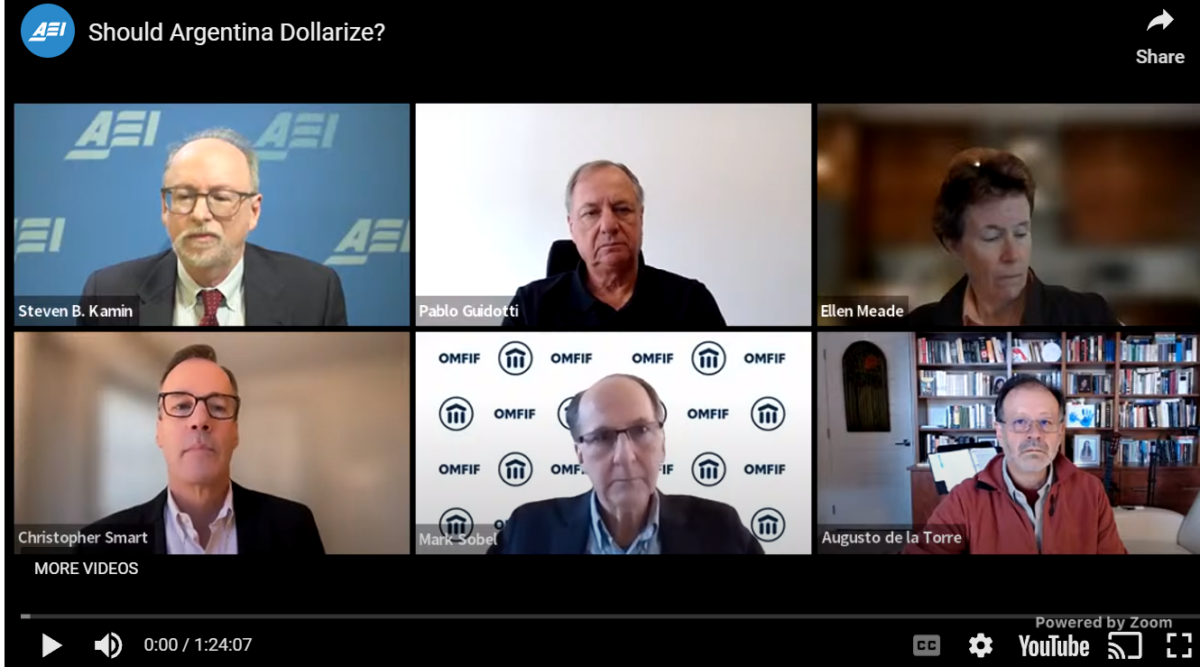

An AEI and OMFIF discussion on Wednesday with Steve Kamin and Mark Sobel.

Some background reading by Kamin and Sobel, and the debate as recounted by Bloomberg.

Dollarization—Argentina’s Last Chance for Economic Stability

https://www.omfif.org/2023/11/argentina-and-germany-two-very-different-fiscal-problems/

A lot of agreement. Argentina needs to reign in its persistent deficits and stop using inflation to cover the gap. The rest is a credibility issue. Solve that and it could retain its own currency.

As I understand it, the president doesn’t have the power to dollarize. He needs legislative authority to do so. I’m not an authority, so feel free to check on that.

The question, then, is whether lawmakers, who are responsible for Argentina’s financial mess, are willing to be constrained by dollarization, forced to stop doing what they been doing. I’m willing to believe they might, because their political rivals will also be constrained. So maybe the decision to dollarize depends on who will receive the most credit from voters, who the most blame, from the decision.

The question is who would dare to oppose it. If someone propose a (plausible) solution to a big problem – and the opposition shuts it down, then the opposition owns the problem. If they go along with it and it doesn’t work (or creates a bunch of other problems), then the president own the problem. My prediction is they will let him do it and then blame him for the austerity.

Straight out of the gate, the new guy had announced a 50% devaluation ofthe Argentine pesos and big government spending cuts:

https://www.reuters.com/markets/argentina-braces-economic-shock-package-peso-shackled-2023-12-12/

The spending cuts were inevitable. The devaluation will increase inflation, which is running at around 160%. Both import and export taxes are being increased, to help remedy the government’s revenue shortage.

President Milei campaigned on budget cuts, and devaluation was widely expected – black market trade had the peso even weaker than it will be after devaluation.

Milei also campaigned on putting the burden of economic reform on thr rich and the elite. There’s no sign of that so far. The IMF is singing the praises of Milei’s policies, which is generally not a good sign for the poor and middle classes, at least in the near term.

None of this is new for Argentina. Putting all three sectors – government, households and business – on a sustainable financial footing is an obvious necessity, but budget rationalization has never lasted for long in post-Peron Argentina.

The idea of dollarization, in addition to stopping current inflation, is to make a return to excess debt and debt monetization next to impossible. As Krugman points out, dollarization doesn’t work all year itself, but requires a sustainable budget:

https://markets.businessinsider.com/news/currencies/dollarization-argentina-dollar-dominance-inflation-debt-economy-recession-paul-krugman-2023-12

So perhaps Milei means to prepare the ground for dollarization with fiscal discipline. In which case, fiscal discipline has to actually succeed before dollarization is attempted; it is never obvious what results any particular fiscal policy will achieve until it has been in effect for a while. Good luck to Argentina.

Yellen on PRC economic policy:

https://www.msn.com/en-us/money/markets/yellen-says-china-s-economic-practices-unfair-encourages-healthy-competition-with-us/ar-AA1lwS83?ocid=msedgntp&cvid=2f1d60a4c6a54481871359365c7ea832&ei=6

Treasury Secretary Janet Yellen urged China to shift from a state-driven approach in economic policy to healthy competition with the United States, saying that their current approach is “unfair.”

“The PRC deploys unfair economic practices, from non-market tools, to barriers to access for foreign firms, to coercive actions against American companies,” Yellen said, at the US-China Business Council’s 50th anniversary dinner in Washington D.C on Thursday evening. “These policies harm American workers and firms.”

The treasury secretary said that China’s state-driven approach can discourage investors, urging the nation to “shift away” from their current economic policy.

“If the PRC were to shift away from its state-driven economic approach in industry and finance, I believe that would be better for the PRC as well,” Yellen said. “Too strong a role for state-owned enterprises can choke growth and an excessive role for the security apparatus can dissuade investment.”

The government has identified 48 injectable drugs subject to price gouging control:

https://www.sandiegouniontribune.com/news/nation-world/story/2023-12-14/older-americans-to-pay-less-for-some-drug-treatments-as-drugmakers-penalized-for-big-price-jumps

The Biden administration continues to rack up wins against anti-competitive business practices. It looks like there has been a change in tactics, using enforcement powers – some newly created in legislation – and aiming anti-trust litigation at big fish that wouldn’t have been attempted in the U.S in recent decades.

https://jabberwocking.com/giuliani-ordered-to-pay-damages-of-148-million-in-defamation-case/

Giuliani ordered to pay damages of $148 million in defamation case

YES! Bankrupt the jerk.

Maga leadership at its finest. Our resident law expert dick striker appears about as capable as rudy in the practice of law these days. Can you believe trump was advised by this turd? Embarrassing for he who only hires the best.

“AEI”……. I can’t, I just can’t.