Reader JohnH, on considering the timing of the boom in manufacturing structures investment, writes:

Looks like its related to Russia’s invasion of Ukraine to me (like so many other changes in the economy!)

While I agree that the expanded Russian invasion of Ukraine did have a big effect on the US — and global — economy, I do not think the timing is right to argue the surge in manufacturing structures investment is due to the war. Rather, I think the conventional wisdom that the CHIPS Act has been critical in this development is correct (e.g., here); this view is buttressed by a closer inspection of the timing of events.

Figure 1: Quarter on quarter change in nonresidential investment ex-structures (blue bar), nonresidential structures ex-manufacturing structures (tan bar), and manufacturing structures (green bar), in bn.2012$ SAAR. Source: BEA 2023Q2 advance, Table 5.4.6U, and author’s calculations.

Nonresidential structures investment growth was negative after the Russian action in February 2022, but manufacturing structures investment only turned positive after the passage of the CHIPS Act.

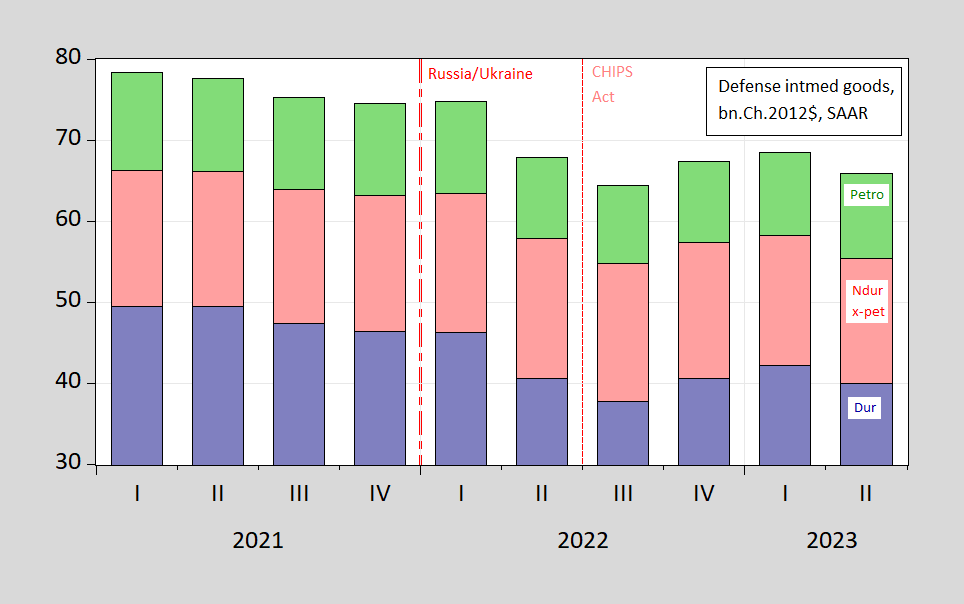

Furthermore, defense procurement (specifically expenditures on intermediate goods) declined after the Russian action.

Figure 2: Expenditures on intermediate durable goods (blue bar), on intermediate nondurable goods ex-petroleum (pink bar), and on petroleum products (green bar), all in billions Ch.2012$ SAAR. Source: BEA 2023Q2 advance GDP release, Table 3.11.6, and author’s calculations.

Hard to see how decreasing expenditures on intermediate goods is then manifested in increased private investment in manufacturing structures.

I like the “tone” of this blog post. Corrective, educational, but not….. you “get” it. I don’t need to say it or want to say it.

Menzie, did you ever watch Billy Martin of the Yankees as player or a MANAGER. As a MANAGER??? If you understand Billy Martin as MANAGER of the Yankees or the MANAGER of the Oakland A’s, you’ll understand me Menzie. I promise you Menzie

Billy Martin defended HIS players, the same as YOU or ME, would defend our students in our classroom. Understand?? I think you understand defending and “taking up for” your students Menzie. You Would do that for your better students, or EVEN the low ones, you’d do that for your students ,

It’s extremely frustrating the ONE comment I want up is not going up on the blog, However…… I do not blame Professor Chinn or Professor Hamilton for this issue. I believe it’s a tech problem, I will go on trying to put my comment up, even if I eventually have to ask Menzie to do that by email. It’s not a vulgar or offensive comment, it relates to interest rates and is mundane. Any efforts the blog hosts have made up to this point to put the comment up is appreciated.

—Angry but tolerant Uncle Moses

Defense spending was running at $918.3 billion annually in April through June 2022.

