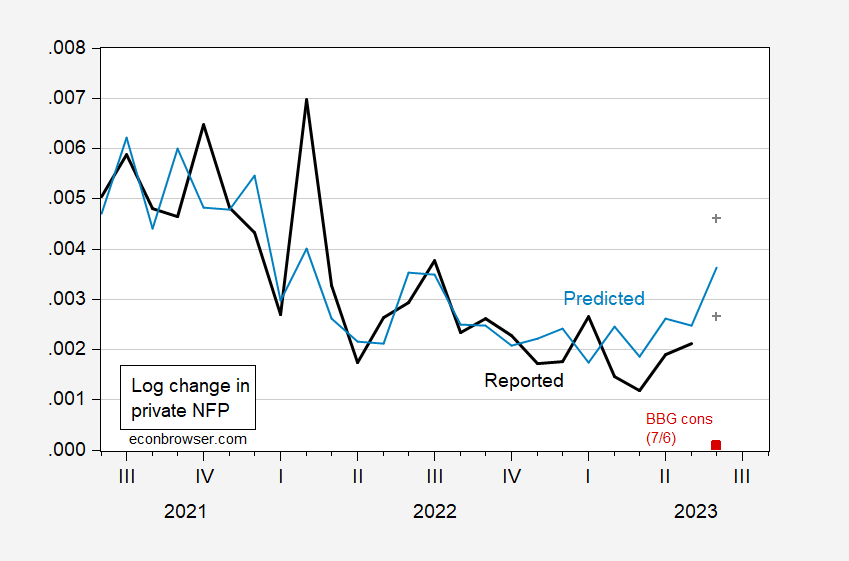

ADP private nonfarm has a blowout upside surprise of +497K vs. consensus +228K. For context, the m/m standard deviation of log first differences is 0.0028, vs. June reading of 0.0039.

Using the correlation between log first differences for BLS nonfarm payroll employment and ADP, I get the following prediction or “nowcast” for the BLS number to be released tomorrow, taken literally, a 486K employment increase (ignoring revisions to previous months):

Figure 1: BLS nonfarm payroll employment series (black), and predicted (light blue), +/- 1 std error (gray +), and Bloomberg consensus of 7/6 (red square), all s.a. Source: BLS, ADP via FRED, Bloomberg and author’s calculations.

I estimate this specification over the 2021M06-2023M05 period :

Δ pnfp_blst = 0.001 + 0.643 Δ pnfp_adpt + ut

Adj. R2 = 0.66 SER = 0.0010, n = 21, DW = 2.24. (Coefficients significant at 5% msl using HAC robust standard errors bold ital.)

Notice a simple autoregression of first differenced private NFP (i.e., an ARIMA(1,1,0) of log NFP) yields a considerably lower adjusted R2 (0.30). Lagged private NFP from BLS does not enter significantly if entered into the above equation.

That being said, the ADP based prediction has outpaced actual BLS changes for the past four months. GS argues that ADP seasonal estimations have distorted that number, and has an estimate for 225K (Bloomberg consensus is 218K for private NFP).

“That being said, the ADP based prediction has outpaced actual BLS changes for the past four months.”

Not to mention that the match betwen ADP and BLS private jobs changes has been a heck of a lot worse in some periods than in the past year or so. Get a load of 2021:

https://fred.stlouisfed.org/graph/?g=16OU4

Maybe GS has found a nut this time.

Maybe they figured in this particular instance there was no predatory treasure to be stolen from their own customers, so this one time GS could tell the truth??

Well, my hobby forecasts are:

200k for NFP and

183k for private employment change.

Can’t get any closer to the experts’ forecasts.

I’ll play along with a guesstimate of 368K.

209 thousand for NFP

https://www.bls.gov/news.release/empsit.nr0.htm

Household survey said 273 thousand

To some extent, future employment gains depend on the supply of a available workers. How many potential employees are out there? Depends on which data series you ask:

Labor force vs labor participation rate tell different, but similar stories:

https://fred.stlouisfed.org/graph/?g=16OZE

Average hourly earnings gains have slowed:

https://fred.stlouisfed.org/graph/?g=16P0a

Employment and unemployment rates both suggest a very limited supply of available workers:

https://fred.stlouisfed.org/graph/?g=16P1i

Tight or very tight are the choices. So a slower pace of hiring or a much slower pace of hiring in coming quarters.

“Average hourly earnings gains have slowed.” That’s a very charitable way of saying it!

In fact, real average hourly earnings are almost exactly where they were back in February, 2000.

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

But I will grant Ducky extra points for actually noticing wages.

I was curious how real GDP compared to the CBO estimate of potential real GDP. It seems the former is 99.2% of the latter which means the output gap is only 0.8%. Not exactly that high with all that fuss over how real GDP growth has been anemic.

One of the latest RECESSION CHEERLEADERS of course has been Jonny boy. Now one would think little Jonny boy to check the data but we all know this chirping troll has no interest in actual economics.