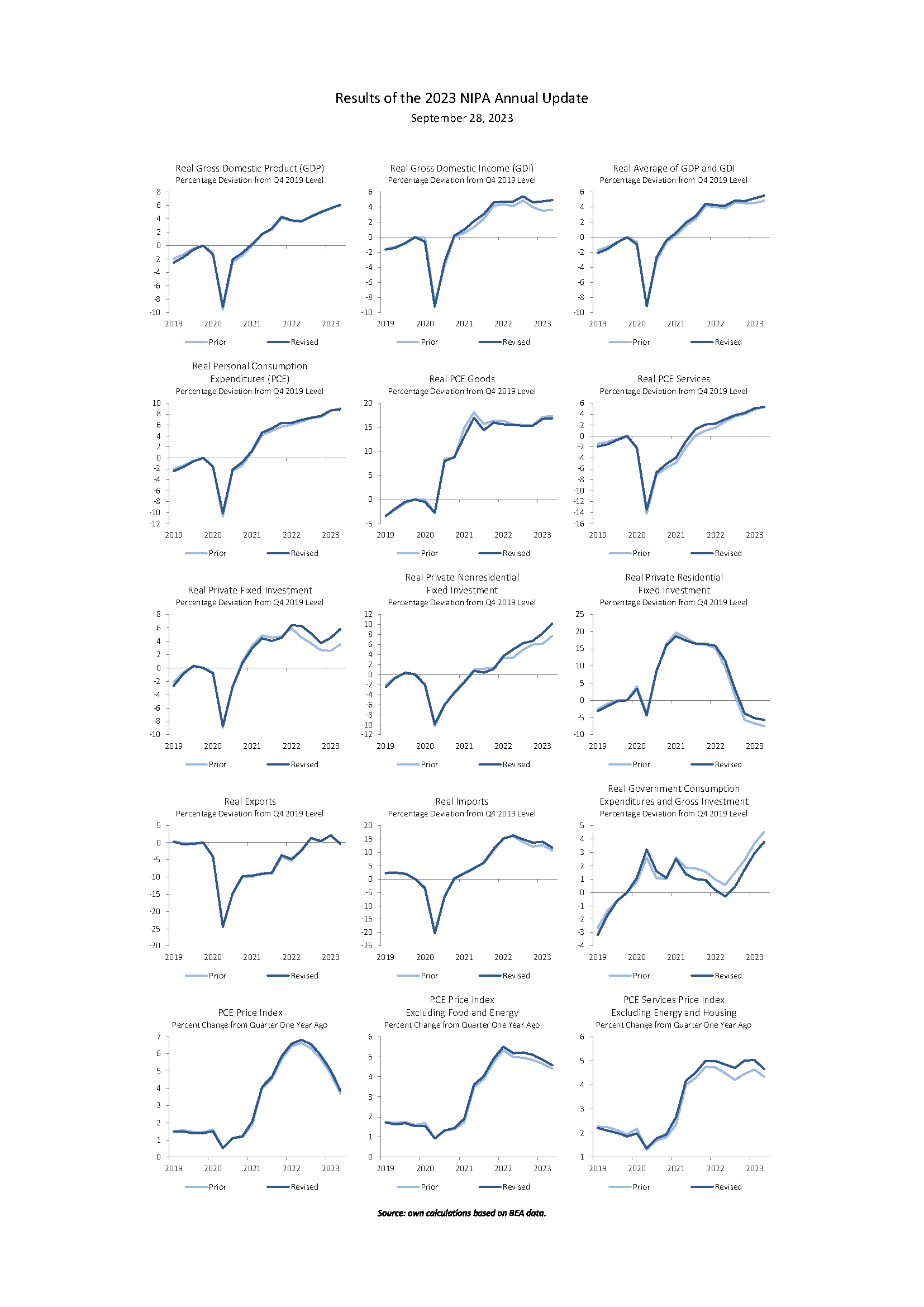

Despite some views that GDP growth would be revised downward substantially (see discussion here), the recent trajectory of GDP and GDO was largely unchanged (even if the level over the period 2019 onward was). A lot of the revisions are summarized in this figure from Paweł Skrzypczyński:

Source: Paweł Skrzypczyński.

