AIDS virus to the world??” I was tempted to answer “I think it started backstage at a Tom Jones/Engelbert Humperdinck concert and those bastards are British anyway” but I didn’t think she’d get the humor so I think I just answered something like “Most of us are born degenerates” and she smiled like I just proved to her Santa Claus was real, so it was a winning moment.

This is interesting – Politico thinks the FTC is finally ready to move against Amazon:

https://www.politico.com/news/2023/07/25/ftc-lawsuit-break-up-amazon-00108130

Amazon has similar troubles in the UK:

https://www.cnbc.com/2023/07/26/amazon-offers-concessions-to-uk-cma-as-part-of-marketplace-probe-.html

Quarterly earnings report Thursday, after the close. Should include comments on contigent risks.

Speaking of Politico, I’m still getting a lot of sadistic laughs out of watching Tim Scott’s presidential run. When will these minority candidates ever learn they have zero chance under the Republican banner, and that all Republicans do is laugh at them the instant they left the room??

Hey, anyone know what Piyush Jindal is doing lately?? 2016 was a heady year for our man Piyush:

“GOP candidates who have gone after Trump, like Lindsey Graham and Rick Perry, have so far not been rewarded in the polls. A CNN/ORC Poll released Thursday found that the real estate mogul continues to hold a commanding lead in the national GOP race, garnering support from 32 percent of Republicans.

Jindal, along with Graham, were at one percent in the poll. Perry polled below one percent.”

https://www.nbcnews.com/politics/2016-election/bobby-jindal-calls-trump-unstable-narcissist-n425071

Tim!!!! Thanks for the much anticipated laughter. One of the rare things to look forward to in politics lately.

I have mixed emotions on this. on one side, I am biased as I own amazon stock. nevertheless, this company is a stunning example of an American success story. they were willing to use technology when others would not or could not see the value. and they took chances, some worked and some failed. but they capitalized on the failures. to be honest, I own amazon not for their retail marketplace. I purchased it because they were the first to seriously monetize the cloud with amazon web services. and today they are a quantum computing hedge.

on the other hand, I do think they have been rather aggressive in some of their labor and marketing practices. although not as bad as others. prime may be a challenge to quit, but the Wall Street journal by far was the worst offender when it comes to making life difficult to cancel.

amazon changed the landscape in how we buy and what service we expect. anybody ever have to wait in line for an hour to return a $10 item at Walmart years ago will attest to some of the improvements through the years. because of amazon, there are half a dozen other services who now compete to drop off my purchases faster than if I had gone to the store myself-without being gouged in the process.

will be interesting to see how this plays out against amazon. I think we lose a lot if amazon is forced to break up. careful what you wish for, I guess.

“Big Consumer Companies Keep Raising Prices, Complicating Fed’s Job…

Coca-Cola, PepsiCo and Unilever have each reported raising prices significantly in the second quarter, from about 8 percent at Unilever to 15 percent at Pepsi…

PepsiCo, which makes Gatorade sports drinks, Lay’s potato chips and Quaker Oats, reported this month that its second-quarter revenue grew 10 percent and that its profit doubled, to $2.7 billion, from a year earlier.”

https://www.nytimes.com/2023/07/26/business/food-prices-fed-inflation.html

Pepsico is pgl’s poster child for a company struggling to keep pace with rising costs–his lame, anecdotal attempt to debunk the idea of seller’s inflation AKA greedflation. Pepsico’s second quarter results pretty well debunk pgl’s weird notions.

Of course, pgl will be delighted that the value of his portfolio has been bolstered, due to Pepsico’s stock price closing near a record high, despite all his pathetic bleating about how badly they have been doing…

As I said, Pepsico has been pgl’s poster child for a company struggling to keep pace with rising costs, his lame, anecdotal attempt to debunk the idea of seller’s inflation AKA greedflation. Home embarrassing it must be for him to have Pepsico double its profits in 2Q23!

Of course, Pepsico’s margins are not representative of corporate America, as much as pgl would like for you to believe that. In fact margins are still near record highs, averaging about 16% over the past year vs. about 12% only five years ago.

And, if pgl had bothered to read the NY Times article I linked to, he would have seen that corporations can still have near-record margins without relying so heavily on price increases…they just don’t pass along the decreasing costs of inputs.

