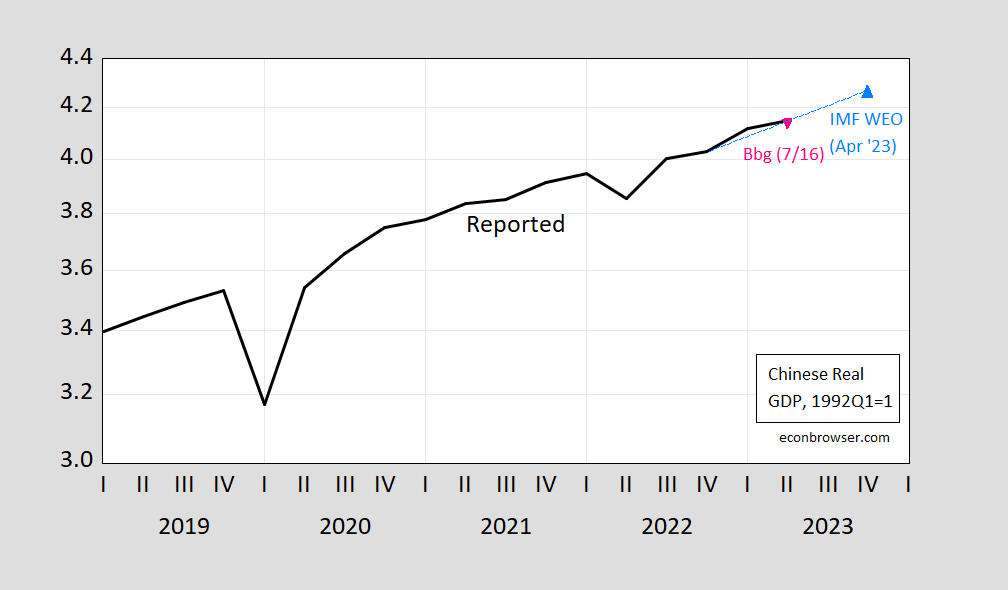

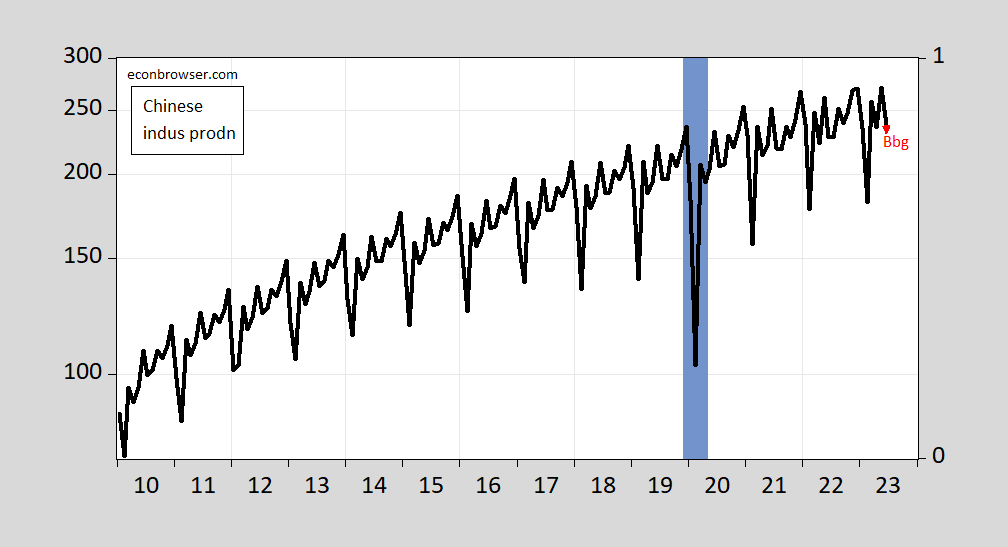

Q2 GDP and June industrial production above consensus. Retail sales slightly below.

Figure 1: Real GDP, 1992Q1=1 (black), Bloomberg consensus of 7/16 (red triangle), IMF WEO April 2023 (light blue triangle). Source: OECD, IMF WEO, Bloomberg.

Figure 2: Chinese industrial production ex-construction (black), Bloomberg consensus of 7/16 (red triangle). ECRI defined peak-to-trough recession dates shaded blue. Source: OECD, Bloomberg, ECRI.

Addendum, 7/17/2023:

While positive news, this doesn’t change the overall concerns one has regarding the trajectory of the economy. Natixis today:

…the Chinese economy has exhibited a much slower growth trajectory heading into H2 2023. The QoQ growth rate of 0.8% equals to an annualized growth rate of only 3.3% for Q2 2023, which is much lower than the 6% figure before the pandemic. That being said, the base effect will continue to provide support for the remainder of the year, albeit to a lesser extent than H1 2023. This means that achieving the GDP growth target of 5% set during the Two Sessions back in March will be increasingly challenging without a stimulus.

Despite that the stimulus is needed to reach the 2023 GDP growth target and avoid a further rapid growth deceleration in 2024, we are conservative about the extent of the policy support down the road. Fiscal policies may not be easily implemented in the current situation, given the already high public debt and the reduced efficiency of these policies. There is a possibility of further reduction in interest rates and/or the required reserve ratio (RRR), but the effectiveness of the monetary policy space may be limited due to the lack of investor confidence. Currently, the market is awaiting further regulatory relaxation on key sectors, such as the real estate sector, which could help bolster investors’ confidence.

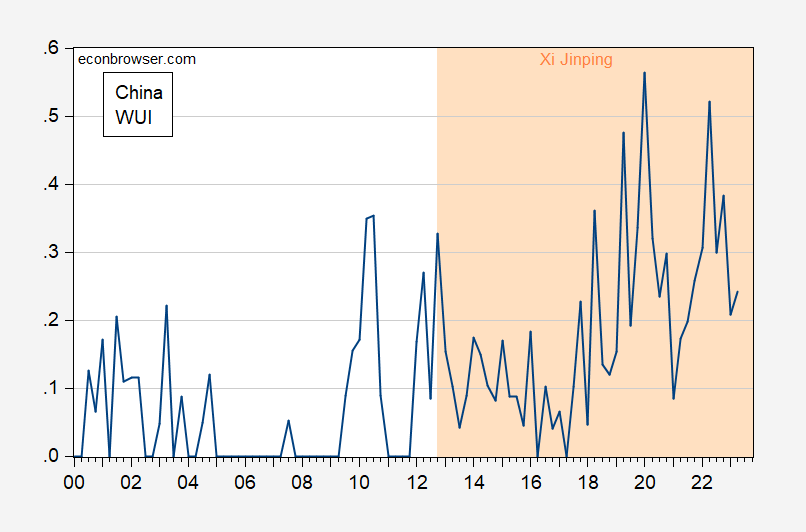

Adding to these headwinds is the decline in inward FDI. This development is not surprising given the elevated levels of uncertainty in China (see empirics in Jardet, Jude and Chinn (2022)), as well as other factors (see Bofit, 2023).

Figure 3: Ahir-Bloom-Furceri World Uncertainty Index for China. Source: WUI via FRED.

Deloitte Australia partner admits he is overpaid!

https://www.abc.net.au/news/2023-07-17/deloitte-ceo-fronts-senate-committe-into-integrity/102610116

The CEO of one of Australia’s major consulting firms has admitted to a Senate committee his position is not worthy of a salary seven times that of the prime minister’s. Four executives from Deloitte fronted a Monday public hearing into the integrity of consulting firms that provide services to the federal government.

The inquiry was launched in response to what has become known as the “PwC tax scandal”, which involved senior partners misusing confidential government information to help big multinational companies avoid paying more tax. In Deloitte’s first appearance before the committee, the top brass were slammed by both senators Deborah O’Neill and Barbara Pocock for being opaque about salaries and employee misconduct.

