Today we are fortunate to present a guest post written by Natasha Che, Alexander Copestake and Davide Furceri (all at the International Monetary Fund) and Tammaro Terracciano (IESE Business School, Barcelona). The views expressed in this paper are those of the authors and not necessarily those of the institutions with which they are affiliated.

Crypto assets vary substantially in their design and value proposition—from an inflation hedge to a provider of more efficient payments, censorship-resistant computing or property rights—yet their prices have moved in common cycles. Periods of exponential returns have attracted retail and institutional investors alike, while subsequent crashes have drawn increasing attention from politicians and regulators. And fluctuations in crypto markets may also be increasingly synchronized with other asset classes: prior to 2020, Bitcoin provided a partial hedge against market risk, yet it has since become increasingly correlated with the S&P500 (Adrian, Iyer, and Qureshi, 2022).

In a new paper, we shed light on the drivers of crypto asset prices by answering the following questions. To what extent is there a common cycle across crypto assets? Are crypto markets becoming more synchronized with global equity markets? If so, why? Given that US monetary policy has been identified as a key driver of the global financial cycle (Miranda-Agrippino and Rey, 2020), does US monetary policy influence the crypto cycle to a similar extent? If so, through which channels?

We begin by using a dynamic factor model to identify a single dominant trend in crypto-asset prices. Using a panel of daily prices for several of the longest-lived tokens, which together account for approximately 75% of total crypto market capitalization, we decompose their variation into asset-specific idiosyncratic disturbances and a common component. We find that the resulting “crypto factor” explains approximately 80% of the variance in the crypto price data.

We then study the relationship of this crypto factor to a set of global equity factors, constructed using the equity indices of the largest countries by GDP (in the spirit of Rey, 2013; Miranda-Agrippino and Rey, 2020). We find a positive correlation over the entire sample, driven by a particularly strong correlation since 2020. The increasing co-movement is not limited to Bitcoin vis-a-vis the S&P500, but pertains more broadly to the crypto and global equity factors. Disaggregating across equity markets, we find that the crypto factor correlates most strongly with the global tech factor and the small-cap factor since 2020, while it is interestingly less correlated with the global financial factor.

The increased correlation between crypto and equities coincides with the growth in the participation of institutional investors in crypto markets since 2020. Although institutions’ exposure is small relative to their balance sheets, their absolute trading volume is much larger than that of retail traders. In particular, the volume of trading by institutional investors in crypto exchanges increased by more than 1700% (from roughly $25 billion to more than $450 billion) from 2020Q2 to 2021Q2 (Auer et al., 2022). Since institutional investors trade both stocks and crypto assets, this has led to a progressive increase in the correlation between the risk profiles of marginal equity and crypto investors, which in turn is associated with a higher correlation between the global equity and crypto factors. When decomposing factor movements following Bekaert, Hoerova, and Lo Duca (2013), we find that correlation in the aggregate effective risk aversion of crypto and equities can explain a large share (up to 65%) of the correlation between the two factors.

