From intro to the WEO:

The baseline forecast is for global growth to slow from 3.5 percent in 2022 to 3.0 percent in 2023 and 2.9 percent in 2024, well below the historical (2000–19) average of 3.8 percent. Advanced economies are expected to slow from 2.6 percent in 2022 to 1.5 percent in 2023 and 1.4 percent in 2024 as policy tightening starts to bite. Emerging market and developing economies are projected to have a modest decline in growth from 4.1 percent in 2022 to 4.0 percent in both 2023 and 2024. Global inflation is forecast to decline steadily, from 8.7 percent in 2022 to 6.9 percent in 2023 and 5.8 percent in 2024, due to tighter monetary policy aided by lower international commodity prices. Core inflation is generally projected to decline more gradually, and inflation is not expected to return to target until 2025 in most cases.

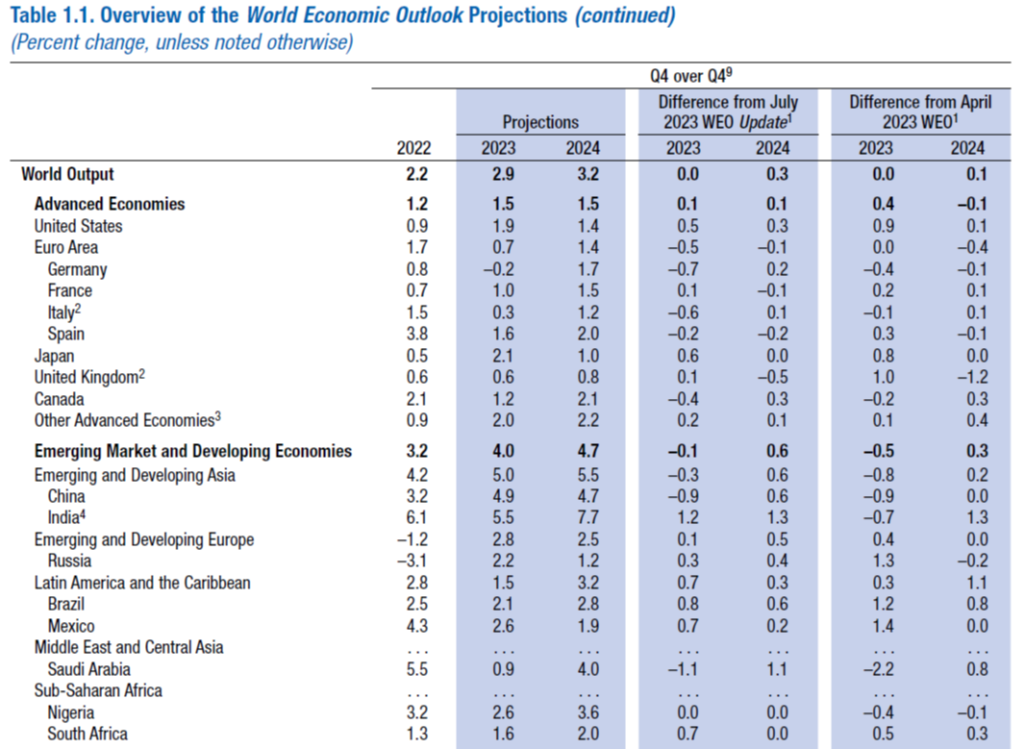

Forecasts (q4/q4) below:

The U.S., India and Japan are among the economies for which forecasts were revised higher, in a report which is mostly full of downward revisions. Downward revisions to forecasts for China and much of Europe show where global drag is mostly coming from.

Looks like there may have been a default by a sizable shadow bank in China:

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-s-shadow-banking-in-structural-decline-as-key-lender-defaults-77219353

The S&P article downplays the risk of this default and credit troubles in the sector. “It’s only sub-prime”, I guess.

Credit growth picked up in August as earlier restrictions on mortgage lending were relaxed and the PBOC worked to expand credit:

https://money.usnews.com/investing/news/articles/2023-09-11/chinas-aug-new-bank-loans-jump-more-than-expected-credit-growth-quickens

This is the same sort of swing we’ve seen repeatedly between efforts to reduce risk (leading to the shadow Bank default) and fright at the resulting collapse in credit leading to renewed risky credit.

