When I want to know what the crazies are thinking, I go to zerohedge. On the BLS employment situation release, I saw zerohedge [1] asserting that the 336K number was the outcome of “upward goalseeking”. “Goalseeking”, I had to look up, “…is the process of calculating in reverse to find the right method when only the desired outcome is known.”

336K is substantially above the 170K consensus reported by Bloomberg. Zerohedge asserts it’s a 6 sigma beat. However, BLS writes that the one standard deviation for employment increase is 80K; hence I get a 2.1 standard deviation beat — still large, but not 6 sigma. In percent terms (which I think more appropriate given the trend in NFP growth), it’s about half sigma, given the m/m change was 0.21%, the implied growth using consensus was about 0.1% (170K on August NFP level), and the relative standard error as reported by BLS is 0.2%, the reported number is well within the range +/- 1 standard deviation.

The howler in the article is this:

Let’s start with the Household survey: here instead of a number anywhere close to the 336K jobs gained (as the far less accurate Establishment survey reports), the number of newly employed workers was just 86K, the lowest since May, and the second lowest of 2023!

I don’t know where the author gets the factoid that the household series is more accurate than the establishment. This is proof by assertion.

Is it seasonality estimation error? From Zerohedge:

How about the Establishment survey? Well, here too, things stink. Yes, the headline surge was great, but the question here is how much of that was purely seasonals.

Consider what Vanda Research FX trader Viraj Patel noted earlier: the official adjusted data showed this Leisure and Hospitality added a whopping +96k jobs. But unadjusted data showed that the sector lost 466k jobs in Sep. This means that the unadjusted private sector payrolls was -399!

Seasonality issues are a concern. After large shocks to employment, estimation of seasonal components is challenging. However, a look at the seasonally adjusted and unadjusted numbers can be helpful.

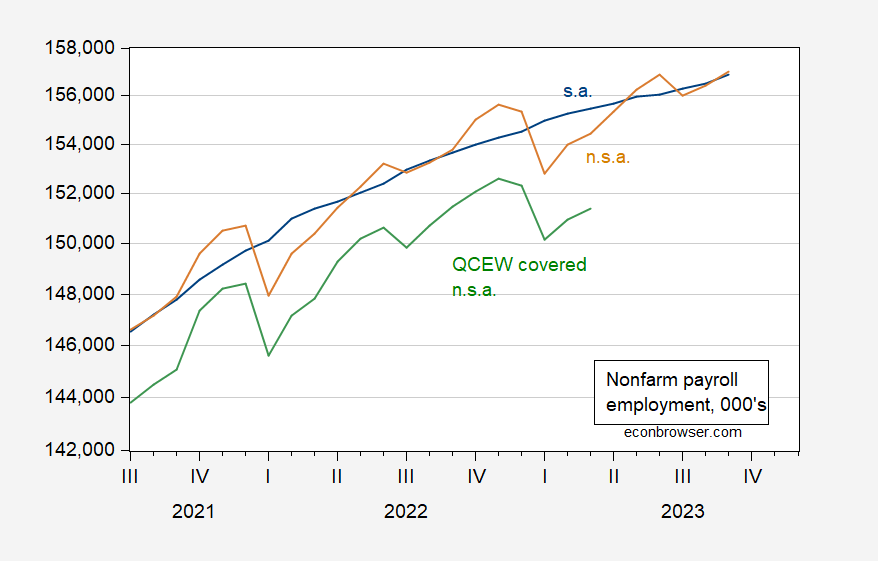

Figure 1: Nonfarm payroll employment, seasonally adjusted (blue), not seasonally adjusted (tan), and Quarterly Census of Employment and Wages total covered employment, not seasonally adjusted (green), all in 000’s, on log scale. Source: BLS, BLS-QCEW.

Note that the September adjusted number is just at the unadjusted number, as it was in 2022, and 2021… Another way to assess the impact of seasonals is to see how the 12 month growth rate has evolved. This is shown in Figure 2.

