Today, we present a guest post written by David Papell and Ruxandra Prodan, Professor and Instructional Associate Professor of Economics at the University of Houston.

The Federal Open Market Committee (FOMC) raised the target range for the federal funds rate (FFR) by 25 basis points to between 5.25 and 5.5 percent in its July 2023 meeting. This followed rate increases totaling 5.0 percentage points between March 2022 and June 2023 preceded by two years at the Effective Lower Bound (ELB). The FOMC did not provide any guidance about the future path of the FFR beyond the June 2023 Summary of Economic Projections (SEP).

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In the latest version of our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to June 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. We analyze four policy rules that are relevant for the future path of the FFR in the post:

The Taylor (1993) rule with an unemployment gap is as follows,

where Rt is the level of the short-term federal funds interest rate prescribed by the rule, πt is the inflation rate, πLR is the 2 percent target level of inflation, ULRt is the 4 percent rate of unemployment in the longer run, Ut is the current unemployment rate, and rLRt is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). Rt-1 equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

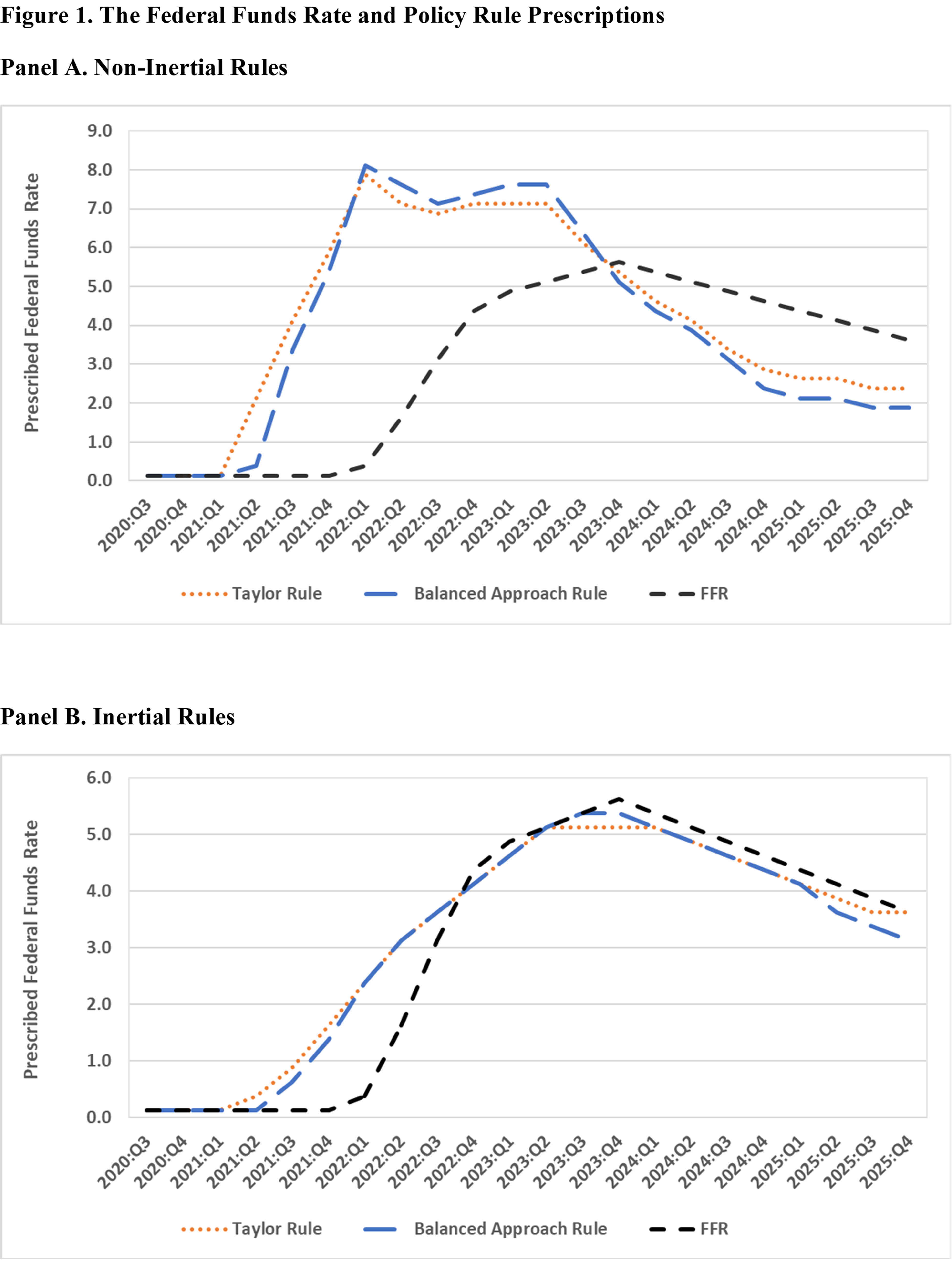

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to June 2023 and the projected FFR for September 2023 to December 2025 from the June 2023 SEP.

Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 5.375 in July 2023 and is projected to rise to 5.625 in December 2023 before falling in 2024 and 2025. The figure also depicts policy rule prescriptions. Between September 2020 and June 2023, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between September 2023 and December 2025, we use inflation and unemployment projections from the June 2023 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in June 2021 when the prescribed FFR increased from the ELB of 0.125 to 2.125 for the Taylor rule and to 0.375 for the balanced approach rule while the actual FFR stayed at the ELB. The policy rule prescriptions sharply increased through 2021 and peaked in March 2022 to 7.875 for the Taylor rule and 8.125 for the balanced approach rule