The Q4 Survey of Professional Forecasters was released Monday. Accelerated growth is forecast, no yield curve dis-inversion, and triggering of the Sahm rule.

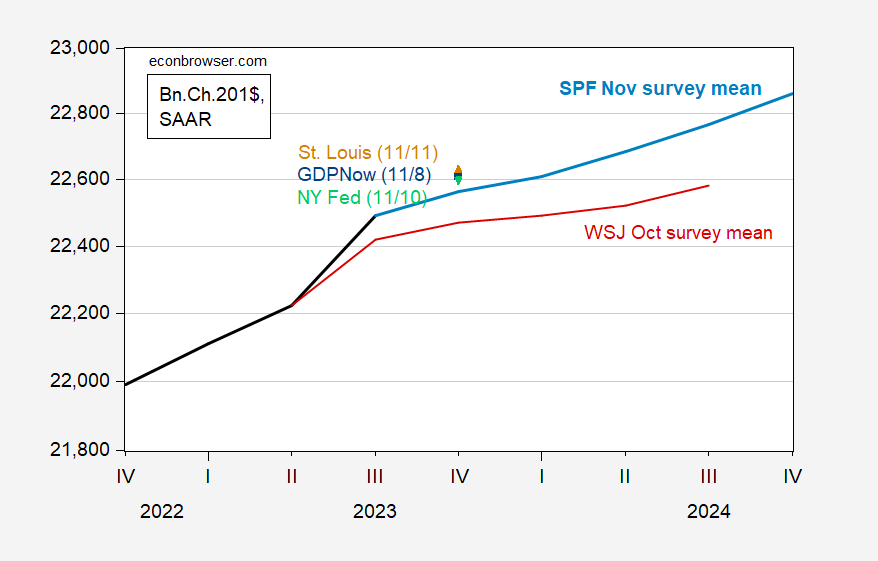

First, GDP:

Figure 1: GDP as reported (bold black), GDPNow of 11/8 (blue square), NY Fed nowcast as of 11/10 (green inverted triangle), St. Louis Fed news nowcast (brown triangle), WSJ survey mean (bold dark red), SPF median (light blue), all in billions Ch.2017$, SAAR. Levels calculated on basis on advance GDP release figure. Note on log scale. Source: BEA 2023Q3 advance, Atlanta Fed, NY Fed, St.Louis Fed via FRED, WSJ, Philadelphia Fed SPF, and author’s calculations.

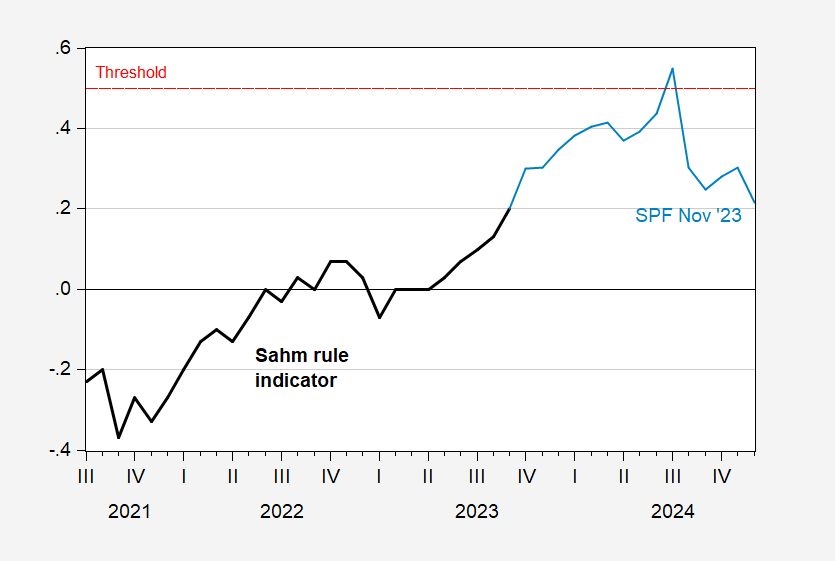

The path of unemployment can be interpreted in light of the Sahm Rule.

