ADP surprises (again) on the upside (324K vs. 189K Bloomberg consensus). I’m not sure we should take too much from that development.

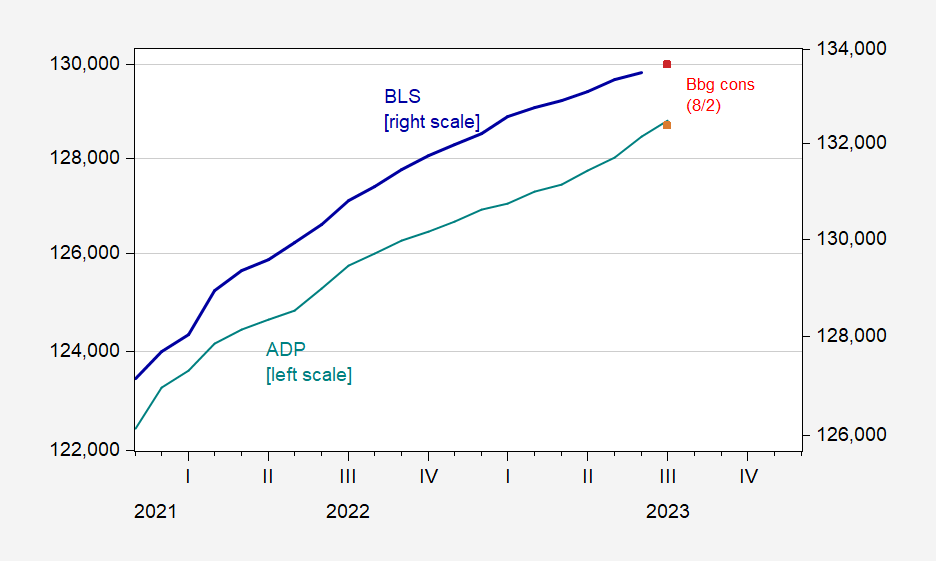

Figure 1: Private nonfarm payroll employment from ADP (teal), Bloomberg consensus (tan square), from BLS (blue bold), Bloomberg consensus (red square), in 000’s s.a. Implied levels calculated by adding consensus change to June release levels. Source BLS, ADP via FRED, ADP, Bloomberg, and author’s calculations.

It’s a little hard to see how big the surprise is in levels terms. Here’s the same information in m/m changes (m/m log differences looks similar).

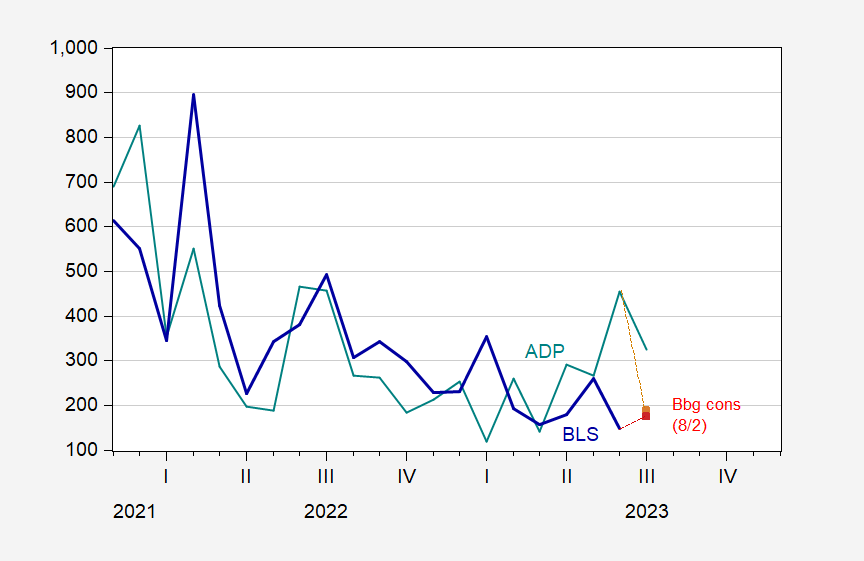

Figure 2: Month-on-month change in private nonfarm payroll employment from ADP (teal), Bloomberg consensus (tan square), from BLS (blue bold), Bloomberg consensus (red square), in 000’s s.a. Source BLS, ADP via FRED, ADP, Bloomberg, and author’s calculations.