I’ve seen claims that credit growth to the factor sector has risen to offset declining credit to construction, but haven’t seen data to verify those claims. This sounds to me like evidence of directed credit rather than a response to real economic demand.

Nothing from Pettis on the latest news.

Sheila Bair: “They say the good things in life are free. That may be true of walks on the beach or picnics in the park. It is not true of money.

The US Federal Reserve kept money free for nearly 14 years in the name of stimulating the economy. This period of “zero-interest rate policy”, or “Zirp”, was characterised by tepid growth, increased market concentrations, low productivity and yawning wealth inequality. Now that the Fed has shifted to a “higher for longer” stance to combat inflation, our economy will have to make painful adjustments to the rising cost of money. But we need to hold our course. Ultimately, higher rates will lead to a fairer, more productive and resilient economy.” https://www.ft.com/content/163db4c6-303d-4a52-9275-66359e4515e2?segmentId=b385c2ad-87ed-d8ff-aaec-0f8435cd42d9

“Economists have struggled to find a correlation between low interest rates and economic growth. Some studies suggest that higher rates are associated with higher economic growth. This is consistent with the US experience. Take the “boom” years of 1982-1990 and 1991-2001, when annual gross domestic product growth of 4 per cent was typical, in comparison with the 2 per cent Zirp norm. In most of those boom years, short and long-term interest rates far exceeded the levels we see today. Households and businesses still borrowed. The economy hummed.”

It is sad to see a former chair of the FDIC getting so utterly confused. Yes – there had been a downward shift of the investment demand curve from the latter part of the 20th century and the period from 2009 onwards. Yes – there were other factors for the higher growth rates in the latter part of the 20th century to the period since. Now we get that little Jonny boy is too stupid to understand the basics so he searches and searches for someone as utterly clueless as he is.

Congratulations little Jonny boy – you just dragged her name into the disgusting flith that permeates your utterly stupid comments. Proud of yourself little boy? Now go have mommy change your diaper.

Congratulations little Jonny boy – you just dragged her name into the disgusting flith that permeates your utterly stupid comments. Proud of yourself little boy? Now go have mommy change your diaper.

Congratulations little Jonny boy – you just dragged her name into the disgusting flith that permeates your utterly stupid comments. Proud of yourself little boy? Now go have mommy change your diaper.

Congratulations little Jonny boy – you just dragged her name into the disgusting flith that permeates your utterly stupid comments. Proud of yourself little boy? Now go have mommy change your diaper.

[ Truly horrible bullying. ]

You have become a pathetic boar. No wonder little Jonny boy likes you.

In a low interest rate environment, interest expense is a smaller part of the expense of running a business, household or government than in a high interest rate environment, generally speaking. As interest expense becomes a larger share of the cost of running an entity, it has a larger effect on decisions.

There was a prolonged period of low interest rates prior to the Fed’s series of rate hikes starting in March of 2022. We are no longer in a period of low rates. Bair’s observations make sense, except for her difficulty in finding evidence that borrowing costs matter. Borrowing costs did matter less in the long period of low rates than they matter now. In the present higher interest rate environment, with interest payme to a larger part of budgets, decisions will be more affected by rates.

Johnny seems to be searching for somebody important to quote, who has said something which seems to validate his nonsense notion that “opportunity trumps interest rates”. If so, he hasn’t done a very good job.

Here’s a simple question that I think will help clear things up. Bair thinks higher interest rates will produce a fairer economy. Let’s assume she’s right (as I think she is). How? Johnny? How will higher interest rates change things if interest rates a= “trumped” by other factors?

As to Bair’s point about rapid growth in higher interest rate environments – please, please, please try to keep cause and effect straight. If you don’t understand what that means, see pgl’s comment.

Typical Tricky Ducky…touting the theoretical advantages of lowering borrowing costs while ignoring the obvious disadvantages of lowering interest income.

