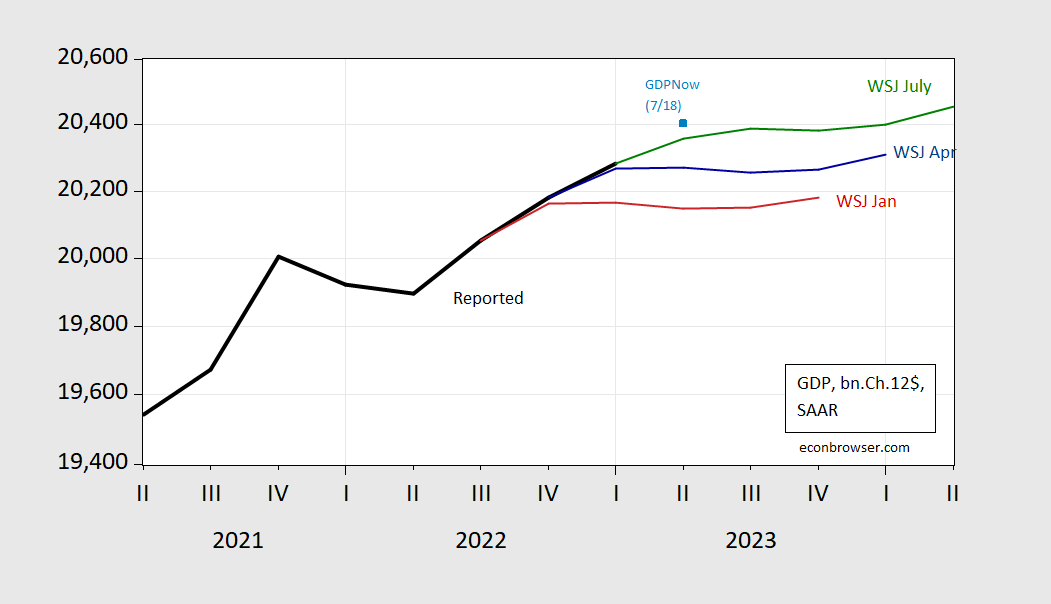

The slowdown keeps on being moved back — according to consensus — to Q4. Mean forecast is for only one quarter of negative growth, but median has two (Q3, Q4).

Figure 1: GDP (black), Mean forecast GDP from July WSJ survey (green), from April survey (blue), from January survey (red), GDPNow nowcast of 7/18 (light blue square), all in bn.Ch.2012$ SAAR. Source: BEA, WSJ surveys (various), and author’s calculations.

While the mean forecast trajectory keeps on rising as actual GDP outcomes keep on surprising on the upside, forecasts are pretty dispersed, as shown in Figure 2.

Figure 2: GDP (black), Mean forecast GDP from July WSJ survey (green), median of Price/Ameriprise Financial (pink), 20% trimmed high of Feinup, Hamilton/Cal Lutheran Univ. (gray), trimmed low of Fratantoni/Mortgage Bankers Association (gray), GDPNow nowcast of 7/18 (light blue square), all in bn.Ch.2012$ SAAR. Source: BEA, WSJ surveys (various), and author’s calculations.

The 20% trimmed high indicates 1.5% average annualized growth over the next 5 quarters (mean/median foreast is 0.68%/0.66%). The trimmed low is 0.46% Note that the sample high forecast (the irrepressible James F. Smith, now of EconForecaster) was 3%(!).

Recession probabilities from the survey, contrasted with term spread based estimates — discussed in this post.

From a political perspective, dems should give what republicans want now-which is a recession today. Pusing it back into 2024 is not politically sustainable. Dems will need a soft landing rather than mild recession if things slow down later.

I think it is hard to forecast when the thing you are trying to forecast are being driven in large part by ignorant consumers and irrational Fed officials. There is the outcome to expect if the world was driven by knowledge and rational decisions – but that is not what they are facing.

Great point, and frustrating reality. I guess we can’t expect utopia. Not as long as public education K-12 keeps being defunded and drained..

what is knowledge?

info theory starts with data, data is parsed(?) evaluated and certain hypotheses arrived at the

Ford cutting the price on their F-150 EV truck. By $10,000, and they’re still having a hell of a time getting rid of inventory on car lots. Funny how Larry Summers’ always perfectly functioning demand supply graph works isn’t it?? While Tesla increases sales with discounts, Ford sits there with their mouth gaping open for months until they lower the price. Wonder why that would be?? Maybe they’re waiting for their next bailout??

Well, Ford is still making money on all those Bronco SUVs whose engine exploded two weeks after their idiot customers drove it off the car lot at premium prices after the American media convinced them to purchase Broncos at a murderous premium to MSRP because “they’re all disappearing like the passenger pigeon”. Hey, pay attention to the American news media who get their ad revenue from the auto companies etc or you’ll have a surplus of K-Y jelly you never had to use.