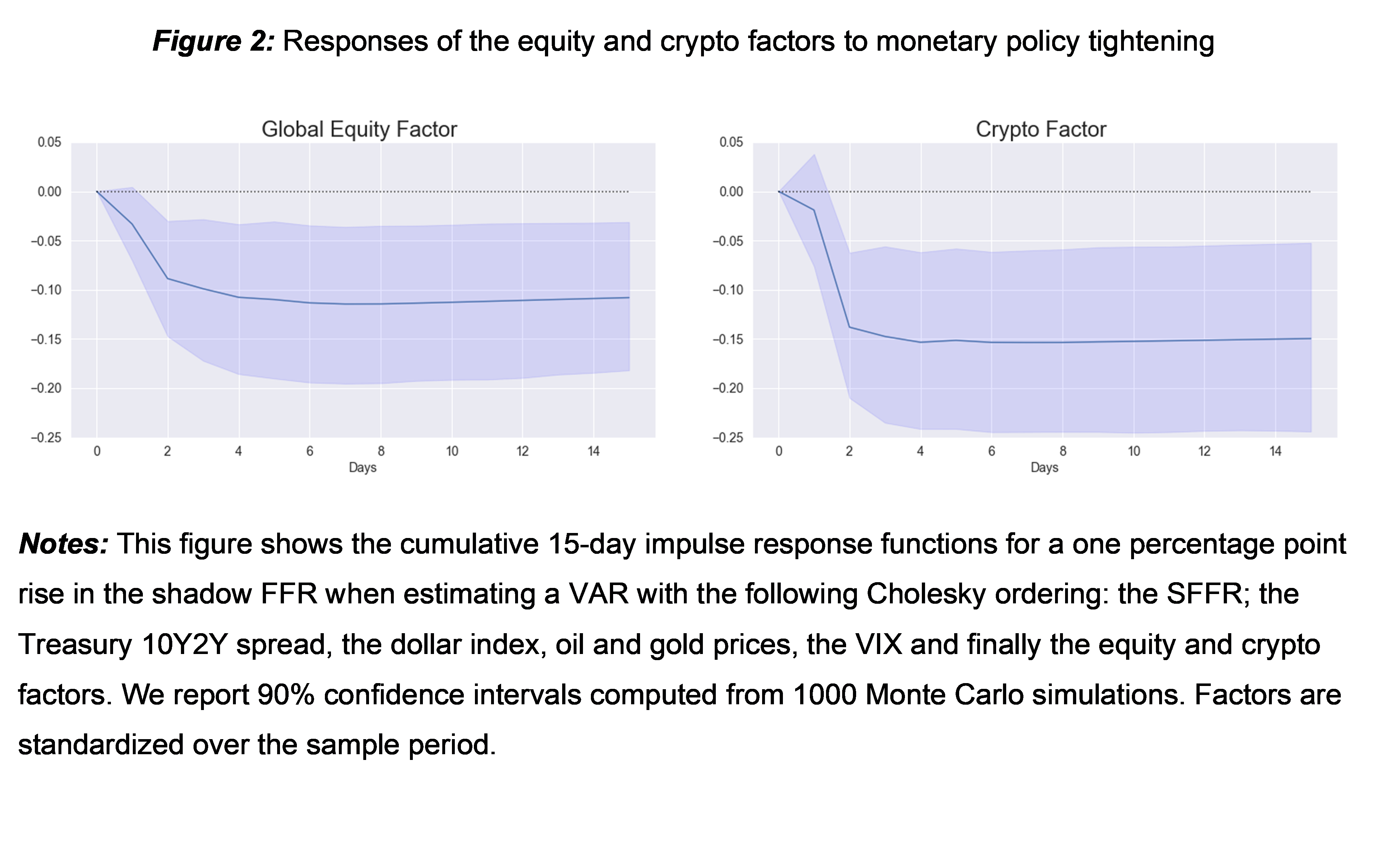

Since US monetary policy affects the global financial cycle (Miranda-Agrippino and Rey, 2020), the high correlation between equities and crypto suggests a similar impact on crypto markets. We test this hypothesis using a daily VAR with the shadow federal funds rate (SFFR) of Wu and Xia (2016) to account for the important role of balance sheet policy over our sample period. We find that US monetary policy affects the crypto cycle, as it does with the global equity cycle, contrasting starkly with claims that crypto assets provide a hedge against market risk. A one percentage point rise in the SFFR leads to a persistent 0.15 standard deviation decline in the crypto factor over the subsequent two weeks, relative to a 0.1 standard deviation decline in the equity factor.

We find evidence that the risk-taking channel of monetary policy is an important channel driving these results, paralleling the findings of Miranda-Agrippino and Rey (2020) for global equity markets. A monetary contraction leads to a reduction of the crypto factor that is accompanied by a surge in a proxy for the aggregate effective risk aversion in crypto markets. When splitting the sample in 2020, we find that the impact on risk aversion in crypto markets is significant only for the post-2020 period, consistent with the entry of institutional investors reinforcing the transmission of monetary policy to the crypto market.

We rationalize our results in a model with two heterogeneous agents, namely crypto and institutional investors. The higher the relative wealth of institutional investors, the more similar the crypto aggregate effective risk aversion becomes to their risk appetite and the more correlated are crypto and equity markets. Even in our simple framework, spillovers from crypto to equities can arise: if institutions’ crypto holdings become large, a crash in crypto prices reduces equilibrium returns in equities.

Overall, our results highlight that despite the range of explanations for crypto asset values, most variation in crypto markets is highly correlated with equity prices and highly influenced by Fed policies. Growth in institutional participation has strengthened these conclusions and increased the risk of spillovers from crypto markets to the broader economy.