But he chooses to not even try to refute Bair’s claim that “the theory of Zirp is that it boosts consumption and productive capital investments by making it cheaper for businesses and consumers to borrow. But the theory has not proved itself in practice. Economists have struggled to find a correlation between low interest rates and economic growth. Some studies suggest that higher rates are associated with higher economic growth. This is consistent with the US experience.”

Repeating the nonsense from this Republican lawyer does not make it economics. Once again – Jonny boy quotes someone without checking his/her credentials.

Who is Jonny boy’s new guru? A Bob Dole Republican who is a lawyer not an economist. Yea she was put in charge of the FDIC by Republican George W. Bush. How did she do?

https://www.fdic.gov/regulations/reform/lehman.html

The Orderly Liquidation of Lehman Brothers Holdings under the Dodd-Frank Act

Oh wait – they let the banking sector collapse in 2008. And the Great Recession followed.

Seriously Jonny boy – try checking the alleged credentials of people who like to cite as gurus.

“…touting the theoretical advantages of lowering borrowing costs while ignoring the obvious disadvantages of lowering interest income.”

Where? Come on Johnny. Quote what I wrote that is theoretical rather than practical. Quoate what I wrote that had to do with advantages to lowering borrowing costs – not effects, but advantages, which is your claim.

You really Ned to work in this honesty stuff, boy.

Not that I should need to do this but here’s the picture:

https://fred.stlouisfed.org/graph/?g=1a1Rd

In the pre-Covid expansion, when rates were persistently low, shipments of machinery wandered all over the place, with no obvious relationship to rates. In the current expansion, when rates have gone from low to relatively high, the 4ise in rates has been followed by a slowing in the growth of machinery shipments.

Anyone who makes a claim about the effect on rates on capital investment should know at least this much. One should also have looked at the spread of some measure of return over the cost of capital – which comes closer to pgl’s point about the demand curve than does the picture of simple interest cost. I leave this exercise for the curious reader.

Jonny boy was peddling the claim that the recent increase in real interest rates did not reduce residential investment. Let’s check the data ala FRED:

https://fred.stlouisfed.org/series/PRFIC1

Real Private Residential Fixed Investment

Now that is quite the drop according to FRED. Now I ask you – who is lying here? FRED or little Jonny boy?

Maybe pgl could show us the correlation between low rates and increased levels of investment, something that seems to be a figment of his imagination.

https://fred.stlouisfed.org/graph/?g=16Tef

Also, the Fed’s low interest rates drive down personal interest income (to state the obvious), in the aftermath of recessions, having predictable consequences for aggregate demand without any offsetting increase in income from capital gains.

https://fred.stlouisfed.org/series/PII

https://fred.stlouisfed.org/series/NCGAGIA

So apart from a one-time boost in incomes of affluent mortgagees from refinanced mortgages and paper wealth of investors, where exactly were the benefits of ZIRP and QE? (Oh yeah, I forgot the boost in stock prices and bank profits.)

Instead of simply insulting Sheila Bair, maybe pgl could actually try to refute the important points she raised.

That’s pretty rich from someone who does not even know what correlation even means. Tell us Jonny – which economic journal has published anything you wrote. Dr. Seuss books do not count.

So, let’s recap the discussion.

Johnny asserted a binary model of investment, claiming “opportunity trumps interest rates.” I answered that a binary model is a poor way to think, that investment decisions take into account a variety of factors, and pgl pointed out that shifts in the demand curve for investment need to be understood before claiming that interest rates don’t affect investments.

Johnny is essentially claiming that he has discovered, by casual observation, that all of economics is wrong – Woo Hoo, correlation!!!. And it’s up to us to prove that economics is right, but not up to him to prove his side. He is pulling the usual fake science trick of insisting that the evidence must be carted in and placed before him, loudly fellow that he is.

Johnny has found a non-economist who he thinks agrees with him. Yippee.

Never wrestle with a pig.

Leave it to pgl to move the goalposts by referring to RESIDENTIAL investment. That’s because he failed to find a relationship between real gross private investment and low interest rates.

https://fred.stlouisfed.org/graph/?g=16Tef

And if he were to be honest for a change, he would have conceded per his own graph that residential investment failed to respond to ZIRP and QE during the early 2010s.