Heads Corporate America wins, Tail consumers lose…but you will never read pgl, ever the corporate shill, acknowledging that.

sounds like you are at war with capitalism, Johnny.

Jonny boy told us that the profit margin in 2022 was higher than it was in 2020.

Profit margin for 2020: 14.3%

Profit margin for 2022: 13.3%

Facts little Jonny boy. But you would not know that as little Jonny boy cannot read a 10K. Duh!

Hey Jonny boy – please, please, please keep reminding us that you are the dumbest troll ever.

‘PepsiCo, which makes Gatorade sports drinks, Lay’s potato chips and Quaker Oats, reported this month that its second-quarter revenue grew 10 percent and its profit doubled, to $2.7 billion, compared with the same time last year.’

Maybe the moron who writes Jonny boy’s favorite fluff should let little Jonny boy know two key things: (1) he is referencing net income and not operating profits; and (2) 2022QII net income included a large deduction for the impairment of intangibles.

Yes Jonny boy is relying on a turkey who flunked basic accounting as little Jonny boy does not know how to read financial filings for himself.

“Pepsico is pgl’s poster child for a company struggling to keep pace with rising costs–his lame, anecdotal attempt to debunk the idea of seller’s inflation AKA greedflation.

Pepsico’s second quarter results pretty well debunk pgl’s weird notions.”

I would not mind having a stalker who had an ounce of brains but my stalker is mentally retarded. Do we need to remind this moron of how the operating margin for Pepsico had fared through 2022?

Come on Jonny boy – one quarter is all you have? I guess it is beyond your little pea brain to check out the facts at http://www.sec.gov. Damn!

https://www.macrotrends.net/stocks/charts/PEP/pepsico/profit-margins

Jonny boy failed to note two things from his latest little article:

‘Prices for consumer goods in the United States have moderated, though inflation is still higher than the Federal Reserve’s goal. Food prices rose 5.7 percent over the year through June, according to the Consumer Price Index.’

OK – the NYTimes writes a story saying food prices are exploding when everyone knows (including the person who wrote this article) food price inflation is moderating. Then there was:

“The companies have cited a strong labor market, in which wages are growing, as source of increased spending.”

But Jonny boy wants us to believe wages will not keep pace with inflation. I guess when one’s only analytical skill is reading poorly written articles in the press – this is the kind of nonsense little Jonny boy spews.

“pgl will be delighted that the value of his portfolio has been bolstered”

To be clear – I have not had a Pepsi since Reagan was President. I rarely drink any soda and when I do – I prefer Dr. Pepper. I have never owned PepsiCo stock.

No I mention this company as I find it amusing how utterly wrong Jonny boy can be on something so simple. The operating margin over time. But hey – Jonny boy is the dumbest troll ever created incapable of doing something really easy – reading the financials of a company at http://www.sec.gov

Yea Jonny boy loves to hurl is dishonest and childish insults at me and others like Macroduck. You see – we have do the mortal sin of simply calling out Jonny boy’s lies and incredible stupidity. And that makes little Jonny boy all ANGRY. Sorry Jonny boy – but your stupidity is not our fault. Grow up little baby boy. Oh wait – your mommy has told me that you never learned how to get out of your own little crib. Never mind.

You’ll notice that pgl says he never drinks Pepsi…but he dodged the question of whether he hearts Pepsico because he owns Pepsico stock or whether the rise in Pepsico’s stock price has fattened his portfolio…typical pgl evasion. I mean, why else would he trot out the ridiculous notion of Pepsico’s margin struggles being representative of Corporate America.

“I have never owned PepsiCo stock.”

did you even read his response before you made a knee-jerk comment Johnny?

Yea – my stalking is mentally retarded.

Shasta just wants everyone to get along. $1.19 for a 2 litre.

$7 bottle of Torani syrup (the lasts weeks) is optional.

How effing dumb are you? I said I do not own PepsiCo stock and then you say I dodge this issue.

Come on Jonny boy – you will never graduate kindergarten until you at least try to learn to read.

How Inequality Is Undermining China’s Prosperity

Report by Ilaria Mazzocco

https://www.csis.org/analysis/how-inequality-undermining-chinas-prosperity#h2-china-s-inequality-challenge

Just in case either ltr or JohnH tries once again to spin the claim that Xi’s PRC is an egalitarian economy.