References

Adrian, Tobias, Tara Iyer, and Mahvash S. Qureshi, 2022, Taking stocks: Monetary policy transmission to equity markets, IMF Blog.

Auer, Raphael, Marc Farag, Ulf Lewrick, Lovrenc Orazem, and Markus Zoss, 2022, Banking in the shadow of Bitcoin? The institutional adoption of cryptocurrencies, BIS Working Papers.

Bekaert, Geert, Marie Hoerova, and Marco Lo Duca, 2013, Risk, Uncertainty and Monetary Policy, Journal of Monetary Economics.

Miranda-Agrippino, Silvia, and Helene Rey, 2020, U.S. Monetary Policy and the Global Financial Cycle, Review of Economic Studies.

Rey, Helene, 2013, Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence, Jackson Hole Conference Proceedings.

Wu, Jin Cynthia, and Fan Dora Xia, 2016, Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound, Journal of Money, Credit and Banking.

This post written by Natasha Che, Alexander Copestake, Davide Furceri and Tammaro Terracciano.

Admirable. This reads as a combination of clear-eyed assessment of what questions to ask and workhorse analysis. Real questions. Real answers, all of which make sense.

China and Russia plan to build a lunar base by 2030:

https://www.space.com/china-russia-moon-base-ilrs

There may be delays:

https://www.space.com/russia-luna-25-moon-lander-glitch

“The Diplomat” takes a look at the background for the Korea/Japan/U.S. leaders’ meeting:

https://thediplomat.com/2023/08/the-japan-south-korea-us-summit-is-bad-news-for-china/

Note that the author traces the history of contention over joint defense to the deployment of THAAD anti-missile defense systems in South Korea in 2017. (There is always more history, and one has to start somewhere. ) The thing to note is that THAAD is a purely defensive system. There is no threat to China from THAAD, only security from Chinese or North Korean missile attacks. Yet China is highly opposed to deployment of the THAAD system in South Korea.

Anyhow, “The Diplomat” sees the meeting as an important rebuff to Chinese diplomacy. China is apparently now seen as a sufficient threat that old anymosities between South Korea and Japan must be set aside.

china perceives a surveillance threat from us force in Korea (usfk) equipped with thaad an/tpy 2’s x band radar.

thaad was upgraded to cue patriot air defence system available for terminal intercept, using a short range radar.

us army thaad is looking to acquire an 8th battery at $75 million.

tpy 2 has good target discrimination at ranges over 2000km. x band radar is a project of us national missile defence agency..

the other surveillance annoyance for china is taiwan surveillance radar, s band which is still good target discrimination, and looks from the south china sea to northeast china. this us made radar is owned and sustained by taiwan. operating since 2013.

not much can fly in china…… that is not classifiable.

I observe that Japan suspended acquisition of two land based surveillance radars, similar to newest x band radar built in alaska

“china perceives a surveillance threat from us force in Korea.” Yep.

“Perceives” covers a lot of ground. THAAD is defensive. Patriots are defensive. China’s objection is to South Korea, Japan and Taiwan increasing their ability to defend against attack. There is a secondary implication that South Korea, Japan and TIwan can be less timid in their actions, but the primary role of the systems China objects to is defense. That says quite a bit about China’s view of the region and perhaps about China’s intentions.

defenses can be offensive…..

Big can be small. Up can be down.

Come on. China isn’t afraid South Korea will invade. China is afraid South Korea won’t bow down.

duck

in Vietnam, one company commander reported, “we burned the village to save it”.

Catch 22 is an operator’s manual.

Long range radar to engage North Korean missile, 500 km is fine, what do the usfk do with the rest that they see. BTW it can see the boost phase, and hope to fix the recently and cue missiles.

Kevin Drum covers the Republican chirping at Biden over the Maui disaster so we don’t have to:

https://jabberwocking.com/breaking-news-republicans-criticize-president-biden/

Of course it was President Trump that saved Puerto Rico by tossing out paper towels.

As usual a great and insightful post. It’s interesting that crypto performance correlates with both small cap stocks and the tech sector. I would venture that the periods that drives this relationship is like tied most closely with equity sector baskets that at times have driven outsized performance in either share of the equity market, namely firms that fall into either unprofitable tech baskets and meme basket firms, thinking basket to the astronomical growth of some tech firms during covid (likely largely an impact of accommodative monetary policy among other factors) but also the Reddit fueled boom in AMC GameStop etc due to similarity among the retail investor base.