The committee asked for an anonymised breakdown of how many Deloitte employees earned more than $1 million but chairman Tom Imbesi said that could not be provided due to commercial sensitivities. “So, providing the number of people in million-dollar bands is something you’re not comfortable giving to the Australian public given that last year you took $712 million of public money?” Senator Pocock said. Eventually, CEO Adam Powick told the hearing the average base salary of a partner at Deloitte was between $500,000 and $600,000.

It has been publicly reported Mr Powick earns around $3.5 million, which Senator O’Neill went on to grill him about. “Are you really worth seven times the salary of the Australian prime minister?” she asked. “No,” he answered. “I happen to deeply recognise that I’m incredibly privileged to earn what I do for what I do.”

pgl thinks that a piece about Deloitte in Australia is somehow related to China, the subject of this thread!!!

Even his ChatGPT insult generator probably could have stuck closer to the subject than he can!

Awww – the kiddies made Jonny boy mad again. Sad little worthless Jonny boy.

Notice Johnny once again used made-up mind-reading as the basis for his “gotcha” attempt. This strawman trick is all Johhny can seem to manage.

Now Ducky has his own random insult generator…how cute!

Nothing rand about it, boy. I’ve pointed out your mind-reader routine several times. You claim to know what economists think in general and in this case, what pgl thinks. You’ve claimed to know what I think. In each case, your claim has been nonsense, a simple-minded strawman. Apparently, you aren’t capable of more.

Jonny boy clearly hates us. After all – we have been so mean to little Jonny boy. How have we been mean? Calling out his numerous lies, his incessant stupidity, and the like. Yea it is our fault that Jonny boy never learned to tell the truth or anything else. Shame on us!

From where I’m looking (probably not the greatest vantage point) I think if China has a recession it will be a kind of “financialization caused” kind of recession. Not much related to economics (if that statement makes sense). The government will do what it needs to, to hold things steady in an economic sense. It’s only a kind of real estate collapse or credit crunch type of thing which would initiate a recession. Which I think relates more to finance issues being a problem.

I don’t like imagining the people I used to know in China as suffering, but I think in the sense of seeing Xi Jinping and other immoral and amoral members of the communist party caught with their pants down, I have to be honest and admit I would get a kind of sadistic thrill out of seeing a real estate/credit caused recession in China. Maybe that makes me a “bad person” (??) but at this point I would view it as poetic justice.

This idea, that China may suffer a recession rooted in finance, makes good sense – consistent with history. Debt ratios have been rising at a pretty brisk pace for years:

https://fred.stlouisfed.org/graph/?g=178xi

That’s often a sign of trouble. The conventional concern is the debt burden itself – debt service is a drag on new demand. More recently, research has shown that the rate of rise in debt, independent of the level of debt, is also a problem. Mal-investment on the one hand, moving potential future demand into the present on the other, are likely when debt ratios rise. Both are destabilizing.

If you turn the debt/GDP ratio upside-down, and think about how much GDP is generated by each new increment of debt, you see the heart of the problem. Debt efficiency is falling when the debt/GDP ratio rises.

I’m babbling. But you get the picture.

The point makes sense to me. My concern about China is that a recession or other stressors there may cause Xi to go on external adventures in order to distract from internal problems. I’m not sure it would work, but I do think Xi is fully capable of it. I certainly hope he looks north and west, rather than east to Taiwan if he does.

Ducky said, “I’m babbling.”

I shocked that he has that enough self-awareness to notice!

This is how you try to make a point? Damn – you are more pathetic than I could ever imagine. Hey Jonny boy – grow up.

Moses Herzog,

I think you’re right on the nature of China’s next downturn. The near-wholly domestic nature of its debt, and the role of state-owned entities means that the fiscal authorities can simply decide which bucket of still-viable assets to empty into which financial black hole. It’s an accounting procedure, not a recession.

The very real and still strong growth in retail consumer spending — even though the definitions of the data do not compare to retail sales in the US — makes me think there is close to zero possibility of a consumer strike-led recession.

Personally, I would have liked to see the banksters suffer after the 2008 financial crisis…but Obama saved them from the pitchforks and did nothing to frog-march them Rikers, while underwater mortgagees got foreclosed on, evicted, and victimized on by banksters.

Let’s hope the Chinese leadership shows a lot more compassion for its people than Obama and the banksters did.

actually, Obama did pretty good in saving the economy. I would have liked more penalties. but there were plenty of republicans who obstructed the penalty side of the financial crisis. overall I give Obama solid grades for the handling of the financial crisis, despite one political party attempting to derail his efforts nonstop.

Johnny, if you have an issue with bankers getting a slap on the wrist, you should show your contempt at the republicans who gave them a free pass.

And we got health care reform. China is still waiting to do health care at all.

“Let’s hope the Chinese leadership shows a lot more compassion for its people than Obama and the banksters did.”

I guess you are clueless about how little the PRC does for the health care of its own citizens. Oh wait – you are clueless about everything. Never mind.

Am I the only person who thinks it’s very fitting that Professor Chinn (consciously/intentionally or not) uses a kind of orange color on the graph to mark the time spans of Xi Jinping’s and donald trump’s time in office (in other graphs)?? Because I gotta say I find it perfectly fitting. A POS is a POS no matter what nation he leads.

This is an ALWAYS present danger for western corporations doing business inside China. And China often mirrors Russia’s behavior (as most of China’s “great ideas” are copied) :

https://www.wsj.com/articles/russia-steps-up-economic-war-with-west-seizing-assets-of-big-conglomerates-e592f137?mod=hp_lead_pos2

I am afraid that so many American companies don’t weigh the risks of investing inside China because of greed of what they foolishly inagine China’s market can bring them. I am sad and afraid to say, the only way American CEOs and American corporate boards will be able to learn this, is learning “the hard way”, that same as Danone and Carlsberg have now done in Russia.

More China upside surprises–“Now, America is in its own game of economic catch-up — in the booming area of clean energy. As of this year, China is the world’s largest car exporter — thanks to a surging electric vehicle industry — and it commands at least 74 percent market share in each step of the solar panel supply chain. China learned to master the solar, battery and electric vehicle industries through the 2010s, while the United States was debating whether to pass clean-energy policy — and even whether climate change existed at all,” preferring to invest instead in things that go “boom!”

https://www.nytimes.com/2023/07/17/opinion/america-china-clean-energy.html

Now pgl’s random insult generator will probably claim the China’s 74% market share in each step of the solar supply chain is not a problem…because China has so many more people! (this inanity parallels pgl’s dismissal of concern regarding China’s installation of 6x the Gigawatts of US’ installations so far this year.)

This is false on many levels. I worked in startups in the solar power industry in the 2000s, through 2012, specifically in the concentrating photovoltaic part, as a statistician, and I can tell you right now that China took over the market through heavily government-subsidized dumping, not through better, or even equivalent, technology. We all knew this because we would go on tours of their manufacturing plants and we could see their equipment etc., which was the same equipment everyone else used, largely made in Germany. We could easily calculate their manufacturing costs, and in one case I remember the company could not have broken even with its pricing if all its employees had worked for free. Guess who paid them? Sure, we could spend 2-3 years collecting data to prove dumping, then go to the WTO, where the average dumping case took, at the time, about 5 years to resolve, but what venture capitalist will fund that sort of 8 year effort while simultaneously funding all your staff’s salaries so you can achieve price competitiveness? And what happens if you win? We knew what would happen because there was at least one case where it *did* happen – the Chinese company declares bankruptcy, sells off its equipment and facilities to a new company, where most of the old company’s employees wind up working, probably at the same desks as before. You get nothing because the company went “bankrupt.” Rinse and repeat. It’s basically U.S. venture capitalists against the Chinese government, and the Chinese government can print money forever, but our VCs can’t print money at all.