Figure 2: Sahm rule real time indicator, in % (bold black), and forecasted indicator from SPF (light blue). Quarterly forecasted figures quadratic interpolation to monthly. Dashed red line is 0.50% threshold. Source: FRED, Philadelphia Fed SPF, and author’s calculations.

This suggests Sahm rule trigger in July, although the interpolation procedure makes timing the exact month tricky.

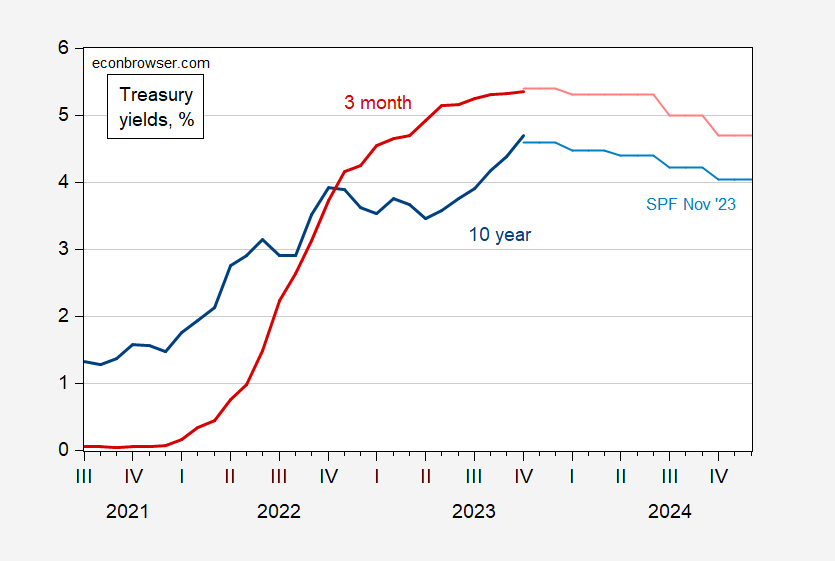

The interest rate forecast is for rates peaking in 2023Q4.

Figure 3: Three month Treasury yield (bold dark red), and forecasted three month yield (red), and ten year Treasury yield (bold dark blue), and forecasted ten year (light blue), all in %. Source: Treasury via FRED, and Philadelphia Fed SPF.

For 2023Q4, forecasted 10yr is 4.6%, vs. 3.9% in the previous survey (August). The peak rate is moved back to 2023Q4 from 2023Q3.

The turn-around in the jobless rate implies either a re-acceleration in job gains, a reduction in participation, or a bit of both. Inother words, a tighter labor market.

The assumption that yields will fall while the labor market tightens means Fed folk adjust their thinking away from the Phillips Curve to inflation. I’d be happy to see that.

One thing about the drop in yields following the CPI report – fund manager optimism regarding yields (optimism means an expectation of lower yields) was the highest in the history of BofA’s global fund manager survey prior to the release of the CPI report:

https://www.google.com/amp/s/finance.yahoo.com/amphtml/news/investors-have-never-been-this-confident-bond-yields-are-headed-lower-bofa-survey-152533445.html

Funds want to buy, and someone certainly has been buying since tens crossed 5%. Ahead of a CPI report, most money is sidelined, then jumps in – depending on the news. So there was a big response to the CPI report.

A strong appetite for bonds is a good sign for yields in the near term. A tame Fed is, too.

The GOP is the party of free (sic) markets, right?

https://www.politico.com/news/2023/11/15/florida-republican-lab-grown-meat-ban-00127447

Maybe not. Maybe the GOP is now purel reactionary. Bruen suggests reactionary, 18th century style. Between Bruen and concern over “affront(s) to nature and creation”, intellectual consistency would require banning plastics, chemical fertilizer, aspirin, antibiotics, internal combustion engines, TV, radio, air travel, space travel, rail travel, vinyl siding, automatic and semiautomatic firearms, moving pictures (?) and Viagra.

What dopes.

It may be awhile before we see the “free money” rates of the ’10s. Meanwhile, CDs are fairly attractive to the risk averse.

You are still yearning for deflation? Oh that’s right – you are a gold bug.