Today, we are pleased to present a guest contribution written by Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti of the Bank of Italy. The views presented in this note represent those of the authors and do not necessarily reflect those of the Bank of Italy.

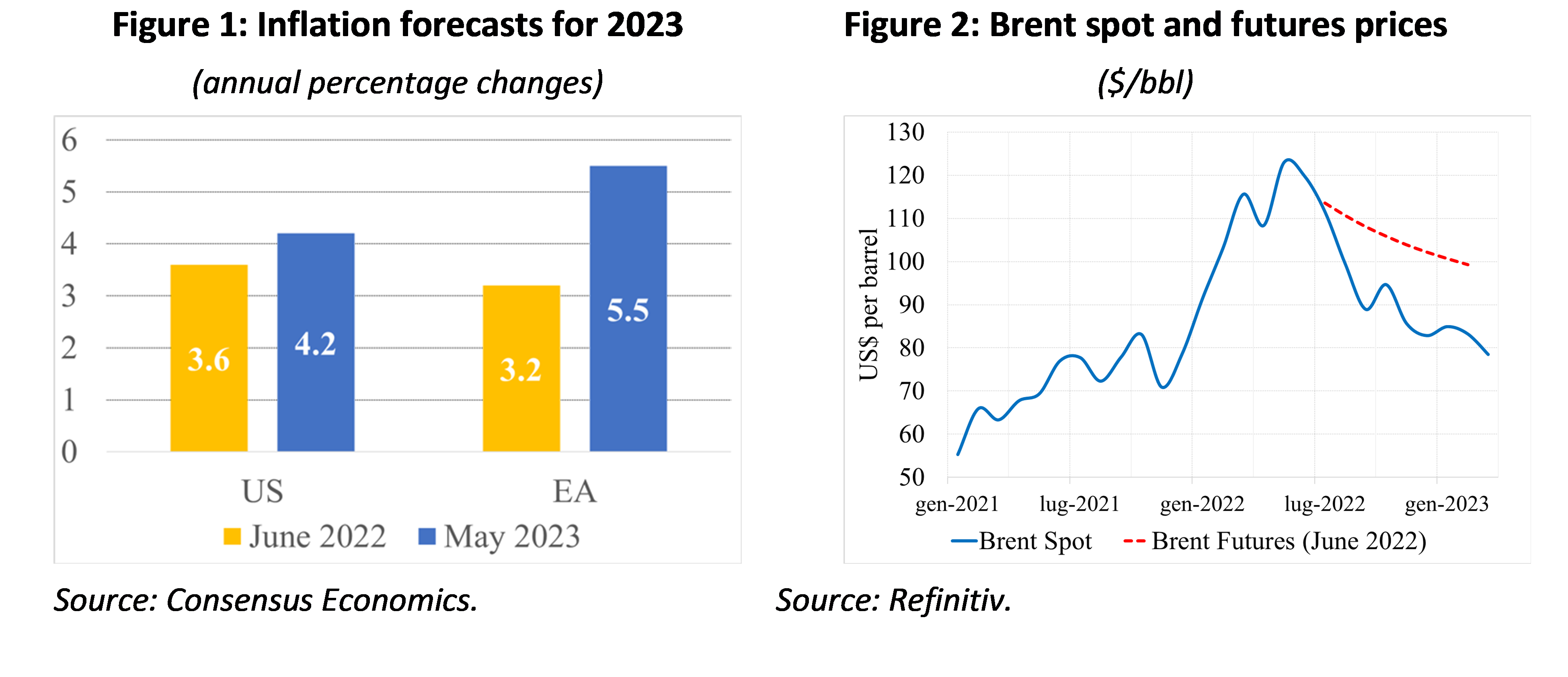

Inflation rates in both the United States and the euro area (EA) have decreased since around the middle of 2022. However, their fall has not occurred as rapidly as initially anticipated. Despite the significant decrease in energy prices, which dropped more drastically than what was projected by futures prices one year ago, professional forecasters have consistently adjusted their predictions for inflation upwards. This trend has been particularly noticeable in the euro area (EA), as depicted in Figures 1 and 2. Unforeseen increases in core inflation, specifically in non-energy industrial goods and services, have been the primary catalyst behind these unexpected inflation hikes.[1]

This bears the question whether surprisingly high core inflation in these economies is the result of the delayed pass-through of past energy prices and what can be expected going forward, given the pronounced fall in energy prices since mid-2022. The analysis summarized in this column concludes that, when it comes to the US, energy prices account for a negligible fraction of core inflation hikes in the past two years. This is not the case for the euro area, where the pass-through was sizeable and still ongoing.

