In a previous post, I presented forecasts of recession based on probit models using term spread plus short rate, and term spread plus short rate, foreign term spread and debt service ratio. The latter only went of to 2024M03 since BIS only published debt service ratio data up to March. I have extrapolated the ratio to June, so as to obtain the following forecasts.

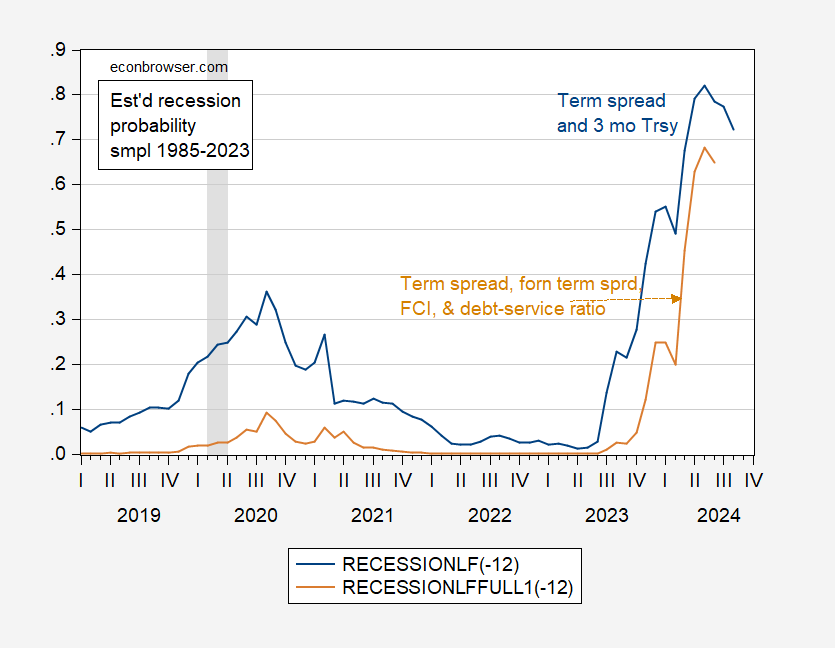

Figure 1: Probability of recession from 10yr-3mo term spread plus 3 mo rate (blue), and from spread, foreign spread, national financial conditions index, and debt service ratio (tan). Models estimated 1985-2023 (assuming no recession to 2023M08). Source: Treasury via FRED, Dallas Fed DGEI, Chicago Fed via FRED, BIS, and author’s calculations.

The full model has a pseudo-R2 of 0.52, vs. that for the term spread model 0.28. The full model has no false negatives and missed positives for the 1989-2022 period.

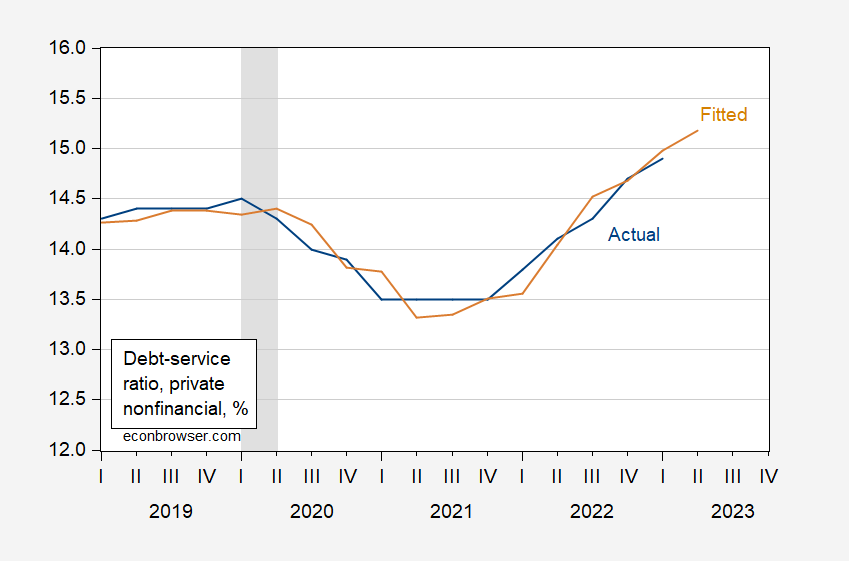

To extrapolate the debt service ratio to 2023Q2, I use the corporate AAA rate, the three month T-bill yield, and two lags of the debt service ratio to predict the debt service ratio (all in first differences). The adj-R2 is 0.69. The fit (for 2019-23) is shown in Figure 2.

Figure 2: Debt service ratio (blue), and fitted value (tan), both in %. Model in first differences estimated 1985-2023. Source: BIS, and author’s calculations.

The (estimated) increase in the debt service ratio from 14.9 to 15.2 pushes up the probability of recession, from 45% to 65% (the term spread model has the probability rising from 68% to 79%).

Hey Menzie, inquiring minds want to know if you attended the Paul Ryan deal on the 26th??

Moses Herzog: Via livestream. He lauded evidence based policy analysis.

Hope he was sincere when he said it.

By the time people read this I imagine most people will already know. But Diane Feinstein has passed away. I don’t want to say it’s good news, but there was no way apparently the woman was going to resign. Enough is enough. Maybe other U.S. Senators will take the hint, but I doubt it.

She was intelligent and great in her day, but when will people realize they are more negative to society than productive. Nancy Pelosi, are you out there?? Taking notes Nancy or prefer to drag us all down with you?? Take life stages in their proper course.

Pelosi and Biden are still going very strong. Just compare the current house speaker to the former who had control until 18 month ago.

“Control” is a very broad term, which has many interpretations. The fact Pelosi relinquished the Speakership when up to that point she had it gripped with white knuckles like she was riding a malfunctioning roller coaster to death, tells you how much “control” Nancy had.