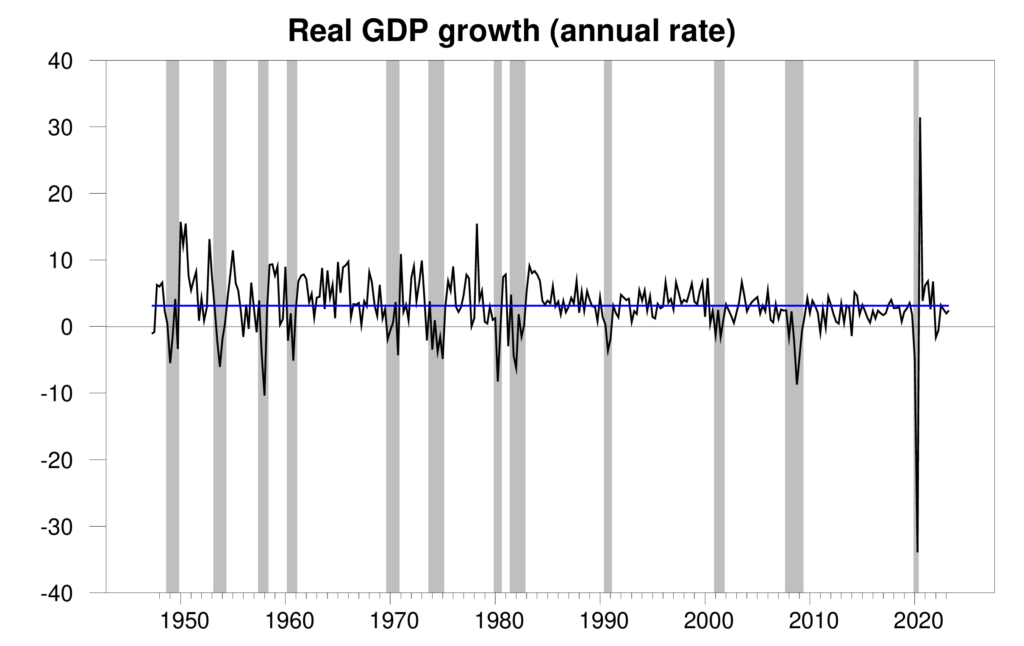

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.4% annual rate in the second quarter, not far from the historical average of 3.1%.

Real GDP growth at an annual rate, 1947:Q2-2023:Q2, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

