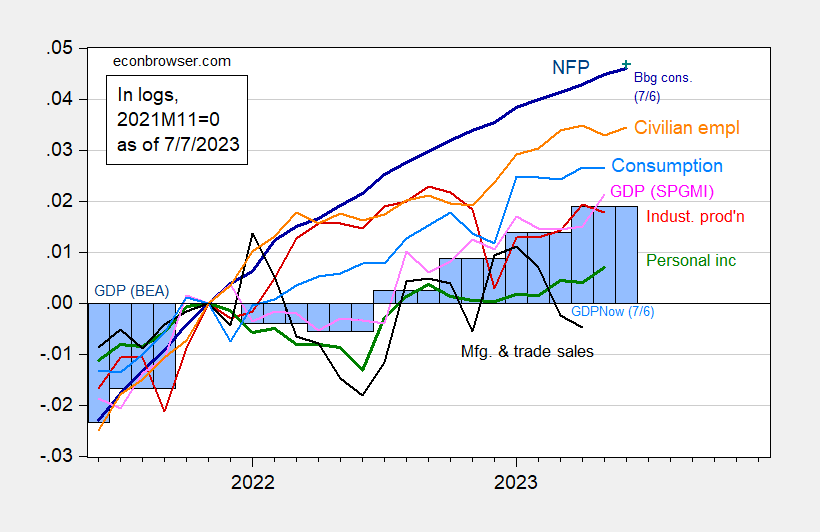

Nonfarm payroll employment surprises on the downside, while preceding months are revised down. Here’s the picture of key indicators followed by the NBER BCDC, along with monthly GDP (SPGMI).

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), 2023Q2 is GDPNow of 7/6, all log normalized to 2021M11=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 3rd release via FRED, Atlanta Fed, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (7/3/2023 release), and author’s calculations.

I’ve always had some admiration for Janet Yellen, and very few women, or men, would have had the inner courage, to tell China about their BS, lies, and tipping the scales while in China. Once again, similar to her Fed exit punishment on Wells Fargo, showing, on personal class and character, among technocrats, she is in a class unto her own.

https://www.ft.com/content/b21cfde0-8940-45db-b3e3-3e9807d7b957

OECD pressed Australia to drop plan to reveal where multinationals pay tax

Organisation behind push for fairer corporate levies lobbied to water down disclosure rules

The Australian Tax Office is perhaps the leading tax authority in enforcing the rules against transfer pricing abuse (rich multinationals evading taxes) and the OECD tells them to tone it down? I’m sorry but this is abandonment of its mission. The OECD either stands down and decides to support the Aussies or the OECD should just be abolished.

@ pgl

Terrific find, and first class-commentary by you. You 100% nailed it. Thanks for the share.

I wish I could say I was “surprised” by the OECD’s corrupt behavior. You can bet money is exchanging hands under the table to higher-ups at the OECD. Hopefully there’s a journalist out there who can find it. This also happens at the Federal Reserve and a large share of “respectful” institutions, which is how you get a preponderance of American economists spouting propaganda that the Fed Reserve is an altruistic outfit, with each new FOMC member instantaneously growing angel wings upon announcement of their confirmation.

https://news.cgtn.com/news/2023-07-08/Focus-on-productivity-not-technology-1lgKEx1zgg8/index.html

July 8, 2023

Focus on productivity, not technology

By Dani Rodrik

Economists have long argued that productivity is the foundation of prosperity. The only way a country can increase its standard of living sustainably is to produce more goods and services with fewer resources. Since the Industrial Revolution, this has been achieved through innovation, which is why productivity has become synonymous, in the public imagination, with technological progress and research and development.

Our intuition about how innovation promotes productivity is shaped by everyday experience in business. Firms that adopt new technologies tend to become more productive, allowing them to outcompete technological laggards. But a productive society is not the same as a productive firm. Something that promotes productivity in a business may not work, or may even backfire, at the level of a whole country or economy. Whereas firms have the luxury of focusing on the productivity of only those resources they choose to employ, a society needs to enhance the productivity of all of its people.

