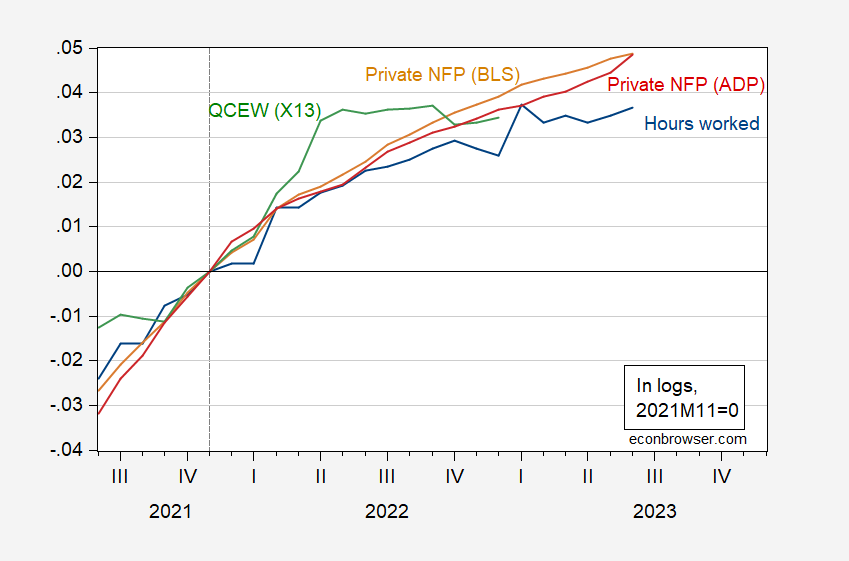

NFP surprised on downside slightly; however, alternative measures indicate continued growth through at least May. That characterization also applies to private NFP.

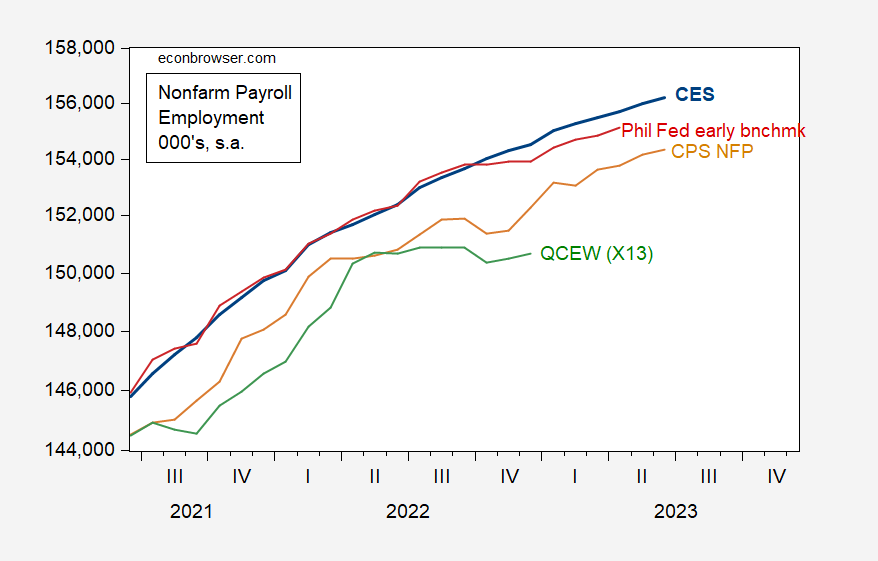

Figure 1: Nonfarm payroll employment from CES (blue), CPS household series adjusted to NFP concept (tan), QCEW total covered aggregate, seasonly adjusted using X-13 (green), all in 000’s, s.a. Source: BLS via FRED, BLS, BSL-QCEW, Philadelphia Fed.

Figure 2: Private NFP from BLS CES (tan), private NFP from ADP (red), private QCEW seasonally adjusted aggregate using X13 (green), and aggregate weekly hours worked (blue), all in logs, 2021M11=0. Source: BLS, ADP via FRED, BLS-QCEW, and author’s calculations.