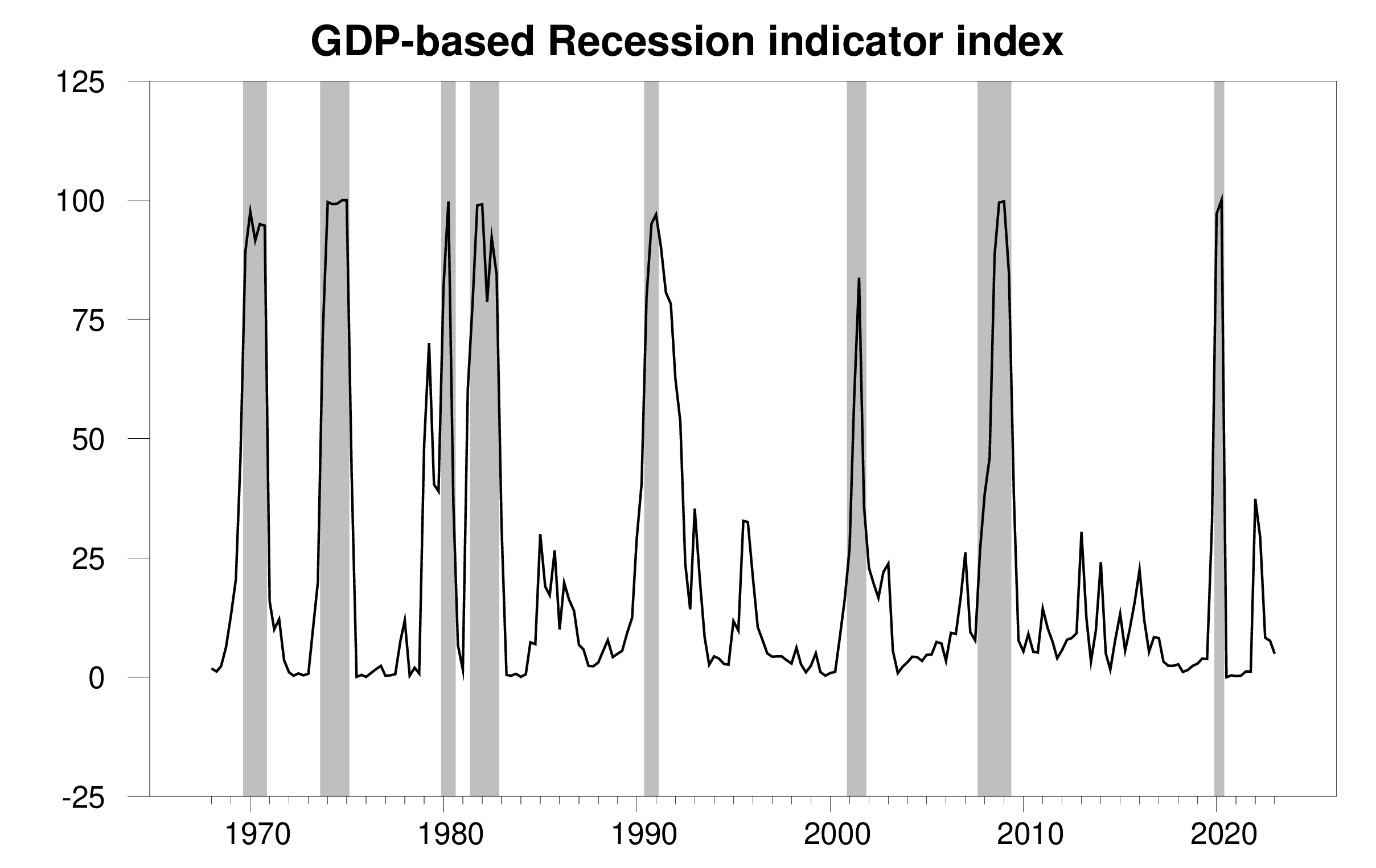

The new data put the Econbrowser recession indicator index at 4.9%, reflecting essentially no recession signal. Staff at the Federal Reserve and the Congressional Budget Office are no longer predicting a recession. Maybe Godot ain’t coming?

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2023:Q1 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

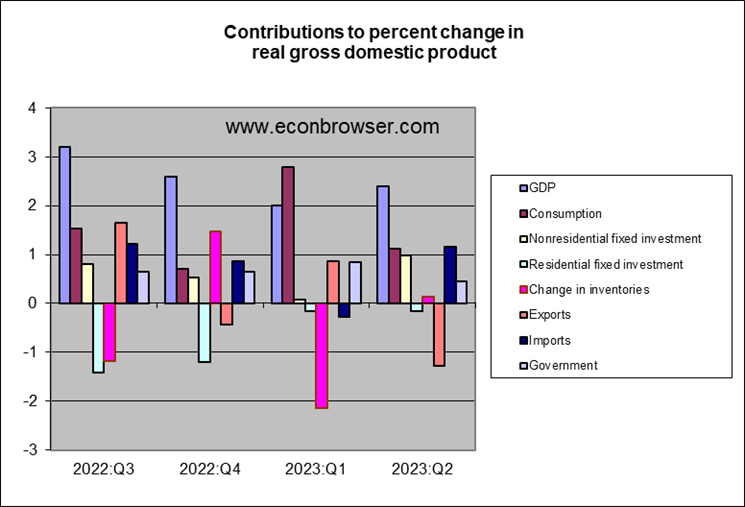

Growth was boosted by surprisingly strong nonresidential fixed investment. A drop in exports was almost all offset by a similar drop in imports.

