In a way, yes — that is in terms of levels. In terms of pace of change, no.

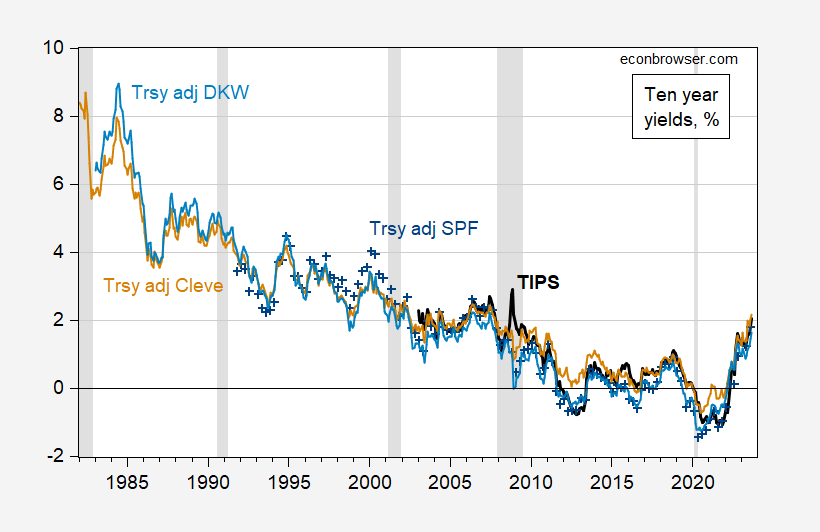

Figure 1: TIPS 10 year (bold black), Treasury 10 year minus Survey of Professional Forecasters median 10 year expected inflation (blue +), minus Cleveland Fed expected inflation (tan), minus KWW expected inflation (light blue), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Philadelphia Fed, Cleveland Fed, KWW from Fed Board, NBER, and author’s calculations.

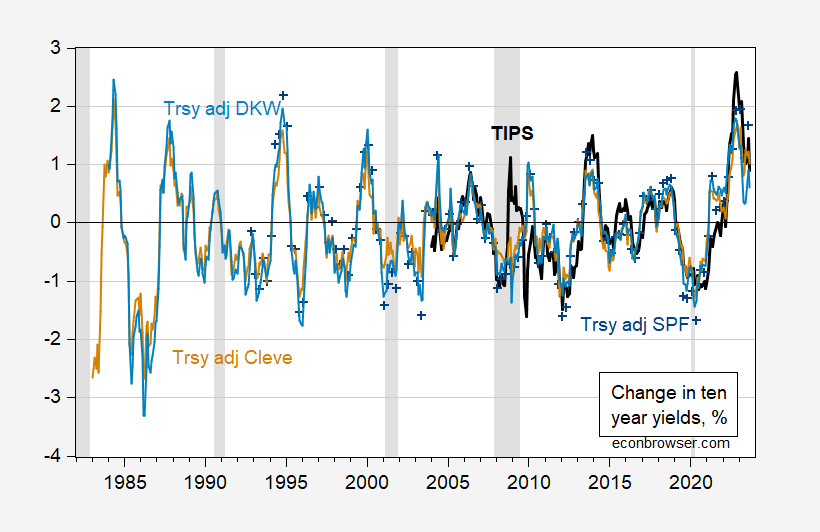

However, looking at the year-on-year change, the run-up in real rates is unprecedented was unprecedented, through 2022M11. For 24 month changes, is is currently unprecedented (over this sample period).

Figure 2: 12 month changes in TIPS 10 year (bold black), Treasury 10 year minus Survey of Professional Forecasters median 10 year expected inflation (blue +), minus Cleveland Fed expected inflation (tan), minus KWW expected inflation (light blue), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Philadelphia Fed, Cleveland Fed, KWW from Fed Board, NBER, and author’s calculations.

While the 12 month change in the 10 year yield has moderated to about 2.3-3% from a peak of 0.9-2.4%, the annualized 24 month change is at a high of 1.5% (TIPS).

