Forecasts of recession vary with indicators (term spread, foreign term spreads, debt-service ratios). Forecasts of economic activity — as measured by industrial produciton — also differ by predictor.

I compare the forecasts from the 10yr-3mo spread, the foreign term spread (Ahmed/Chinn), and stock market factor identified by Chatelais/Stalla-Bourdillon/Chinn (my thanks to Arthur Stalla-Bourdillon for updating the stock market factor).

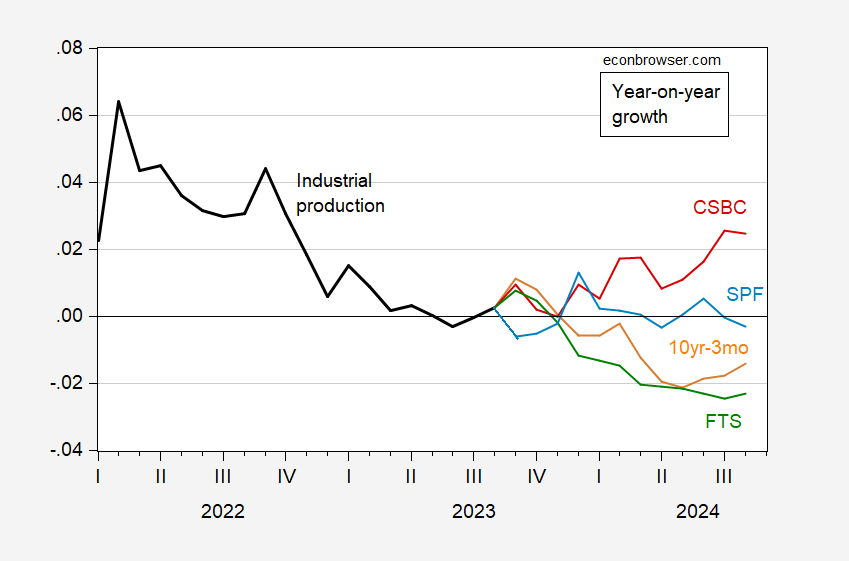

Figure 1: Year-on-year growth of industrial production (black), 1 year-ahead prediction from 10yr-3mo term spread (orange), from foreign 10yr-3mo term spread (green), from Chatelais/Stalla-Bourdillon/Chinn stock market factor (red), and from Survey of Professional Forecasters August forecast (light blue). Foreign term spread is GDP-weighted long term interest rate minus short term policy rate. SPF industrial production quadratic interpolation to monthly. Forecasts based on three year sample ending 2023M08 (not from rolling window). Source: Federal Reserve, Treasury via FRED, Stalla-Bourdillon calculations, Philadelphia Fed, Dallas Fed DGEI, and author’s calculations.

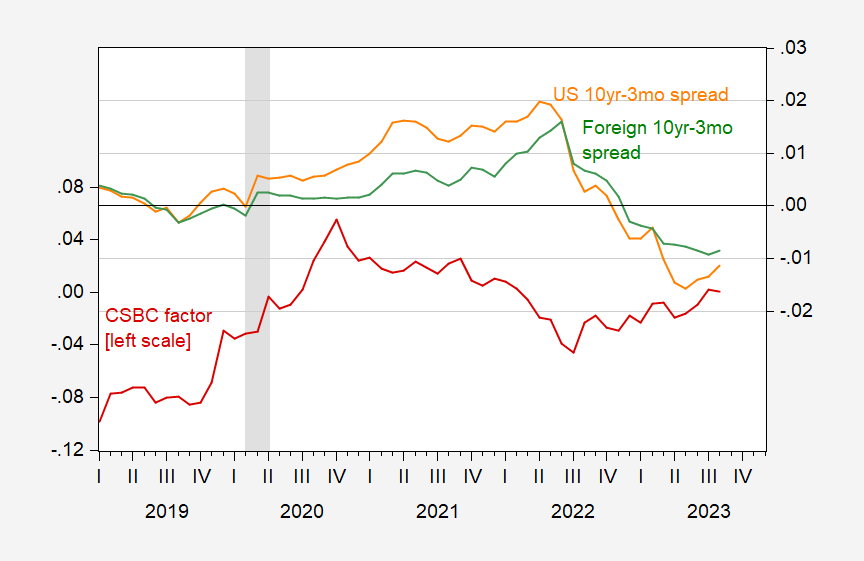

Caveat: I use the Dallas Fed DGEI spread instead of the Ahmed-Chinn version. The former is GDP weighted for all advanced countries, whereas the latter uses Canada, Euro area, UK, and Japan only. The two move pretty similarly. The adj-R2 of regressing the Ahmed-Chinn measure on the one used here is 0.8 (in levels, 0.45 in first differences).

The term spread (domestic, foreign) both present a pessimistic outlook. These indicators also paint a picture of imminent recession. The stock market factor that incorporates information about leading sectors (like housing related) predicts resumed growth.