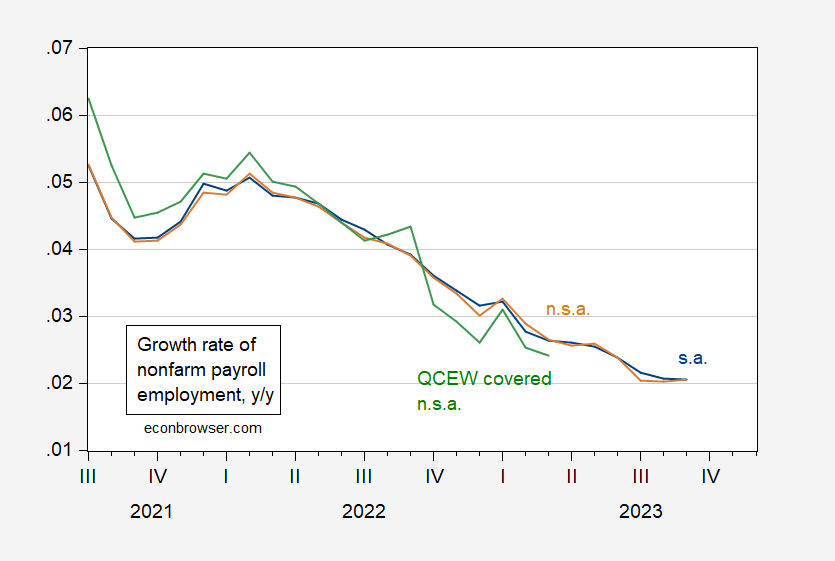

Figure 2: Year-on-year growth rate of nonfarm payroll employment, seasonally adjusted (blue), not seasonally adjusted (tan), and Quarterly Census of Employment and Wages total covered employment, not seasonally adjusted (green). Source: BLS, BLS-QCEW, and author’s calculations.

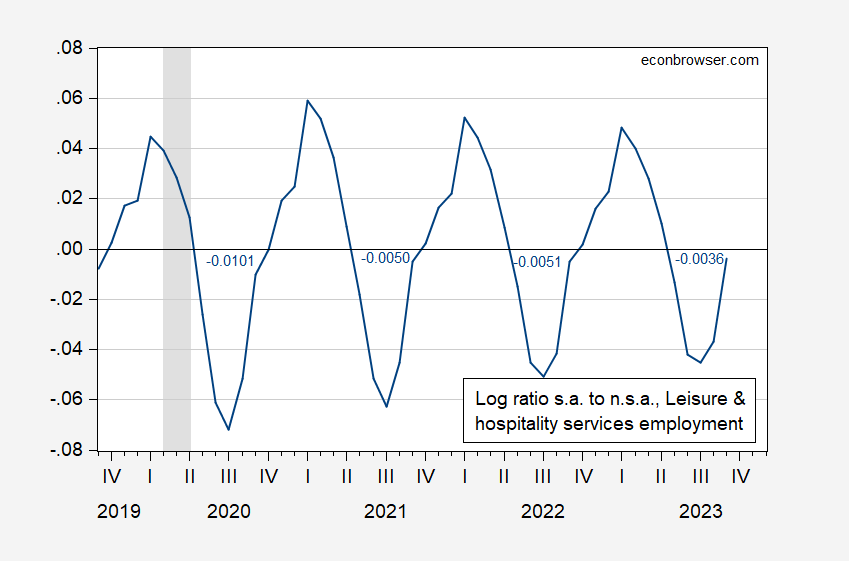

What about Zerohedge’s example in the leisure and hospitality services industry, where adjusted employment grew 99K, but unadjusted fell 466K? Well, if it was manipulation in 2023, then it also occurred in 2022, and 2022, and 2021…

Figure 3: Log ratio of seasonally adjusted leisure and hospitality services employment to not seasonally adjusted (blue). Numbers indicate value of log ratio at September of each year. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Just another example of data paranoia from Zerohedge (see previous discussion of another example).

“I don’t know where the author gets the factoid that the household series is more accurate than the establishment.”

He’s been watching Kudlow on Faux Business.

“Zerohedge asserts it’s a 6 sigma beat.”

OK – he sucks at basic statistics. Wait – did JohnH ghostwrite that for ZeroHedge?

Sort of interesting to accuse other of “upward goal seeking” while using downward goal seeking.

“BLS writes that the one standard deviation for employment increase is 80K”

Tyler did a lot of blatant lying there but I think I know how he got his 6 Sigma claim. He does not write what he is assuming for this 1 standard deviation but the graph is suggesting he is assuming this is 30 not 80. Tyler went out of his way to mislead his readers. But hey – so does Kudlow.

