Innumerate CoRev writes:

“[I am] Just smiling at the idiocy and cognitive dissonance of the renewables zealots. …EV purchases dropping…coal use rising”

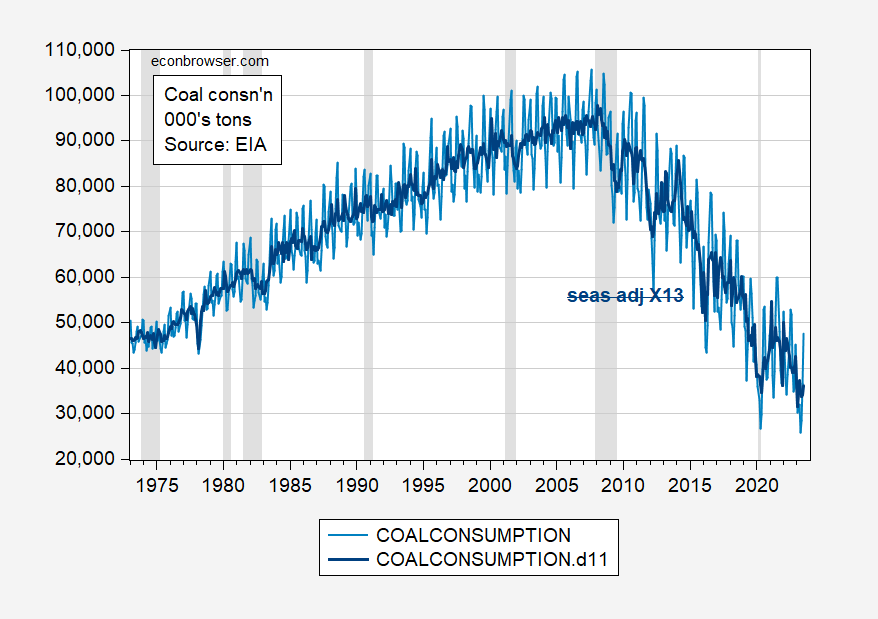

Like innumerable things CoRev writes, this seemed wrong, so I looked up US DoE EIA data, and downloaded this:

Figure 1: US coal consumption (light blue), seasonally adjusted by author (dark blue), all in thousands of tons. NBER defined peak-to-trough recession dates shaded gray. Source: EIA, NBER, and author’s calculations.

Coal consumption looks like it’s declining to me, unless one is looking at a very short horizon.

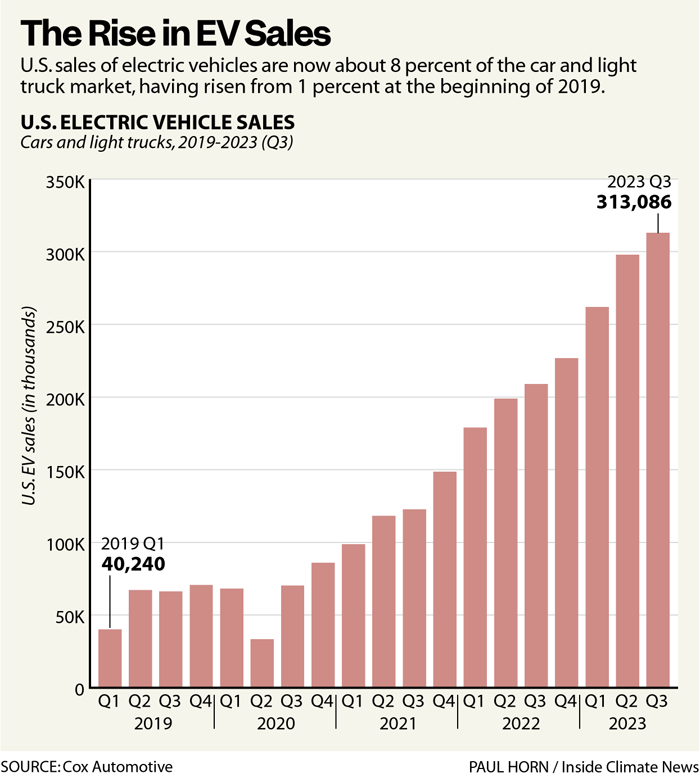

As for EV sales, they look like they’re rising to me:

Source: Gearino, InsideClimate, Oct 26, 2023.

Now, it may be that CoRev has access to super-secret alternative series that tell a different story than the EIA series (or it may be a plot by the Deep State’s statistical minions). And he might also know that Cox Automotive has been infiltrated by said Deep State agents, so those numbers are not to be believed. I am afraid I don’t have time to investigate these possibilities.

I leave it to readers to dissect CoRev’s other errors in his comment. My main point – do not take as given assertions by (1) individuals who have no idea how to conduct time series analysis (let alone apparently read a graph), and (2) those who go about accusing others of manipulating data without understanding where the data are coming from. For a compendium of CoRev-related cautionary tales I give my policy analysis/stats students, see here (or if you just want to laugh and laugh and laugh).

Thanks for finding this information. Looking at 2017 to 2021 it is clear that Trump was killing the coal industry. There is a bit of a rebound under Biden. Is this known in West Virginia?

My read is more like a drastic fall during early Covid, with a rebound back to a downward trend. Many of the old coal plants located close to coal mines are still making some money. But they are no longer worth major renovations or upgrades so they get old and close down. No new coal plant has been build since 2014.

