From Cleveland Fed; and compared to Bloomberg consensus.

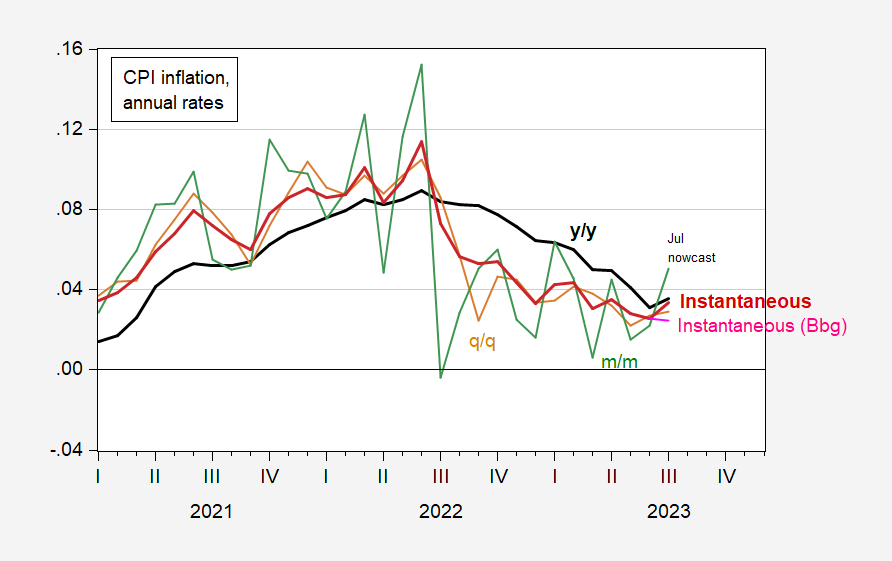

Figure 1: Annualized CPI inflation, year-on-year (bold black), quarter-on-quarter (tan), month-on-month (green), instantaneous per Eeckhout, T=12, a=4 (bold red) and instantaneous using Bloomberg consensus. Source: BLS, Cleveland Fed (accessed 8/9/2023), Bloomberg, and author’s calculations.

Note that year-on-year CPI inflation will have a bump up if Cleveland Fed’s nowcast of 0.4% m/m headline inflation proves right. So too will instantaneous (3.5% annual rate). However, the Bloomberg consensus is for 0.2%, which means in a slightly declining instantaneous inflation rate (2.4% annual rate).

“Note that year-on-year CPI inflation will have a bump up if Cleveland Fed’s nowcast of 0.4% m/m headline inflation proves right. So too will instantaneous (3.5% annual rate). However, the Bloomberg consensus is for 0.2%, which means in a slightly declining instantaneous inflation rate (2.4% annual rate).”

Inflation has been running at something near 3%? I’m confused – we were told by the world renowned economic forecaster JohnH that inflation would be 6%. And of course Jonny boy is never wrong.

Looks like energy accounts for some of the expected rise in headline CPI, whether from BBG or the Cleveland Fed:

https://fred.stlouisfed.org/graph/?g=17HTL

We might want to keep an eye on core CPI and Sticky CPI(s), which have lately been tame:

https://fred.stlouisfed.org/graph/?g=17HTD

To repeat myself, the Fed’s rhetoric suggests more hikes than does money market pricing. That’s probably a formula for asset price volatility if CPI (especially core and sticky measures) come in high. Not so much if they come in low, maybe.

Thursday’s July number will replace the July 2022 number of 0.0 in the annual inflation calculation. So if Thursday’s number is 0.2, expect a 0.2 up tick in the headline annual inflation number.

Be prepared for all the doom-saying which is almost guaranteed for those who don’t understand elementary arithmetic. However 0.2 is a perfectly reasonable number in line with an eventual 2% inflation rate.

Pretty good. Joseph, you’re an underrated commenter here. Because you’re a “quiet” “subdued” man. “Don’t say something unless you have something to contribute” You remind me of my ex~GF who was reserved in her comments (even at a table with her parents and me). When you type or speak, it should affect things in a positive way/

i.e. I love you man