Durden is in the business of pretending to know more than he does. His audience is made up of people who either don’t know or don’t mind that he pretends to know more than he does.

He peddles sensationalism. Peddlers of sensationalism need to pick an audience. Tabloid mentality? Sure, but not soap opera stars feuding or country musicians cheatin’ – the actual tabloids have that covered.

No, there’s another audience with a tabloid mentality that’s interested in economics and markets. They love conspiracy theories. They hate Soros. They buy gold because Ron Paul and Glenn Beck tell them to. They buy crypto currencies from Sam Blankman-Freid. Mostly male. Mostly macho. Easily misled.

Johnny knows the shtick, though he seems to have yet another audience in mind.

At least Yellen is trying:

FACT SHEET: The Impact of Climate Change on American Household Finances

https://home.treasury.gov/news/press-releases/jy1775

Off topic, the violence between the Palestinian resistance and Israel –

In November of 1954, Algeria’s National Liberation Front (FLN) escalated its attacks on French colonial occupiers, beginning to kill civilians as well as soldiers and police. In August of 1955, attacks on civilians moved from the countryside to urban areas, and civilian deaths rose quickly, numbering in the hundreds. The French response was drastic. Roughly 400,000 French troops were sent to Algeria. Torture became a common French tactic. Thousands of FLN fighters and non-combatants alike were killed.

Two things happened in response to the French escalation. One was that Algerians flocked to support the FLN. Another was that the French public became opposed to the war.

The lesson learned was that provoking colonial powers to atrocities can be useful in winning support for resistance movements and in eroding support for colonialists.

I have to wonder if this lesson is behind Palistinian attacks in Israel.

The most anti-Palistinian Isreali government in decades comes to power, the flow of Jewish settlers into Palestinian land increases and settler violence against Palestinians increase. The governments of former supporters of a Palistinian state, meanwhile, improve relations with Isreal. The possibility of Palestinian autonomy is slipping away. So Palestinian militants attack, confident that Israel’s response will involve killing roughly ten Palestinians for every Israeli killed. This, it is hoped, will enrage the citizens of Israel’s former enemies, so that their governments will end their diplomatic advances with Israel and resume support for the Palestinian resistance.

Just a guess.

Republican National Committee Chair Ronna McDaniel appeared on Fox News on Saturday, telling the network about what Republicans need to do to contrast themselves with Democrats following Hamas attacking Israel. “I think this is a great opportunity for our candidates to contrast where Republicans have stood with Israel, time and time again, and Joe Biden has been weak,” McDaniel said. “And when America is weak, the world is less safe. We’re seeing this not just with the war in Ukraine and with an emboldened China, but now with an attack on Israel.”

The MAGA hatters never miss an opportunity to exploit anything they can. No caring for Palistinians or even Israelis. Just blame Biden because they can.

Yes as soon as Israel got the extreme right wing government in place, Hamas conducted actions that are sure to provoke extreme violence against their own civilians. It will also allow the Israeli right wing authoritarians to get a stronger grip on power and cement the fear-violence-anger-violence cycle.

Israel decided to just wall out Gaza in 2005, after occupying it turned out to be way too costly and impractical. It sort of worked for almost 2 decades with periodic interruptions of “rockets – bombardment” episodes. This rocket attack is so massive that the right wing response has to be reoccupation. Hamas must be ready for that, or they would not have provoked it.

There’s an alternative to re-occupation. You ain’t gonna like it. Hamas has to be betting that either way, Israel will stop before reaching its goal.

Israel turned Gaza into a prison camp already, so it would not be unthinkable for them to turn it into a termination camp – as their hatred and fear grows exponentially. However, a number of hostages have been taken back to Gaza, so I think Israel is limited in how brutal they can become against the civilians. They value jewish lives enough that they have been exchanging prisoners at rates of something like two soldiers for 500 Palestinians. The other thing is that they probably understands that the final Hamas desperation/revenge act would be a dirty bomb in Tel Aviv, making large areas of Israel uninhabitable for thousands of years. Would they dare risk precipitating the Hamas “enclosnung” by instituting their own? Even as their own population is paralyzed with stupefying fear, I think/hope they have leaders that understand where they are and where things are going.

