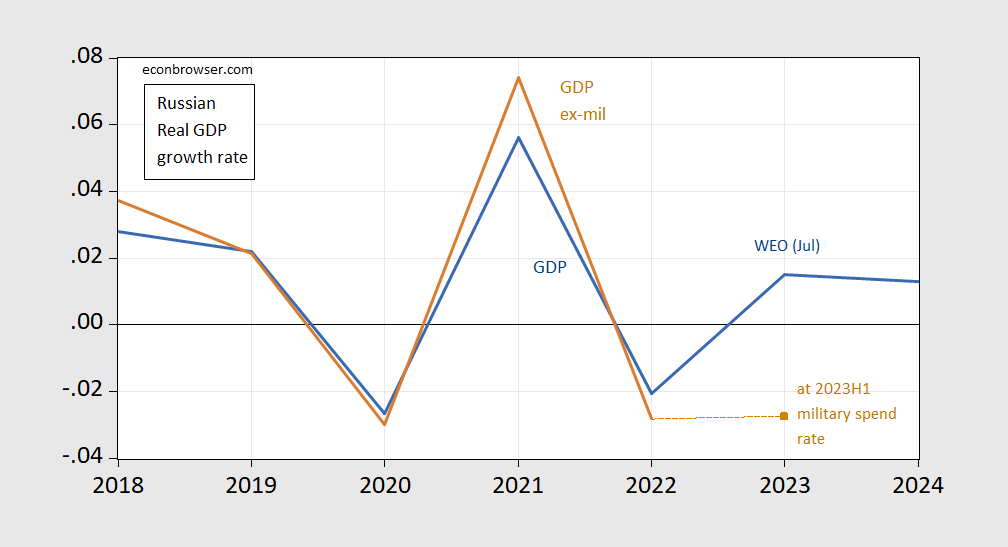

There has been much discussion of how Russian GDP growth exceeded some forecasts (see discussion here). While GDP measures output, it does not measure only output that contributes to necessary to welfare. It also excludes non-market mediated activities. One big change in the past year and a half is military expenditures, which is now a larger component of GDP. In Figure 1 below, I show real GDP growth y/y as reported, and real GDP growth ex-military spending as tabulated by SIPRI.

Figure 1: Russian real GDP growth (blue), and GDP ex-military spending (tan), both y/y. GDP growth for 2023 and 2024 is IMF WEO July 2023 forecasts. 2023 ex-military spending value is calculated using spending rate in 2023H1. Source: GDP from IMF WEO (April, July), military spending from SIPRI, Reuters.

Note that the calculation of real GDP ex-military spending relies upon applying the GDP deflator to the GDP ex-military spending output. In the absence of reliable deflators for the two components, this is just an expedient.

The calculations imply that y/y GDP ex-military spending contracted at a rate of 2.8% in 2022, and will again in 2023, assuming that military spending in 2023H2 proceeds at the same nominal rate it did in 2023H1 (the April 2023 IMF WEO assumed about 10% inflation rate in the GDP deflator, so my assumption is pretty conservative I think).

One might be very well skeptical of the validity of these calculations, given doubts about Russian GDP statistics, as well as SIPRI calculations. I will note that a lot of the surge in manufacturing production seems to be defense related (see discussion at BOFIT), so something of this phenomenon shows up in other statistics.

More detailed discussion from this June SIPRI report.

If one wanted to calculate net GDP (another step in the process of calculating the old Tobin-Nordhaus MEW), one would likely get a lot slower growth than reported in GDP. That’s because lots of capital has become obsolescent faster given sanctions; that’s not to mention the destruction of military capital assets.

On this last point, I gave up trying to calculate and/or estimate a number. For instance, in a July Bloomberg article:

“Russia has lost nearly half the combat effectiveness of its army,” Radakin told the legislature’s defense committee. “Last year it fired 10 million artillery shells but at best can produce 1 million shells a year. It has lost 2,500 tanks and at best can produce 200 tanks a year.”

Without knowing the composition of the 2500 tanks (T-90s vs T72s, etc.), and valuation, it’s hard to say how gross investment differs from net.

I

In other words, Putin turned a recession economy into an economy showing overall GDP growth the same way Hitler did the same of Germany back in the 1930’s. Yep – run military Keynesianism by committing war crimes on the citizens of another nation.