Ivan assure us: ” No new coal plant has been build since 2014.” Except this parochial view is dead wrong. ~2/3 of coal generated electricity is done in just 2 countries, China and India. This article dispels Ivan’s lie: https://www.npr.org/2023/03/02/1160441919/china-is-building-six-times-more-new-coal-plants-than-other-countries-report-fin

“China permitted more coal power plants last year than any time in the last seven years, according to a new report released this week. It’s the equivalent of about two new coal power plants per week. ”

Breaking promises to stop adding new coal plants is a common thread from both China and India. This days old article shows India’s actual intent: https://www.reuters.com/world/india/india-wants-private-money-coal-fired-plants-despite-western-opposition-2023-11-21/

Is it naivety? Or deliberate ignorance? Regardless it is IGNORANCE.

The Faux news coming from CoRev is slightly more sophisticated than the lies from Tucker Carlson – slightly. When it comes to non-specific & non-scientific postulates such as “coal use rising” – you can be grossly misleading without needing to say a factual lie. Coal use can indeed be rising if you are allowed to pick your own geographical area and timeframe. Other methods used by those who want to “support” their favorite narrative (rather than inform), is whether you normalize data or not (the absolute value for coal use can increase even if it is dropping as a % of the energy mix).

For actual information on the complex issue of trend in energy sources and use of electricity in different countries and regions of the world:

https://www.nytimes.com/interactive/2023/11/20/climate/global-power-electricity-fossil-fuels-coal.html

For switching quickly away from fossil fuel look at Denmark and UK (yes it can be done) – they also managed to reduce their total use of electricity. Expanding electricity use mostly from non-fossil fuel look at Chile and Ecuador. Minuscule use of fossil fuel for electricity since 2000 look at France, Norway and Sweden). The amazing thing is how different each country is when it comes to producing electricity. Clearly developing countries are expanding their use of electricity a lot since 2000 – most have done that with fossil fuel (except for Chile and Ecuador). Most developed countries have stabilized their use of electricity and are replacing fossil fuel sources with clean energy. Nothing surprising or unpredictable here.

Ivan lies all the time re: renewables, and then says this: ” Other methods used by those who want to “support” their favorite narrative (rather than inform), …”

Followed with an example which he uses to ““support” their favorite narrative (rather than inform)”: “For switching quickly away from fossil fuel look at Denmark and UK (yes it can be done) – they also managed to reduce their total use of electricity. Expanding electricity use mostly from non-fossil fuel look at Chile and Ecuador. Minuscule use of fossil fuel for electricity since 2000 look at France, …”His exemplary countries are unique with conditions, typically hydro, nuclear and wind resources except the UK which has jumped the shark with wind (on/off) shore resulting in increased electricity pricing. Look at the monthly chart here: https://ember-climate.org/data/data-tools/europe-power-prices/

Note, Ivan chose the countries I just chose the geopolitical region as opposed to cherry picking examples supporting the favored narrative.

Ivan lies all the time?

Excuse me troll but is your real name Ivan. You have been lying about this issue for way too long.

I would ask little CoRev to grow up but his mommy tells me little CoRev is a hopeless cause.

Lots of accusations, no evidence. From CoVid, who is a founding member of the troll choir.

For CoVid’s “cherry picking”, substitute “leading by example”. ‘Cause that’s what Ivan’s claim is. Truly a weak effort on CoVid’s part to distract us from the facts.

I doubt CoRev is to stupid to understand the difference between cherry-picking to make a generalized point and using an example of something atypical. So you would have to conclude that he simply is disingenuous.

that is what happens when you let an idiot get behind a keyboard. the thing is, covid really is too stooopid to understand how silly his comments are. he just keeps digging a whole with some kind of silly comeback, ya know.

Baffled, why do you think Menzie ignored the remainder of the comment: “…electricity pricing climbing, off shore wind losing money, coal use rising, fossil fuel use rising, etc. Your reliance on unicorn gas is an amazement.”

Because the rest of the comment is blather? You want Menzie to refute “unicorn gas”? Wow.

Why don’t you tell us why you lied about trend i. EV sales and coal demand?

unicorn gas is what CoRev has been smoking over the holidays! Cannabis and more!

Dr. Chinn did address your LIE about US coal consumption rises. OK – you changed it to global coal consumption rising. And I exposed that lie too.

Dude – you lie all the time. But you suck at that too.

Pgl, yes, Menzie did try to refute “…coal use rising” by limiting a fungible world-wide commodity to JUST the US. That was not my point. This: https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2023/11/World-Electricity-1700996876.7661.jpg?fit=1244%2C741&ssl=1 and this: https://www.iea.org/data-and-statistics/charts/global-coal-consumption-2020-2023 both give a more accurate picture of world-wide coal use.

It take real deep ignorance to lie: ” OK – you changed it to global coal consumption rising. And I exposed that lie too.” Only Menzie and the choir limited the general comment to JUST the US.

There’s a derogatory term for that.

“That was not my point.”

Yea – I get your point. You tell one lie change the topic and then tell another lie. It is your own talent.

“more accurate picture of world-wide coal use.”

OK – a longer horizon than your previous attempt to deceive. Get your glasses out Mr. Magoo and notice how world coal consumption FELL from 2018 to 2020. That was MY point. LIAR!

“Only Menzie and the choir limited the general comment to JUST the US.”