We don’t have futures pricing yet, but I’m interested to see what this does to crude. If Saudi Arabia did, in fact, promise increased exports in return for a deal with Israel, facilitated by the U.S., and Hamas has succeeded in scuttling that deal, oil will probably open higher.

If Hamas, which is Sunni, and Hezbollah, Shi’ite, make common cause against Israel, does that foster reproachment between Saudi Arabia and Iran? Any reduction in friction between the two is probably good for a few pennies for oil prices over the longer term.

Brent up 2.8% on the futures open.

Picked up half a tank of gasoline today (Weds 11th) on the old Toyota. $3.179

In others news, this means Friday 13th is two evenings away. Watch out for the black cats and don’t put hats on top of the bed.

One more niggling detail:

Pentagon Sends U.S. Arms Stored in Israel to Ukraine

January 7, 2023

https://www.nytimes.com/2023/01/17/us/politics/ukraine-israel-weapons.html

Whether Israel intends to employ much artillery against Gaza, an urban area housing 2 million civilians, I will leave to others to consider.

Well, I dunno. Jews probably know better than most that big armies tend to crush revolts; e.g., the Warsaw Uprising in 1944 and the Jewish War catastrophe in the year 70 C.E. that changed the course of Judaism forever.

Except that recent technological “progress” has begun favoring the underdogs. Anti-armor and anti-aircraft missiles are now small enough to hide in the trunk of a civilian car. Drones and drone swarms are devastatingly effective. One video show a drone dropping a bomb on an Israeli tank, destroying it. The IEDs and remotely detonated car bombs used by insurgents in Iraq were one of the main reasons we had to leave. Sure big armies still win in direct open warfare – but they lose the occupation.

Lavrov is going to mocked for this but I’m sure Putin has given his pet poodle JohnH the responsibility of defending Lavrov’s pathetic rant:

Russia furious at Norway: “It’s Nazism”

Russia has expressed strong displeasure with Norway. The EU Commission decided in September that cars registered in Russia could no longer enter the EU. This decision made it significantly more challenging for Russians to cross borders into countries like Finland, Latvia, Lithuania, or Estonia. Norway, not being a part of the EU, also shares a border with Russia. The 196-kilometer stretch could easily be exploited by Russian drivers to enter Finland, as border control between the two Nordic countries is not particularly strict due to their inclusion in the Schengen Area. However, Norway put an end to this loophole earlier in the week by aligning its decision with the rest of the EU. Russia’s Foreign Minister, Sergey Lavrov, described the ban imposed by several European countries on Russian-registered cars entering their territories as a manifestation of Nazism. Lavrov also expressed astonishment at how representatives of European countries have “lost their sense of decency.”

Putin gave a speech a few days ago that revealed an interesting perspective (sorry I lost the reference). He ridiculed the idea that Russia was conducting a war of conquest, saying that Russia has more than enough undeveloped territory in Siberia and doesn’t need more land. That is an obvious truth, but also abandons the only strategic reason for his war of conquest in Ukraine. If he doesn’t want to fight in Ukraine to restore Russias footprint to the old glory days, why would he want to keep fighting? The idea of NATO being a threat to Russian territory is a great tool to get the ignorant masses fired up, but no thinking human being would actually act on such an absurd idea. Taking over Ukraine was clearly the goal when he thought he could do it in 2 weeks. Now it seems he has finally asked himself again “what are we fighting for”? Back when they were kicked out of Kharkiv oblast Putin talked about how an area could “develop” into being able to become independent – with a clear hint at Donbas maybe not needing to be part of Russia. Is he strategically moving in that direction again?

Speaking with Steve Bannon, former White House senior advisor to Trump and now host of the War Room podcast, Lindell vowed that he would not settle with Dominion and Smartmatic. Lindell said he would “never settle anything” and “never stop fighting no matter” while reiterating false claims about the 2020 election. Bannon asked Lindell: “You’re prepared to take this to the bitter end even if it means the bankruptcy of MyPillow?” Lindell responded: “We don’t have a country if we don’t win this. You know what – my employees, everybody understands that.

Well Mike – you don’t have a company because your pillows suck and your slippers are worthless. So let MyPillow go bankrupt as no one cares about the trash you are peddling. I would feel sorry for his employees but they probably are all KKK members.

