Data from 2023Q2 post-revision, and Census construction numbers:

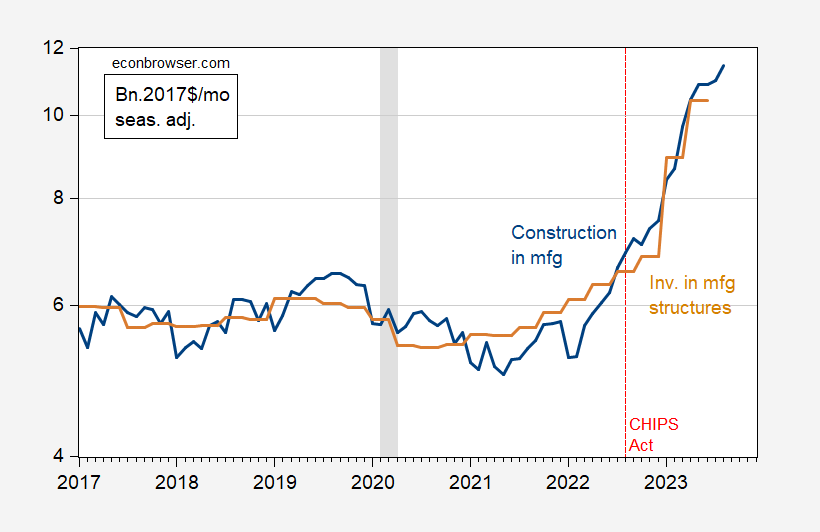

Figure 1: Construction in manufacturing, in bn 2017$ per month (blue) and investment in manufacturing structures, in bn Ch.2017$ per month (tan), both on a log scale. Construction deflated by PPI in material and components for construction. NBER defined peak-to-trough recession dates shaded gray. Source: Census, BLS via FRED, BEA (2023Q2 3rd release), NBER, and author’s calculations.

It’s important to note that these data are drawn on a log scale. The jump in manufacturing structures investment is even more dramatic if shown in levels.

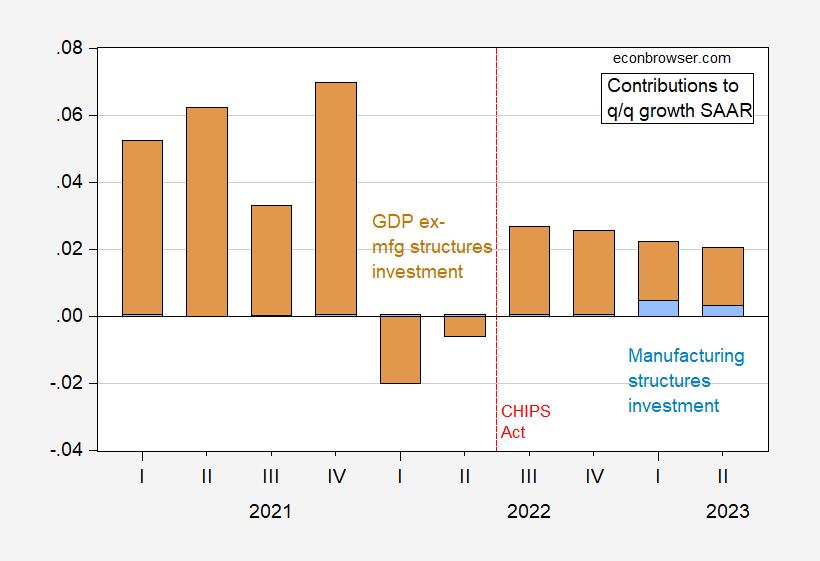

The accounting contribution of investment in manufacturing structures in the NIPA is quite striking in 2023H1.

Figure 2: Contribution to quarter-on-quarter growth at annual rate of GDP from all categories ex-manufacturing structures investment (tan), from manufacturing structures investment (blue). Source: BEA 2023Q2 3rd release.

While nonresidential (total) structures investment contributed 0.46 ppts of Q2’s 2.1 ppts GDP growth (SAAR), GDPNow as of today has this components contribution at 0.02 ppts of Q3 nowcasted 4.9 ppts growth.

So, the CHIPS Act seemingly has spurred nonresidential structures investment. CBO uses a multiplier for transfers to states for infrastructure spending between 0.4 to 2.2. The midpoint of this range is 1.3. This suggests around half a percentage point (at annual rates) of 2023H1 growth can be attributed to the stimulus coming from this measure.

