CBO above market?

The CBO’s July 2023 update provided an updated projection of 10 year Treasury yields that was both higher and lower than that from February. Both were higher than corresponding consensus views of economists.

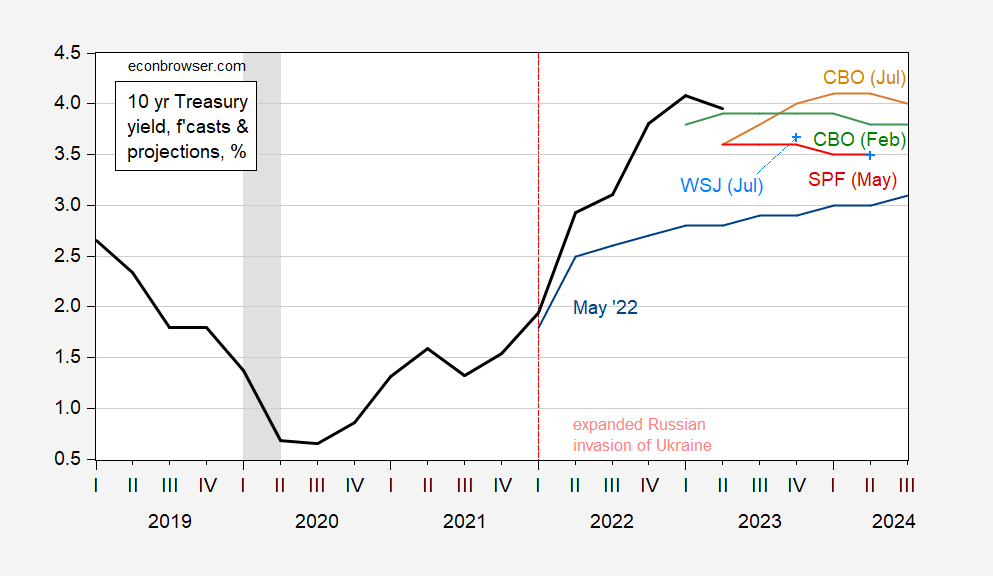

Figure 1: Ten year Treasury yield (bold black), CBO projection from July 2023 (tan), from February 2023 (green), from May 2022 (blue), mean forecast from May 2023 Survey of Professional Forecasters (red), and from July 2023 WSJ Survey for end-of-quarter (sky blue +), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, CBO, Philadelphia Fed, WSJ, NBER.

CBO projections in May 2022 were for a rapid increase in the wake of the expanded Russian invasion of Ukraine. February projections were for a plateau, while the most recent indicates a peak at higher levels, and then decline. May and July private consensus are for a 10 year yield over half a percentage point lower than CBO’s estimate.

Over the 1983-2018 period, the average error for the CBO (Blue Chip) forecasts of the 10 year yield is 0.9 ppts (1.0 ppts), while the RMSE is 1.2 ppts (1.2 ppts) (see CBO (2023)). Hence, it’s not clear there is reason to think one is more accurate than the other, on the basis of the historical record.

I should check our wildman at Doubleline and see what he’s saying about rates. Some of his firm’s documents and projections are more difficult to get a hold of (or as Okies say “aholt of”) than in the past but I seem to recall his CNBC interviews etc he usually tips the direction of where he sees them going. If nothing else, worth comparing the differences.

NY Times has an interesting piece on the Russian economy, something that hasn’t been talked about much lately.

“The strong growth figures have upended expectations among some Western officials that the aftershock of going to war would push Russia into a prolonged recession and trigger a popular backlash against Mr. Putin’s government.”

https://www.nytimes.com/2023/07/31/world/europe/russia-war-economy.html

IMF forecast: 1.5% real GDP growth

https://www.imf.org/en/Countries/RUS

Inflation: 3.2%

https://tradingeconomics.com/russia/inflation-cpi

Real wages: 10.8%

https://tradingeconomics.com/russia/wage-growth

Reality intervenes to disprove the hubris and bravado of lousy Western economic forecasts of a year ago.

