With nonfarm payroll employment in November released (+199K vs. +180K consensus), we have the following picture of business cycle indicators followed by the NBER BCDC (plus monthly GDP). The employment series below incorporates the preliminary benchmark revision.

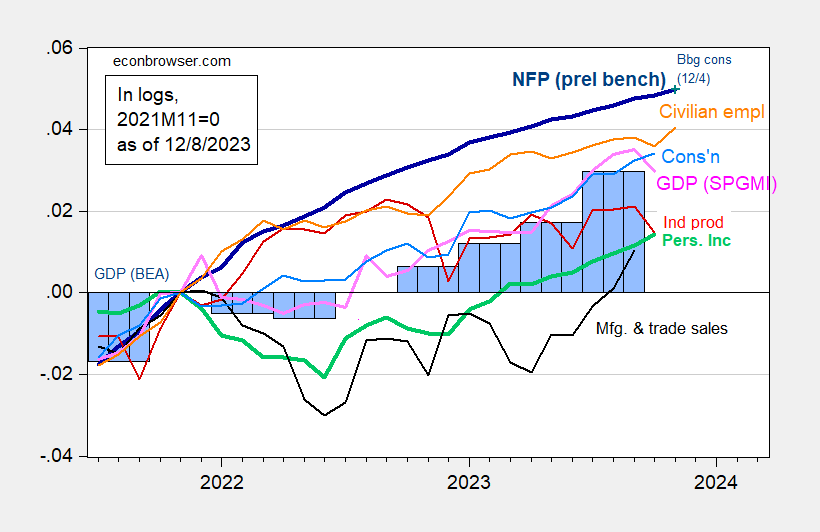

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 12/4 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (12/1/2023 release), and author’s calculations.

The employment growth shows continued strength in the economy. The participation rate rose 0.1 ppt to 62.8 (0.1 ppt above consensus), while y/y wage growth of 4.0% was at consensus.

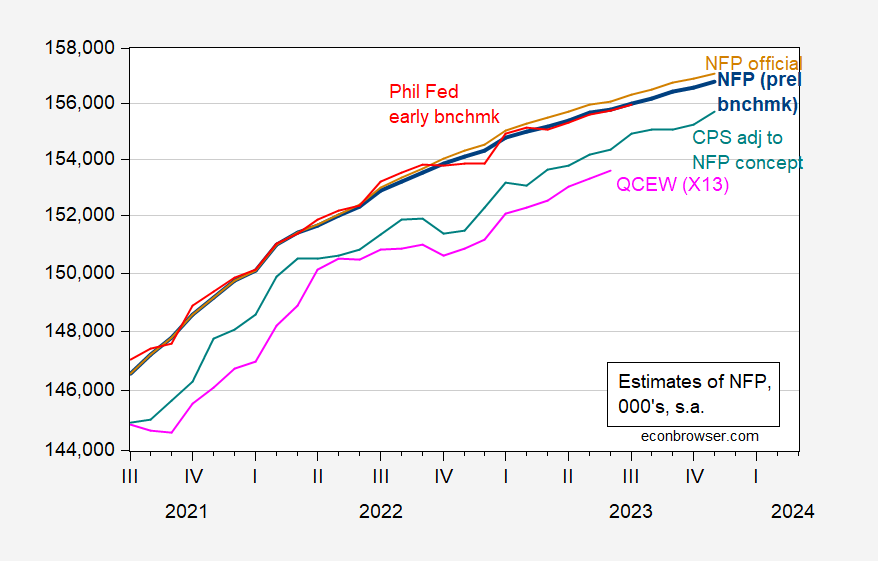

In order to forestall arguments that the standard NFP series has been distorted, it’s of interest to see the trends in other measures of nonfarm payroll employment.

Figure 2: Nonfarm payroll employment (tan), nonfarm payroll employment incorporating preliminary benchmark (bold dark blue), Philadelphia Fed early benchmark (red), CPS civilian employment adjusted to NFP concept (teal), and QCEW total covered employment seasonally adjusted by author using X13 (pink), all in 000’s, s.a. Source: BLS via FRED, Philadelphia Fed, BLS, BLS-QCEW, and author’s calculations.

Census data ends mid-year, so we can’t rely too much on series based on that data to guide us. The BLS’s research series using CPS data adjusted to NFP concept actually rose faster in November than did the CES NFP (3.7% m/m AR vs. 1.5%).

As an aside, as we get more labor market data — including Census based — it becomes more apparent that the labor market, at minimum, was not in a recession in 2022H1 (as some observers have argued).

Uh oh… Chinese CPI came in soft November:

https://tradingeconomics.com/china/inflation-cpi

Food and energy were particularly weak.

Slight deflation is good for the purchasing power of ordinary folks, but bad for banksters and highly leveraged folks. Economists get spooked by the slightest deflation. I wonder why.

Yea – you were always the leading gold bug. Let’s check Jonny boy’s math. UK nominal wages fall by 3% and its price level falls by 1%. David Cameron wants some clown to say workers are better off and little Jonny boy jumps right in.

An interesting chart from the BLS. Note the projection verses prior trend (2011-19) excluding “black swan” event). Of course projections are only good until the next actual data is available.

https://www.bls.gov/emp/graphics/total-employment.htm

Bruce finds a chart that he says is interesting but totally misses the fact that employment took a big hit in 2020. Hmmm – Trump was still President and Kelly Anne still has little Brucie on a tight leash.