So… the U.S. government devised a program to extend loans to business ventures that were too risky for VCs; this was the loan program that Solyndra was partially funded by. Overall, the government made a ton of money from it, as “greater risk associated with individual investments” does not mean “negative expected return over a portfolio of investments”, but the Republicans made a huge stink about Solyndra, and the program collapsed. It’s as if some manager benched Babe Ruth for his career after he struck out once, but Republicans and economics don’t go well together, so there’s that.

Essentially the same thing happened in the rare earths market; rare earths aren’t rare, they are everywhere, but Western mining operations can’t compete with massive Chinese government subsidies, and dumping claims take many years to resolve, during which you’re losing a lot of money, so it’s cheaper to just go out of business. (The godfather of my daughter was a high-end mining engineer in the rare earth extraction business for most of his career, hence my knowledge of this market.)

Thanks for correcting Jonny’s BS on green energy. You know this area better than I do. But that line that China is the world’s leader in overall car exports is so incredibly stupid that I may be falling on the floor laughing for the rest of the day.

Johnny should not be generalizing his complaints about the usa. if Johnny were legitimate, he would be criticizing the republican policies in government, and supporting the party that better aligns with his “stated” objectives. however, Johnny is not really after those stated objectives. johnny’s preference is to weaken the usa, because his allegiance lies with some foreign nation trying to catch up. so both parties are fair game. but notice there is never any criticism aimed at his foreign friends.

Glad you’ve decided to settle in here. Knowledge-based comments are very much appreciated.

I second that opinion. As much noise and entertainment we get from a handful of idiots and willfully ignorant people – the rest of the group here really appreciate when a knowledgable person sets the record straight. It’s not going to change the idiots, but the rest of us leave with deeper insights.

“It’s not going to change the idiots”

So true but it is interesting that Dr. Chinn has become incredibly upset with CoRev threatening to ban him. Same should go re Jonny boy.

China’s exports are 74% of all car exports? We know you were a moron but damn!

Classic misrepresentation by pgl. The quote was “74 percent market share in each step of the solar panel supply chain,” not 74% of all car exports.”

pgl’s automated, random BS generator just can’t get it right! Probably an offshoot of the program that kept telling us last year that the Russians were running out of weapons and ammo.

Yea – the comment that China exports more than Germany was what made me fall on the floor laughing. It is a wonder than anyone can reply to your stupid garbage as it is … stupid garbage.

“As of this year, China is the world’s largest car exporter”

Some reporter take one week of exports as reporter by another reporter and Jonny write this?

https://www.worldstopexports.com/car-exports-country/#:~:text=Searchable%20List%20of%20Car%20Exporting%20Countries%20in%202022,%20%20%2B16.6%25%20%206%20more%20rows%20

Car Exports by Country

Below are the 15 countries that exported the highest dollar value worth of cars in 2022.

Germany: US$155.1 billion (20% of total exported cars)

Japan: $87.2 billion (11.2%)

United States: $57.9 billion (7.5%)

South Korea: $51.7 billion (6.7%)

Mexico: $46.9 billion (6%)

China: $44.7 billion (5.8%)

Belgium: $33.9 billion (4.4%)

Spain: $32.9 billion (4.2%)

United Kingdom: $29.5 billion (3.8%)

Canada: $29.5 billion (3.8%)

Slovakia: $26.3 billion (3.4%)

Czech Republic: $25.4 billion (3.3%)

France: $20.9 billion (2.7%)

Italy: $16 billion (2.1%)

Hungary: $12.2 billion (1.6%)

Even if 2023 exports from China were triple what they were in 2022 (which I doubt), China would still trail Germany.

Yea Jonny boy is the most gullible moron God ever created.

I guess Jonny boy forgot to read his own link once again:

But Ford has a solution. In February, it announced plans to open a new $3.5 billion L.F.P. battery factory in Michigan. It would license the technology from a Chinese battery maker, whose engineers would — in the words of Bill Ford, the automaker’s chairman — “help us get up to speed so that we can build these batteries ourselves.” It seemed like a win-win: The Chinese company, CATL, would get cash and prestige; Ford would learn how to make these batteries; and America would get 2,500 new manufacturing jobs. This was, apparently, exactly the kind of situation that Biden’s climate law was meant to set up.

Yet Senator Joe Manchin, the West Virginia Democrat who helped shape the law, exploded at the news. “I’ll be damned if I’m going to give them $900 out of $7,500, to let it go to China for basically a product we started,” he told an energy conference in Houston. (He was referring to the subsidy that the law grants to buyers of new electric vehicles, though Ford says none of that federal money would go to the Chinese company.) “You’re telling me we don’t have the smart people and the technology, and we can’t get up to speed quick enough?” he asked. “That doesn’t make sense.”

Manchin wants to steal Chinese IP? Oh wait – they steal our IP. Of course if Ford wants to pay royalties to Chinese companies, I’m all for it. But a 12% royalty rate? Maybe a deal at 8%? That’s how we used to deal with these issues.

“Now pgl’s random insult generator will probably claim the China’s 74% market share in each step of the solar supply chain is not a problem”

If you wrote that garbage maybe you should outsource your babble to that corrupt version of ChatGPT you own. BTW try reading your own damn links for a change. Geesh!

Are central bank digital currencies the new “woke”?

https://www.coindesk.com/consensus-magazine/2023/05/04/central-bank-digital-currencies-are-unexpectedly-becoming-a-presidential-election-issue/

Most Americans spend little time thinking about central bank digital currencies, if they even know what they are. For those who don’t, CBDCs are digital forms of national currencies, issued by a country’s central bank. The United States Federal Reserve has no plans to issue a digital dollar. Yet, potential presidential candidates in next year’s U.S. election are already sounding an alarm. “Expect this CBDC issue to become a presidential campaign talking point,” said Ron Hammond, director of government relations at Blockchain Association. “Perfect intersection of fear of government, China and finance collapse with the bank crisis.” Indeed, a number of potential presidential candidates have recently taken a strong stance against CBDCs. Opponents paint a future digital dollar as a government attempt to monitor and even control citizen transactions. A CBDC could theoretically be designed so it could be used for certain items but not others. Florida Governor Ron DeSantis, a likely Republican contender, suggested that the U.S. government could use a CBDC to restrict purchases of gas or prevent you from buying too many rifles.

Leave to DeSantis to cook up this level of stupidity.

Manufactured outrage works. Yellow peril. Commies in the State Department. Women competing with men in the workplace. Pot. Gun rights. Vaccines. Grooming. Books. Disney. Why not digital currencies that aren’t hidden from scrutiny?

https://www.federalreserve.gov/central-bank-digital-currency.htm

While the Federal Reserve has made no decisions on whether to pursue or implement a central bank digital currency, or CBDC, we have been exploring the potential benefits and risks of CBDCs from a variety of angles, including through technological research and experimentation. Our key focus is on whether and how a CBDC could improve on an already safe and efficient U.S. domestic payments system.

CBDC is generally defined as a digital liability of a central bank that is widely available to the general public. Today in the United States, Federal Reserve notes (i.e., physical currency) are the only type of central bank money available to the general public. Like existing forms of money, a CBDC would enable the general public to make digital payments. As a liability of the Federal Reserve, however, a CBDC would be the safest digital asset available to the general public, with no associated credit or liquidity risk.

The Federal Reserve Board has issued a discussion paper that examines the pros and cons of a potential U.S. CBDC. As part of this process, we sought public feedback on a range of topics related to CBDC. The Federal Reserve is committed to hearing a wide range of voices on these topics.