It was YOU that focused on US EV sales. You are one pathetic little troll. I would ask you to write clearly but your preK teacher tells me you do not have the mental capacity to do so.

Tried and succeeded. You didn’t specify in your original comment whether you hand in mind U.S. conditions, worldwide conditions or some other concoction that would allow you to justify your claim. This blog more often than not addresses U.S. conditions, and you original claim was in response to a post about U.S. gasoline prices.

If a liar like you obscures his intended meaning, it’s hardly Menzie’s job to work out how you meant to lie and work around it.

Pgl, claims: “It was YOU that focused on US EV sales.

Nooooo! That again is a lie. I never mentioned the US nor any other country.

Why is it so necessary for YOU to lie to make a point. It’s extraordinarily immature.

McQuack, in assuming any economic component, such as COAL and EV is limited to just the US is both parochial and ignorant.

Displaying your cognitive dissonance and IGNORANCE also reinforces your display of zealotry.

Speaking of idiots digging ?wholes? (sic), here is even another graph of WORLD COAL use for electricity production: https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2023/11/World-Electricity-1700996876.7661.jpg?fit=1244%2C741&ssl=1 BTW, that chart is from our World in Data, and not from some biased source.

Since I’m talking about electricity production, here’s what happens to Wind Farms when they must compete on reliably producing electrons for the grid: https://notalotofpeopleknowthat.wordpress.com/2023/11/12/europes-largest-wind-farm-facing-bankruptcy/I'll synopsize for the lazy and incapable of reading and/or understanding:

“What is different about this one is that the PPA forces the wind farm to buy power on the spot market, when the wind does not provide enough:…” for those suffering from cognitive dissonance, that means the wind farm must match the reliability of its competitors.

For those who still believe that electrons generated by Wind is free or at least lower than fossil fueled, and that free/lower price means cheaper electricity rates. The article explains: “In other words, the wind farm is obliged to pay the costs of its own intermittency. And, of course, when wind power is low, spot market prices rise.” Covering the reliability issue of Wind and Solar adds cost higher than any savings due to lower Wind and Solar.

“Since I’m talking about electricity production”

Changing the topic again? Dr. Chinn and the rest of us were talking about total coal consumption. Dude – you are even worse than JohnH for such dishonest BS.

“Not a lot of people know that” is a sure sign little CoRev has found yet another Faux News related nutjob blog which BTW reads:

404: Page Not Found

Gee CoRev – these liars took down the trash you are promoting. Go figure!

Pgl’s not the sharpest knife in the drawer, and also horribly reactive. 1st comment says my link resulted in “404: Page Not Found” and thenj right below he says “Unlike CoRev – I figured out the link. ”

Why must this clown always lie? Dude – we figured out your clownishness a long time ago.

You were the dumbass you failed to properly provide the link. Now I figured out how to do so. Oh wait – you were exposed on relying on that Paul Homewood clown again. I can see why little CoRev is so upset! AHHHH!

https://notalotofpeopleknowthat.wordpress.com/2023/11/12/europes-largest-wind-farm-facing-bankruptcy/

Unlike CoRev – I figured out the link. It’s Paul Homewood once again! Dude – we figured out who this clown is a long time ago.

You are relying on Twitters from Simon THE Wakter? Do you have a clue who he is? Didn’t think so. Try this:

https://www.linkedin.com/feed/update/urn:li:activity:7131323450186465280/

Nuclear power promoter’s Twitter account as your new guru on wind energy? Come on dude. But do read this LinkedIn discussion as he is not as anti-wind when he talks to people in the industry.

Pgl, di you refute any of the facts of the article? Or are you just showing you ignorance and over reactive approach to LOSING a discussion?

Of all the commenters here you are by far the most egregiously wrong due to you constant lying.

\It is an amazement.

There were no facts in that BS. Refuting a lie – not worth my time troll m

“they also managed to reduce their total use of electricity. ”

it has been amazing how many fossil fuel proponents have also been against energy efficiency. you can use more than 6 led bulbs for every 1 incandescent bulb, and yet look how many people were up in arms about that transition? they were all anti-renewable, pro-coal folks. same folks who are also against improved gas mileage in cars. bad gas mileage simply makes an EV more attractive, and yet they don’t understand the economics. idiots.

CoRev lives a wonderful life totally unencumbered with pesky things like facts or reality.

While we are talking about facts and EVs vs ICE vehicles, thios graph provides a nice comparison of the their recent past, current, and estimated future USE: https://external-content.duckduckgo.com/iu/?u=https%3A%2F%2Fevadoption.com%2Fwp-content%2Fuploads%2F2021%2F05%2FICE-EVs-in-operation-2020-2030-chart.png&f=1&nofb=1&ipt=4b0e76d15e2d7d7cd11297ca00ea0b8751d48697c54df5fda23ee87ba1361618&ipo=images

It’s interesting to keep referring to larger picture factors, use being one example, while the cou9nter factual zealots rely on the smaller picture example, US sales, as depicted in the 2nd Figure, of this article.

I leave it to readers to dissect Menzie’s other mis-representations/information in his article. I suspect knowledgeable, reality based readers will have a different view than the unicorn-gas zealots.

DuckDuckGo? Seriously?

BTW Mr. Magoo – even your own link is forecasting a rise in EVs which seems to contradict your LIE about EV sales falling.

“Coal consumption looks like it’s declining to me, unless one is looking at a very short horizon.”