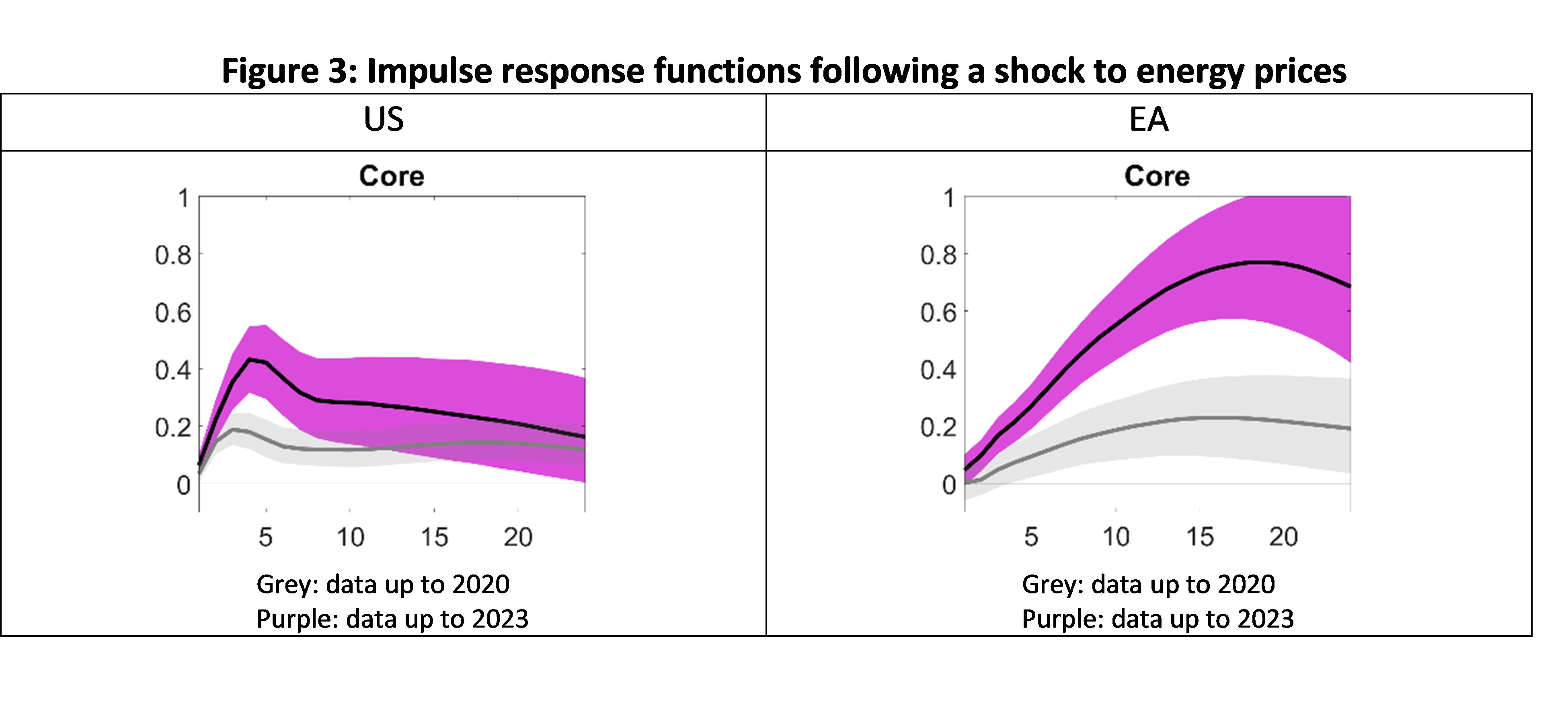

The pass-through of energy prices to core inflation can be gauged on the basis of the response of core prices to an unexpected change in energy prices in the context of Vector Autoregression models. We estimate such a model with data up to 2020 first (therefore excluding the 2021-2022 energy price shock), to then extend the sample to the last available 2023 data point. The baseline specification includes consumer energy inflation, food inflation, core inflation[2], the unemployment rate, and negotiated wages growth.[3]

Using data up to 2020, a sample that pre-dates the most recent energy price shock, a 10% increase in consumer energy prices leads to a relatively muted rise in core inflation for both the United States and the euro area (EA), by approximately 0.1 to 0.2%, as illustrated in Figure 3 within the grey-shaded regions. However, when the analysis is extended to include the data in 2023, which incorporates the energy price shock of 2021-2022, the response of core inflation to changes in energy prices rises significantly in the EA (as indicated by the purple-shaded areas in Figure 3). This suggests that the surge in energy prices caused a shift in the relationship between core prices and energy input costs. Indeed, following a 10% energy price shock, the maximum impact on core inflation resulting from an energy price shock is estimated at 0.8% for the EA (a fourfold increase) and at 0.4% for the US (only a twofold increase).