But many economists (and others) have failed to appreciate this distinction, owing to the assumption that technological progress will eventually trickle down to everyone, even if its immediate benefits accrue only to a small group of firms and investors. As economists Daron Acemoglu and Simon Johnson remind us in their useful new book, this belief has not quite been true historically. The Industrial Revolution may have inaugurated the period of modern economic growth, but it did not produce advances in well-being for most ordinary workers for the better part of a century.

Worse, the conventional narrative may have become even less true with the most recent wave of technological advances. New technologies may fail to lift all boats because their benefits can be overwhelmingly captured by a small group of players – be it a few firms or narrow segments of the workforce. One culprit is inappropriate institutions and regulations, which skew bargaining power in the economy or restrict entry by outsiders to modern sectors. Another is the nature of technology itself: innovation often empowers only specific groups, such as highly skilled workers and professionals.

Consider one of the paradoxes of the hyper-globalization era. After the 1990s, as trade costs fell and manufacturing production spread around the world, many firms in low- and middle-income countries became integrated into global supply chains and adopted state-of-the-art production techniques. As a result, these firms’ productivity increased by leaps and bounds. Yet the productivity of the economies in which they were domiciled stagnated in many cases, or even regressed.

Mexico provides a startling case study, since it was once a poster child for hyper-globalization. Thanks to the government’s liberalizing reforms in the 1980s and the North American Free Trade Agreement (NAFTA) in the 1990s, Mexico experienced a boom in manufactured exports and inward foreign direct investment. Yet the result was a spectacular failure where it really mattered. Along with many others in Latin America, Mexico experienced negative total factor productivity growth in subsequent decades….

An excellent assessment by Rodrik in all but one regard. Policy prescriptions ostensibly aimed at increasing productivity have often been cover for trickledown economics. Tax cuts for the wealthy, light regulation of the labor market, light environmental regulation, light financial regulation, light anti-trust enforcement have all been sold as productivity-boosting policies.

To a considerable extent, reliance on technological progress to boost welfare for the median household is rather like all the above-named trickle-down canards. But all the above-named were sold as productivity policoes.

https://fred.stlouisfed.org/graph/?g=16NcB

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2022

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=16NcG

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2022

(Indexed to 1992)

Kevin Drum’s ‘Climate change is all about fossil fuels, period’

https://jabberwocking.com/climate-change-is-all-about-fossil-fuels-period/

Kevin Drum takes on some misleading spin in the LATimes. Interesting stuff but I fear the comment box over there is about to be inflicted with the usual BS we see from CoRev.

https://fred.stlouisfed.org/graph/?g=16Qp3

August 4, 2014

Real per capita Gross Domestic Product for Brazil, Argentina, Chile, Mexico and China, 1992-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16Qp8

August 4, 2014

Real per capita Gross Domestic Product for Brazil, Argentina, Chile, Mexico and China, 1992-2022

(Indexed to 1992)

UN Secretary-General Antonio Guterres said what needed to be said and of course Israel complained:

https://www.msn.com/en-us/news/world/un-chief-refuses-to-retract-condemnation-of-israel-s-jenin-raid/ar-AA1dAMLI?ocid=msedgdhp&pc=U531&cvid=f8523d6ec9cc4d02b2b95001da66b4f8&ei=14

Israel’s United Nations ambassador has called on UN Secretary-General Antonio Guterres to retract his condemnation of Israeli forces for using excessive force and harming civilians during their devastating raid on the Jenin refugee camp in the occupied West Bank. UN deputy spokesperson Farhan Haq responded on Friday saying that Guterres had conveyed his views on Israel’s operation in the Jenin refugee camp “and he stands by those views”. Guterres, angered by Israeli air attacks on Jenin and the danger posed to the civilian population, issued a statement on Thursday in which he said the assault had left over 100 civilians injured, uprooted thousands of residents, damaged schools and hospitals, and disrupted water and electricity networks. “Israel’s air strikes and ground operations in a crowded refugee camp were the worst violence in the West Bank in many years, with a significant impact on civilians,” Guterres said. The UN chief also criticised Israel for preventing the injured from receiving medical care and humanitarian workers from reaching those in need during the military raid, which left 12 Palestinians dead and approximately 100 wounded.

