In my MJS article on inflation, I wrote:

Looking forward, the inflation surge is probably over. The upward pressure in rental rates is dissipating, while supply chain problems have already disappeared. Finally, because the Fed has been raising interest rates over the last year and a half, thereby slowing the economy’s growth, the labor market has cooled substantially, further relaxing upward price pressures.

That means that in the absence of any big surprises – like another large disruption to oil markets – inflation is likely to continue to moderate, although perhaps more slowly than most people would like. On the other hand, if the Fed has already overly tightened – as the effects of past interest rate increases continue to ripple through the economy – inflation may fall even faster, although perhaps at the cost of a recession.

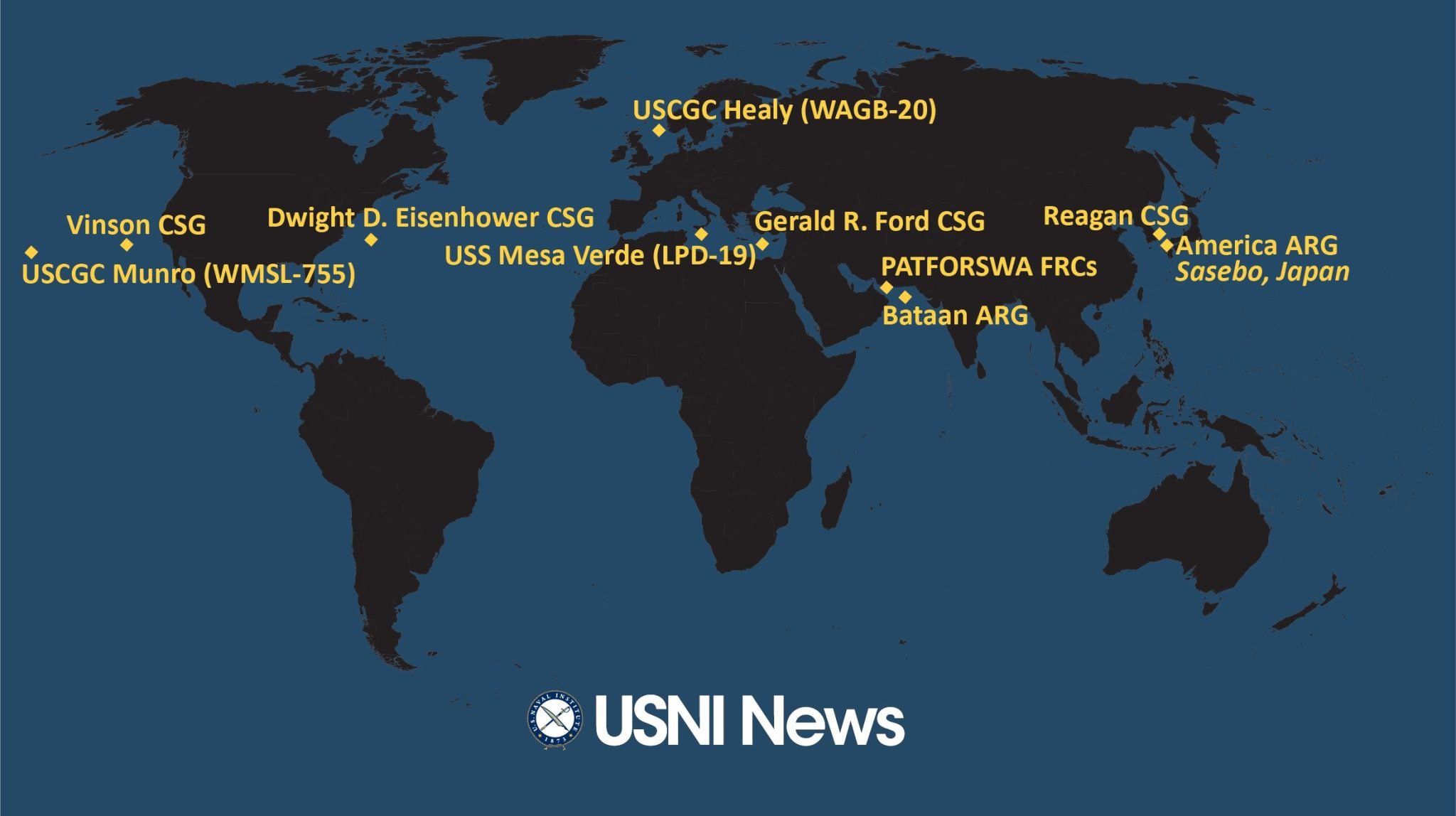

What’s one potential big surprise? Here’s a graphic:

Figure 1: Map as of October 16, 2023. Source: USNI.