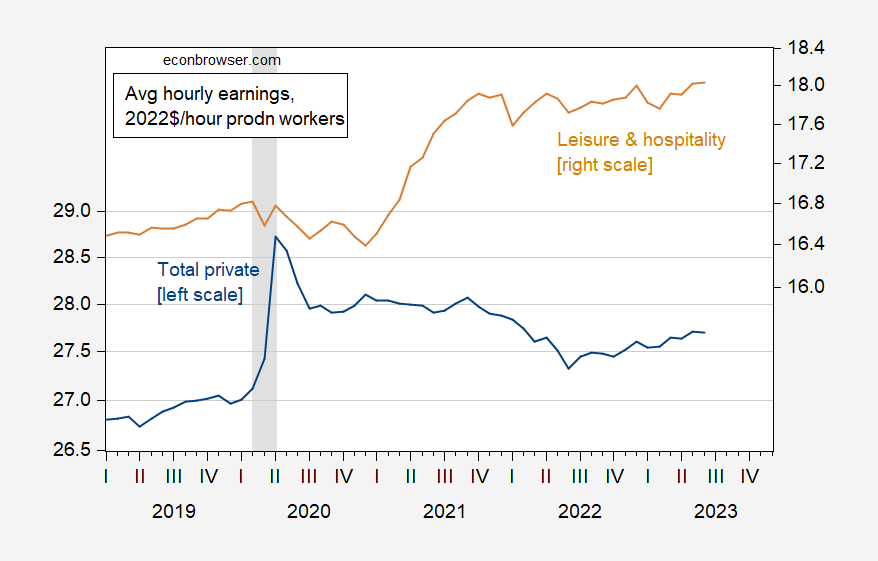

While nominal wages continued to rise in June, real wages — as calculated using the Cleveland Fed nowcast for June, are pretty flat. That being said, real wages have been rising for total employment since June of 2022. Leisure and hospitality production and nonmanagerial workers have seen their wages rise by 7.2% since the NBER defined peak at 2020M02.

Figure 3: Average hourly earnings in total private nonfarm (blue, left log scale), and in leisure and hospitality services (tan, right log scale), both in 2022$ (CPI-all deflated). June observation uses CPI nowcast from Cleveland Fed as of 7/9/2023. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, Cleveland Fed, NBER, and author’s calculations.

Total private hourly earnings are 2.1% above NBER peak levels.

FT had an interesting article about this. And it implies the Fed is nearly finished with rate hikes.

https://www.federalreserve.gov/econres/notes/feds-notes/a-new-index-to-measure-us-financial-conditions-20230630.html

Good catch!

From the article:

“In recent months, a wedge has appeared between the FCI-G and other FCIs, reflecting the lags through which the rapid and sustained tightening of financial conditions recorded in 2022 acts as a headwind to future GDP growth.”

That “wedge” is the largest divergence between the new growth-linked index and conventional financial conditions indices on record. This difference represents, in fact, one of the key questions regarding the U.S. growth outlook; rapid, extensive Fed tightening “should” cause a recession, but may not. If it doesn’t cause a recession, it will be in part because the transmission of the monetary shock through financial conditions to economic activity has been muted. This muting of the effect of Fed tightening is one explanation of what the wedge between conventional FCIs and this new FCI represents. Another, suggested in the quoted text above, is lags; the other FCIs need time to catch up.

Let’s see what happens next!

It has been my experience that minorities and individuals with disabilities are the “last hired and first fired” – but I guess Powell and Summers have never had to deal with any of that. https://www.cnbc.com/2023/07/07/the-unemployment-rate-among-black-workers-increased-in-june.html So more belt tightening – working class.

Also when do the villagers in the media switch to a “Dems are better for the economy” framing for their economic stories – https://simonwdc.substack.com/p/another-strong-jobs-report-the-american

Coal Cost Crossover 3.0: Local Renewables Plus Storage Create New Opportunities for Customer Savings and Community Reinvestment by MICHELLE SOLOMON, ERIC GIMON, MIKE O’BOYLE (ENERGY INNOVATION®), UMED PALIWAL, AND AMOL

PHADKE (UNIVERSITY OF CALIFORNIA, BERKELEY) JANUARY 2023

https://energyinnovation.org/wp-content/uploads/2023/01/Coal-Cost-Crossover-3.0.pdf

Let me quote a few paragraphs from the Executive Summary:

This research shows all but one of the country’s 210 coal plants are more expensive to operate than either new wind or new solar. If the IRA’s new energy community tax credit is included in the equation, 199 of the 210 plants are more expensive to operate compared to local solar resources sited within 45 kilometers of the plant. Local wind resources are also costeffective and readily available, with 104 plants having cheaper wind resources within 45 kilometers.

Altogether, 205 plants have local renewable options that would be cheaper than coal-fired electricity. This potential to replace existing coal plants with cheap, local clean energy generation creates significant economic benefits for community transition. Our analysis finds replacing these plants with local solar or wind would drive $589 billion in local capital investment that could support economic diversification, job creation, and tax revenue.

These local wind and solar resources could also help solve the problem of long interconnection queues—a significant barrier to renewables deployment. Renewable projects built near a retiring coal plant could use the existing plant’s interconnection, helping to further lower costs. If more policymakers consider this dynamic, they can streamline economic replacement and anticipate coal retirements, which are accelerating due to the cost dynamics analyzed in this report.

