And what’s up with the University of Michigan survey measure?

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, University of Michigan via FRED and Investing.com, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and NBER.

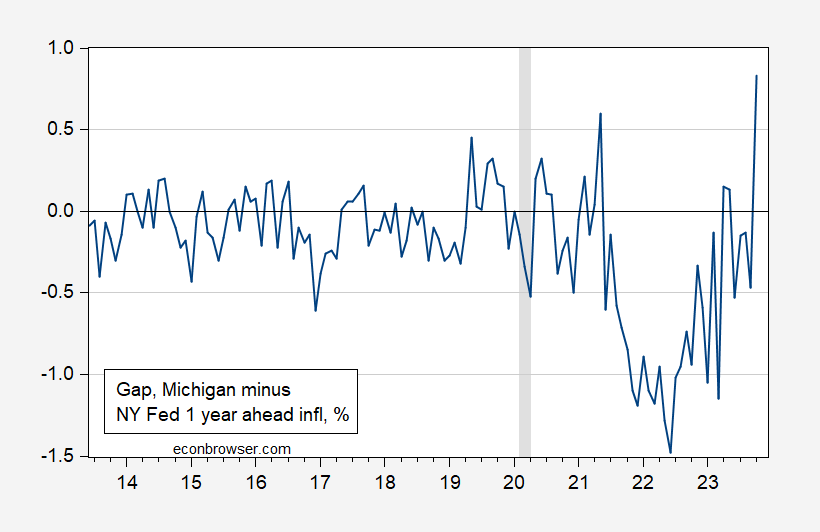

Typically, the NY Fed and University of Michigan surveys have pretty much tracked each other (see discussion here), while economists’ forecasts and mixed survey/financial market data measures track each other and diverge from household/consumer expectations. What is unusual is Michigan’s deviation from the NY Fed’s measure in recent months.

Figure 2: Median expected 1 year inflation from Michigan Survey of Consumers (red) minus median from NY Fed Survey of Consumer Expectations (light green) as of indicated date, both in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, University of Michigan via FRED and Investing.com, NY Fed, NBER, and author’s calculations.

Now, it could be the NY Fed that has deviated, rather than the University of Michigan measure. One way to answer the question of which one deviates is to regress each measure on actual CPI inflation, and to see where there are structural breaks. I use the 1 step ahead Chow test to determine the breaks. First the NY Fed:

Now the University of Michigan survey:

The NY Fed series/Actual relationship exhibits a break associated with the inflation surge, with significance around April 2021. The Michigan series exhibits a significant break around February 2021. However, while the NY Fed series exhibits no further breaks, the Michigan series does in April 2023 and again in September 2023.

“Typically, the NY Fed and University of Michigan surveys have pretty much tracked each other (see discussion here), while economists’ forecasts and mixed survey/financial market data measures track each other and diverge from household/consumer expectations.”

That prior discussion you linked to was a good reminder. But the NY FED and the UM measures are survey of households who tend to over forecast inflation. So maybe someone should ask the UM crowd if they get their economic news from Faux Business.

Taiwan’s presidential election race just took an interesting turn:

https://www.reuters.com/world/asia-pacific/taiwan-opposition-rushes-register-candidates-after-talks-implode-live-tv-2023-11-24/

Odds of the current ruling party, the Democratic Progressive Party, holding power just improved. The DPP is fairly staunchly opposed to surrendering power to China.

And next time ltr repeats her whopper about China being benign, reread the bit in the Reuters article about China saying the outcome of this election will be the difference between war and peace.

It would be interesting to find out where Reuters got that unattributed quote about “China, which has framed the election as a choice between “peace and war.”

China’s position was clearly stated by X: “Xi Jinping said China wants to be friends with the US and said his nation won’t fight a war with anyone, one of his clearest remarks yet proclaiming a desire for peaceful ties between the world’s two largest economies.

