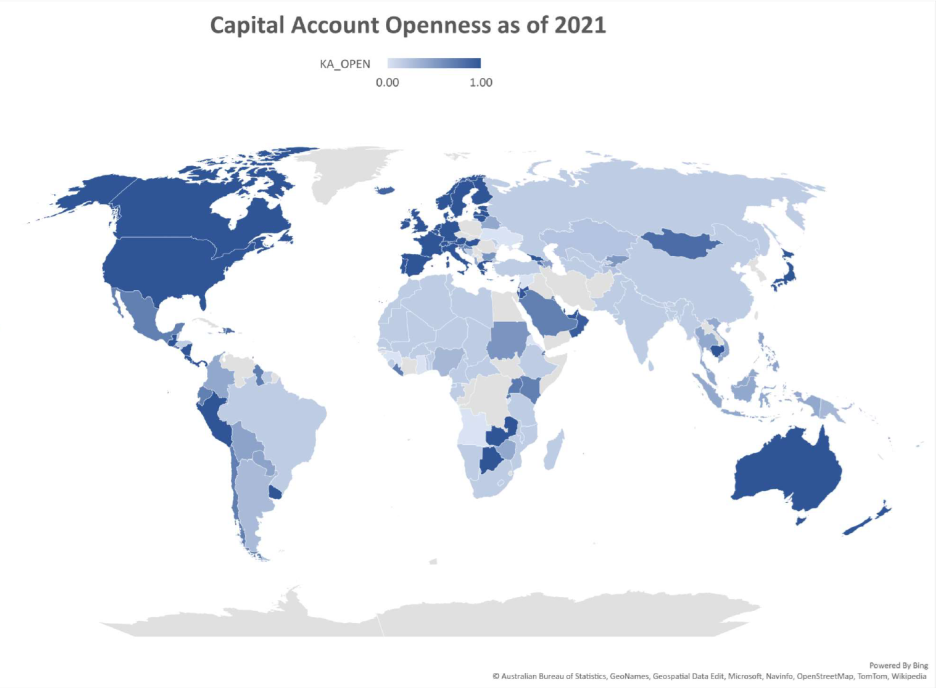

Just published, Chinn-Ito index, available here. Normalized to [0,1], with 1 being most open, here’s the world.

The description of the current dataset is Ito and Chinn (2022).

Hiro Ito and I constructed the index because there was few single, widely available and consistently updated measures of financial openness at the time, with the exception of Quinn’s (APSR, 1997) measure, which at the time was more limited in coverage. Individual dummy variables based on the IMF’s (old) de jure classification of controls (on exchange rates, export proceeds, capital account, current account) didn’t prove informative in one of my early empirical analyses of financial development (Chinn, 2004, ungated version here). The Chinn-Ito index, based on the aforementioned IMF de jure classifications, was converted into a single index using by taking the first principal component (essentially — the capital account component is smoothed), and was developed for a project to assess how financial openness correlates with financial development, published in JDE (2006) (with lots of help from friends, including Ashok Mody, Antu Panini Murshid).

Quinn, Schindler and Toyoda (IMF Econ Rev 2011) provide an early comparison of measures. More recent comparisons are in Graebner et al. (2021) and Erten et al. (2021). In the aggregate, the measures move together.