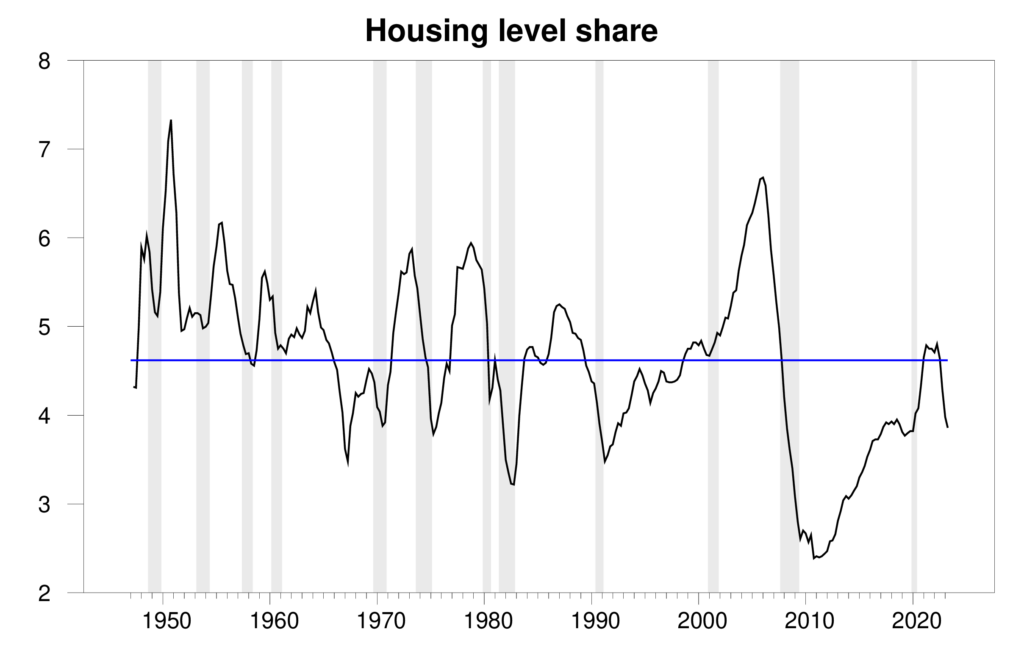

Housing, which we’d expect to bear the brunt of the Fed’s effort to slow the economy, continued to be a modest drag on GDP, but much less so than in the first two quarters of this year. Looking at housing construction as a percent of GDP, all the stimulus since 2020 has been undone, and we currently stand somewhat below the historical average.

Residential fixed investment as a percentage of nominal GDP. Blue line represent historical average of 4.6%. Data source: BEA Table 1.5.5.

As Jeff Frankel says, maybe this is what a soft landing would look like.

If I read the tables right, non-residential fixed investment accounted for 0.99% of the 2.4% (SAAR) rise in real GDP. Transportation equipment alone accounted for 0.5%. Military spending? Just 0.09%.

Final sales of domestic product up 2.3%.

Final sales to domestic purchasers up 2.3%.

Gross domestic purchases up 2.5%.

Disposable personal income up 2.5%.

Inventories a 0.14% add, trade a 0.12% drag – both quite small compared to most recent quarters.

Growth looks pretty even. Nothing in here to cast a pall over growth prospects for coming quarters.

2.6% y/y is not chugging along. Much better indication than the annualised number that only yanks ‘use’.

Well, to a simpleton, I suppose it might seem that your super-favorite growth measure is like, dude, really way better than anything anybody else might use. Awsome, right?

Couple of things, though. The year-over-year comparison involves four quarters of old information and only one quarter of new information. We might have reason to want to dilute the new information with a bunch of old information, but we might not. Fortunately, we can look at both at no extra cost, thereby avoiding unnecessary ignorance.

The second thing is that potential growth in real U.S. GDP has run at between 1.4% and 2.0% since the end of the Great Recession:

https://fred.stlouisfed.org/graph/?g=17os7

So the 2.4% annualized growth in Q2 of this year is faster than the sustainable long-run pace of growth. You want to quibble about “chugging along” when we’re running above the long-run sustainable growth pace? Really? That’s your big contribution?

Is this just you, feeling a little inferior? What with your native land growing at less than 1% (SAAR) in Q1 over Q2. By the way, that’s 2.3% y/y, so either way, not up to your own “chugging along” standard.

Interesting chart. I did not know there was so much variability in this measure of Real Potential Gross Domestic Product.

Now it has been kind of accepted that potential output has been growing around 2% for the past 20 plus years so 2.4% growth is helping us get closer to potential output. If we can keep this up for the rest of 2023, we will be back to potential.