The article makes clear that Russia’s economic performance since Russia invaded Ukraine is the result of a choice to emoy risky fiscal policy – guns and butter in an economy which has had its share of debt troubles in the past. You conveniently left that out.

Forecasts are built in assumptions. Forecasters assumed a more cautious fiscal policy than Putin has chosen.

I assume that, if Putin’s fiscal gamble leads to a debt-driven recession or financial crisis, you’ll acknowledge that you, and Putin, we’re grievously mistaken.

And, by the way, product growth is a critical issue when assessing the risks of Putin’s guns-and-butter gamble. Recent productivity data suggest the risk is high:

https://www.ceicdata.com/en/indicator/russia/labour-productivity-growth

Ya see, Johnny, this is why just cutting and pasting links to headlines which flatter your bias is so lame; the text itself may not be what you imagined. Of course, running through the economics of a situation might save you embarrassment, if you can manage it.

“guns and butter in an economy which has had its share of debt troubles in the past. You conveniently left that out.”

Jonny boy has a habit of misrepresenting his own links. BTW – Jonny boy criticized the US for the same thing. The poor boy thinks he invented “guns and butter”. Yea – he is that clueless.

View Russia’s Labour Productivity Growth from Mar 1996 to Mar 2023 in the chart:

Now that is an interesting chart!

I was modestly chagrined withnoah’ pinion advocating more $$ for the military industry congress complex….

something about winning a sea war 5000 miles west of San Francisco Bay.

of course everyone knows to avoid a land war in Asia above the 38 parallel,

and above Haiphong harbor

https://www.noahpinion.blog/p/uh-guys-we-really-should-think-about

July 29, 2023

Uh, guys, we really should think about spending more on defense

That’s not a message many people want to hear, but it’s true.

By NOAH SMITH

“Basically, the report says that the U.S. military’s technological superiority has mostly eroded, and to address that, we need to shift from projecting power to defending against attacks by other powers (i.e. China).”

Are you promoting China bashing? I ask because that seems to be what Noah is peddling.

Under another post where you warned us of Noah’s latest, I decided to bash the underlying premise of this incredibly misleading post.

Jonny boy apparently failed to read the entire article:

The economic high may not be sustainable. The expansion of spending and the decline of Russia’s oil and gas revenues have pushed the nation’s budget into deficit. In the first five months of the year, Russia’s federal government spent in nominal terms nearly 50 percent more than in the same period of 2021, according to calculations by the Moscow-based Gaidar Economic Institute. The country’s energy revenues from January to May have halved compared to the same period last year, as sanctions forced Russia to sell its oil at a discount and European nations slashed purchases of Russian natural gas. The recovery is also severely constrained by Russia’s chronic worker shortage, a problem that Mr. Putin has few means of solving. Mr. Putin’s decision to mobilize 300,000 men for the front has removed many blue-collar workers from the economy. Hundreds of thousands of predominantly white-collar Russians have left the country in protest of the war or to avoid mobilization. And even before the war, the population was in a long-term decline. Despite the rising wages, Russia has been unable to cover the worker shortage with migrants, as sanctions have reduced their ability to send earnings home. In announcing the recent rate hike, Elvira Nabiullina, the central bank governor, repeatedly mentioned labor shortages in guarded remarks to the press, a sign of her concern with the scale of the problem. She also said the demand for goods and services was outstripping supply, feeding inflation and threatening financial stability. “As an economist, I don’t know how this bubble can be deflated,” said Alexandra Prokopenko, a researcher at the Carnegie Russia Eurasia Center in Berlin, and a former adviser at the Russian central bank. “One day it could all crash like a house of cards.”

Russia Real Wage Growth

If one takes this chart back to early 2022, it suggests a net decrease. This reminds me of how you LIED about UK real wages under Cameron. You kept hyping data for the last year ignoring the huge drop that preceded that.

You are indeed the most dishonest troll God ever created.

“Extensive Western sanctions imposed in response to Moscow’s actions in Ukraine resulted in a 7.2% decline in real wages during April 2022.”

Jonny boy failed to mention that his little link had this line. Yea – Jonny boy has the integrity of Donald Trump.