I am all for the right of Israeli citizens to live in peace but those rights also extend to the Palestinians.

https://news.cgtn.com/news/2023-07-08/Focus-on-productivity-not-technology-1lgKEx1zgg8/index.html

July 8, 2023

Focus on productivity, not technology

By Dani Rodrik

[ Dani Rodrik’s essay is important in showing that the development problem Mexico has experienced was a result of a relative lack of investment. Chinese planners understood this early on and emphasized investment and set aside criticism by Western economists. Painting and assembling cars has little growth effect for Mexico. What is necessary is to build an entire car. ]

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weo-report?c=223,924,534,273,199,111,&s=NID_NGDP,NGSD_NGDP,&sy=2007&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2022

Total Investment & Gross National Savings as a percent of GDP for Brazil, China, India, South Africa and United States, 2007-2022

2007

China

Total Investment ( 40.4)

Gross National Savings ( 50.4)

Mexico

Total Investment ( 23.1)

Gross National Savings ( 22.2)

2022

China

Total Investment ( 44.8)

Gross National Savings ( 46.4)

Mexico

Total Investment ( 20.8)

Gross National Savings ( 19.6)

The lithium mining sector has seen a proliferation of activity in the last 10 years. It has documented record revenues as lithium becomes more sought after due to its centrality in electric vehicle battery technology. We list the five biggest lithium producers by market cap, along with an overview of their current projects and main areas of business.

https://www.mining-technology.com/features/top-5-largest-lithium-companies/

I started wondering who the major players were after my little news feed had some discussion of how the Aussies were about to challenge China as suppliers of lithium. This list of the 5 largest companies included two from China, one in Chile, one in the US, and yea one in Australia.

“China’s government, banks and companies have propelled [Latin America’s] energy transition, with about 90% of all wind and solar technologies installed there produced by Chinese companies. China’s State Grid now controls over half of Chile’s regulated energy distribution, enough to raise concerns in the Chilean government…

China has also become a major investor in Latin America’s critical minerals sector, a treasure trove of lithium, nickel, cobalt and rare earth elements that are crucial for developing electric vehicles, wind turbines and defense technologies.”

https://asiatimes.com/2023/07/latin-america-renewables-boom-not-just-a-china-story/

Stiglitz: “The West meanwhile is investing “very little” in developing economies, compared to countries like China, said the 80-year-old American, a former World Bank chief economist.

“There’s a joke that we give them lectures about what to do, and they give them money,” he said.”

https://www.barrons.com/news/hostile-us-policies-on-china-risk-dividing-world-stiglitz-5c8e00be

Once again Jonny boy does not read his own link:

But the relationship between China and Latin America is also increasingly complicated as Latin American countries try to secure their resources and their own clean energy futures. Alongside international investments, Latin American countries are fostering energy innovation cultures that are homegrown, dynamic, creative, often grassroots and frequently overlooked.

To the degree that Latin America relies on foreign based multinationals, they may suffer from transfer pricing manipulation. Which is why the largest copper multinational Codelco is owned by Chile and not the US or China.

Oh wait I took this conversation to the adult table and just lost little Jonny boy.

pgl tries to refute my quote from the article by claiming that the article is totally self contradictory!

Next he’ll claim that Stiglitz actually meant the opposite of what he said in his quote!

“totally self contradictory”

How effing stupid are you. I noted something in this story you choose to omit. It may contradict your BS but the real world contradicts your BS on an hourly basis.

‘Latin America renewables boom not just a China story’

That was the title. Come on Jonny – you can’t even bother to read the title. Damn – you are DUMB!