Dcuky has his own random insult generator…that can’t even recognize the subject of this thread!

Wow! Here’s little Johnny, claiming pgl and I both rely on “random insult generators” – thereby demonstrating that he relies on random insults. Kind of pathetic.

Johnny, pointing out your own, personal failings is beyond easy. Falling back on random insult generator would be a waste of effort.

Most particularly, you’re a liar, and in very particular ways. You pretend to knowledge you don’t have. You claim that others think things they obviously don’t think. You claim to know things about people you can’t actually know. (Johnny, what financial firm am I affiliated with? You claimed to know that I’m affiliated with a financial firm, but you’ve shied away from telling us which one.) You make goody two-shoes arguments against the U.S. while defending the behavior of Russia and China. You cheered for Ergogan’s money-expansion approach to fighting inflation – an approach Erdogan has now abandoned in the face of its abject failure. You misunderstand even the simplest economic concepts.

Why ever would I bother with random insults when you are so completely vulnerable to specific ones? You’re a mess, Johnny.

Ever wonder why all of the other kiddies keep making fun of little Jonny boy? So many reasons, so little time.

“EVs Just Made China The Largest Exporter Of Vehicles, Threatening American Jobs…

Electric vehicles have recently made China the world’s largest vehicle exporter. The country’s low-cost manufacturing, investment in battery production, and control over raw materials, expedited its dominance years before experts predicted. But for America’s car makers, China’s accomplishment is a sign of serious trouble ahead.”

https://www.forbes.com/sites/jeremyalicandri/2023/06/14/evs-just-made-china-the-largest-exporter-of-vehicles-threatening-american-jobs/?sh=647e057e7703

pgl’s random BS generator gets it wrong again!

Another reporter whose research skills suck. Germany exports a lot more cars than China has. But Jonny boy keeps finding stupid headlines from reporters who are as clueless as he is.

Bloomberg’s report on car exports by country looks at the number of vehicles but not the dollar value of these exports:

https://www.bloomberg.com/news/articles/2023-01-26/how-china-is-quietly-dominating-the-global-car-market

By this measure, China has caught Germany but both trail Japan. Of course German cars sell for more per unit than Japanese cars and China is known for selling really cheap cars.

But wait volume v. Value. We just went WAY over Jonny boy’s teenie little brain.

Awwww–did pgl have to succumb to facts and walk back his ravings that China not the world’s largest car exporter???? What a come down!

Imagine this!!! pgl actually did some research and validated that the information in Robinson Meyer’s Op-Ed in the NYT was accurate when he stated that ” China is the world’s largest car exporter — thanks to a surging electric vehicle industry — and it commands at least 74 percent market share in each step of the solar panel supply chain. China learned to master the solar, battery and electric vehicle industries through the 2010s, while the United States was debating whether to pass clean-energy policy — and even whether climate change existed at all. ” https://www.nytimes.com/2023/07/17/opinion/america-china-clean-energy.html

How humiliating It must be for pgl to be forced to acknowledge that the information contained in a NYT article is actually accurate!!! Of course, this won’t prevent him from asserting his constant BS that I must be a liar because I quote from other highly reliable sources.

In any case, the workings of pgl’s BS generator have clearly been revealed for all to see.

I get you are dumb but damn. The Bloomberg data shows China is not the largest exporter of cars. But for some dumb reason you took a victory lap? Poor little Jonny boy – claiming victory when he has lost. Sort of like Trump and Stop the Steal.

“EVs Just Made China The Largest Exporter Of Vehicles”

Really? In the field of EVs China may be the largest exporter, in the field of cars China is most likely not the largest exporter.

To cite articles without checking basics is stupid.

Thanks for saying this. I have tried to provide actual data but Jonny boy has his list of moronic reporters that he holds out as supposed experts.

Maybe I should repeat this:

https://www.worldstopexports.com/car-exports-country/#:~:text=Searchable%20List%20of%20Car%20Exporting%20Countries%20in%202022,%20%20%2B16.6%25%20%206%20more%20rows%20

Car Exports by Country

Below are the 15 countries that exported the highest dollar value worth of cars in 2022.

Germany: US$155.1 billion (20% of total exported cars)

Japan: $87.2 billion (11.2%)

United States: $57.9 billion (7.5%)

South Korea: $51.7 billion (6.7%)

Mexico: $46.9 billion (6%)

China: $44.7 billion (5.8%)

Belgium: $33.9 billion (4.4%)

Spain: $32.9 billion (4.2%)

United Kingdom: $29.5 billion (3.8%)

Canada: $29.5 billion (3.8%)

Slovakia: $26.3 billion (3.4%)

Czech Republic: $25.4 billion (3.3%)

France: $20.9 billion (2.7%)

Italy: $16 billion (2.1%)

Hungary: $12.2 billion (1.6%)

Gee China came in 6th place in 2022 but little Jonny boy gives them the gold medal! How sweet!

Actually, pgl, it is the BBC, Forbes, and the NY Times who acknowledged that China is the world’s leading exporter of cars.

https://www.forbes.com/sites/michaelharley/2023/05/22/china-overtakes-japan-as-the-worlds-biggest-exporter-of-passenger-cars/?sh=76f435252c4f

Poor pgl, reality is so hard to accept. Three year olds have the same problem…

Number of cars does not translate to the value of cars when German cars are 4 times more value than cheap Chinese cars. Of course someone who cannot count past 10 without taking his shoes off is never going to get this.

JohnH

July 18, 2023 at 11:53 am

Jonny boy faced with the facts he is wrong decides this information makes him correct so he goes off on a victory lap. Yea – this troll is beyond pathetic.

“If GM can’t compete, one respected Wall Street analyst explained, on the condition of anonymity, that a merger with another automaker is one likely scenario.”

I think I know why this analyst did not want to be named. It seems neither he nor this Forbes clown knows how to look up the financials for GM. Its 10-K filing noted GM’s operating profits were $10.3 billion in 2022 on sales over $156 billion. Now may the future is not as rosy as the past year but did little Jonny boy bother to check GM’s stock price. It is doing quite well too.

So Jonny boy finds a couple of Wall Street/Forbes clowns spewing utter nonsense but the market seems to be saying GN is far from bankruptcy.

Come on Jonny boy – we have been over this before. Do some basic research before you highlight your usual clueless sources.

How hilarious is this! pgl is totally oblivious to the dynamics of the automobile market.

“Say goodbye to the US car market as we know it: Cheap Chinese EVs are coming…

“Is it possible for Chinese companies to do what others have done before, only now with electric vehicles? The answer is absolutely,” Bill Russo, a former Chrysler executive and the CEO of Automobility, a Shanghai-based advisory firm, told Insider. “Who doesn’t want affordable vehicles?” https://www.businessinsider.com/cheap-chinese-electric-cars-will-upend-the-us-vehicle-market-2023-5?op=1

The only way Detroit is going to keep its profits is if the US government keeps Trump’s tariffs in place, something that pgl loves!

And where-o-where have all those “free trade” fundamentalist economists gone? Why, I vividly remember the days only a few years ago when anyone questioning the wisdom of corporate-friendly trade policies was verbally tarred and feathered as a [gasp!] protectionist. Apparently the winds have shifted for mainstream, group thinking, corporate friendly economists!

JohnH: I wish, if you were to continuously bemoan corporate friendy economists dominance, you would do it on some blog where the authors were not corporate friendly economists. Your understanding of the economics profession (as opposed to those writing in the newspapers and blogs) is woefully inadequate, so much so that it’s kind of pathetic.

the dynamics of the automobile market? And Jonny boy gets the car sector. Dude – there is a reason your mommy will never let you drive a car. She’s protecting you from your own incompetence.