My skepticism in inferring too much from this ADP number is that the relationship of the seasonally adjusted numbers is apparently weak (GS has pointed the finger at distortions in the seasonal adjustment process). Using the estimated relationship for June, a big BLS number was predicted. Instead, we got a number weaker (149K) than consensus (218K).

https://www.nytimes.com/2023/08/01/opinion/us-economy-covid-2008.html

August 1, 2023

Out of the frying pan, into a lost decade

By Paul Krugman

Today I want to talk about frying pans. No, I haven’t joined the staff of The New York Times Wirecutter. * I’m talking instead about a suddenly popular new type of economic chart, dubbed “frying pan charts” by Alex Williams of Employ America. Here’s an example, depicting the percentage of Americans in their prime working years actually employed:

https://static01.nyt.com/images/2023/07/31/opinion/krugman010823_1/krugman010823_1-jumbo.png?quality=75&auto=webp

As you can see, up to 2020 this chart kind of looks like a skillet — a flat section, the handle, in the years before the 2008 financial crisis, then a long dip, the pan itself, before it finally got more or less back to its pre-crisis level. There was another plunge with the Covid recession, but it was brief, and we’re now all the way back to pre-Covid employment levels.

Here’s another chart, showing the ratio of real gross domestic product to the Congressional Budget Office estimate of “potential” G.D.P. — what the economy should be able to produce at full employment. It’s not quite as pretty, but looks similar:

https://static01.nyt.com/images/2023/07/31/opinion/krugman010823_2/krugman010823_2-jumbo.png?quality=75&auto=webp

You can draw comparable charts for many other economic variables, some of them just showing levels like the two figures above, others showing deviations from the pre-2008 trend. Their consistent shapes all tell the same story: The U.S. economy remained significantly depressed for many years — indeed, a decade or so, after the financial crisis — and this lost decade could have been avoided with the right policies.

How do we know that it could have been avoided? Because of what happened the past few years, when the U.S. economy, boosted by major federal spending programs, came roaring back from the Covid slump, regaining all the lost ground in just over three years. If America had done as well after the financial crisis, we would have been back on trend by mid-2011.

So why didn’t that happen? President Obama did pass what media reports insistently called a “massive” fiscal stimulus, but it was in fact far too small, given the size of the financial shock. That’s not 20/20 hindsight; I was tearing my hair out over the plan’s inadequacy in real time. It was also obvious to me, although apparently not to Obama officials, that they had only one shot at getting it right — that if the plan failed to produce a vigorous recovery, Republicans would say, “See, stimulus doesn’t work,” and nothing more would be done.

In fact, by 2010, with unemployment still close to 10 percent, the Very Serious People of Washington lost interest in job creation in favor of obsessing about the national debt. As a result, we turned to years of fiscal austerity that held the economy back….

What Krugman is forgetting is that there were not the needed support in congress for anything larger than what was passed – and that predictably was not sufficient.

Ya gotta ask. Summers told Obama not to ask. Romer tore her hair out. Some time later, Summers told Romer she had been right. Shoulda asked for more.

They did ask, but not as a big public event. In politics you sit down with the leaders of your own party and figure out what we can all agree to – then go out and have a big “united we stand” press conference. There was a lot of fear and resistance among conservative democrats (and the 3 GOP senators) to anything that started with a T so they ended just below a trillion. They settled on the compromise idea was that if this proved to be not enough they could always go back and get more – that was a big miscalculation. Same thing with Obamacare, settle for what you can get and then go back for more. As much as we all would like to force our ideas through, there is no alternative to that approach in a democracy.

Back then Christina Romer was literally screaming for more fiscal stimulus whereas Summers kept worrying about what would excite him and the Republicans. Obama should have fired Summers and listened more to Romer.

From a perspective which focuses on labor needs, we are passing through the most successful monetary tightening period in the last 50 years. The Fed has raised interest slowly and gradually enough to allow for a robust labor market while quickly limiting price increases:

https://fred.stlouisfed.org/graph/?g=mYFT

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2000-2023

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=mYFV

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2000-2023

* Employment age 16 and over

(Indexed to 2000)

” The Fed has raised interest slowly and gradually enough…”

Where on eartg did you get that notion? Fed rate hikes were neither slow nor gradual:

https://fred.stlouisfed.org/graph/?g=17wnQ

Rate hikes were the fastest in the U.S. since the mid-1980s, the earliest days of the Great Moderation.

