From the advance release:

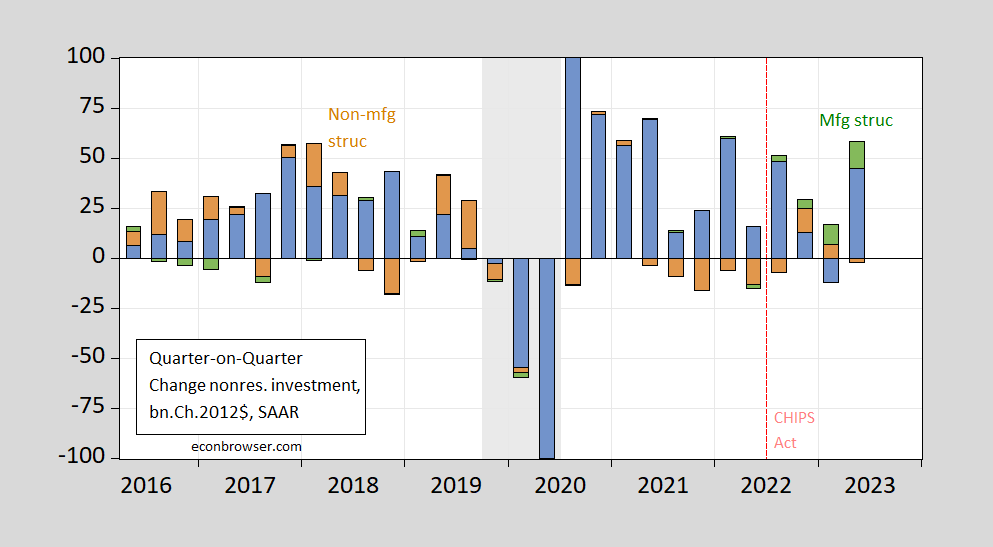

Figure 1: Quarter on quarter change in nonresidential investment ex-structures (blue bar), nonresidential structures ex-manufacturing structures (tan bar), and manufacturing structures (green bar), in bn.2012$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2023Q2 advance, Table 5.4.6U, NBER, and author’s calculations.

Nonresidential structures investment growth accounted for 0.2ppts of Q2 growth (SAAR).

Didn’t Republicans justify that 2017 tax cut for rich people telling us it would lead to a Structures Investment Boom? I don’t see it – do you?

In fact, we had a bust during the pandemic but the 2021 recovery reversed that. And of course the Chips Act has led to this promised Structures Investment Boom.

Looks like its related to Russia’s invasion of Ukraine to me (like so many other changes in the economy!)

I guess Jonny boy thinks the US is investing in domestic manufacturing capacity to assist Jonny boy in taking delight in the suffering of innocent Ukrainians. Could you be more STOOPID? Oh wait – you can and you will. Duh!

[I guess Jonny boy thinks the US is…]

[I guess Jonny boy thinks the US is…]

[I guess Jonny boy thinks the US is…]

The standard introduction from pgl’s random insult generator to a whole load of BS. pgl is clueless as to what I think, and he’s delighted to let you know how clueless he is.

It actually makes sense that the US would ramp up military manufacturing capabilities in time of war, but don’t pgl that!

You serve up the stupidity – I shoot it down. Grown up little boy.

“It actually makes sense that the US would ramp up military manufacturing capabilities” Seriously?

Now this is Deloitte US and not Deloitte Hungary so maybe the authors have more credibility than your BFF Princeton Steve:

https://www2.deloitte.com/us/en/insights/economy/spotlight/investment-in-business-structures.html

The six major categories of nonresidential investment in structures are commercial, health care, manufacturing, power and communication, mining exploration, and “other.”

Huh – no mention of “military”. Yea – Jonny boy does what he does best – LIE.

Here we go again, with a style of response that JohnH makes that is VERY similar to ltr’s style of responding. Am I the ONLY person who thinks ltr and JohnH are the same person?? Really?!?!?!?

