What is your answer to the question: How Close to Full Capital Mobility Are We?

It’s got to depend on what countries are involved, what time horizon, etc. In a recent paper entitled “Measuring Financial Integration:

More Data, More Countries, More Expectations”, Hiro Ito and I tackle this question of mobility and substitutability (terminology due to Frankel), relying upon a key decomposition:

The items in the [square bracket] and <angle bracket> are relevant to the question of why interest rates, adjusting for expected exchange rates, differ. Frankel (1983) defined zero covered interest differentials as full capital mobility, and zero exchange risk premium as full capital substitutability, and in this discussion I retain this terminology, and associated decomposition.

Covered interest differentials used to be attributed to the presence of capital controls, or the threat of imposition thereof. More recently, they can arise (in the real world) because of capital requirements and other regulatory-induced frictions, associated liquidity issues, as well as default risk. Exchange risk premium — the deviation between forward discount and expected depreciation — is associated with the risk of holding a currency, in earlier times modeled as return covariance with wealth, or more recently (1990’s) with return covariance with consumption growth.

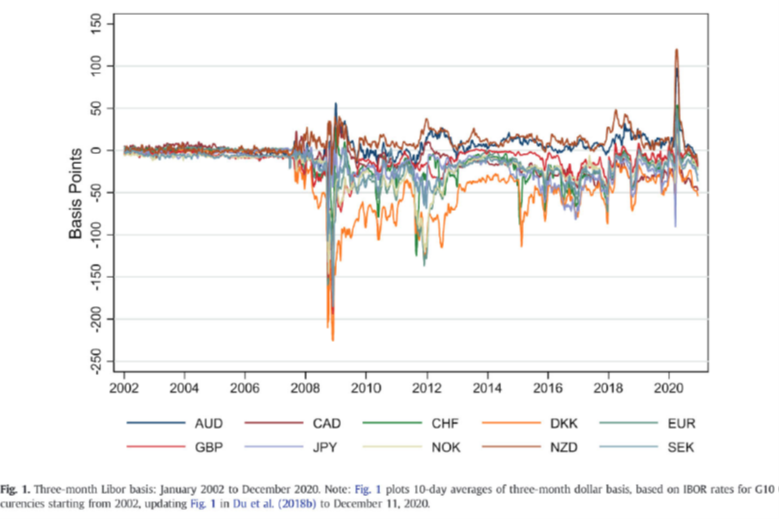

By the criterion of covered interest parity holding, mobility seems to have decreased in the wake of the Global Financial Crisis, as this graph from Cerutti et al. indicates.

Figure 1: Covered interest differentials, bps. Source: Cerutti et al. (2021).

While financial capital is now less free to move, it’s important to understand that to a certain extent, this development is intentional; that is the deviations in recent years are partly driven by capital requirements that are aimed at reducing the likelihood of crises in short term credit markets (see discussion in Wu and Schreger, 2021). For six emerging markets, where different factors come into play, see the paper by Geyickzi and Ozyildirim (2021, JIFMIM 2023).

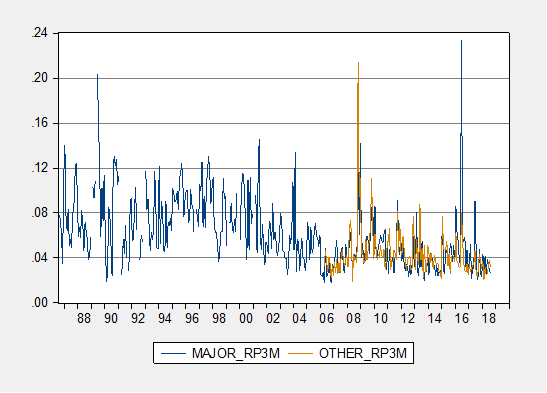

For the second item, relating to exchange risk, we forego the rational expectations assumption and use survey data to evaluate the size of exchange risk premia at short horizons (3 months), and find that over the past three decades, they have generally decreased, for major currency pairs. On the other hand, for emerging market and developing country currencies (against the USD), there’s been little change on average over the past two decades.

Figure 2: Average absolute uncovered interest differential for advanced economy currencies (blue), for emerging market currencies (tan), annualized. Calculated using survey data. Source: Chinn and Ito (2023).

