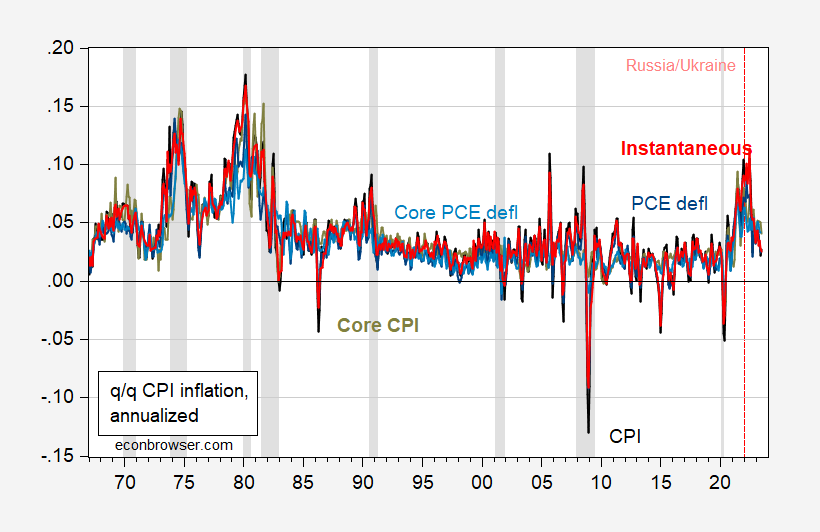

Transitory vs. Persistent: You decide.

Figure 1: Quarter-on-quarter CPI inflation (black), core CPI (chartreuse), PCE deflator (blue), core PCE deflator (light blue), and instantaneous CPI inflation T=12,a=4 (red). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA via FRED, NBER, and author’s calculations.

We had two transitory events one after another. First Covid related supply issues drove up prices, then Russias invasion drove pressures on grain and oil/NG prices. Both issues were substantial and also transitory. Not much the Fed can do about either but their drastic changes in rates could drive us into deflation

Off topic but I have always wondered about measuring a nation’s top trading partner by the sum of imports and exports. Yes we import a lot from China but our exports to China are not as high as our exports to Mexico:

https://www.dallasfed.org/research/economics/2023/0711?stream=business

Mexico seeks to solidify rank as top U.S. trade partner, push further past China

Luis Torres

July 11, 2023

Mexico became the top U.S. trading partner at the beginning of 2023, with total bilateral trade between the two countries totaling $263 billion during the first four months of this year.

Mexico’s emergence followed fractious U.S. relations with China, which had moved past Canada to claim the top trading spot in 2014. The dynamic changed in 2018 when the U.S. imposed tariffs on China’s goods and with subsequent pandemic-era supply-chain disruptions that altered international trade and investment flows worldwide.

Mexico’s gains mirror its rise in manufacturing, a key component of goods moving between it and the U.S. During the first four months of 2023, total trade of manufactured goods between Mexico and the U.S. reached $234.2 billion.

Overall, Mexican imports to the U.S. totaled $157 billion; U.S. exports to Mexico reached $107 billion.

Mexico–U.S. trade during the first four months of 2023 represented 15.4 percent of all the goods exported and imported by the U.S.; the Canada–U.S. share followed at 15.2 percent and then the China–U.S. share at 12.0 percent.

Mexican-American trade policy and acceleration since 1985 and since NAFTA has resulted in continually faltering Mexican growth. Mexican growth has been nearly the poorest in Latin America since 1985 and 1992. Domestic investment in Mexico since 1985 and 1992 has been insufficient and relatively poor in quality.

https://fred.stlouisfed.org/graph/?g=16S27

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1985-2022

(Indexed to 1985)

https://fred.stlouisfed.org/graph/?g=16S2l

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1985-2022

(Indexed to 1985)

Mexican trade after NAFTA has dramatically increased, while Mexican growth has faltered and has been among the poorest in Latin America:

https://fred.stlouisfed.org/graph/?g=16NcB

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2022

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=16NcG

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2022

(Indexed to 1992)

Transitory or persistent ??? Ask Larry Summers, Because…… he’s….. like….. a genius……and stuff.

Whatever Larry says there is a very high probability that the opposite is true.

Summers has turned deficit hawk – ahem. I posted a link to The Atlantic discussion under the post on how hot it has been. Please get your knives out as Summers needs to be taken down.

Real wages 1Q23, $363; 4Q19, $362–transitory or persistent?

https://fred.stlouisfed.org/series/LES1252881600Q

Corporate profit margins 1Q23, 15.7%; 4Q19. 12.5%–transitory or persistent?

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Real weekly wages. Different from real hourly wages when people on average are working fewer hours. But dude – continue with your insistence of sloppy writing.