How Putin Cannibalizes the Russian Economy to Fund His War

Yale SOM’s Jeffrey Sonnenfeld and Steven Tian write that the Russian leader is fueling battles in Ukraine by shaking down his own people and leveraging his country’s future.

https://insights.som.yale.edu/insights/how-putin-cannibalizes-the-russian-economy-to-fund-his-war

Nearly 18 months into the Russian invasion of Ukraine now, amidst last week’s failed coup attempt, battlefield setbacks, and global diplomatic condemnation, Putin is coming under increasing strain to finance his increasingly-expensive war—and there’s a history lesson for how this will all end.

Far from the prevailing narrative on how Putin funds his invasion, Putin’s financial lifeline has his merciless cannibalization of Russian economic productivity. He has been burning the living room furniture to fuel his battles in Ukraine, but that is now starting to backfire amidst a deafening silence and dearth of public support. That is far from the prevailing narrative on how Putin funds his invasion. Ample western commentators posit that Putin is pulling in billions from trade to finance the invasion thanks to high commodity prices, weak western sanctions, and sanctions evasion.

But energy prices across both oil and natural gas are now cheaper today than before the invasion, as are grain, wheat, lumber, metals, and practically every commodity that Russia produces. Amidst lower commodity prices across the board, thanks in part to the effective G7 oil price cap, Russia is now barely breaking even on oil sales with unwanted Russian Urals oil trading at a persistent discount but continuing to flow in ample volumes – exactly as it was designed. In short, the world has now largely replaced Russian supplies so commodity exports are no boon to a desperate Russia right now.

It is often overlooked that Putin is funding his invasion of Ukraine not only through marginal commodity exports or trickles of sanctions evasion but through the cannibalization of Russia’s productive economy. As an extractive authoritarian dictator with state control over 70% of the economy, Putin will never really run out of money since he can always pull the authoritarian equivalent of finding money under the couch, or pull a schoolhouse bully act and shake down kids (i.e. oligarchs) for their lunch money at recess time.

Putin has levied draconian “windfall taxes” on basically anything that moves. Many thought last year’s record $1.25 trillion ruble windfall tax on Gazprom and certain other Russian state owned businesses was a one-time occurrence, but Putin has only doubled down and ordered more windfall taxes in the months since, raising trillions of rubles more from companies and oligarchs alike. Likewise, first Putin resorted to levying onerous taxes on both companies and people leaving Russia after the invasion before he dropped all pretense and just started indiscriminately seizing money and property instead.

Similarly, Putin has abandoned all pretense of responsible fiscal policy, running record budget deficits, printing record amounts of money out of thin air, forcing Russian banks and individuals to buy near-worthless Russian debt, and drawing down Russia’s hundreds of billions in sovereign wealth funds, mortgaging away Russia’s future. No wonder disenchanted elites such as oligarch Oleg Deripaska are reduced to complaining to the press while across Russia, labor strikes are taking place with increasing frequency in a throwback to 1917 amidst already disastrous labor shortages.

Some, like Deripaska, even argue that Putin’s shakedowns are hurting the Russian economy even worse than western sanctions – which are already causing entire sectors of the Russian economy to implode, as we’ve shown before. And on top of sanctions, with over 1,000 western companies leaving Russia practically overnight, already Russian consumers are hard-pressed to find erstwhile staples, ranging from consumer electronics to automobiles.

Amidst such undisguised plundering of the Russian economy, stripping it down for war toys, it is perhaps no surprise that Prigozhin’s failed putsch this past weekend revealed no lost love for Putin domestically from the Russian populace and elites. After all, not only did military leaders and civilians alike passively wave columns of Wagnerites through checkpoint after checkpoint on the road from Rostov to Moscow without a shred of resistance; even Putin’s own regional governors were lethargic in their response, and even now, a whopping 21 of them have yet to express any support for Putin. Ironically, the only group of Russians who rushed to Putin’s defense with any genuine enthusiasm prior to Belarusian President Lukashenko’s diplomatic intervention were brigades of Chechens who sped to Moscow and Rostov, led by Putin’s longtime ally and newly-minted selfie-pal Ramzan Kadyrov.