Moses Herzog: ltr seems to be able to link to FRED series competently, and understand their nature. JohnH on the other hand seems incapable of linking to correct series, and understanding them. He/she often also thinks series that exist do not exist. So, no, I don’t think they are the same person.

Or…and I realize this is far-fetched…the jump in spending on non-residential structures could be the effect of the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), which together provide about $1.25 trillion in federal money for infrastructure, and the CHIPS Act, which provides $50 billion in support for domestic microchip production.

Paging “New Deal Democrat”. Paging “New Deal Democrat”. We need an update on your best date for USA patient’s hospital admittance. Tested for blood you said was in patient’s stool. Turns out it was just cranberries.

It seems Jonny boy’s comment on how China does not have that much foreign debt has disappeared which is a good thing I guess since Jonny boy once again has decided to rely on incomplete and misleading information. Here is how the adults do this for the US:

https://www.bea.gov/data/intl-trade-investment/international-investment-position

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was –$16.75 trillion at the end of first quarter of 2023, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $32.74 trillion, and liabilities were $49.49 trillion.

And yet we have a positive net income from abroad position. How can this be? Jonny boy has no idea even though the Dark Matter literature dates back to 2006.

China has a positive net international investment position but its net income from abroad. I’ve in the past posted something called Dark Anti-matter to note and hopefully explain this. Of course this is way above Jonny boy’s pay grade so do not expect this clown to provide updated information.

But maybe Dr. Chinn has something useful here for China’s situation.

I wrote this back in 2015:

https://econospeak.blogspot.com/2015/05/chinas-dark-anti-matter.html

China’s Dark Anti-Matter?

It plays on the US issue known as Dark Matter which I linked to. I mention this in light of JohnH’s pathetic little excuse of him trying to school Macroduck. OK Jonny boy’s comments are always rather juvenile and uninformed so I expect nothing from this worthless clown. But if the adults here have something useful for an update – please let us know.

Dark matter is what’s between pgl’s ears.

Yea – I knew you would never understand it. You never do.

Maybe I have to draw this in the sandbox for little Jonny boy:

“So China’s holding of foreign assets are $4 trillion but receive a 2.8% return while foreign holdings of Chinese assets are $2 trillion but receive a 5.7% return.”

Paying more on liabilities than receiving on assets. Where have we seen this before? Oh yea – those banks that went under. Jonny boy goes bananas when banks do this but when the PRC does the same – he thinks Xi is grand. OK, OK – we know this is way over your pea brain so all’s good.

There’s an interesting discussion of Chinese domestic debt partway through this article: https://www.salon.com/2023/07/30/chinas-great-leap-backward-so-much-for-the-next-dominant-superpower/

TL;DR – things don’t look good for China.

One would think Xi’s agents (ltr and JohnH) would go after this analysis. Only problem is this is economics and little Jonny boy has no clue what it means.

One would think Xi’s agents (— and —–) would go after this analysis.

One would think Xi’s agents (— and —–) would go after this analysis.

One would think Xi’s agents (— and —–) would go after this analysis.

[ Notice the racism and of course the falseness, since racism is always falseness. ]

Dean Baker’s take on US climate policy: “The Chinese need to stay poor because the United States has done so much to destroy the planet.

That line is effectively the conventional wisdom among people in policy circles. If that seems absurd, then you need to think more about how many politicians and intellectual types are approaching climate change.”

https://rwer.wordpress.com/2023/07/31/the-chinese-need-to-stay-poor-because-the-united-states-has-done-so-much-to-destroy-the-planet/

Thank you, John, for this critically important reference:

https://cepr.net/the-chinese-need-to-stay-poor-because-the-united-states-has-done-so-much-to-destroy-the-planet/

July 21, 2023

The Chinese Need To Stay Poor Because the United States Has Done So Much To Destroy the Planet

By DEAN BAKER

Some more facts: https://ourworldindata.org/grapher/per-capita-ghg-emissions?tab=table

U.S. greenhouse gas emissions have been declining, albeit slowly, since roughly 2000, on an absolute as well as per capita basis – falling about 23% per capita from 2000 to just before the pandemic hit. We are not the worst in the world per capita by any means, Australia and Canada are higher, as are several of the oil states, Turkmenistan, etc. Russia is only about 5% below us per capita. (All numbers are CO2 – equivalent numbers, so methane counts for way more than CO2.)