These are measures of deviations from CIP and UIP. They do not directly inform the question of “what’s the slope of the BP=0 schedule” in the IS-LM-BP=0 model. But they do suggest that the BP=0 line is unlikely to be perfectly flat, even for advanced economies where capital controls are absent.

Lecture notes on IS-LM-BP=0 (aka Mundell-Fleming) here:

https://econbrowser.com/archives/2023/08/no-gdp-downturn-forecasted-spf#comment-303299

August 12, 2023

—, you lying scum…

—, you lying scum…

—, you lying scum…

[ Notice the language and understand the drive to repeatedly threaten and try to intimidate. ]

No, you lying scum, I didn’t threaten you. I labeled you. It is dishonest to intentionally confuse one with the other, you lying scum.

Here’s the entire comment, which I stand by:

“ltr, you lying scum. How many times do I have to tell you this. Nobody is demeaning your civilization. We are calling you out for your dishonest behavior. To claim otherwise is to compound your dishonesty.

You, ltr, you are the target of criticism, of disdain. When you drag the rest of China into it, you demean a 5,000 year old civilization by associating that civilization with your behavior.”

“the difference between insult and threat is that insult is an action or form of speech deliberately intended to be rude while threat is an expression of intent to injure or punish another.” (https://wikidiff.com/threat/insult)

I fail to see how the phrase “you lying scum” can be read as an intent to injure or punish someone, or, for that matter, as intimidation.

Your inability to use words correctly, which you demonstrate almost as often as you post (well, other than your copy-posts of articles or links to other sites,) is a constant source of annoyance. If you’re going to write irrelevant posts about, for example, how somebody somewhere in China did something worth doing – as though that doesn’t happen anywhere else in the world – you could at least check your diction with, well, the dictionary now and again. Literacy is a thing, you know.

https://econbrowser.com/archives/2023/08/when-next-you-have-to-teach-mundell-fleming#comment-303307

August 12, 2023

No, you lying scum…

No, you lying scum…

No, you lying scum…

[ Notice the language and understand the drive to repeatedly threaten and try to intimidate. Threats and savage bullying. ]

Again, there is no threat. Your refusal to acknowledge that fact is more evidence that you lie like a dog. Scum is a bomus.

duck you are rude

There are times when people deserve to be “called out” for what they are. That is not being “rude”. When you see a hyena approaching your family you don’t say “Look honey, a toy poodle.”

https://econbrowser.com/archives/2023/08/when-next-you-have-to-teach-mundell-fleming#comment-303307

August 12, 2023

No, you lying scum, I didn’t threaten you. I labeled you. It is dishonest to intentionally confuse one with the other, you lying scum….

No, you lying scum, I didn’t threaten you. I labeled you. It is dishonest to intentionally confuse one with the other, you lying scum….

No, you lying scum, I didn’t threaten you. I labeled you. It is dishonest to intentionally confuse one with the other, you lying scum….

[ Notice the ceaseless threats and savage bullying. ]

And again, you are lying when you say I’ve threatened you. Tell me your address, though…

@ Macroduck

I’m guessing an “urban village” in Guangzhou. Possibly migrant construction worker from Guizhou province. They get to sleep in some pretty luxurious high rise hotels though:

https://www.indiatimes.com/trending/wtf/when-you-see-it-chinese-construction-workers-hit-snooze-at-160ft-on-narrow-steelbars365341.html

You really can’t ask for a more loving government than that though, can you??

https://voxeu.org/article/mundell-difference

April 12, 2021

The Mundell difference

By Paul Krugman

The opening sentence of Robert Mundell’s 1963 paper “Capital mobility and stabilization policy under fixed and flexible exchange rates” — one of the two most influential in a series of path-breaking papers he published in the late 1950s and early 1960s — is curious: “The world is still a closed economy, but its regions and countries are becoming increasingly open.”

“Still”? Was Mundell thinking of a future with interplanetary trade, so that eventually the world as a whole wouldn’t be a closed economy? OK, he probably wasn’t, but if he was, it would have been in character. Mundell, who passed away on 4 April, was an economist ahead of his time.

Specifically, those seminal papers were written in an era when many of the restrictions imposed on international transactions during the Depression and WWII were still in place. Britain’s foreign exchange controls persisted until Margaret Thatcher came to power; France didn’t abolish its controls until 1989. Yet in those papers Mundell envisaged a world with high mobility of capital and perhaps other factors of production; indeed, his stabilisation paper made the strategic assumption of perfect capital mobility, with money flowing instantly to equalise rates of return across countries.