Another off-topic comment –

The financial press is freaking out about long-term Treasury yields:

https://markets.businessinsider.com/news/bonds/bond-market-treasury-collapse-sell-investors-pain-credit-wall-street-2023-10

I’ll spare you the more quotidian headlines, but this first carries:

“The bond market meltdown is going to get worse before it gets better”

That headline is attributed to “experts”. Uh huh… So the logic is that, if we knew where prices were going in the future, we’d put prices there today, give or take the cost of carry. We don’t know that the bond “meltdown” is going to get worse, ’cause if we did, prices would already BE worse. But the rapidity of recent losses, on top of big earlier losses, is causing a stir.

Here are more examples, with less stupid headlines:

https://markets.businessinsider.com/news/bonds/treasury-bond-yields-market-selloff-market-crashes-dot-com-bubble-2023-10?utm_medium=ingest&utm_source=markets

https://www.investopedia.com/we-re-in-the-biggest-treasury-bond-bear-market-of-all-time-bank-of-america-says-8348729

https://www.reuters.com/markets/rates-bonds/euro-zone-bond-rout-continues-treasury-yields-surge-2007-levels-2023-10-04/

Here’s a picture of ten-year Treasury yields, Fed funds, one version of inflation expectations and term premium:

https://fred.stlouisfed.org/graph/?g=19Tz4

Since May, when the recent rise in yields began, term premium is up about 55 basis points. This is where overseas demand and increased issuance and most of the stuff in financial market headlines shows up. Ten-year yields are up about 125 basis points in the same period. Inflation expectations up about 35 basis points. That leave about 35 basis points accounted for by the expected coast of funds.

If the story behind the scary but illogical headline proves correct, most of any additional drop in price will result from a rise in term premium.

In recent comments, I noted the deterioration in portfolio metrics for Treasury assets, and the question came up whether the low price of Treasuries doesn’t mean it’s time to “buy low”. I’d make two observations in answer. First, repeating something I wrote at the time, is that many portfolio managers do not (cannot) operate on the basis of speculative bets, but rather operate based on portfolio rules. That’s why portfolio metrics matter.

The second observation is that, if a year ago you had bought Treasuries because prices were already “low” – and they had already fallen substantially then – you’d have lost money. Buying low and selling high works in sideways and upward-trending markets. In downward-trending markets, it’s mighty tough to do. That’s why folks are freaking out; making money in Treasuries – and equities – is hard right now.

And if yields do continue to rise, it will be harder to make money in the real economy, too.

Ducky still hasn’t explained why he thinks it’s a bad move to move to invest in bonds now. Yields are higher than they’ve been since July, 2017. Assuming you buy a 10-year treasury and hold to maturity, 4.7% is the worst you can do. And if rates drop, you can sell with a nice capital gain.

TIPS are not bad either–2.5% plus inflation with an upside gain if inflation drops.

Sure, bonds bought before this year are an absolute disaster…as I wrote repeatedly a few years ago, anybody who bought long term bonds at historically low rates was an absolute nut case. That’s why only a third of my retirement portfolio is in bonds, half of that being in TIPS and I-bonds with a fixed rate above 2.6%. (The I-bonds have quadrupled in value since I bought them.) The balance is mostly in short and intermediate bond funds which will work themselves out in just a few years.

Ducky must be tallking about the idiots who bought long term, but that absolutely does not mean that investing in certain types of bonds now is a bad idea.

Johnny is once again attributing views to me which are not mine. It’s something he does quite a bit, and with more people than just me.

Basic reading comprehension should allow an honest person to realize that I haven’t offered an investment view. Nowhere have I recommended or discouraged investment in Treasuries. I have offered an explanation of how the world has changed in an area I understand reasonably well.

Portfolio managers – how many times do I have to say this? – portfolio managers aren’t punters. “I bought it because I think it gonna go up” is not something your typical portfolio manager would say. “I needed more duration…my risk profile needed adjustment…I was over/under hedged…gains/losses in asset X mean I was over/underweight in sector Y…” That’s how portfolio managers think.

Johnny is out of his depth, but he’s apparently not interested in how the world works. He’s more interested in supporting Putin’s war against Ukraine and making stuff up about people who disagree with him, as he’s doing here.