Emissions per “unit” of GDP stack very heavily in favor of the U.S., which produces about $4,550 per metric ton of CO2-equivalent, whereas China produces about $1,420 per metric ton of CO-2 equivalent. So, by being efficient, China could both *decrease* CO2 emissions and greatly *increase* per-capita GDP. Another way of looking at is that China could more than *triple* per-capita GDP with no CO2 emissions increase if it could duplicate U.S. efficiency, but can only increase per-capita GDP by about 80% by ramping up emissions to U.S. levels.

‘This complaint against China hinges on two sorts of arguments that would be dismissed as nonsense if they were used against the United States.

Population size doesn’t matter. We care about how much China is emitting on the whole, not per person.

Levels don’t matter, we only care about rates of change.’

Dean is right. Both claims are nonsense. Funny thing – a lot of the babble Jonny boy writes about hinges on one of these arguments if not both.

https://www.worldometers.info/coal/coal-consumption-by-country/

A follow-up. China consumes 5.9 times as much coal as the US. But let’s do this in per capita terms as China’s population is 4 times that of the US.

Oh wait – Chinese coal consumption per capita is still much higher than that of the US!

Thanks for posting Menzie – in between the latest Trump rant on Pravda Social, House GOP investigating UFOs and MGT flashing explicit photos of a private citizen in Congress, it is difficult to find reports that Biden admin is working for all of us and trying to address real world issues – like investing in renewable energy https://apnews.com/article/biden-unions-ai-clean-energy-strikes-4d00b53cd5bfeac09dfcea3218430353

https://www.msn.com/en-us/money/companies/tesla-dominance-pushes-major-carmaker-to-exit-electric-vehicles/ar-AA1eyZnK?ocid=msedgdhp&pc=U531&cvid=b004fa7ab63a4918a87f58e8d10e1f7e&ei=10

One account of how various competitors are faring in the EV market.

Greed inflation? Someone is suggesting this is nonsense:

https://www.economist.com/leaders/2023/07/06/greedflation-is-a-nonsense-idea

Inflation is high, and the search is on for the culprit. The latest in the frame in Europe is profiteering businesses. The idea that greedy companies were to blame has taken a knock in America, where corporate profits are falling even as consumer prices continue to rise too fast. But that has not stopped the notion taking hold across the Atlantic. The imf has found that higher profits “account for almost half the increase” in the euro zone’s inflation and Christine Lagarde, the president of the European Central Bank, has at times seemed sympathetic to the argument. In Britain the government has asked regulators to look for evidence of price gouging; on July 3rd the competition watchdog added fuel to the fire with a finding that supermarkets had increased their margins on petrol between 2019 and 2022. The “greedflation” thesis is in part a reaction against another common explanation for inflation: that it is driven by fast-growing wages. Central bankers live in fear of wage-price spirals. Last year Andrew Bailey, governor of the Bank of England, asked workers to “think and reflect” before asking for pay rises. The remark was incendiary because the inflation that has troubled the rich world since 2021 has largely left workers worse off. Wages have not driven prices up but lagged behind them.

OK enough from the UK version of Times Magazine. I mention this fluff in part because whoever wrote this is saying profits are coming down. And our host has suggested the same thing. As far as Andrew Bailey – he needs to stay away from the union house for his own safety.

Anchor Brewery is my favorite microbrew:

https://www.msn.com/en-us/money/companies/america-s-oldest-craft-brewer-has-shut-down-after-127-years-here-s-how-it-could-be-saved/ar-AA1eBiUp?ocid=msedgdhp&pc=U531&cvid=b4fdbaff359b48ae9c869306dc65d464&ei=7

Please tell me this will not close.

“The brewery employee group, represented by Warehouse Union Local 6 ILWU, wants to buy Anchor and run it as a worker co-op.”

Grand idea!