There is a historical pattern here. Of the two major Russian revolutions over the past century, both were undergirded by debilitating economic woes caused partially by military overreach and struggles on the battlefield. After all, wars are never cheap: economic analysts estimate that sustaining its military efforts costs Russia at least $1 billion a day, and it surely didn’t help that Putin sunk billions in not only the Wagner Group but also Prigozhin’s other companies. Likewise, World War I drained Tsar Nicholas II’s coffers prior to his abdication in 1917, when Russia was wracked by over 100 labor strikes amidst widespread famine, exacerbated by both forced conscription as well as returning military veterans. And prior to the collapse of the Soviet Union, the escalating costs of the Cold War combined with low oil prices and severe recession undermined the Soviet economy from within. Losing wars seems to go hand-in-hand with economic morass and regime change in Russia.

For over a year, we have been saying that the Russian economy was imploding despite claims of Russia’s economic resilience. That resilience is nothing but a Potemkin façade, sustained not through genuine economic productivity but rather through shaking down the entire country for pennies to direct towards war.. Putin can continue to sustain his invasion of Ukraine this way, but in doing so, continues to rip off his own people. In avoiding outright economic collapse by mortgaging Russia’s future, he grows more unloved by his people and is thus increasingly weakened. Economic decay is never the only cause of regime collapse; but nor should it be ignored as a demonstrated potent force in bringing down tyrannical regime after tyrannical regime, especially amidst military overreach.

Historian Daniel Goldhagen’s 1996 book Hitler’s Willing Executioners reminds us that the evil of the Third Reich triumphed through the complicity of average Germans through their complacency. We now see Russians’ willing complacency with the murderous autocratic Putin.

Interesting that Russia chooses to pay for its wars…as opposed to, say, the United States, which cut taxes during the Iraq War, essentially financing the war with debt.

But is Russia financing its war with debt? Maybe a little…but its government debt is still very, very low (17.2% of GDP)

https://tradingeconomics.com/russia/government-debt-to-gdp

Meanwhile the US’ government is 129% of GDP, due in large measure to financing of a bloated, unaccountable military budget and pointless and futile wars in Iraq and Afghanistan. https://tradingeconomics.com/united-states/government-debt-to-gdp

In addition Russia has a sovereign wealth fund equivalent to about 8% of GDP.

Since pgl’s source doesn’t take these factors into account, we can pretty much dismiss this screed as largely propaganda, something that pgl just loves to propagate.

“Since pgl’s source doesn’t take these factors into account, we can pretty much dismiss this screed as largely propaganda…”

Holy crap, little Johnny! Did you seriously think you’d get away with that? The authors’ claims are either true or not. That’s what matters. Not your pretend test. You don’t get to toss out made-up requirements for deciding who to ignore. You’re nobody.

So here’s a little test for Johnny. It’s an economics test, so Johnny will need help, which I have provided. Specifically financial economics, so maybe Johnny should get extra time. Here we go:

The U.S. public debt/GDP ratio is 118.6%. Japan’s is 217.6%. The UK’s is 186.5%. France, 116.5%.

Russia’s public debt/GDP ratio is 20.9%. South Africa 75.6%. Argentina 84.5%. Mexico 46.3%.

What common factor accounts for the higher debt ratio in the first group of countries, relative to the second group?

Bonus question: Is a higher debt/GDP ratio a sign of financial strength or weakness?

(Hint – consider credit worthiness.)

Much appreciated as it takes a village to take out Jonny boy’s incessant trash.

Aswath Damodaran (NY University) is a highly respected financial economist:

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

Country Default Spreads and Risk Premiums

Last updated: July 14, 2023

Check out Russia’s credit rating. Junk bond status as in Moody’s Ca.

Now who to believe – Dr. Damodaran or Putin’s pet poodle?!

Since little Jonny boy cannot do research on his own made up trash permit me to educate my mentally retarded stalker. There were two funds.

The Reserve Fund, which was invested abroad in low-yield securities and used when oil and gas incomes fall, and the National Wealth Fund, which invests in riskier, higher return vehicles, as well as federal budget expenditures. The Reserve Fund was given $125 billion and the National Wealth Fund (NWF) was given $32 billion. The Reserve fund was exhausted by 2017. The Reserve fund had been depleted by budget deficits and the low oil price prices and it was emptied by the end of 2017 and ceased to exist, leaving the National Wealth Fund as the sole reserve fund.