The failure of low interest rates to stimulate investment is mostly why, according to Bair, “economists have struggled to find a correlation between low interest rates and economic growth.”

Tricky Ducky keeps trying to claim that respond to low interest rates, even though the evidence of the early 2010s shows that real gross private domestic investment was not stimulated appreciably by low interest rates. The phenomenon of industry’s non-responsiveness to historically low rates became known as the Fed “pushing the wet noodle,” something that Tricky Ducky is apparently unaware of.

Now you have the contrary phenomenon companies like multi-family residential developers maintaining high investment levels in the face of high interest rates. IOW they see opportunities lucrative enough to trump high interest rates.

So why prioritize ineffective policies like ZIRP and QE which stimulate capital gains, stock buy-backs, and industry concentration while draining the economy of income, such as interest income, which could be used to maintain and increase demand and investment opportunities.

Of course, when Tricky Ducky’s precious low interest rate dogma is shown not to stimulate investment in the absence of opportunities, but to benefit the wealthy, he gets mighty testy! (You’re not supposed to know about the famous wealth effect!)

Why does Tricky Ducky insist on prioritizing capital gains income for the few over interest income for the many?

‘JohnH

October 12, 2023 at 4:06 pm

Leave it to pgl to move the goalposts by referring to RESIDENTIAL investment.’

Jonny boy has placed his goal posts on the 30 yard again. Now why would he do this? Oh yea – he got caught lying about residential investment not declining. Jonny boy is one sad little boy.

We had a recent increase in real interest rates. Now you claimed that did not lower residential investment. But the data from BEA says this investment fell a lot. Now Jonny boy – someone is lying here. And it is not the good folks at BEA.

No, pgl, you’re lying yet again. What I noted was the higher interest rates have failed to reduce MULTI-FAMILY RESIDENTIAL INVESTMENT, which is mostly rental housing. pgl is trying to move the goalposts yet again.

“JohnH

October 12, 2023 at 4:09 pm

No, pgl, you’re lying yet again. What I noted was the higher interest rates have failed to reduce MULTI-FAMILY RESIDENTIAL INVESTMENT, which is mostly rental housing. pgl is trying to move the goalposts yet again.”

Yes as I pointed out that is what your data showed. Buit you tried to pretend this was evidence that all residential investment was interest insensitive. So now you decided to deny your original dishonest claim.

Yes – single family residential investment fell a lot. And I guess little Jonny boy pretends this does not count.

Dude – you are a serial liar. Get over it as everyone here knows that.

https://www.ft.com/content/163db4c6-303d-4a52-9275-66359e4515e2?segmentId=b385c2ad-87ed-d8ff-aaec-0f8435cd42d9

October 10, 2023

Higher rates for longer are a good thing

The era of zero interest policy was characterised by sluggish growth and yawning wealth inequality

By SHEILA BAIR

[ Thank you for posting this essay, which deserves careful consideration ]

Written by a lawyer not an economist. A Bob Dole Republican who made it to the FDIC via Bush43. It was your usual silly trash that JohnH loves to peddle but you call it an important essay? Wow – JohnH peddling to your PRC spin has got him a new BFF. Yawn.

pgl loves casting aspersions…but as we learned when mainstream economists denied that Corporate America was a significant factor in driving inflation–you often can’t count on mainstream economists to acknowledge what is going on. Robert Reich and other non-economist identified Corporate America’s pernicious role in inflation long before economists would depart from their knee-jerk platitudes.

To get an idea of what’s really going on with the economy, it’s important to listen to knowledgeable non-economists like Sheila Bair, people who are not beholden to their theories and dogma.

Talk about moving the goal posts! Dude – inflation is running near 3% (see the latest post). So I guess according to little Jonny boy – falling profits (see the BEA NIPA table 1.10 dumbass) has helped bring inflation down.

Comments on the favorable competitive economic effect of relatively high interest rates, remind me of similar comments made in a lecture by Robert Rubin. Robert Rubin was remarkably effective as Treasury Secretary, but his sense of the favorable competitive effects of relatively high interest rates was not shared by economists working under him.

