Instantaneous, instantaneous core, and trimmed mean m/m.

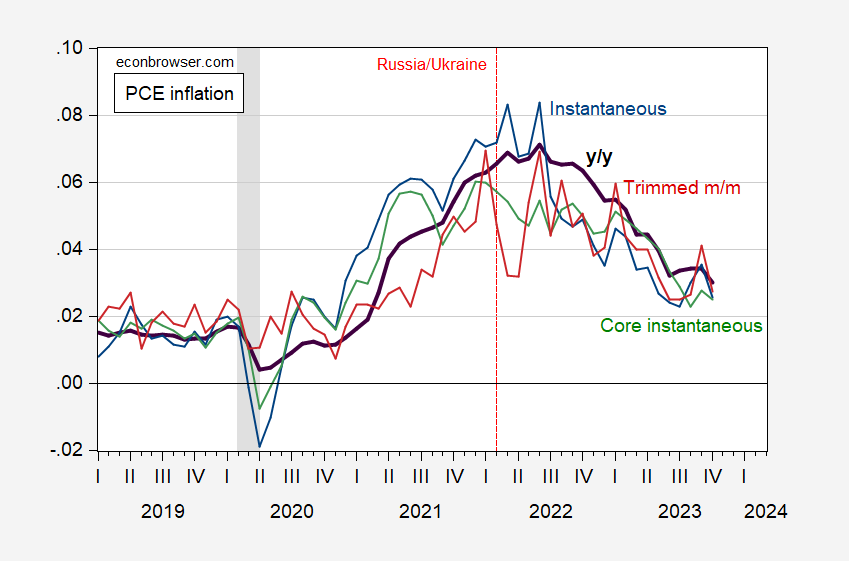

Figure 1: Year-on-Year PCE inflation (bold black), instantaneous PCE inflation (blue), instantaneous core PCE inflation (green), and 16% trimmed mean PCE inflation, m/m AR (red). NBER defined peak-to-trough recession dates shaded gray. Instantaneous inflation setting T=12, a=4 per Eeckhout. Source: BEA, Dallas Fed, NBER, and author’s calculations.

Am I mistaken, or does the chart show that oil prices started declining just a few months after Russia’s invasion of Ukraine? Not the kind of blowback that I expected!

But it’s possible, as Carlotta Breman and Servaas Storm explain in “Oil Prices, Oil Profits, Speculation, and Inflation”

“Hiigher energy prices have been a major driver of the surge in the U.S. PCE inflation, accounting for 21% of PCE inflation in June 2022. Under reasonable empirical assumptions and using the model of Knittel and Pindyck (2016), our analysis shows that speculative activity in the crude oil market has been responsible for 24%-48% of the increase in the WTI crude price during October 2020-June 2022. A back-of-the-envelope calculation suggests that these estimates translate into an oil price increase of around $18-$36 per barrel and an increase in the U.S. PCE inflation rate by circa 0.75 to 1.5 percentage points during October 2020-June 2022.

Our estimations of the extent by which speculative activity in the oil market has driven up oil prices, are supplemented by direct evidence of the degree of speculative activity in the WTI crude oil market.”

https://www.ineteconomics.org/perspectives/blog/oil-prices-oil-profits-speculation-and-inflation

Now we’ll likely see pgl try to provide cover for oil companies and Wall Street speculators’ profiteering…

Johnny is at it again. He gets caught supporting Putins war in Ukraine and he gets caught spouting nonsense about economics, and his response it to lie about the intentions and allegiances of others.

Why would pgl try to cover for Wall Street types or oil companies? He certainly hasn’t made a practice of it in comments here. What pgl has done is point out Johnny’s ignorance and dishonesty, so Johnny uses rhetorical trickery to make pgl out to be a shill. Simplest trick in the world.

“Am I mistaken, or does the chart show that oil prices started declining just a few months after Russia’s invasion of Ukraine?”

Yes, Johnny, you’re mistaken. Oil is not one of the series represented in the chart.

Now, a point about causality in markets. Johnny seems to want to suggest (but who can really tell?) that Russia’s second invasion of Ukraine isn’t responsible for the spike in oil prices, because speculators are responsible. Market participants – including speculators – respond to news. Russia’s invasion was news. Causation runs from invasion through news, through the market response to prices.

“Not the kind of blowback that I expected!”

Not sure what Johnny means by “blowback” here, but Johnny’s expectations aren’t important. He’s just a Putin supporter who doesn’t know much about markets or economics.

If Ducky had read my post, he would have seen that “Hiigher energy prices have been a major driver of the surge in the U.S. PCE inflation, accounting for 21% of PCE inflation in June 2022.” But Ducky makes the outrageous claim that, “Oil is not … represented in the chart.” Well, it’s true oil is not represented directly, but Ducky conveniently provides cover for the effects surging oil prices, by intentionally ignoring the fact that it is indirectly represented, an effect that he would have known, had he bothered to read the link to the Carlotta Breman and Servaas Storm piece.