Figure 2: 10yr-3mo term spread (orange), foreign 10yr-3mo term spread (green), Chatelais/Stalla-Bourdillon/Chinn stock market factor (red). Foreign term spread is GDP-weighted long term interest rate minus short term policy rate. Source: Treasury via FRED, Stalla-Bourdillon calculations, Dallas Fed DGEI, and author’s calculations.

Important point in thinking about these results versus those for recessions. Recessions are analyzed using a binary variable conforming to the NBER chronology. Industrial production growth is a continuous variable, and is only one of several key variables followed by NBER’s Business Cycle Dating Committee (nonfarm payroll employment and personal income ex-transfers rank higher)b.

Most financial data impound forecasts by their very nature – forecasts of future earnings, credit demand, credit cost, inflation, risk preference and the like. Turns out, a bunch of expectations of narrow conditions work out reasonably well to forecast general conditions.

One exception is the debt-service ratio, which isn’t a reflection of expectations, not directly, anyhow. It does involve an interest rate, so there’s that. But the value of this ratio seems, to me anyhow, to result from the information it embodies regarding household finances and recent consumption.

Now, we’re engaged in an experiment to see whether this stew of narrow expectations amount to an accurate expectation of general economic conditions in today’scircumstances. Are things different this time?

I have gone on record as saying I don’t think we will have a recession that starts in 2023. And that includes when the BCDC looks back at it in hindsight. But my view is that one of the things that can predict recession is just what I would label “generally abnormal numbers”. Say for example, if you got a 1 year CD now what rate would you get?? 4.5%?? 5%?? I don’t know exact. Depends on institution etc. But what about credit card rates now?? Look at that number over many years, and tell me that has any kind of “normalcy” look to it at all??? Something is off kilter, and, as per usual, it’s the large banks or really any bank that is winning over Joe Six-Pack

https://fred.stlouisfed.org/series/TERMCBCCALLNS

Why are consumers being charged that rate vs what they get on a one year CD?? Because consumers are dumb—and they put up with, are are not aware of, when they are getting the royal screw put to them. Do economists have any interest in discussing this number, and explaining to consumer how they are being openly robbed right now?? Do economists have any interest at all in discussing that number and the gap?? No corporate endowed professorship chairs to be had in that data??

right now there is not a high chance of recession. that is why the maga crowd is pushing for a government shutdown. but that will only work if they can effectively blame biden for the shutdown and resulting economic slowdown. the shutdown has nothing to do with budgets and borders. it is about inflicting economic pain to slow down the biden economy. elections.

off topic, but important. the courts found trump and his companies committed fraud for years:

https://www.cnn.com/2023/09/26/politics/trump-organization-business-fraud/index.html

A good ruling but wasn’t this obvious?

You mean, obvious vs how New York State and New York City have “punished” donald trump in the past?? Which time was more obvious, as NY State/NY City did nothing before?? Your state (and its bribed AGs/DAs) handed him to the nation on a silver platter, whether you like that prima facie fact or not.

Oh my – did you wake up on the wrong side of the bed or what? David Cay Johnston has been telling about Trump’s financial frauds for decades. But no – he is not a judge. Alas.

Just saying…… if he had been charged earlier we might not be “where we are” right now. Someone dropped the ball and it wasn’t Wyoming.

I get crotchety when I haven’t drank in few days, what can I tell you.

OK – let me say Moses is right here. I have always wondered what the legal system was waiting for. The thing is that it was only New York that failed us as Trump has committed so many crimes in so many jurisdictions it takes a program to keep up. Yea – the FEDs are finally getting around to this and that prosecutor in Atlanta is doing some interesting things. But Trump is doing all he can to run out the clock.

“In defendants’ world: rent-regulated apartments are worth the same as unregulated apartments; restricted land is worth the same as unrestricted land; restrictions can evaporate into thin air; a disclaimer by one party casting responsibility on another party exonerates the other party’s lies,” the judge wrote.

Wow – claiming that rent restrictions do not affect the value of Manhattan property? I know a lot of landlords would take strong exception to this claim.

Now let’s take his place on the Uppity East Side. Value of property there is about $10,000 per square foot so if your pad is 10,000 square feet, then you are worth $100 million. Right? But Trump put the value at over $300 million by claiming his pad covered 30,000 square feet.

Wait stating something is three times as large as it really is? I bet that is how he gets ladies in the sack. After all 9 inches might sound fun but we know from Stormy Daniels, reality is only 3 inches.

Yeah, that’s pretty damaging. The appeal comes next, and liquidation of assets will probably be put in hold till then. This is New York stuff, so probably not headed for the U.S. Supreme Court. As I understand it, only a challenge to the constitutionality of NY law would go to the Supreme Court, and that would probably already have happened in some other case if it were going to happen.