Maybe you should address this since it was what I was talking about re transfer pricing manipulation:

In April 2023, Chile’s president announced a national lithium strategy to ensure that the state holds partial ownership of some future lithium developments. The move, which has yet to be approved, has drawn complaints that it could slow production. However, the government aims to increase profits from lithium production while strengthening environmental safeguards and sharing more wealth with the country’s citizens, including local communities impacted by lithium projects. Latin America has seen its resources sold out from under it before, and Chile doesn’t intend to lose out on its natural value this time.

Like I said – Chile is being smart. I guess Jonny boy wants the Chinese investors to rip off Latin American countries. Of maybe this Know Nothing troll have never heard of the Base Erosion and Profit Shifting issue. Hottest thing in international tax and Jonny boy as usual is totally clueless.

BTW that Chinese lithium monopolist you are praising saw its sales jump to $5.6 billion and its profit margin jump to almost 60%:

https://www.google.com/finance/quote/002466:SHE

Greed inflation is OK with you if it is done by a Chinese monopolist? Huh!

Apparently pgl wants me to paste in the whole story,,,when anyone is free to click on the link. Or he could just paste in the parts he finds interesting…without engaging in insults and personal attacks.

Unfortunately, making personal attacks is what pgl is all about.

JohnH

July 10, 2023 at 10:07 am

This reply is all you have? No substantive response to facts you cannot admit to. You are truly a worthless little lying dumbass. No wonder you never get invited to adult conversations.

“Some of the other countries here may help persuade the G7… that part of the problem is that the G7, particularly the US, is not present in Latin America and Africa. So while we say we’re competing, we’re not doing the investment,” Stiglitz said.

This may be true in general but if little Jonny boy knew a damn thing about mining investments (such as lithium) he might realize that Swiss based multinationals such as the evil Glencore has invested a lot. And as everyone on the planet knows (except Know Nothing Jonny boy) the prospect for shifting the economic rents out of Africa and Latin America from mining things like lithium has been a huge issue ever since the commodity boom began a generation ago.

One would think someone who pretends to be a progressive would be concerned about this. But Jonny boy is not a progressive. No – he is just a loud mouth MORON.

https://qz.com/1292202/china-now-effectively-controls-half-the-worlds-lithium-production

One Chinese company now controls most of the metal needed to make the world’s advanced batteries

Tianqi Lithium, a Chinese company, recently paid more than $4 billion to become the second-largest shareholder in Sociedad Química y Minera (SQM), a Chilean mining company. The deal gives the company effective control over nearly half the current global production of lithium, a critical component in battery technology. The investments is producing an unusual amount of drama. Last month, the Chinese government had to intervene (paywall) to warn the Chilean government that blocking the deal, which it has the power to do, could harm their bilateral relations. The Chilean government is worried that giving Tianqi so much control over lithium could distort the market.

This company is trying to monopolize the lithium market. Now one would expect a true progressive to oppose such monopolization. But little Jonny boy is applauding this? Oh wait – Jonny boy is not a progressive. No – he is just the most uninformed loud mouth in the sand box where the other kiddies mock him daily.

Off topic, financial risk from climate change –

Turns out, the Erasmus U. paper on the underestimation of financial risk in current climate risk stress tests (https://cepr.org/voxeu/columns/climate-risk-stress-tests-underestimate-potential-financial-sector-losses) is complimented by a new paper on actuarial estimates of financial risks from climate change:

https://news.exeter.ac.uk/faculty-of-environment-science-and-economy/climate-scenario-models-in-financial-services-significantly-underestimate-climate-risk/#:~:text=A%20new%20report%20from%20the,to%20our%20planet%20and%20society

The actuarial concern is that, obviously enough, backward-looking actuarial estimates do not account for increasing risks from rising sea levels, heat stress and wild fires – primary factors – nor do they account for the potential risk from secondary factors, such as civil unrest. (I’d add mass migration, legislative and regulatory change and such like.)

The Erasmus U. paper focuses on the inadequate appreciation in current stress test models for complex interactions between climate events, production, asset prices and the functioning of the financial system.

These two problems clearly overlap. The lack of proper accounting for climate event risk means the inputs to stress tests underestimate risk. Inadequate appreciation of the feedback between, climate, the economy and finance takes the underestimate of climate shocks and magnifies it.