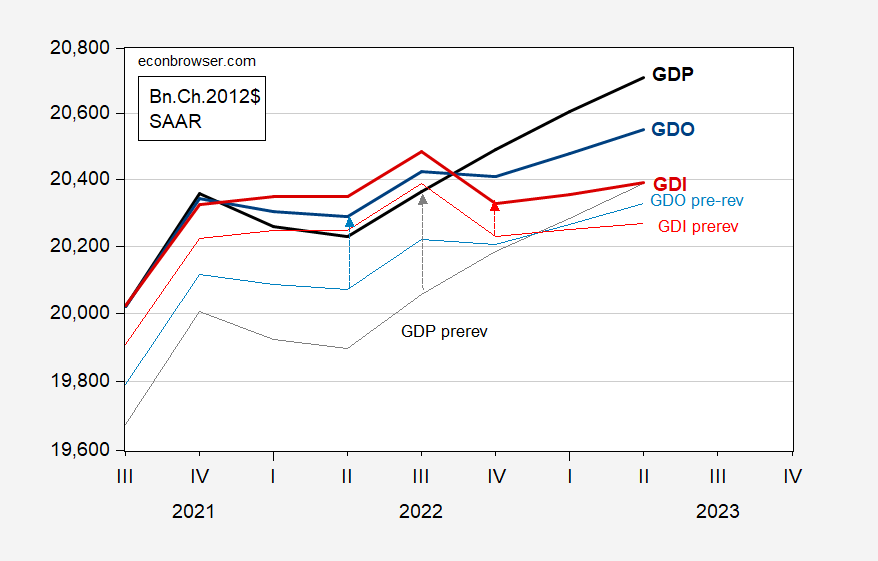

Since the data are indexed to 2019Q4 (NBER defined peak), it’s hard to see that the level of real GDP, GDO, and GDI in recent quarters has been substantially shifted up. I show these aggregates in Chained 2012$ (SAAR) to better see this point.

Figure 1: GDP post-revision (bold black), GDP pre-revision (gray), GDI post-revision (bold red), GDI pre-revision (light red), GDO post-revision (bold blue), GDO pre-revision (light blue), all in Chained 2012$ SAAR. Post-revision 2012 figures calculated by dividing nominal values by rescaled post-revision GDP deflator. Source: BEA 2023Q2 3rd release/comprehensive revision, ALFRED, and author’s calculations.

One big difference is the level of fixed nonresidential investment (see dead center graph in Skrzypczynski’s figure). More on that soon.

“A lot of the revisions are summarized in this figure from Paweł Skrzypczyński”

LinkedIN – arrrrgh! Pawel correctly notes that real GDI was stronger than previously reported.

Now that might upset JohnH who has been cheering for a collapse in real GDI. Jonny boy should take a little cheer instead as that previously reported fall in real GDI came from weaker profits – which contradicts a lot of his usual BS. But the revisions show the fall in real profits was less dramatic at the end of the day.

Sounds like GDI is back in pgl’s good graces again…now that it is somewhat closer to his preferred outcome….

What a weasel!!! Project much?

My retarded striker once again has no point.

For those of us who have to consume coffee first thing in the morning – good news on the pricing front:

https://tradingeconomics.com/commodity/coffee

Arabica coffee US futures fell to $1.50 per pound following a significant selloff in risky assets, prompted by the Federal Reserve’s suggestion that interest rates could remain high for an extended period. Additionally, the Brazilian real weakened, indicating increased export selling by Brazilian coffee producers, which exerted downward pressure on prices. Furthermore, additional pressure ensued after Conab, Brazil’s crop forecasting agency raised its 2023 Brazil Arabica coffee crop estimate to 38.2 million bags from the previous forecast of 37.9 million bags. Nevertheless, current coffee supplies remain tight, with ICE-monitored Arabica coffee inventories reaching a 10-1/4 month low of 440,853. Meanwhile, the USDA’s Foreign Agricultural Service projected in its biannual report that coffee production would increase by 2.5% from the previous year to 174.3 million bags in 2023/24, driven by a 6.9% surge in Arabica output to 96.3 million bags.

FCOJ, in the other hand…

https://futures.tradingcharts.com/hist_OJ.html

Weather beats cost of carry this time.

Russians fighting against Putin’s war criminals:

https://www.msn.com/en-us/news/world/breaking-clashes-in-russia-by-pro-ukraine-paramilitary-group/ar-AA1hp6Pf?ocid=msedgdhp&pc=U531&cvid=aee04f4130aa4762993e161d9b6bd82f&ei=9

paramilitary group, known as the “Russian Freedom Legion,” has crossed the Russian border and is currently engaged in combat in the Belgorod region of western Russia. The group consists of ethnic Russians who are fighting in solidarity with Ukraine against the oppression of Putin’s regime. According to a message posted on Telegram, the group has successfully entered the Russian region and is carrying out offensive operations. They stated that no soldiers have been killed or injured and that everything is going according to plan. In a separate post, the group vowed to continue their efforts to “liberate Russia from Putin’s filth.” They promised to provide more details as the fighting continues.

The average Russian would be much better off if Putin is removed from power.

