Inflation has not kept with wage growth over the last year.

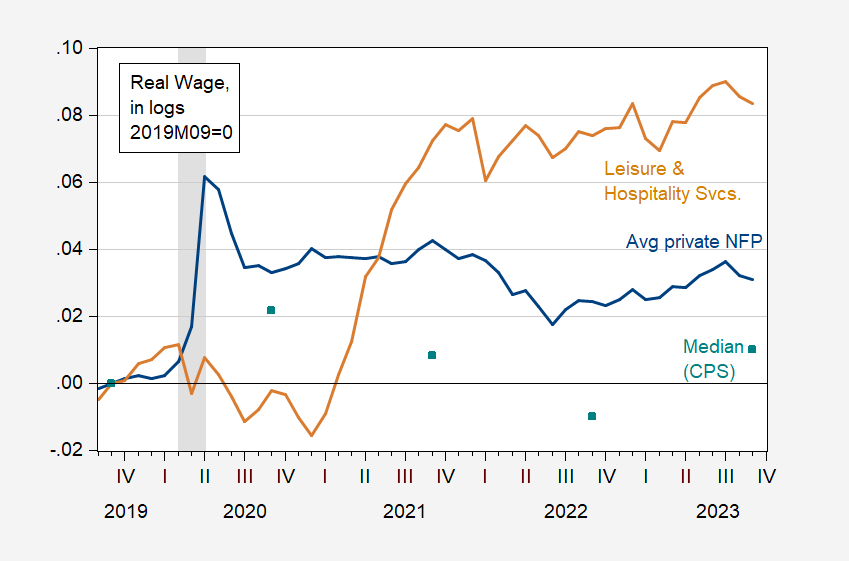

Figure 1: Cumulative growth of average hourly earnings from CES adjusted by Chained CPI (blue), leisure and hospitality services (tan), median average hourly earnings calculated from CPS data (teal squares), relative to 2019M09. CES hourly wages for production and non-supervisory workers. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Atlanta Fed, NBER and author’s calculations.

Are Lowe’s workers driving tiny delivery trucks part of the service economy?? If so I think I know the reason for the recent downturn.

That first sentence could use a bit of editing, I think.

If I read this graph right, it looks like secular stagnation. Fine, L&H wages have risen by 2% per year, which is no great shakes, but not a disaster.

Avg. NFP is up 3% in four years? Yuck.

And CPS is even worse, up 1% since 2019. That’s some kind of secular stagnation, isn’t it? Is it a surprise that so much of the public dislikes Bidenomics?

Real wages growing by 2% a year is no great shakes? Dude – you write some of the dumbest things ever. Please find another blog to pollute with your arrogant stupidity.

“That’s some kind of secular stagnation, isn’t it?”

Modest increases in real wages is not secular stagnation. Then again – you have no idea what the expression means. None. Economics is not little Stevie boy’s thing. Stop writing BS. Damn!

If you’re happy with wage growth of the last four years, then congratulations! The rest of the country, by a disapprove: approve margin of 2:1 doesn’t like Biden’s economic policies. Do you think all-but-stagnant wages for employees in the NFP category may be part of the problem? Or do you think a 1% increase in wages over four years is solid progress?

https://thehill.com/homenews/administration/4191672-58-percent-in-new-poll-say-bidens-policies-making-economy-worse/

I never said I was happy with the growth of the economy or wages since 2019 but we did have that 2020 which of course a moron like you blames on Biden.

I say your use of “secular stagnation” proves you are beyond the dumbest troll here. And for that you come back with an angry rant like that? I would ask little baby Stevie to grow up but we know you better.

I just checked with FRED to see how real GDP per capita has fared over the last 22 years. Up by 32.4% which means real income per capita has been growing by 1.28% per year. Now one might expect real wages to grow at that rate (overall we know the labor share has been falling).

But if someone has been getting real income increases = 2% per year that person would be doing better than the rest of the economy.

But little Stevie declares 2% growth to be “no great shakes”. Just wow – your sense of reality is about as distorted as it gets. I’m beginning to wonder if you have a clue what the real world even looks like.

How is it that Stevie, who pretends at sophistication in economics, has mistaken growth rates in excess of the pre-Covid average, for “stagflation” or “no great shakes”? I mean, someone who actually familiar with the data couldn’t make those mistakes, could they?

https://fred.stlouisfed.org/graph/?g=1amoE

Perhaps I should ask, WHY is it that Stevie has made such a crude mistake?

