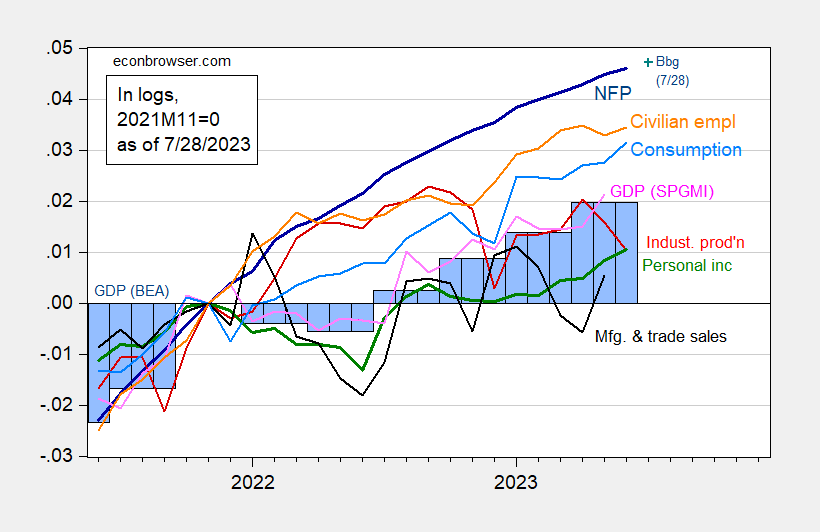

Nominal consumption spending surprises on the upside. Here’s a picture of the series the NBER BCDC follows, along with monthly GDP.

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), 2023Q2 is GDPNow of 7/18, all log normalized to 2021M11=0. Source: BLS, Federal Reserve, BEA 2023Q2 advance release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (7/3/2023 release), and author’s calculations.

Creon Butler of Chatham House is bemused by what he sees as the failure of asset prices to reflect climate risks:

https://www.chathamhouse.org/2023/07/climate-change-threatens-cause-next-economic-mega-shock

Finance specialists are steeped in the notion that asset prices are a rational reflection of all available information, are perfectly risk adjusted. The literature of recent decades has begun to question that notion, but received wisdom dies slowly, especially when the underlying justification (propaganda) for the size and power of the financial sector is its efficient allocation of resources.

So Bulter faces the puzzle that many have faced over the years; he thinks he’s right about risks, but asset prices imply that he’s wrong. Talk to those who bought credit default swaps from AIG or who held prime or Alt-A tranches of MBS in the mid-2000s, anyone who piled into the JASDAQ during the tech bubble, and you may run into a lack of faith in market efficiency.

Perhaps, though, Butler is not bemused. He may instead be an evangelist for actively directing investment into preparation for climate change, energy transition, food security and a decarbonized world. Getting the moneyed classes scared is good way to change investment patterns.

He may be doing it for selfish reasons, but still sounds like a lot of it is correct. I keep on thinking about housing prices in a city like Miami, which some have claimed large sections of Miami will be underwater in a few years. I guess if you have some kinds of insurance and you are ultra wealthy losing a house isn’t as big a deal. But I would think those types of insurance would be more difficult to get as time wears on and that even for ultra wealthy you wouldn’t want to “take a bath” (no pun intended) on the complete value of a seaside home.

To be clear, I agree that we are going to tip over the asset-market apple cart. I imagine one of the growth areas in finance will be figuring out which assets will be hurt, and by how much, and what will happen with asset correlations. Within the next decade or so, I think the Great Funancial Crisis will look like a walk in the park. But what do I know?

And I definitely approve if Butler is trying to stampede the rich folk – not just to buy fortified compounds, but to get busy selling the rest of us a sustainable future. They won’t do it for humanitarian reasons, but the mark-up on sustainability is likely to be huuuuuge.

Professor Rosser was a fan of consumption. About 68% of GDP as I understand it.

The far-right side of this graph is interesting, if you’re thinking about buying a car. It might pay off to try and wait two more years before purchasing a new or even a used car:

https://fred.stlouisfed.org/series/IPG33611NQ

Apparently, there is still room for more vehicle production:

https://fred.stlouisfed.org/graph/?g=17qoS

I should stick them on the same graph, but got other stuff to do.

Here we go:

https://fred.stlouisfed.org/graph/?g=17qps

Curious about the divergence beginning in the middle of the teens.

“Eyeballing” it (which I am sure Menzie and many others would tell me is not the ideal way you wanna do it) it looks like to me it is the capacity part, more than the production part that is creating the divergence or gap, if I am reading you correctly. And yeah, like, certainly by 2015 you can see it.