To casual observers, these issues may seem obvious, as they surely do to the specialists who write these studies. The problem for the specialists is that they need to price risk, and the systems they have for doing so aren’t up to the task in the era of climate change.

McQuack opines: “…actuarial estimates of financial risks from climate change:…

The lack of proper accounting for climate event risk means the inputs to stress tests underestimate risk. Inadequate appreciation of the feedback between, climate, the economy and finance takes the underestimate of climate shocks and magnifies it….

The problem for the specialists is that they need to price risk, and the systems they have for doing so aren’t up to the task in the era of climate change.”

This is so misguided it can;t even be called wrong. The recent articles concerning the renewables impacts on ERCOT’s Texas electricity grid show us that REAL AND ACTUAL costs are ignored for the “replace fossil fuels with renewables” ?Climate change? mitigation strategy.

When we do the simplest math concerning ERCOT replacing its thermal sources we find those IGNORED costs are ~35 to 38 times the current ERCOT investment in current renewables production. (~70MW demand / ~2MW planned renewables production)

Worse these cost estimates do not include the electrification of transportation, electrification of home heating, or even any growth in demand over the implementation time frame. Why do they also ignore the beneficial impacts of using fossil fuels? How has life style improved over the period of fossil fuel use?

How ignorant is this approach?

The ignorant liberal mind is an amazement.

Another incoherent rant? Dude – get a version of ChatGPT that is not so outdated and corrupt.

From 1600 to 2022 in England, there has been essentially no improvement in social mobility. Family membership, out to 4th cousins, remains as strong a predictor of social class now as in the 17th century:

https://www.pnas.org/doi/full/10.1073/pnas.2300926120

This suggests that improvement in social status depends largely on changes in the relative status between social classes, because the class mobility is low. In other words, more progressive tax structures, more guillotines.

Of course, that’s just England.

The ‘Greedflation’ Debate Is Deeply Confused By Eric Levitz

https://nymag.com/intelligencer/2023/07/the-greedflation-debate-is-deeply-confused.html

A rather long but thoughtful discussion. Hat tip to Kevin Drum who offers his own comments.

An interesting article, but…

I think Levitz is doing what ever-so-many debaters do – he is simplifying the argument to his own advantage. His description of the “big” debate in the first paragraphs is fair enough, but the point he really aims to make is about the “little” debate, over the causes of post-pandemic inflation. In assessing the “little” debate, Levitz assigns progressives the view that basic supply-and-demand economics doesn’t apply. While some progressives may be that dumb, most aren’t. Take this bit:

‘The crude version of the greedflation argument, as articulated by former Labor secretary Robert Reich and The Lever, goes (roughly) like this: The relationship between the demand for, and supply of, goods and services has little to do with inflation. Rather, rising prices are a product of excess corporate power. As Reich writes, “Corporations have the power to raise prices without losing customers because they face so little competition.” And they face so little competition because, “since the 1980s, two-thirds of all American industries have become more concentrated.”’

When Levitz quotes Reich, we’d not hear Reich make the claim that “The relationship between the demand for, and supply of, goods and services has little to do with inflation.” Perhaps Reich makes that claim elsewhere. If he does, he’s obviously wrong. But the actual quote from Reich is lifted straight out of the theory of industrial organization. That theory does a good job of meshing supply-and-demand analysis with market concentration. No need to pretend progressives are denying basic economics.

If Levitz would allow for a more subtle debate – the debate that I think is really happening when the Johnnys of the world aren’t involved – he could make the same points without pretending other parties to the debate are ignorant.

I’m glad you read this discussion and offered an adult reply. I’m getting lazy so I have little taste for reading the latest BS from JohnH. I’ll leave that to your skilled hands.