CoRev is JohnH’s best student.

Coal fired electric utility plants have not been built in the US for several years because they are too expensive to operate. They are ‘stranded assets’ – uneconomic to operate, but their debt still has to be paid off. Recent bids for a 400 MW electricity plant in Colorado indicate we are on the cusp of seeing natural gas/methane power plants become stranded assets. Specific bid data has not been released, but Strategen analyzed ‘generic costs’ of several kinds of plant equipment presented in the Appendix of the resource plan that Public Service Company of Colorado released, after receiving bids. Strategen concludes that several combinations of wind, solar, and batteries are lower cost to build (by $29 million) and lower cost to operate than the natural gas ‘generic cost’ for a new 400 MW plant.

It is possible that the Colorado bids are not yet typical of all US construction for electricity plants, but if so, the data suggests the US is nearing a situation that natural gas plants will all soon be stranded assets. The economic transition of an industry experiencing major technical change is a process, not a single event.

More information about the Colorado plant is at: https://pv-magazine-usa.com/2023/11/16/restorage-better-than-a-colorado-utilitys-proposed-400-mw-gas-unit-strategen/?utm_source=USA+%7C+Newsletter&utm_campaign=b0c74e9ddc-RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_80e0d17bb8-b0c74e9ddc-160113585

Last thing I saw, said that 60% of new electricity generation being build in US is renewable. So most power companies are finding it to be the cheeper and preferable option. In addition to building cost it is also worth considering that the fossil fuel plants face an unpredictable fuel cost for the life of the plant. Renewable has no fuel cost and very low and predictable maintenance/operating cost. For utility size batteries the new sodium ion technology will make for much cheeper energy storage – making the whole renewable “package” much more attractive. The materials for sodium ion batteries are found right here in the US.

And there goes Ivan, even again, lying or exaggerating the impacts of his preferred narrative: renewables cheap(er) than fossil fueled plants, unless the renewables are required to price in the cost of reliability. For a WIND example we have this paper/article:https://www.netzerowatch.com/content/uploads/2023/09/Renewables-Increase-Electricity-Bills.pdf?mc_cid=6e29dd563a&mc_eid=4961da7cb1

Which concludes:

“Summary

In summary, adding a windfarm to the grid increases costs to consumers in no fewer than six ways:

• The inefficiency effect

• The capacity market effect

• The levy effect

• Constraints payments

• Artificial inertia

• The transmission effect

Only the displacement effect could theoretically reduce

costs to consumers, but in practice this is likely to be zero,

because of the urgent need to keep gas-fired power stations

on the grid.

In summary, it seems implausible that windfarms will ever reduce costs….”

To understand/recognize the weaknesses of Wind read the article. to continues to pontificate and live in unicorn-land don’t.

CoRev: The author is a lapsed CPA. Nothing against CPAs, but this is your authority on benefit/cost analysis of windpower?

https://www.theguardian.com/environment/cif-green/2010/sep/14/montford-climategate-gwpf-review

Montford write the Climategate inquiries back in 2010 but this review short of lets us know what a hack he really is.

Sometimes he really has to pick the bottom of the barrel to come up with someone who will support his desperate narratives. In the mean time those who need to make the finances and power delivery systems work – are installing solar and wind at record paces all over the world. I guess the market have spoken regardless of what CoRev want them to say.

Menzie, you have a problem refuting my comments you quoted and now the above article? What’s you problem with someone who gave up (lapsed) a license/certification? Nothing against University Professors,but when did they become authorities on ALL science?

Surely you can refute his article!?

There are a handful of things that CoRev should have known, but clearly did not. Menzie has pointed out two very obvious ones, that coal use is trending lower, EV purchases higher. Another is that natural gas prices peaked in 2008, the same yeas as domestic coal consumption. Gas prices plunged and coal use followed. This is basic energy market stuff, known to anyone who bothers to look atthe facts.

Fracking killed coal. Not the EPA. Not liberals. When Trump told miners he’d get their jobs back, he lied to them:

https://fred.stlouisfed.org/series/CEU1021210001

And yes, you can see Covid’s effect in mining jobs and coal consumption, just as you can in thousands of data series. Only an idiot or a liar would try to spin that as a triumph for coal. Sad little CoVid seems to have nothing but sneers to fallback on.

All Employees, Coal Mining

Down under Trump – slight recovery under Biden.

“When Trump told miners he’d get their jobs back, he lied to them”

Trump lied and his minions here (yes little Brucie – you) lied when they said it was Biden that was killing this sector.

Mc Quack should have know this was a lie: “Fracking killed coal.” Fracking killed oil. Regulation killed coal in Western countries, but no in developing countries plus India and China. But this an Economics blog populated by many unicorn-based thinkers, and blanketing such a FUNDAMENTAL commodity such as electricity with increased costs, and ignoring its effects is the norm.

CoRev: Still waiting for that apology for accusing me of manipulating the BLS data by using FRED as a source.

CoVid lies about lying? No surprise, since this post is about CoVid lying, and about this very subject. The cost of a btu of natural gas fell below the cost of a btu of coal before Trump madehis claim about bringing back coal jobs. It’s a simple fact.

Natural gas was used in peak production of electricity before its coat per btu fell below that of coal. So was oil, but gas-fired turbines are more flexible thaneither coal or oil, so gas turbines were used in preference to either coal or oil for peak load generation. Natural gas generating units also don’t require the scale ofcoal-fired units – see Mr. Laird’s comment about stranded assets for a related problem. As gas prices fell, more gas generating capacity was installed, shutting out new coal generation. Gas had become cheaper and is more flexible.