Eisenhower Carrier Strike Group (CSG) to Med; Vinson CSG deploying to “Indo-Pacific”. Bataan Amphibious Ready Group (ARG) to Eastern Med.

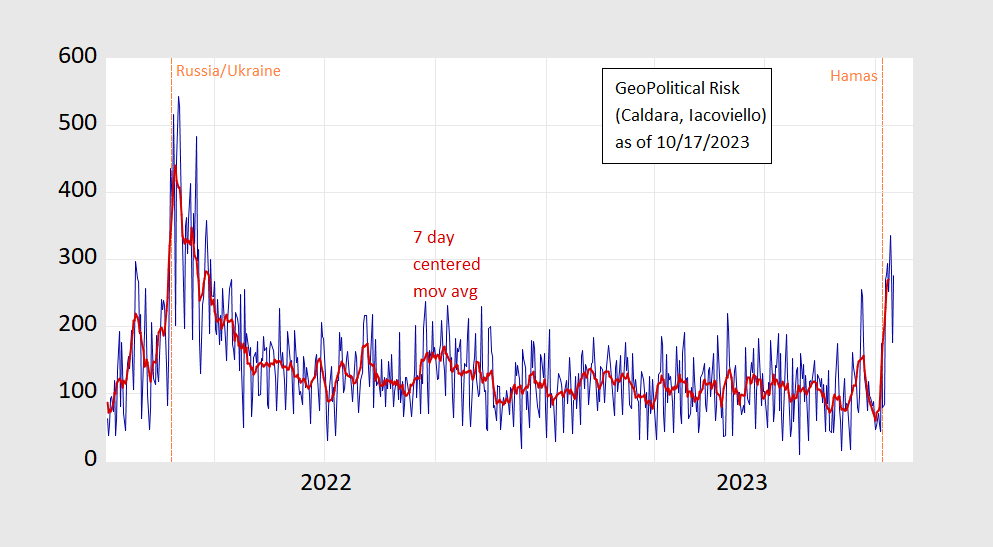

Here’s another:

Figure 2: GeoPolitical Risk daily index (blue), and centered 7 day moving average (red). Source: Caldara-Iacoviello, and author’s calculations.

The GeoPolitical Risk index is elevated, and likely to remain so. Expansion of the war to cause a tightening of oil supplies would certainly exacerbate inflationary pressures.

Good thing I got that $700 (plus tax and BS fees) refrigerator Monday. Kids, remember, Whirlpool and NOT Frigidaire. Also, Amana, once upon a time one of the greatest product manufacturers in the world, can no longer make something as simple as a refrigerator/freezer door seal. I suspect one of Bruce Hall’s nephews may be in charge of Quality Control at Amana now.

Just an out of the window impression:

Higher oil prices could continue to fuel perceived inflation and inflation expectations.

Higher oil prices could cause problems for some politicians.

Higher oil prices are in and of themselves unlikely to significantly increase the probability of a near-term recession. Things are different than they were in the 1970s as petroleum-based fuels occupy a smaller portion of expenditures.

Barring regional conflicts spinning out of control, any US recession will likely be shallow and short-lived.

I think the two main risks in oil are:

1. A big Chinese economic downturn.

2. A Saudi led middle eastern reduction of exports.

The two would work in opposite directions. I don’t think there is a big risk of either. I think the Saudis have seen how high hydrocarbon prices permanently reduced demand in Europe. I doubt they care enough about the people in Gaza to risk that kind of permanent damage to themselves.

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

The IRS Decided to Get Tough Against Microsoft. Microsoft Got Tougher.

This 2020 discussion is a long read but a must read. Microsoft’s abuse of the legal system makes Team Trump look like saints. That decent lawyers decided to help the IRS stop blatant and massive tax evasion might seem like a noble thing but the good guys got bloodied. All with the help of Senator Orrin Hatch who has always been bought and paid for by the rich tax cheats.