when the FFR first rose above the ELB to 0.375. The gap also peaked in March 2022 at 750 basis points for the Taylor rule and 775 basis points for the balanced approach rule. The gap narrowed considerably between March 2022 and June 2023 as the FFR rose from 0.375 to 5.125 while the prescribed FFR’s fell by 75 basis points for the Taylor rule and 50 basis points for the balanced approach rule. Looking forward, the gap between the FFR projections and the policy rule prescriptions narrows considerably in September 2023 and, starting in December 2023, the FFR projections are above the policy rule prescriptions through December 2025.

Panel B reports the results for the inertial Taylor and balanced approach rules. They are much more in accord with the FOMC’s practice of raising the FFR slowly when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021 and rise to 0.375 for the Taylor rule in June 2021. The FOMC fell behind the curve starting in September 2021 when the prescribed FFR increased to 0.875 for the Taylor rule and 0.625 for the balanced approach rule while the actual FFR stayed at the ELB. The gap between the policy rule prescriptions peaked in March 2022 at 200 basis points for both rules. At that point, the prescribed FFR was 2.375 while the FFR first rose above the ELB to 0.375.

The Fed is no longer behind the curve. The gap narrowed steadily and, in June 2023, the FFR was equal to both policy rule prescriptions. The inertial rules prescribe a much smoother path of rate increases from September 2021 through June 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward through 2025, the FFR projections are generally 25 basis points above the policy rule prescriptions with a range between zero and 50 basis points. The current and projected FFR is in accord with prescriptions from inertial policy rules.

This post written by David Papell and Ruxandra Prodan.

I promise, I respect the two authors, but this smells a little like “Fed worship” of an institution who hands out jobs to their same profession, whoever “glad hands” them. Do any of you realize, ANY of you realize the stink that puts out?? Asking for a friend.

Moses Herzog: You should read the preceding guest posts by these two authors; you might have a different assessment. See e.g., The Fed fell behind the curve by not following its own policy rules.