The National Wealth Fund has two roles. One is lender of last resort for the banking system and the other is to support Russia’s pension system. The US has other agencies perform those roles. Now Jonny boy does not know that as Jonny boy is STOOOOPID!

http://www.worldgovernmentbonds.com/country/russia/#:~:text=Last%20Update%3A%2018%20Aug%202023%2017%3A15%20GMT%2B0%20The,is%20NR%2C%20according%20to%20Standard%20%26%20Poor%27s%20agency.

Russia Government Bonds – Yields Curve

Gee Jonny boy – people holding Russian government bonds are getting a 12% yield. I bet that makes you so happy. But wait – such high nominal yields are likely a reflection of:

(a) high expected inflation; or

(b) junk bond status for Russian government bonds.

Or maybe a combination of both. Now do us a favor and use your incredible “expertise” to decipher how much of these high nominal yields represent (a) v. (b).

This should be a laugh riot!

JohnH: Has it ever occurred to you that maybe Russia doesn’t issue debt to fund its wars because it can’t. Since 2014, Russian government debt has been graded as “speculative” (Ba1 by Moody’s; BB+ by S&P). Right now, Russian debt is “NR” (well, they’re essentially in default).

By the way, 129% US debt-to-GDP is gross debt, not debt held by the public. You should look up why that matters.

“Since 2014, Russian government debt has been graded as “speculative” (Ba1 by Moody’s; BB+ by S&P).”

Damodaran puts their credit rating at Ca but Ba1 strikes me as consistent with the interest rate which is near 12%.

We asked Jonny boy to address why Russian government bond rates are so high but something tells me he was duck this fact like he ducks everything else.

pgl: Sorry, my mistake in wording. It was Ba1/BB+ until the 2022 expansion of invasion of Ukraine, at which time it went to junk. So from 2014 onward, it would’ve been expensive to borrow (now it’s prohibitive for international investors).

GHW Bush graduated from Yale, and was in skull and bones……

crowded place in downtown new haven.

Ike said the military industry complex was grabbing away hospitals and schools.

what was cannibalized to spend $2 trillion on Afghanistan and Iraq?

The interesting thing about news on Ukraine is that a second narrative has developed in the mainstream media. For most of the war the narrative included reports of the Russian economy imploding, Russia running out of ammunition, and how Ukraine was winning. Though none of that narrative has been realized, the narrative is still alive and well.

Now a second narrative has emerged, one that expresses doubt:

Washington Post: “U.S. intelligence says Ukraine will fail to meet offensive’s key goal:

https://archive.is/GmW5m#selection-777.0-777.69

The Telegraph: “Ukraine and the West are facing a devastating defeat.”

https://www.telegraph.co.uk/news/2023/07/18/ukraine-and-the-west-are-facing-a-devastating-defeat/

Now the finger pointing begins…

The Hill: “Ukraine’s offensive is stalling and the West owns a portion of the blame”

https://thehill.com/opinion/national-security/4148753-ukraines-offensive-is-stalling-and-the-west-owns-a-portion-of-the-blame/

Politico: “As Ukraine counteroffensive gets bogged down, it’s back to the drawing board”

https://www.politico.eu/article/ukraine-counteroffensive-volodymyr-zelenskyy-russia-back-to-the-drawing-board/

Even worse. there are reports that “US admits to pushing Ukraine into a fight it can’t win.” https://mate.substack.com/p/us-admits-to-pushing-ukraine-into

We are seeing the usual course of yet another pointless and futile war unfold before our eyes. First, there was the war frenzy and over-optimism. Second, doubts creep in and finger pointing starts. People start to push back, seeing Maui burn while Biden sends $billions to Ukraine. Then, years later, the US pulls back, leaving behind a country in ruins. Vietnam, where the US had to destroy a village to save it, understands this…having suffered millions of deaths while the US touted its superior human rights values.

Lily Tomlin–“No matter how cynical you become, it’s never enough to keep up.”

Wow! Ukraine’s defense against Russia’s invasion is both pointless and futile! I could have imagined one or the other, but not BOTH!

That’s the point ignored in each of the links Johnny has provided – Ukraine is fighting back against Russia’s invasion. Johnny pretends it’s a war of choice, but this war was force on Ukraine by Russia.