Defense spending was running at $970.7 billion annually in April through June 2023:

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

July 27, 2023

Defense spending was 55.6% of federal government consumption and investment in April through June 2023. *

$970.7 / $1,747.2 = 55.6%

Defense spending was 20.8% of all government consumption and investment in April through June 2023.

$970.7 / $4,684.1 = 20.7%

Defense spending was 3.6% of GDP in April through June 2023.

$970.7 / $26,835.0 = 3.6%

* Billions of dollars

You repeat, so I repeat –

Well this must be embarrassing. ltr, in one of her many, many, “China good, U.S. bad!” comments, wrote this:

ltr

July 11, 2023 at 11:05 am

Here is precisely the sort of problem China has been investing in, both through a comprehensive weather satellite program and Artificial Intelligence compilation:

https://www.nytimes.com/2023/07/11/climate/climate-change-floods-preparedness.html

July 11, 2023

Vermont Floods Show Limits of America’s Efforts to Adapt to Climate Change…

Notice the racism and, of course, the falseness.

If China’s “comprehensive weather satellite program and Artificial Intelligence compilation” are soooo much more effective than what Vermont is up to, why is much of Beijing under water?:

https://www.reuters.com/world/china/typhoon-doksuri-thousands-flee-their-homes-heavy-rain-lashes-beijing-2023-07-31/

Xi’s “competent autocrat” shtick must be wearing thin, huh?

Oh, and the BBC is reporting that Uyghurs living in the UK face pressure from China to spy on fellow expatriates. China threatens family members still in China to compel compliance from Uyghurs overseas. Now theres some racism.

http://www.chinadaily.com.cn/a/202307/30/WS64c5e9d4a31035260b819461.html

July 30, 2023

China reports fewer geological disasters in H1

BEIJING – China has reported fewer geological disasters in the first half of the year than the same period of last year, official data showed.

During the January-June period, the country has reported a total of 665 geological disasters, down 86.4 percent year-on-year and 70 percent less than the average of those reported in the previous five years, according to Yu Haifeng, an official with the Ministry of Natural Resources.

The number of deaths and people reported missing during these disasters also fell 48.1 percent from the same period last year, Yu said.

He added that the country has succeeded in forecasting 59 geological disasters in the first half, avoiding possible casualties of 676 people.

The country has launched a national-level mechanism to monitor geological disasters and meteorological risks, and mobilized 267,000 people nationwide to take part in disaster monitoring and early warning, he said.

Have you factored in the significant lags involved in congressional approval of aid, the procurement process, manufacturing capacity design, approval, and contracting for new construction? Let’s not forget that the Omnibus Spending Bill, which included Ukraine aid, only passed in May, 2022. Raytheon only got its contract last November.

https://www.usnews.com/news/us/articles/2022-11-30/pentagon-to-award-1-2-billion-contract-to-raytheon-for-ukrainian-nasams-source-and-document

Increasing manufacturing capacity supported by investment in manufacturing structures is not like turning on a spigot. Much of the initial aid sent to Ukraine was already in DOD inventory, some of it obsolete (to the dismay of the Ukrainians.) In addition, much of the additional procurement would have been accommodated by increased utilization of existing capacity.

“The Pentagon has made a habit of touting high-dollar weapons transfers to war-torn Ukraine, but less of a habit of placing orders to replenish its stockpiles of donated missiles and bombs, senior executives say—despite Congress appropriating funds and giving Pentagon officials special permission to award bulk contracts that span multiple years.

“If you think about this $30-some billion of the weapons that we’ve supplied to Ukraine, we’ve only got $2 billion of that under contract today,” RTX CEO Greg Hayes told Defense One in a June interview.

Hayes echoed that sentiment during a quarterly earnings conference call Tuesday, but said he expects some $2.5 billion in replenishment weapons deals over the next 12 months.

The deals are particularly important as the Pentagon pushes defense companies to expand their munitions production to not just replace what has been given to Ukraine, but to further build up U.S. stockpiles.”

https://www.defenseone.com/business/2023/07/raytheon-still-awaiting-deals-replace-billions-dollars-worth-weapons-given-ukraine/388819/

Authorized spending? This is like saying I have decided to build a house and then pretend to live it the house that had not even received its foundation. Not much help if it rained overnight.

Look dude – you lied. Own up to it.

“defense procurement (specifically expenditures on intermediate goods) declined after the Russian action.”

Take a close look at Dr. Chinn’s graph. Durable defense expenditures was $50 billion in 2021 but only $40 billion in 2022. That strikes me as quite the drop.

Oh wait – little Jonny boy never learned to read graphs. Never mind.