Looking to the data I think Rubin was correct, at least through the Clinton years.

Robert Rubin was not stupid enough to suggest that investment demand does not respond to the real cost of capital. That dumb premise is the trash JohnH is peddling. Now if you want to declare you too are a village idiot – be my guest. But do not lie about what our former Treas. Sec. believed.

The latest survey data from the National Federation of Independent Business (NFIB) are generally positive, but not great. Here’s the short version of the NFIB labor report:

https://www.nfib.com/foundations/research-center/monthly-reports/jobs-report/

The Hiring Plans index leads non-farm hiring. The index is still positive, but trending downward. Many small businesses have openings they have been unable to fill, which is helping to keep hiring plans elevated.

Another feature that is worth watching is access to credit. The Availability of Loans index, at -8, is the second weakest since January 2012, the weakeet being -9 in March of this year. Other credit measures, such as Credit Needs Satisfied, are also quite weak. Growth without credit is tough, hiring without growth limited.

https://www.nfib.com/surveys/small-business-economic-trends/

The Fed’s Summary of Economic Projections from September anticipates real GDP growth slowing from 2.1% this year to 1.5% next, unemployment rate 3.8% at the end of this year and 4.1% next. The WEO has U.S. growth at 1.9% this year, 1.4% next. The slowing reflected in either forecast is broadly consistent with NFIB hiring and credit data.

And the U.S. is among the bright spots in the global economy.

Van Orden strikes again. Will Republicans punish him?? Since donald trump and other Republicans have made this “the new normal” he won’t even get a slap on the wrist. Who in the White House let the bastard in is what I’d like to know. It was a Democrat closed meeting. Do Republicans let Democrats wander in and do shoutdowns at their closed meetings. I swear, a good deal of the time Democrats are so unbelievably stupid, they deserve this type stuff. No, you can’t stop it at the SOTU address, but you sure as hell should be able to stop it at a Democrat closed meeting. No checking credentials at the door?? What’s next, Democrats letting the 6 felonies guy in the fake UPS brown outfit in??

https://www.politico.com/live-updates/2023/10/11/congress/van-orden-outburst-house-israel-00120961

This has to be a little more emotionally upsetting for Israelis than the typical terrorist threat. You have to wonder how much being more cautious in going out shopping effects the individual country forecast for Israel.

I also wonder how much of a wake up call this is for America?? We don’t seem to take domestic threats with dozens or scores of Americans killed by guns seriously, so how vigilant is the CIA/FBI being on Arab threats?? For one small example, are American Government agencies paying attention to the number of and backgrounds of Arab Americans and Persian Americans going to school or training with motor-powered hang gliders?? Those types of checks on pilot training/pilot education inside America’s own borders would have been a tell all for 9-11.

Actually, law enforcement official (an FBI agent, if memory serves) did report that Saudi nationals in the U.S. had asked in pilot training courses if they could skip take-off and landing and just study in-flight control of aircraft. The report was ignored.

Just like Clinton’s National Security Director warned Bush’s NSD about al Qaeda, and was ignored. Remember Condi Rice saying over and over “no one could have known”? She could have known, but didn’t want to admit she could have.

Condi Rice was the worst NSA ever. And yet Republicans think she is so important. Why? Because she failed miserably?

John O’Neill?? That was the postmortem story that really stuck in my craw when they ran it on “Frontline”. It still gets me angry, I guess when O’Neill went out to drink he drank with the wrong people, like people in the national security trenches who actually knew what the hell they were doing?? If I recall correctly his wife, who was separated from him didn’t have a negative word to say about O’Neill. Not on camera anyway.

Then there was the story about Rick Rescorla, a British-American, who makes me think of another British-American hero Fiona Hill. It’s semi-strange to see British born Americans who care more deeply about America than native born Americans.