In a speech to business executives in San Francisco shortly after meeting US President Joe Biden on Wednesday, Xi said China “never bets against the United States” and “has no intention to challenge the United States or to unseat it.”

https://www.bloomberg.com/news/articles/2023-11-16/xi-says-china-seeks-to-be-friends-with-us-wants-peaceful-ties#xj4y7vzkg

The January Taiwanese presidential election picture is much more complex than Ducky’s Manichean notion of US vs. China or independence vs. reunification: “roughly 70 percent still agree that there is no need for declaring independence because the Republic of China (Taiwan’s official title) is already independent. Moreover, almost 60 percent in both polls oppose independence if it triggers a People’s Republic of China (PRC) attack. ” (Wise people.)

https://nationalinterest.org/feature/what-latest-opinion-polls-say-about-taiwan-46187

“Those satisfied with (incumbent, pro-US) Tsai’s performance continues to hover around 24 percent. However, those dissatisfied with her performance has jumped from 57 percent to 66 percent. And a solid majority (57 percent) continues to support conducting cross-strait relations under the “one China, different interpretations” formula—an arrangement that facilitated a cross-strait détente during the previous administration.” (Again, wise people.)

All of which makes you wonder how the United States would react if the Taiwanese opposition managed to win…or came close enough to take a page out of the US playbook and stage a peaceful color revolution.

JohnH: You are citing a 2019 article. Just so you know. Also, you’re citing “The National Interest”? Wow.

I guess you don’t like realist foreign policy and prefer neocon publications that promote forever wars?

The National Interest was founded by two uber neocons – William Kristol and Richard Nixon.

I was going to ask how effing stupid are you but that question has been asked and answered many times.

“The National Interest (TNI) is an American bimonthly international relations magazine edited by American journalist Jacob Heilbrunn and published by the Center for the National Interest, a public policy think tank based in Washington, D.C., that was established by former U.S. President Richard Nixon in 1994 as the Nixon Center for Peace and Freedom. The magazine is associated with the realist school of international studies.” Kristol moved on from being a realist to becoming a neocon.

https://en.wikipedia.org/wiki/The_National_Interest

“William Kristol born December 23, 1952) is an American neoconservative writer.[1] A frequent commentator on several networks including CNN, he was the founder and editor-at-large of the political magazine The Weekly Standard. Kristol is now editor-at-large of the center-right publication The Bulwark.” Together with David Kagan. Kristol founded the Project for a New American Century which included President George W. Bush, including Dick Cheney, Donald Rumsfeld, and Paul Wolfowitz. Kimberly Kagan, who married David Kagan’s brother Robeert (a fellow at AEP,) founded the Institute for the Study of War and supported the 2007 troop surge in Iraq and subsequently advocated for an expanded and restructured American military campaign in Afghanistan.” https://en.wikipedia.org/wiki/Kimberly_Kagan

ISW is essentially a neocon publication, which is highly regarded by some here. As we’ve seen from their past comments, pgl and Ducky are more aligned with neocon policy positions that advocate forever wars.

Your “realist foreign policy” approves Russia invading Ukraine, destroying their infrastructure, and killing and maiming thousands of civilians, including women and children? Enabling you to parade around as a concerned humanitarian?

A realist?

Get a clue.

My understanding is that The National Interest was founded by the likes William Kristol (who was a major supporter of invading Iraq in 2003) and former President Nixon (who turned down a peace deal with North Vietnam in 1969).

Little Jonny likes to accuse others of being neocons but it seems he is also fond of praising some of the worst neocons ever.

JohnH

November 25, 2023 at 11:21 am

Jonny boy suggests I have praised ISW and Kimberly Kagan. I have never done so – not even once. Which is why Jonny boy could not be bothered to find one single comment from me in this regard. Not one.

Yea Jonny boy is a serial liar but at least he is noting that his new favorite group of alleged experts are all neocons. Good boy little Jonny boy.