““If you think about this $30-some billion of the weapons that we’ve supplied to Ukraine, we’ve only got $2 billion of that under contract today,” RTX CEO Greg Hayes told Defense One in a June interview.”

RTX is the new name for Raytheon Technologies. Jonny boy seems to be focused on how much investment in fixed assets this company has been making since Putin invaded Ukraine. But Jonny boy once again failed to check the financial filings even though they are readily available at http://www.sec.gov. So permit me.

Fixed assets at the end of 2021 were $15 billion. Fixed assets now? $15.3 billion.

Oh wow – a $300 million increase. That’s the huge increase in military construction? Seriously?

“Increasing manufacturing capacity supported by investment in manufacturing structures is not like turning on a spigot.”

Well – the nondefense sector certainly turned on the spigot. Raytheon’s increase in fixed assets since the end of 2021? A mere $300 million so far.

My on my – reality is so MEAN to little Jonny boy!

Funny, funny Johnny. A walking, talking “whataboutism”.

You merely made a guess, based on your own agenda, about what led to the manufacturing construction boom. When Menzie looked to evidence, you ask whether he factored in this and that and the kitchen sink. You don’t have any standards yourself, but suggest others overcome any random objection you might raise. Odiouand obvious.

I came across one of those press accounts which Jonny boy just loves that made the claim that Raytheon profits in 2022Q4 were DOUBLE what they were in 2021Q4. Now I did not trust this story so I checked the 10-K filings:

2021: Sales = $64.388 billion and operating profits = $4.958 billion

2022 Sales = $67.074 billion and operating profits = $5.414 billion

Let’s keep the facts in mind lest Jonny boy finds this story and peddles its nonsense too.

“defense procurement (specifically expenditures on intermediate goods) declined after the Russian action.”

I posted a link to a detailed analysis from Deloitte-US on who spent more on manufacturing investment and none of the increase came from the Defense Department. It would be nice if JohnH checked the actual data before making his usual dumb comments. But he never does.

Petrol: The supply chain for DoD fuel is managed by Defense Energy Supply Center (DESC of Defense Logistics Agency)) at the wholesale level (in many products, jet fuel, the wholesale was (I’ve been out of it during this century) located at point of sale, as well as central/theater stocks) .

Ukraine activity did not add to budgeted flight times and ship steaming….. Had USA gone to extended operations, war stocks would be replenished and would show an increase in expenditures for fuels. I suspect in both Gulf wars fuel expenditures rose during deployment and operational phases, Ukraine participation is not in that mode.

DESC owns and manages war stocks, as well as sells fuels and bulk lubricants, for current training operations. That expenditure pattern is supported by large contract vehicles and at least within contract period would have set limits to price escalation and have negotiations during market extremes. The petroleum inflation was too short lived and most fuel already sourced by March 2022 which is half time in fiscal year.

Non durable supplies are consumable repair parts and other ‘throwaway’ supplies i.e. meal ready to eat, small arms ammunition, medical supplies….. Expenditures would rise if operations increased significantly and the industry could deliver increased orders in time. As with fuel operations did not increase that would be noticed in higher consumption.

Durables declining suggests the variability of deliveries of large items like F-35, which USAF is not taking delivery until a technical refresh needed to add a new radar is installed…… Durables delivered to DoD book a sale, sometimes the order was made years ago.

The quotes about billions of dollars in military shipments reflect deliveries from DoD stocks and war reserves, which do not precipitate an expenditure until the replacements are contracted for and delivered, which could take a number of years in case of industrial items such as artillery shell.

Generally, conventional munitions are “manufactured” in government owned contractor operated plants most exist since WW II! I suspect the surging defense supply chain won’t need too much real estate development.

An interesting aspect is manufacturing supplies which are no longer in production and in many cases the technology content is no longer in production…… lead times could be long!

Many years ago (in the last century) I almost took a job in “industrial mobilization”!

My observation abut a civilain manufacturing construction boom: what about all the empty plants in the rust belts?

https://econbrowser.com/archives/2023/07/treasury-yield-forecasts-and-projections#comment-302522

July 31, 2023

I was modestly chagrined with Noahpinion advocating more $$ for the military industry congress complex…

Something about winning a sea war 5000 miles west of San Francisco Bay.

[ https://www.noahpinion.blog/p/uh-guys-we-really-should-think-about

July 29, 2023

Uh, guys, we really should think about spending more on defense

That’s not a message many people want to hear, but it’s true.

By NOAH SMITH ]

While I respect some of the writings of Noah Smith on things like labor economics and macroeconomics, I would not be suggesting he ever head OMB. For example if he really wants to have a Reagan style defense department – how on earth do we pay for this without higher taxes? Yea – we have a Speaker of the House would slash and burn Social Security and Federal spending on health care but come on Noah, please tells us you do not agree.