And let’s have a look at little Johnny’s links. Of the five links, only the first is straight journalism. The rest are opinion pieces. Johnny has rounded up opinions which serve his agenda, calling them “mainstream journalism”. That’s simply not true. Not that this is new behavior from Johnny – it’s practically all he ever does. He parrots opinions he likes and he lies.

The one piece of straight journalism notes that an intelligence assessment finds it unlikely that Ukraine will meet one of its counter-offensive objectives. One assessment. One objective. So now Russia is winning? Nonsense.

Some time ago in comments here, I speculated that Johnny works for Russia. His twisting of the truth, always in favor of Russia’s invasion, his constant misuse of U.S. economic data to exploit wedge issues, his often childish efforts to discredit views which differ from his own, his refusal to acknowledge his errors – these are all right out of the propagandist’s playbook.

My question is, if Russia’s economy is doing so well, why can’t they afford better help?

Yadda yadda yadda… Ducky’s pea brain can’t conceive of someone actually being opposed to the US’ pointless and futile wars. Like George Bush, you’re either with us or against us. Black and white thinking. Back in the Vietnam War days, anti-war protesters got vilified as communist sympathizers. Joe McCarthy would have been proud of Ducky!

Aw, Johnny…I’m soooo chastened by your “yadda yadda”. Never has anyone crafted a more devastating rebuke!

You have yet again pretended to know what I think, what I can “conceive”, rather than responding to what I actually wrote. Coward.

Let’s keep the truth front and center. Russia invaded Ukraine. Ukraine has defended itself. We are helping Ukraine, but have not sent troops. Russia started this war. Ukraine is fighting back. The U.S. is helping the victims of Russian aggression. Those are the facts which Johnny has never acknowledged.

“Yadda yadda yadda”

is the noise the “adults” in Charlie Brown cartoons make. You should know as this is the only place little Jonny boy can pretend to be an adult as all of your pointless rants are nothing more than Yadda yadda yadda.

This is kind of pathetic from the troll who could not be bothered to protest against the 2003 invasion of Iraq. I did but Jonny boy ducked into some place to have dinner.

And do not dare talk about W’s fiscal fiasco. I blogged against this over at Angrybear and not one time did Jonny boy ever say a word anywhere. Not at Angrybear, Thoma’s place, or any where else.

You are truly a Jonny come lately who has no right to lecture anyone on anything. None.

Aaron Maté of the Grayzone? Dude – we can check your sources even if you do not know how to. Why not just cite Putin’s preapproved Kremlin sources?

Now we get your job is lying for Putin but damn – you really come up with the dumb ones.

Someone else who worked for RT and the Grayzone:

Meet the Sneakiest Defenders of Putin’s Invasion of Ukraine

https://www.thedailybeast.com/meet-the-sneakiest-defenders-of-vladimir-putins-ukraine-invasion-and-chinas-xinjiang-repression

Hey Jonny boy – these liars are your kind of people. And they are making money pushing Putin’s lies. So tell us little Jonny boy – how much is Putin paying you?

“Ukraine’s defense against Russia’s invasion is both pointless and futile! ”

yes.

what is the point of ukraine defense (counteroffensive sounds so defensive)? get territory attached by lenin in 1921*, or being a nato jumping off point**.

futile: nato operational schema, weapons and extant logistics are not up to the need***, who planned this? what were they thinking?

and the mines, with real time delivered artillery seeded mines were used on the russians last spring!

what does ukraine do with ethnic russians if they got the territory back like north vietnam did in 1975? ethnic cleanse? that was going on in 2014.

disagreeing with neocon dogma des not make one a putinbot!

*history

** neocon policy

*** unsuitable is the testers’ term: less than reliable, hard to repair, use a lot of fuel, mainly outdated. if not too little used in manner not conducive to tactical result.

anonymous: As usual, I have little idea of what you are trying to convey in your garbled grammar. Could you please try to use conventional grammar as we (I think) learned in primary school.

Now, I think using your logic, if PRC were to seize Taiwan by force, shooting back would be futile. Or if PRC seized half the island, it would be futile to try to retake that portion of the island. Please clarify.

Peddling Putin narratives does make one a Putin bot.

Making presumptions and false postulates that serve Putin’s narratives does make one a Putin bot.

Accepting the right wing authoritarian world view that if a piece of land once back in history were under the control of a country, then that country has a right to “take it back” – doesn’t make one a Putin bot – just a plain old brain dead moron.