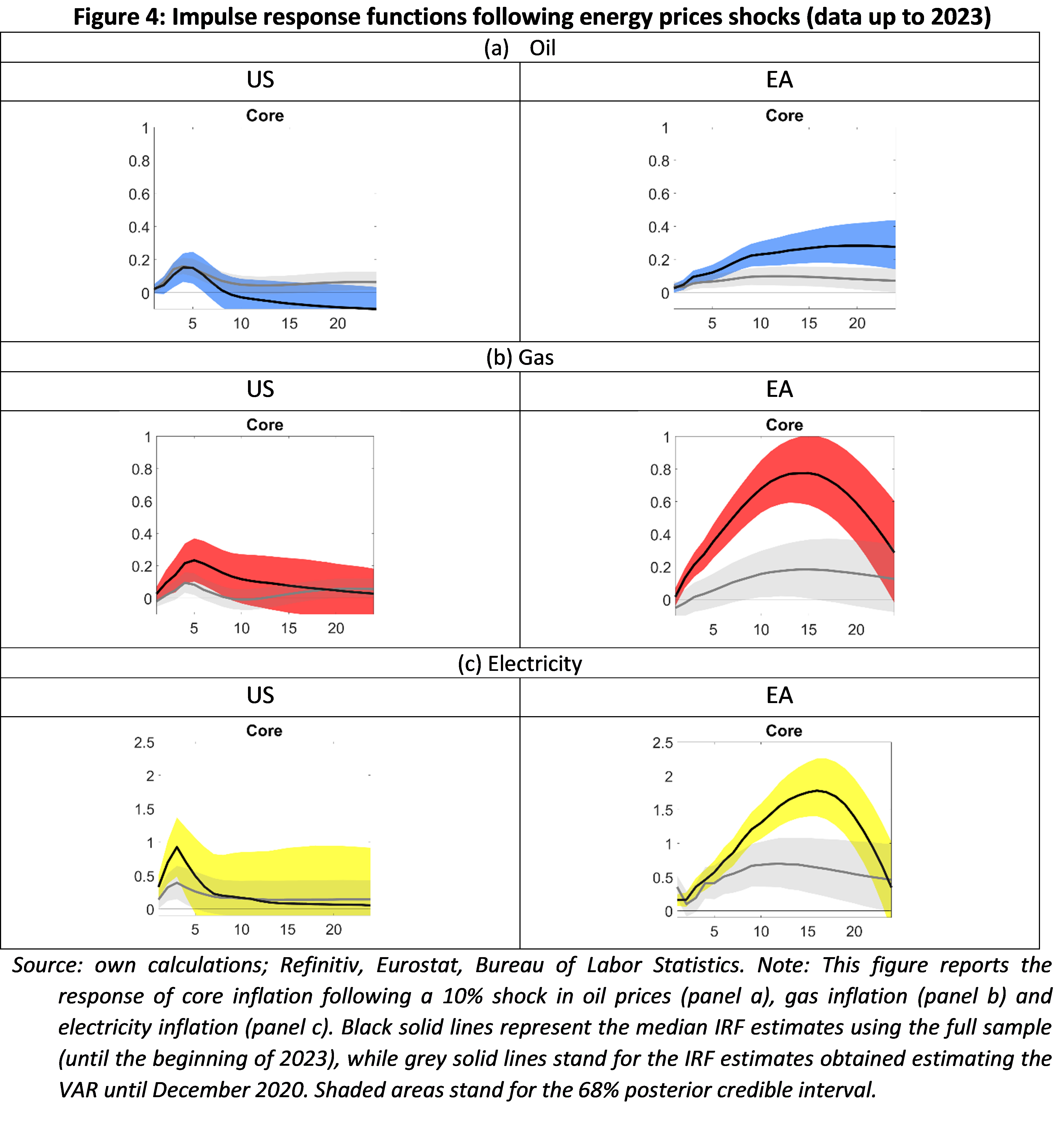

A more granular analysis – see Figure 4 – reveals that the sharp increase in the sensitivity of EA core inflation to energy prices is mostly explained by the stronger sensitivity of core inflation to gas and electricity price shocks. Our conjecture is that the exceptional size of the shock to these costs induced a non-linear adjustment of final prices. This likely reflects both the unprecedented size and duration of the shocks in the EA. The shock to energy prices in the EA was indeed of historical proportions. For example, between beginning of January 2021 until their peak in the summer of 2022, spot gas prices rose by roughly a factor of 17 in the EA (based on TTF prices; this compares to a factor of 3.8 in the US, based on Henry Hub prices). A shock of these proportions is likely to have triggered some non-linearity along the transmission chain in the EA.

This explanation would be consistent, for instance, with pricing models in which firms face a fixed cost of price adjustment. Cavallo et al. (2023) show that indeed in general models with menu costs “large shocks travel fast”.[4] Faced with a shock to their production costs, firms need to decide whether to reset optimally their price and pay the menu cost, or to leave prices unchanged at the cost of lower profits. The latter alternative become less and less appealing the larger the shock is, and therefore the more distant the actual price from the profit maximizing price is.[5]

Two conclusions emerge from the analysis. First, core inflation in the US is unlikely to benefit from the normalization of energy prices. US core inflation is currently bolstered by the sustained pace of growth of shelter prices and of the prices of items such as garments, furniture and some non-shelter services. It will take time, and probably some slack in the labour market, before these prices start decelerating durably. Second, in the EA there is scope for a deceleration of core prices due to lower energy prices. In the EA, both goods and services prices are still influenced by past energy price shocks. As these prices have started to fall they should contribute meaningfully to cooling down core prices.

[1] US core inflation forecasts for the last quarter of 2023, elicited from the SPF, rose from 2.9% to 3.4% between Q2-2022 and Q1-2023. In the case of the EA, SPF core inflation forecasts were revised over the same period from 2.3 to 4.4%.