Noah claims we can afford more defense spending with this?

‘That historical experience suggests that defense spending is not a simple tradeoff of “guns vs. butter”. Yes, it’s possible for a country to bankrupt itself by spending too much on defense, but in the 50s and 60s we dedicated double the fraction of GDP to the military that we do now, and it didn’t interrupt our prosperity.’

Either Noah has become dumber than JohnH or he is misleading us. We did spend a lot less on things like the Great Society programs and Federal funding of health care back then than we do now. We also taxed the rich a lot more back then than we do now. If Noah does not know this – may I suggest he give up blogging. Damn!

and real defense expenditures are up to Reagan build up levels, since the war on terror via w bush.

the mix of spending is the problem, a lot more pentagon dollars going to operations than new weapons and stockpiling war materials.

one of the groups pointing out a fraction of gdp for pentagon is Hoover institute….

the pentagon and industry marketing has lost fraction of gdp, but not real $

Considering Xi’s imperial ambitions, being able to fight a war successfully 5000 miles west of San Francisco Bay is a reasonable goal. Containing Putin’s imperial ambitions in Europe is a message to Xi. The CHIPs act is part of it. As a well established chip maker, China has some leverage. A large number of more advanced chips come from Taiwan, which may be one of the reasons Xi wants to own Taiwan so badly. Building both advanced and basic chips in the US prevents a war over Taiwan from becoming a logistic nightmare for all kinds of production. That takes a huge lever away from Xi. Giving Xi levers is a terrible idea.

Star Wars had the Clone Wars. We may have the CHIPS Wars!

“Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world in 2022, according to recently released figures from the Stockholm International Peace Research Institute (SIPRI). U.S. defense spending increased by $71 billion from 2021 to 2022, in part due to a military aid sent to support Ukraine in its ongoing conflict, and the United States now spends more on defense than the next 10 countries combined (up from outspending the next 9 countries combined in 2021).”

https://www.pgpf.org/blog/2023/04/the-united-states-spends-more-on-defense-than-the-next-10-countries-combined

Bernie Sanders: “The Pentagon doesn’t need $886bn. I oppose this bloated defense budget.

As a nation, the time is long overdue for fundamental changes to our national priorities” to Medicare for All, addressing climate change, supporting education, ending homelessness, etc. etc.

This is your defense of your latest error? Change the subject? JohnH – dumber than a rock. More dishonest than Trump. And a complete waste of time.

Now this is useful.

Technical accounting questions:

(1) It seems little Jonny boy tries to justify his previous lie by claiming Congress has authoritized military investments in structures. But these authorizations have yet to even start construction. Excuse me but is authorized spending counted in historical investment spending?

(2) Now the DoD has reached into its inventories of missiles. But are missiles government consumption or government investment?

Now only the adults here are invited to answer my two questions. After all – we have had way more than our share of babble from little Jonny boy.

In partial answer to your question, I think old-fashioned investment-cycle thinking is useful. If firms anticipate a prolonged increase in demand, they expand capacity. If they anticipate a temporary increase in demand, they run existing capacity as hard as is economically feasible.

China’s militarization and Russia’s belligerence are reasons to expand capacity for military hardware. Ukraine? That depends on one’s assessment of the length of the war. Compare Russia’s war to the CHIPS Act. The CHIPS Act aims at structural change in tech, at a persistent increase in domestic production. Russia’s war is not, in itself, a permanent state of affairs. It does, however, represent a potentially permanent shift – a new Cold War.

Building capacity to deal with a new Cold War will involve many budget cycles over many years. The Ukraine war is evidence of a new, permanent state of affairs, but is not, itself, a permanent state of affairs.

Both evidence and our understanding of how capacity decisions are made suggest that little Johnny is wrong. Johnny being wrong is the normal state of affairs.

It feels bizarre to me to correct Johnny’s nonsense, and I suspect it does for others. I’m opposed to a strongly skewed distribution of income, opposed to high levels of military spending, opposed to military adventurism, but I do not stand with Johnny on any of these issues. I correct Johnny because he’s so obviously lying, because his arguments are disasters of logic, because he will say anything in service of his agenda, because he has no standards. Johnny’s response, to me and to others who point out his dishonesty, is to claim that we support militarism, support Wall Street, support the enrichment of the rich. He lies when he makes those claims – just as he lies about everything.