This is a separate issue from whether the CHIPS Act, as a type of industrial policy, is a good idea. Those factories still have to be manned, and the chips actually produced.

Some states take advantage of great legislation like the CHIPS Act. Other states just watch the money fly away in the breeze. And who gets hurt when those dollars fly away in the wind?? The group Republicans LIE 24/7 that “they care about so much”: children

https://kfor.com/news/local/missed-deadline-could-send-millions-of-education-dollars-back-to-d-c-instead-of-oklahoma-classrooms/

re: “While nonresidential (total) structures investment contributed 0.46 ppts of Q2’s 2.1 ppts GDP growth (SAAR), GDPNow as of today has this components contribution at 0.02 ppts of Q3 nowcasted 4.9 ppts growth.

i try to compute the contribution of construction to GDP in aggregate, which is hard enough, and i get a 101 basis point contribution in the 3rd quarter, using the producer price index for final demand construction as a deflator, in lieu of the 2 dozen price indices the BEA uses…

here’s my dirty math:

That producer price index showed that aggregate construction costs fell 1.2% in August after rising 0.2% in July, being unchanged in June and rising by 0.1% from April to May…on that basis, we can estimate that construction costs for August were roughly 1.0% less than those of May and June, and roughly 0.9% less than those of April, while obviously 1.2% more than those of July…we then use those percentages to deflate higher priced spending figures for July and for each of the 2nd quarter months, which, for comparison purposes, is arithmetically the same as adjusting lower priced August construction spending upward…annualized construction spending in millions of dollars for the second quarter months is shown at $1,956,226 for June, $1,946,733 for May, and $1,907,837 for April in this report, while it was at $1,973,693 million for July and $1,983,470 million for August….thus to compare July and August’s inflation adjusted construction spending to that of the second quarter, our formula becomes: ((1,983,470 + 1,973,693 * 0.988 ) / 2 ) / (( 1,956,226 * 0.990 + 1,946,733 * 0.990 + 1,907,837 * 0.991 ) / 3) = 1.0253053, meaning real construction over July and August averaged 2.53% higher than that of the 2nd quarter….hence, that means that after adjusting for inflation, real construction for the 3rd quarter rose at a 10.51% annual rate from that of the 2nd quarter….put another way that’s real growth at a $48,540 billion annual rate, which means that if September should show no improvement, the increase in real construction would add a net of about 1.01 percentage points to 3rd quarter GDP across those components that it influences..

i also get a 99 basis point contribution from 2 months of trade in goods, using the 2017 dollars figures provided by the BEA in exhibit 10 here: https://www.bea.gov/sites/default/files/2023-10/trad0823.pdf

“This is a separate issue from whether the CHIPS Act, as a type of industrial policy, is a good idea. Those factories still have to be manned, and the chips actually produced.”

In the near term, the fact that the U.S hasn’t staffed chip production facilities on a scale similar to what the CHIPS Act envisions means there will probably be labor shortages. However. In the longer run, the very high productivity of chips production facilities should mean high wages, which should in turn lead to an easing of any labor shortage:

https://fred.stlouisfed.org/graph/?g=19LDJ

And yes,I know that labor productivity, not total factor productivity, is the appropriate measure, but I couldn’t fins as narrow a measure for labor productivity as for total factor productivity in the chip-producing sector, so I improvised.

Just a bit of applause for James, who was apparently first in comments to point this out:

James

June 9, 2023 at 2:17 am

I’m curious to see how many U.S. manufacturing jobs will be added by Biden admin/Democrats in the next two years. https://www.businessinsider.com/us-building-factories-census-data-chips-act-inflation-reduction-act-2023-6?op=1 Also – we can all agree – that the switch to EVs and solar is much needed now. The lesson learned here is that Democrats get things done https://www.nytimes.com/2023/06/06/opinion/biden-trump-ira-chips-manufacturing.html

Thanks Macroduck! – ! Since I am not economist – among this august and some infamous crowd of commentators – I try to keep my comments to a minimum and only comment on things that seem painfully obvious to me. Related to that comment and the current post: Although we must be aware of the latest Trump authoritarian call to violence https://www.dailykos.com/stories/2023/10/5/2196058/-Donald-Trump-uses-Nazi-propaganda-to-support-abhorrent-views-on-immigrants and the latest GOP demonstration of their failure to provide responsible governance https://abcnews.go.com/Politics/stalled-bills-looming-shutdown-matters-house-speaker/story?id=103725574 – has anyone asked the GOP why they keep saying global warming is a hoax and they keep blocking a transition to electrification and renewable energy in the face of “gob smacking” warming https://www.dailykos.com/stories/2023/10/5/2197624/-What-the-Hell-Just-Happened Also we are looking at record levels of both Greenland ice sheet and Antarctic sea ice melting https://nsidc.org/arcticseaicenews/ Maybe when Mar-a-Lago is underwater the GOP will take action?