“If” provides all kinds of slack.

https://getyarn.io/yarn-clip/11770b60-2f76-4e4a-a1c0-de486d8d5087

NBC News today: “Chinese electric vehicle makers lead the world, rivaling U.S. pioneers…

China’s EV makers are now pursuing expansion abroad, especially in emerging markets. Last year, China’s exports of EVs increased 131.8% year on year to around 680,000 units, official data showed. Thanks in part to the surge in EV sales, China overtook Japan as the world’s top auto exporter in the first quarter of this year….

Chinese industry leader BYD — a Shenzhen-based company whose name stands for “Build Your Dreams” and which is backed by American investor Warren Buffett — now rivals Tesla as the world’s biggest seller of electric vehicles, including hybrids.”

https://www.nbcnews.com/news/world/chinese-electric-vehicle-makers-lead-world-rivaling-us-pioneers-rcna88990

But pgl’s BS generator insists that it’s not so!!! Ha! Ha! Ha! Ha! Ha! Ha! Ha! Ha!

Dude – our host is mocking you. Our latest informed reader is mocking you. And you continue to make a total fool out of yourself? OK!

Math quiz. a 131% increase from zero is what Jonny boy? Oh wait you answered infinity!!!!

So Jonny boy looks at the percentage increase in EVs and concludes China leads the world in the sale of all cars? Look – we know Jonny boy is mentally retarded but DAMN!

Interesting information over time ala the EPA that you will not see on any of CoRev’s lying blogs:

https://www.epa.gov/climate-indicators/climate-change-indicators-heat-waves

Climate Change Indicators: Heat Waves

This indicator describes trends in multi-day extreme heat events across the United States.

Serious unemployment for young people in China.

https://www.bbc.com/news/world-asia-china-66172192

Their tone-deaf dictator appears to not understand the problem and think it can be solved if the young ones would just accept it and “eat bitterness”. Other “leaders” invent new terms like “slow employment” thinking that a problem can be defined away. The combination of over 20% unemployment among young people, and a steep challenge for finding a job after the ripe old age of 35 is not a good sign for the future. Add to that an imploding marriage and birth rate and you are looking at a one-two punch for Chinese society within a few decades.

Remember Operation Warp Speed. Kevin Drum reviews the dates and it seems all the real work had been done BEFORE announced this little marketing slogan:

https://jabberwocking.com/the-real-story-behind-operation-warp-speed/

I’ve got no beef with Operation Warp Speed, which set up a pretty effective program to handle expedited development and manufacturing of COVID vaccines. That said, virtually everything of importance regarding vaccine development happened before Warp Speed was announced, and it was funded by grants from Congress, not Donald Trump. It was an effective marketing slogan, but beyond that it mostly just picked up a ball that was already in play.

I don’t like imagining the people I used to know in China as suffering, but I think in the sense of seeing Xi Jinping and other immoral and amoral members of the communist party caught with their pants down, I have to be honest and admit I would get a kind of sadistic thrill out of seeing a real estate/credit caused recession in China. Maybe that makes me a “bad person” (??) but at this point I would view it as poetic justice.

I don’t like imagining the people I used to know in China as suffering, but I think in the sense of seeing Xi Jinping and other immoral and amoral members of the communist party caught with their pants down, I have to be honest and admit I would get a kind of sadistic thrill out of seeing a real estate/credit caused recession in China. Maybe that makes me a “bad person” (??) but at this point I would view it as poetic justice.

I don’t like imagining the people I used to know in China as suffering, but I think in the sense of seeing Xi Jinping and other immoral and amoral members of the communist party caught with their pants down, I have to be honest and admit I would get a kind of sadistic thrill out of seeing a real estate/credit caused recession in China. Maybe that makes me a “bad person” (??) but at this point I would view it as poetic justice.

[ There is need here for professional assistance, but the racial animus that has been cultivated since before 1882 and the Chinese Exclusion Act accounts for such terrifying and distressing thinking:

https://en.wikipedia.org/wiki/Chinese_Exclusion_Act . ]

The Chinese Exclusion Act has been covered and condemned by this blog many times. The vast majority of the readers here have agreed with Dr. Chinn’s coverage. Now I get that the MAGA crowed (which includes some of our Usual Suspects) have anti-Asian sentiments but trust me most of the readers here have and will continue to condemn such racism.

I’m pretty sure nobody here was around in 1882. It’s pretty clear the paragraph you needlessly repeated was aimed at China’s brutal dictator, not the Chinese people. It’s absolutely obvious that “racism” is your favorite lie.

Recently, another commenter observed that much of what China does as a matter of policy is rehashed Russian policy. The same is true for propaganda.

During the 2016 election, Russia flooded social media with astroturf racial animus, in an effort to magnify divisions in U.S. society. China is now clearly doing the same, with ltr as the best evidence I’ve seen. Just more evidence that China can’t generate suficient intellectual property, even if the vilest sort, on its own.

ltr, who has denied China’s enslavement of Uyghurs, defended China’s take-over of Tibet, lied about China’s racist policies at every turn, keeps accusing any critic of China of racism. Not only is this despicable; it’s also intellectually lazy.

Menzie, you have made clear that you will ban anyone who posts racist comments. I have a question: is it racism of a sort to falsely accuse others of racism?

I see some value in exposing your students to ltr, as an example of how China’s propaganda machinery operates in the world. I wonder, though, if allowing her to abuse the notion of racism in so cavalier a manner isn’t as harmful to your intentions as overt racism. Would be.

Macroduck: Well, so far I haven’t banned anybody for outright stupidity and mendacity. But he/she is teetering. I’ll first ban him/her for quoting full articles when I have told him/her not to if he/she continues.

“The Great Society were big government programs to address education, medical care, urban problems, rural poverty, transportation, Medicare, Medicaid, food stamps and welfare, the office of Economic Opportunity, and big labor and labor unions. Now, LBJ had the Great Society, but Joe Biden had Build Back Better. And he still is working on it. The largest public investment in social infrastructure and environmental programs that is actually finishing what FDR started that LBJ expanded on.”

Marjorie Taylor Greene noting how these three progressive Presidents made America a better place!

Oh wait – MTG was complaining about SOCIALISM that has allegedly left us with a massive government debt. Now Social Security did not prevent the debt/GDP ratio from falling after WWII ended. And of course this ratio fell to less than 33% in the late 1970’s even with the Great Society in place. Now of course Presidents before RONALD REAGAN understood we needed to avoid massive tax cuts for the rich. I guess MTG has never figured that out.

God Bless John Kerry:

https://www.msn.com/en-us/money/markets/john-kerry-tilts-at-chinese-coal-plants/ar-AA1dZABz?ocid=msedgdhp&pc=U531&cvid=a32b276be7c641389cc69cadd2cf9235&ei=7

The U.S. climate envoy is in Beijing this week to tell Chinese officials that they need to follow America in putting their economy further at risk by moving away from fossil fuels at a rapid pace. Mr. Kerry said last week that he’ll discuss cuts to methane emissions and coal, among other items. Somehow we doubt his Chinese counterparts will take Mr. Kerry’s advice, though they might do their diplomatic best to humor him. That’s how they’ve strung the world along on climate for years. China signed the 2015 Paris climate accord, but that deal gave Beijing a pass to increase its emissions until 2030. And that’s exactly what it’s doing. According to the Climate Action Tracker, which monitors national progress under the Paris agreement, “China’s emissions under current policies remain sky high with no sign of substantial emission reductions before the 2030 peaking timeline.” The Climate Action Tracker says that between 2015 and 2022 China’s greenhouse gas emissions increased nearly 12%, while U.S. emissions declined some 5%. China’s methane emissions rose about 3% from 2015 to 2021, the latest year with good data, while the U.S. cut them by 5%.