@ Macroduck

This is a great comment by you. When people discuss greedflation/profiteering as a legitimate and existing problem (and scourge on the working man) the childlike assumption is (the childlike assumption made by the likes of “experts” like Larry Summers) that it is an “all or nothing” proposition. That if an intelligent and independent thinker such as Isabella Weber says greedflation is a significant problem for American society which needs to be discussed, that she is “then saying” demand and supply have left the picture completely. So “experts” cannot cope with an honorable debate. They have to dumb-down the original contention of greedflation being a real fixture, into saying “If you argue greedflation is a negative component in the system, you are saying supply and demand have zero bearing on events”. It’s a false attribution hoisted on progressive economists, made to delegitimize progressive economists’ real argument. The existence of greedflation as occurring rampantly at the same time supply and demand is also a component in price determination—they are not “mutually exclusive”. And only an ass-hat like Larry Summers would argue it as such.

Thank you for articulating this Macroduck, as this had entered my thoughts but I was too lazy to type it out as astutely as you did.

Corporate friendly. mainstream economists’ main argument against “greedflation” can be summarized as: “concentrated industries never exploited their market power to increase inflation before, ergo they didn’t do it during and after the pandemic.” That argument demonstrates a poor understanding of how concentrated American businesses behave. What economists should be asking is “why wouldn’t business exploit an opportunity to raise prices and profits?”

Blatant flaw #1: economists seem to be saying that business behavior is constant, not dynamic. But anyone who has the least familiarity with corporate America knows that it is not constant. It is subject to fads. It’s culture and behavior changes. When I started working at a Fortune 200 de facto monopolist, corporate values consisted of a triad: customer, worker, community. Within a decade, this had shifted to “record revenues and profits every quarter.” When I started, Jack Welch, Michael Porter, and strategic planning were all the rage. The goal was to dominate your industry or to exit (monopolize or bust!). Over the course of a few years, the importance of strategic planning got reduced to a perfunctory exercise. A few years later, in response to Japanese competition, Edwards Deming and Total Quality became all the rage, only to fade over time. The real question that should be asked is: given the dynamism of business culture and values, why wouldn’t concentrated corporate America suddenly decide that raising prices faster than costs is in vogue?

Flaw $2: concentrated corporate American business “suddenly” decided to raise prices faster than costs. Can corporate friendly, mainstream economists provide evidence that corporate America did not in fact raise prices faster than costs in the preceding years? I doubt that they can, since the subject has probably never been adequately studied. What we do know is that profit margins steadily increased since the 1970s and then exploded during the pandemic and in its aftermath. Why would some of that increase over the years before 2020 NOT be attributable to price increases? https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Flaw #3: concentrated corporate America never aggressively pursued pricing as a path to increased profits. Isabella Weber gained prominence by showing that Corporate America had actually behaved that, though not during the lifetime of most economists.

In my experience at that Fortune 200 de facto monopoly, investigation of opportunities to increase prices was a major part of the budgeting process. Since the company was a de facto monopoly, competitor reaction was not a concern. (The same would be true in stable oligopolies where the price leader “signals” the price increases to the rest of the industry.) What was a major concern was fear of what was called “customer resistance,” which could lead to a decline in sales volume. In essence the issue was: how much blood can you bleed from a rock next year? This was a huge issue, ultimately decided at the highest levels. The sales force was adamant about having a good story to tell customers as a way to explain away concerns about the higher price.

The pandemic supply shortages provided Corporate America with the perfect story, and many responded by increasing prices faster than costs. In a survey conducted in November, 2021, when economists were only just coming to grips with the fact that inflation was not transitory, more than half of retail business were already using inflation to engage in price gouging. https://digital.com/half-of-retail-businesses-using-inflation-to-price-gouge/

For opportunistic businesses, (what successful businesses aren’t?), it was the perfect opportunity–there were scapegoats. Price increases could be explained by supply shortages and transitory wage increases. Moreover, stimulus checks made consumers flush with unexpected cash, which would reduce price resistance. Was there ever a better opportunity to engage in price gouging?

Yet corporate friendly, mainstream economists, refusing to investigate the matter or to connect the dots, continued to believe that Corporate

America was not a significant factor, because they “hadn’t behaved this way before.”

https://www.kentclarkcenter.org/surveys/inflation-market-power-and-price-controls/

Fortunately, the matter has finally become the subject of debate. Economists could do themselves a favor and instead of just assuming ‘constant markups,’ study how businesses actually behave.