Ford having trouble selling EVs? I bet it is because they had Bruce Hall lead the marketing campaign.

My understanding is that Ford had originally jacked up the price but now realize this was a mistake.

@ pgl

That’s NOT greed inflation or profiteering on those earlier Ford EV prices with low sales, OK?? Ford had a data scientist on a “Larry Summers Says Women Suck at Math”©® Scholarship who set those EV prices, and when Tesla’s CEO and the Tesla board decided to be masochistic by raising sales revenues with lower prices, what could Ford do but go against Larry Summers’ demand supply intersect point?!?!?!?!

Damned Tesla socialists!!!!!

“Ford cutting the price on their F-150 EV truck. By $10,000, and they’re still having a hell of a time getting rid of inventory on car lots.”

if I am a car executive, I am not sure the optimal plan to kick off your EV dreams is to rely on a target population of pickup truck owners composed of rednecks with hostility towards the renewable energy sector.

The marketing people completely dropped this one. They have mostly been going like “see its here, new and shiny”. It should have been targeted to fleets first, where the cut in fuel cost is a big seller. The redneck crowd will take some time to get around and will need to see obvious benefit from a few contrarians in their midst before they even consider giving up the wroom wroom and the upsetting those terrible greeny leftists by blowing pollution in their faces.

nephew has a rivian, owned for more than a year in ny metro.

I’ve been through the truck with him. he is happy with the ride and feel, range has improved by software updates I think managing battery flows.

f-150 has strong competition.

interesting how Tesla pickup runs against a decent competitor.

Who knew Matt Gaetz’s wife was a movie critic?

https://www.msn.com/en-us/tv/news/matt-gaetz-s-wife-wants-you-to-boycott-barbie-despite-attending-the-film-s-glitzy-premiere-ken-s-testosterone-is-disappointingly-low/ar-AA1e4vmJ?ocid=msedgdhp&pc=U531&cvid=a82d3cf12efa45a79c064f389ef8a35f&ei=9

Ginger Gaetz, the wife of Rep. Matt Gaetz (R-FL), advised her Twitter followers to skip the much-talked about Barbie movie — despite attending the film’s Washington, D.C. premiere.

“I’d recommend sticking to getting outfit inspiration and skipping the theater. Here’s why: The Barbie I grew up with was a representation of limitless possibilities, embracing diverse careers and feminine empowerment. The 2023 Barbie movie, unfortunately, neglects to address any notion of faith or family, and tries to normalize the idea that men and women can’t collaborate positively (yuck).”

She even provided a critique of the film which included disappointment in the testosterone levels for Ken.

Interesting she was disappointed with Ken’s testosterone levels given the fact that her husband was likely getting excited over having sex with a Barbie doll.

Remember kids, it’s not profiteering or Greed inflation folks, it’s those darned criss-crossing lines that Ford has on their demand-supply. Keep it straight or the orthodox economists will take a bamboo cane to the back of your head the same way they did Isabella Weber.

It’s not greedflation or profiteering when the government slaps a 27.5% on your foreign competitors…it’s just government protected free trade! Suddenly the narrative shifts–the welfare of the American consumer doesn’t matter anymore, but that of the American worker (read the big American corporation) matters a lot.

But hey, if no one notices the new narrative, is it really protectionism?

Wait – there was this JohnH who called for more trade protection. You should get a job as an iHop cook the way you flip flop.

Or maybe it’s all those mainstream economists who used to be free trade fundamentalists that should be working at iHop…

Damn – you don’t get anything. Do you? Can you name a single economist who has flip flopped on this issue the way you have? Oh wait – they get international trade … something way over your little pea brain.

johnny, are you for or against those tariffs?

johnny, are you for or against free trade?

please state your position. what i hear is you simply gripe, against opposite positions.

If the world were Econ 101, we wouldn’t need to talk about decision-making in any detail. Automobile prices would be set at the marginal cost of production.

So Elon decides to bleed his competitors by reducing his margins. This choice is only available because Elon isn’t pricing at marginal cost. Not 101. More Industrial Organization – lots of oligopoly and monopolistic competition.

We have gone from a period in which skinning the buyer was a workable sales model to a period of fighting for market share. The transition was marked by Elon throwing down a gauntlet. The business press kindly explained Elon’s intention for those who couldn’t guess for themselves. The transition was also marked by rising inventories.

So Ford responds decisively and quickly to increased price competition? (Imagine calendar pages flipping by themselves for a considerable time, perhaps in black and white…) Game theory doesn’t generate clean solutions in oligopolistic markets, but this is still pretty weird.

