Reader Econned, in response to my posting of pictures of M2 divided by real GDP, and the GDP deflator, castigates me for the use of conventional monetary aggregates:

M2? This is a pitifully disingenuous post – those who see value in QTM use a divisia index as the monetary aggregate. And you know this.

I am aware of the theoretical bases for the use of divisia monetary measures. I am, however, unaware that use of these measures validates in a robust fashion the quantity theory of money.

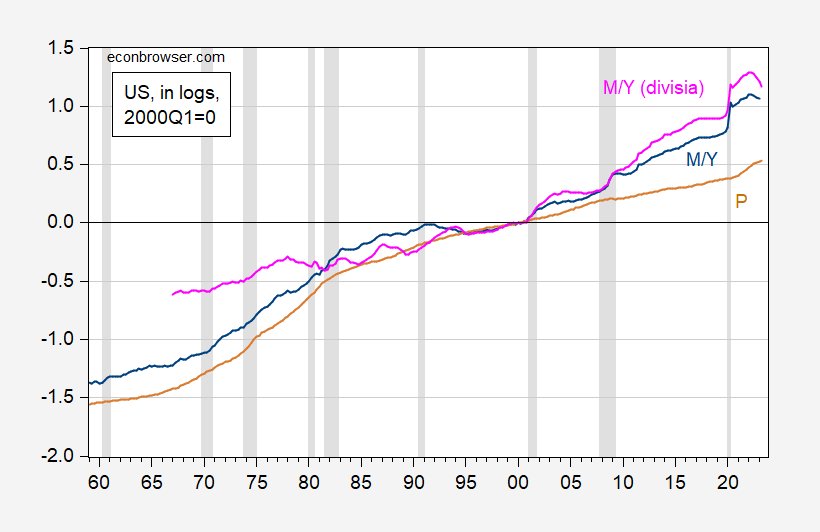

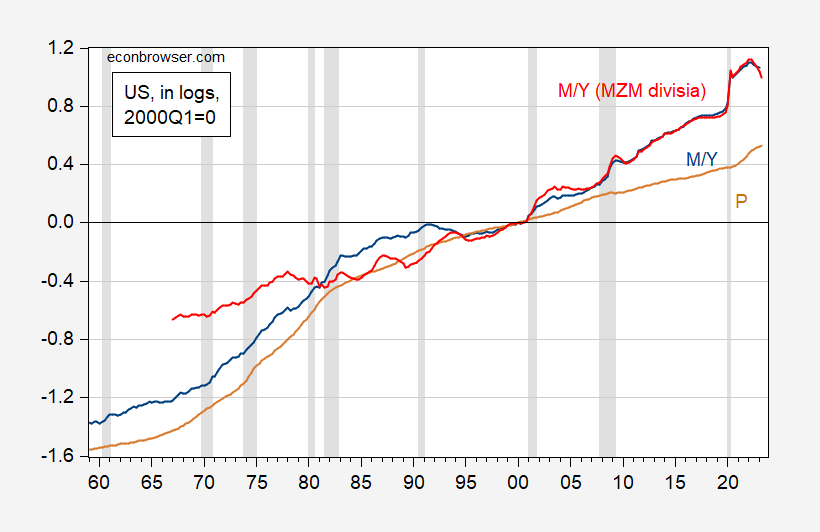

I reprise Figure 1 from the allegedly offending post, adding in M2M and MZM (Figures 1 and 2, respectively).

Figure 1: Log M2 divided by real GDP (blue), log GDP deflator (tan), log M2M divisia (pink), all 2000Q1=0. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Federal Reserve Board via FRED, Center for Financial Stabiity, NBER, and author’s calculations.

Figure 2: Log M2 divided by real GDP (blue), log GDP deflator (tan), log MZM divisia (red), all 2000Q1=0. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Federal Reserve Board via FRED, Center for Financial Stabiity, NBER, and author’s calculations.

Now, it is true that if one uses MZM or M2M instead of M2 in a maximum likelihood estimation of the cointegrating vector over the 1968-2023 period, one can find a bit more evidence for cointegration (reject at 10% msl using trace and max eigenvalue tests, asymptotic critical values, and allowing for intercept in cointegrating vector and VAR), but the price coefficient has the wrong sign. So, I’m happy to use the divisia indices instead of conventional, but I’m not sure you resurrect the empirical version of the quantity theory by doing so.

