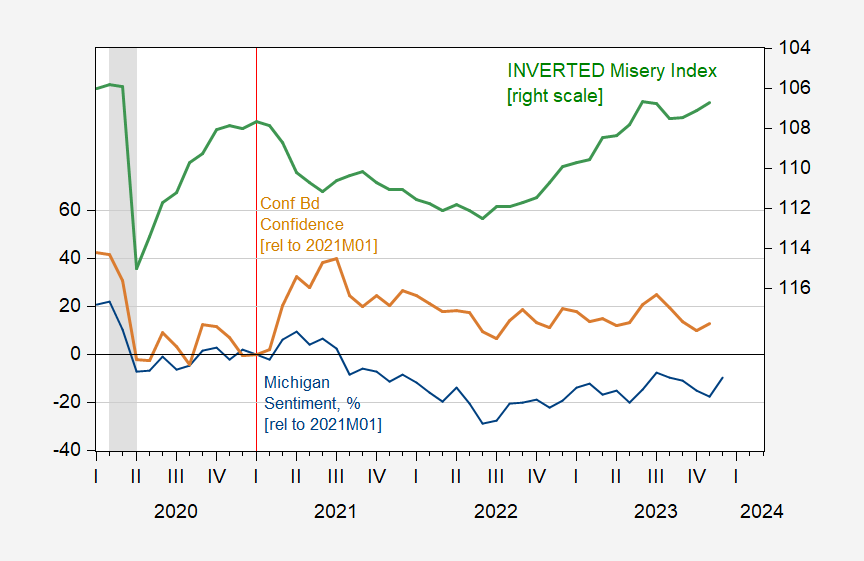

on the upside. But the disjuncture between (inverted) misery and sentiment (and confidence) continues.

Figure 1: Michigan Consumer Sentiment (blue, left scale), and Conference Board Consumer Confidence (tan, left scale), both normalized to 2021M01=0; and inverted Misery Index (green, right inverted scale). November Misery Index uses nowcast for CPI as of 12/8/2023. NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, Conference Board, BLS, NBER, and author’s calculations.

Note that while the Conference Board confidence index has risen since Biden’s inauguration, it also remains somewhat disconnected from the Misery Index.

Mechanically, the disjuncture can be partly ascribed to differences in weights on uemployment vs. inflation (see here).

“Year-ahead inflation expectations plunged from 4.5% last month to 3.1% this month. The current reading is the lowest since March 2021 and sits just above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations fell from 3.2% last month to 2.8% this month, matching the second lowest reading seen since July 2021.”

” neither economist nor consumer estimates tracked future inflation especially well. With respect to CPI, diverging realized and expected values dominate the plot. Core CPI forecasts look a bit more accurate. In particular, the mid-1990s predictions show considerable alignment within the series. More recently, during the 2010s, the economist forecast does a decent job anticipating the average level of inflation, albeit with much higher volatility than Core CPI…In general, consumers and economists both missed the post-pandemic inflation surge.” https://blogs.cfainstitute.org/investor/2023/11/16/better-inflation-forecasters-economists-or-consumers/

But economic forecasters and Chicago Cubs fans, there’s always next year, right?

I wonder why there are so few analyses (like monthly) of how well economic forecasters have performed. Businesses track revenues against budgets and forecasts on a monthly basis.

Where to start?

This post, an the comment to which you have responded, have to do with consumer moods. If consumers do a poor job of predicting inflation, it’s irrelevant to the effect of inflation expectations on consumer mood. So what’s the point of repeating your standard moan about the accuracy of inflation expectations? Other than moaning?

Businesses control their expenses and plan for sales. And still, many don’t do what you imply that they do – hit their forecasts. Economists, weather forecasters, vulcanologist and their kin don’t control what they forecast. So, once again you’ve provided a poor analogy. And a biased one.

As I’ve pointed out before, Bloomberg tracks the performance of economists in its forecast surveys. The fact that you’ve been called out on this before may explain why you’ve decided to say “few” analysis this time. But since the Bloomberg record is comprehensive for those who participate, one is enough. There is a pretty extensive literature on forecast accuracy, if you’d bother to educate yourself. So your simply wrong that forecast accuracy is not tracked. As you are wrong about most things.

From Jonny boy’s own link:

The Federal Reserve Bank of Cleveland’s Inflation Expectations model is the metric for economists’ inflation expectations, which charts them 1, 5, and 10 years ahead. The model’s data begins in 1982, and its key inputs include the Blue Chip CPI forecast, current month and historical CPI, short- and long-term Treasury yields, and the Survey of Professional Forecasters median year-over-year (YoY) CPI inflation rate, among other variables.

But Jonny boy tells us that these forecasting records are not tracked. Another episode of Jonny boy not reading his own damn links!

Ahem, Ducky…this thread started out with consumer sentiment, which you immediately highjacked to consumer expectations. I addressed your comment, so why are you upset? (Ducky just has to have something to whine about.)