Tricky Ducky said, “making money in Treasuries – and equities – is hard right now, And if yields do continue to rise, it will be harder to make money in the real economy, too.” but he wasn’t offering investment advice!!!

And my response was that you can make money in Treasuries…if you weren’t stupid enough in the past to buy long term treasuries when rates were at historic lows. As for ‘portfolio metrics,’ why would any rational investor heavily weight investments whose prices were at historical highs and yields at historical lows? Lets face it, portfolio managers are squealing like stuck pigs now because their metrics left them needlessly and illogically exposed to a correction from historically unprecedented rates.

I expect a lot of these geniuses were the same as the ones telling us that inflation was going to be 2% forever, even when it was ripping along at 8%.

All of which suggests that portfolio managers are involved more in a Keynesian beauty contest than in a common sense analysis of fundamentals.

Anyone who follows your advice is likely more bankrupt than Rudy Guiliani. Keep it troll as reading your fluff is the funniest thing I have seen in years.

Every word Johnny wrote here misunderstands portfolio theory, what portfolio managers do, why portfolios exist. And he continues to misrepresent what I wrote. Beyond that, no problem.

“Macroduck

October 9, 2023 at 6:53 am

Every word Johnny wrote here misunderstands portfolio theory”

Jonny boy is the type to put all his eggs in one basket. And whenever his basket is doing poorly – Jonny boy is not to be heard. But on the rare occassion when his volatile basket does well, Jonny boy goes crowing that he is better at this than anyone else.

Yea – little Jonny does not understand a damn thing about financial market. Even what a fixed real return (TIPS) means.

DUMBEST TROLL EVER!

“And my response was that you can make money in Treasuries…if you weren’t stupid enough in the past to buy long term treasuries when rates were at historic lows.”

so to be clear, johnny, you were one of the investors buying 1 month treasuries for 0.1% rather than 10 year treasuries for 2%? bonds are not stocks. most people do not invest in bonds for capital gains. they invest for income. that is why even sane people reached for yield at 2% and eventually got burned. but a decade of 0.1% did not produce any income for most folks, so they had no choice. johnny, you are looking at the past couple of years with 20/20 hindsight and criticizing, and that is not appropriate. anybody who is fully loaded in short term high yield treasuries today made no money with that capital the past decade-that is why they had cash to buy today. as macroduck noted, those running a portfolio have a different viewpoint than day traders. your advice has not been very accurate here johnny, and it is based on hindsight.

“TIPS are not bad either–2.5% plus inflation with an upside gain if inflation drops.”

You are the dumbest troll ever. Do you not get that the nominal yield on these bonds adjusts up or down as inflation goes up or down? Do you not understand what a fixed real return even means?

Come on Jonny boy – you are so bad at economics that you do not get the most basic definitions. And yet you babble on proving every comment that your IQ is negative.

I would have thought linking to this was unnecessary as any one who follows an economist blog should know what TIPS means. But it seems JohnH – who is the dumbest troll ever – does not:

https://www.treasurydirect.gov/marketable-securities/tips/

Treasury Inflation Protected Securities (TIPS)

As the name implies, TIPS are set up to protect you against inflation. Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term. When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount. TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies.

In other words if inflation goes up (or down) nominal payments go up (or down) so the real return is fixed.

But little Jonny boy claimed that if inflation goes down those who hold TIPS get a better real return.

Yea Jonny boy is incredibly STUPID. Which he shows with each and every one of his dumb comments.

https://www.msn.com/en-us/news/opinion/wsj-opinion-tim-scott-takes-on-a-core-liberal-belief/vi-AA1hT0Ad?ocid=msedgdhp&pc=U531&cvid=6c9d280fcbc442f2914aaa26ca842a43&ei=6

Watch Uncle Tom Scott blame LBJ for the problems blacks face in America. Of course we have some KKK clown saying Scott is right.

I’m, certainly not on team JohnH, but I do have questions about your statements regarding Treasuries. Here is what you said:

Macroduck: “All three metrics have deteriorated, making Treasuries less attractive. If your investment decisions are purely math-driven, you will shift your asset allocations away from Treasuries. If, instead, some part of your investment decision is speculative – forecast-driven – you need to anticipate an improvement in some of these metrics in order not to decide to hold a smaller share of assets in Treasuries.”

You haven’t explained why you think Treasuries are less attractive when prices are down and yields are up. Are they less attractive than when prices were high and yields were down? How does that make any financial sense?