Since Xi considers Taiwan to he part of China, it wouldn’t be a war, but rather suppression of an internal disruptive, rebellious faction. We wouldn’t consider it a war if Rhode Island deckared its independence and we sent troops in to quash the “secession.” Words matter.

“The past year proved to be a disappointment for Taiwan’s president, Tsai Ing-wen, and the independence-leaning DPP. Few Taiwanese believe that his or her economic situation is improving. Both surveys revealed that only 6 percent believe they are better off than the previous year, while 28 percent claim to be worse off and 65 percent see no change.”

This discussion was about the LAST election not this one. BTW troll Tsai Ing-wen is eligible to run this time around. Of course little Jonny boy has no clue WTF is going on. He never does. Could you at least bother to check the damn date of the links you rely on? Damn!

More information on Taiwan election: “Even if the dpp retains the presidency, it is likely to lose its majority in Taiwan’s legislature in concurrent assembly elections. That would make it harder to pass laws against Chinese influence or budgets with increased defence spending. In any event, it is already clear that the question of Taiwan’s posture towards the mainland will dominate the election. Most of Taiwan’s voters appear torn. They want a president who can navigate the next four years of America-China competition, by at once avoiding war and maintaining Taiwanese sovereignty. Now that the question of candidates has been settled, the debate on how to thread that fiendishly tricky needle can begin.” https://www.economist.com/asia/2023/11/24/taiwans-presidential-election-will-be-a-three-way-race-after-all

Like so many other “good vs. evil” disputes portrayed by the Western media, the issue is not what the Taiwanese want. Rather it’s about geopolitics. “When elephants fight the grass gets trampled,”

Are you still focused on the elections 4 years ago? Hard to tell since your babbling is so utterly incoherent.

“the issue is not what the Taiwanese want.”

Odd your own link focused on what the Taiwanese want. I guess this is something else little Jonny boy did not bother to read. DUH!

Thumb through the personal finances series of charts and you’ll find deterioration in several measures in the latest month. I don’t find consistent deterioration in other broad categories. I wasn’t very systematic. There was no obvious further widening of the sentiment gap between Republicans and Democrats, either.

Let’s give it a month.

Sorry. Here are the charts I mentioned:

https://data.sca.isr.umich.edu/charts.php

People still pay attention to consumer inflation expectations?

“It has long been a central tenet of mainstream economic theory that public fears of inflation tend to be self-fulfilling.

Now though, a cheeky and even gleeful takedown of this idea has emerged from an unlikely source, a senior adviser at the Federal Reserve named Jeremy B. Rudd. His 27-page paper, published as part of the Fed’s Finance and Economics Discussion Series, has become what passes for a viral sensation among economists.

The paper disputes the idea that people’s expectations for future inflation matter much for the level of inflation experienced today.”

https://www.nytimes.com/2021/10/01/upshot/inflation-economy-analysis.html

The notion that public fears of inflation tend to be self-fulfilling is what I call magical thinking…unless you subscribe to the theory that Corporate America uses consumer expectations as a guide for how much price gouging they can indulge in…something that curiously enough is a possibility that I have never seen economists consider. Apparently understanding the behavior of corporations that have the means, the motivation, and the potential to create an opportunity to profit and geneerate inflation is not something that mainstream economists consider to be within their domain.

However, Isabella Weber does get close to making this very point: “prices are also social relations. And firms navigate these prices as social relations. If there is a context that makes these price increases appear reasonable, then [consumers] are much more willing to pay these higher prices than if these were no such larger social context.” IOW, never let a disaster go to waste–hype the cost increases, influence consumer expectations, and take advantage of them to engage in price gouging.

JohnH: Yes, lots of people pay attention to inflation expectations. In fact, we’re now in a golden age of both collecting and relying on survey based expectations on all sorts of things, including inflation expectations. When I started out as a newly minted PhD, it was rare for people to think of using anything but RatEx. Now, it’s widely accepted that surveys contain useful information. And while you can cite Rudd’s paper (113 google scholar citations), you might also want to consider Coibion, Gorodnichenko and Kamdar (JEL, 2018) with 431 citations, or Coibion and Gorodnichenko (AEJ-Macro 2015) with 868 citations.