It is not evident that Fed policy allowed job growth nor that it is the major factor in limiting inflation. It is not easy to imagine how Fed policy could have done both, since weakening the labor market is one of the main pathways for rate policy to weaken inflation.

What we actually have is a fascinating period of economic performance which doesn’t conform well to familiar patterns. Trying to shoe-horn today’s economy into conventional patterns is a great way to misunderstand what’s happening.

Exactly. Inflation moderation had little to do with the rate hikes because price increases were not driven by cheep loans but by supply chain problems. Solve the supply chain issues (something that is done by markets, not the Fed) and inflation goes down. At best you could say that the Fed took advantage of inflations predictable patterns and hiked rates under its cover. It is clear that we needed to get back towards more normal rates (with real rates being positive), so this was as good a time as any to get there. Only time will show to what degree they overdid it – since they really couldn’t wait and see the results if they knew inflation was going to go down, regardless.

You just made the case that the FED increased interest rates too much.

I have been of that opinion for a while. However, I also thought there was a better than 50/50 chance of negative GDP for 2 quarters in a row and that was too pessimistic.

There is a lot to be said for having 10 year treasuries yield 2-3% above inflation. Savers can get a small and steady income from a very safe investment, rather than be forced into risky endeavors where they should not be. This prevents a lot of bubbles from forming in different markets (as ignorant investors desperately seek higher yields). It also ensures that truly risky endeavors will have to pay a sizable risk premium go attract money.

I was concerned the speed and magnitude of the rate increases would throw the economy into a recession – but that seems unlikely at this time. Biden has brilliantly made sure that an appropriate stimulus countered the effects of rate increases. The remaining concern is what will happen to housing and commercial real estate. Increased rates means increased cost or decreased values, and the speed of rate changes means there will be little time to adapt to that. It will take a few years for that to fully play out – so we will see how bad it gets.

https://fred.stlouisfed.org/series/DFII10

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed

10-year real rates were around 2% before the Great Recession.

“10-year real rates were around 2% before the Great Recession”

Yes, and had it not been for the absurd deregulation of the Bush II administration (begun under Clinton) we would not have had the bubble and the crash. People went with what seemed like safe bonds at good rates – but nothing safe about them because of lax regulation and corrupt/incompetent rating agencies.

https://fred.stlouisfed.org/graph/?g=ltTj

January 4, 2018

United States Employment-Population Ratio, * 2000-2023

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=lMaN

January 4, 2018

United States Employment-Population Ratios for Men and Women, * 2000-2023

* Employment age 25-54

A Chinese company hiring Michigan workers to make batteries for their EV?

https://www.scmp.com/news/china/article/3217798/despite-outcry-michigan-approves-us175-million-chinese-owned-ev-battery-plant

A proposed Chinese-owned EV battery component plant in Michigan facing public opposition eked out a key legislative win on Thursday when the state’s Senate Appropriations Committee approved US$175 million in incentives by a 10-9 vote. All six Republican members and three Democrats on the Senate Appropriations Committee voted against financing Gotion Inc’s 700-acre project in Green Charter Township in rural Michigan. The vote was the final one needed to approve the transfer of state tax dollars, allowing officials to move forward. The Michigan House approved the funding last month.

Registered in California, the company is an American subsidiary of China-based Gotion High tech. For months, it has faced public and political backlash because of speculation over its alleged ties to the Chinese Communist Party. At the hearing, Chuck Thelen, Gotion Inc’s vice-president for North American operations, announced that the company had received clearance from the Committee on Foreign Investment in the United States (CFIUS), an inter-agency federal panel that reviews transactions involving foreign investments for possible national security threats.

And JohnH was telling us this could never happen. But rest assured that Bruce Hall will do all he can to make sure people from China are banned from his state.

pgl’s Chat GPT random insult generator is once again busy fabricating what people say…

Jonny boy has been taking comedy lessons from Donald Trump! Only problem little Jonny boy – EVERYONE here knows you are full of malarky. Read the room moron – EVERYONE here is laughing AT you.

Dude – find another blog where the readers do not know you yet because you are toast here.