And then you go into some gobbledygook about realized performance vs forecast performance. What you seem to be saying is that investors are traumatized by recent bond market value losses so should avoid the sector. That makes no sense and is contrary standard investment theory.

And then you go into something about how portfolio managers think which makes no sense. If a portfolio has lost value in bonds, then portfolio theory says they should buy more bonds to maintain their desired stock to bond allocation. This has nothing to do with speculation about future bond yields. That’s standard portfolio theory. You seem to be hypothesizing some strange portfolio theory I’ve never heard of and you don’t seem inclined to explain it.

Can you explain in simple English without the gobbledygook exactly why you think Treasury bonds would be less attractive to portfolio managers at this time? Can you explain the math in “if your investment decisions are purely math-driven, you will shift your asset allocations away from Treasuries.” That certainly seems like an investment recommendation to me.

I’m staying out of their food fight. Except for this. Little Jonny boys claimed that the 2.5% real return on TIPS would be higher if inflation falls. Yea – little Jonny boy has no clue what a fixed real return bond represents. On that alone should tell us not to follow investment advice from this clown.

First. The fact that you don’t unserstand what I’ve writtenmeans one of two things – either I’ve written something that makes no sense, or I’ve written something over your head. The tone of your response suggests the first. Having worked with this stuff for years, and kept clients happy doing it, I’m confident it’s the latter. But here, let me dumb it down for you.

Portfolio theory and investment in general involves risk-adjusted return. “Risk” in finance is closely related to price volatility. Treasury prices have moved rapidly in the past three years, relative to historic performance, so “risk”, as typically measured, is up. My link to the MOVE index in an earlier comment gives evidence of that rise in volatility and risk.

As regards risk-adjusted returns, the higher the risk, the higher the necessary return. That means that, for now, Treasuries need to carry a higher return, all else equal. The fact that they do carry a higher return now is not, in itself, evidence that they are “cheap” in the sense that they are under-priced relative to some hypothetical “right” price. You have to do a bit of math to draw any conclusion about risk-adjusted returns, and I haven’t seen any math from you.

There is a second problem with Treasuries carrying a higher risk now than in the past. Treasuries are held in part to reduce portfolio risk. Their value in lowering portfolio risk is diminished now, because they carry higher risk. They don’t serve one of their purposes as well now as in the past, so portfolio managers may choose to hold fewer of them. Cash, because of its shorter duration, is less volatile and is likely to be substituted for long-term Treasuries. And, at least for now, cash still pays higher yields than long-term

Again, notice that I have not made an investment recommendation. Nor have I made a market call. I have explained something which you apparently did not understand. Perhaps you still don’t. If my explanation doesn’t help, perhaps you should read a book.

Hey, you’re the one who claimed to have a mathematical explanation yet I have seen a single number from you.

If portfolio managers are fleeing from long term to short term treasuries as you claim, you might wonder why short term has higher yields. So your claim is that a sell off in long term treasuries is causing their yield to be depressed and their prices to go up? That’s an interesting theory.

“If portfolio managers are fleeing from long term to short term treasuries as you claim,”

it is no slam dunk that the fed is done raising rates. longer duration is more risky that short term because of that situation. until we get clarity that rates have peaked, there is more risk with duration. that will change once rates start to fall. but they have not, yet. and comments from the fed imply they will not fall for a while. until rates begin to fall, i can gain between 1/2% and 1% additional yield on short term treasuries compared to 2 years or longer. if rates continue to rise, or even hold steady, for the next year or two, who in their right mind thinks a longer term treasury is the correct buy?

when i buy a 10 year treasury and rates fall, that holding is very liquid for me because its values increases. i can sell it without reservation. but if i buy a 10 year treasury and rates rise, it becomes illiquid or a loss. that explains why people would be hesitant on a longer duration, today.

baffling: “i can gain between 1/2% and 1% additional yield on short term treasuries compared to 2 years or longer. if rates continue to rise, or even hold steady, for the next year or two, who in their right mind thinks a longer term treasury is the correct buy?

Do you realize you are advocating the classic “sell low/buy high” market timing strategy that a lot of unfortunate people did in the depths of 2009? You think you can time the bottom and then jump back in at just the right time to catch the rise.