The NYTimes ran this a few days ago. Now ‘you forgot to mention this story:

Russia Raises Interest Rates, Trying to Cool Wartime Economy {Russian inflation at 60%, thanks to the ruble’s freefall}

New York Times ^ | 21st July 2023 | Neil MacFarquhar and Anatoly Kurmanaev

Moscow took sharp action on Friday to curb inflation, fearing the effects of ever higher spending on the war in Ukraine and of a weakening Russian ruble. Russia’s central bank took the unexpected step of raising its benchmark interest rate by a full percentage point, to 8.5 percent from 7.5 percent. It was the first large hike in more than a year, and the bank warned that further increases were likely. “It is a surprise and on its face reflects more concern at the central bank about inflation and how the economy is doing than we had appreciated,” said Robert Kahn, the head of the Geoeconomics Team at the Eurasia Group, a New York-based risk analysis firm. “It suggests that the war is proving increasingly disruptive to economic activity and pushing up inflationary pressures.” Elvira Nabiullina, the central bank governor, only made oblique references to the war in announcing the increase. “Companies cannot immediately open new production lines and find the additional work force for them,” she said. “When demand begins to consistently surpass the ability to increase supply, prices invariably grow.”

Now some might wonder why Putin’s pet poodle forgot to mention this NYTimes story. But I get it – if you were remotely honest, the Kremlin would cut off your dog food.

https://econbrowser.com/archives/2023/07/structures-investment-booms-esp-in-manufacturing#comment-302502

July 31, 2023

One would think Xi’s agents (— and —–) would go after this analysis.

One would think Xi’s agents (— and —–) would go after this analysis.

One would think Xi’s agents (— and —–) would go after this analysis.

[ Of course, I made no comment at all, but notice the racism and falseness.

Notice the racism and, of course, the falseness, since racism is always falseness. ]

Well this must be embarrassing. ltr, in one of her many, many, “China good, U.S. bad!” comments, wrote this:

ltr

July 11, 2023 at 11:05 am

Here is precisely the sort of problem China has been investing in, both through a comprehensive weather satellite program and Artificial Intelligence compilation:

https://www.nytimes.com/2023/07/11/climate/climate-change-floods-preparedness.html

July 11, 2023

Vermont Floods Show Limits of America’s Efforts to Adapt to Climate Change…

Notice the racism and, of course, the falseness.

If China’s “comprehensive weather satellite program and Artificial Intelligence compilation” are soooo much more effective than what Vermont is up to, why is much of Beijing under water?:

https://www.reuters.com/world/china/typhoon-doksuri-thousands-flee-their-homes-heavy-rain-lashes-beijing-2023-07-31/

Xi’s “competent autocrat” shtick must be wearing thin, huh?

Oh, and the BBC is reporting that Uyghurs living in the UK face pressure from China to spy on fellow expatriates. China threatens family members still in China to compel compliance from Uyghurs overseas. Now theres some racism.

Ducky notes that “Russia’s economic performance since Russia invaded Ukraine is the result of a choice to emoy risky fiscal policy – guns and butter in an economy which has had its share of debt troubles in the past.”

Of course, he conveniently leaves out the fact that both government debt and external debt amount to only about 17% of GDP. It also ignores the Sovereign Wealth Fund, which currently amounts to more than 8% of GDP.

https://www.ceicdata.com/en/indicator/russia/external-debt–of-nominal-gdp

https://tradingeconomics.com/russia/government-debt-to-gdp

Ducky also claims that “Forecasters assumed a more cautious fiscal policy than Putin has chosen.” The question is “Why did they make such an assumption?” Wishful thinking, virtue signaling their patriotism, political expediency to be in synch with US propaganda?