Hey fellow frogs – have a good day- just be aware that the pot of water we live in – is now boiling.

You forgot some of the commenters here [ gushes and blushes while looking off sideways ] are distinguished, worldly, suave, conjecturing visionary……. foreign policy “expert”. And that’s just when I’m drinking. And then there’s….. Oh nevermind, we don’t have that much time.

I learned my ability to be meek and unassuming from Barkley Rosser. I think he was on to something with this modest stuff. I have to go for my manicure now.

In the Trump administration “infrastructure week” was a joke – in the Biden administration it is an action plan.

Dick Butkus passed away. At age 80. Wow.

“Woke” people, if you don’t understand why “old school” and WWII generation don’t respect you. Watch Dick Butkus highlights. And MAYBE…….. maybe…… You’ll “get” why they don’t respect people sitting around saying they got it bad. Chicago is Midwest. Chicago is (was??) “working man” and “working class”. That used to mean something in America. Not sitting around crying and holding a mobile phone 3 inches from your face. He was on two winning teams his entire pro career. The guy you looked at across the line of scrimmage and immediately felt fear.

Yeah, and he was in Miller Beer commercials. Did we talk about this recently??

I remember watching him as a child thinking to myself I would have no chance at running the ball in the NFL. Incredible athlete and a good guy.

“Butkus is tough” was a true statement for “ da Bears” from the early ‘70’s.

Good times!

RIP!

I guess you missed the games from 1965 to 1969.

you are that old?

I was seated in the “closed end” of the LA Coliseum for the Rams-Bears game in 1966 pitting the Rams’ emerging D against the Bears whose roster included Butkus, Mike Ditka AND Gayle Sayers. Sayers had an incredible , unforgettable run, coming right toward us that I’ve seen in B&W NFL films. Rams scored final TD when the soon to be Fearsome Foursome crunched the Bears’ QB and forced a TD interception.

Those, indeed, were the days.

Wasn’t investment in manufacturing structures supposed to be increased under Trump? $6 billion per year is all he could manage? It has literally doubled under Biden. And they say Biden is too old.

Where is the recession of the Doomsayers? I am talking about the the WSJ , CNBC, CNN, NYT Bloomberg, and others who have been crying recession, recession, recession.

The last and least is ADP which they need to find another job. The projected 89000 jobs only, The Biden/Harris admin has created 13.95 Million new jobs since Jan 2021.

“The Biden/Harris admin has created 13.95 Million new jobs since Jan 2021.”

Of course Kudlow is telling people over at Faux News that only 2.6 million new jobs have been created.

THE EMPLOYMENT SITUATION — SEPTEMBER 2023

Total nonfarm payroll employment rose by 336,000 in September, and the unemployment rate was unchanged at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in leisure and hospitality; government; health care; professional, scientific, and technical services; and social assistance.

https://www.bls.gov/news.release/empsit.nr0.htm

Now the household survey indicated employment grew by 86,000. There will be a race among the Three Stooges (Kudlow, JohnH, and Princeton Steve) to be the first to claim the household survey is the only reliable measure.

Isn’t it interesting how high interest rates have not impeded investment in manufacturing? Does this mean that opportunity trumps interest rates in corporate investment decisions? If so, what are the implications for future QE and ZIRP?

Gee – Jonny boy has discovered the idea that demand curves can shift outward. Now if we can only get him to figure out how to tie his shoes!

Opportunity “trumps” interest rates? No. The two both influence investment decisions, as do other factors such as risk and access to capital, simultaneously.

Anyone who thinks in binary absolutes, like trumps in a hand of cards, doesn’t understand business decision-making. And until one understands the complexities of funancial and business decision-making, one will not be able to grasp the workings of monetary policy.

Why do you ask?