Tesla will have a manufacturing cost advantage over other Western EV manufacturers due to economies of scale and cumulative experience. (BCG proved the substantial cost reduction effects of experience in the 1970s, something that somehow managed to escape Econ 101.) China ultimately has the advantage, partly due to scale, but also because its exchange rates are driven mostly by goods, not finance.

Exchange rates are driven by goods? Really? I guess the Great Johnny has spoken!

But here’s what the IMF thinks determines exchange rates, in case anyone lacking Johnny’s god-like knowledge is curious:

https://www.elibrary.imf.org/display/book/9781589060944/ch10.xml

Apparently, the IMF thinks it’s more complicated than “goods”.

And, just for the sake of – I dunno, humor? – let’s assume “goods” is the right answer. Has the Great Johnny made the case that China has “goods” as an exchange rate advantage? No. No he hasn’t.

Johnny boy is faking it. Again.

How many things can Jonny get wrong in a single sentence? His garbled language seems to be saying China is doing currency manipulation to favor a single sector. No – currency manipulation affects the entire tradeable goods sector not just cars. So Jonny flunked basic theory. And he is wrong on the evidence:

https://www.scmp.com/comment/opinion/article/3025621/why-us-claims-china-currency-manipulator-are-groundless

The View by Guan Tao

Why US claims that China is a currency manipulator are groundless

The yuan has appreciated significantly since the global financial crisis, and a review of China’s policy decisions show that it has, in fact, done more than any other major economy to honour its commitment to hold the value of its currency

Guan Tao wrote this to condemn Trump’s trade war. Now tariffs do affect specific sectors but at the time China’s currency appreciated not depreciated.

Look Jonny boy has no clue what’s he is babbling about. But didn’t Bernanke comment on this? At least he gets it.

That IMF discussion is a good review of the various aspects of this issue. Jonny boy has read exactly NONE of this literature. And even if he tried to read up on this issue using this discussion as motivation – he would not understand a word of it. Now I think it is very clear to all. JohnH is incredibly STUPID. So why should he waste his time reading actual economics – something beyond the mental capacities of little Jonny boy.

Quite likely, JuniorHighJohn has no idea that Tesla’s “economies of scale” (?) have been greatly aided by significant government subsidies especially those provided by Nevada beginning in 2014 and extending through 2023.

From the Reno Gazette Journal, 2/23/2023: “tTesla is no stranger to receiving tax incentives from Nevada, Back in 2014, the company was awarded $$1.3 Billion in tax incentives—the largest ever given by the state—as part of efforts to woo Tesla to build its first gigafactory in Nevada”

And “Tesla won big in Nevada once again after the state approved more than $330 Million in tax incentives for the company’s new electric truck and battery manufacturing facility.”

Seems JHJ has been critical of companies receiving any government assistance for EV development with the exception of those in China, of course.

As usual JHJ continues speaking with a forked tongue. Angry that companies here would accept any government incentives or assistance, Quietly cheering foreign entities doing same, especially EV manufacturers in China.

Yes, he’s a fraud. A big one.

“JuniorHighJohn has no idea that Tesla’s “economies of scale” (?) have been greatly aided by significant government subsidies especially those provided by Nevada beginning in 2014 and extending through 2023.”

I just looked at their 10-K filing. Shhh – Jonny has never learned how to use http://www.sec.gov.

Lots of discussions of these government subsidies. They are open and out front on this but little Jonny has no clue as little Jonny does even what a 10-K filing even is.

China’s exchange rates are not driven by anything. They are set by the government, not a competitive process.

Even if the yuan were freely floating – Jonny’s statement is about the dumbest thing I have ever read. Look – Jonny boy has trouble tying his own shoe laces. International macroeconomics has never been his thing.

https://www.nytimes.com/2023/07/19/health/health-insurance-medicaid-denials.html

July 19, 2023

Insurers Deny Medical Care for the Poor at High Rates, Report Says

Investigators found that major companies overseeing Medicaid patients’ health care frequently rejected doctors’ requests for approval of treatments and procedures.

By Reed Abelson

Private health insurance companies paid by Medicaid denied millions of requests for care for low-income Americans with little oversight from federal and state authorities, according to a new report by U.S. investigators published Wednesday.

Medicaid, the federal-state health insurance program for the poor that covers nearly 87 million people, contracts with companies to reimburse hospitals and doctors for treatment and to manage an individual’s medical care. About three-quarters of people enrolled in Medicaid receive health services through private companies, which are typically paid a fixed amount per patient rather than for each procedure or visit.

The report by the inspector general’s office of the U.S. Department of Health and Human Services details how often private insurance plans refused to approve treatment and how states handled the denials.

Doctors and hospitals have increasingly complained about what they consider to be endless paperwork and unjustified refusals of care by the insurers when they fail to authorize costly procedures or medicines. The companies that require prior authorization for certain types of medical services say these tools are aimed at curbing unnecessary or unproven treatments, but doctors claim it often interferes with making sure patients receive the services they need.