I have GREAT respect for you putting my comment up. My word is to you I’ll read your link, I’m drunk, whatever,. But I’ve been trying about 72 hours to get another comment up here, your server is messed up Menzie , “Internal Server Error” anyone readiing this, I’m not implying anything, it IS a server problem

I have GREAT respect for you putting my comment up. My word is to you I’ll read your link, I’m drunk, whatever,. But I’ve been trying about 72 hours to get another comment up here, your server is messed up Menzie , “Internal Server Error” anyone readiing this, I’m not implying anything, it IS a server problem

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022….

[ There may be such agreement, but given the dual mandate of the Fed, which Chairman Powell seems especially concerned with, my sense is that Fed policy has been just right and properly allowed for a strong labor market as long as possible. This Fed has set policy perfectly from the perspective of the most vulnerable workers. ]

Fed policy, nearing the close of a tightening cycle, strikes me as having been perfect from the perspective of ordinary or the most vulnerable workers:

https://fred.stlouisfed.org/graph/?g=tMAF

January 4, 2018

Unemployment rates for Whites, Blacks and Hispanics, * 1980-2023

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=tMFN

January 4, 2018

Unemployment rates for men & women, * 1980-2023

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=T8Hb

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2000-2023

* Full time wage and salary workers

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=lMaX

January 15, 2018

Real Median Weekly Earnings for men and women, * 2000-2023

* Full time wage and salary workers

(Indexed to 2000)

Short term rates are one issue; long term rates are another. Wolf Richter: “US Government Debt Spikes by $1.2 trillion since Debt Ceiling, to $32.7 Trillion. Treasury to Add $1.5 Trillion in Debt by Year-End…

Last time the government issued securities at this pace and faster was in 2020, but back then, the Fed was buying Treasuries hand over fist, including $3 trillion in March through May 2020. Now the Fed is shedding Treasuries at a pace of about $60 billion a month.

Markets not only have to digest the new issuance but also pick up the $60 billion a month that the Fed is walking away from….

This increased supply of longer-term securities will have to attract enough buyers with a yield that is high enough. Currently, Treasury bills are paying somewhere near 5.5%. But the 10-year yield is only around 4%. So this will be interesting.” https://wolfstreet.com/2023/07/31/us-government-debt-spikes-by-1-2-trillion-since-debt-ceiling-to-32-7-trillion-treasury-to-add-1-5-trillion-in-new-debt-by-year-end/

Maybe folks trying to save for their first home, set aside money for their kids college education, or planning to retire some day will finally get positive real returns on their secure savings? Could long term rates even rise to the point where they could earn positive, real, after tax returns on their secure savings?

https://fred.stlouisfed.org/graph/?g=MueG

January 15, 2018

Interest Rate on 5-Year Treasury and 5-Year Inflation-Indexed Securities, 2017-2023

https://fred.stlouisfed.org/graph/?g=xLHj

January 15, 2018

Interest Rate on 10-Year Treasury and 10-Year Inflation-Indexed Bonds, 2017-2023

What’s your point?

When someone relies on the trash from Wolf Richter – as in Debt out the Wazzo – one has no point.

But this is Jonny boy who has no clue what anyone of this means. Suggesting real rates are negative? See ltr’s graph which contradicts Jonny’s latest stupidity.

Ducky asks, “what’s my point?” How about relishing the possibility that people saving for a house, sending their kids to college, or planning for retirement might finally be able to get a positive, real after tax return on their secure savings.

A truly positive time value of money…a recently unheard of concept that economists might rediscover and come to appreciate!!!

Didn’t your own mommy ask to cease writing such utter BS? You have embarrassed this good lady way too much.

Let’s see, my bank is offering over 4% on 6-month CDs and the expected inflation rate is around 3%. 4 minus 3 is not positive? How effing stupid are you? Oh that’s right – little Jonny boy believes inflation is running at 6% because little Jonny boy is a MORON.

“Could long term rates even rise to the point where they could earn positive, real, after tax returns on their secure savings?”