It turns out that college freshmen learn about movements along the (investment) demand curve (from changes in real interest rates) versus shifts of the demand curve early on in any principles of economic class,

But this is WAY OVER little Jonny boy’s feeble brain. Come to think of it people like Princeton Steve, Bruce Hall, and CoRev never learned the basics either. Which is why I call them the USUAL SUSPECTS.

Are you suggesting that liberal economists group think about ever lower interest rates during the 2010s might have been binary thinking…ignoring other influences on spending and investment decision making? Why was the impact of higher interest rates (income for many families) and the resulting demand supported by them routinely ignored in favor low interest rates that mostly boosted stock portfolios?

What a stupid comment even for you. Economists both liberal and conservative realized that the demand for investment fell during that period. Come on Jonny boy – take a damn course in basic economics. But only after you learn to count past 10 without taking off your shoes.

Hilarious!!! How many times over the past decade did pgly advocate for ever lower interest rates…even as demand for investment failed to respond to rock bottom interest rates? As I wrote over and over, the Fed had failed to push the noodle and stimulate economic growth with ZIRP and QE. Yet they persisted with avid support from mainstream, liberal economists.

Meanwhile, people’s ability to earn positive real yields on their secure savings was crushed, yields that were needed to save for a house, their kids college education, fund their own retirements or maintain their level of consumption . Instead, yields on high risk stocks boomed, yields that were driven, not by productive new investment, but by stock buybacks, cheap margin loans, and speculation. Bernanke justified this by the “wealth effect,” demand stimulated by the income gains of wealthy investors. Of course, the income effect of higher interest rates got ignored and denigrated by mainstream, liberal economists, even though it is a fact that higher interest rates generate income, some of which is spent and supports consumption.

At the time, pgl was a low interest rate zealot, advocating lower interest rates even earlier this year, even though the economy has yet to be harmed by higher interest rates. In fact, high levels of consumer spending may be due in part to increased income from high interest rates.

The question is why so many economists were so enamored with low interest rates, whose primary effect was to drive asset bubbles? Why not drive demand by paying ordinary folks positive, real interest rates and ultimately stimulate increased investment via increased demand?

JohnH

October 6, 2023 at 5:31 pm

Seriously? Jonny boy whines about Macroduck allegedly putting words in his mouth but we get this long winded rant that misrepresents what I have said.

I get I have a stalker but why is my stalker so mentally retarded?

Long, long ago, when Daniel Yergin still ran Cambridge Energy Research Associates, I was invited to speak on the interest rate outlook at a CERA conference. Yergin’s people would cover everything else, but the Fed and interest rate markets were not among their areas of expertise, so I got a first class flight and some free food. We were under the same corporate umbrella, so no stipend.

Anyhow, I was about half way through my presentation when Yergin’s second in commad interrupted and said we should take a short break before I finished up and took questions.

CERA’s presentation, which included a good many optimistic comments about the investment environment for some parts of the energy sector, assumed steady borrowing rates. That is a very common median estimate among market forecasters, so I understand how they came up with it. My presentation was all about how the Fed was going to start hiking rates within the next 12 months, and that I expected longer-term rates to begin rising soon in anticipation of Fed hikes.

The CERA guys were freaking out. They had based their presentation on what Johnny calls “opportunity”. My presentation was based on interest rates. During the break in my presentation, Yergin’s guy explained that the room was full of some of the most interest-rate sensitive fixed investment decision-makers in the world, and I was causing them to rethink everything the CERA guys had told them. And they had each plunked down thousands to be there. Ugly.

Nobody in that room thought “opportunity trumps interest rates”, nor vice versa. When you think about it, this is a binary notion applied to incremental changes in two factors. Other than some utterly arbitrary definition of “trumps”, how would one ever judge that one factor trumps another? Zero investment when monetary policy is tighter than neutral? It’s dumb.

By the way, the Fed did, indeed, begin hiking rates a couple of quarters later.

It doesn’t look like high interest rates have adversely effected US oil production, which climbed to near record highs in July. Yet another case of opportunity trumping high interest rates?

QE and ZIRP RIP!

Oil production is not investment demand dumbass. How effing stupid are you? Don’t answer that as even retarded dogs are laughing at you.

Strong payroll job gains in September. August revised higher. Average hourly earnings up just 0.2%, the smallest gain since February of last year. You have to go to 2 decimal place to see that the September gain was slower than August – this may be why the fed funds response is muted for now.