The investigators also raised concerns about the payment structure that provides lump sums per patient. They worried it would encourage some insurers to maximize their profits by denying medical care and access to services for the poor.

The report emphasized the crucial role that state and federal officials should play to ensure the denials were justified. “People of color and people with lower incomes are at increased risk of receiving low-quality health care and experiencing poor health outcomes, which makes ensuring access to care particularly critical for the Medicaid population,” the investigators said….

https://fred.stlouisfed.org/graph/?g=14GnA

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2021

https://fred.stlouisfed.org/graph/?g=11RG7

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2021

The U.S. Federal Reserve will raise its benchmark overnight interest rate by 25 basis points to the 5.25%-5.50% range on July 26, according to all 106 economists polled by Reuters, with a majority still saying that will be the last increase of the current tightening cycle.

Ahem. I would be cutting interest rates right now. Put me down for saying if the FED does this, it would be a mistake.

pgl is always for reducing interest rates…a clue as to his employer’s business.

My employer? Seriously dude – we know your employer is the Kremlin. Which is why you cheer for a US recession.

Johnny doesn’t have the chops to debate the facts, so relies instead on dishonest attacks other people’s motives. Johnny doesn’t know who pgl works for, any more than he knows about economics. Johnny’s a fraud.

I never worked for a bank let alone a Wall Street bank. Jonny boy knows that but Jonny boy is having one of his patented emotional break downs.

Continuing to raise rates makes no sense to me. As far as I can tell, inflation is slowing, with no apparent need to raise rates any further. The fact that inflation is slowing without a dramatic rise in unemployment should be celebrated, not choked by continuing to try to slow growth. What am I missing here?

The often wise Barry Ritholz makes 12 points about inflation:

https://ritholtz.com/2023/07/contrarian-inflation/

Notably, every one of those points has been made here at one time or another.

Just to quibble, I think he may overstate the case for OER driving inflation. It drives CPI, not actual inflation. Only to the extent that the Fed is engaged in misguided anti-inflation theater does OER drive policy. Feel free to weigh in on theater…

Anyhow, the list is a useful encapsulation of what we’ve learned over the years about inflation, inflation fighting, and policy error.

Ritholz has come a considerable distance over the years in his thinking about inflation. He was once a bit of a reactionary on the subject, a hawk when we were already a decade or more into the long period of disinflation. We once had a lengthy exchange about the definition of inflation, with Ritholz arguing for money growth itself as inflation, alternatively raw commodity price increases as inflation. Look at him now! This is how you know the guy isn’t captive to his own past.

I think people do deserve positive credit and kudos when they change positions. Most people have a hard time doing it (myself included). But in Ritholtz’ case could it just fall under the category “tired of being wrong” ?? I have mixed feelings about Ritholtz, but his blog is fun and you can learn things there (although it’s probably been at least 5 years since I was a regular reader there. Not sure why. When he’s wrong he’s way wrong. “Opinionated” is the word that comes to mind on Ritholtz. But you also have to appreciate that he’s not milquetoast too.

This is one of the reasons I respect Ritholtz and follow his blog. He is data driven and will change his opinions when the data suggests he was wrong. Nothing more painful and embarrassing than someone who like Larry Summers just keep inventing crazy new arguments for why he actually is right when reality refuse to support the narratives. Barry quite often have contrarian opinions, but he explains them so you know where they come from – and can agree or disagree based on facts and arguments.

ritholtz’ partner josh did a big Jim Cramer on cnbc yesterday.

recommended ‘toast’, which promptly had bad news, and big price drop.

maybe he meant wait a few weeks

have not read Barry in a while

The piece covers a lot of the issues thoughtfully, concisely, and in plain English. It’s interesting that Ritholtz is not an economist…

I’ve been both a forecast consumer and a forecaster. One thing I realized early was that forecasts often amount to admissions of past forecast error. When job growth exceeds forecast in June, July forecasts are higher than June forecasts. That’s not a bad thing. Call it adaptive learning.

I also realized that the economy behaves differently in different periods, so that the performance of various forecasting systems can be quite good for a while, then go to pot. Years ago, the top forecaster in (I believe it was) Bloomberg’s stable of forecasters for CPI, GDP and employment was interviewed about his model. Pure monetarism. The economy had slid over to where he was. Then it slid somewhere else. Never saw him do anything remotely like it again.

So now, the economy keeps doing better than forecast. Given the choice between sticking to their guns or adapting, most forecasters have adapted. That’s probably wise, but we won’t know until the we arrive at today’s forecast horizon and pick up some revisions, as well.

Just gotta keep in mind how forecasting works if you want to make the best use of forecasts.