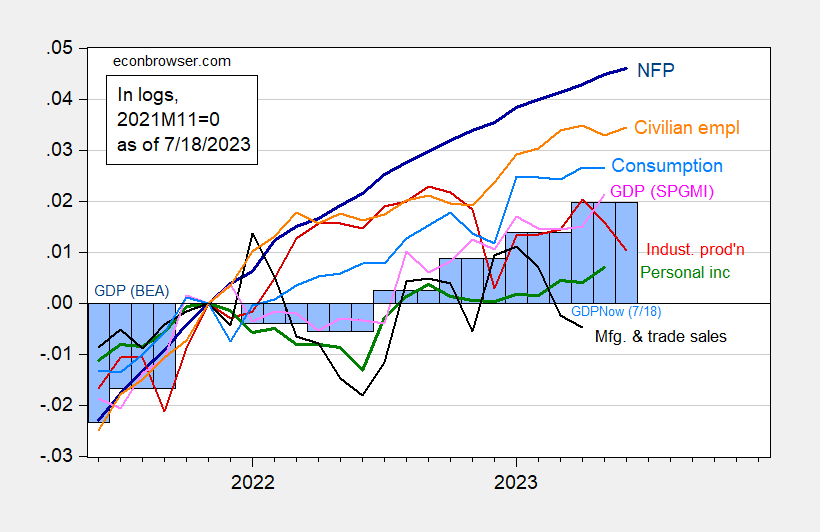

Industrial production surprises on the downside (-0.5% vs. 0% Bloomberg consensus m/m), as does manufacturing (-0.3% vs. 0% m/m). Here’s the picture of key indicators followed by the NBER BCDC, along with monthly GDP (SPGMI), as well as GDPNow (Q2 up by 10 bps relative to 7/10).

Figure 1: Nonfarm payroll employment, NFP (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), 2023Q2 is GDPNow of 7/18, all log normalized to 2021M11=0. Source: BLS, Federal Reserve, BEA 2023Q1 3rd release via FRED, Atlanta Fed (7/18), S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (7/3/2023 release), and author’s calculations.

GDPNow for Q2 at 2.4% SAAR as of today. GS at 2.5%, while SPGMI at 1.7%.

Retail sales were generally under consensus. Here’re time series of industrial production, manufacturing production, and retail sales deflated by final demand/finished goods PPI, over the same period shown in Figure 1.

Figure 2: Industrial production (red, left log scale), manufacturing production (purple, left log scale), and retail sales ex-food services deflated by PPI final demand finished goods, millions 1982$ (green, right log scale), all seasonally adjusted. Source: Federal Reserve, Commerce Department, BLS all via FRED, and author’s calculations.

In a recent blog thread we had a disagreement about car exports of different nations. This strikes me as well-sourced data and also some great visual presentation of exports and imports data on cars.

https://oec.world/en/profile/hs/cars

It strikes me that if you wanna know which nation is “winning the war” on trade or possibly sheer quality of autos, possibly net exports would be the best number?? But I can’t understand anyone buying a car outside of basically Toyota, Honda, and Subaru, unless they get the car from Grandma Jones for a steal. So that’s how weird my mind works.

A lot of information. Thanks. Note this:

EXPORTS

In 2021 the top exporters of Cars were Germany ($135B), Japan ($88.6B), United States ($55.4B), South Korea ($44.7B), and Mexico ($41.5B).

IMPORTS

In 2021 the top importers of Cars were United States ($139B), Germany ($71.1B), China ($47.6B), France ($40.3B), and United Kingdom ($33.6B).

China in 2021 had more imports (in $ terms not # of cars) than it exported. Now if we can get this data for 2022.

That was the only disappointing thing about that site, the time lag of two years. Still…… the data (rankings anyway) is not that fluid and gives you a good gauge. I think it was all originally to be “open source” but then I assume someone at MIT said “Why aren’t we making a buck off this??” and then they decided you had to pay for the most recent data. Not surprising, yet still seems disappointing. If I thought they shaved it off MIT students’ tuition costs it wouldn’t bother me, but somehow I doubt that’s where the site fees go.

Still like the site though. You get what you can get.

In 2018 the average tariff for Cars was 22%, making it the 78th lowest tariff using the HS4 product classification.

Interesting statistic. Protectionism is a huge part of understanding trade in this sector. The US imposed a 27.5% tariff on imports of Chinese cars. When I simply suggested we might consider reducing this tariff, JohnH went off attacking me for not blaming Biden for what Trump had done. Yea Jonny boy has downgraded the discourse on this blog in so many ways.

https://oec.world/en/resources/about

https://dspace.mit.edu/handle/1721.1/76532

Lest we overlook how average Americans are faring, median usual weekly real earnings rose 0.5% in Q2, which puts the average American worker 0.8% ahead of where s/he was before the pandemic.