And over the decades that followed, as capital flows surged and fixed exchange rates gave way to floating rates, Mundell’s work provided an essential guide.

In what follows, I’ll try to explain Mundell’s contribution to economic thought and policy.

Let me admit from the outset that the trajectory of Mundell’s ideas makes this a tricky project. Most of his influence within the economics profession comes from a handful of brilliant papers written when he was very young; most of his public prominence came from arguments he made later in his career, which often seemed to conflict with his earlier work.

Now, great economists often change their views over time, as they should when new information arrives. Mundell, however, changed his whole intellectual style; if you were to read his Nobel lecture without knowing who wrote it, you might never have guessed that it was the same man who devised those crisp little models several decades earlier.

But let me begin with those models, which remain the foundation of modern international macroeconomics….

https://krugman.blogs.nytimes.com/2013/03/27/on-mundell-fleming-very-wonkish/

March 27, 2013

On Mundell-Fleming (Very Wonkish)

By Paul Krugman

Aha. I see that Simon Wren-Lewis is on a campaign against the use of the Mundell-Fleming model, * a simple international macroeconomic extension of IS-LM analysis, ** because of the way it handles the relationship between interest rates and exchange rates. And it’s true that the simplest version of Mundell-Fleming assumes that interest rates are equalized by capital flows, taking no account of expectations of future exchange rate changes.

But is that the way it’s taught? It’s certainly not the way the issue is handled in the leading undergraduate textbook in international economics, which for nine editions — 25 years! — has worked with an exchange rate model in which investors expect the exchange rate to revert to a long-run norm, so that you get a downward-sloping relationship between the interest rate and the price of foreign currency:

https://static01.nyt.com/images/2013/03/27/opinion/032713krugman4/032713krugman4-blog480.png

So that book, at least, has it covered.

True, I can’t speak to what people being taught this stuff from the wrong textbooks may be learning.

* https://mainlymacro.blogspot.com/2013/03/why-we-should-stop-teaching-mundell.html

** https://archive.nytimes.com/krugman.blogs.nytimes.com/2011/10/09/is-lmentary/

Given the failure of exchange-rate expectations derived from models to conform to real-world results, how are expected exchange rates dealt with in practice? How much do we learn from such models if they don’t conform to real-world results?

*You meant Du and Schreger instead of Wu and Schreger. Come on Menzie, Chinese don’t mess up Chinese names, that’s for absent minded white guys like me to do. Stay in your lane.

I’m friendly teasing you Menzie, I prefer you don’t post this comment.

Although it’s roughly 3 weeks old, I thought there was a chance some people had missed it, and I thought it was superbly well written. So I wanted to share it. It’s written by J.W. Mason who I was directed to by Mike Konczal’s old “Rortybomb” blog, back in the day:

https://jwmason.org/slackwire/at-barrons-who-is-winning-the-inflation-debate/

I’m not familiar with Professor Mason. He writes well, so thanks for the introduction.

I think it was Krugman who, some years ago, said inflation is whatever the FOMC chooses it to be, plus or minus. That view has been recanted.

Just before the Covid epidemic, the Fed adopted a new opeational approach which increases reliance on communicating the Fed’s dedication toa balanced inflation target over time, despite strong evidence that the public has little knowledge of what the Fed’s target or operating approach is.

Fed officials initially declared Covid-era inflation to be transitory, then did an about face just in time for inflation to be demonstrated to have been transitory.

Fed officials have made clear that they are focused on backward-looking measures of inflation rather than forward-looking trends, pretty much ignoring Friedman’s notion of lags.

Asociated with ignoring inflation trends is Fed officials insistence that labor market has to be weakened, despite decades of evidence from the Phillips curve that the non-accelerating-inflation rate of unemployment is low and variable.

This bewildering context seems pretty fertile ground for a Thomas Kuhn-style paradigm shift. Such paradigm shifts famously occur one funeral at a time.

Mason is an Associate Professor of Economics at John Jay College, City University of New York. Dr. Chinn is familiar with one aspect of his writings if we go back to the 2016 debate over whether that infamous Gerald Friedman paper. My problem with the weird modeling of Friedman’s controversial paper had to do with its complete disregard of potential. Sure we were below full employment at the time which Mason kept stressing. But as Dr. Chinn pointed out back in the day – the output gap was nowhere near 18%.