And then Ducky makes a lame attend to provide cover for speculators! “Market participants – including speculators – respond to news. Russia’s invasion was news. Causation runs from invasion through news, through the market response to prices.” Yeah, Ducky, speculation is great, particularly if it results in driving inflation and harming consumers!

Read my reply to his comment. You accusing ME of being a shill for Big Oil. No lying little Jonny boy – you are one pathetic little dude.

“Ducky makes a lame attend to provide cover for speculators”

I guess Putin did not allow you to read how I torn down Gazprom for ripping off the average Russian via transfer pricing manipulation. Yea – you nothing more than a sick joke.

So, my claim is outrageous, but it’s true? Johnny, you really need to do a better job with this “narrative” stuff you chatter on about. A “nareative” in which you insist that something that’s true is also outrageous needs work.

Didn’t say it was great. Said it’s true. So once again, what’s true doesn’t suit you so you go all crazy trying to make the truth sound blameworthy. Seems like maybe falsehood is more your kind of thing.

“Hiigher energy prices have been a major driver of the surge in the U.S. PCE inflation, accounting for 21% of PCE inflation in June 2022.”

You deduced this from the chart? Really? Damn you are dumb.

Gee I did not even notice that lying little Jonny boy accused me of being a shill for oil companies. Never mind I have consistently advocated an excess profits tax on them.

If you had looked at an actual chart of oil prices, e.g., the WTI Crude Oil Price daily 10 year history that’s readily available online, you would have seen that oil prices climbed immediately after the invasion, for what one hopes are obvious reasons, and did not return to their previous levels for over five months. They then dropped to about the levels of Oct. – Dec. 2021. One hopes your memory of early 2021 is not so poor that you have forgotten there was increasing concern that Russia would invade, and, naturally, there was some ramp-up of oil prices as a result. Having noted your rhetorical style before, I’ll pre-empt one of your lines of “argument” by observing that “concern” is not the same as “conviction.”

There was concern in early 2021 that Russia would invade Ukraine? Show me the proof!!!

In 2021 neither inflation nor rising oil prices had anything to do with a potential invasion. As I have shown before, concern about a possible invasion didn’t get onto the radar until about January, 2022. In fact, oil prices actually dropped in December 2021, which is inconsistent with mounting concern.

What the chart suggests, by isolating the invasion as the only exogenous causal factor, is that inflation, having risen dramatically for two years, reached a peak coincident with the invasion, and started to drop shortly afterwards. Interestingly enough, that inflection point was also coincident with the peak in oil prices and the end of their speculative bubble, which was embedded in the PCE, though not directly shown.

https://fred.stlouisfed.org/series/DCOILWTICO/

BTW I am not suggesting that the invasion had nothing to do with rising prices in early 2022…I’m only commenting on the message that the chart seems to convey.

‘There was concern in early 2021 that Russia would invade Ukraine? Show me the proof!!!’

Dr. Chinn covered this many times. I would ask how stupid are you but we know your IQ is below zero.

My typo, I meant early 2022, during the two or so months before the invasion.

Here’s a representative oil market outlook from December, 2021, just two months before Russia’s invasion of Ukraine. Analysts were predicting a strong market in 2022 due to a number of factors. There is NO mention of either Russia or Ukraine. The impact of an invasion was NOT on their radar.

https://www.reuters.com/markets/commodities/global-oils-comeback-year-presages-more-strength-2022-2021-12-23/

It should be noted that the nefarious impacts of speculation also drove inflation in other markets: “A group of ten leading ‘momentum-driven’ hedge funds made an estimated $1.9bn trading on the food price spike at the start of the Ukraine war that drove millions into hunger, a new analysis by Unearthed and Lighthouse Reports has found… some observers believe the price spike was driven more by financial speculation than by real food shortages caused by the war. Russia and Ukraine are major wheat exporters, but worldwide most wheat is consumed in the country in which it is grown.

The shortfall in global exports caused by the invasion amounted to around 7m tonnes – less than 1% of the global crop, according to Michael Fakhri, UN special rapporteur on the right to food. Yet the price spiked by at least 50%.

‘What explains that price is the effect of the speculation: the financial markets, the hedge funds, etc,’ he told Unearthed. ‘Their fear, their panic, their algorithms cause the price to spike. It didn’t reflect real world supply and demand, real world readjustment to find new supply routes, real world concerns – it reflected the needs, desires and function of the financial market’.”

https://unearthed.greenpeace.org/2023/04/14/ukraine-wheat-food-price-crisis-speculation/

Interestingly enough, the UK implemented a windfall profits tax on oil companies: “UK Windfall Tax See Oil Giant Shell Pay First Net Taxes in Years”

https://oilprice.com/Latest-Energy-News/World-News/UK-Windfall-Tax-See-Oil-Giant-Shell-Pay-First-Net-Taxes-in-Years.html

Yet, I have seen no mainstream economist in the US, apart from Isabella Weber, make such an obvious, common sense public policy proposal…certainly none at this public policy site. Greed is evidently good…

Just to repeat what you’ve been told several times before –

You don’t know enough about economics to make broad statement’s about what “mainstream economists” think or write.