Maybe Ducky could provide a link to Bloomberg forecast surveys that regularly track the performance of economic forecasts over time, particularly ones that routinely look at forecast performance and don’t merely revise the most recent forecast.

Of course, businesses don’t always meet their forecasts, but they are provided data on a monthly basis as to current results compared to forecast and to budget. Managers are constantly under the gun to explain why discrepancies between actual and forecast performance. However, economists never seem to be held to account for past performance–“neither economist nor consumer estimates tracked future inflation especially well,” but they routinely release new forecasts without caveat of past performance and with the implicit expectation that they no matter how bad past forecasts have been, the new ones will be on the money or at least indicate something or other. And then posters like Ducky repeat the forecast, as he did above, suggesting that the forecasts mean something or other.

“Maybe Ducky could provide a link to Bloomberg forecast surveys that regularly track the performance of economic forecasts over time”

Maybe he needs to prove 2 plus 2 = 4 for you. Dude – we get you are a moron. But damn.

You’re in tune with “people on the street,” right? You have the pulse of everyday workers. right? How about providing your results.

“My guess is” you don’t have any, other than cherry picked quotes you decide to parse.

You’d really love to be in an “economist’s ivory tower” but, like me, your’re quite deficient in the subject. The only way you get in is on tour.

But you do enjoy showing your ignorance by babbling and making a fool of yourself on a daily basis. Or gobble. Gobble. Gobble.

Yeah, yeah, Noneconomist, feel free to criticize me and ignore the surveys I linked to showing how few workers actually demand raises.

BTW, can you provide any evidence that economists have recently bothered to base their assumption that workers demand raises on actual survey data? If not, why not?

How many people are you going to ask to do your homework? You are not only stupid and dishonest but the laziest troll ever.

Surveys you linked to? I thought you were surveying, that you were out among regular working folk you think you represent. You certainly spend enough time “lecturing” on subjects you know little about constantly banging on doors at that ivory tower where economists chuckle loudly at your ignorance.

To quote you “I guess” and “my guess is” you get more clueless by the post.

A better guess? Your time in that Fortune 200 company was spent behind a broom or making sure copy machines had sufficient paper supplies.

You ignore Bloomberg. You even denied the Cleveland FED’s work EVEN THOUGH your own CFA link noted it. Dude – you are nothing more than a lying little moron so Shut the EFF Up.

“I wonder why there are so few analyses (like monthly) of how well economic forecasters have performed.”

There are lots of such analyzes. But Jonny boy does not know that as Jonny boy is as blind as a bat.

Sure, pgl, lots of historical analyses of forecast performance, but where are the ones tell us how they’ve performed recently? Why doesn’t every forecaster provide that data and then boast about his results?

Oh, yeah, the CFA Institute study just go released…and given the results…it’s easy to see why forecasters would not want to boast about their results or even reveal how well they did!

serious question for you Johnny. in order to accurately predict inflation over the past couple of years, one needed to both accurately predict that a pandemic and war were going to occur. and then they would have to accurately anticipate how each of those would unfold. these are both outliers in world events. so exactly what economic models exist that would incorporate those outliers accurately? it is obvious to all but you that there are some circumstances upon which accurate predictions of the future will be flawed because of outlier events. you seem to require that economists have a crystal ball for all time. that is not a reality.

Bloomberg? Cleveland FED? I bet they are more up to date than you will ever be. CFA Institute? Seriously? BTW – they noted how these forecasts are regularly tracked but little Jonny boy once again did not read his own damn link.

Republicans account for most of the improvement in all three indices. Here are recent data for the headline index:

Dem. Ind. Rep

October. 2023. 83.4. 63.5. 46.9

November 2023. 83.9. 56.6. 43.1

December 2023. 90.1. 62.1. 59.1

Change in Dec. 7.8. 5.5. 16.0

7.4% 9.7% 37.1%

Fingers crossed the table renders correctly.

Moses, how’re family and friends?

More on Venezuela’s threat to grab roughly half of Guyana:

https://foreignpolicy.com/2023/12/07/venezuela-maduro-guyana-esequibo-interstate-war-oil-referendum-icj/

The real goal of the land grab would be a water grab. A recent discovery of oil offshore is almost entirely in Guyanese waters, under international law. Moving the border eastward would change that in Venezuela’s favor. Here’s some background:

https://www.worldoil.com/news/2019/8/13/guyana-may-not-be-ready-for-its-pending-oil-riches-but-exxonmobil-is

Guyana has been asking for U.S. help. Given the hemisphere in question, this is quite a kettle of fish. Given that the potential aggressor is Venezuela, well, bigger kettle.