And Putin is also reducing the size of his country’s population by a decent amount. According to Ukrainian counts, there are 250k fewer men than there were a couple years ago. In a country of 144 million, that doesn’t seem like that many, but when you consider their demographics and who is getting killed, it’s worse than it looks at a quick glance. That will have many years of impact on Russian productivity. And, of course, military spending is all about sending stuff off to get destroyed. It does nobody any good at home. When you divert the productivity of a whole nation into military spending, it can’t be good for standards of living. I don’t see any way Putin will be able to recover from this war.

Pointing out the obvious is my superpower sometimes.

“According to Ukrainian counts, there are 250k fewer men than there were a couple years ago.”

putin will be dead long before this really becomes an issue. not a concern of his in the least. long term Russian concerns are not a priority for putin. that is what makes him so dangerous.

Putin = Trump in this regard. Both of them care only about themselves.

Page 2 of the SIPRI report:

Besides the categories of forces and equipment involved, the notion of ‘special military operation’ can also be understood in terms of the level of intensity of war fighting that Russia expected to encounter. Having faced stiff

Ukrainian resistance, Russia’s expectation of a quick victory evaporated but it was not willing to abandon the term and admit publicly that its invasion was in fact a fully fledged war of aggression. However, in assessing funding of

the war, this dimension is important. Russia has been engaged in the conflict in a financially limited manner, as if seeking to minimize its economic cost and the impact on domestic society. It appears to be fought, not with the

resources of a full-scale war, but indeed as a more limited military operation. For that reason, the war is at times referred to in this paper as the ‘SVO’. This does not mean endorsement of this perspective but is intended to reflect a

factor influencing decisions on resource allocation, which this paper focuses on.

In other words, Putin thought Russia could take Ukraine on the cheap. It has not turned out that way at all. This reminds me of how the Bush neocons told us we could take Iraq in 2003 on the cheap. That did not turn out so well either.

Of course, what ultimately matters is not how much is produced this year, but rather how much can be produced this year without reducing next year’s consumption; i.e., net domestic product. The long run prospects for a two trillion dollar economy with a 10 percent depreciation rate are very different from a two trillion dollar economy with a 5 percent depreciation rate. And building stuff with the intent of blowing it up is almost the very definition of depreciation.

“And building stuff with the intent of blowing it up is almost the very definition of depreciation.”

One of my colleagues during my first year taking graduate microeconomics was an ex-CIA analyst with a cutting sense of humor. He referred to what you just described as the Invisible Foot.

my brother, who worked in the defense industry, referred to our nations infrastructure (bridges, building, dams, power plants, etc) not as infrastructure, but as targets.

Frederic Bastiat writing about investing in fortifications such as Verdun said any money spent on war things that depreciate/ need sustainment, as well as things that might not be used is money better spent elsewhere. See Maginot line.

Money spent while at war does not have the same chances to be wasted.

If Russian federation sees the SMO as existential, then shifting demand to war materiel is justified.

Seeing the war in Ukraine as “existential” would be a fantasy. So war spending should be evaluated as a loss to the welfare of Russian citizens.

Was the Holocaust existential? Of course not. You are excusing war crimes.

Are they trying to say that Putin shot his wad??

This is one of the better and more emotionally moving documentaries I have seen in awhile. Highly recommended. It’s free, just hit the play button in the middle of the image after you make the link jump:

https://www.pbs.org/video/far-east-deep-south-ovijey/

As we should know by now, GDP does measure the “economy” but doesn’t necessarily correlate with how ordinary people are faring, which is why I look at real wages. https://tradingeconomics.com/russia/wage-growth

One of the neocons’ goals was to make ordinary Russians suffer via sanctions to the point that they would overthrow the government. Of course, governments were not overthrown in Cuba, North Korea, Iran, Venezuela, and most other countries where sanctions were applied. Pointless and futile…except that foreign policy elites got to enjoy the suffering of others.

However, there is a fair amount of talk about how our allies, specifically Germans, are not doing so well…maybe Germany was the real target? https://tradingeconomics.com/germany/wage-growth

Ah yes – Biden made Putin invade Ukraine. Even though we all know you are a complete moron who lies 24/7, pray tell what is your “expert” forecast of Russian real wages?

Jonny boy demanded Dr. Chinn take a longer term view of US real wages even though Jonny boy wanted us to ignore the 2008 to 2013 incredible decline in UK real wages. Take a longer term view of Russian real wages and it seems Jonny boy did it again:

https://tradingeconomics.com/russia/wage-growth

Yes sending your young men off to die in a war can cause labor shortages. But notice all the periods where Russian real wages had declined under Putin. Jonny boy wants us to ignore all of that. Same old lying Jonny boy.

“Germans, are not doing so well”

Folks – take a longer look at German real wages. Some periods of very strong increases which lying little Jonny boy does not want you to know about.