Odds of a 25 basis point hike in November have repriced to around 30% from around 20% yesterday. The odds of easing at future Fed meetings have declined across all maturities – the impact of strong jobs data is more “keep rates high” than it is “push rates higher”. That can change, of course.

Ten-year yields have added 15 basis points. S&P down about 0.8% from yesterday’s close. The dollar index is at its highest level this year, up about 0.3% on the day.

Treasuries, with just 3 months to go, are on track for a third year of losses. Never happened before. This is probably going to change portfolio risk metrics for some time to come – not necessarily a bad thing, but disruptive. When we see headlines about reserve managers holding fewer Treasuries, we can’t simply conclude this is politics. To some extent, it’s math.

Let’s hope that the Fed will hold their powder until they see the white in inflations eyes rather than fire early when they see the fear in Wall Streets eyes. Not holding my breath or anything.

Speaking of Treasury losses and portfolio metrics, the MOVE index is around 130 these days, a level last seen in 2009. Tough sledding for portfolio managers, particularly at insurance and pension funds.

Think of what has happened to the main portfilio metrics for Treasury assets ovet the 2021-2023. Total return is down. Volatility is up. Price correlation between Treasuries and other major asset classes ismore positive.

All three metrics have deteriorated, making Treasuries less attractive. If your investment decisions are purely math-driven, you will shift your asset allocations away from Treasuries. If, instead, some part of your investment decision is speculative – forecast-driven – you need to anticipate an improvement in some of these metrics in order not to decide to hold a smaller share of assets in Treasuries. If the Fed outlook stops wobbling aroud, some metrics could improve.

We are regularly treated to assertions about China’s and Japan’s and Middle Eastern wealth and reserve managers’ motivations and their impact on U.S. borrowing costs. I have yet to see anyone offering these assertions mention portfolio analytics as drivers of Treasury demand. Not only is official demand driven by the same metrics as everybody else, but everybody else is much, much bigger than official foreign accounts.

It’s as if financial journalists and other pundits (and wannabe pundits – you know who you are) think that talking about politically-driven foreign investment makes them seem sophisticated. If you don’t base your investment thinking on portfolio metrics, you ain’t sophisticated.

Macroduck: “All three metrics have deteriorated, making Treasuries less attractive. If your investment decisions are purely math-driven, you will shift your asset allocations away from Treasuries. If, instead, some part of your investment decision is speculative – forecast-driven – you need to anticipate an improvement in some of these metrics in order not to decide to hold a smaller share of assets in Treasuries.”

I don’t follow. Treasuries are at their lowest price, the best deal, in a couple of decades. So your investment recommendation is sell low and buy high?

Joseph,

You’re highlighting the difference between performance metrics and forecast-based investment decisions. Realized performance is bad now. Portfolio decisions based on those metrics argue for reduced Treasury exposure. Forecast-based decisions depend on the forecast. If you expect rates to come down, yes, invest in Treasuries.

But it is clear that portfolio metrics based on realized performance suggest reduced Treasury holdings, and increased cash holdings, relative to earlier periods. And many portfolios run on realized performance, especially the ones required to be conservative.

Ducky is probably referring to Treasuries not held to maturity. For those not engaged in short term speculation, returns on Treasuries haven’t been better in more than a decade.

God – how are you stupid? He may be talking about people who purchased long-term bonds in 2019. Even if they are held to maturity they are not getting that 5% interest rate.

I would advise Jonny boy take a class in finance but I fear the professor would come to my house and cuss me out for having the dumbest troll ever enter his lecture hall.

https://fred.stlouisfed.org/series/DGS10/

If little Jonny boy bought 10 year Treasuries at the beginning of 2019, his coupon rate would be 1.8% even if this moron held his bonds to maturity. Now if Macroduck decided to buy 10 year government bonds today – his yield would be 4.8%.

Oh wait – little Jonny boy thinks he should be getting a 4.8% coupon rate on his bonds now. No little Jonny boy – it does not work that way. You could sell your old bonds at a discount and buy new bonds but the market would discount the face value of your old bonds.

Yea I get little Jonny boy is throwing a temper tantrum over this. But that’s the way markets work. And it ain’t my fault little Jonny boy is too stupid to get even the basics.

That’s the part I don’t understand. The fact that someone lost money on Treasuries bought in 2019 at 1.8% should not make buying Treasuries less attractive today when they are yielding 4.8%. Macroduck seems to be advocating buying high and selling low.