The Trump ‘haircut’: yes, Deutsche Bank really used this term in reducing what Trump said he was worth

https://www.msn.com/en-us/money/companies/the-trump-haircut-yes-deutsche-bank-really-used-this-term-in-reducing-what-trump-said-he-was-worth/ar-AA1i40cP?ocid=msedgdhp&pc=U531&cvid=b67722af66e94ae3b1096801252e26af&ei=8#interstitial=2

They called it the Trump “haircut.” Really, that was what Deutsche Bank – Donald Trump’s most generous lender – called the routine cuts they applied to whatever the former president told them he was worth. The “haircut” reference was made Wednesday at Trump’s New York civil fraud trial, now mid-way through its second week. The word jumped out during an esoteric finance discussion. “First of all, what is a haircut?” Kevin Wallace, an attorney for the AG’s office, asked while questioning one of the former president’s chief barbers, so to speak, Nicholas Haigh. Haigh is a banker who helped sign off on the more than $400 million that Deutsche Bank loaned the former president over the past decade. “A haircut is a way by which the bank reduces the stated value of the asset in order to form some kind of assessment of what it might be worth” should there be a default, Haigh testified in a crisp British accent. Trump’s pre- and post-haircut net worth varied wildly, the banker showed. In 2011, Trump told the bank he was worth $4.26 billion. But after the bank’s haircut, meaning in a hypothetical default, he’d be worth as little as $2.365 billion, according to the fourth page of Deutche Bank’s 2011 Trump “credit report,” an internal banking document entered into evidence in the morning.

Less than 50% for Deutche Bank? Stormy Daniels put this haircut at 70% as Donald told her before their date he was 10 inches.

Trump tells court he had no duty to ‘support’ the Constitution as president

https://www.msn.com/en-us/news/politics/trump-tells-court-he-had-no-duty-to-support-the-constitution-as-president/ar-AA1i3W4m?ocid=msedgdhp&pc=U531&cvid=bc1be2d9a90f44c3bd5bdb72955abf39&ei=11

Tormer President Donald Trump is arguing to a judge in Colorado that he was not required to “support” the Constitution as president, reported Brandi Buchman from Law & Crime. The argument came as he seeks to dismiss a lawsuit filed in the state by Citizens for Responsibility and Ethics in Washington (CREW), seeking to have him disqualified from the ballot in the state under the 14th Amendment. The Insurrection Clause of the amendment prohibits those who have “engaged in insurrection” against the United States from holding a civil, military, or elected office without unless a two-thirds majority of the House and Senate approve. But Trump’s lawyers are arguing that the specific language of the Constitution argues that this requirement only applies to people in offices who are bound to “support” the Constitution — and the presidency is not one of those offices.

Just wow – so when he took his oath on 1/20/2017 he was lying then too? Well Trump did all he could to undermine the Constitution. After all the Presidential Records Act gave him the right to do whatever he wanted to do including grab them by the MEOW!

AMEN

Article 14, Section 3

No person shall be a Senator or Representative in Congress, or elector of President and Vice-President, or hold any office, civil or military, under the United States, or under any State, who, having previously taken an oath, as a member of Congress, or as an officer of the United States, or as a member of any State legislature, or as an executive or judicial officer of any State, to support the Constitution of the United States, shall have engaged in insurrection or rebellion against the same, or given aid or comfort to the enemies thereof. But Congress may by a vote of two-thirds of each House, remove such disability.

So Trumps lawyers are arguing that officeswl which were specifically named – Senator, Representative, Elector – are covered, but offices otherwise described – any office, civil or military, under the United States, or under any State – are not covered? So why exactly were the offices otherwise described mentioned in the Amendment?

These guys are at least consistent – don’t bother with reason, precedent, law or grammar. Say anything, ignore anything, claim anything. It worked in 2016, right?

AMEN.

I love it when a right winger screams READ THE CONSTITUTION since most of these morons never have.

pgl That reminds me of a Tea Party rally during which one of the featured speakers (some braindead GOP Congress critter) told the crowd that he was going to read the Constitution for the benefit of President Obama…and then proceeded to read the Declaration of Independence. And no one in the crowd seemed to notice.

A breakdown on the current political “goings on” of Poland:

https://www.ft.com/content/685608a1-7503-48c2-88b7-ddbadc5bea25

Wow, long time since I have seen the aged Lech Walesa in a newspaper photo. Whatever happens, I hope it doesn’t hurt Ukraine, and I hope it doesn’t hurt any of Menzie’s regular readers hanging out at Narodowy Bank Polski. God bless.