Does Dr. Chinn have to put a new blog post calling you out on things like this. Of do you really think expected inflation is 6%? Never mind – you are so incredibly stupid that you probably do.

The 10 year Treasury is now above 4% while the YOY inflation rate is 3%, so we’re finally getting there.

Personally, I would never rely on ‘expected inflation’ to calculate an ex ante “real” return, given how bad the forecasts of expected inflation have been over the past few years.

Stop the presses. Little Jonny boy finally got one right. Of course this undermines your previous million moronic comments.

“I would never rely on ‘expected inflation’ to calculate an ex ante “real” return, given how bad the forecasts of expected inflation have been over the past few years.”

God you are a moron. The ex ante real return is by definition the nominal return minus expected inflation. So what would Jonny boy use instead? The size of his little pea brain.

BTW a year ago most measures of expected inflation were near 3%. And little Jonny boy kept telling us this measure should be 6%. We now have the historical data and its seems inflation has been 3%. So economists got this right and of course little Jonny boy was WAY OFF.

Dr. Chinn’s comments had to do with mortgage rates, not secure savings rates, which are much lower.

I guess pgl never bothered to calculate the real, after tax rates he was getting on his bonds over the past decade. Heck, I’m not even sure he knows how!

Hint: the nominal, before tax yield on the Vanguard Total Market Index Fund was 1.1% per year over the last decade while inflation amounted to 2.7%.

And to think that pgl constantly advocates for even lower interest rates!!!

I advocate for full employment. You are the gold bug who cheers on recessions.

Jonny boy finally realized that short-term government bond rates used to be low? Dude the adults here have known that for over a decade. Come dude – after 10 million moronic comments, isn’t it time you pollute some other blog?

Your boy Wolf Richter began blogging under this name:

TESTOSTERONE PIT, a short, edgy, and humorous novel about car salesmen, their customers, managers, and shenanigans at a large Ford dealership. It will forever change the way you think about buying a car. Written by an insider (yours truly).

The post you note here is not much better. Yea Jonny boy loves to waste our time with this kind of trash.

What kind of moron writes trash like this?

‘The Treasury Department today jacked up its borrowing plans to deal with the lower-than-previously-expected revenues and the higher-than-previously-expected outlays, as the deficit keeps careening out of all control.’

Oh yea – the morons Jonny boy loves to cite as expert commentary. Dude – we get it. You are STOOOPID. Take a vacation. Damn!

Of course, pgl is free to correct Wolf Richter’s data any time he wants…but pgl is too lazy to offer better data or constructive criticism. After all, it’s a lot easier to trash someone else’s data than to find evidence to refute it.

Dude – I do not waste my time reading garbage like what Wolf Richter writes. Reading your trash is bad enough.

‘The Treasury Department today jacked up its borrowing plans to deal with the lower-than-previously-expected revenues and the higher-than-previously-expected outlays, as the deficit keeps careening out of all control.’

Gee Dr. Chinn covered this but maybe you were not paying attention:

https://fred.stlouisfed.org/series/gfdegdq188S

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

Fell from 135% to less the 120%. Wolfie is a liar preaching to morons like you.

Off topic, the new Cold War and the scramble for raw materials –

Politico has a new piece on Mongolia as a potential source of raw materials, an alternative to China

https://www.politico.com/news/2023/08/01/u-s-quest-minerals-adversaries-00108231

The article points out Mongolia’s location, sandwiched between Russia and China. One risk immediately comes to mind for Mongolia; if the U.S. does begin funding development in Mongolia as a way to circumvent Chinese control of raw materials markets, China may treat Mongolia as it has treated Tibet, Hong Kong, Xinjiang, Kinmen and Matsu Islands and, if it gets the chance, the entire South China Sea. That’s bad for Mongolians.

We can’t count Russia out, either. Russia is expansionist and a raw material exporter. That combination is risky for Mongolia, especially Mongolia receives U.S. investment on a large scale.