Congress Gasps When Rep. Elise Stefanik Cites Jim Jordan’s Wrestling Past In Speech

https://www.msn.com/en-us/news/politics/congress-gasps-when-rep-elise-stefanik-cites-jim-jordan-s-wrestling-past-in-speech/ar-AA1inUdg?ocid=msedgdhp&pc=U531&cvid=5cabb1878d024b5bb215ba912d59c558&ei=9

While nominating Jordan for the job, Stefanik claimed that he “is the voice of the American people who have felt voiceless for far too long. Whether as judiciary chair, conservative leader, or representative for his constituents in West Central Ohio, whether on the wrestling mat or in the committee room, Jim Jordan is strategic, scrappy, tough and principled.” The “wrestling mat” comment may not have left the impression Stefanik intended. When Jordan was an assistant wrestling coach at Ohio State University between 1986 and 1994, he reportedly ignored molestation allegations against the team’s doctor, Richard Strauss.

Stefanik may be from New York but she is dumber than even Marjorie Taylor Greene.

https://www.msn.com/en-us/news/world/u-s-intelligence-shows-gaza-militants-behind-hospital-blast/ar-AA1iqDrW?ocid=msedgdhp&pc=U531&cvid=618271cc10884e008aafe199aa5fc688&ei=10

The U.S. has collected “high confidence” signals intelligence showing that the explosion at a Gaza hospital compound on Tuesday was caused by the militant group Palestinian Islamic Jihad, U.S. officials said, buttressing Israel’s contention that it wasn’t responsible for the blast.

It is too early to conclude one way or the other who caused this horrific destruction of the Gaza hospital and the senseless death of 500 Palestinians. But if Hamas knows it was their allies and they are cynically blaming the IDF, this is just another reason that the innocent Palestinians need new leadership. Of course I would add Israel needs to take a different course so maybe one day we can have real peace.

Results of 2nd Speaker vote:

Jeffries 212

Jordan 198

Other Republicans 22

Jordan gained two votes but lost four votes and so he failed a 2nd time.

Again – no one likes this clown so go find someone who is not utterly revolting.

Some suggests that the classic right wing heavy handed bullying used by Jordan backers was backfiring.

Jim Jordan fails AGAIN. 3rd vote expected. I always suspected a large number of Republicans were pro-pedo cannibals, but I didn’t expect them to bring it out into the open like this. This is good though, because with Matt Gaetz and Jim Jordan it finally gives QAnon some real pedo stories to talk about instead of pizza parlors that don’t even have a “basement”.

3rd vote tabled. Jordan does not get the gavel any time soon!

But not before so many Republicans (Tom Cole, House Rep “red state” “conservative” Oklahoma etc) could get on the House floor, and tell you/us that a guy who failed to report sexual crimes (RAPE) committed on college wrestlers was really “a super swell guy”. I assume Tom Cole and these same Republicans will have Jordan chaperoning their 12 year old son’s/nephew’s date with the local pedo youth minister sometime later this week.

Praising a man who hides rape of minors~~Republican “family values”

https://www.wkyc.com/article/sports/college/osu/new-lawsuit-further-alleges-ohio-us-rep-jim-jordan-knew-of-former-ohio-state-doctors-abuse/95-0e70134f-5fc9-492f-9a03-cfd3d934a4ab

Well, one place that won’t be seeing inflation anymore is staff and faculty salaries in the Wisconsin University system.

Speaking of inflation – new research on who gained and who lost from inflation:

https://www.nber.org/papers/w31775

Is There Really an Inflation Tax? Not For the Middle Class and the Ultra-Wealthy

Edward N. Wolff, October 2023

One hallmark of U.S. monetary policy since the early 1980s has been moderation in inflation (at least, until recently). How has this affected household well-being? The paper first develops a new model to address this issue. The inflation tax on income is defined as the difference between the nominal and real growth in income. This term is always negative (as long as inflation is positive). The inflation gain on household wealth is the revaluation resulting from asset price changes directly linked to inflation. This term can be positive or negative. The net inflation gain is the difference between the two, which can also be positive or negative. The empirical analysis covers years 1983 to 2019 on the basis of the Federal Reserve Board’s Survey of Consumer Finances (SCF) and historical inflation rates. It also looks at the sensitivity of the results to alternative inflation rates, and considers the effects of inflation on real wealth growth, wealth inequality, and the racial wealth gap. The results show that inflation boosted the real income of the middle wealth quintile by a staggering two thirds. In contrast, the bottom two wealth quintiles got clobbered by inflation, losing almost half of their real income. Inflation also boosted mean and especially median real wealth growth, reduced wealth inequality, and lowered the racial and ethnic wealth gap. Both the income and wealth results are magnified at higher (simulated) rates of inflation.

We should note that the period from 1983 to 2019 was one of modest inflation rates.

“Inflation also boosted mean and especially median real wealth growth, reduced wealth inequality, and lowered the racial and ethnic wealth gap.”

Or put another way…

“The tendency of money to depreciate* has been at times a weighty counterpoise against the cumulative results of compound interest and the inheritance of fortunes. It has been a loosening influence against the rigid distribution of old-won wealth and the separation of ownership from activity. By this means each generation can disinherit in part its predecessors’ heirs; and the project of founding a perpetual fortune must be disappointed in this way…”

J. M. Keynes, “A Tract on Monetary Reform”

*”The tendency of money to depreciate” is nowadays called “inflation”.

A Jedi Knight quoting a Jedi Master. As Onslow (one of my great heroes in life, next to George Costanza) used to say on Keeping Up Appearances: “Niiiiiiiiiiiice!!!!”

https://www.nytimes.com/2023/10/17/opinion/economy-recession-inflation.html

Real interest rates have risen but we have not seen a recession at least yet. Why? Well a Village Moron like JohnH would say economics does not work the way we teach it as he knows investment demand is inelastic. But real economists like Paul Krugman have a simpler explanation:

If you had told me two years ago that interest rates would soar like this, I would have predicted a nasty recession with spiking unemployment. But in fact job growth, and probably G.D.P. growth, have just kept chugging along. The problem for economic analysts is that there are two possible reasons the recession dog hasn’t barked. One is that we’re seeing fundamental economic change — that new investment opportunities have increased r-star, so that the economy can handle high interest rates indefinitely. The other is that there are, as Milton Friedman claimed, “long and variable lags” in the effects of monetary policy, and high rates will eventually break something major.

Huh – that is what Macroduck has been saying. That is what I have been saying. But what do we know? Jonny boy thinks he is such a genius that he should have received the Nobel Prize rather than Krugman.

Off Topic —

China To Q-3 2023

China’s statistical authorities announced that the economy grew 4.9% YoY in the third quarter, down from 6.3% in Q-1 and 4.5% in the first period of the year.

In an indication of data reliability, inflation has averaged just 0.4% YoY this year whereas the money supply (M2) rose 11.6%.

The renminbi has fallen 6.1% against the greenback this year, and 8.9% on a real broad effective exchange rate basis. In the first nine months of the year exports are off 5.7%, imports are down by 7.5%, and the trade balance is flat, at US$630.4 billion.

Real broad effective exchange rate down 8.9%. Inflation 0.4%? Yeah, there’s a credibility issue.

REER down 8.9% and exports down 5.7%? That’s not just a credibility problem. That’s an economic problem.

Word around the campfire is, Mr. Rear and Stevie Kopits are going to start a think tank on China.

[ insert canned laughter from brainless poorly written half-hour comedy show (examples: “Friends”, “Big Bang Theory”) here ]

“2. A Saudi led middle eastern reduction of exports.

The two would work in opposite directions. I don’t think there is a big risk of either. I think the Saudis have seen how high hydrocarbon prices permanently reduced demand in Europe. I doubt they care enough about the people in Gaza to risk that kind of permanent damage to themselves.” -Ivan

I believe the thinking on the oil as a political weapon has shifted. It does not work. Countries such as Saudi Arabia are in a better position to help the Palestinians if they keep their economies strong.

In the background, the hawkish noises coming out of Israel could be helping to push up US 10-year bond yield and make more likely a US recession. I would bet that OPEC+ does not want to push oil prices high enough to tip the global economy into a major slowdown.