“Home to significant swaths of the Amazon rainforest, Esequibo is a mineral-rich territory, containing vast gold and copper deposits. In 2015, the region’s worth skyrocketed after ExxonMobil discovered large quantities of oil off its coast, setting Guyana up to become the richest nation in Latin America on a per capita basis. Just offshore and almost, but not quite entirely, in Guyana’s exclusive economic zone, is an oil gusher with at least 11 billion barrels of crude. If Venezuela were to grab Esequibo, then it could lay claim to basically all of that offshore wealth.”

I’m surprised Putin has not tried to grab this area. Oh wait – the Russia navy is inept.

“As for Guyana, the government estimates the Exxon deal will bring in $300 million in 2020, or about a third of the country’s entire tax revenue, and surge to $5 billion by 2025.”

Of course this assumes Exxon does not abuse transfer pricing to shift oil profits to Bermuda. And of course one might impose a high tax rate on oil profits.

But how could have just said all that as JohnH says I’m a shill for Big Oil. Oh wait – Jonny boy has no effing clue how oil is taxed or what transfer pricing even is.

https://www.kaieteurnewsonline.com/2023/11/22/guyana-oil-tax-your-future/

Parliament’s decision to create—what amounts to—a zero tax clause in the petroleum production agreement keeps power and wealth in the hands of its foreign counterparties and contributes to Guyana’s economic inequality…The rhetoric inscribed within the agreement places the income tax liability of the multinationals onto the shoulders of the Guyanese taxpayers. This tax loophole exempts ExxonMobil Guyana Ltd., CNOOC, and Hess (now or soon to transfer to Chevron) from the income tax laws applicable to every other entity doing business in Guyana. This is a monumental financial loss for all things Guyana; the type of revenue that oil taxes are generating should be making positive tangible changes for everyday citizens here in the territory.

Zero tax rate on oil profits? The nation taxes other sectors at either 25% of profits or 40% of profits. Read on as the author advocates a 40% tax on oil profits. I like his proposal even if little Jonny boy thinks I’m a lackey for Big Oil.

The U.S. and Guyana will undertake joint naval exercises:

https://www.worldoil.com/news/2019/8/13/guyana-may-not-be-ready-for-its-pending-oil-riches-but-exxonmobil-is

My guess is Biden will go far to protect Guyana. Given that it is Venezuela on the other side its almost a can’t lose situation to be “tough”.

I do think that the social media doom hype cycle encourages the Trump/GOP doom/chaos hype – https://www.infinitescroll.us/p/the-age-of-doom – the facts say Biden is a good president and the Biden administration has done a great job of building a growing economy https://www.hopiumchronicles.com/p/the-economy-is-remarkably-strong

Also “Renewable energy – powering a safer future” – https://www.un.org/en/climatechange/raising-ambition/renewable-energy

“the facts say Biden is a good president and the Biden administration has done a great job of building a growing economy”

this needs to be repeated more often. almost everybody I know is better off today than during the trump administration.

This has been the Year of Cheaper Drugs for the Biden administration. The beat goes on:

https://apnews.com/article/biden-drug-prices-patents-2024-campaign-f92da4ee89814d3ab89a909399bf4c85

The government’s power to limit patents come in this case under the government’s “march in” rights:

https://www.law.cornell.edu/uscode/text/35/203

Here’s a picture of producer prices for prescription drugs and for insulin in th U.S.:

https://fred.stlouisfed.org/graph/?g=1cvTj

There has been progress. But there is room for more:

https://www.visualcapitalist.com/cost-of-insulin-by-country/

https://twitter.com/Martin_Indyk/status/1733849212205273302?s=20

I would agree with you if @netanyahu wasn’t currently causing a rift with Joe Biden, Israel’s only friend in this crisis. His determination to stay in power no matter the cost is a clear and present danger to Israel. He needs to resign…yesterday!

Netanyahu has been a disaster for over 20 years. Get rid of him now.

https://www.msn.com/en-us/news/politics/giuliani-could-pay-millions-as-ga-election-worker-defamation-trial-starts/ar-AA1lhdI2?ocid=msedgdhp&pc=U531&cvid=ef81c960469c4c7e9cae21f39c97df42&ei=12

RUDY might have to pay those 2 poll workers in Georgia over $43 million? That would be a good thing.

There is some disagreement about Rudy’s finances. Is he worth $80 million?

https://www.caclubindia.com/wealth/rudy-giuliani-net-worth/

Or $1 million?

https://www.celebritynetworth.com/richest-politicians/republicans/rudy-giuliani-net-worth/

I assume more than one court has demanded his financials. His delay in paying his lawyers is predicated on financial distress. He wouldn’t lie, right?

https://www.rawstory.com/rudy-giuliani-obama-racism/

‘Former New York Mayor Rudy Giuliani blamed Barack Obama — the nation’s first Black president — for a deterioration of race relations in the United States.’

I guess RUDY thinks we will have been fine if black people decide shining his shoes for a quarter is the road to prosperity and happiness!