Other than that – his writings are always interesting to check out.

Oh, and extraordinary rapid interest rate hikes in conjunction with Fed asset sales have so far not induced recession and a steeply inverted yield curve has so far not been a precursor to recession.

What is missing for a paradigm shift is a new paradigm. What is interesting about this argument that we have microeconomic rather than macroeconomic causes for inflation is that:

1) it could represent a viable new paradigm

2) the economics profession has been mechanically grinding out micro-foundation-based research for decades but now baulks at a particular microeconomic explanation for inflation

This is consistent with Kuhn’s view of revolutionary paradigm shift. I’m pretty sure, though, that identifying paradigm shift as it happens is more a matter of guess work that clear-eyed observation.

Off topic: Do international agreements achieve their goals? –

Research across a wide range of international agreements concludes that such agreements mostly fall short:

https://www.democracywithoutborders.org/23344/most-existing-international-treaties-do-not-work-study-concludes

Two categories of international agreement mostly do achieve their goals, though. Those are trade and finance agreements. So essentially, when private-sector money is directly at stake, international deals are enforced. When human rights, environmental quality, refugees, weapons or rhinos are the issue, there is more slippage. I suspect this result reflects the fact that many international are only signed because enforcement is unlikely.

Have to hand it to the researchers – this was a big undertaking into unexplored territory.

Signaling at its most obvious –

https://www.aa.com.tr/en/europe/poland-to-send-10-000-troops-to-border-with-belarus/2966021

Poland is rapidly reinforcing its border with Belarus. Belarus has been moving troops to its border with Poland and asking Poland not to notice, while training with the Wagner Group.

Belarus messing with Poland gives NATO a problem other than Russia’s invasion of Ukraine to think about, one which involves a positive obligation to get involved. For Rusdia, it’s a cat-among-the-pigeons kind of thing; who cares about a little additional risk, when you’ve already smooched the pooch? Stir things up and see if NATO cracks.

Just guessing. Haven’t seen any analysis on this.

Given Putin’s past disgusting behavior, I bet they will let Belarus duke it out with Poland on their own. Putin is both an opportunist and a coward.

That was February 23 of 2022. Here’s an update from August of 2023.

https://www.rferl.org/a/russia-strikes-kharkiv-crimes-drones-attack/32545053.html

Totals from Kharkiv deaths up to early June (no swarthy people here for Kopits to undercount, so I assume even Kopits would agree with these June numbers):

https://www.amnesty.org/en/latest/news/2022/06/ukraine-hundreds-killed-in-relentless-russian-shelling-of-kharkiv-new-investigation/

What does “they will move on” mean to a PhD holder?? Does “they will move on” mean residential areas are being hit with Russian cluster bombs?? Guess it depends on the PhD holder, I only have my Bachelor’s, so I wouldn’t know. Would the PhD prof just “move on” if cluster ammunitions hit in his housing district?? Presumably, judging by his statements, he’d just “move on” eating his ice cream if those bombing near his house were the same ethnicity, as that was his assumption in Kharkiv’s case.

This same PhD holder seemingly thought the Russian troops were lined up on the southern border of Belarus to play ice hockey [he definitively predicted no war in one of his comments] , so I presume he’d think Belarus soldiers lined up near Poland was probably just a new amateur Lacrosse league being formed.

At the very beginning of my just above comment I intended to link to a comment related to the beginning of the 2nd Russian invasion of Ukraine, made by a Uni Prof who said many times on this blog he was an “expert on Russia”, but for some reason the blog server was giving me fits every time I attempt to include the link to his comment in my comment.

I’ll let you folks decide if the summer heat has gotten to my brain or Ghoulies have entered Menzie’s server, or a combination of the two.

I bet Mundell-Fleming was mentioned a few times when Saint Reagan finally decided to hire real economic advisers (Feldstein, Poole, a young Krugman, and yes even Summers). But this was after the damage done by the toxic mix of an ill-advised fiscal stimulus that was overwhelmed by tight money under a floating exchange rate.