Johnny’s agenda-driven speculation about factory construction is a good example of the point I’m making. I think the U.S. is likely to expand its capacity to produce military hardware in response to what appears to be a permanent increase in belligerence from Russia and China. I see no evidence that the increase in factory construction is, so far, an effort to expand production of weapons. Neither does Johnny, but he pretends that he does, and tenaciously defends this pretense, just as he defends every one of his fabrications.

Same old Johnny.

“I think the U.S. is likely to expand its capacity to produce military hardware in response to what appears to be a permanent increase in belligerence from Russia and China. I see no evidence that the increase in factory construction is, so far, an effort to expand production of weapons. Neither does Johnny, but he pretends that he does, and tenaciously defends this pretense, just as he defends every one of his fabrications.”

Jonny boy makes a big deal out of Raytheon. OK but through the end of June 2023 their financials show no increase in capacity. Jonny did not know that because Jonny did not check. His article talked about the incentives to invest in new capacity going forward which as you say is likely to happen.

Now Jonny boy could have looked at the stock price for Raytheon but he didn’t. I did. It is at the same price as it was at the end of 2021. So not much evidence there either.

I found this Treasury Dept report useful: “The boom is principally driven by construction for computer, electronic, and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component.” https://home.treasury.gov/news/featured-stories/unpacking-the-boom-in-us-construction-of-manufacturing-facilities

Thanks for posting Menzie.

On another topic – have we given the U.S. manufacturers enough of a break – isn’t it time to lift the tariffs on Chinese goods? What impact might that have on inflation and U.S. consumers? Also I really don’t like the knee jerk “China is the U.S. rival” tone in the media. Certainly there are real world implications with our relations with other countries but shouldn’t we seek trades that are mutually beneficial? The Trump/GOP refrain of “China is beating us” bugs me. No Trump – didn’t you learn at the Wharton School of Business that we are trading to mutual benefit? The Biden admin current tone seems like a much more realistic view of Chinese-U.S. relations “The world is big enough for both the United States and China to thrive- No one visit will solve our challenges overnight. But I expect that this trip will help build a resilient and productive channel of communication,” Yellen told a news conference in Beijing. https://www.cnn.com/2023/07/08/economy/us-china-yellen-visit-presser-intl-hnk/index.html See also Blinken and Kerry visits to China.

Reading the 10-K of Raytheon, it seems the PRC is not a big fan:

Of note, China previously announced it may take measures against Raytheon Technologies Corporation (RTC) in connection with certain foreign military sales to Taiwan involving RTC products and services. In addition, China has indicated that it decided to sanction our Chairman and Chief Executive Officer Gregory Hayes, in connection with another potential foreign military sale to Taiwan involving RTC products and services. RTC is not aware of any specific sanctions against Mr. Hayes or RTC, or the nature or timing of any future potential sanctions or countermeasures. If China were to impose sanctions or take other regulatory action against RTC, our suppliers, affiliates or partners, it could potentially disrupt our business operations. The impact of potential sanctions or other actions by China cannot be determined at this time. From time to time, our businesses have sold, and are expected to sell in the future, additional defense products to Taiwan, and we are unable to determine the potential impact, if any, of any future sanctions or other actions by China in response to these sales. Moreover, the Chinese government has generally expanded its ability to restrict China-related import, export and investment activities, which may have an adverse impact on our ability to conduct business or sell our commercial aerospace products in China. In addition, in response to the Russian military’s invasion of Ukraine on February 24, 2022, the U.S. government and the governments of various jurisdictions in which we operate, including Canada, the United Kingdom, the European Union, and others, have

imposed broad economic sanctions and export controls targeting specific industries, entities and individuals in Russia. The Russian government has implemented similar counter-sanctions and export controls targeting specific industries, entities and individuals in the U.S. and other jurisdictions in which we operate, including certain members of the Company’s management team and Board of Directors. These government measures, among other limitations, restrict transactions involving various Russian banks and financial institutions and impose enhanced export controls limiting transfers of various goods, software and technologies to and from Russia, including broadened export controls specifically targeting the aerospace sector. These measures have adversely affected and could continue to adversely affect the Company and/or our supply chain, business partners or customers.

Kevin Drum put up a chart of real residential construction v. the inflation adjusted level of other construction. One of his readers was frustrated with his chart so linked to total construction which was up 32% in nominal terms since 2019Q4. Nominal v. real. Ahem. Well the price level rose by 16% over this period so real total construction is still up a lot.

https://fred.stlouisfed.org/series/TTLCONS

Total Construction Spending: Total Construction in the United States

Census data starting in 1993. Back then this spending represented 6.65% of GDP.

Now it represents 7.22% of GDP!