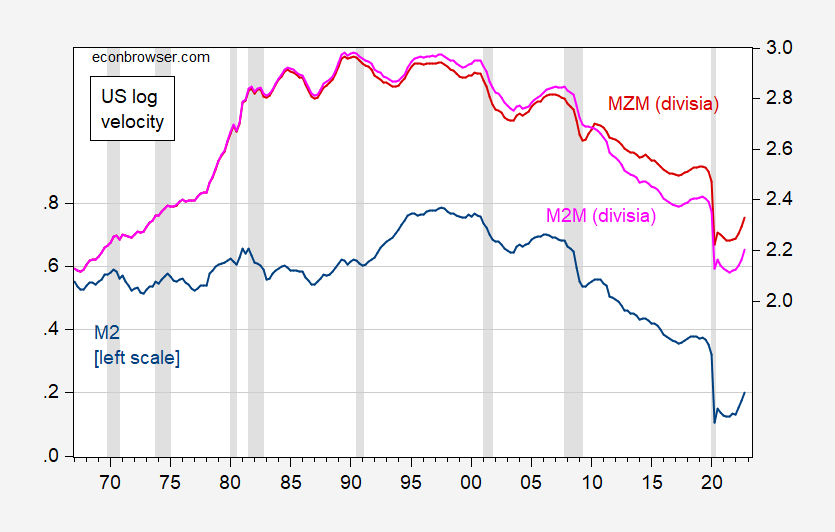

For completeness’s sake, I plot velocity for M2 (blue), MZM (red), and M2M (pink).

Figure 3: Log nominal GDP divided by M2 (blue, left scale), divided by M2M divisia (pink), divided by by MZM divisia (red), all 2000Q1=0. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Federal Reserve Board via FRED, Center for Financial Stabiity, NBER, and author’s calculations.

So Econned subscribes to the “Go Fishing” approach to econometrics. If this series fails to validate my discredited little excuse of a theory, cook up another series. And if that does not work, cook up another series.

BTW “Go Fishing” as a statistical tool was an incredibly delicious comment on the state of pseudo economics that one of my better students quipped after we got to endure Ed Leamer’s Let’s Take the Con out of Econometrics.

Obviously Econned is all about putting the Con back into Econometrics!

Menzie Chinn,

Barnett, et al. (2022)

Bordo, et al. (2023)

Econned: Well, these are not addressing exactly the same question. Barnett et al. (2022) look at money demand equations; there you’re imposing a unit coefficient on price, i.e., homogeneity. In Bordo et al. (2023), he’s looking at velocity, so once again imposing some unit coefficients — and looking at very broad measures of “money”. Sure, I’ll grant you looking at an aggregate that has Treasurys in it will behave differently than one that doesn’t.

By the way, in the Barnett et al. paper, cointegration is found using both conventional and divisia indices.

Econned once again is incapable of providing a title or a link so permit me to do so:

https://www.hoover.org/sites/default/files/research/docs/23109-Bordo-Duca.pdf

Money Matters: Broad Divisia Money and the Recovery of Nominal GDP from the COVID-19 Recession

Michael D. Bordo and John V. Duca

Economics Working Paper 23109

May 19, 2023

OK boys and girls – you can read this Hoover quality for yourself. BTW Bordo has a history of trying to defend this pseudo-economics.

Menzie Chinn,

Also see the following recent blog post & comment section.

https://www.econlib.org/new-inflation-numbers-are-a-huge-win-for-the-quantity-theory/

Cameron Harwick? Still taking classes at NYU while being an adjunct professor at George Mason. Seriously dude – find someone with more credentials than your worthless knowledge of actual economics.

and the professional jealousy of econned shines through once again. econned, don’t try to project your own personal and professional failures onto others. it is unbecoming. here’s a little cheese for your whine….

@ Stalker

Don’t you know that Scorpio lost all of his battles with Callahan?? Come on dude, take that ugly tape off your nose and get a real hobby.

Ehh-Conned anybody?

No I didn’t think so. There are a few micro brains in the comment sections here – but most can recognize dishonest arguments and moving the goalpost silliness.

I had to be annoying, especially when I don’t have the time to check it myself, but it is usually recommenddd with divisia to use the broadest measure of money possible. I think on that CFS site M4 including treasuries is the broadest.

Let’s recall that Stalkerconned made a claim about what some poorly defined group of people thinks:

“…those who see value in QTM use a divisia index as the monetary aggregate.”

Not some specific group of academic economists. Not people who publish in or subscribe to a particular monetary journal. Just “those who see value in”. Unfalsifiable. Vague.

I once worked with a fellow who claimed to be one of the two remaining “practicing” moerarists, and he never mentioned divisia money measures. I’ve read hundreds, perhaps thousands of claims for quantity theory which used M2, M3, MZM and such as their M in employing QTM. So this “those who see value in” QTM is demonstrably wrong. I doubt such an odd construction as “see value in” just tumbled out of Stalkerconned’s brain. That sort of strained use of language is often intentional, used to provide weasel room.

What we know is that QTM is not useful, no matter how strenuously one manipulates the M measure. What we know is that Stalkerconned didn’t provide evidence for his claim about “those who see value in”. What we know is that Stalkerconned is a stalker.