Mr. Kerry will have an uphill climb on Chinese coal in particular. The Climate Action Tracker says China’s “coal production reached record levels in 2022 for the second year running,” and “coal is set to remain the backbone” of China’s energy system. No kidding: Between 2020 and 2022, China added some 113 gigawatts of new coal-fired power plants, according to S&P Global Commodity Insights. The entire world managed to retire some 187 gigawatts of coal plants between 2017 and 2022.

Alas the PRC is not listening to Kerry. Of course our climate change denier CoRev wants to mock him. Maybe CoRev should work for Xi.

https://fred.stlouisfed.org/graph/?g=F7qB

January 30, 2018

Total Reserves excluding Gold for China, 2017-2023

https://fred.stlouisfed.org/graph/?g=mGFp

January 30, 2018

Total Reserves excluding Gold for China, Germany, India, Japan and United States, 2007-2023

https://fred.stlouisfed.org/graph/?g=gxkQ

January 15, 2018

Real Broad Effective Exchange Rate for China, Germany, India, Japan and United States, 1994-2023

(Indexed to 1994)

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=GGXWDG_NGDP,&sy=2001&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Government gross debt as percent of GDP for China, Germany, India, Japan and United States, 2001-2022

2017

China ( 55)

Germany ( 65)

India ( 70)

Japan ( 231)

United States ( 106)

2020

China ( 70)

Germany ( 68)

India ( 89)

Japan ( 259)

United States ( 133)

2022

China ( 77)

Germany ( 67)

India ( 83)

Japan ( 261)

United States ( 122)

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924&s=BCA,BCA_NGDPD,&sy=2007&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Current Account Balance * and Balance as a percent of Gross Domestic Product for China, 2007-2022

2017

Balance ( 188.7)

Balance percent of GDP ( 1.54)

2020

Balance ( 248.8)

Balance percent of GDP ( 1.67)

2021

Balance ( 317.3)

Balance percent of GDP ( 1.79)

2022

Balance ( 417.6)

Balance percent of GDP ( 2.31)

* Billions of dollars

Target letter for Donald Trump but not one for Rudy Giuliani? Maybe RUDY flipped and has decided to rat out his former mob boss:

https://www.msn.com/en-us/news/politics/sounds-like-rudy-flipped-giuliani-evades-jan-6-target-letter-after-meeting-with-prosecutors/ar-AA1e1HA1?ocid=msedgdhp&pc=U531&cvid=5e07560f47884df9906beb35bc5c6ca5&ei=6

https://fred.stlouisfed.org/graph/?g=16LR4

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16LRa

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2022

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=16Tou

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1992-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16ToC

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1992-2022

(Indexed to 1992)

Mark Levin actually compared Jack Smith to Joseph Stalin’s Soviet-era security chief Lavrentiy Beria?

https://www.msn.com/en-us/news/politics/mark-levin-says-attorney-general-garland-trump-prosecutor-trying-to-throw-election/ar-AA1e1Rrz

MAGA land has become more unhinged that usual,

https://english.news.cn/20230714/47d50e0e14274cf3a90f9703675c2302/c.html

July 14, 2023

China’s auto industry rides new wave of smart, electric innovation

* China’s auto production and sales have ranked first in the world for 14 consecutive years, and those of NEVs topped the global market for the eighth year in a row.

* As China’s auto industry is going through a transformation of unprecedented magnitude, traditional automakers are revving up NEV production.

* Some domestic NEV brands, such as BYD, have gained a foothold in overseas markets.

CHANGCHUN — At a smart factory of China’s leading automaker FAW Group Co., Ltd., over one hundred automated guided vehicles shuttle back and forth, while vision-guided robots apply silicone sealants on car windows, just like in a sci-fi movie.

A rare scene in the past, this is now a common sight at the FAW Jiefang J7 complete-vehicle smart factory in Changchun City, northeast China’s Jilin Province.

The construction of the First Automotive Works, China’s first automotive manufacturing plant and predecessor of FAW Group Co., Ltd., was launched in Changchun on July 15, 1953, marking the beginning of the nation’s auto industry.

From its first car rolling off the production line to being one of the world’s top 500 companies, the FAW has become the epitome of China’s auto industry development.

Showing resilience and a strong momentum of rapid development, China’s auto production and sales have ranked first in the world for 14 consecutive years, and those of new energy vehicles (NEVs) topped the global market for the eighth year in a row.

Particularly, China’s vehicle exports soared to around 1.07 million units in the first quarter of 2023, data from the General Administration of Customs showed, indicating that China had become the world’s largest auto exporter in the period, outpacing Japan.

INTELLIGENT AND DIGITAL EMPOWERMENT ….

Finally someone mentioned the name of one of China’s automobile manufacturers – something beyond the capabilities of JohnH. My understanding is that this company is state owned but I did get limited financial data:

http://www.faw.com/eportal/ui?pageId=464869

3.5 million cars selling for about $100 million in 2021. Less than $30,000 per car. Now it would be nice to see how profitable this company was but the data I found does not say.

Particularly, China’s vehicle exports soared to around 1.07 million units in the first quarter of 2023

4 million cars per year at $30,000 per car. That would be something near $120 billion for the year which is still FAR less than German car exports.

SAIC Motor, Dongfeng Motor Corporation and Changan Automobile are the other three members of the Big Four. All four of these Chinese car companies are state owned.

BTW FAW’s production has been declining since 2022. Maybe 2023 will be different but never ever trust the stupid babble from JohnH on this sector, which is one of the many things he does not even remotely understand.

“China’s auto production and sales have ranked first in the world for 14 consecutive years”

BTW China consumes more cars than it produces. Which is why it imports more than it exports.

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=NID_NGDP,NGSD_NGDP,&sy=2990&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Total Investment & Gross National Savings as a Percent of GDP for China, Germany, India, Japan and United States, 2000-2022

2020

China

Total Investment ( 42.9)

Gross National Savings ( 44.5)

Germany

Total Investment ( 22.1)

Gross National Savings ( 29.1)

India

Total Investment ( 28.7)

Gross National Savings ( 29.7)

Japan

Total Investment ( 25.3)

Gross National Savings ( 28.2)

United States

Total Investment ( 21.1)

Gross National Savings ( 19.3)

2021

China

Total Investment ( 43.3)

Gross National Savings ( 45.1)

Germany

Total Investment ( 23.3)

Gross National Savings ( 31.0)

India

Total Investment ( 31.2)

Gross National Savings ( 30.0)

Japan

Total Investment ( 25.6)

Gross National Savings ( 29.5)

United States

Total Investment ( 21.1)

Gross National Savings ( 18.0)

2022

China

Total Investment ( 43.9)

Gross National Savings ( 46.2)

Germany

Total Investment ( 24.8)

Gross National Savings ( 29.0)

India

Total Investment ( 31.6)

Gross National Savings ( 29.0)

Japan

Total Investment ( 26.6)

Gross National Savings ( 28.8)

United States

Total Investment ( 21.6)

Gross National Savings ( 18.7)

https://www.nytimes.com/1995/03/27/obituaries/joseph-needham-china-scholar-from-britain-dies-at-94.html

March 27, 1995

Joseph Needham, China Scholar From Britain

By Sarah Lyall

Joseph Needham, an extraordinarily prolific British biochemist and scientific historian who spent decades researching, writing and editing a monumental history of scientific development in China, died on Friday. He was 94 years old and lived in Cambridge.

His death was announced yesterday by Gonville and Caius College at Cambridge University, with which he was associated for 70 years. The cause of death was not announced.