Ducky just figured out one of the most important factors behind US overseas military interventions? And all this time he’s bought the BS that the US invades Iraq, Libya, and Afghanistan because of their deep commitment to human rights!?!

It turns out that Ukraine has tremendous mineral wealth…Afghanistan, too…Sudan…Niger…and most any other global hot spot. And apparently Ducky is just waking up to the fact the US wants to control those resources as it has presided over the liberalized oil markets for decades.

Yet Ducky believes that US interventions are solely about human rights…Boy, do I have a Human Rights Bridge in Brooklyn to sell him!

What a moronic comment. Oh wait – you are a moron. Carry on!

“Fernandez said Mongolia is an example of what the United States hopes to achieve through the Minerals Security Partnership, an initiative with 14 mostly Western countries to bolster sustainable investment in the mining, processing and recycling of critical minerals. It includes Australia, Canada, Japan, South Korea, India and several European nations. It puts an emphasis on the private sector and works to ease the risk for businesses through diplomatic support and government-backed financing mechanisms like the Export-Import Bank of the United States.”

Private sector with the assistance of the Ex-Im bank does not sound like how your boy Putin would do this. No Putin would send in the Wagner Group to kill any Mongolian who stood in his way.

A President DeSantis would eliminate four federal agencies if elected president: the Internal Revenue Service, the Department of Commerce, the Department of Energy, and the Department of Education. Why? According to DeSantis – there four agencies are “too woke”. And we thought Trump was a moron!

Every GOP presidential candidate has to propose eliminating a number of departments and then count them once on their finger and a second time on their toes. Remembering the names of the exact departments to be eliminated is no longer required – as long as you eliminate enough of them.

I often highlight smart things said by Kevin Drum so his latest post is disappointing:

https://jabberwocking.com/the-equity-premium-has-disappeared

Conventional wisdom says that, on average, you should earn more from an investment in stocks than an investment in government bonds. This is the equity premium, the reward you get for making a riskier investment. But the equity premium has been drifting lower for the past year and a half. As of today, it’s negative. You can earn more from 100% safe government bonds than you can from the stock market

Doesn’t Kevin know what on average means? OK the actual return from stocks in one period was lower than the actual return from government bonds. But a one-period ex-post return is not the same thing as expected returns. Fortunately his readers have already called Kevin on this post.

Could be Drum was prompted to comment on the equity premium by DeLong’s latest:

https://braddelong.substack.com/p/draft-why-have-superhigh-long-run

DeLong has been thinking about the equity premium for years. He once, embarrassingly, recommended investing Social Security funds in equities because the premium would eventually collapse. The context was the Clinton budget surplus – maybe there wouldn’t be enough Treasuries to go around. Of course, the Shrub years were a disaster for equity returns, making DeLong’s timing rather embarrassing.

DeLong no longer claims to seek compromise with the right, as he did back when. Anyhow, if the premium has disappeared for now, it’s because Treasuries went “splat” right along with equities during the early period of rate adjustment. Nobody was capturing gains from the narrowing of the equity premium.

One of the comments over at Kevin’s place was to note this from Brad.

https://www.nytimes.com/2023/07/31/opinion/goldilocks-and-the-bidenomics-bears.html

July 31, 2023

Goldilocks and the Bidenomics Bears

By Paul Krugman

It’s hard to overstate how good the U.S. economic news has been lately. It was so good that it didn’t just raise hopes for the future; it led to widespread rethinking of the past. Basically, Bidenomics, widely reviled and ridiculed a year ago, looks a lot better in retrospect. It’s starting to look as if the administration got it mostly right, after all.

About the economic news: First up was the employment report for June, which didn’t just show continuing solid job growth. It showed that once you adjust for population aging, the employed share of American adults is at its highest level in decades.

Then came the Consumer Price Index, which showed inflation falling to its lowest level since spring 2021. Thanks to falling inflation, most American workers now have higher real wages than they did before the pandemic — in fact, nonsupervisory workers are earning roughly what we would have expected if the pandemic had never happened.