Anyone who’d like to do a little spreadsheet work can confirm for themselves that natural gas is has been cheaper than coal, btu to btu, for years. CoVid, who lied in his claim about coal and EVs, has lied about Ivan and about me iin his responses to being caught lying. Remarkable consistency.

Now, I’ve never worked in coal. My father, grandfather, uncle and three siblings all worked in coal, so I rely on them for specialist knowledge of the coal industry. I only ever worked in economics and regulatory policy. Which obviously have nothing to do with CoVid’s claim that regulation killed coal in the West, right?

CoVid has made claims to knowledge, but has offered no evidence, either for his claims or for specialist knowledge. He simply lies, and then lies again.

It would be great to hear fromsome honest advocates of fossil fuels, but f they xist, they are drowned out by people who will say wnything to keep us on our present,dangerous course

McQuack, all that misinformation to refute my comment that coal us has risen, as this chart shows: https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2023/11/World-Electricity-1700996876.7661.jpg?fit=1244%2C741&ssl=1 Noting that “The cost of a btu of natural gas fell below the cost of a btu of coal before Trump madehis(sic) claim about bringing back coal jobs.” It’s a simple fact that this does not refute my claim of coal use rising. Noting that during Trump’s administration the price of gas dropped is noteworthy, but also does not refute my claim of coal use rising.

This article confirms your contention that gas prices was a major factor in closing coal plants, but also confirms my contention that regulation was also a major factor: “Cheap gas from record shale production and rising use of renewable sources of power have kept electric prices relatively low in recent years. That makes it uneconomic for generators to continue operating older, less efficient coal plants, especially if they need upgrades to meet increasingly strict federal and state environmental rules.” https://www.reuters.com/business/energy/us-coal-fired-power-plants-scheduled-shut-2021-10-28/

Regardless, none of this refutes my claim that coal use has increased.

New post up which makes you look stupid for this:

none of this refutes my claim that coal use has increased.

And yea I expect you to go off again which is cool as your rants have me on the floor laughing at your stupidity.

Did CoRev get a job at The Economist? Check out the postscript to Kevin Drum’s discussion of real construction spending to see why I ask:

https://jabberwocking.com/raw-data-capital-spending-after-passage-of-the-infrastructure-bill/

“I looked up US DoE EIA data”

This data has all sorts of useful tables. The year 2022 has been well discussed but apparently little CoRev missed it. Yea Americans consumed less coal in 2022 v. their massive consumption of coal in 2021 in large part because the price of coal soared. US coal production was actually up so we may have seen an increase in our net exports of coal.

This is classic demand and supply – something little CoRev never understood.

https://www.eia.gov/energyexplained/coal/imports-and-exports.php#:~:text=The%20United%20States%20exports%20coal%20to%20many%20countries,MMst%207%25%206%20South%20Korea%205.23%20MMst%206%25

The United States is a net exporter of coal

The graph shows US production and consumption of coal from 1950 to 2022.

Unless CoRev is Mr. Magoo he could have plainly seen the decline in production and consumption over the last several years.

I love the parochialism: ” US coal consumption (light blue)…” from Figure 1. While on a short term the BIG COAL USERS have increased their consumption.https://www.iea.org/data-and-statistics/charts/global-coal-consumption-2020-2023 If you are concerned over the time period we can take a longer look: https://futuretimeline.net/blog/images/315-coal-demand-future-timeline.jpg. The 2023 drop in coal usage can easily be explained due to the lower price of Nat Gas, but it take s rational mind to do so instead of blind zealotry.

All the while the price of electricity goes up, some of which is directly related to the implementation of renewables on grids. If we want to use CA as the proxy for futures US the trend is clear: https://revel-energy.com/wp-content/uploads/2020/05/Rising-Electricity-Costs-1024×736.png.webp From this article: https://revel-energy.com/california-2020-electricity-rate-increase-will-outpace-the-states-historical-growth-rate-by-double/

As for EVs that future is also clear: ” US agency predicts an EV-majority market won’t happen anytime soon

Even under a scenario with high oil prices, electric vehicles will account for less than a third of car and truck sales through 2050, according to projections from the US Energy Information Administration.” take a look at the associated char in the article! https://www.cnn.com/2023/08/20/cars/electric-cars-sales-gas-cars-dg/index.html

Incentives and mandates dominate the short term sales increases which can be largely described as the VIRTUE SIGNALLING part of society: “Last year, the California Air Resources Board voted to ban sales of new gas-powered cars by 2035. At least 17 other states have agreed to follow California’s lead.”

EV production is being cut back: “And now, many are dialing them back. GM is scrapping its target of producing about half a million new EVs by the middle of next year, Ford extended its timeline to hit a goal of 600,000 EVs a year, and even Tesla sees demand softening.

Electric cars are a harder sell, in part, because of prices, said Abuelsamid. “It’s actually become somewhat more of an issue in the past year or so, even though prices of a lot of EVs have come down.“” https://www.marketplace.org/2023/11/02/ev-demand-production-reality-check/ Even though sales are making new records, but those are easy headlines for new products, where each new sale sets a new cumulative record. Ignore the fact that it is below expected cumulative totals and rates.