Georgia DA Has Texts, Emails Tying Trump Team to Vote Breach: CNN

https://www.thedailybeast.com/georgia-da-has-texts-emails-tying-trump-team-to-coffee-county-vote-breach-cnn

Georgia prosecutors have texts and emails that tie Donald Trump’s legal team to the unauthorized access of Coffee County’s voting systems in the days before the election of Joe Biden was to be certified, CNN reports. A “written invitation” from the local elections official who helped make the breach possible was sent to Trump allies, including a law firm hired by Trump’s attorneys, CNN says, citing sources. The invitation was then shared with former NYPD Commissioner Bernard Kerik, who was working with Rudy Giuliani on drumming up evidence of non-existent voter fraud that would invalidate Biden’s victory. The Georgia DA is expected to present her case to the grand jury this week.

Now the mere mention of Kerik makes my skin crawl. After all he was the police commissioner for Racist Rudy back in the day and he is one corrupt piece of trash. But there may still be a useful role for Bernie if he rats Trump out.

Problems with the debt of hinese regional governments have been highlighted in recent finacial reporting, as for instance here:

https://www.scmp.com/economy/china-economy/article/3230828/china-debt-these-3-regions-have-most-daunting-debt-piles-so-what-can-be-done-about-it

Note reference to local government financing vehicles, described as a “both public and corporate … created to skirt restrictions on local government borrowing…” Like many financial innovations, LGFVs were created to get around prudential regulation. Innovation to allow increased risk – what could go wrong?

The “rock and a hard place” nature of China’s policy delimma is highlighted here:

https://www.scmp.com/economy/economic-indicators/article/3226660/china-speed-infrastructure-projects-shore-growth-amid-call-determine-scale-debt?module=hard_link&pgtype=article

Hey Moses,

Are you familiar with “The Rise of China’s Industrial Policy” by Barry Naughton? It’s free here:

https://ucigcc.org/publication/the-rise-of-chinas-industrial-policy-1978-to-2020/

I’m working on reading it. Seems a good chronology of the period of reform and modernization. It’s quite good on the shift from early, rapid growth mostly due to economic reform and regional government efforts, shifting to a less interventionist approach around 2000 and the rising central government intervention in recent years. Central government intervention has apparently been less successful than regional governnent in earlier times.

“hina”? “Delimma”? So now, auto-correct decides to take a break?

There’s a way to reset auto-correct to not function on your computer. Next to a change in keyboards I made a few months ago, one of the best anti-frustration tech decisions I ever made in my life. And my typing errors (though still too many) have dropped precipitously, both drunk and sober. My moments of staring in anger at the monitor at a 4th grade level error are way way down. I mean seriously, junking auto-correct is a big contribution to mental health. Sometimes I think Bill Gates forced auto-correct on everyone (it’s default choice on most comps yes??) just so the general populace could find one other thing in the world to hate more than him.

I made a pretty horrific blunder. Deng only died 4 years before I got to China. Still, it proves my point all the more the strangeness of their attitude to Deng. Maybe that is how I got the time warp in my head?? Certainly I don’t think I was even aware in my early days in China (when I was more conscious of those things) how only very recently he had died. But that’s actually very embarrasing, because, it probably would have been very late in my junior year of college I wrote paper, that was largely aimed at explainging the effects of Deng’s death on China’s economic policies. So, you’d think it would have stuck with me he died in ’97. But I had a zillion things going on back then, trying to absorb a country polar opposite culture to my own, and knowing Jiang was going back to the old ways, thinking about the lost opportunities if Deng had done a better job on leadership handover, just tended to make me angry.

I have not read the Naughton book. I will make it a priority and move it near the top of my reading list. Thanks for pointing me to it.

One of the many mysteries of my mind when I was in China, was not only the continued hero-worship of Mao, who had starved to death millions of Chinese, but was how Deng Xiaoping was barely an afterthought. He takes them out of living barely in a gutter, to a world of hope, and his “thank you” from the typical mainland Chinese citizen is “Huh??? Oh….. yeah….. I remember him.” Now think about that, the man died roughly 25 years before I got there. Tiananmen was 12 years before I got there. So to be navel-gazing for a moment, Tiananmen would have been roughly the mid-point between Deng’s death and my arrival. Then you had Jiang Zemin (old school corruption type, many Chinese joked Jiang’s face was “grandma-ish”)), and then Hu Jintao (some hope for reform with Hu). It’s yet another, of many, indications of the revisionist history of Chinese textbooks/ TV state news and how mainland Chinese have no connection or context to their real history. Certainly anything after 1935. It’s lie on top of lie on top of lie.