Wait for it – Jonny boy is about to go off on his patented temper tantrums.

If pgl had bothered to look at the FRED chart, he would have noticed that it dealt with median usual weekly real earnings, which are back almost exactly to where they were in 2019. So pgl, looking at the chart, which shows them rising and then falling since the onset of the pandemic, demonstrate that the trend transitory or persistent? Or maybe, like most corporate friendly, mainstream economist, is it a subject that they would prefer to just NOT discuss?

what is your point Johnny? only a fool would think that the pandemic is not going to impact wages in a dramatic fashion. why would you expect REAL wages to change appreciably over a three year period, if a pandemic were excluded? and did you think pandemic gains should be permanent?

Baffling clearly thinks that real wages should be flat as corporate profit margins spike during a tight labor market!

JohnH

July 14, 2023 at 4:13 am

Baffling clearly thinks that real wages should be flat as corporate profit margins spike during a tight labor market!

What a pathetic reply. Come on Jonny boy. You have the temperament of a spoiled two year old brat. Oh wait – this is how you always reply. Like I said you are nothing more than a dishonest disgusting mental retard.

one would expect profit margins to increase before real wages do. only a foolish businessman would expect real wages to increase before profits increase. Johnny, you seem to think economics works via ideology, and not the real economy. Johnny, I think your economics expectations are foolish.

baffling–do you really think that profit MARGINS should persistently increase over a period of half a century?

And why do you think that real wages should not rise over time in a developed, prosperous economy?

In a democracy, what do you think is the goal of an economy? Benefit a wealthy few or the vast majority?

baffling must really adore Trump, who is a big fan of rising profit margins and reduced pay for workers.

Johnny, i work in a factory making a widget. I work 40 hours a week. My work effort remains constant over a decade. I improve my output over that decade not because i work harder, but the machines i use have been updated to improve efficiency. Justify why my real wages should have increased over that decade? And should the new hire makes less than me for the same work?

Why should my real wages rise simply because of an evolution of time?

Look, i am not against the working class. But arguments are being made to justify pay raises that are not sound. Just because.

Johnny, I am going to follow this up even more. Johnny thinks the workers are entitled to the increased profit share. fine. there exists a model for that in the United States, for a long time. it is a workers cooperative. the workers are also owners, and share the rewards and responsibilities of owning the company. workers and management are basically one and the same. so this option does exist, Johnny. problem is, very few work cooperatives exist. so most workers are CHOOSING not to take on the responsibility of risk and ownership. Johnny can’t seem to accept that the world actually disagrees with him.

Johnny wants to promote a very socialist view of an economy on this site. but he is very dishonest. he points out flaws against capitalism, when he can. but he completely avoids mention of the flaws and failures of the communist, socialist and totalitarian view he wants to “promote”. paid political propaganda from Johnny, as usual.

“it dealt with median usual weekly real earnings”

MY point had to do with weekly v. hourly. Come on Jonny boy – we get your reading skills such but DAMN!

“JohnH

July 14, 2023 at 5:38 pm

baffling–do you really think that profit MARGINS should persistently increase over a period of half a century?”

Could someone please remind this moron what persistently even means? Yes profit margins in 2021 were quite high but anyone who has ever looked at profits over times gets there is a lot of volatility. But not Jonny boy. It’s like Jonny boy took CoRev’s BS on global warming and translated it to this conversation.

1Q23, 15.7%

2022Q3 16.9% so they have already started coming down. BTW Jonny boy told us PepsiCo’s profit margin was higher in 2022 than in 2020 even though Pepsi’s own Annual Reports said just the opposite.

OK – time for Jonny boy’s temper tantrum!

https://www.macrotrends.net/stocks/charts/pep/pepsico/operating-margin

Macrotrends delivers. It reports PepsiCo’s operating margin by quarter. Now Jonny boy kept telling us how this was rising. It seems Jonny boy lied about this – but what’s new?

pgl loves to cite a single company (out of thousands) to “prove” the opposite of BEA data is true!!!

And he surely won’t address the question of whether rising profit margins are transitory or persistent…even though margins have steadily increased since the 1970s!

Obviously pgl is a corporate shill…

Oh brother – it was YOU that brought up PepsiCo not me. Of course you were too stupid to read their actual financials.

But of course a lying weasel like you will do anything but take responsibility for your stupid mistakes. That’s who are – a lying little weasel.

A chartist will claim that 2021 will be the repeat of 1971 unless the Fed raises rates by another 500 bp. We can help some of those people–like the genius Larry Summers– buy a time machine so that they can go back to that decade. I was born then, but I’m glad I didn’t spend much time in it.

The price of gas around here hasn’t budged in a few months. And, I passed a Rivian pickup truck on the highway yesterday.