There are now three things in life that are certain – Death, Taxes, and Jonny boy lying about real wages.

Once upon a time Germany had decent real wage growth…but that came to an abrupt end when they decided to substitute expensive LNG for Russian natural gas. Of course, pgl chooses to overlook recent events.

https://www.fxmag.com/forex/german-industrial-decline-persists-stagnation-prevails

And the loser is…Germany.

“but that came to an abrupt end when they decided to substitute expensive LNG for Russian natural gas.”

Jonny boy wants everyone to know he is the dumbest troll ever created. Gee Jonny boy – when did this natural gas substitution occur? Oh yea – last year. So Jonny boy admits without knowing it that he cherry picked an incredibly short period of time.

Yea – Jonny boy is THAT STUPID.

“Once upon a time Germany had decent real wage growth…but that came to an abrupt end when they decided to substitute expensive LNG for Russian natural gas.”

First of all German wages are much higher than Russian wages. But yea Jonny boy finds a short period of time where they may have dipped a wee bit. And of course Jonny boy says the sole cause of this is higher natural gas prices in Europe. I guess our dumbest troll ever does not know that these prices are lower than they were in early 2022:

https://fred.stlouisfed.org/series/PNGASEUUSDM

Yea proving someone as stupid as Jonny boy must be as challenging as asking ARNOLD to bench 20 pounds.

So they are fighting a war at 10 times its sustainability level (producing 200 tanks but losing 2500, using 10 million shells but producing 1 million). On the opposite side is Ukraine who with backing from the West is constantly increasing the amount of war material it can gets and can use. The people who peddle Putins narrative that time is on Russias side and that they can just hold on and “wait it out”, will be surprised at how things develop over the next 2 years. The West has a vastly bigger ability to increase military production than Russia.

An honest accessment. Get ready for it as you have made Putin’s pet poodle angry and Jonny boy has an entire file of pointless insults.

My concern in that matter is not that Ukraine will run out of weapons. They won’t for the reason you point out. But they are not an enormous country to begin with, and they have had a low birth rate for some time. They will run out of people to fight this war if it goes on too long. And then they won’t have much of a workforce when it’s over.

That is why Ukraine is using tactical approaches that spare soldiers. They have been quite good at that – and Russia has been very bad at it. Furthermore, Russia has lost over 1 million young people who have left in order to not be drafted. Those will be permanent loses so Russia will face a much bigger population crunch than Ukraine.

After the end of a war, the economy usually get a huge lift by the rebuilding and replacement of destroyed infrastructure and productive assets, with something brand new, modern and more efficient. That will happen in Ukraine with a huge “Marshall plan” effort from western Europe. Russia will struggle using its dwindling hydrocarbon revenue to rebuild useless non-productive military stock. My guess is that 2 decades from now the GDP of Ukraine will top that of Russia.

It is worth noticing that Russia has not yet put its society on a full scale war footing. Biden has brilliantly kept Putin under the illusion that he can win this conflict without doing that – if he just wait it out. Furthermore, by keeping the war from entering Russian territory, it becomes hard for Putin to get political cover for the sacrifices of a switch from “special military operation” to full out war. While Putin is “waiting it out”, his military is being degraded to the point where even a full all out war effort from Russia would not allow them a win. This is a very complicated and delicate political situation – thank God we have a competent President.

“After the end of a war, the economy usually get a huge lift by the rebuilding and replacement of destroyed infrastructure and productive assets, with something brand new, modern and more efficient. That will happen in Ukraine with a huge “Marshall plan” effort from western Europe.”

Let’s just make sure Trump does not regain the White House as this Putin puppet would do all he could to undermine this Marshall Plan II.

Back in Iowa Donald Trump was on the road telling farmers there that the world is coming to an end thanks to Biden who apparently does not “care” about farmers they way Trump cared about farmers. Now readers of this blog know soybean prices were really low under Trump and have risen rather dramatically since Biden took office. So I decided to see if corn prices were different:

https://www.macrotrends.net/2532/corn-prices-historical-chart-data

Huh – low under Trump but much higher since Biden took office. But hey – Trump cares and Biden is a socialist.

As a person born in Iowa, (and someone who, although has spent most of my life in the South Plains, views myself and identifies more as a Midwesterner) all this does is make me feel extreme shame to be Iowan. When I see Iowans cheer trump it literally makes me wince in shame.