The term secular stagnation generally refers to a period where private consumption and government purchases that even extremely low interest rates cannot get us back to full employment. Today we have high consumption and government purchases such that we are near full employment even as the FED has raised interest rates a lot.

So little Stevie has no clue what he meant by “secular stagnation”. Then again Stevie knows nothing about basic economics. Nothing at all.

Some people begin with the conclusion and then go out to find the data to support said conclusion – ignoring any that doesn’t. It is the unfortunate side-effect of teaching average students about the concept of hypothesis testing before they fully understand the concept of hypothesis generation.

And now little baby Stevie defends his misunderstanding of WTF secular stagnation by flashing some popularity poll. Yea – this is one dumb troll.

Its simply politics and media that are denigrating “bidenomics”. In reality, the biden economy is crushing what happened in the trump years. Crushing it. Anybody who says otherwise simply has an axe to grind. Trump could only dream of having an economy running as smoothly as biden.

Latest from me, also on Gaza Partition

https://www.princetonpolicy.com/ppa-blog/2023/10/17/urals-rebounds-renewed-emphasis-on-cap-enforcement-gaza-partition

Your title suggests this Hamas-IDF war has led to a higher Urals price. Your own graph shows the Urals price has been falling over the past few days.

Dude – I would ask how stupid are you but we all know the answer to that.

No, I said that Brent increased by $5 the day after Biden announced enforcement measures on shippers.

You say a lot of stupid things. Pardon me for not keeping up with your trash.

https://oilprice.com/oil-price-charts/67

Ural price was near $80 a barrel. It is now around $76 a barrel. I get that little Stevie wants back on Fox and Friends badly so he has to tell us this war is driving up Urals prices. But as usual, little Stevie is being less than honest.

At this point, I don’t see the war impacting the oil price. I am still penciling a relatively contained war in Israel. But there are other scenarios. If Iran enters the war in earnest, then all bets are off.

Another one of your malleable opinions. I guess this means you do not trust even your own stupid blog post.

“malleable”?? You’re usually not this delicate with Stevie. Are you two going 50/50 on a Massachusetts lottery ticket he bought??

“Malleable”…….. You’ve been watching Dames insult each other on BBC costume dramas again, haven’t you?? (friendly teasing)

“At this point, therefore, we can claim that the Price Cap mechanism is riddled with holes”

And yet the Brent Urals discount is $14 a barrel. Yea – Stevie loves to double down on his dishonest rants.

Yes, but a narrow reading is that only 31% of Russia’s crude exports are subject to the Price Cap. If more than 2/3 of Russia’s crude exports occur outside the Price Cap regime — let alone enforcement thereof — then I think we can say that the Price Cap program is riddled with holes.

It looks like oil prices are on the rise again. As Brent rises, I expect the discount to compress once again. That’s been the pattern recently.

$14 price differential. Babble whatever BS you want – this is the market reaction.

“If more than 2/3 of Russia’s crude exports occur outside the Price Cap regime — let alone enforcement thereof”

At what price Stevie – oh a massively discounted price. For someone who pretends to be an expert on oil, you are beyond incompetent.

Gasoline in my town today $3.05. Not much if you drive a high mph sedan.

brainfart. mpg. Yesterday was rare, Brain still recovering. That’s my excuse and I’m sticking to it.

Does your latest contain errors in the scale of you first comment to this post? We wouldn’t want people spending time on mistakes of that magnitude, would we?

https://www.msn.com/en-us/news/politics/jordan-suspends-bid-for-us-house-speaker-backs-mchenry-lawmaker/ar-AA1iwcEs?ocid=msedgdhp&pc=U531&cvid=07170ab9a583452ea34870da357cba9f&ei=6

Jim Jordan gave up his bid to become Speaker because it seems no one likes this jerk.

To be clear, he hasn’t given up. He is buying time. He wants to temporarily appoint McHenry as acting speaker until he can twist enough arms/threaten enough of his colleagues’ wives and families to convince them to vote for him in January.

He may come back later after all those unpleasant compromises with democrats have been passed, and leadership by bomb-throwing wouldn’t get him burned. They all know that the “my-way-or-the-highway” GOP caucus is too big to be included in any legislation that can pass the house. So to avoid a complete meltdown, the rest of the GOP will have to work with the Democrats.