“In my experience at that Fortune 200 de facto monopoly”

Why do you never tell us the name of this company. Oh yea – it went bankrupt as their CEO was stupid enough to hire you.

Now you have decided to babble more trash – source? Or did you note read what I linked to? Oh wait – it was all over your little pea brain as usual.

Funny someone posting under the name ‘anonymous’ criticizes me for not revealing my identity!

And he offers absolutely no constructive criticism or refutation of any of the points I made. Heck, he probably doesn’t even know who Jack Welch was or how he influenced and changed American industry.

OK troll. Macroduck and I too have also challenged you here. Fess up Jonny boy – what was the name of that company you sent to bankruptcy with your usual incompetence

So why don’t pgly and Ducky gladly reveal their identities instead of whining about others?

And why doesn’t pgl try to address the fact that business behavior is not constant…and that Corporate America does in fact adapt to changing circumstances that present opportunities for increasing profit margins…the most recent example being greedflation.

pgl might be interested in the following: “The governor of the Bank of England has accused retailers of putting further strain on households by overcharging consumers on petrol and other goods at a time when UK authorities are struggling to curb inflation.” Yet only four months ago, he saw no evidence!

https://www.theguardian.com/money/2023/jul/06/bank-of-england-governor-andrew-bailey-uk-retailers-overcharging-petrol-goods-fuel-prices-inflation

JohnH

July 10, 2023 at 10:19 am

And we thought CoRev was the most worthless babbling idiot here. Jonny boy relax. You are winning the 2023 troll of the year hands down.

The “gentleman’s game” is now cool with human rights abuses, the murder of Washington Post journalists, etc. Kind of brings a warm fuzzy to your heart about all these arrogant, serially adulterating and serially fornicating guys whacking a ball around a water wasting green, doesn’t it??

https://www.cnbc.com/2023/06/06/pga-tour-agrees-to-merge-with-saudi-backed-rival-liv-golf.html

Being born on third base and fantasizing you hit a triple has its advantages. And those wealthy suburban white PGA fans whose own fraud “domestic” lives probably mirror the philandering ball whackers will continue their adoration and worship of the PGA ball whackers. Good luck chasing the “cabbage patch chicks” with the Saudi Arabian blood money guys. Keep it classy.

https://www.npr.org/sections/thetwo-way/2016/11/16/502312268/kim-fatty-the-third-no-more-china-reportedly-censors-mockery-of-kim-jong-un

China appears to have censored an insulting nickname for North Korean leader Kim Jong Un, blocking it from appearing on popular websites. The name in question: “Kim Fatty the Third.”

The Associated Press reports:

“Searches for the Chinese words ‘Jin San Pang’ on the search engine Baidu and microblogging platform Weibo returned no results this week. “The nickname pokes fun at Kim’s girth and his status as the third generation of the Kim family to rule the world’s only hereditary communist dynasty. It’s especially popular among young, irreverent Chinese who tend to look down on their country’s would-be ally. … ” ‘Kim Fatty the Third’ is such a widely used term in China that it is sometimes suggested by auto-complete algorithms on web portals such as Baidu, China’s leading search engine. While searches for ‘Jin San Pang’ returned no results this week, Baidu left untouched results for other versions of the nickname, such as ‘Kim Fat Fat Fat.’ ”

Reuters, which ran a similar search for the nickname, reports that a spokesman for China’s Foreign Ministry denied that the government had banned the search term while also saying China “does not approve of insulting or ridiculing language to address any country’s leader.”

Trump may be wondering if such a ban could be imposed on those of us who call out how incredibly fat he is too.

Funny. Any updated on current censorship of Winnie-the-Pooh search terms and images?? The level of personal insecurity exhibited by Xi Jinping is laughter inducing.

‘Latin America renewables boom not just a China story’

That was the title. Come on Jonny – you can’t even bother to read the title. Damn – you are DUMB!