[2] Consumer prices are measured on the basis of the HICP in the EA and of the CPI in the US. For the US, we consider a measure of core inflation that excludes the “housing” component. This component has a disproportionate weight in US core inflation (about 40 percent) and is completely insensitive to energy prices. It would therefore strongly bias downwards the sensitivity of US core prices to energy prices and distort the comparison with the EA. The index of core inflation net of housing also features prominently in the monetary policy debate in the US, as Fed officials and in particular FOMC Chair Powell have often referred to it as “the most important category for understanding the future evolution of core inflation. See “Inflation and the labour market”, by Jerome H. Powell, November 30 2023, available here.

[3] The energy shock is identified by assuming – as standard in this literature – that all the variables in the system may respond contemporaneously to the energy shock, but that consumer energy prices respond only with a lag to other shocks.

[4] Cavallo A., F. Lippi F. and Miyahara K. (2023), “Inflation and misallocation in New Keynesian models”, ECB Forum on Central Banking, Sintra, 27 June.

[5] See also Nakamura, E.,and J.Steinsson,‘‘Five Facts about Prices: A Re-evaluation of Menu Cost Models,’’ Quarterly Journal of Economics, 123 (2008), 1415–1464 and J. Vavra “Inflation Dynamics and time-varying volatility”, the Quarterly Journal of Economics, 129 (2014), 215-258.

This post written Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti.

Thanks to the authors for allowing Menzie to post this here. Fascinating/interesting study. I’ve been reading about the Biden admin’s Inflation Reduction Act (IRA). “The IRA directs nearly $400 billion in federal funding to clean energy, with the goal of substantially lowering the nation’s carbon emissions by the end of this decade.” I wonder with the increased energy efficiency from “electrification” and increased inputs of renewable energy – what impact this will have on energy prices? https://www.mckinsey.com/industries/public-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it

The switch will eventually make energy prices lower. It will also disallow OPEC+ from using their monopoly power to keep hydrocarbon prices high. They will be forced to follow alternative energy prices lower and lower – or lose market share. At some point Europe will demand that CO2 release is accompanied by an equivalent carbon capture – that will be the end of hydrocarbons there.

The use of heat pumps, hyper insulation, home sized wind and solar; combined with home sized energy storage – will induce a huge increase in grid disconnection and micro grid communities. Initially a little more expensive but in the long run a big savings from much more stable energy delivery. No more big blackouts and fires when the wind does what the wind does.

CPI less fictitious shelter is up 1.0% YoY.

Core CPI less fictitious shelter is up roughly 3% YoY. Core CPI including actual house prices and asking rents is probably up a little under 2% YoY.

“Our conjecture is that the exceptional size of the shock to these costs induced a non-linear adjustment of final prices.”

Isn’t there evidence that absolute energy scarcity is more contractionary than a mere price shock? Professor Hamilton had a hand in this, yes?

Perhaps absolute scarcity also has greater inflationary pass through than a mere price shock. Currency adjustment is an obvious channel.

In the decision to reprice – the menu decision – the fact of a persistent policy change with regard to Russia gas probably tilted that choice toward repricing. That’s on top of the effect of a larger input price increases inducing repricing.

More Chinese government racism:

https://www.npr.org/2023/08/17/1189860622/china-muslims-mecca-hajj-travel-surveillance

ltr? Hello?

When Trump says he and his minions love farmers – what they mean is that they love to rip off farmers:

https://www.businessinsider.com/rudy-giuliani-biden-documentary-scam-money-lawsuit-2023-8

Rudy Giuliani pocketed $300,000 from farmers investing in anti-Biden documentary that was never made, lawsuit claims

and Hunter Biden’s corrupt dealings in Ukraine want their money back.

In 2019, a new lawsuit alleges, California fruit-and-nut farming magnates and brothers Baldev and Kewel Munger met Tim Yale, a Republican political operative at a fundraiser. A few months later, Yale introduced them to Rudy Giuliani, the former mayor of New York City, according to the suit. By then, Giuliani was hard at work trying to dig up election-year dirt on Joe Biden in his capacity as President Trump’s personal attorney.

Giuliani, the lawsuit alleges, asked for the farmers’ help finance efforts to make sure Trump was elected to a second term. But Giuliani wasn’t seeking a donation — he wanted them to invest in a documentary.

The suit was filed this month by a Munger-owned LLC, one of several entities controlled by the multinational agro-barons, who also hold part ownership of Naturipe, the world’s largest producer of blueberries.

Giuliani was working with Yale and cannabis investor George Dickson III, per the suit. The lawsuit claims that the three men pitched the farmers on a film that would be “a possible ‘kill shot’ to Biden’s presidential campaign.” The three men “all represented that they possessed key documents that were ‘smoking guns’ that would establish that the Ukrainian government engaged in a quid pro quo exchange with the Biden family to benefit Burisma,” the complaint continues.

Burisma, of course, is the energy company that paid Hunter Biden hundreds of thousands of dollars to sit on its board. Republicans have long alleged but have never proven a nexus between Hunter’s work on Burisma’s board and Joe Biden’s efforts, as vice president, to remove a Ukrainian prosecutor who was investigating the company.