Liquidation of real assets means there are insufficient financial assets to satisfy the ruling. No surprise, since Trump’s businesses run in debt. The real question, then, is whether Trump organization real assets are sufficient to satisfy the ruling.

Trump has pretty obviously been creating a political brand as a source of personal income, not necessarily just because his business brand is in the rocks, but certainly that’s a factor. Wonder if any of that has been outside the law.

So Nikki Haley wants to be both pro-life and pro-women? One of her fan girls tries this spin on Face the Nation. Read the Twitter replies to see how no one is buying this BS:

https://twitter.com/FaceTheNation/status/1695826430477697427?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1695826430477697427%7Ctwgr%5E4c0c0f45a82ddb6781ba720450e282784e14e3c9%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.americainsider.org%2F2023%2F09%2F26%2Fnikki-haley-shows-her-true-colors-its-not-pretty%2F

What kinds of distortions are happening in industrial production on account of Russia’s invasion of Ukraine and the ongoing war?

@ Willie

From May ’22

https://www.federalreserve.gov/econres/notes/feds-notes/the-effect-of-the-war-in-ukraine-on-global-activity-and-inflation-20220527.html

From Sept ’23

https://www.ers.usda.gov/amber-waves/2023/september/global-fertilizer-market-challenged-by-russia-s-invasion-of-ukraine/

Best I could do on a quick perfunctory Google search. There has to be much better data out there, but I didn’t find it yet.

So poor countries, farmers and people take ot in the shorts because of Russia’s invasion.

Over to you, Johnny.

We no longer use Johnny as an in the field war correspondent. He was involved in some kind of Roger Ailes/Bill O’Reilly controversy with multiple women and I can’t say anymore than that because I had to sign an NDA. I think he fetches coffee at Newsmax now.

Willie,

Industrial production is reported as an index rather than a volume, which ran me into trouble in trying to answer your question in terms of industrial production. However, a look at manufacturing data provides this:

https://fred.stlouisfed.org/graph/?g=19lYJ

As you can see, the contribution of U.S. produced materiel to Ukraine’s defense hasn’t had a big impact on overall factory output. Note that the “defense capital goods” line doesn’t cover everything. If one subtracts ex-defense from total, you’d probably get a bigger number. I was lazy.

Interesting paper which may explain why we pay more for electricity than we should:

https://haas.berkeley.edu/energy-institute/research/abstracts/wp-329/

Dunkle Werner, Karl and Jarvis, Stephen “Rate of Return Regulation Revisited” (September 2022)

Abstract:

Utility companies recover their capital costs through regulator-approved rates of return on debt and equity. In the US the costs of risky and risk-free capital have fallen dramatically in the past 40 years, but utility rates of return have not. Using a comprehensive database of utility rate cases dating back to the 1980s, we estimate that the current average return on equity could be around 0.5–5.5 percentage points higher than various benchmarks and historical relationships would suggest. We discuss possible mechanisms and show that regulated rates of return respond more quickly to increases in market measures of the cost of capital than they do to decreases. We then provide empirical evidence that higher regulated rates of return lead utilities to own more capital – the Averch–Johnson effect. A 1 percentage point rise in the return on equity increases new capital investment by about 5%. Overall we find that consumers may be paying $2–20 billion per year more than they would otherwise if rates of return had fallen in line with capital market trends.

Part of this paper is an exercise in the Capital Asset Pricing Model. Currently the risk-free rate is near 4% and a generous estimate of the risk premium is 3%. So if a regulated utility is being granted more than a 7% cost of capital, then they are overcharging its customers. And as Averch–Johnson notes – they are also overinvesting in capital.

Republican House members say McCarthy won’t bring the Senate continuing budget resolution to a vote, and the Senate CR is the currently only viable bill to prevent a shutdown. So we shut down a chunk of the federal government.

But nobody has said “never, ever, never” so who knows? A brief shutdown, just to say he did it, might be what McCarthy wants. The Senate bill is only for a few weeks, long enough for some actual legislating. So maybe some celebrating among the Matt Gaetz crowd and a little harm to some innocents is enough to allow grown-ups to pass a CR, on the way to a real budget.

The arguments will go that some rural school districts and even low-income inner city cannot afford this kind of luxury or expense. But still I thought it’s an interesting solution to a problem that is probably not going away at this point. Am I pro trans rights?? It doesn’t matter if I am pro trans rights or not. This is where society is going, it’s probably never going back. We can either face this reality or go on with arguments and problems ad nauseam, when this could solve a huge part of the problems. And possibly even save school districts paying 7-figure lawsuits.

https://www.reddit.com/r/minnesota/comments/16s8lck/this_is_a_gender_neutral_bathroom_in_a_high/

Most districts pay for what they choose to pay for. The expense/cost issue 75% of the time will just be communities dragging their feet.