Putin doesn’t need to have those bots under direct control; he just need them to be stupid enough to buy into his BS and to think that being contrarian makes them smart.

Do you and Jonny boy cuddle up each night to watch Ukrainian children get murdered by your dear Russian war criminals?

Professor China;

Futile is when the forces/units, support fires, geography/terrain, and logistic of the plan to achieve goals/objectives are not matched to the tactics, assets, and preparation of the enemy resistance.

Custer at Little Big Horn, and 1858 Light Brigade at Balaclava, Crimea come to mind, cavalry being analog to mechanized war. In 1858, the British and French were attacking because the Tsar was supporting the locals in Balkans, against Turks.

Ukraine lacks air assets to affect any condition on the battlefield. Ukraine lacked defenses against Russian air attack, both helicopter and fixed wing, very deficient in mine clearing tactics, and had inadequate mechanized infantry to cover tanks from ground threats. Artillery; guns and shells, same issue Lee had at Gettysburg, a limiting factor.

At this point the last “exploitation” units are attacking in the gray zone, being attrited. German version of Bradley, and US wheeled Strykers with a few UK Crusader tanks.

Skirmishes in the gray zone were executed out of NATO doctrine from Cold War, by Russians. Who could not anticipate that?

These weaknesses should have been addressed.

It seems no one presented the correct assumptions and ground rules, as well as enemy preparation of the battle space in the several simulation run on the operations.

If Taiwan is served as badly as Ukraine in the processes of defense planning, and PRC is willing to over match, then negotiation are in order.

PRC has the resources to over match and prevail.

The effects to both sides would be considered.

What good to tame Taiwan that is largely broken?

Futile happens when no one tells the emperor he has no clothes

Anonymous: You and I apparently read different sources re: balance of forces including logistics in the Ukraine theater. I’ll rely on ISW, CSIS. I think your assessment of how much the newly equipped brigades have been attrited is off. And on air power, it is clear that Russia does not have air superiority to sufficient degree to be able to deploy air cover. How many sorties by fighters or attack copters do you hear about? It’s all missiles and drones.

Still waiting to hear about effective *combined arms* assaults aided by close air support by Russian forces. Please provide examples if you have.

Professor,

I am not aware of any successes Russian forces have had with combined arms offensives. Small operations in Syria possibly.

Two observations: NATO Intelligence, Surveillance and Reconnaissance (ISR) support to Ukriane has been effective, second Ukraine has had defensive assets and preparation similar to the Russian lines on the south front. The Russians tried a small move last spring and it looked a lot like the past 10 weeks of Ukraine attempts. The Russians have assumed the defense, and Ukraine is obliging washing up against their defenses.

Given the situation, a strategic defense, with an enemy pushed to attack [as Picket and Gettysburg on 3 July 1863] seems to be a useful operational scheme.

I find ISW to be an editorializing paper, it is run by Vicky Nuland’s in-laws, the little I have read I find defective and I worry that one or two of the principals teach/taught at West point. I find CSIS to be slanted and the few things both centers write that I have direct knowledge of are not accurately related.

I read Naked Capitalism links for Ukraine most days, and follow a couple of their regulars who share a different perspective than that sold by ISW and CSIS.

I am a US veteran and self paced student of modern and 19th century war making.

‘Truth is the first casualty of war’, and in many cases selling new weapons.

Some people are dumb enough to think that if they can be contrarian against someone with expertise, then they are “smart”. Indeed most contrarians are of that type, even those with some credentials. They are too stupid to realize that they are using “off the shelf”/”dime a dozen” contrarian rhetorical tricks and methods, that are almost certain to be unable to connect reality to an insight. Because they begin with the goal of finding “support” for a specific (contrarian) narrative, their journey is in the ditch as soon as it begins. But their general intelligence and scientific abilities are way too low for them to even recognize that they are in a ditch – they just keep driving. You may be able to derive some entertainment from them – but never any insights.

Aaron Maté writes for the Grayzone known for misleading reporting and sympathetic coverage of authoritarian regimes. The Grayzone has downplayed human rights abuses against Uyghurs.

I could go on but you get the idea. Yes Jonny boy’s sources are even more dishonest and disgusting than those of CoRev.

“First, there was the war frenzy and over-optimism.”

Your boy Putin did have war frenzy and he was so sure he’d take Kiev in a week. Now that is over optimism.