Allegedly, the film was supposed to reveal a “smoking gun” that would take the Bidens down, secure Trump’s second term, and enrich the Mungers in the process. “Yale and Dickson represented that this documentary movie was going to be bigger and more profitable than Michael Moore’s ‘Fahrenheit 9/11,’ which earned $200 million at the box office.”

The Mungers, who had given tens of thousands of dollars to Republican candidates, were sold. They turned over $1 million to finance the film, according to promissory notes attached to the complaint as exhibits. Out of that money, $300,000 allegedly went to Giuliani himself; the rest “was stolen by Dickson and Yale for their own personal use,” the lawsuit claims.

None of the promises allegedly made by the film’s backers materialized.

The film was never made or released. Joe Biden won the 2020 election. And the Mungers’ million-dollar bet vanished.

Giuliani, after conducting interviews with various Ukrainian officials, was unable to produce a “smoking gun.” As Election Day drew near, his attention drifted from filmmaking to a different October surprise — emails and other data obtained from Hunter Biden’s laptop.

Yet despite Giuliani’s opposition research effort, Trump failed to win a second term. Giuliani’s efforts to erase that democratic outcome, first with spurious lawsuits and then with denialism and a call to “trial by combat” now have him facing criminal charges in Georgia. He also faces a civil suit filed by his former assistant Noelle Dunphy, which accuses Giuliani of wage theft and sexual assault.

Giuliani is not a defendant in the Mungers’ California lawsuit over the film. But he and Dickson were reportedly investigated by the FBI over the movie. The bureau searched Dickson’s home in connection with the film 2021, but no charges were ever filed in connection with it. The suit also includes “John Doe” defendants, and could be updated to include more names.

Details about Yale and Dickson’s efforts to raise $10 million to finance the film were reported in 2020 by Mother Jones. The magazine reported in 2021 that the production was a disaster that only resulted in 15 minutes of low-quality footage, while Giuliani was paid six figures to fly out in a private jet to woo potential investors.

This isn’t the first time that the Mungers have been involved in litigation. Their company Munger Bros. paid $3.75 million to settle a lawsuit that accused them of having “mistreated and illegally fired Mexican nationals” who worked at their blueberry farm in Washington state and was hit with $3.5 million in penalties and back wages in 2019 for improperly recruiting foreign workers, housing them in unsanitary conditions, and dodging pay rules.

The aborted Giuliani film project also forms part of a whistleblower disclosure from Johnathan Buma, an FBI special agent whose allegations were first reported by Insider. Buma’s statement alleges that Giuliani raised money for an election-year Biden film from a group of California activists and that Giuliani was soliciting information on Biden from “Ukrainian and also likely Russian sources.”

The Mungers, their company’s CEO Bob Hawk, lawyers for their company, Yale, Dickson, and a spokesperson for Giuliani did not immediately respond to requests for comment. Buma’s attorney declined to comment.

Its not just that the natural gas increases in Europe was huge its also that they were predictably going to be of long duration. There was no way that Europe would make itself dependent on Russian NG again even if the war ended. So the whole energy sector adjusted to the expectation of the more expensive LNG rather than pipelines of Russian NG. The good news is that it instantly made alternative energy, heat pumps and hyper isolation projects a clear winner. The future Europe will be much less dependent on hydrocarbons and their influence on inflation.

Yes, exactly.

The FT carries a piece on climate change risks for asset prices:

https://www-ft-com.ezp.lib.cam.ac.uk/content/899472a8-e5e2-4fde-bc91-7e548ba35294

The upshot is that climate change risks are not adequately priced in. A lik from the FT article gives one reason why that is so:

https://www.brookings.edu/articles/flying-blind-what-do-investors-really-know-about-climate-change-risks-in-the-u-s-equity-and-municipal-debt-markets/#:~:text=Today%2C%2060%20percent%20of%20publicly,level%20rise%20(see%20chart).

Corporate reporting tend to spend more time on regulatory compliance than on actual climate risk. (Seems to me like a case if recalcitrant attitudes showing up in print.)

Of course, asset values will be a small part of the problem when climate risks manifest, but this is an economics blog, not a “how are my kids going to cope?” blog.

Now, which troll will be first to pretend the FT and Brookings are getting it wrong?

“The pass-through of energy prices to core inflation can be gauged on the basis of the response of core prices to an unexpected change in energy prices in the context of Vector Autoregression models. We estimate such a model with data up to 2020 first (therefore excluding the 2021-2022 energy price shock), to then extend the sample to the last available 2023 data point. The baseline specification includes consumer energy inflation, food inflation, core inflation[2], the unemployment rate, and negotiated wages growth.[3]”

What is the beginning date for the data. Apology if I missed reading the beginning date.

I know I’m being a bleep bleep for saying this , but the Jerome Powell paper should be dated ’22.

“The 30-year fixed-rate mortgage averaged 7.09% in the week ending August 17, up from 6.96% the week before, according to data from Freddie Mac released Thursday. A year ago, the 30-year fixed-rate was 5.13%.”

https://www.cnn.com/2023/08/17/homes/mortgage-rates-august-17/index.html

https://investor.vanguard.com/investment-products/mutual-funds/profile/vbtlx#portfolio-composition

Even the yield on the Vanguard Total Bond Index Fund (4.53%) is well above YOY inflation (3.2%.) The after-tax real yield is finally starting to turn positive as well. After years of having the purchasing power of their secure assets eroded, it looks like people trying to save for a home, for their kids college education, or for retirement are finally going to get a break.