Economic growth, as measured by gross domestic product, came in above expectations, once again defying predictions of recession.

Finally, an alternative price measure favored by the Federal Reserve also gave solid evidence of falling inflation, while employment costs moderated — that is, there’s no hint of a wage-price spiral.

It’s still too soon to be sure that we’ll manage to pull off a soft landing, but the prospects for getting inflation under control without a recession have never looked better.

This is all great news. But why should it make us reconsider the past? …

CNBC quality reporting:

https://www.cnbc.com/2023/08/01/bp-q2-earnings-2023.html

”Oil major BP on Tuesday reported a nearly 70% year-on-year drop in second-quarter profits on the back of weaker fossil fuel prices, echoing a trend observed across the energy industry.’

Sort of the flip side of JohnH’s nonsense. Maybe CNBC should tell us that these companies were making record profits a year ago. Now I would not accuse CNBC of being as dishonest as JohnH but this is really bad.

pgl pathetically bleats about another company that is not registering record profit margins. Meanwhile BEA reports that overall profit margins are just off their record highs…close to 16% vs. about 11% only five years ago.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Practically every day pgl shows what a corporate shill…trying to gloss over near-record corporate profit margins…and trying to provide cover for greedflation.

On a positive note, the more pgl provides cover for corporate greed, the more I get to provide facts about just how greedy they are!

WTF? I thought you would be happy that their profits have fallen off their enormous levels. Damn – my stalker is mentally retarded and has serious emotional issues.

I just saw your moronic comment in reply to what Macroduck noted about Mongolia. Yea – you are an incredibly worthless piece of trash. Go pollute some other blog.

https://fred.stlouisfed.org/graph/?g=ltTj

January 4, 2018

United States Employment-Population Ratio, * 2000-2023

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=lMaN

January 4, 2018

United States Employment-Population Ratios for Men and Women, * 2000-2023

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=mYFT

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2000-2023

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=mYFV

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2000-2023

* Employment age 16 and over

(Indexed to 2000)

Job openings declined 13.7% in the first half of the year, as compared to January-June 2022. The drop follows a 3.4% fall in the second half of last year, after the very strong 2021/22 bounce-back from the worst of the COVID recession. Hiring was down 6.7% (vs. 5.1% in July-December 2022). Quits fell 10.4% (-3.7%) as the unemployment rate continued to fall.

_ _ _ _ _ Unemployment Rate_ _ Employment Growth

Jan-Jun 2021 _ _ 6.1% _ _ _ _ _ _ _ _ +0.2%

Jul-Dec 2021 _ _ 4.7% _ _ _ _ _ _ _ _ +4.6%

Jan-Jun 2022 _ _ 3.7% _ _ _ _ _ _ _ _ +4.8%

Jul-Dec 2022 _ _ 3.6% _ _ _ _ _ _ _ _ +3.8%

Jan-Jun 2023 _ _ 3.5% _ _ _ _ _ _ _ _ +2.7%

With unemployment looking rather sticky over the medium term (despite the quick drop in June), I’m leaning toward the Fed having finished raising rates, but not of the school that thinks they’ve gone too far.

Another solid analysis from P&P. It would seem to suggest 30 fixed mortgage rates above 6% through 2025.

Another prediction from Princeton Steve. Have oil prices reached $180 a barrel yet?

https://fred.stlouisfed.org/graph/?g=o5t7

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2000-2023

https://fred.stlouisfed.org/graph/?g=qVRw

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2017-2023

” The FOMC did not provide any guidance about the future path of the FFR beyond the June 2023 Summary of Economic Projections (SEP).”

I guess little Stevie thinks the FOMC provided guidance for the next 2 years but they didn’t. Now little Stevie keeps telling us we will have a recession any day now. Now would not that mean lower interest rates? Don’t ask the world’s worst consultant as he has no clue.