Update on the price war among Chinese EV manufacturers:

https://www.msn.com/en-us/money/markets/tesla-restarting-its-price-war-in-china-with-new-cuts-sending-the-shares-of-its-warren-buffett-backed-competitor-down-6/ar-AA1ffxyq?ocid=msedgdhp&pc=U531&cvid=ed0a3bb944b54c649edd65c62dfed485&ei=8

The brutal EV price war in China could be starting up again. The Elon Musk-run carmaker Tesla is slashing the starting price of its Model Y Long Range and Performance models by 14,000 yuan, or just over $1900, according to Reuters…Last month, China’s automakers pledged not to “disrupt fair competition with abnormal pricing,” a reference to the price war. They were joined by Tesla, the only foreign automaker to take part. (The pledge also contained a promise to uphold China’s “core socialist values.”)

Core socialist values? Marx must be rolling in his graves. The pledge is nothing more than old fashion oligopoly behavior. Of course, oligopolist collusion often breaks down when the demand for a good is below what has been set as the player’s supply. The breakdown of this pledge is good news for consumers but sort of sucks for the profits of the oligopolists.

Trump may have lost his marbles:

https://www.msn.com/en-us/news/other/trump-says-former-lt-governor-shouldn-t-testify-in-georgia-election-tampering-probe/ar-AA1fggWU

Former President Trump on Monday said former Georgia Lt. Gov. Geoff Duncan (R) shouldn’t testify before a grand jury that is preparing to potentially indict Trump this week. “I am reading reports that failed former Lt. Governor of Georgia, Jeff Duncan, will be testifying before the Fulton County Grand Jury. He shouldn’t,” Trump wrote on Truth Social. Duncan confirmed Saturday that he had been requested to testify before a Fulton County grand jury Tuesday, indicating charges in District Attorney Fani Willis’s (D) 2020 election investigation are imminent.

First of all – interfering with a witness itself a crime. A crime that could land Trump in an orange jail suit even before any trial. Secondly Geoff Duncan is a very well respected person for a Republican. There may be a lot of Trumpian racists where Marjorie Taylor Greene calls home but not enough to counter the number of sensible people in places like Atlanta. Chalk Georgia up as a Democratic win in 2024.

An interesting economics question regarding Russian oil production/exports. Russia has agreed to voluntary production cuts as part of OPEC+, as has KSA. OPEC forecasts Russian production will fall from 11.20 million barrels per day (mbpd) in 1Q23 to 9.57mbpd in 4Q23. This would put their forecast 2023 production at 10.38mbpd. Opec then forecasts Russian production will rebound from Q423 levels in 2024. That rebound would keep their annual 2024 production flat with 2023 (10.38mbpd). This would create a projected shortage of barrels in 2H23, which will require global inventories to be drawn on. The demand “call on OPEC” is greater than their current production.

But, what if we look at Russian supply as two separate sources. One that is subject to price caps, and one that is not. When deciding which barrel to cut as part of the voluntary OPEC+ cuts, they would clearly choose the price capped barrel. In theory, that would also mean there is no supply elasticity to the voluntary cuts outside of driving price up to a point where it breaks the cap.

North American producers have committed to fiscal discipline. Many have made pledges to use a % of free cash flow (fcf) to pay down debt, and use the rest to be returned to shareholders in the form of dividends/buybacks. As an example, CVE will return 50% of FCF to shareholders until their net debt reaches 4bln, then 100% will be used to return to shareholders. There also isn’t the oilfield service spare capacity to meaningfully increase production. Supply elasticity is constrained by commitments to shareholders and capacity (e.g. rigs, frac crews, sand).

Of the biggest 3 producers in the world (US, Russia, and Saudi Arabia) only one has meaningful supply elasticity. According to the IEA, global oil demand is at a record high. One final note, there is an alternative source of barrels outside production/commercial inventory, strategic petroleum reserves. The US still has ~350 million barrels, down roughly 50% from 2016. And while China’s SPR isn’t public, their total commercial and SPR inventories are estimated to be >900million according to KPLER.

Interesting but one caveat. Russia will likely cheat on its agreement to curb its production.

Fair enough. China and India are taking so much Russian crude, that perhaps the entire price cap has failed. Strange that Russia would volunteer to cut, in a war, with a collapsing Ruble however.

Are you saying Russia makes strange policy choices?? Insightful. MP123, Can you tell me…… does ocean water still have salt in it or is that just a bad rumor??

Lies and reneging on oil production levels in the OPEC cartel happen all the time. The outlier is when these promises are kept.

Under Saddam Hussein, Iraq cheated on the cartel production quotas routinely. Let’s see – Putin took over Crimea for oil. Saddam invaded Kuwait for the same reason.