While solar and wind replacement resources provide significant low-cost energy and reliability value to the grid, savings generated by switching from more expensive coal to cheaper clean energy can finance other resources to provide additional energy and reliability value.

We find that the savings generated by shifting to local solar could fund the addition of 137 GW of four-hour batteries across all plants, and 80 percent or more of the capacity at a third of existing coal plants – the economics of replacing coal with renewables are so favorable that they could fund a massive battery storage buildout to add reliability value along with emissions reductions. However, it is important to remember reliability is a system attribute—replacement renewable portfolios need not bear sole responsibility for replacing the reliability services of individual coal plants.

Thanks for the link. Nothing like information from professionals who actually know their stuff.

Again the good news is that from a pure commercial standpoint renewable energy sources are more profitable. Their intermittency issues is a feature not a bug and dealing with it (reserve energy storage) makes the grid as a whole more reliable and capable of dealing with those once every few year or decade events that commercial outfits refuse to prepare for. It’s a win/win for consumers and power providers alike.

I think this number will keep dropping, looking at about a two year time horizon before they possibly stabilize. But don’t tell Larry Summers these will drop as wages stay the same, as inflation, according to Larry Summers, is caused by increased wages for the working class.

PRO TIP: If you’re not absent-minded like me, it always helps to include the graph you’re vaguely referencing.

https://tradingeconomics.com/united-states/used-car-prices-mom

https://www.bloomberg.com/news/articles/2023-07-10/chinese-women-economists-who-met-yellen-called-traitors-online#xj4y7vzkg

Chinese Women Economists Who Met Yellen Called Traitors Online

Nationalists accuse woman of being a spy for meeting Americans

Treasury chief shares experience of being only woman in room

A group of Chinese female economists and entrepreneurs who dined with Treasury Secretary Janet Yellen have been blasted by online nationalists for betraying their country by interacting with the US official.

It’s a good thing that Dr. Yellen got to dine with Chinese woman economists but for folks to accuse these economists of being spies? Weird.

China’s version of the MAGA crowd. Only believe it or not, they probably consist of a larger percentage of the population than MAGA does here. Because China’s version of NPR/BBC/DW/PBS spends all day telling citizens the evil foreigners are pure evil and coming to slaughter them in their beds sometime tomorrow morning.

I’m separating this so ltr = let tyranny rule can copy/paste this easier. I want my author’s credit and licensing rights. CCTV, CGTN, Xinhua etc. still “hashing out” Japan’s WW2 actions~~(they can handle Chinese brutality of Chinese, but Japanese winner’s brutality means they got their ass handed to them by foreigners, THEREFOR it is unacceptable brutality).

BTW, I think all of these six women are lionhearted and unflinching in pursuing knowledge and wider experiences in life than just mixing veggies in a carbon steel wok with oil and handing their husbands a beer, or just limiting themselves to service industry jobs. But it could pretty much tell you everything you want to know about China’s cowardly, weak, and fragile makeup, that in a nation of >1.4 Billion people, they shiver in fear at the thought of more than 6 female economists interacting with a foreign female icon.

Female icon you mean Yellen? lol. For someone who thought that Japan in WW2 was benign and innocent for atomic power (or shall I say karma), you just cannot expect they have innate judgement:)

It is also WEIRD that Ernest Hemingway felt being spied in his later years for some reason right?

Didn’t Foxconn pulls this stunt with Wisconsin too?

https://www.msn.com/en-us/money/markets/foxconn-drops-19-5-billion-vedanta-chip-plans-in-blow-to-india/ar-AA1dFhD7?ocid=msedgntp&cvid=e67dc8605d504421b771853798641349&ei=17

Taiwan’s Foxconn said on Monday it has withdrawn from a $19.5 billion joint venture with Indian metals-to-oil conglomerate Vedanta, in a setback to Prime Minister Narendra Modi’s chipmaking plans for India. Foxconn, which did not say why it had taken the decision, and Vedanta signed a pact last year to set up semiconductor and display production plants in Modi’s home state of Gujarat.” Foxconn has determined it will not move forward on the joint venture with Vedanta. Foxconn is working to remove the Foxconn name from what now is a fully-owned entity of Vedanta,” it said in a statement. Modi has made chipmaking a top priority for India’s economic strategy in pursuit of a “new era” in electronics manufacturing” and Foxconn’s move represents a blow to his ambitions of luring foreign investors to make chips locally for the first time.

Thanks for the post and updated info, though we do have an unpleasant N/a/z/i in comments