Dr. Needham was a lecturer, professor and author of more than a dozen books on a broad range of topics. The crowning achievement in his long and achievement-rich life was “Science and Civilization in China,” which was conceived in the 1940’s as a short book but which grew so extensive that he and dozens of associates worked on it for the next five decades.

“Science and Civilization in China” so far comprises more than 16 published books * extending to tens of thousands of pages. The project, which is not expected to be completed until at least the year 2000, covers every possible facet of its subject, including chemistry, mathematics, navigation, medicine, botany, mechanics, civil engineering and agriculture.

Students of China consider the work a singular achievement and have compared Dr. Needham’s work to that of Darwin and Gibbon in its size and scope. Reviewing a shorter volume by Dr. Needham on Chinese science in The New York Times Book Review in 1982, the historian Jonathan Spence said “Science and Civilization in China” was “the most ambitious undertaking in Chinese studies during this century.” …

* Twenty-seven books (1954-2008)

The Nature Index 2023 Annual Tables highlight the most prolific institutions and countries in high-quality research publishing for the year 2022-2023.

https://www.nature.com/nature-index/institution-outputs/generate/all/global/all

1 April 2022 – 31 March 2023

Rank Institution ( Count) ( Share)

1 Chinese Academy of Sciences ( 7035) ( 2133)

2 Harvard University ( 3466) ( 1107)

3 Max Planck Society ( 2398) ( 639)

4 French National Centre for Scientific Research ( 4297) ( 619)

5 University of Science and Technology of China ( 1690) ( 606)

6 University of Chinese Academy of Sciences ( 2964) ( 598)

7 Nanjing University ( 1360) ( 583)

8 Tsinghua University ( 1652) ( 570)

9 Peking University ( 2115) ( 562)

10 Stanford University ( 1795) ( 537)

11 Helmholtz Association of German Research Centres ( 2490) ( 514)

12 Zhejiang University ( 1301) ( 504)

13 Massachusetts Institute of Technology ( 1843) ( 470)

14 Sun Yat-sen University ( 1148) ( 456)

15 Shanghai Jiao Tong University ( 1283) ( 444)

16 Fudan University ( 1226) ( 432)

17 University of Cambridge ( 1368) ( 408)

18 National Institutes of Health ( 1186) ( 404)

19 University of Oxford ( 1519) ( 390)

20 The University of Tokyo ( 1139) ( 377)

Their tone-deaf dictator appears to not understand…

Their tone-deaf dictator appears to not understand…

Their tone-deaf dictator appears to not understand…

[ Would understanding mean ending severe poverty in a country of 1.4 billion, a country that had little more than half the per capita GDP of India in 1980? No hunger, no homeless, comprehensive public schooling, public pensions, public medical care provision for 1.4 billion? Then there is the stunning greening of China. What precisely is the president unable to hear or understand?

https://fred.stlouisfed.org/graph/?g=15BnK

January 15, 2018

Life Expectancy at Birth for China, India, Brazil, Turkey and South Africa, 2017-2021

https://fred.stlouisfed.org/graph/?g=15BnQ

January 30, 2018

Infant Mortality Rate for China, India, Brazil, Turkey and South Africa, 2017-2021 ]

Tone-deaf dictator appears to not understand that it is not for a leader to just tell people to suck it up. It is absurd to have a large group of people unemployed and another group working 12 hour days 6 days a week. Considering how centralized and controlled China’s economy is, the obvious solution should not be that hard to implement.

The Chinese economy is not all that centralized.

A few industries — finance, telecoms, resource extraction — are dominated by SOEs, but the bulk of the economy (retail, manufacturing, etc) are not.

https://www.nature.com/articles/s41586-023-05921-z

May 24, 2023

Flexible solar cells based on foldable silicon wafers with blunted edges

By Wenzhu Liu, Yujing Liu, Ziqiang Yang, Changqing Xu, Xiaodong Li, Shenglei Huang, Jianhua Shi, Junling Du, Anjun Han, Yuhao Yang, et al.

Abstract

Flexible solar cells have a lot of market potential for application in photovoltaics integrated into buildings and wearable electronics because they are lightweight, shockproof and self-powered. Silicon solar cells have been successfully used in large power plants. However, despite the efforts made for more than 50 years, there has been no notable progress in the development of flexible silicon solar cells because of their rigidity. Here we provide a strategy for fabricating large-scale, foldable silicon wafers and manufacturing flexible solar cells. A textured crystalline silicon wafer always starts to crack at the sharp channels between surface pyramids in the marginal region of the wafer. This fact enabled us to improve the flexibility of silicon wafers by blunting the pyramidal structure in the marginal regions. This edge-blunting technique enables commercial production of large-scale (>240 cm2), high-efficiency (>24%) silicon solar cells that can be rolled similarly to a sheet of paper. The cells retain 100% of their power conversion efficiency after 1,000 side-to-side bending cycles. After being assembled into large (>10,000 cm2) flexible modules, these cells retain 99.62% of their power after thermal cycling between −70 °C and 85 °C for 120 h. Furthermore, they retain 96.03% of their power after 20 min of exposure to air flow when attached to a soft gasbag, which models wind blowing during a violent storm.

China is known for selling really cheap cars.

China is known for selling really cheap cars.

China is known for selling really cheap cars.

[ Sort of like Tesla, which is more than 95%, in all, made in China:

https://english.news.cn/20230705/afbb2affff354299b6da869b25947786/c.html

July 5, 2023

Deliveries of Tesla vehicles from Shanghai plant up 19 pct in June

SHANGHAI — Tesla’s Shanghai Gigafactory delivered 93,680 vehicles in June, up 19 percent year on year, according to the company.

Tesla’s Shanghai plant delivered a total of 476,500 vehicles in the first half of this year, two-thirds of last year’s 710,000 vehicles.

As of June, Tesla has set up more than 1,600 supercharging stations, more than 10,000 supercharging piles, over 700 destination charging stations and over 2,000 destination charging piles on the Chinese mainland…. ]

@ ltr = let tyranny reign

Where do you think most automakers choose to make cheap cars?? You only get one shot at the correct answer and then you can’t even get a “parting gift” for being that dumb.

Now, I hope this doesn’t make you too sad as a Chinese, when I tell you, intelligent people look inside the driver’s car door jam (or under the hood) for a sticker with VIN that starts with a “J”, which indicates the car was manufactured in Japan. Because cars made in the Japan tend to be the best made, and cheapest for the value/quality in the world. Now, ltr = let tyranny reign, I hope, as I am a man with predominantly north European blood/DNA, I hope you don’t think me “racist” for saying Japan kicks both America’s and China’s ass in terms of vehicle quality and consumer value. Because China manufactures very crappy cars, and America manufactures only slightly less very crappy cars than China does. Have a great day ltr.

https://www.chinadaily.com.cn/a/202302/14/WS63eaef83a31057c47ebaea94.html

February 14, 2023

Chinese electric cars become new black in Israeli market as new energy vehicle industry thrives

JERUSALEM — Chinese electric cars have taken Israel by storm in a short period of time, as according to the latest figures issued by the Israel Vehicle Importers Association, China jumped to Israel’s largest supplier of imported passenger cars in January, with 7,753 units sold in the month, up from only 685 last year.

With almost 3,000 units sold in Israel in January, the electric model Atto 3 manufactured by China’s BYD Auto, which only began sales in Israel in October 2022, is now the best-selling electric car in the country.

For the entire year of 2022, the Geometry C electric model, manufactured by China’s automaker Geely Auto Group, was crowned the best-selling electric vehicle in Israel with 5,381 units sold, ahead of the US Tesla’s Model 3, which sold 2,959 units.