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

For some added context, real factor incomes of the bottom 50% declined by 2.3% from January, 2020 through March of 2023, while real factor incomes of the middle 40% declined by 1.1%. https://www.realtimeinequality.org/

Real factor incomes for the top 10% increased by 5.8% through March, 2023, while real GDP increased by 5.6% from 4Q19 through 1Q23. GDI, which has dropped in the latest two quarters, rose by only 3.6% from 4Q19 through 1Q23.

https://fred.stlouisfed.org/series/a261rx1q020sbea

https://fred.stlouisfed.org/series/GDPC1/

Judging by this data, the top 10% are doing about as well as the “economy,” while the vast majority of Americans are losing ground.

https://fred.stlouisfed.org/graph/?g=1334M

January 30, 2018

Share of Total Net Worth Held by Top 0.1%, Top 90 to 99%, Top 50 to 90% and Bottom 50%, 2000-2023

https://fred.stlouisfed.org/graph/?g=1334U

January 30, 2018

Share of Total Net Worth Held by Top 0.1%, Top 90 to 99%, Top 50 to 90% and Bottom 50%, 2000-2023

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=T82W

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2000-2023

* Full time wage and salary workers

https://fred.stlouisfed.org/graph/?g=T8Hb

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2000-2023

* Full time wage and salary workers

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=rAbi

January 15, 2018

Real Median Weekly Earnings for men and women, * 2000-2023

* Full time wage and salary workers

https://fred.stlouisfed.org/graph/?g=lMaX

January 15, 2018

Real Median Weekly Earnings for men and women, * 2000-2023

* Full time wage and salary workers

(Indexed to 2000)

Johnny has here provided yet more evidence that he doesn’t really understand what he’s talking about. Johnny says “Real factor incomes for the top 10% increased by 5.8%…”

“Real factor income” for labor is simply “real income”. Factor incomes differentiate incomes between factors – rent, capital, labor. Factor incomes don’t differentiate between income levels. Income comparisons do that, without any need to clutter things up with “factor”.. Johnny has simply aped something he read (or skimmed, anyhow) without understanding it. This is not new for Johnny. Recall, for instance, that Johnny for some time declared that there were no official U.S. statistics on median usual real incomes. Now, he writes the same old comment about the data series he claimed didn’t exist.

It’s funny to watch, but not edifying.

Gee Jonny boy has stopped telling us that China leads the world in car exports now that Moses has given us actual data. Wait for it – Jonny boy is going to be hurling his usual pointless dishonest insults.

Yeah, I know, per Duckey Zucman and Saez at UC Berkley are just feeding us inane garbage!

What a lame comment by a corporate-friendly economist trying to mask growing inequality for his patrons.

Zucman and Saez are at UC Berkley. And Jonny boy tried to peddle the lie that economists in the US do not address income inequality. BTW I listed a lot of other economists who teach here that write excellent materials on this issue. And Jonny boy’s reply? He ran and cried to his mommy that we are being mean to little Jonny boy.

Johnny, I said you are peddling garbage. You. Not the people whose work you pretend to understand. You.

And Johnny, who are my patrons? You keep pretending to know where I work. You’re lying, boy. Over and over. Tell the nice people where I work.

This seems like another good source of auto export and import data, though primarily focused on Europe:

https://www.acea.auto/nav/?content=figures

https://www.acea.auto/reliable-data-statistics/

https://www.acea.auto/press-release-calendar/

Regarding the semiconductor export blockade, the Semiconductor Industry Association made the following statement: “Allowing the industry to have continued access to the China market, the world’s largest commercial market for commodity semiconductors, is important to avoid undermining the positive impact of this effort. Repeated steps, however, to impose overly broad, ambiguous, and at times unilateral restrictions risk diminishing the U.S. semiconductor industry’s competitiveness, disrupting supply chains, causing significant market uncertainty, and prompting continued escalatory retaliation by China.

We call on both governments to ease tensions and seek solutions through dialogue, not further escalation. And we urge the administration to refrain from further restrictions until it engages more extensively with industry and experts to assess the impact of current and potential restrictions to determine whether they are narrow and clearly defined, consistently applied, and fully coordinated with allies.”

https://www.semiconductors.org/sia-statement-on-potential-additional-government-restrictions-on-semiconductors/

No economists mentioned. And none were mentioned in a NY Times article last week, though the Times did quote a history professor. A history professor!!! Why, I seem to recall back in the day economists were regularly quoted in articles having anything remotely concerned with corporate-friendly “free” trade policy. Where have they all gone?

Where have they all gone? Dumb question. They haven’t gone anywhere.

Why didn’t the NYT quote an economist? Ask the NYT.

The question is: have economists become personae non grata as a result of the new economic war of sanctions and prohibitive tariffs? Or have mainstream economists decided that it in this political climate, it’s in their own best interest to get with the program and avoid criticizing protectionism? I mean, where are all those economists who were shocked and outraged at Trump’s tariffs on washing machines? Washing machines?!?

In the economics blogs I follow, free trade seems so passé…off the table.

Dude – your attempt to smear Jeff Frankel with your crap almost got you banned. Keep it up ad your being banned would be a wonderful thing.

So you are now taking the words of the Semiconductor Industry Association as gospel? Jonny boy has become a corporate sell out.

In the short term both industrial production and manufacturing production appear to have rolled over in Q2:

https://fred.stlouisfed.org/graph/?g=17a9h

Not for the first time in this expansion.

Relatively flat manufacturing output is what one would expect, given the pace of new orders for factory goods:

https://fred.stlouisfed.org/graph/?g=17afp

retail sales at gas stations were reported 1.4% lower, gasoline prices were reported 1.0% higher, and the EIA showed gasoline demand at an 18 month high, so at least one of those figures can’t be right. my guess would be that retail sales of gasoline will be revised higher next month. the inconsistency will likely persist, though..