Why aren’t the “free” trade fundamentalists complaining about the tariffs on Chinese EVs, like they did about the tariffs on washing machines? Unlike removing tariffs on washing machines, removing tariffs on EVs could make a difference.

Assumes facts not in evidence. The labeling is sloppy. The claims are unsubstantiated.

When you actually have something to say, let us know.

It is odd that when I advocated removing the 27.5% tariff on imports of Chinese EV – Jonny boy went off attacking Dr. Frankel because Jonny boy thought this was a Biden tariff. No – it was imposed when Trump was President.

Ducky can’t find prominent economists who oppose the tariff on Chinese EVs…but only a few years ago those opposing the tariff on washing machines were everywhere to be found.

Whatever happened to all those “free” trade fundamentalists? Have they all magically had an epiphany and become [gasp!] protectionists??? Or is it just that the political winds have shifted, so economists have just fallen in line?

“Ducky can’t find prominent economists who oppose the tariff on Chinese EVs…”

Is there a reason you keep repeating this lie? I oppose the tariff but I guess I’m not prominent. Jeff Frankel is prominent and Dr. Chinn had to remind you he opposes it.

When Dr. Chinn did remind you – there was some talk of banning your lying rear end. Maybe it is time to ban you for good so the rest of us will not have to endure your serial garbage.

JuniorHighJohn. What are you babbling about now? Thought you said there were tons of new Chinese EVs being shipped all over including to the mother ship in Russia where the streets of Moscow are full of these vehicles, where Russian car buyers are in long lines awaiting more.

I guess you have something against people being able to afford washing machines. Dude – your mother is still washing Jonny boy’s laundry as Jonny boy does not know how to do that for himself.

From Jonny boy’s favorite little article:

‘PepsiCo, which makes Gatorade sports drinks, Lay’s potato chips and Quaker Oats, reported this month that its second-quarter revenue grew 10 percent and its profit doubled, to $2.7 billion, compared with the same time last year.’

Maybe the moron who writes Jonny boy’s favorite fluff should let little Jonny boy know two key things: (1) he is referencing net income and not operating profits; and (2) 2022QII net income included a large deduction for the impairment of intangibles.

Yes Jonny boy is relying on a turkey who flunked basic accounting as little Jonny boy does not know how to read financial filings for himself.

BTW – this was only a single quarter. If one looks at the first 6 months of 2022, one would see its operating profits were $7.344 billion while operating profits for the first 6 months of 2023 were only $6.288 billion. Whoops! A little challenge for Jonny boy. Try to figure out how this could be. We’ll wait!

Putin is in Africa telling leaders there that Ukraine should be a “neutral state”. This from the war criminal who has been trying to reform the Soviet Union by having Ukraine become part of Putin’s empire? Huh – it sounds to me that Putin has finally admitted his aggression has failed.

https://www.msn.com/en-us/news/politics/ky-governor-has-set-the-stage-for-ignoring-law-banning-him-from-appointing-a-dem-if-mcconnell-steps-down-report/ar-AA1ewJWh?ocid=msedgdhp&pc=U531&cvid=79cdf27021184089a6911d17bc51e28e&ei=2

If McConnell resigns from the Senate, will Gov. Beshear be able to appoint a Democrat to the Senate?

Beshear has to appoint a Republican –

Procedures for filling of vacancy.

(1) (a) The Governor shall fill vacancies in the office of United States Senator by appointment and the appointee shall serve until a successor has been elected

and qualified under subsection (2), (3), (4), or (5) of this section.

(b) The appointee shall be selected from a list of three (3) names submitted by the state executive committee of the same political party as the Senator who held the vacant seat to be filled, shall have been continuously registered member of that political party since December 31 of the preceding year, and shall be named within twenty-one (21) days from the date of the list

submission

True but Beshear may take this to the courts.

Newsweek article by Ewan Palmer:

“In 2021, the Republican-run Kentucky legislature voted to introduce a law that changes how the state would fill a vacant Senate seat in the case of death, illness, or any other reason for early departure. Previously, Kentucky’s governor was able to choose who would fill the position from any political party. In this case, the decision would have been made by Democrat Gov. Andy Beshear.

However, following the passing of Senate Bill 228, the Kentucky governor would now have to pick a successor from the same party as the departed senator. This would be from a list of three names provided by the executive committee of the departing senator’s state party.

A special election would then be held to determine who takes over the seat on a permanent basis, unless the vacancy occurs within three months of an already scheduled election.”