Says Menzie:

“So, the CHIPS Act seemingly has spurred nonresidential structures investment. CBO uses a multiplier for transfers to states for infrastructure spending between 0.4 to 2.2. The midpoint of this range is 1.3. This suggests around half a percentage point (at annual rates) of 2023H1 growth can be attributed to the stimulus coming from this measure.

This is a separate issue from whether the CHIPS Act, as a type of industrial policy, is a good idea. Those factories still have to be manned, and the chips actually produced.”

This is basically an admission that the growth in “Manufacturing Structures Investment” is force-fed, politically driven – it is not driven by market considerations, by preferences, technology and free market capital investment decisions. These are bureaucrats sitting in cubicles somewhere in the dungeons of Washington DC politically assigning tax-payer money to politically favored companies and industries.

Sad state of affairs, but apparently this is the “New Economics” that so many talk about.

Manfred? You are opposed to tax cuts for corporations? Has Manfred come out against supply side economics?

Of wait Republican supply side economics – good.

Democrats do the same thing and the Manfred has a temper tantrum!

“This is basically an admission that the growth in “Manufacturing Structures Investment” is force-fed, politically driven – it is not driven by market considerations, by preferences, technology and free market capital investment decisions.”

Where to start? Anyone who thinks that investment decisions are not market driven when the private sector is doing the investing has no business offering opinions about “manufacturing structures investment” or any other investment. All investment takes place within markets affected by private AND public factors. Anyone who has ever used the expression “the rule of law” has tacitly admitted this.

If you disagree, try living in Somalia. Which, by the way, is as close to a “free” market, utterly unfettered by government, as exists anywhere in the world. There are markets regulated by government, and there are markets governed by criminals and goons. There are no “free” markers. Only more or less efficient, more or less well-governed markets and jungle law. Take your pick.

“Force-fed” means having something shoved into your gullet that you don’t want. Anyone who thinks investors in manufacturing plant are forced to take government subsidies has no business offering opinions about “manufacturing structures investment” or any other investment.

Does Manfred really ever write anything but the libertarian version of “Darned kids, get off my lawn!”?

I see that THE MANFRED could not tell us what the CHIPS Act does. Investment Tax Credits and promoting R&D for example are Republican ideas. I doubt THE MANFRED has suddenly turned Bernie Sanders.

And subsidizing private investment? Does THE MANFRED not get this is how the Asian Tigers (South Korea, Taiwan, etc.) leap frogged us in this sector?

Oh wait THE MANFRED has no clue what a damn semiconductor even is. Never mind.

Competence matters. Biden is not only talking about how to get manufacturing jobs back to the US – he is actually doing it.

Yield curve inversion (10 year spread-2 year) disappearing fast! https://fred.stlouisfed.org/graph/?g=lp5h

Meanwhile Freddie Mac reports 30 year mortgages last week at 7.49%. Mortgage News Daily reporting 7.69% today. But curiously multifamily residential housing starts for rent keeps chugging along despite the high rates…opportunity trumps interest rates?

https://www.census.gov/construction/nrc/pdf/quarterly_starts_completions.pdf

Whenever Jonny boy cherry picks a statistic always check with FRED:

Real Private Residential Fixed Investment

https://fred.stlouisfed.org/series/PRFIC1

Looks like the higher real interest rates has reduced residential investment demand to me.

But no – Jonny boy finds an Alternative Fact so he can misrepresent once again – for no apparent reason. Oh wait- the reason is obvious. Jonny boy’s lead for 2023 troll of the year was getting narrower. Way to go little Jonny boy!

Again, no. Is this your new favorite misunderstanding? I don’t think you need a new one. You have so many already.

I take your new mistake to mean “Well I wanted the U.S. to have a recession, but if I can’t have that, I’ll find something else to suggest there’s some kind of problem.”

2 year yield ranging ~5% since July, 10 year rising in past several months….. 4.7 today

“multifamily residential housing starts for rent”

Units in buildings with 2 units or more for rent may not have declined. Units in buildings with 2 units or more for sale have declined. Single family units have declined.

Yep – there it is. Jonny cannot honestly say residential investment has not declined so this stupid lying troll cherry picks to misrepresent.

Now Jonny – I guess you figured no one would check your link. I did – and once again you are a serial liar.

That’s “cold” Menzie, That’s ICE freeze cold. I except your decision, but it’s Ice freeze cold you didn’t put up Dick Butkus’ NFL video Menzie, That’s ice freeze cold.