Everything in context. The Fed has been in a panic about inflation and we all have been fearing they would sink us into negative growth rates with they endless increase in rates. GDP refuses to be influenced that much, because a lot of the increased consumption is driven by increased incomes – not loans. Similarly we don’t expect inflation, driven by supply issues, to respond much to the rate hike hammer. But thank god those supply issues are solving themselves, as predicted, so the Fed will soon have to stop themselves, for running out of excuses.

Provided that the absurdly quick increase in rates don’t end up triggering a crisis in housing, we could end up with: 1) rates at more “normal” levels, 2) inflation at 2% and 3) “full” employment. In that case you could interpret this as a case of “never let a good crisis go to waste”, where the Fed used a temporary supply chain crisis and huge government stimulus as an excuse to get up to “normal” rate levels. A lot could still go wrong but I do see a path where nothing does. Bidenomics has been a huge success that may have allowed the Fed to do this without sinking the economy.

“Provided that the absurdly quick increase in rates don’t end up triggering a crisis in housing”

and this is still a possibility. mortgage rates have been rising above 8% at times. I am not sure how we can go from under 3% to this level without some type of crisis. either home values will have to fall a bit, or housing sales will continue to plummet. but with rates where they are, it becomes very difficult for a family to buy up into a bigger house, financially speaking. lack of new housing is what has propped up prices until now. will it continue to do so?

Maybe some people are paying 8% mortgage rates but this series only briefly past 7%.

https://fred.stlouisfed.org/series/MORTGAGE30US

Yea – that is high and residential investment has suffered.

Then again Jonny boy LOVES high interest rates but was screaming mortgage rates were through the roof. Malleable opinions is his cup of tea.

Real Private Residential Fixed Investment

https://fred.stlouisfed.org/series/PRFIC1

Quite the drop but we are seeing a lot of new investment in other sectors.

Manufacturing construction! I was a bit tongue tied for what Kevin Drum called this investment boom but here’s his post:

https://jabberwocking.com/raw-data-manufacturing-construction-since-1960/

If interest rates rise, then the selling price of a house will fall. That may constrain supply sometime but not immediately. Housing has been a slow moving wreck for a long time. What’s happening now won’t change that.

Mortgage rates are irrelevant for new home construction and sales. That is about capital flows and much to Putin’s chagrin, capital is surging again. Aided by Fed rate hikes.

Bill McBride at Calculated Risk posits that higher mortgage rates imply lower existing house inventory as buying up is challenging in a low inventory seller market from a 3% mortgage toward a ~7% mortgage.

That gives builders some pricing power and they can build to a lower strike price.

New starts are now lower but not as low as existing house on sale inventory.

Financial condition remain eased and m2 is still >$20T

While the Fed balance sheet is now a touch lower than before the mini QE over SVB, etc.

Good news – core PCE is rising at around 2% per year:

https://www.bea.gov/news/2023/personal-income-and-outlays-june-2023

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index also increased 0.2 percent (table 9)

Buying up and even “buying down”, if you have a mortgage, can be swapping a 3% loan for a 7+% loan and that is a bad enough deal that many who have the option to just stay, will just stay. Sales are already slower but prices are sticky.

Even a lot of the “cash” purchases from companies that renovate and rent out are from borrowed money, and will be affected by rates. I doubt we will have a crash, but a slow grinding reduction is almost certain.

Commercial real estate is worse (all on “adjustable”/short term loans), but that is mostly going to hit banks – and most of them can afford it.

Existing Homes for sale as a percentage of total inventory are near 40 year lows. Homebuilders are enticing buyers with temporary rate buy downs (the new ARMs). Corporate interest expense is near 60 year lows, as they borrowed long, and are receiving higher rates on cash. Not surprisingly, the opposite of the FED. So, the transmission of higher ST rates to the economy is muted. The real burden of higher rates is being carried by the US Government for now (higher I-rate expense, and the loss of future FED remittances due to massive losses in the biggest curve trade ever made). But, slow to develop doesn’t mean it won’t develop. Lots of people were trying to short housing in 06, talking about neg-am loans, and ridiculous lending standards.