You can count on pgl and Ducky to advocate for policies that increase market concentrations and asset prices and exacerbate wealth inequality while only marginally helping the economy and average American workers. But worst of all, these self proclaimed “objective” economists only promote the advantages of such policies and never bother to mention the obvious side-effects and downsides. As such, they can be seen as mere apologists for certain monied interests that benefit from the policies they trumpet.

“You can count on pgl and Ducky to advocate for policies that increase market concentrations”

Oh little Jonny boy is so upset that he has to blatantly lie about what others have said. I have long supported the breaking up of oligopolies and every one here knows that.

A request I rarely make but could we just ban this worthless lying troll. Damn!

Advocate for policies? Where? Quote m advocating for a policy in this discussion.

Johnny is lying again.

Here’s a error Johnny makes routinely,but with greater than usual frequency lately – Johnny confuses normative statements – statements advocating a position – with positive statements – statements asserting a fact. When I say interest rates have an impact on investment, Johnny claims I’m supporting a policy. I’m simply stating a fact. When I say portfolio managers have less incentive to hold Treasuries now that Treasury volatility is high and recent performance is historically bad, he claims I’m giving g investment advice. Again, I’m simply stating a fact.

I know I’ve written this a dozen times, but apparently it never wears out; only ignorance or dishonesty can account for what Johnny has written, and the two are not mutually exclusive.

Tricky Ducky keeps telling us about how real wages have been rising on every measure…except for one problem…real average hourly earnings have dropped 0.6% in just the last two months…and have risen by a mere 0.1% since before the pandemic. But hey, liberal economists insist that the economy is stupendous!

But…shhh…let’s not talk about that! It might fuel the discontent of average Americans and force politicians to do something about it.

https://www.bls.gov/

“Real average hourly earnings increased 0.5 percent, seasonally adjusted, from September 2022 to

September 2023.”

From YOUR own link. Gee Jonny boy – do learn to READ your own links before you make an a$$ out of your worthless little self.

Talk about pgl’s moving the goal posts yet again! I cite data that shows that real average hourly earnings have dropped for the past two months…and pgl asserts that I misrepresented data for the last year.!!!

When is pgl going to stop making such blatant lies?

It is the way you made that statement that was misleading. BTW – over that 2 month period, real wages fell by 0.5% not 0.6%. Learn to do preK arithmetic dumbass.

“real average hourly earnings have dropped 0.6% in just the last two months”

Little Jonny boy made two blatant lies in just one short sentence:

(1) Real wages had been rising in the previous 10 months and by more than the recent decline.

(2) Over the last two months, the decline was 0.6% not 0.5%.

Since Jonny boy is too stupid to do so, I did the real work. Yes CPI = 1.1 times what it was as July. Nominal wages were 1.0444 times what they were in July. PreK arithmetic puts the decline at 0.5% not 0.6%. Then again little Jonny boy flunked preK arithmetic.

Lying AGAIN. I said by most measures. And Johnny has picked a very short period because over any lo g period he’s likely to be wrong.

Lying with statistics.

He even got the arithmetic wrong for his short period. But hey – give the little boy a break. After all the other kiddies in play school have been mocking him all day.

“And Johnny has picked a very short period because over any long period he’s likely to be wrong.”

Ask little Jonny boy how he reached the absurd conclusion that UK real wages rose under Cameron. Oh yea – look at a couple of quarters at the end where the massive decline for most of the period was only partially reversed. Jonny boy has been at this lying campaign for many many years. And when we point out reality – he says we moved the goalposts. Same old trash he pulled at Thoma’s place.

Bank runs in China, contained for now(?) due to Evergrande worries:

https://www.erienewsnow.com/story/49821398/chinese-officials-urge-calm-after-evergrande-fears-reportedly-spark-small-bank-run

The headline doesn’t mean the bank run is small, but rather that the banks facing runs are small. That’s a common pattern; too-big-to-fail is everywhere.

The one thing China has in their favor to control bank runs is the ability to arrest people for spreading rumors – true or false.