According to Israeli experts and importers, advanced technologies, higher availability and better configuration are the three main reasons for the success of Chinese electric vehicles in the Israeli market….

Is China leading in unicycle sales as well?? Let us know. You’ve entered a nation/market roughly equal to the size of Nanjing, and are now selling 5,400 cars. Impressive. The sky is the limit~~next~~ 10 cars in Yates Center Kansas

Here is the real laugher of this comment by ltr = “let tyranny reign”, he pretends to be mortally wounded by the accusation that China copies nearly every halfway decent idea they can ever muster from foreign countries, then mentions the Geely Auto pathetic ripoff of the Tesla Model 3. Look at the photo of the two cars at the top of the “Car and Driver” link I give below, and tell me, which mainland China “genius” of creativity and imagination came up with body style of the Geely Geometry C model??? Senior Geely Auto engineer Haoyu Kapee Ka ??

https://www.caranddriver.com/news/a27206051/geely-geometry-a-vs-tesla-model-3/

https://www.nytimes.com/2023/07/17/opinion/america-china-clean-energy.html

July 17, 2023

America Can’t Build a Green Economy Without China

By Robinson Meyer

Roughly a century ago, when Henry Ford revolutionized modern car production, engineers from France, Japan, Germany and the Soviet Union flocked to Detroit to learn how to copy his miraculous methods. Ford’s River Rouge plant, then the world’s largest factory, ultimately inspired facilities by Renault, Volkswagen, Toyota and the Russian automaker Gaz. It also gave rise to the nightmarish wartime economies of World War II, when tanks, planes and toxic chemicals rolled off assembly lines worldwide.

Those engineers weren’t just in Detroit out of curiosity. They knew they had to catch up to American methods. As one Weimar conservative said, Germany had to “study the means and mechanisms of the Americans” or become “America’s prey.”

Now, America is in its own game of economic catch-up — in the booming area of clean energy. As of this year, China is the world’s largest car exporter — thanks to a surging electric vehicle industry — and it commands at least 74 percent market share in each step of the solar panel supply chain. China learned to master the solar, battery and electric vehicle industries through the 2010s, while the United States was debating whether to pass clean-energy policy — and even whether climate change existed at all….

China often mirrors ——– behavior (as most of China’s “great ideas” are copied)

China often mirrors ——– behavior (as most of China’s “great ideas” are copied)

China often mirrors ——– behavior (as most of China’s “great ideas” are copied)

Even Ulenspiegel doubts that China has become the largest exporter of vehicles, something the BBC reported, too!

https://www.bbc.com/news/business-65643064

Reality is such a bitch…

https://www.globaltimes.cn/page/202305/1290669.shtml

May 14, 2023

China becomes world’s largest auto exporter in Q1, outpacing Japan: data

China exported 1.07 million vehicles in the first quarter of 2023, surging by 58.3 percent year-on-year, data from China’s General Administration of Customs (GAC) recently revealed, indicating that China has now become the world’s largest auto exporter, outpacing Japan….

Damn – how stupid can you be? We already noted your BBC reporter cited no actual data. Keep on making a fool out of yourself Jonny boy. We are ALL laughing AT you.

“We are ALL laughing at you.” That’s right, at you, pgl. The BBC report linked to Chinese export data, but pgl was too stupid or too lazy to look at it!!!!!

LOL!!!

Last year, China overtook Germany to become the world’s second largest car exporter.

According to China’s General Administration of Customs, China exported 3.2 million vehicles in 2022, compared to Germany’s 2.6 million vehicle exports.

Let’s assume this is true. We also know German exports represented $155 billion while Chinese exports represented only $45 billion. Now I get little Jonny boy cannot do preK arithmetic so permit me. German cars sell for almost $60 thousand per car while Chinese cars sell for only $15 thousand per car. It sounds like China is adopting the South Korean strategy a generation ago of marketing cheap trash. Ever wonder why Daewoo went bankrupt and was bought out by GM? Little Jonny boy has no clue.

A POS is a POS no matter what nation he leads.

A POS is a POS no matter what nation he leads.

A POS is a POS no matter what nation he leads.

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weo-report?c=924,532,546,111,&s=PPPGDP,PPPSH,&sy=1980&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2022

Gross Domestic Product and Share of World Total based on purchasing-power-parity (PPP) for China & United States, 1980-2022

1980

China ( 2.3)

United States ( 21.3)

1990

China ( 4.0)

United States ( 21.6)

2000

China ( 7.6)

United States ( 20.3)

2010

China ( 14.1)

United States ( 16.7)

2020

China ( 18.5)

United States ( 15.7)

2022

China ( 18.9)

United States ( 15.5)

Alas the PRC is not listening to Kerry.

Alas the PRC is not listening to Kerry.

Alas the PRC is not listening to Kerry.

[ China is of course a leading country in hydro, solar, wind, hydrogen, nuclear, ultra-high voltage electricity transmission, a range of energy storage mechanisms, new energy vehicles, electric rail systems, continual development of agricultural conservation systems, water conservancy… What precisely is China not listening to or hearing, alas, about climate change needs? ]

China is of course the leading country in coal.

ouch.

kind of negates all the positives listed.

CO2 is a result of CUMULATIVE fossil fuel consumption.

So how does cumulative Chinese coal consumption over the last 200 years compare with cumulative US and European coal consumption over the centuries?

As is usual in its so-called “rules based order,” the West wants to be exonerated for all the climate damage it has caused, while forcing China to bear the brunt of climate mitigation while simultaneously manufacturing all sorts of stuff for voracious Western consumer markets, which have intentionally off-shored their own manufacturing to avoid environmental regulations.

The hypocrisy is mind boggling.

https://www.globaltimes.cn/page/202305/1291391.shtml

May 25, 2023

Chinese researchers find way to manufacture highly flexible, paper-thin solar cells

Chinese researchers have developed a special technology to tailor the edges of textured crystalline silicon (c-Si) solar cells, based on which the solar cells can be bent and folded like thin paper, allowing for broader application and use.

The breakthrough was achieved by Chinese researchers at the Shanghai Institute of Microsystem and Information Technology (SIMIT) under the Chinese Academy of Sciences. The results * have been featured on the cover of the May 24 edition of Nature journal.

The c-Si solar cells fabricated with the new technology can be 60 millimeters thin with a bending radius of about 8 millimeters.

According to the Technology Daily, c-Si solar cells are a type of solar cell seeing fast development at the moment. They have advantages including long service life and high conversion efficiency, making them a leading product in the photovoltaic market.

Such c-Si solar cells have a market share of more than 95 percent, according to Di Zengfeng, deputy head of the SIMIT, who is one of the authors of the research paper.

Although c-Si solar cells were developed nearly 70 years ago, their use is still limited, the paper explained. Currently, the c-Si solar cells are mainly used in distributed photovoltaic power stations and ground photovoltaic power stations. Hopefully, such solar cells can be used in construction, backpacks, tents, automobiles, sailing boats and even planes.

They can also be used to generate clean energy for houses and a variety of portable electronic and communication devices as well as for transportation, according to the researchers.

Liu Zhengxin, a research fellow with the SIMIT, and another author of the paper, said that the study verified the feasibility of mass production, providing a technical route for the development of lightweight and flexible c-Si solar cells.

At the same time, the large-area flexible photovoltaic modules developed by the research team have been successfully applied in the fields of near-space vehicles, building photovoltaic integration and vehicle-mounted photovoltaic systems, Liu said.

* https://www.nature.com/articles/s41586-023-05921-z

Damn – how stupid can you be? We already noted your BBC reporter cited no actual data. Keep on making a fool out of yourself Jonny boy. We are ALL laughing AT you.