“Even the yield on the Vanguard Total Bond Index Fund (4.53%) is well above YOY inflation (3.2%.)”

Gee this Jonny boy has finally figured out that inflation is not 6%. Now since you told us that the after-tax real mortgage rate was negative, please show us your “homework”.

The real question is: has pgl finally figured out what the mortgage spread is…and why it has been close to 3%?

[Don’t hold your breath!]

Haven’t read that NY FED paper I provided you? Same worthless little Jonny boy.

BTW you have been claiming that this mortgage spread is the highest ever or at least in the last 40 years. Gee Jonny boy – was 2008 40 years ago?

https://www.bankrate.com/mortgages/high-rate-spreads/

Hint for our favorite moron – see the graph under this:

Mortgage spreads

The gap between 30-year mortgages and 10-year Treasury yields has widened.

CNN says that “This week’s average rate is the highest the 30-year, fixed-rate mortgage has been since April 2002 when it was 7.13%.”

https://www.cnn.com/2023/08/17/homes/mortgage-rates-august-17/index.html

If pgl confuses the mortgage rate and the mortgage spread, it’s painfully obvious that he still can’t comprehend what the mortgage spread is…after lots of efforts to educate him!

WTF do you get your worthless trash? Go find something productive to do – like watching the grass grow.

It seems Jonny boy forgot about this:

‘The rising average rate for a 30-year, fixed rate loan is mirroring the trend of 10-year treasury yields, which recently hit their highest level since the summer of 2007.’

No it is Jonny boy who confuses rates and spreads. In fact this moron once looked at some Zero Hedge graph of the VOLATILITY of the spread and thought that was referring to the spread itself.

Come on Jonny – just accept the fact that you are a MORON. Trying to falsely claim others are dumber than you proves nothing except for the simple fact – you are a MORON.

“If pgl confuses the mortgage rate and the mortgage spread”

I pointed out that the long-term mortgage rate at the end of 2008 exceeded the long-term government bond rate at the time by more than 3% (look it up for yourself if you know how – snicker) AND Jonny boy comes back with how the long-term mortgage rate past 7%. And this pathetic mental retard writes

If pgl confuses the mortgage rate and the mortgage spread, it’s painfully obvious that he still can’t comprehend what the mortgage spread is…after lots of efforts to educate him!

Ah Jonny boy – I guess you are too retarded to look up with the current long-term government bond rate is now. Yea – you are STOOOPID as it gets.

Astroturf anti-environmental “activism” in California –

https://www.sacbee.com/news/politics-government/capitol-alert/article277266828.html

SoCalGas regularly violates state and federal law by paying business associations to gin up opposition to environregulations.

Just keep in mind, when you see anti-environmental jabber un comments here, in opinion pages, in “thought leadership” pieces, that it very likely is NOT the honest personal opinion of the speaker or writer. It is propaganda, bought and paid for by polluters with big money.

Such bought-and-paid-for corruption of public discourse is not, of course, limited to environmental issues:

https://www.theguardian.com/business/2023/aug/17/who-panel-aspartame-diet-coke-guidelines

The big ones tend to be the worst offenders.

Doesn’t Trump drink a lot of Diet Coke. I have not add any soda in the last 15 years.

Rudy’s RICO Origin Story Is as Fake as His Hair Color

https://www.thedailybeast.com/rudy-giulianis-rico-origin-story-is-as-fake-as-his-hair-color?ref=home?ref=home

The prosecutor-turned-mayor-turned-MAGA lackey had wielded the Racketeer Influenced and Corrupt Organizations (RICO) statute to become a famous mob-buster. And now he was being accused of violating a similar law in a bungled attempt to overturn an election For nearly four decades, Giuliani has claimed that it was his idea to use RICO to prosecute 11 members of New York’s five crime families in 1985—after crime boss Joe Bonanno published a memoir that described the workings of the Mafia. “I dreamed up the tactic,” Giuliani wrote in his 2002 book Leadership. “I revealed that Bonanno’s description of how families were organized provided a roadmap to precisely what the RICO statute was designed to combat. As soon as I became the U.S. Attorney, I was able to hoist Bonanno by his literary petard.” But the legal eminence who actually drafted the RICO statute and a former top New York state organized crime prosecutor tell The Daily Beast that is not how it went down at all. Their version suggests an added irony to the Georgia indictment: the numerous lies that Giuliani is accused of perpetrating to keep Donald Trump in office were superseded by a bogus origin story. As described in the book Giuliani: The Rise and Tragic Fall of America’s Mayor, Ron Goldstock of the New York State Organized Crime Task Force maintains he took the idea of using RICO against La Cosa Nostra to Giuliani two months after he became the U.S. Attorney in Manhattan. Giuliani has denied that, and the conflicting accounts have stood as a he said-he said situation.