It is probably in the interest of Jordan to not be house speaker when those things passes the house, over objections and screaming hissy fits from the MAGA king and his princelings. Then Jordan can wash his hands, say “I didn’t do it”, and try to become speaker again when there is no policy that must be made and, therefore, no political price to be paid for it.

Bait-and-Switch? That’s no way to run the legislature of a great nation, so of course, you’re right. That’s what Jordan intends to do.

It shows you how all those Republicans who pretend innocent and altruistic, are familiar with all the old tricks in the book. It appears Jordan took one out of the mainland China book “Lies For 5 Year Olds” or “How Dumb Do You Think I Think You Are??”

He hasn’t given up, just paused his campaign. He’s looking to buy time by getting McHenry appointed as temporary speaker with additional powers. He can then use the time to twist arms/threaten his colleagues’ wives and families so that he can get the votes he needs in January.

This is a major blow to the Gaetz/Jordan pro-pedophilia wing of the Republican party. And it seemed like an ideal platform for them when the founding father of RepubluhPedos, Dennis Hastert, brought them in. What a pity. Showed so much promise for exponential growth with fundamentalist MAGA’s pedo pipeline.

Did I hear this correctly. Some in the Republican caucus almost came to blows with little Matty boy!

There were hints of violence months ago on the umpteenth vote for McCarthy, I remember that. But how much of that was a show for the C-SPAN cameras I don’t know. I was watchin’ him do an interview, I don’t know, last 3 weeks, and it looked like somebody “inadvertently” elbowed Gaetz in the back during the interview. He ended the interview about 3 seconds later. It was enough of an elbow jam to the lower back to smart but yet deny culpability.

‘It was enough of an elbow jam to the lower back to smart but yet deny culpability.’

Sounds like how I play defense in pickup basketball!

The previous story in the MSN cue speculated that Jeffries might win the Speakership because a handful of House Republicans would defect. Jordan would get some of th blame, though the nutso fringe would get most of it.

Anyhow, I imagine GOP House leaders are going crazy to find a way to elect a GOP Speaker, before some new milestone in political disfunction is reached. Government shutdown? Hakeem Jeffries? Saints preserve us! And it’s all the Democrats’ fault!

Que. Not cue.

If irony were the iron law of history, John Boehner would be the next Speaker.

Matt Gaetz says “no”, so the plan to make McHenry “bait-and-switch” speaker has been killed by Republicans. Even though Democrats probably would have joined in to vote for him. Back to Jordan as the top unelectable candidate.

Matt Gaetz says “no”

What? No one purchased a 17 year old prostitute for Matty boy?

Would be fun if McHenry got 10+ GOP votes and then the democrats switch and elect him. You can change your votes until voting closes. Get out your popcorn and chocolate milk for tomorrows vote.

We’ve wasted too much time in comments dealing with Putin’s Pet on interest rate issues. Let’s look at an actual implication of higher borrowing rates, as seen in interest rate spreads. Here’s a picture of the 10-year Treasury yield, the BBB corporate spread and the 15-year mortgage spread:

https://fred.stlouisfed.org/graph/?g=1amGv

Notice that the corporate spread has narrowed since May of this year, when the ten-year yield began a fairly steady climb, but that the mortgage spread stayed wide until September.

Why, you ask? The conventional explanation is that the risk of lending to corporate borrowers declined even as borrowing costs rose, while the risk of mortgage lending remained high. Remember, evidence of economic improvement – the falling risk of recession – was behind the rise in overall borrowing costs. Lower recession risk means lower risk of default so narrower spreads – except, apparently, for mortgages.

What’s up with mortgages? I can think of two things. One is that the housing market is a mess, so the risk of mortgage default is elevated. The other is that the Fed had absorbed a great deal of mortgage risk while buying mortgage (and other) assets, and is now injecting that risk back into private portfolios by reducing its mortgage (and other asset) portfolio.

So higher borrowing costs and narrower corporate credit spreads reflect improved expectations for the economy. Persistently wide mortgage spreads reflect problems specific to the housing market.

I think.

Interesting chart. Before Jonny boy starts his usual chirping about how higher interest rates are a good thing but higher mortgage rates are evil, let’s point out that most of the increase in mortgage rates comes from the fact that government bond rates have risen a lot. The spread may vary which allows Jonny boy to do his usual cherry picking (or what that moving his goal posts to the 30 yard line) but as you note, the mortgage spread today is about where it was a couple of years ago.

But don’t let facts get in the way of Jonny boy’s usual chirping.