You might read Claudia Sahm on consumer expectations. At the Fed she delved deeply into the subject, trying to figure out how expectations are formed and basically came up empty.

And you didn’t respond to my point on how Corporate America probably uses consumer expectations to gauge how much they can’t engage in price gouging. From my own experience, pricing is an integral part of the budget process with a lot of contentious debate on just how much to raise prices…some likened the process to trying to squeezing blood from a stone. If consumers expect prices to go up, it certainly reduces the risk to sales volumes from higher prices.

Has there been any work besides Isabella Weber’s on Corporate America’s use of consumer expectations and how it affects there pricing decisions?

JohnH: Believe it or not, I have read Dr. Sahm’s work. I don’t recall the piece you are citing (is it an academic paper, or a blogpost?).

Sahm covered this extensively in her blog, where she detailed some of the research she did at the Fed. I don’t believe it resulted in a paper.

She was a big supporter of Jeremy Rudd’s paper.

I doubt Jonny boy has a clue what he is babbling about but here is an oped she just wrote:

https://www.bloomberg.com/opinion/articles/2023-11-24/economists-may-have-been-flying-blind-all-along#xj4y7vzkg

As far as this:

‘And you didn’t respond to my point on how Corporate America probably uses consumer expectations to gauge how much they can’t engage in price gouging.’

They probably use what to do what? Jonny boy just babbles on incoherently as he has no clue. None at all.

JohnH

November 25, 2023 at 11:24 am

Sahm covered this extensively in her blog

But Jonny boy can’t bother to provide a link? Sorry dude but no one trusts you.

Here is her blog:

https://macromomblog.com/

There are no blog posts on the topic that Jonny boy claims she has written extensively on which is why this lying troll could not link to them.

This seems interesting (more interesting that the babble from Jonny boy for sure):

http://www.bondeconomics.com/2021/09/rudd-inflation-expectations-article.html

Rudd Inflation Expectations Article

Posted by Brian Romanchuk

Take a look and let us know if you see any value in these musings.

Apparently pgl could not extract and summarize the value he saw in the musings.

The premise is straightforward: inflation has behaved differently in the developed countries in the 1990s than the 1970s because most people largely stopped paying attention to it (other than the general elevated concern about gasoline prices, and of course the hard money enthusiasts have been panicked about imminent hyperinflation for decades). This is not the same thing “anchored expectations” as neoclassicals view it — inflation expectations were still exceedingly important, they just didn’t move.

I figured even a village moron would have noticed this. But once again I overestimated little Jonny boy’s intelligence.

Apparently, Johnny is only able to speculate about theweakness of others’ thinking, whereas the weakness of his own is displayed routinely in come ts here.

Johnny, you don’t get to assign homework to others. You aren’t important. You certainly have no basis for claiming pgl failed to do homework that you didn’t even ask for.

Pretty much everyone you lecture about expectations, or economics in general, understand the subject in greater depth than you. You keep waving links around and pretending the substance of the link means something which you never quite get around to stating, but which you pretend is devastating for somebody. It’s silly. Write something that makes sense, something clear – decipherable anyhow – and let us know what you think it has to do with the issue at hand. Just once.

Your “Nyah, nyah, I said something so now you’re wrong” style of argumentation is getting really old. Mostly, it just adds to the evidence that you don’t know anything.

https://www.economist.com/by-invitation/2022/05/17/claudia-sahm-on-what-is-driving-inflation-in-america

Claudia Sahm did write something on inflation back in May 2022:

Claudia Sahm on what is driving inflation in America

The former White House economist considers whether covid-19 rescue plans deserve any blame

The excess demand story and certainly not little Jonny boy’s tale. Look Jonny boy – we get you are a dishonest troll but could you please not drag her name into your stupid lies?