So RUDY! Always taking credit for other people’s efforts.

I noted a while back that Lawrence Kudlow has a Faux News show where he just lies about job growth under Biden v. job growth under Trump. Well this story compares Kudlow’s lies to the actual figures from BLS:

https://www.msn.com/en-us/news/politics/fox-propaganda-for-trump-reaches-new-low-with-altered-statistics/ar-AA1fsd6k?ocid=msedgdhp&pc=U531&cvid=e39ab43b478d41a9aab5566d775f927c&ei=9

Lame comment. Your unsupported declarations about the future of anything are irrelevant to the discussion. Same goes for Karen. How is Karen, by the way?

The SPF series for inflation forecasts is for CPI. The authors need a long-term forecast. They don’t need your permission to use it.

Interesting take from Politico on Commerce Secretary Raimomdo’s trip to China:

https://www.politico.com/news/2023/08/18/raimondo-china-economic-downturn-00111912

The “China will ask for U.S. help with its economy” presentation strikes me as intentionally from a U.S. point of view. “China will ask the U.S. to get off its back” might be as accurate.

The U.S response might well be “In return for what?” Vague “growth is good for everybody” arguments won’t wash. And as Politico notes, Congress is impatient with the small (invisible) returns from the Blinken and Yellen visits.

So while the Politico take is interesting in its way, I kinda think it might be nothing more than standard journalism – we gotta write something which sounds like a story, so here’s something that sounds like a story.

“The Commerce secretary is likely to get an earful about how U.S. export and investment restrictions are kneecapping China’s economy.”

Reminds me of Joan Robinson’s tirade against Beggar Thy Neighbor.

And by the way, sending three cabinet officials to China in quick succession is a clear sign that the U.S. is open to improving relations. China’s treatment of Blinken was childish, and the U.S. has let it slide; further evidence of openness to improvement.

Serious statecraft looks for results. If the tools Biden is using are effective enough that China sees them as a threat to economic performance, points to Biden. What does China offer in return for less pressure from the U.S?

a reaction to the ‘invigorated security doctrine’ at camp david between usa, japan and south korea……… ?

You mean Chinatreatment of Blinken. Sort of a “Pre Hoc Ergo Propter Hoc” thing?

how many army and marine brigades is blinken “being annoyed” worth shipping to Guam?

Here we go…

Why should the U.S. stop using effective policy tools in its rivalry with China while China continues to threaten violence against the people of Taiwan?

Oops:

https://edition.cnn.com/2023/08/18/china/china-launches-military-exercises-taiwan-intl-hnk/index.html?utm_term=link&utm_content=2023-08-19T04%3A30%3A04&utm_medium=social&utm_source=twCNNi

“GDP at 70: why genuinely sustainable development means settling a debate at the heart of economics…As the economist Kate Raworth writes in her 2017 book, Doughnut Economics, “We have economies that need to grow, whether or not they make us thrive; what we need are economies that make us thrive, whether or not they grow.”

https://www.nature.com/articles/d41586-023-02509-5

A good discussion from Nature Magazine…followed by “Reducing inequality benefits everyone — so why isn’t it happening?”

https://www.nature.com/articles/d41586-023-02551-3?utm_source=Nature+Briefing&utm_campaign=5ffa7df8b9-briefing-dy-20230817&utm_medium=email&utm_term=0_c9dfd39373-5ffa7df8b9-49125439

Well for one thing, macroeconomists seem obsessed with GDP growth, which overwhelmingly goes to the top 10%. Absent any other explanation, you have to conclude that there are powerful incentives in place to focus on GDP growth and to ignore distribution and externalities.

” there are powerful incentives in place to focus on GDP growth and to ignore distribution and externalities.”

Everything in that discussion has been discussed extensively by economists. To suggest economists ignore the distribution of income is just another one of your pointless little emotional rants. And the only person here who wants to dismiss externalities is CoRev who is not an economist. OK CoRev is almost as stupid as you are. And what was your point? That CoRev deserves a Nobel Prize? Seriously?

pgl says that “Everything in that discussion has been discussed extensively by economists…” but you sure don’t see pgl or anyone else here talking much about it. Sure, if you look around enough, you can find the occasional economist who talks about these issues…but economists obsessing over GDP growth are a dime a dozen.

“you sure don’t see pgl or anyone else here talking much about it. Sure, if you look around enough, you can find the occasional economist who talks about these issues”

This is the most pointless lie in the book. But one Jonny boy has to say every day. No Jonny boy – you are nothing more than a sad carnival barker hoping anyone will listen to your stupid BS. But sad to say – no one gives a damn about your stupid lies.

“…macroeconomists seem obsessed with GDP growth, which overwhelmingly goes to the top 10%.”

Johnny is learning!!!! He finally got the “macro” part. Now if he could just work in getting anything else right. Anything at all.

OK, so let me rephrase that macroeconomists seem obsessed with GDP growth, but not with the fact that it overwhelmingly goes to the top 10%. The care and feeding of the top 10% is paramount…but glossed over for some strange reason…having to do with embedded, unacknowledged incentives?