Now, it may be that Menzie has access to super-secret alternative series that tell a different story than the manufacturers, but he doesn’t have to report to stock holders and senior management.

“[I am] Just smiling at the idiocy and cognitive dissonance of the renewables zealots. …EV purchases dropping…coal use rising”, electricity rates rising, off shore wind mills failing, all the while touting the increased fossil fuel production. It is an amazement.

Wait – your first comment claimed US coal consumption was rising but when the data is presented that made a fool out of our favorite fool – you show global coal consumption? Come on CoRev – this shape shifting of yours is getting pathetic.

Global coal consumption, 2020-2023

Oh wow – world consumption is higher than it was during the pandemic. Damn it – I thought JohnH had the 2023 dumbest troll of the year won but I guess CoRev just took the lead!

PGL, so you confirm my contention: “Oh wow – world consumption is higher than it was during the pandemic.” How does that compare to restricting the data to JUST the US? My original comment did not do that! your clearly bought into that!

Hey dumbass – see the new post.

Look we got that you lie 24/7 years ago. Relax.

Hey dumbass – If found the IEA chart for 1978 to 2020. Your little trickery showing only 2020 (pandemic year) to now is busted.

Dude – we all know you are a serial liar. And a liar who is so stupid, you get busted with little effort.

BTW – GLOBAL coal consumption has been falling since 2014. According to your source dumbass.

“If you are concerned over the time period we can take a longer look”

This longer look includes what is labeled as a forecast of global demand through 2020. Yea the forecast was rising but as the historical data (which CoRev has now many times failed to provide) showed global demand for coal declined from 2014 through 2020.

CoRev is the classic “so many lies, so little time”.

Wow! You confirmed that commodity prices go up and down. You are truly a superior economist or something.

WTF? Are you now arguing with yourself? Damn!

I just accused CoRev of lying (what’s new) with his futuretimeline chart which appears to be more of a forecast than what actually happened to global coal consumption. From CoRev’s favorite blog:

https://futuretimeline.net/blog/2022/12/23-coal-power-future-timeline.htm

A December 23, 2022 showing actual global consumption from 2000 onwards. And I noted, this series peaked in 2014. CoRev is clearly a liar but it seems his lies are so easily debunked.

“All the while the price of electricity goes up”

A chart of nominal prices over 3 decades. Come on CoRev – this is an economist blog. Not doing this in inflation adjusted terms is stupid even for you.

“Electric vehicle sales have been growing — just not as quickly as hoped, per Guidehouse Insights analyst Sam Abuelsamid. “A lot of the projections that automakers talked about were pretty optimistic,” he said.

This is from CoRev’s own link and it does not say EV sales are down. It says EV sales are growing – just not as quickly as some optimist had hoped.

OK – it is time to watch Michigan v. Ohio State as rebutting the lies and stupidity from little CoRev is just way too easy.

CoRev claimed without a shred of evidence that electricity prices are rising but FRED seems to disagree:

https://fred.stlouisfed.org/series/CUSR0000SEHF01

Nominal prices have not increased at all since Feb. 2023. If someone has the time, it would be nice to see this series inflation adjusted.

Little CoRev pulls two tricks in one: (a) redefine his lie about US coal consumption by showing world coal consumption, but (b) he shows consumption from 2020 (the pandemic year) until now. I found this:

World coal consumption, 1978-2020

https://www.iea.org/data-and-statistics/charts/world-coal-consumption-1978-2020

Even world coal consumption has been falling since 2014.

CoRev is a liar but not a very good one at that.

This is the full discussion behind what CoRev tried to abuse to make the claim global coal consumption (he switched gears from simply the US) had risen to record levels in 2022. We should note a few things including the date of the report – July 2022. It was a FORECAST not what occurred as this report clearly notes.

CoRev has a habit of conflating forecasts with actuals. Is he lying or just the dumb troll we all expect?

https://www.iea.org/reports/coal-market-update-july-2022/demand

Global coal demand rebounded strongly in 2021 (from the pandemic)

‘Worldwide coal consumption in 2021 rebounded by 5.8% to 7 947 million tonnes (Mt), according to our data, as the global economy recovered from the initial shock of the Covid pandemic and higher natural gas prices drove a shift towards coal-fired power generation. Global coal consumption in 2021 rose above 2019 levels, taking it very close to its all-time high’

The all time high was in 2014 not 2021 and certainly not 2022 since the year had not closed yet. CoRev has another habit of giving us cherry picked snipnets that he chooses to misrepresent. Now it would be nice if this lying troll had the integrity of linking to the actual report but that would not be CoRev’s style.

I was wondering what CoRev meant by “Unicorn Gas”:

https://www.fieldsfamilyfarmz.com/strain.php?strain=unicorn_gas

Introducing “Unicorn Gas,” an exciting and enchanting cannabis strain that combines the genetics of “Purple Push Pop” with an enigmatic mystery strain. This hybrid cultivar holds a captivating allure, boasting a unique blend of flavors, aromas, and effects that are sure to leave users spellbound.

The title of this post asked what has CoRev been smoking over the holidays. I think we now know!

Had little lying CoRev written that Chinese coal consumption is still rising, that might be correct and it has been noted many times by people like Macroduck. This handy chart shows the percent of world coal consumption by nation. Note China consumes almost 55% of world coal consumption:

https://www.statista.com/statistics/265528/countries-with-the-largest-share-of-global-coal-consumption/

Most rational people abhor the amount of Chinese coal consumption but little CoRev cheers on the PRC for the damage it is doing to our climate. Little CoRev is that kind of guy.