Currently Russia seem to be dealing with needs for reinforcements in specific areas of the Ukraine front, by lateral redeployment. They don’t have rested backup troops to send into hot spots, so they move them from one place to another. Now they may have to move troops back home. Ukraine has been playing that weakness very competently. There was a report on ISW yesterday of a 1 Km stretch of very strongly fortified defensive line where the two sides had been going heavily at each other all day – then suddenly the Russians had run out of ammunition and then ran away.

they could stand to do another comprehensive revision right now, as there are still problems lingering with chaining all the way back to 2017….the worst i’ve found so far is with inventories, which grew at an inflation adjusted $14.9 billion rate, after inventories had grown at a revised inflation adjusted $27.2 billion in the 1st quarter, but that $12.2 billion (2017$) negative change in real inventory growth subtracted 0.00 percentage points from the 2nd quarter’s growth rate, revised from the 0.09 percentage point subtraction due to lower inventory growth shown in the second estimate, when the negative change in inventories was only $5.3 in 2012 dollars…

i am citing tables 2 and 3 in today’s report: https://www.bea.gov/sites/default/files/2023-09/gdp2q23_3rd.pdf

and last month’s report: https://www.bea.gov/sites/default/files/2023-08/gdp2q23_2nd.pdf

how do we explain that?

let me try to better explain what happened there…the dollar and chained dollar data for GDP (table 3) and the growth rate of the components (table 1) are computed separately from the contributions to change in real GDP (table 2)…the chained dollar change introduces discrepancies into contributions to the percent change, which are compounded and get worse every year between the benchmark year and the present…as a result, the growth rate of GDP as computed from from the chained dollar changes is different than the GDP growth rate arrived at by adding the contributions to percent change in real GDP…rather than leave those differences as they’re computed, the BEA “forces” the contributions to percent change in GDP to match that of the growth rate of chained dollar GDP, by fudging figures in the former to match the later, as a numerically challenged consumer might do when encountering an out of balance checkbook…hence, even though a $12.2 billion decrease in chained dollar inventories would suggest a 5.5 basis point hit to GDP, the BEA’s forcing of those contributions to percent change in real GDP to match the end result leaves the negative inventory contribution at zero, and also leaves real final sales of GDP equal to GDP…

@ rjs

I’m not following all of what you say here, not because your explanation isn’t solid but because it’s a little above my head. But I would think if the BEA hasn’t addressed this issue somewhere in their footnotes already that they would in the near future. It’s great you put this up in the discussion as I don’t doubt some of Menzie’s readers follow your train of thought better than me and must be asking the same question you are.

Moses, i have suggested (in an email exchange) that they publish the contributions to GDP data that their computations reveal, and then include a footnote analogous to the often seen “totals may not add up due to independent rounding” to explain the difference…i was told they would take up that suggestion at their next meeting….that was years ago and nothing has changed…

Would be interesting to know how Kopits thinks his false narrative of Biden’s and Europe’s “policy failure” on the $60 price cap fits in with this story:

https://www.reuters.com/business/energy/russia-faces-domestic-fuel-crunch-braces-more-shortages-2023-08-31/

The gasoline shortage in Russia will get worse before it gets better. I hope that doesn’t make Kopits sad.

i don’t know what is being argued here, Moses, but i just happened to see this story:

Your point on the Urals price is very fair. I would just say the Urals price is still lower than it would otherwise be (even if it’s higher than would be ideal) and that Russia’s urgency to sell oil on world markets (along with sanctions separate just from the oil price cap) is probably part of what is causing Russia’s domestic gasoline shortages. And in so far as making Russia’s citizens feel the pain of an unnecessary war, all of that is to the good, even if Russia losing $12 on its sales makes guys like Kopits upset.

Biden’s policy of engaging in the facilitating of Ukraine’s war supplies is costing Russia more military manpower, more resources, and vastly increasing the cost of aggressive invasion for Russia. Any way you slice it, that’s better than having a U.S. President who says on the global stage “Yes, I trust Putin more than my own intelligence agencies.”

GDPNow is still estimating 4.9% for Q3.

Do you think the Atlanta Fed is going to take a good hard look at their model when the real numbers come in?

Does look a little rosy compared to NY Fed’s 2.12%.

Probably not. They’re method of counting up is meant to represent counting up – plus some assumptions about data not yet available. No changes in judgements about those assumptions quarter to quarter. Sometimes, that approach works really well from early in the quarter. Sometimes not. That’s the way the cookie crumbles.

@ joseph

Menzie has more than once offered me this wise guidance on Nowcasts, offered by a fine gentleman and Cali deeeeeewwwwwd who likes to hang ten out San Diego way and is rumored to play a mean acoustic guitar:

https://econbrowser.com/archives/2016/05/dueling-nowcasts

I should say there’s another post in the archives of this blog about Nowcasts, whose comment thread I have a particular fondness of, but, uh, nevermind.

The rapidly rising dollar isn’t going to help exports this quarter and next.

FX influency on real trade balances tends to occur with a lag. Profits reflect FX effects more immediately.