If one watches Charlie Brown shows, the adults always come across as “blah, blah, blah”. I guess little Jonny boy loves these cartoons as Jonny boy for once gets to play the adult.

I have to wonder if little Jonny boy has even read this:

Doughnut Economics

https://www.weforum.org/agenda/2017/04/the-new-economic-model-that-could-end-inequality-doughnut/

The hole at the Doughnut’s centre reveals the proportion of people worldwide falling short on life’s essentials, such as food, water, healthcare and political freedom of expression – and a big part of humanity’s challenge is to get everyone out of that hole. At the same time, however, we cannot afford to be overshooting the Doughnut’s outer crust if we are to safeguard Earth’s life-giving systems, such as a stable climate, healthy oceans and a protective ozone layer, on which all our wellbeing fundamentally depends.

I’ll grant the morons like Kudlow who advised the Trump Administration bothered to read what she wrote. But if Jonny boy thinks Kudlow is an economist then Jonny boy is dumber than even I gave her credit for. But matters like climate change and inequality have been discussed by real economists since before little Jonny boy was even born. And much of what she is recommending had its place in Biden’s Build Back Better proposals. For Jonny boy to declare no one except him cares about such matters is a stupid lie that wastes too much of our time. No Jonny boy should find something else to do with his worthless little life.

The Constitution Prohibits Trump From Ever Being President Again

The only question is whether American citizens today can uphold that commitment.

By J. Michael Luttig and Laurence H. Tribe

https://www.theatlantic.com/ideas/archive/2023/08/donald-trump-constitutionally-prohibited-presidency/675048/

Why do conservatives hate renewable energy?

https://jabberwocking.com/why-do-conservatives-hate-renewable-energy/

Interesting post from Kevin Drum. As to his question – maybe we should ask CoRev. Check out the link to that costly nuclear power plant Georgia Pacific finally got up and running.

Ita love/hate relationship. If you love the extraction and combustion of hydrocarbons, then you hate clean energy.

It strike me as odd that Drum went for the emotional immaturity of those who squack “liberal, liberal, liberal” and ignored the money. He knows better. “Liberal, liberal, liberal” is a cover for moneyed interests doing what moneyed interests do.

The money interest for the 1% is clear – but why do all the poor, uneducated MAGA heads hate renewables. They certainly don’t express much love for Wall Street. If anything the idea of every man in his own house producing his own energy (via solar panels and small roof wind turbines) fits like hand in a glove with the rugged independent individualist meme so popular on the right. I think there is a good case to be made that it simply is their hate of liberals combined with their immense ignorance that guides this resistance to clean energy. The technical/scientific issues are to complicated, but if the other side is for it, then they will be agains it.

get up to date, the latest term for maga/deplorables is listless vessels

At last, somebody gets it –

https://jacobin.com/2023/08/federal-reserve-inflation-rate-hikes-price-shocks

The Fed hasn’t brought inflation down, certainly not by itself. The sources of inflation were mostly transitory, and have passed. The Fed’s suppression of housing demand has also suppressed supply. Nonresidential fixed growth remains above the pre-Covid average. Not the Fed.

Nonresidential fixed INVESTMENT growth…

Little Jonny boy is chirping that economists do not understand why mortgage spreads are elevated. I get little Jonny boy is incapable of reading actual economists but for the adults in the room, here is a paper I have provided before:

https://www.newyorkfed.org/research/staff_reports/sr674.html

Understanding Mortgage Spreads

May 2014 Number 674

Revised June 2018

Authors: Nina Boyarchenko, Andreas Fuster, and David O. Lucca

Most mortgages in the U.S. are securitized in agency mortgage-backed securities (MBS). Yield spreads on these securities are thus a key determinant of homeowners’ funding costs. We study variation in MBS spreads over time and across securities, and document a cross-sectional smile pattern in MBS spreads with respect to the securities’ coupon rates. We propose non-interest-rate prepayment risk as a candidate driver of MBS spread variation and present a new pricing model that uses “stripped” MBS prices to identify the contribution of this prepayment risk to the spread. The pricing model finds that the smile can be explained by prepayment risk, while the time-series variation is mostly accounted for by a non-prepayment risk factor that co-moves with MBS supply and credit risk in other fixed income markets. We use the pricing model to study the MBS market response to the Fed’s large-scale asset purchase program and to interpret the post-announcement divergence of spreads across MBS.

OK – little Jonny boy does not know what prepayment risk means so he will once again not read this paper. Back to little Jonny boy’s chirping.

One of the drivers of divergence between perception of inflation vs. reality is that lay people don’t understand the term the same way economist define it. That has the unfortunate effect of making lay people think that economist don’t know what they are talking about – and then they listen to Faux news hosts instead.

If a bag of potatoes goes from $4 to $8 in a year, both economists and lay people accept that there has been inflation. If during the next year the price stay at $8 the lay people will still talk about inflation being bad, whereas the economist will (correctly) say (annual) inflation is 0% and we have to worry about deflation. When lay people talk about inflation they talk about prices, whereas the economist talk about the delta in prices.

Economists may need to change their communications to better fit with lay peoples vocabulary. Maybe talk about prices still being high but having stabilized. Or prices of something being back to where they were before event X.