Now the original stupid comment from CoRev seemed to be talking about US coal consumption which has clearly falling since 2014. And the US is consuming less than 6.2% of world coal consumption. Which of course drives CoRev insane. Oh wait – CoRev was born insane. Never mind!

Both China and India are developing countries with huge increases in electricity use in the past two decades and at least for another decades or two. Both have substantial domestic production of coal and see a national security benefit from using coal to make electricity. Yet both have increased their clean energy production substantially and the use of coal for electricity production has probably peaked in China this year (or it will next year). India has pledged to build more solar/wind – however, those project have bigger upfront cost (even though the lifetime cost of electricity is lower). So access to capital may be a limiting factor.

There are very few places left in the world where it makes economic sense to build new coal fired power plants. A lot of the coal plants will end up as stranded assets when the cost of paying off the construction loans and paying for the coal fuel, exceeds the payments on loans for new alternative energy power plants. At places where the government guaranteed those loans to construct coal plants, there will be serious strains on those governments.

Tee hee hee, Pgl admits again that world-wide coal consumption is going up, but because it is China (and India) they shouldn’t count because Climate Change or something!? BTW, IEA (not to be confused with EIA) is know for its bias

I made no such admission. But do make up $hit as you go. It is your style. See the new post – more proof you are a lying moron.

“IEA (not to be confused with EIA) is know for its bias”

This is funny since it was lying CoRev that was the first to cite their data. On wait – CoRev misrepresented their information.

CoRev: Sorry, in what direction is the bias. I didn’t know of this stylized fact. Here is an analysis of why IEA projections are biased, historically, in Liao et al. (2016). You should read, although since you do not seem to be familiar with concepts like RMSFE I’m not sure you’ll get much out of it.

“The International Energy Agency (IEA) has published its annual World Energy Outlook (WEO) concerning energy demand based on its long term world energy model (WEM) under specific assumptions towards uncertainties such as population, macroeconomy, energy price and technology.”

We never see little CoRev doing anything like this. Then again Princeton Stevie does not either. Having a forecast error one way of the other is not saying a model is biased. Anything who took Statistics 101 knows this but sorry – we are already WAY OVER CoRev’s little brain.

CoRev’s biggest problem is that he still doesn’t understand why a responsible benefit/cost analysis captures total costs and not just nominal market failure costs.

Thanks Menzie for dispelling some of the smoke that the MAGA/fossil fuel crowd blows about EVs. One overall thing to keep in mind – EVs are way, way more more energy-efficient than internal combustion vehicles (an astonishing 87-90% of original energy goes to wheels in EVs compared to 16-25% with IC engines.) https://www.motortrend.com/news/evs-more-efficient-than-internal-combustion-engines/

Also I think a lot of the action in renewable energy is with household appliances like solar hot water heaters – which are popular even in red states like Texas with its unreliable electric grid https://www.alliedmarketresearch.com/solar-water-heater-market-A07957

Finally being a working class hippie (does that also make me a renewable zealot?) in Madison WI – I can dream about buying an EV – but now I’m thinking Electric Bike – more affordable and I can use for everyday commutes at least 3 seasons out of year (also way more energy efficient than a 4-passenger car) http://theconversation.com/the-worlds-280-million-electric-bikes-and-mopeds-are-cutting-demand-for-oil-far-more-than-electric-cars-213870

An important point that ICE vehicle convert only 16-25% of the energy in the gasoline to kinetic energy (wasting the rest as released heat). If that gasoline (or equivalent BTU amount of natural gas) is used in a combined cycle power plant it is about 85% of the energy content that gets converted into electricity*. That electricity going into an EV with a 90% conversion to kinetic energy makes for a much more efficient overall conversion of hydrocarbon energy into vehicle movement. So even if the electricity is produced in a power plant that use hydrocarbons, there is a huge saving in having those hydrocarbons burned in a (highly efficient) power plants (instead of being burned in an extremely wasteful ICE). That saving comes to the consumer as a much lower fuel cost and to the planet by a much lower CO2 release per mile.

*The combined cycle plant first use the fuel to drive a jet engine making electricity from that; then take the heat produced and make more electricity from that.

Check out the jump in this reported interest rate:

Commercial Bank Interest Rate on Credit Card Plans, All Accounts

https://fred.stlouisfed.org/series/TERMCBCCALLNS

12% through 2016 was already sky high.

Under Trump, this went to near 15%.

But 21%?

Just wow. I get Treasury bill rates went up a bit. And maybe default risk has a little to do with this. But come on man – this is loan shark behavior.

Just another benefit of Bidenomics!?

So you are know blaming Bidenomics for your dishonesty, incompetence, and general stupidity. Good to know!

Now I get the fact that little CoRev got confused about forecasts of coal consumption v. historical coal consumption (what’s new) but maybe he should consult with Goldman Sachs on the forecast of EV sales:

https://www.goldmansachs.com/intelligence/pages/electric-vehicles-are-forecast-to-be-half-of-global-car-sales-by-2035.html#:~:text=EV%20sales%20will%20soar%20to%20about%2073%20million,be%20well%20over%2080%25%20in%20many%20developed%20countries.