As for “right minds” do you think you are smarter than the bond traders who actually have billions at stake rather than just a cheap blog comment? The bond traders certainly think longer treasuries can be a correct buy — their yields are lower/prices higher than short Tbills. Their prices aren’t higher because traders are selling them off — just the opposite.

And Macroduck seems to believe that he has a “mathematical model” that shows that the entire bond market is wrong and he is right — I guess like those Nobel winners at LTCM or the mortgage backed security wizards and their VARs. He claims that “portfolio managers” agree with him, but if you look at the yields, that can’t be true.

The name of the model I “seem to think” I have in mind is the Capital Asset Pricing Model. You should give it a look.

Joseph, your assessment of what I am advocating for is incorrect.

since mid 2020, 10 year yields have steadily increased. which means the value of those bonds has steadily decreased. there is not a single person who bought a newly issued 10 year bond for the last three years that has made a dime on appreciation. please explain how I made a good investment with 10 year treasuries purchased last year, compared to shorter term bonds? I am asking for financial advice here.

baffling: “please explain how I made a good investment with 10 year treasuries purchased last year, compared to shorter term bonds? I am asking for financial advice here”

The past is past. Whether or not you made a good or bad investment in the past is irrelevant. The question is what to do now.

You are just like the folks who in 2009 said “please explain how I made a good investment with the S&P 500 purchased last year” and then said I’m getting out of the market — right at the time that the market was cheapest. Sell low and buy high. That’s what you are advocating.

If your expected investment horizon is more than 6 years duration, you will have higher expected returns with a 10-year treasury bond than Tbills. Or else you think the entire bond market is crazy and their pricing is “wrong”. Good luck with that. That’s what the folks who bailed out of the market in 2009 thought.

At least you acknowledge a duration of 6 years. Time horizon makes all the difference here. But you accuse me of market timing. That is EXACTLY what you are doing here. If i have 1 month rolling treasuries i have alot of flexibility. And if rates stay inverted for another year, which from the sound of the fed may actually occur, your approach makes less money. Giving up 1% or more per year is a pretty big loss for low risk bonds. Maybe you dont care about losing money though.

At any rate, i think macro was more accurate with his risk observation than you are with your bond peak call today.

Dude, there ain’t no such thing as a free lunch.

Long bonds have interest rate risk, which means their market prices are volatile but their rates are stable. On the other hand, short bonds have reinvestment risk, which means their prices are stable, but their rates are volatile. You can avoid price volatility or rate volatility but you can’t avoid both simultaneously.

These are two sides of the same coin. What you are calling “flexibility” is actually reinvestment risk. Now, you may think that you can cleverly time your move from short to long but that is the classic fallacy of the market timer. If that were easy, just rolling over 1-year bills, no one would be buying anything but Tbills right now. But professional bond traders know that isn’t easy, which is why lots of them are buying longer bonds.

I’m not advocating market timing at all. Just the opposite. I’m saying that you should invest according to your desired holding period, not just willy-nilly whichever has higher current yields. If you plan on investing for 6 years or more, you have a higher expected return in 10-year treasuries.

I am not substituting my own speculation for the market prices. I’m assuming that my odds of beating the professional bond traders is not good and trusting that their estimates for prices are better than my own, so I buy treasuries according to my holding period. You are assuming that you can beat the bond traders with clever market timing.

Joseph, I may not agree with all that you have said, but I thank you for your comments. and I do appreciate the points you are trying to make. our differences are more related to desired duration and liquidity, I think.

Oh, wait. I remember now. You were the one a while back predicting the Treasury liquidity apocalypse, sounding like a Zerohedge fanatic. It never happened, even when many were predicting after the debt limit showdown in June. The Treasury auctioned off half a trillion in one month to replenish their near zero General Account with not even a hiccup.

Methinks you are projecting your obsession with liquidity and volatility on innocent portfolio managers.

treasury liquidity was a valid concern. once macro pointed out the issue, it was on my radar, and i noted it as a discussion point from several different sources. nobody claimed it would be a disaster. but most people with knowledge of the topic understood that it introduced risk that previously had not been considered. that was the concern, it became a known risk factor, but markets did not have a clear understanding of how it would play out. so it could not be ignored, if you took your finances seriously. you could have certainly proceeded with the ignorance is bliss approach.