Along with all the other bad news from the insurance sector, how ’bout this?:

https://www.fitchratings.com/research/insurance/global-reinsurers-pull-back-from-natural-catastrophe-cover-24-08-2023

Reinsurers are withdrawing coverage for natural disasters. This is not something I’ve seen discussed in the press; maybe I’ve been lazy. Why didn’t so.ebody tell me about this?

Anyhow, this is bad. Incrementallybad, but it’s a big increment on top of other big increments. Far too little attention is paid to insurance. Recession odds and monthly jobs data are cyclical. No kidding, right? But insurance is fundamental, bedrock stuff for the economy. Affordable insurance makes other things more affordable, more available. Insurance reduces risk to individuals, so individuals can take risks. And reinsurance is fundamental, bedrock stuff for insurance.

Insurance deals with bad outcomes. Climate change is a prolonged, progressive increase in bad outcomes. So there is no surprise that insurance is becoming less available, less reliable and more expensive.

Part of the problem is that we want to get the price of insurance right, but a prolonged, progressive increase in bad outcomes makes pricing of risk very difficult. “Laissez faire” ain’t workin’so well. Caps on insurance premia aren’t working so well, either; ask California and Florida.

Anyone hearing any bright ideas?

Maybe Jim Jordan, James Lankford, and Tom Coburn can tell us why, in this world where global warming is “made up” and “imaginary” why insurance corps are CHANGING the rates???

I forgot, “he of the Winter snowball” Republican Senator James Inhofe. Does he know why human caused / natural disasters insurance rates have gone up drastically. or <b. ARE NOT EVEN INSURED now?? Because global warming is “made up”???

Well, that does seem like a fair question, now that you mention it.

Macroduck Actually, a few years ago I mentioned this in an exchange with Corev. One of my nephews was a program manager for a very large agricultural reinsurer in Des Moines and he told me that he was switching careers because his company had looked at the climate change risk (uncertainty vs variability) and concluded that it was time to start withdrawing from that market and move on to greener pastures.

I appreciate you guys, you two mentioning it , as I respect you two guys greatly, but the point is , Republicans are always talking “free markets”, but they put their hands over their eyes, when “free markets” give them an answer they don’t like or want

Yeah. See below.

Once upon a time, insurance sometimes took the form of people – businesses or guilds – creating pools of cash as their own insurance funds. Merchants similarly pooled risk by taking shares in cargoes, which is the forerunners of public ownership of stocks. That arrangement – a few people facing similar risks pooling money and risk – doesn’t diversify risk very broadly. So the cost of risk is high. Organizational costs are high. It’s sand in the gears of the economy. Same with creating public insurance schemes which cannot know what the price of risk ought to be.

Anyone who says “let markets handle it” is pouring more sand in the gears. Same for anyone saying “let the state’s handle it”. States can’t diversify risks as broadly as possible geographically. If the answer is states getting together to create insurance pools, dandy, but the broadest diversification occurs when all 50 states participate, at which point the federal government might as well run it. And we still wouldn’t know how to price risk.

While we’re in the subject…

Here is an intriguing bit of economic history, having to do with Southern support for low wages and opposition to the New Deal. One detail which sounds quite familiar is that support in the South for low wages and opposition to the New Deal was narrowly based, with many Southerners realizing their interests were in line with the rest of the country’s. It was the effort of a self-interested few which serve as the basis for modern Southern antipathy to high wages and New Deal programs. And those Southern views have become the views of modern U.S. conservatives, to a large extent. Here we go:

Dollars for Dixie: Business and the Transformation of Conservatism in the Twentieth Century

Katherine Rye Jewell

From the Economic History Net review:

“In the 1930s, SSIC (Southern States Industrial Council) rhetoric emphasized a distinctive southern regional economic identity, namely a poor, developing region whose prospects depended on maintaining low wages. This stance was often at odds with business interests elsewhere in the country. Indeed, the SSIC was founded by John Edgerton, president of the Lebanon Woolen Mill, barely two years after he had been ousted as leader of the National Association of Manufactures. The organization initially favored working from within the National Recovery Administration, supporting greater representation for southerners in crafting NRA codes. But the SSIC became increasingly hostile to the New Deal after 1935, with the demise of the NRA and passage of the National Labor Relations Act (better known as the Wagner Act). As Jewell recounts, southern rhetoric supporting mill-village paternalism during this period generated some “strange congruencies” between industrial interests and the anti-modern Agrarians, such as Donald Davidson (p. 71). Despite these efforts, the SSIC basically lost this battle with passage of the Fair Labor Standards Act in 1938. The defeat reflected the political isolation of the South, but also the fact that wage legislation and other New Deal measures actually had strong support from working-class white southerners…”

https://www.eh.net/page/5/?s=%27Labor+Unions+in+the+United+States%27

There are a number of public insurance schemes around the country, as supplements to or replacements for private insurance. I’ve heard pundits suggest that public insurance will fill the gap as private insurance withdraws from difficult markets. Simple, right?

I think that’s a little glib. What happens during the transition, which is already underway? We want the right price on insurance, no matter the source of that insurance, but the public sector faces the same problems in assessing risk – which is price in the world of insurance – as does the private sector.

Funding insurance requires money up front. Politicians seem increasingly focused on politics rather than governance, so just a discussion of this problem, much less funding to address it, seems unlikely until the problem gets worse. Which it will.

You could consider FEMA the insurance company. Whenever there is a catastrophic event, they come in a bail out a lot of people. Premiums are paid byfederal taxes and there is no need to calculate and price the risk.

Maybe Florida will become so expensive it will depopulate before it falls into the sea.

florida has an insurance problem. for too many years, insurance was too cheap and easily available in Florida. this resulted in over building of residences next to the water, especially on the gulf coast. that was fine when these homes were summer and vacation homes. but now, they are permanent residences. the cost to insure is quite different. we have let entire communities build on locations that were considered too hazardous 75 years ago. insurers have increased the bill quite a bit over the past decade. my own home, which is not in a flood zone, has seen an enormous increase in insurance cost over the past 5 years. the next step, as people on this blog noted, is insurers will simply walk away from the market. this is going to devastate housing prices along the gulf coast over time, as a million dollar house that cannot be insured is no longer a million dollar house.

https://www.hollandhart.com/webfiles/2021_10_26-Order-re-Motion-for-Leave-Coca-Cola-762.pdf

The third paragraph of page 2 from this Tax Court ruling should crack anyone up who has been following Trump’s thousands of excuses to delay his many criminal trials. But the issue here isn’t the criminality of the 45th President but the attempts of Coca Cola to evade US taxes forever. After all if a corporation hires two prominent Constitutional lawyers – then tax evasion on a permanent basis is their Constitutional right under the 5th Amendment. Gag me.

(BTW – this order was not supposed to be in the public domain and this version is nothing something one can cut and paste from).

There ya go, rooting for big corporations again.

Get him, Johnny!

I had a discussion with a couple of Wall Street players who love to short sell corporations when they are in trouble just after the big Tax Court victory for the IRS that nailed Coca Cola’s tax evasion. It seemed they wanted to pick my brain for a possible shareholder lawsuit as upper management failed to let shareholders that this was a big risk.

I told them while I know a lot about the key intercompany issues involved – I had to decline public conversations over this. After all there are ethical considerations. Something our little Jonny boy would have no clue about. But yea – they mislead their outside shareholders.

“…a party could string litigation out indefinitely, if it’s pockets were deep enough” wrote the judge to Coca Cola, the 87th largest company in the U.S.

That’s a funny little “if”.

We have seen some sniping from JohnH trying to mock economists because we do understand the differrence between shifts of the investment demand curve v. movements along the curve (yea – I just went WAY OVER little Jonny boy’s pea brain) but may I note what this excellent graph shows. Long-term real interest rates are mere 2% which was seen as modest back in the 1990’s (I guess my internet stalker is too retarded to remember the internet-computer-telecom boom).

Contrast that to the 6% real interest rates during Reagan’s early years. And of course little Jonny boy does not remember that really high interest rates led to investment slump and a massive recession back. Or maybe Jonny boy does want a recession. After all his RECESSION CHEERLEADER skirt goes well with his MAGA hat.