Electric vehicles are forecast to be half of global car sales by 2035

The adoption of electric vehicles is rising sharply as the global push for net-zero carbon emissions accelerates. EVs will make up about half of new car sales worldwide by 2035, according to Goldman Sachs Research. While the EV sector is beset by some major crosscurrents — rising prices for electrical power, inflation for the materials that make up battery components and government policies like the Inflation Reduction Act in the U.S. and Europe’s response to the IRA — our strategists expect technology innovation to supersede these forces in the coming years. EV sales will soar to about 73 million units in 2040, up from around 2 million in 2020, according to forecasts by Goldman Sachs Research. The percentage of EVs in worldwide car sales, meanwhile, is expected to rise to 61% from 2% during that span. The share of EV sales is anticipated to be well over 80% in many developed countries.

CoRev might want to check out the two cool charts. EU sales will make up 16 million of that 73 million with Chinese sales at 16 million and US sales at 14 million. So no little CoRev – historical EV sales in the US are rising and we are just getting started. And before little CoRev tries to tell us that auto losses will occur:

As the ecosystem grows, Goldman Sachs Research expects the way the industry makes money will be transformed. Our strategists forecast sales of EVs to grow by 32% annually this decade, even as sales of products related to gasoline engines slump. The global car industry’s operating profits are expected to rise to $418 billion in 2030, up from $315 billion in 2020, while the pool of profits for EVs is forecast to increase to $110 billion from $1 billion. In the meantime, the market for EV batteries, which account for as much as 40% of the car’s cost, is becoming concentrated. The top five battery makers had more than 80% of the global market share in 2020, according to Goldman Sachs Research estimates. By comparison, the top five automakers had about 40% of the worldwide market. Pricing power has shifted to the battery makers, giving them an edge in generating higher earnings. In an attempt to rebalance their pricing power with battery makers, finished-vehicle assemblers are rushing to develop vertically integrated production and joint-venture plants.

A fascinating forecast even if it contradicts the incessant lies from little CoRev.

Norway exports a lot of oil but it seems this nation has the highest EV per capita of any other nation by far. An interesting discussion of the pros and cons:

https://www.vox.com/future-perfect/23939076/norway-electric-vehicle-cars-evs-tesla-oslo

Lying CoRev lectures our host for checking US coal consumption and US EV sales when now this writing illiterate claims he meant global coal consumption and globle EV sales. OK!

https://www.statista.com/chart/26845/global-electric-car-sales/

Global Electric Car Sales Doubled in 2021

Felix Richter, Feb 15, 2022

While 2021 was another difficult year for the car industry, heavily affected by the global chip shortage, global electric car sales more than doubled over the past twelve months, reaching 6.6 million, compared to just 3 million in 2020. That’s according to preliminary EV-volumes data cited by the International Energy Agency (IEA), which reports that all net growth in global car sales in 2021 can be attributed to electric vehicles.

China in particular had a breakout year in 2021, almost tripling electric car sales from 1.2 to 3.4 million. Europe remains the second largest market for electric cars, with new registrations increasing by almost 70 percent to 2.3 million, roughly half of which were plug-in hybrids. In the United States, sales surpassed half a million for the first time, but the overall market share of electric vehicles remains far below that of China and many European markets.

So global EV sales doubled! And lying little CoRev wants us to believe EV sales are falling. Yea – he is a liar. Just not a very good one.

The World Economic Forum provides this graph of Global sales of electric vehicles from 2013 to 2022:

https://www.weforum.org/agenda/2023/05/electric-vehicles-ev-sales-growth-2022/#:~:text=EV%20sales%20rose%20by%2055%25%20in%202022%2C%20reaching,13%25%20of%20light%20vehicle%20sales%20worldwide%20in%202022.

They rose each and every year and often dramatically but I bet little CoRev is standing on his little head when he reads this graph.

CoRev is apparently smoking Chinese unicorn gas:

https://www.statista.com/statistics/265491/chinese-coal-consumption-in-oil-equivalent/#:~:text=Coal%20consumption%20volume%20in%20China%201998%2D2022&text=As%20of%202022%2C%20China%20was,percent%20of%20the%20total%20consumption.

If Corev’s point is that western environmental efforts are failing, then he’s using an awfully misleading definition of “failing”. Western policy efforts are working in the West. U.S. efforts are working in the U.S.

We need to move faster at replacing fossil fuels and limiting overall energy demand. CoRev wants us to give up trying.

Anybody here remember the “Fish Cheer”?

“…well there ain’t no time to wonder why!

Whoopee! We’re all gonna die!”

That’s the future CoRev is working toward, though he may not be smart enough to realize it.

Menzie Chinn,

What a petulant blog post. Is your ego bruised from burning the thanksgiving turkey and upsetting your holiday guest?

Gobble gobble.

Hey Econned – try to defend CoRev’s dishonesty. Oh wait – you can’t. Then SHUT the eff UP.

and the professional jealousy of econned surfaces once again, even over the holidays. the resentment of his failed academic career must be enormous.

Menzie Chinn,

Or maybe you were in charge of the dessert? Didn’t remove all of the pecan shells? That’s bitter… just like you!

Is it pee-can or puh-kahn?

Did you get banned from all the right wing blogs? Dude – you are not only annoying. You are beyond STUPID.

and the professional jealousy from the wannabe failed academic econned continues. he fails at life and tries to sink others along with him. sophomoric behavior on econned’s part.