Of course, most Western economists also overlooked the possibility that “when applied to a large, resource-rich, technically-proficient economy, after a period of shock and adjustments, sanctions are isomorphic to a strict policy of trade protection, industrial policy, and capital controls success in other countries. They are policies that the Russian government could not plausibly have implemented, even in 2022, on its own initiative. Their success or failure in Russia will be determined over time. However, strong claims for the effectiveness of sanctions in this case, so far, do not appear warranted.” https://www.ineteconomics.org/perspectives/blog/the-effect-of-sanctions-on-russia-a-skeptical-view

By imposing sanctions that are isomorphic to a strict policy of trade protection, industrial policy, and capital controls, did Biden grant Putin a huge gift? Instead of weakening Russia, will Biden’s policies actually make Russia stronger? [US foreign policy has this strange habit of shooting itself in the foot!)

Poor Johnny. He can’t do economics, so he has to fall back on putting thoughts in other people’s heads. Here’s the latest example:

“The question is “Why did they make such an assumption?” Wishful thinking, virtue signaling their patriotism, political expediency to be in synch with US propaganda?”

Johnny has no knowledge, so he relies on innuendo (the rhetorical ploy, not the Italian suppository).

Johnny is a bought-and-paid-for hack. He’ll say anything, no matter how dishonest, and when called on it, he usually doubles down, as he has done here.

I don’t know why the (hypothetical) economists in question made the assumptions they made. Neither does Johnny. Johnny simply pretends he does. But I will say that assuming a sustainable policy set is common practice; it doesn’t imy the bias that Johnny relies on to make his argument.

I challenged little Jonny boy to go beyond his external debt nonsense and look at things like net foreign assets as well as the net income from abroad that is generated by the components of this balance sheet concept. He hasn’t in part because little Jonny boy has no effing clue what any of this means.

You are still pushing this external debt silliness? Can you even bother to check on the net foreign assets for once in your incompetent life? Damn!

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

July 27, 2023

Defense spending was 55.6% of federal government consumption and investment in April through June 2023. *

$970.7 / $1,747.2 = 55.6%

Defense spending was 20.8% of all government consumption and investment in April through June 2023.

$970.7 / $4,684.1 = 20.7%

Defense spending was 3.6% of GDP in April through June 2023.

$970.7 / $26,835.0 = 3.6%

* Billions of dollars

None of this has a thing to do with this issue. Please stop.

Bernie Sanders: “The Pentagon doesn’t need $886bn. I oppose this bloated defense budget…As a nation, the time is long overdue for fundamental changes to our national priorities”…climate change…health care…education…etc., etc.

https://www.theguardian.com/commentisfree/2023/jul/24/the-pentagon-doesnt-need-886bn-i-oppose-this-bloated-defense-budget

The WSJ wants you to know DeSantis wants us to be tough on China but it was his criticism of the FED that had me on the floor laughing:

https://www.wsj.com/articles/desantis-calls-for-ending-normal-trade-ties-with-china-26417f12?st=oeawgkv4rrl9sr5&reflink=desktopwebshare_permalink

DeSantis has increasingly criticized the Federal Reserve and its chairman, Jerome Powell, accusing it of fueling inflation by printing trillions of dollars and saying it accepted Biden administration claims that price pressures were transitory. Interest-rate hikes, he has said, have hurt average Americans. Last week, the Fed resumed interest-rate increases, bringing them to a 22-year high. Inflation has retreated from a 40-year high hit last summer, with the consumer-price index climbing 3% in June from a year earlier. That is well below the June 2022 peak of 9.1%, when gasoline prices reached a U.S. record average of $5 a gallon. Still, absent falling pump prices, core inflation remains at 4.8%.

DeSantis will appoint a Fed chairman who will focus on maintaining a stable dollar, according to his proposal. “The Fed must focus on stable prices; it is not a social engineer and cannot be allowed to be an unaccountable economic central planner,” the plan says.

OK DeSantis is a gold bug. But he also opposed the FED raising interest rates to curb inflation? What did he expect – the Turkish idea of lowering interest rates when inflation was high?

DeSantis is also floundering, and needs new new shouting points to have a chance of political survival. Signaling to Fed haters isn’t, in itself, a sign of desperation, but in context? Desperate. DeSantis is also going g to run out of money if he doesn’t find a new batch of donors. Fed haters are probably a good source of contributions. Just look at the Paul family’s staying power.