More on China’s banking sector: Official intervention through purchase of shares to prop up the sector; limited purchase and limited effect –

https://www.reuters.com/breakingviews/chinas-timid-bank-buying-sends-rescue-signals-2023-10-12/

I don’t have dog in this fight, but the argument takes sense – Russia may have encouraged recent troubles in Azerbaijan and Armenia, Serbia and Kosovo, in West Africa and Israel, as a way to draw attention and resources from Ukraine:

https://www.ynetnews.com/article/sj0dtokba?utm_source=taboola&utm_medium=referral&utm_content=internal

More suffering to serve Putin’s ends is the gist of it.

Kemp is a former officer in the British army, a pro-Brexit campaigner and opponent of investigations into potential war crimes by British soldiers. He is also a critical of the U.N. report on the 2014 Gaza conflict:

https://www.ohchr.org/en/hr-bodies/hrc/co-i-gaza-conflict/report-co-i-gaza#report

Norman Finkelstein, who I am a fan of, has had lots to say about the Gaza conflict, written in books. Sometimes it’s hard to differentiate what the Palestinians do to themselves, and how much of it is sadistic caused by Israel. Children in Palestine for years have a hard time getting things as simple as water. But….. when Palestinian extremists use the shipment routes to import weapons, it’s somewhat hard to blame Israel for going over shipments to Palestine with a fine toothed comb. There’s a gray area there, much of it created by weapons going into Palestine, but how much of that gray area is just an excuse to hurt families in Palestine?? This is the stuff that builds up anger in Palestine over time. And if you’re Netanyahu, always presenting yourself (donald trump style) as “the only man” who can protect Israel, creating that Palestinian anger over constant shortages of water and continual need for national security works to your favor. But Netanyahu throwing wads of straw into already burning fires, does NOTHING in help the security or safety of Israelis. NOTHING to make them safer.

In other MAGA news:

https://www.theguardian.com/us-news/live/2023/oct/12/biden-israel-steve-scalise-republican-house-speaker-vote-politics-latest?page=with:block-6527ff668f0830b0d91d88ec#block-6527ff668f0830b0d91d88ec

I can only assume jared kushner agrees with donald trump on this as jared agrees with donald on everything else

I truly appreciate your courage, candor, and insights on this difficult issue.

Rob Rogers has a great cartoon on the Israel-Hamas conflict this morning:

https://robrogers.com/2023/10/13/eye-for-an-eye/

I guess when everybody has become blind they will begin cutting off noses, then ears.

A jewish friend who was trained as a rabbi told me that one of the differences between our religions was that jews put as much emphasis on “justice” as christians put on “forgiving”. Neither religion seem to actually practice what they preach – hatred and fear override everything.

“Putin has been fomenting conflict between Azerbaijan and Armenia, Serbia and Kosovo, in West Africa and now in Israel.”

Faux peace advocate JohnH has not condemned the Hamas attack which begs the question why not. Oh his master Putin supports Hamas. Got it.

I don’t think it is in Putin’s interest to have his countries allies fighting and drawing away resources that Russia cannot afford to give. Much more likely that some of the players are seeing Russia and the West occupied, and decided that now was a good opportunity to pursue armed conflict with less of a risk that the other side would get help.

What Putin could have done is to hand over some captured Western anti-aircraft and anti-tank missiles to Hamas. That would serve his goal of trying to get the west to stop supplies to Ukraine. It would also explain why Hamas is now trying to lure Israel into Gazza street fighting again.

I tell you, between guys who hide colleagues’ rape of minors, and guys who mess around with escorts who are minors to commit statutory rape, the Republican party is just jam-packed with winners:

https://www.theguardian.com/us-news/live/2023/oct/12/biden-israel-steve-scalise-republican-house-speaker-vote-politics-latest?page=with:block-652803b98f0889b52d8c2e07#block-652803b98f0889b52d8c2e07

I presume this is Mace’s version of rationalization for claiming she’s “anti-rape” and turns around and votes for a man who knowingly hides rape of minors??

And Republican women run out to vote for these guys in droves. You go girl !!!! #MeTooOhWaitThoseWereMaleRapeVictims