That is Stephen Moore, on June 27, 2022. He further notes: “Moore pointed to the GDP data on Monday, noting that the “first six months of the year have been negative for growth.” Here are the data around that time.

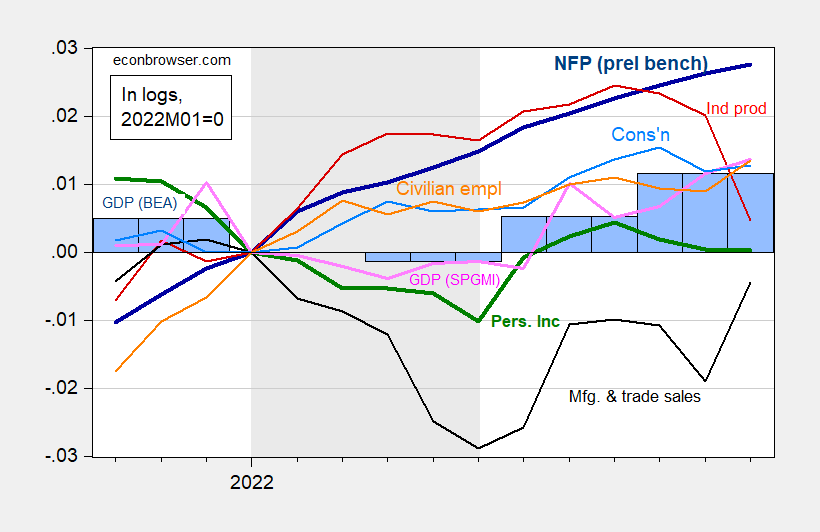

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Light gray indicates a recession as hypothesized by Stephen Moore, and by Steven Kopits. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q2 third release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (10/2/2023 release), and author’s calculations.

The NBER BCDC’s key indicators are employment and personal income ex-transfers. The former continues to grow during the entire 2022H1 period.

I am dubious that a recession occurred in 2022H1. Note that GDO and GDP+ indicate a smaller decline (if any) for the 2022H1 period.

The NY Post story in the link is entitled “US is already in a ‘soft’ recession, top economist says”.

There must be a non-standard definition of “top” in use here, one of which I am unaware. Moore has an MA, does no research and doesn’t teach. He’s a polemicist, and that’s being polite. But then, that’s how the Post reprts on the world; it doesn’t matter that Moore isn’t much of an economist, as long as he says what the Post wants said.

The Fox news definition of an “expert”: someone who tells us what we want to believe.

https://fred.stlouisfed.org/series/a261rx1q020sbea

Princeton Steve was also telling his Fox and Friends fans we were in a recession in early 2022.

I provided real GDI which was still rising back then. Oh wait real GDI fell in the 2nd half of 2022 so Stevie’s minnie me JohnH kept telling us that meant we were in a recession in the latter part of 2022.

That’s the thing with Faux News. They have a deep bench of hacks.

Yet another lie, courtesy pgl: what I pointed out was that GDI and GDP were moving in different directions, which begged the question of which was right. However, economists of different political allegiances insisted on calling it “growth” while others said “no growth.” It was rare to find an honest man who called it “too close to call,” “anemic” or some other similar synonym.

Naturally, pgl, being a Democratic partisan hack, insisted on telling us how great the economy was, even though at that point real wages had stagnated since just before the pandemic.

Prepare yourselves for yet another pgl hissy fit, full of yet more misinterpretations, misrepresentations, insults, and outright lies…

You are such a little weenie. Own up to your trash or just STFU.

It was written by a Faux Business clown. To them Lawrence Kudlow deserves the Nobel Prize.

we have already seen people abuse the “eminent” description and apply it to completely unqualified economists. it is no surprise a rag would similar apply a “top” description to an eminently unqualified economist.

Well, NY Post. ‘Nuff said.

Huntington National Bank director of investment management Chad Oviatt lays out his macro market picture on ‘The Claman Countdown.’ “And then when you add to that the fact that people’s incomes in real terms are falling really fast, something like $2,000 to $3,000 a year, that’s a recession,” he continued. “So yeah, we’re in a recession.”

Who on earth is this Oviatt clown and how in the world did he determine real income per capita fell by $3000. Does he make BS up as he goes or what?

I looked up the bio for this Chad Oviatt. Undergraduate degree in business administration. Career working for banks one has never heard of. Yea – he is the kind of clown that Faux Business elevates to top economist.

I do apologise for being lazy but has this moore fellow defined a soft recession

I think the definition is the same as Princeton Steve’s suppression.

@ Not Trampis

I would presume he has moving goal posts based in which party holds the White House. But I would have to read Moore’s writings to know that, and I am not that into self-torture. Hangovers to my lower gut region is about as self-tortuous as I get.

Soft recession . . . so, the Fed nailed it, for the first time since the mid-1990s?

[cue childish insults.]

Childish is going to a child labor factory in India or Bangladesh, EVERYONE and their brother knew you were coming beforehand and then going “WOW!!! You people aren’t committing any crimes against children here. Good job!!!!”

That would be very childlike. Not child-friendly, but childlike.

“Former Conveniently Dumbshit to HK Officials Idiot Agrees With Stephen Moore, News at Eleven”

Mr Herzog,

Did you not read that post carefully? It really did say that I knew it was a model factory, didn’t it?

Now, compare that to every factory you’ve been to in Bangladesh … I’ll wait.

@ Mr. O’Rear

Yes, I imagine India and Bangladesh save all the “special” “model” child labor factories for only your viewing. Only the sub-par useful idiots get to see the “everyday” suffering in child labor factories in India and Bangladesh. Do you imagine how this is coming across to the readers here?? ANY idea how that reads???

Mr. Rear, the only man in recent memory…… who said he knew most of the child labor in India and Bangladesh was “beneficial” to the children. Any other wisdom for us today Mr. Rear??

This Really Is What a Macroeconomic Soft Landing Would Look Like

Bottom Line: As far as nominal wage growth is concerned, it looks as though we are in a soft landing…

Brad DeLong

Nov 4

https://braddelong.substack.com/p/this-really-is-what-a-macroeconomic?utm_source=post-email-title&publication_id=47874&post_id=138584081&utm_campaign=email-post-title&isFreemail=true&r=bh5a5&utm_medium=email

. . .

Mr Herzog,

You really need to (a) improve your reading comprehension; and (b) find a new hobby.