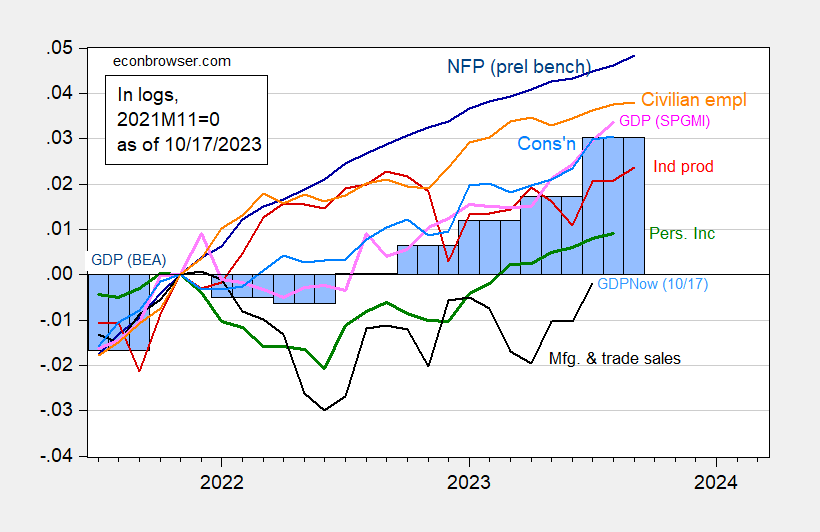

Industrial and manufacturing production surprise on the upside (0.3% m/m vs. 0.1% consensus, 0.4% vs. 0.1% respectively), with August growth revised up. Here is a picture of key indicators followed by the NBER BCDC as well as monthly GDP (SPGMI) and GDPNow (at 5.4% q/q SAAR as of today).

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q2 third release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (10/2/2023 release), Atlanta Fed (10/17/2023 release), and author’s calculations.

Hard to see the recession as being here in September (not speaking of October onward). Though the usual caveat applies – all series will be revised, and GDP very much.

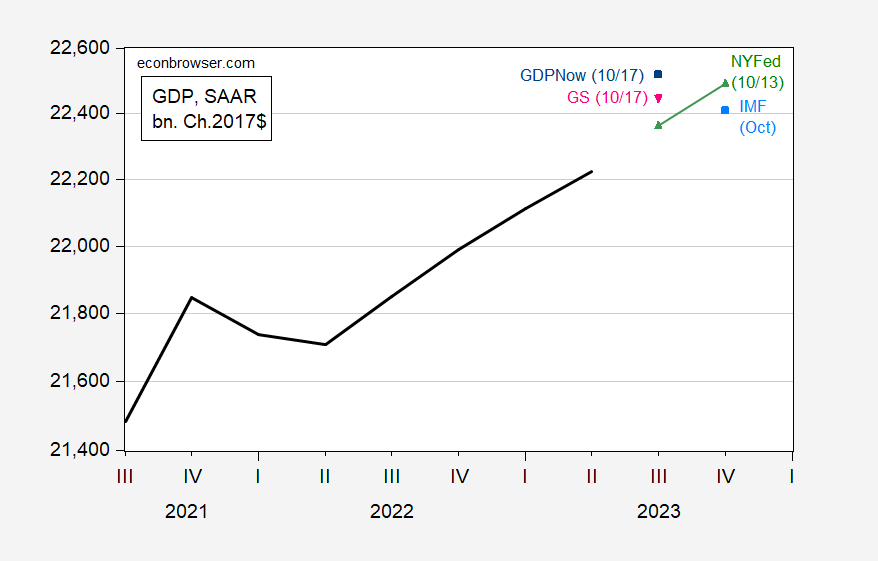

Here are more nowcasts as of today.

Figure 1: GDP as reported (bold black), GDPNow of 10/17 (blue square), NY Fed nowcast of 10/13 (green triangles), Goldman Sachs tracking as of 10/17 (pink inverted triangle), IMF October WEO (sky blue square), all in billions Ch.2017$, SAAR. Source: BEA comprehensive revision, Atlanta Fed, NY Fed, Goldman Sachs, IMF WEO, and author’s calculations.

No slowdown in Q3 according to these nowcasts.

So is there anything that could stop the consumer spending from keep going up?

Plenty of jobs, so no fear of losing yours. Salaries are good and growing, especially the low (consumer class) salaries. Price increases are moderating so more stuff for your bucks. I don’t see anything that would get the consumer to hold on to their money. Even those who in surveys say the economy stinks, say that they themselves are doing fine.

Mostly in reply to the prior post –

The U.S. mortality rate has a connection to economic conditions and the economic outlook. The link is laid out in detail in “Deaths of Despair and the Future of Capitalism” by Anne Case and Angus Deaton*:

https://press.princeton.edu/books/hardcover/9780691190785/deaths-of-despair-and-the-future-of-capitalism

The gist is that governing an economy solely on the basis of private sector returns is bad for a large part of the population. Anything bad for a large part of the population is unlikely to maintain general public support for long.

The Fed plays a role here. Let’s think about trend and variation around trend. The trend in the mortality rate in the U.S. is rising, in contrast to most of the rest of the developed world. There is also evidence that most of the causes of early death cited by Case and Deaton are sensitive to economic cycles. There has long been evidence that suicides rise during economic contraction:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4473496/

There is also a link between suicide and unemployment:

https://www.nature.com/articles/s44220-023-00042-y#:~:text=Extensive%20evidence%2C%20including%20studies%20of,in%20working%2Dage%20males3.

Long-term unemployment is linked to increased alcohol consumption:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3609661/#:~:text=Khan%20et%20al%20(2002)%20analyze,risk%20factor%20for%20heavy%20drinking.

Same with opioids:

https://www.gao.gov/products/gao-22-104491#:~:text=older%20adults%20in%20the%20labor,have%20experienced%20periods%20of%20unemployment.

The Fed has no mandate to support equity or longevity, but the society which the Fed serves arguably does.

Case and Deaton use a title which suggests a link between capitalism and a rising mortality rate, but for most of the capitalist era, mortality rates have fallen. Rightly seen, the link is between rising mortality and late neo-liberalism, rather than capitalism in general. The U.S. mortality rate rose briefly during the Volcker recession, but has risen persistently since the Great Recession.

If we take overall welfare into account, rather than the Fed’s mandate as a definition of welfare, there are a few policy choices worth noting. The big spend in response to Covid plays a role – probably a quite limited role – in inflation, but also reduced poverty and unemployment. In a late neo-liberal world, that’s a bad trade-off. In a kinder world, it’s a good one.

Obamacare.

“Prevailing wage” clauses in the Inflation Reduction Act and other federal spending packages.

A solution to the housing shortage might help.

Anti-trust enforcement, inheritance taxes, capital gains taxes all can provide indirect assistance in de-immiserating those on the short end of society’s stick, but health, employment and income support are fundamental to solving Case and Deaton’s despair problem. So is avoiding recession.

*Angus Deaton is a Nobel Prize winning economist. Anne Case is married to one.

Can you imagine breakfast conversation at the Case/Deaton table? It’d be like with Yellen and Akerlof. Or the Curies. Or John and Abigail.

Cher and Sonny Bono?? Madonna and Sean Penn?? Larry King and the last girl he met at a diner??

Wait…… you read in a different section of the bookstore than I do, don’t you?? I kept wondering why I was running into CoRev in the New Age Religion section and Bruce Hall reading failed auto companies books in fetal position on the floor and never saw you at Borders books.