There is a substantial literature on Piguvian taxes which absolutely recommends higher taxes on fossil fuels – hiigher taxes in general, a far better policy than windfall taxes. There are plenty of economists who favor higher corporate taxes, which would serve the same purpose as windfall taxes in limiting the profits from financial speculation. Your preference for windfall taxes doesn’t make them a superior policy to general corporate taxes. If you’d care to make the case, feel free. I’m quite certain you can’t, though you may link to an article you don’t understand as your “proof”.

One more thing. Johnny is still trying to blame speculators for the surge in food and energy prices while deflecting blame from theroot cause – Russia’s invasion or Ukraine. There is, however, a point in the very Greenpeace article Johnny linked to which undermines his argument. The speculators he wants to blame instead of Russia were trend-followers. They responded to an upward trend in prices. What caused that upward trend? Why, Russia’s invasion of Ukraine, of course.

If Johnny actually understood any of this stuff, he would have made such an obvious mistake.

“Interestingly enough, the UK implemented a windfall profits tax on oil companies: “UK Windfall Tax See Oil Giant Shell Pay First Net Taxes in Years”

Yet, I have seen no mainstream economist in the US, apart from Isabella Weber, make such an obvious, common sense public policy proposal”

I have many times. Many others have as well. Dude – your lies are just pathetic.

“in Norway, Europe’s other North Sea oil giant, Bloomberg said Shell paid $2.12 billion in corporate income tax on $3.85 billion in profits—a high tax bill that came second only to the $4.56 billion it paid to Oman.”

I have noted how the Norwegian tax rate on oil profits = 78% (22% on all other profits) many times. But little Jonny boy is too stupid to have noticed. So little Jonny boy accusing ME of being a shill for big oil.

Little Jonny boy is a pathetic liar as well as being beyond stupid.

“Am I mistaken, or does the chart show that oil prices started declining just a few months after Russia’s invasion of Ukraine?”

Hey dumbass – PCE inflation as clearly labeled in the post is overall price inflation not oil prices. Macroduck got this one right (as usual) and yet the dumbest troll ever created just make up $hit as he goes. Dude – we get your IQ is in the single digits so please just stop.

Menzie – I found this interesting – contrary to what some commentators on your blog claim – it appears that “costs for renewables have plummeted and growth is exceeding expectations” https://www.wsj.com/business/energy-oil/now-for-some-good-news-about-climate-27236f56

Interesting. Too bad CoRev cannot comment in this as that climate change clown get his rear end banned!

This drop in prices for renewables has led to a drop in building of hydrocarbon plants. About 80% of new power this year has been renewable. This is very similar to what happened with coal fired power plants a decade ago. Nobody want to fund building of a new NG power plant when they in all likelihood will not be able to sell the electricity at a price that will cover both the cost of fuel and payments on the loans taken out to build it.

Consider what will happen when renewables have cut the price of electricity in half. Lots of hydrocarbon power plants will become stranded assets unable to make more money that what it costs to run them. Electric cars will become an even better deal. Energy intensive industries will be able to sell products at lower prices/ higher profits.

The geopolitical consequences of wind and solar taking over will be huge. The 3 biggest producers of hydrocarbons are US, Saudi Arabia and Russia. US will be fine since we never build our economy on oil/NG wealth. The Saudis have a huge wealth fund and will do OK. Russia has build a big kleptocracy and not much else from its hydrocarbon wealth – and they need a lot of money to rebuild and keep their country together. They are at risk of becoming a failed state splintering into their many ethnic components with lots of armed conflicts.

When energy is provided by solar and wind there will not be a lot of countries spending substantial money on importing energy. It will almost certainly be cheeper to just produce energy at home rather than importing it from far away. Some energy storage systems may temporarily create another Saudi Arabia of say, batteries? However, that is less likely because there is quite a diversity of energy storage options; so anybody trying to create a cartel and drive prices way above cost, will suffer substitution. Furthermore, because the things used for making solar panels and batteries are not used up – recycling will eventually put a cap on the needs to import critical materials and components from potentially hostile countries.

Off topic, some recent headlines on the war in Gaza –

Plans to depopulate Gaza:

https://twitter.com/ryangrim/status/1730695483398537666

I have been unable to find the original press report, so cannot verify.

Plans to reduce most of Gaza to rubble:

https://www.theguardian.com/world/2023/dec/01/israel-signals-intent-to-launch-ground-invasion-of-southern-gaza

https://www.thedailybeast.com/israeli-defense-forces-spokesman-says-most-of-southern-gaza-will-suffer-same-fate-as-north?ref=home%3Fref%3Dhome

This is, of course, old news:

https://www.nytimes.com/2023/11/07/world/middleeast/israel-control-security-gaza-war.html

One more not-so-nice report out of Israel:

https://www.middleeasteye.net/news/israel-palestine-war-ai-habsora-random-killing-mathematics

The gist is than Israel’s government has decided that any number of civiliandeaths is justifiable if a single low-level member of Hamas van be killed. And a machine picks the targets.